- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei 225 17,672.62 +297.83 +1.71%

Shanghai Composite 3,210.10 +14.06 +0.44%

S&P/ASX 200 5,345.73 0.00 0.00%

FTSE 100 6,753.18 +22.75 +0.34%

CAC 40 4,508.55 +19.28 +0.43%

Xetra DAX 10,693.69 +25.74 +0.24%

S&P 500 2,164.20 -0.25 -0.01%

Dow Jones Industrial Average 18,868.69 +21.03 +0.11%

S&P/TSX Composite 14,598.45 +43.04 +0.30%

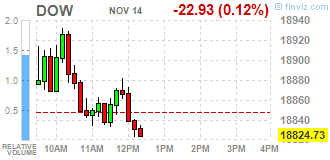

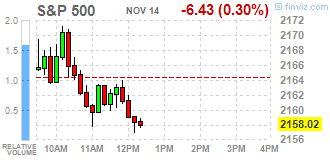

Major U.S. stock-indexes slightly fell. The S&P 500 and the Dow Jones industrial average pared early gains and were little changed on Monday as investors looked for more clarity on President-elect Donald Trump's policies. The tech-heavy Nasdaq Composite was lower, adding to last week's losses. The Dow, which capped off its best week in five years on Friday, hit a another record-high just after the start of trading. Since Trump's triumph last Tuesday, investors have been betting on his campaign promises to simplify regulation in the health and financial sectors and boost spending on infrastructure.

Most of Dow stocks in negative area (19 of 30). Top gainer - UnitedHealth Group Incorporated (UNH, +3.61%). Top loser - Visa Inc. (V, -4.59%).

Most of S&P sectors also in negative area. Top gainer - Conglomerates (+1.7%). Top loser - Technology (-1.3%).

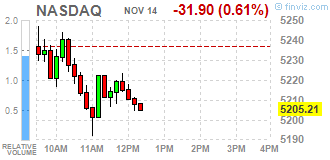

At the moment:

Dow 18782.00 -5.00 -0.03%

S&P 500 2154.75 -6.75 -0.31%

Nasdaq 100 4690.25 -57.75 -1.22%

Oil 42.34 -1.07 -2.46%

Gold 1219.20 -5.10 -0.42%

U.S. 10yr 2.21 +0.09

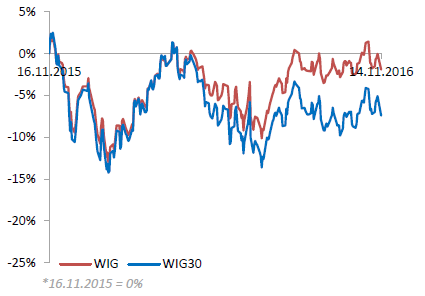

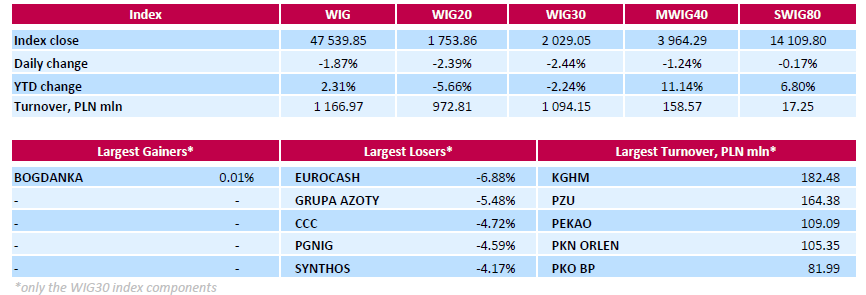

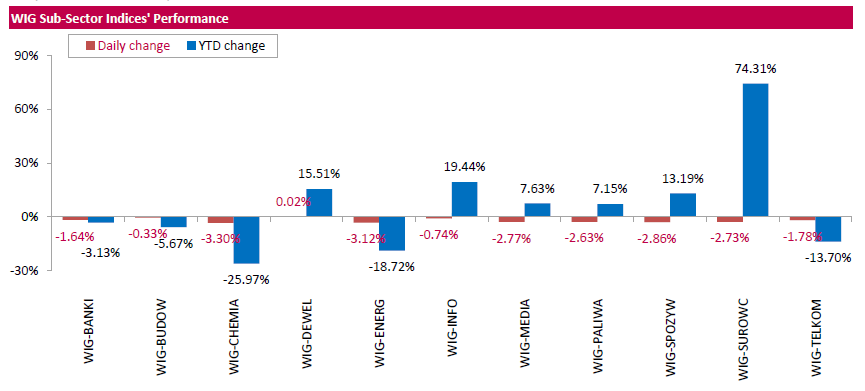

Polish equity market closed lower on Monday. The broad market benchmark, the WIG Index, plunged by 1.87%. The WIG sub-sector indices were mainly lower with chemicals (-3.3%) lagging behind.

The large-cap companies' measure, the WIG30 Index, fell by 2.62%. Thermal coal producer BOGDANKA (WSE: LWB) was sole gainer within the index constituents, edging up 0.01%. At the same time, FMCG-wholesaler EUROCASH (WSE: EUR) and chemical producer GRUPA AZOTY (WSE: ATT) suffered the steepest drops, down 6.88% and 5.48% respectively. Other major underperformers were footwear retailer CCC (WSE: CCC), oil and gas producer PGNIG (WSE: PGN), chemical producer SYNTHOS (WSE: SNS), agricultural producer KERNEL (WSE: KER), and two gencos PGE (WSE: PGE) and ENERGA (WSE: ENG), which lost between 3.88% and 4.72%.

The week on the Warsaw market did not start well. The trading for a few hours is not able to pick up from the session lows. Adding to this the style of today's descent (width, rotation, scale) it does not look good. In the initial phase of the session we were not able to take advantage of the relatively positive sentiment on core markets and in particular the surprisingly positive start of trading in Europe, which was inspired by a better behavior of the US contracts. Entry into afternoon phase of trading in Europe was held under the sign of far more modest than previously growth, and at the same time leaving the level of resistance, visible especially in Germany and France.

The market in the US opens with increase, but the beginning looks neutral on the background of recent observed volatility.

An hour before the end of today's trading the WIG20 index was at the level of 1,759 points (-2.06%).

U.S. stock-index futures inched up as a slump in crude prices sapped some momentum from investors' surging appetite for riskier assets.

Global Stocks:

Nikkei 17,672.62 +297.83 +1.71%

Hang Seng 22,222.22 -308.87 -1.37%

Shanghai 3,210.10 +14.06 +0.44%

FTSE 6,752.16 +21.73 +0.32%

CAC 4,506.42 +17.15 +0.38%

DAX 10,723.30 +55.35 +0.52%

Gold $42.77 (-1.47%)

Crude $1,221.40 (-0.24%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 29.53 | 0.23(0.785%) | 330 |

| ALTRIA GROUP INC. | MO | 61.89 | 0.13(0.2105%) | 3595 |

| Amazon.com Inc., NASDAQ | AMZN | 744.78 | 5.77(0.7808%) | 25016 |

| Apple Inc. | AAPL | 108.19 | -0.24(-0.2213%) | 97997 |

| AT&T Inc | T | 36.59 | 0.08(0.2191%) | 8340 |

| Barrick Gold Corporation, NYSE | ABX | 14.74 | -0.10(-0.6739%) | 115163 |

| Boeing Co | BA | 149 | 0.48(0.3232%) | 1146 |

| Caterpillar Inc | CAT | 93.29 | 0.28(0.301%) | 7214 |

| Chevron Corp | CVX | 106.35 | -0.29(-0.2719%) | 1810 |

| Cisco Systems Inc | CSCO | 31.42 | 0.06(0.1913%) | 7504 |

| Citigroup Inc., NYSE | C | 53.09 | 0.26(0.4921%) | 267959 |

| E. I. du Pont de Nemours and Co | DD | 69.57 | 0.36(0.5202%) | 685 |

| Exxon Mobil Corp | XOM | 85.38 | -0.29(-0.3385%) | 6612 |

| Facebook, Inc. | FB | 119.35 | 0.33(0.2773%) | 133164 |

| Ford Motor Co. | F | 12.24 | -0.04(-0.3257%) | 26080 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14.17 | 0.23(1.6499%) | 208937 |

| General Electric Co | GE | 30.82 | 0.11(0.3582%) | 36271 |

| General Motors Company, NYSE | GM | 33.82 | -0.20(-0.5879%) | 5761 |

| Goldman Sachs | GS | 204.94 | 1.00(0.4903%) | 18585 |

| Google Inc. | GOOG | 758 | 3.98(0.5278%) | 9745 |

| Home Depot Inc | HD | 130.55 | 0.70(0.5391%) | 2216 |

| HONEYWELL INTERNATIONAL INC. | HON | 113.68 | 0.43(0.3797%) | 184 |

| Intel Corp | INTC | 34.63 | 0.02(0.0578%) | 2262 |

| International Business Machines Co... | IBM | 161.96 | 0.69(0.4279%) | 3114 |

| International Paper Company | IP | 45.79 | 0.13(0.2847%) | 100 |

| Johnson & Johnson | JNJ | 119 | 0.53(0.4474%) | 1314 |

| JPMorgan Chase and Co | JPM | 77.05 | 0.36(0.4694%) | 25692 |

| McDonald's Corp | MCD | 114.55 | 0.33(0.2889%) | 950 |

| Merck & Co Inc | MRK | 64.2 | 0.25(0.3909%) | 3617 |

| Microsoft Corp | MSFT | 59.15 | 0.13(0.2203%) | 59590 |

| Pfizer Inc | PFE | 33.09 | 0.50(1.5342%) | 30448 |

| Procter & Gamble Co | PG | 83.71 | 0.13(0.1555%) | 2365 |

| Starbucks Corporation, NASDAQ | SBUX | 54 | 0.07(0.1298%) | 4548 |

| Tesla Motors, Inc., NASDAQ | TSLA | 188 | -0.56(-0.297%) | 11387 |

| Twitter, Inc., NYSE | TWTR | 18.85 | 0.30(1.6173%) | 225765 |

| Visa | V | 82.55 | 0.67(0.8183%) | 290 |

| Yahoo! Inc., NASDAQ | YHOO | 40.3 | -0.12(-0.2969%) | 367 |

| Yandex N.V., NASDAQ | YNDX | 18.42 | -0.29(-1.55%) | 945 |

Upgrades:

Citigroup (C) upgraded to Overweight from Equal-Weight at Morgan Stanley

Other:

The Warsaw market from the very beginning of the session grabs clear shortness of breath, unable to fully take advantage of a favorable environment, which is consolidating at key resistance of core markets indices. But this is not a surprise, the WSE fits clearly in the attitude of emerging markets where trade is taking increasingly lower levels. To the weakness of blue chips attached worse attitude of the broad market in the form of small and medium-sized companies. In addition, in Western Europe there was also deterioration in sentiment in the noon phase of trading, although increases there are still maintained. Locally, in the case of blue chips not much left from the post-election rally and at the level of the WIG20 index we are back to the area of lows from the beginning of November, when the market feared a victory of Trump.

At the halfway point of today's trading the WIG20 index was at the level 1,767 points (-1,67%), with the turnover of PLN 465 million.

WIG20 index opened at 1794.23 points (-0.14%)*

WIG 48626.04 0.37%

WIG30 2089.27 0.46%

mWIG40 4029.09 0.38%

*/ - change to previous close

The cash market started the day from a discount of 0.14% to 1,794 points, but quickly rises above, piercing even the psychological level of 1,800 points.

The beginning of the session on the Warsaw Stock Exchange is the answer to better performance of core markets, namely the maintenance of nearby peaks, which opens the way to the theoretically possible attack. The first violin again plays KGHM, reacting to Friday's turmoil in the copper market, which look like classic solstice. The market is very volatile and these fluctuations after the one day break must find a new balance.

After fifteen minutes of trading the WIG20 index was at the level of 1,799 points (+0,17%).

The Warsaw Stock Exchange into the new week comes with the need to catch up the one missing day of trading. On Friday, during our national holiday the global financial market worked and a lot on it happened. Investors are still trying to discount the possible changes associated with Donald Trump winning. The market is counting on increased spending financed by increased issuance of bonds while reducing taxes. As a result increase the bonds profitability, strengthens the dollar, and the assets of emerging markets have come under pressure. On Friday, the MSCI Emerging Markets index went down by 2.9% and broke the important support. It's not the best news for the Warsaw Stock Exchange.

Morning mood is very positive. Contracts in the US gain of 0.6%, which should lead to positive openings in Europe.

In Asia, the Nikkei gaining only and the other emerging parquets are under pressure. Copper prices remain very volatile but the balance puts the price of metal near the close on Thursday, which means a relatively neutral impact on our market.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.