- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei -24.25 19609.50 -0.12%

TOPIX -2.50 1574.90 -0.16%

Hang Seng -1.72 23827.95 -0.01%

CSI 300 -1.41 3456.69 -0.04%

Euro Stoxx 50 -16.06 3399.43 -0.47%

FTSE 100 -9.23 7357.85 -0.13%

DAX -1.24 11988.79 -0.01%

CAC 40 -25.34 4974.26 -0.51%

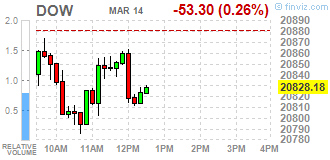

DJIA -44.11 20837.37 -0.21%

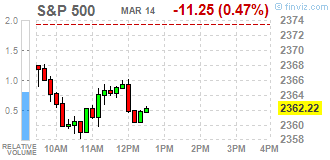

S&P 500 -8.02 2365.45 -0.34%

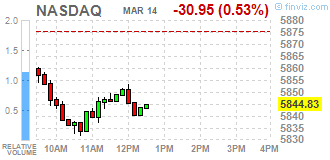

NASDAQ -18.97 5856.82 -0.32%

S&P/TSX -165.21 15379.61 -1.06%

Major US stock indexes declined on Tuesday amid falling oil prices and expectations of the Fed meeting.

Investors focused on the Fed meeting, which is expected to raise interest rates. At the moment, the chances of a decision to raise rates at this meeting according to the dynamics of futures on federal funds are estimated at 93%. The head of the Federal Reserve, Janet Yellen, said earlier that the regulator is likely to raise the rate in March. However, investors are most interested in the Fed's signals about how quickly it is planned to raise rates this year. Now the probability of raising rates three or more times this year, they estimate in 64%.

The volume of trading was low, as the northeastern US state caught a snowstorm, leaving people at home.

The focus of investors' attention was also data on changes in producer prices last month. As it became known, in February, producer prices rose by 0.3% m / m, which is above the average forecast of analysts at + 0.1%. The base producer prices also rose by 0.3%, while analysts had expected growth of 0.2%.

The components of the DOW index mostly decreased (20 out of 30). The shares of Chevron Corporation fell more than others (CVX, -1.55%). Leader of growth were shares of Wal-Mart Stores, Inc. (WMT, + 1.34%).

All sectors of the S & P index ended the session in negative territory. Most of all, the main materials sector fell (-1.4%).

At closing:

Dow -0.21% 20,837.54 -43.94

Nasdaq -0.32% 5,856.82 -18.96

S & P-0.34% 2,365.38 -8.09

Major U.S. stock-indexes lower on Tuesday as oil prices fell and investors focused on the Federal Reserve's policy meeting, where it is widely expected to raise interest rates. Trading volumes were light as a blizzard in the northeastern United States grounded flights and kept people indoors.

Most of Dow stocks in negative area (21 of 30). Top loser - Chevron Corporation (CVX, -1.49%). Top gainer - Wal-Mart Stores, Inc. (WMT, +1.58%).

All S&P sectors in negative area. Top loser - Basic Materials (-1.4%).

At the moment:

Dow 20783.00 -60.00 -0.29%

S&P 500 2358.25 -13.50 -0.57%

Nasdaq 100 5373.75 -25.50 -0.47%

Oil 47.35 -1.05 -2.17%

Gold 1204.20 +1.10 +0.09%

U.S. 10yr 2.59 -0.01

U.S. stock-index futures fell ahead of the Federal Reserve's closely watched two-day meeting, where it is widely expected to raise interest rates.

Global Stocks:

Nikkei 19,609.50 -24.25 -0.12%

Hang Seng 23,827.95 -1.72 -0.01%

Shanghai 3,238.62 +1.60 +0.05%

FTSE 7,355.68 -11.40 -0.15%

CAC 4,971.34 -28.26 -0.57%

DAX 11,952.13 -37.90 -0.32%

Crude $47.83 (-1.18%)

Gold $1,204.80 (+0.14%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 191.1 | -0.42(-0.22%) | 500 |

| Amazon.com Inc., NASDAQ | AMZN | 852.04 | -2.55(-0.30%) | 1942 |

| Apple Inc. | AAPL | 138.9 | -0.30(-0.22%) | 25795 |

| Caterpillar Inc | CAT | 92.01 | -0.63(-0.68%) | 2312 |

| Chevron Corp | CVX | 108.53 | -0.82(-0.75%) | 4330 |

| Citigroup Inc., NYSE | C | 61.15 | -0.38(-0.62%) | 36839 |

| Exxon Mobil Corp | XOM | 81.15 | -0.27(-0.33%) | 22462 |

| Facebook, Inc. | FB | 139.25 | -0.35(-0.25%) | 27554 |

| Ford Motor Co. | F | 12.51 | -0.03(-0.24%) | 32778 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.45 | -0.11(-0.88%) | 102636 |

| General Electric Co | GE | 29.79 | -0.07(-0.23%) | 16499 |

| Goldman Sachs | GS | 247 | -1.16(-0.47%) | 2906 |

| Intel Corp | INTC | 35.1 | -0.06(-0.17%) | 25593 |

| International Business Machines Co... | IBM | 176.07 | -0.39(-0.22%) | 2233 |

| JPMorgan Chase and Co | JPM | 90.9 | -0.46(-0.50%) | 6112 |

| Merck & Co Inc | MRK | 64.17 | 0.02(0.03%) | 1350 |

| Microsoft Corp | MSFT | 64.58 | -0.13(-0.20%) | 6569 |

| Nike | NKE | 56.7 | 0.03(0.05%) | 3202 |

| Tesla Motors, Inc., NASDAQ | TSLA | 246.35 | 0.18(0.07%) | 7933 |

| Twitter, Inc., NYSE | TWTR | 15.15 | -0.06(-0.39%) | 13301 |

| Verizon Communications Inc | VZ | 49.42 | -0.05(-0.10%) | 13148 |

| Visa | V | 89.91 | -0.20(-0.22%) | 3819 |

| Wal-Mart Stores Inc | WMT | 70.55 | 0.60(0.86%) | 13607 |

| Walt Disney Co | DIS | 111.7 | 0.18(0.16%) | 7996 |

| Yandex N.V., NASDAQ | YNDX | 23 | -0.24(-1.03%) | 2020 |

Upgrades:

Walt Disney (DIS) upgraded to Buy from Neutral at Guggenheim

Downgrades:

Other:

FedEx (FDX) initiated with a Outperform at Wells Fargo

Wal-Mart (WMT) added to US 1 List at BofA/Merrill

European stocks climbed in volatile trade Monday, but with investors trading cautiously ahead of potentially market-moving events this week, including the Dutch election, the U.K.'s Brexit bill vote and a U.S. interest-rate decision.

Stocks closed marginally higher after switching between small gains and losses on Monday as investors refrained from making sizable bets ahead of a Federal Reserve meeting that is widely expected to deliver an interest-rate increase.

Stocks closed marginally higher after switching between small gains and losses on Monday as investors refrained from making sizable bets ahead of a Federal Reserve meeting that is widely expected to deliver an interest-rate increase.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.