- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei 225 17,862.21 +194.06 +1.10%

Shanghai Composite 3,205.41 -1.57 -0.05%

S&P/ASX 200 5,327.67 0.00 0.00%

FTSE 100 6,749.72 -43.02 -0.63%

CAC 40 4,501.14 -35.39 -0.78%

Xetra DAX 10,663.87 -71.27 -0.66%

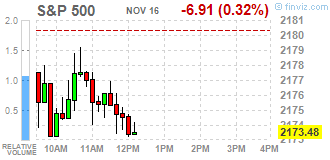

S&P 500 2,176.94 -3.45 -0.16%

Dow Jones Industrial Average 18,868.14 -54.92 -0.29%

S&P/TSX Composite 14,733.22 -22.88 -0.16%

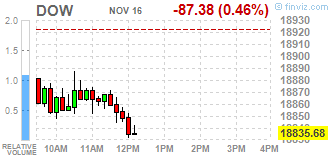

Major U.S. stock-indexes mixed. S&P and Dow were lower on Wednesday as financial stocks dropped after a seven-day rally since Donald Trump's surprise election win, while a recovery in technology shares boosted the Nasdaq. U.S. stocks have been on a tear since Trump's victory. The Dow had closed higher for seven days, with the last four at record levels. But they have given back some gains as investors look for more clarity regarding his policies and brace for higher interest rates.

Most of Dow stocks in negative area (20 of 30). Top gainer - Apple Inc. (AAPL, +2.23%). Top loser - The Goldman Sachs Group, Inc. (GS, -2.37%).

Most of S&P sectors also in negative area. Top gainer - Services (+0.4%). Top loser - Utilities (-1.1%).

At the moment:

Dow 18813.00 -67.00 -0.35%

S&P 500 2170.75 -8.50 -0.39%

Nasdaq 100 4783.25 +17.25 +0.36%

Oil 45.62 -0.19 -0.41%

Gold 1228.40 +3.90 +0.32%

U.S. 10yr 2.21 -0.02

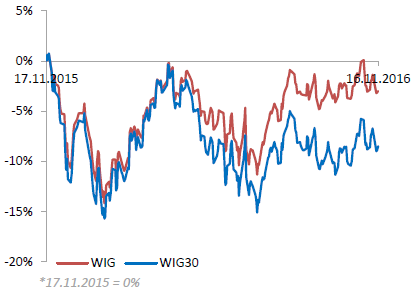

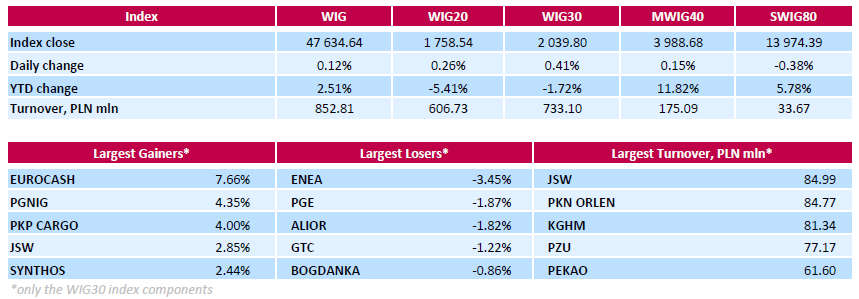

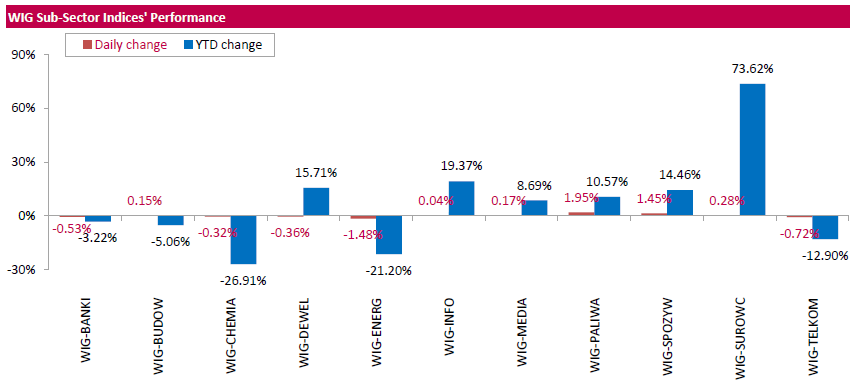

Polish equity market closed higher on Wednesday. The broad market measure, the WIG Index, rose by 0.12%. Sector performance within the WIG Index was mixed. Oil and gas sector (+1.95%) outpaced, while utilities (-1.48%) underperformed.

The large-cap stocks gained 0.41%, as measured by the WIG30 Index, with the way up led by FMCG-wholesaler EUROCASH (WSE: EUR), which surged by 7.66%. It was followed by oil and gas producer PGNIG (WSE: PGN) and railway freight transport operator PKP CARGO (WSE: PKP), jumping by 4.35% and 4% respectively. The latter reported it ended Q3 with a net loss of PLN 5.7 mln, which, however, was lower than analysts' consensus projection, calling for a loss of PLN 9 mln. Other major advancers were coking coal miner JSW (WSE: JSW), chemical producer SYNTHOS (WSE: SNS) and agricultural producer KERNEL (WSE: KER), which added between 2.26% and 2.85%. On the other side of the ledger, utilities name ENEA (WSE: ENA) kept its position as the worst performing name, tumbling by 3.45%, as it continued to suffer from yesterday's announcement the stock would be removed from MSCI Poland Index. Among other laggards were genco PGE (WSE: PGE), bank ALIOR (WSE: ALR) and property developer GTC (WSE: GTC), which lost between 1.22% and 1.87%.

Today's afternoon brought weaker readings of data from the US, signaling a weaker-than-expected condition of the industry. Zero growth in industrial production and lower-than-expected capacity utilization complement worse-than-expected PPI inflation reading. The data are in contrast with recent readings of the economy and should encourage corrective post-election mood after having increased. Contracts for US indices signaled a weaker opening on Wall Street, so the start of trading with discounts in the US market was no surprise. After the first minutes of trading on Wall Street contracts on the S&P 500 rebounded from the session lows allowing similar maneuver for European indexes. The beginning of the US session therefore leads to more stability than the confirmation of declines.

The Warsaw market still feeling the effects of a strong withdrawing from the beginning of the week and it is hard to think that the final hour will bring a major change in the balance of power. The biggest problem is the lack of strong capital on the side of the bulls. From the technical analysis point of view, today's session looks like another day of balance and wait for the stimulus for either party.

An hour before the close of trading the WIG20 index was at the level of 1,758 points (+ 0.27%).

U.S. stock-index futures retreated as a selloff in Treasuries resumed, raising concerns that interest rates could rise faster than investors anticipated amid speculation that Donald Trump's policies will boost inflation.

Global Stocks:

Nikkei 17,862.21 +194.06 +1.10%

Hang Seng 22,280.53 -43.38 -0.19%

Shanghai 3,205.41 -1.57 -0.05%

FTSE 6,789.08 +35.90 +0.53%

CAC 4,490.95 -45.58 -1.00%

DAX 10,634.61 -100.53 -0.94%

Crude $45.44 (-0.81%)

Gold $1,224.90 (+0.03%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 173 | -0.13(-0.0751%) | 2178 |

| ALCOA INC. | AA | 29.86 | -0.35(-1.1586%) | 1722 |

| ALTRIA GROUP INC. | MO | 61.76 | -0.05(-0.0809%) | 812 |

| Amazon.com Inc., NASDAQ | AMZN | 738 | -5.24(-0.705%) | 22896 |

| American Express Co | AXP | 72.01 | -0.46(-0.6347%) | 2611 |

| Apple Inc. | AAPL | 106.3 | -0.81(-0.7562%) | 52645 |

| Barrick Gold Corporation, NYSE | ABX | 15.62 | 0.04(0.2567%) | 76156 |

| Boeing Co | BA | 147.95 | -0.16(-0.108%) | 101 |

| Caterpillar Inc | CAT | 93.99 | -0.45(-0.4765%) | 8463 |

| Chevron Corp | CVX | 173 | -0.13(-0.0751%) | 2178 |

| Cisco Systems Inc | CSCO | 31.63 | -0.07(-0.2208%) | 16419 |

| Citigroup Inc., NYSE | C | 54.77 | -0.68(-1.2263%) | 38087 |

| Deere & Company, NYSE | DE | 90.9 | -0.35(-0.3836%) | 436 |

| E. I. du Pont de Nemours and Co | DD | 68.43 | -0.21(-0.3059%) | 1000 |

| Exxon Mobil Corp | XOM | 86.5 | -0.32(-0.3686%) | 503 |

| Facebook, Inc. | FB | 114.25 | -2.95(-2.5171%) | 505526 |

| Ford Motor Co. | F | 12 | -0.04(-0.3322%) | 729 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.72 | -0.27(-1.9299%) | 106368 |

| General Electric Co | GE | 30.65 | -0.10(-0.3252%) | 1967 |

| Goldman Sachs | GS | 209 | -2.19(-1.037%) | 26820 |

| Google Inc. | GOOG | 753.67 | -4.82(-0.6355%) | 3747 |

| Home Depot Inc | HD | 123.6 | -0.80(-0.6431%) | 15820 |

| Intel Corp | INTC | 34.9 | -0.01(-0.0286%) | 3506 |

| International Paper Company | IP | 47.81 | 0.06(0.1257%) | 1625 |

| Johnson & Johnson | JNJ | 116.35 | 0.03(0.0258%) | 1215 |

| JPMorgan Chase and Co | JPM | 78.6 | -0.76(-0.9577%) | 82486 |

| Microsoft Corp | MSFT | 58.75 | -0.12(-0.2038%) | 15336 |

| Nike | NKE | 49.98 | -0.15(-0.2992%) | 1800 |

| Pfizer Inc | PFE | 32.15 | -0.08(-0.2482%) | 14616 |

| Starbucks Corporation, NASDAQ | SBUX | 54.5 | -0.09(-0.1649%) | 1755 |

| Tesla Motors, Inc., NASDAQ | TSLA | 182.66 | -1.11(-0.604%) | 13164 |

| The Coca-Cola Co | KO | 41.3 | -0.14(-0.3378%) | 1255 |

| Twitter, Inc., NYSE | TWTR | 18.95 | -0.03(-0.1581%) | 52201 |

| United Technologies Corp | UTX | 107 | -0.02(-0.0187%) | 100 |

| UnitedHealth Group Inc | UNH | 151.5 | -0.73(-0.4795%) | 200 |

| Verizon Communications Inc | VZ | 47.33 | -0.04(-0.0844%) | 9159 |

| Visa | V | 78.4 | -0.005(-0.0064%) | 1124 |

| Wal-Mart Stores Inc | WMT | 72.2 | 0.78(1.0921%) | 12413 |

| Walt Disney Co | DIS | 98.6 | 0.90(0.9212%) | 45399 |

| Yahoo! Inc., NASDAQ | YHOO | 40.05 | -0.16(-0.3979%) | 2678 |

| Yandex N.V., NASDAQ | YNDX | 18.2 | -0.07(-0.3831%) | 12800 |

Upgrades:

Walt Disney (DIS) upgraded to Buy from Hold at Deutsche Bank

Downgrades:

Other:

Home Depot (HD) target raised to $146 from $145 at RBC Capital Mkts

In the first half of today's trading the WIG20 index broke out the forenoon consolidation and went on daily maxima, at which were some problems with the continuation of growth. Of course, not conducive to us is the exterior atmosphere with a predominance of red color on the main Euroland parquets and the weakening of the Polish zloty.

At the halfway point of today's quotations the WIG20 index reached the level of 1,760 points (+ 0.34%). The turnover in the index of the largest companies was amounted to PLN 270 million.

WIG20 index opened at 1757.61 points (+0.20%)*

WIG 47725.58 0.31%

WIG30 2040.04 0.42%

mWIG40 3983.78 0.02%

*/ - change to previous close

The night strengthening of the Polish currency is a thing of the past. On the threshold of the session on the Warsaw Stock Exchange EURPLN and USDPLN pairs gained in value. Investors on the spot market choose the optimistic scenario and ignore the weakening of the zloty. The market focuses on the belief that after days of downward pressure on the emerging markets, there is room for correction of depreciation, which element was Monday's slump on the WSE. Above all of the first line companies positively stands out in the PGNiG, Tauron (WSE: TPE), KGHM and Orange (WSE: OPL). The WIG20 index quickly enough reports around yesterday's highs.

After fifteen minutes of trading the WIG20 index was at the level 1,761 points (+ 0.41%).

Tuesday's session on the New York stock exchanges brought the seventh time in a row the historical record of the Dow Jones Industrial, which rose by 0.29 percent, the S&P 500 gain by 0.75 percent and the Nasdaq Comp. increased by 1.10 percent. Tuesday's sessions can be seen as an attempt to return to the increases, which helped macro data and a little less pressure from the debt market. In the morning, rising also the Japanese Nikkei. On the green side are also contracts for the S&P500 and DAX, thus the current atmosphere in the markets shows that the day in Europe will start from modest increases.

From the point of view of the Warsaw market, the WSE and the Polish zloty have recently been victims of more attractive assets from developed markets and poor attitude to other emerging markets. Although the night weakening of the dollar and strengthening of the zloty favors having increased at the opening of today's session. Bulls should help also defended yesterday the support in the area of 1,750 points.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.