- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Index | Change items | Closing price | % change |

| Hang Seng | +14.22 | 28539.66 | +0.05% |

| CSI 300 | -20.60 | 3472.09 | -0.59% |

| Euro Stoxx 50 | -5.46 | 3449.08 | -0.16% |

| FTSE 100 | -61.42 | 7600.45 | -0.80% |

| DAX | +20.29 | 12561.02 | +0.16% |

| CAC 40 | -19.77 | 5409.43 | -0.36% |

| DJIA | +44.95 | 25064.36 | +0.18% |

| S&P 500 | -2.88 | 2798.43 | -0.10% |

| NASDAQ | -20.26 | 7805.72 | -0.26% |

| S&P/TSX | -66.39 | 16494.73 | -0.40% |

Major US stock indices fell mainly on Monday, as a sharp fall in crude oil prices affected the energy sector and offset the rebound of shares of financial corporations after strong results from Bank of America strengthened the expectations of the earnings season.

Negligible impact on the course of trading also provided data on the United States. As it became known, in June retail sales increased significantly, which was facilitated by an increase in purchases of cars and a number of other goods, which led to the revival of reliable economic growth in the second quarter. The Commerce Department reported that retail sales rose 0.5% last month. Data for May were revised upward to show an increase in sales of 1.3% instead of the previously achieved 0.8% growth. May's growth in retail sales was the largest since September 2017.

However, the results of research published by the Federal Reserve Bank of New York, showed that the region's production index fell in July slightly less than the average forecast of economists. According to the data, the production index in the current month fell to +22.6 points compared to +25.0 points in June. Previous value was not revised. Economists had expected the index to fall to +22.0 points.

Inventories in the US continued to grow in May, and sales recorded the largest increase in eight months, according to government data on Monday. The Ministry of Trade reported that inventories increased by 0.4% after an unrevised growth of 0.3% in April. The May growth in inventories, which are a key component of the gross domestic product, met the expectations of economists.

Most components of DOW finished trading in the red (18 out of 30). Outsider were shares of Caterpillar Inc. (CAT, -1.90%). Leader of the growth were shares of JPMorgan Chase & Co. (JPM, + 3.97%).

Most S & P sectors recorded a decline. The largest drop was shown by the commodity sector (-1.2%). The conglomerate sector grew most (+ 1.2%).

At closing:

Dow 25,064.36 +44.95 +0.18%

S&P 500 2,798.43 -2.88 -0.10%

Nasdaq 100 7,805.72 -20.26 -0.26%

U.S. stock-index futures were flat on Monday, as expectations of a solid corporate earnings season were outweighed by a drop in crude oil and expectations of the outcomes of the meeting between U.S. President Donald Trump and Russian President Vladimir Putin.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | - | - | - |

| Hang Seng | 28,539.66 | +14.22 | +0.05% |

| Shanghai | 2,813.92 | -17.27 | -0.61% |

| S&P/ASX | 6,241.50 | -26.90 | -0.43% |

| FTSE | 7,591.84 | -70.03 | -0.91% |

| CAC | 5,414.84 | -14.36 | -0.26% |

| DAX | 12,545.59 | +4.86 | +0.04% |

| Crude | $69.40 | | -2.27% |

| Gold | $1,242.90 | | +0.14% |

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 201.76 | 0.58(0.29%) | 220 |

| ALCOA INC. | AA | 47.1 | -0.16(-0.34%) | 200 |

| Amazon.com Inc., NASDAQ | AMZN | 1,820.03 | 7.00(0.39%) | 55661 |

| Apple Inc. | AAPL | 191.46 | 0.13(0.07%) | 64621 |

| AT&T Inc | T | 31.71 | 0.04(0.13%) | 39490 |

| Barrick Gold Corporation, NYSE | ABX | 12.93 | 0.02(0.15%) | 4400 |

| Boeing Co | BA | 352.88 | 2.09(0.60%) | 7316 |

| Caterpillar Inc | CAT | 140.5 | -0.25(-0.18%) | 3780 |

| Chevron Corp | CVX | 122.89 | -1.15(-0.93%) | 7523 |

| Cisco Systems Inc | CSCO | 41.9 | 0.12(0.29%) | 43783 |

| Citigroup Inc., NYSE | C | 67.26 | 0.26(0.39%) | 61719 |

| Deere & Company, NYSE | DE | 137.75 | 0.17(0.12%) | 100 |

| Exxon Mobil Corp | XOM | 82.5 | -0.81(-0.97%) | 14450 |

| Facebook, Inc. | FB | 207.58 | 0.26(0.13%) | 54304 |

| FedEx Corporation, NYSE | FDX | 232.39 | -1.36(-0.58%) | 565 |

| Ford Motor Co. | F | 10.93 | -0.05(-0.46%) | 138528 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 16.85 | 0.05(0.30%) | 44354 |

| General Electric Co | GE | 13.93 | 0.04(0.29%) | 55764 |

| General Motors Company, NYSE | GM | 39.54 | 0.18(0.46%) | 3000 |

| Goldman Sachs | GS | 227 | 0.59(0.26%) | 690 |

| Intel Corp | INTC | 52.27 | 0.05(0.10%) | 11734 |

| International Business Machines Co... | IBM | 146.06 | 0.16(0.11%) | 439 |

| Johnson & Johnson | JNJ | 125.9 | -0.03(-0.02%) | 3821 |

| JPMorgan Chase and Co | JPM | 106.35 | -0.01(-0.01%) | 34294 |

| McDonald's Corp | MCD | 159 | 0.49(0.31%) | 892 |

| Microsoft Corp | MSFT | 105.7 | 0.27(0.26%) | 45408 |

| Nike | NKE | 77.4 | 0.02(0.03%) | 162 |

| Pfizer Inc | PFE | 37.5 | -0.03(-0.08%) | 763 |

| Procter & Gamble Co | PG | 79.45 | 0.14(0.18%) | 1828 |

| Starbucks Corporation, NASDAQ | SBUX | 51.6 | -0.02(-0.04%) | 9845 |

| Tesla Motors, Inc., NASDAQ | TSLA | 311.51 | -7.36(-2.31%) | 165877 |

| The Coca-Cola Co | KO | 44.51 | -0.23(-0.51%) | 265 |

| Travelers Companies Inc | TRV | 126.64 | 0.01(0.01%) | 405 |

| Twitter, Inc., NYSE | TWTR | 44.38 | -0.11(-0.25%) | 65448 |

| United Technologies Corp | UTX | 129.82 | 0.31(0.24%) | 4018 |

| UnitedHealth Group Inc | UNH | 259.5 | 0.80(0.31%) | 551 |

| Verizon Communications Inc | VZ | 51.1 | -0.31(-0.60%) | 2395 |

| Visa | V | 139.31 | -0.11(-0.08%) | 1351 |

| Wal-Mart Stores Inc | WMT | 87.48 | -0.22(-0.25%) | 1579 |

| Walt Disney Co | DIS | 109.76 | -0.24(-0.22%) | 1581 |

| Yandex N.V., NASDAQ | YNDX | 38.2 | 0.29(0.77%) | 2881 |

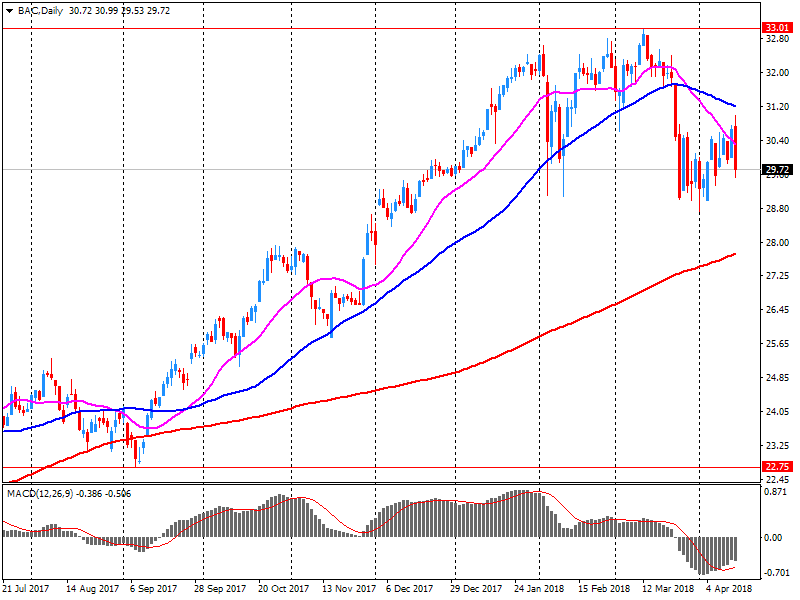

Bank of America (BAC) reported Q2 FY 2018 earnings of $0.63 per share (versus $0.46 in Q2 FY 2017), beating analysts' consensus estimate of $0.57.

The company's quarterly revenues amounted to $22.600 bln (-0.9% y/y), generally in-line with analysts' consensus estimate of $22.486 bln.

BAC rose to $28.91 (+1.26%) in pre-market trading.

July 16

Before the Open:

Bank of America (BAC). Consensus EPS $0.57, Consensus Revenues $22485.63 mln.

After the Close:

Netflix (NFLX). Consensus EPS $0.79, Consensus Revenues $3937.69 mln.

Jul 17

Before the Open:

Goldman Sachs (GS). Consensus EPS $4.65, Consensus Revenues $8743.43 mln.

Johnson & Johnson (JNJ). Consensus EPS $2.07, Consensus Revenues $20387.21 mln.

UnitedHealth (UNH). Consensus EPS $3.04, Consensus Revenues $56094.64 mln.

After the Close:

July 18

Before the Open:

Morgan Stanley (MS). Consensus EPS $1.10, Consensus Revenues $10051.52 mln.

After the Close:

Alcoa (AA). Consensus EPS $1.29, Consensus Revenues $3469.28 mln.

American Express (AXP). Consensus EPS $1.81, Consensus Revenues $10049.34 mln.

IBM (IBM). Consensus EPS $3.04, Consensus Revenues $19860.34 mln.

July 19

Before the Open:

Travelers (TRV). Consensus EPS $2.43, Consensus Revenues $6664.94 mln.

After the Close:

Microsoft (MSFT). Consensus EPS $1.08, Consensus Revenues $29228.68 mln.

July 20

Before the Open:

General Electric (GE). Consensus EPS $0.18, Consensus Revenues $29342.97 mln.

Honeywell (HON). Consensus EPS $2.01, Consensus Revenues $10813.52 mln.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.