- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei -0.98 22380.01 +0.00%

TOPIX -4.62 1778.87 -0.26%

Hang Seng -30.06 29152.12 -0.10%

CSI 300 -28.72 4099.35 -0.70%

Euro Stoxx 50 -18.14 3556.38 -0.51%

FTSE 100 -0.76 7414.42 -0.01%

DAX -40.94 13033.48 -0.31%

CAC 40 -26.05 5315.58 -0.49%

DJIA -30.23 23409.47 -0.13%

S&P 500 -5.97 2578.87 -0.23%

NASDAQ -19.72 6737.87 -0.29%

S&P/TSX -113.13 15913.13 -0.71%

Major US stock indexes finished trading in negative territory against the backdrop of a strong fall in shares of General Electric for the second day in a row, as well as a collapse in oil prices.

In addition, as it became known today, in October the producer price index in the US has steadily increased, which indicates an increase in inflationary pressures. The producer price index, the inflation rate experienced by enterprises, increased by 0.4% in October compared with a month earlier, the Labor Ministry reported on Tuesday. If we exclude more volatile food and energy components, the so-called base prices also increased by 0.4% in October. According to the economist of the Ministry of Labor, the growth of the general producer price index as a whole was due to the surge in trade services, which grew by 1.1% compared to a month earlier. Economists had expected a 0.1% increase in total producer prices and 0.2% in base prices.

Oil prices fell by about 2%, due to the evidence of growth in US production, and a gloomy outlook for demand growth in the report of the International Energy Agency (IEA). The IEA in its monthly report presented a surprisingly gloomy outlook for oil demand, which suggests slowing consumption, and contradicts the more bullish forecasts from OPEC voiced the day before. IEA lowered the forecast of growth in oil demand by 100,000 barrels per day this year and in 2018, to about 1.5 million barrels per day in 2017 and up to 1.3 million barrels per day in 2018. The IEA said that warmer temperatures could reduce consumption, while a sharp increase in output outside the OPEC group of producers could mean that the global market will return to excess in the first half of 2018.

Most components of the DOW index finished the session in the red (16 of 30). Outsider were shares of General Electric Company (GE, -5.52%). The growth leader was the shares of The Home Depot, Inc. (HD, + 1.54%).

Almost all sectors of the S & P index recorded a fall. The greatest decrease was shown by the sector of raw materials (-1.8%). Growth was recorded only by the utilities sector (+ 0.8%).

At closing:

DJIA -0.13% 23,409.54 -30.16

Nasdaq -0.29% 6,737.87 -19.72

S & P-0.23% 2.578.86 -5.98

U.S. stock-index futures were lower on Tuesday as investors continued to worry about Republican tax plans.

Global Stocks:

Nikkei 22,380.01 -0.98 0.00%

Hang Seng 29,152.12 -30.06 -0.10%

Shanghai 3,429.97 -17.87 -0.52%

S&P/ASX 5,968.75 -53.03 -0.88%

FTSE 7,425.27 +10.09 +0.14%

CAC 5,318.98 -22.65 -0.42%

DAX 13,042.65 -31.77 -0.24%

Crude $56.47 (-0.51%)

Gold $1,272.90 (-0.47%)

(company / ticker / price / change ($/%) / volume)

| ALTRIA GROUP INC. | MO | 65.76 | -0.08(-0.12%) | 1502 |

| Amazon.com Inc., NASDAQ | AMZN | 1,133.64 | 4.47(0.40%) | 13808 |

| Apple Inc. | AAPL | 173.8 | -0.17(-0.10%) | 53680 |

| AT&T Inc | T | 34.19 | 0.02(0.06%) | 8748 |

| Barrick Gold Corporation, NYSE | ABX | 13.85 | -0.10(-0.72%) | 74226 |

| Boeing Co | BA | 262.64 | 0.22(0.08%) | 3953 |

| Caterpillar Inc | CAT | 137.3 | 0.77(0.56%) | 3068 |

| Citigroup Inc., NYSE | C | 71.7 | -0.29(-0.40%) | 8317 |

| Facebook, Inc. | FB | 178.6 | -0.17(-0.10%) | 15734 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14.21 | -0.22(-1.52%) | 35298 |

| General Electric Co | GE | 18.95 | -0.07(-0.37%) | 797837 |

| General Motors Company, NYSE | GM | 43.56 | -0.01(-0.02%) | 460 |

| Google Inc. | GOOG | 1,025.25 | -0.50(-0.05%) | 702 |

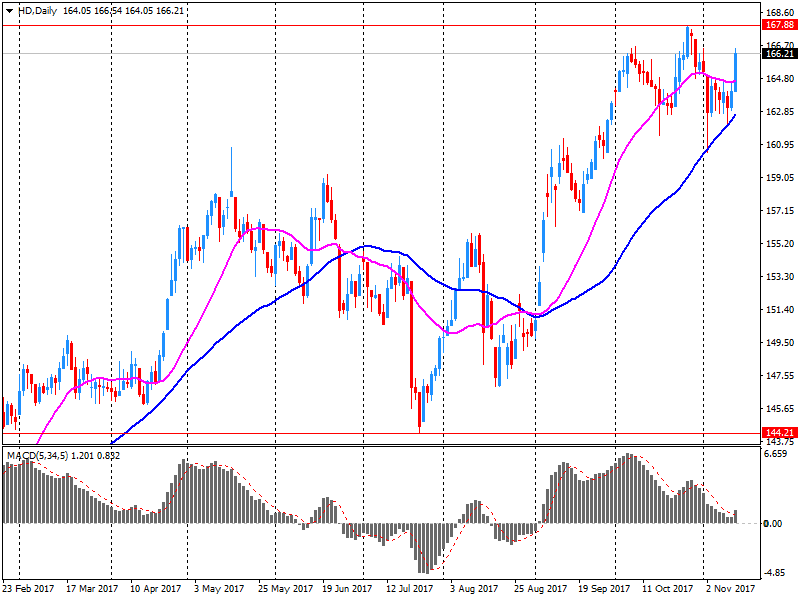

| Home Depot Inc | HD | 165.7 | 0.35(0.21%) | 245532 |

| Intel Corp | INTC | 45.6 | -0.15(-0.33%) | 2804 |

| International Business Machines Co... | IBM | 148.74 | 0.34(0.23%) | 3086 |

| JPMorgan Chase and Co | JPM | 97.52 | -0.34(-0.35%) | 2435 |

| McDonald's Corp | MCD | 167.42 | 0.05(0.03%) | 770 |

| Merck & Co Inc | MRK | 55.59 | 0.49(0.89%) | 175 |

| Microsoft Corp | MSFT | 84 | 0.07(0.08%) | 4657 |

| Nike | NKE | 55.93 | 0.02(0.04%) | 1526 |

| Pfizer Inc | PFE | 35.29 | -0.01(-0.03%) | 3229 |

| Tesla Motors, Inc., NASDAQ | TSLA | 314.84 | -0.56(-0.18%) | 24070 |

| The Coca-Cola Co | KO | 46.91 | 0.19(0.41%) | 40237 |

| Twitter, Inc., NYSE | TWTR | 20.2 | 0.03(0.15%) | 13153 |

| Wal-Mart Stores Inc | WMT | 91.04 | 0.05(0.06%) | 8003 |

| Walt Disney Co | DIS | 104.75 | 0.01(0.01%) | 1444 |

Apple (AAPL) maintained at Outperform at RBC Capital Mkts; target $190

General Electric (GE) downgraded to Sector Perform at RBC Capital Mkts; target lowered to $20

Coca-Cola (KO) upgraded to Outperform from Market Perform at Wells Fargo

Home Depot (HD) reported Q3 FY 2017 earnings of $1.84 per share (versus $1.60 in Q3 FY 2016), beating analysts' consensus estimate of $1.82.

The company's quarterly revenues amounted to $25.026 bln (+8.1% y/y), beating analysts' consensus estimate of $24.533 bln.

HD fell to $164.63 (-0.44%) in pre-market trading.

European stocks on Monday closed lower for a fifth straight session, after French utility Electricite de France SA issued a profit warning, and on concerns about Brexit weighing on growth prospects for the eurozone. Markets also appeared rattled by uncertainty surrounding progress for a cut in U.S. taxes.

U.S. stocks closed marginally higher Monday after the Dow and the S&P 500 posted their first weekly drops in two months last week. Upside was capped, however, as uncertainty continued to swirl around the state of Republican tax-cut legislation while blue-chip General Electric Co. tumbled to a more-than-five-year low.

Global equity markets were lower in Asia on Tuesday, as a pullback in commodity shares dragged Australia's benchmark index lower, while tighter liquidity weighed on Chinese stocks. Commodity stocks have been key to the recent rebound for Australia's underperforming equities market, helping the S&P/ASX 200 XJO, -0.92% hit 10-year highs earlier this month, but profit-taking pressure has been building.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.