- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Index | Change items | Closing price | % change |

| Nikkei | -29.51 | 22764.68 | -0.13% |

| TOPIX | -1.62 | 1749.59 | -0.09% |

| Hang Seng | -106.56 | 28010.86 | -0.38% |

| CSI 300 | -2.98 | 3428.34 | -0.09% |

| Euro Stoxx 50 | -13.44 | 3471.64 | -0.39% |

| FTSE 100 | +7.69 | 7683.97 | +0.10% |

| DAX | -79.65 | 12686.29 | -0.62% |

| CAC 40 | -30.37 | 5417.07 | -0.56% |

| DJIA | -134.79 | 25064.50 | -0.53% |

| S&P 500 | -11.13 | 2804.49 | -0.40% |

| NASDAQ | -29.15 | 7825.30 | -0.37% |

The main US stock indices have moderately decreased amid a multitude of weak quarterly reports and a continuing tension due to the trade war.

Investors' attention was also attracted by the statements of US President Trump, who noted that he would not like to see a further increase in the Fed's rates. "I am dissatisfied with this rate hike," Trump said, "In the past, US presidents tried to refrain from commenting on monetary policy." The Fed has raised rates twice this year and has planned two more increases by the end of the year. "Trump said his displeasure is due to the fact that each time the economic situation improves, "they want to raise rates again." He noted that he will not interfere in the work of the Fed.

A certain influence on the course of trading was provided by the US data. The report presented by the Federal Reserve Bank of Philadelphia showed that the index of business activity in the production sector increased in July, reaching a level of 25.7 points compared to 19.9 points in June. Economists had expected the growth of the indicator only to the level of 21.5 points.

At the same time, in June the index of leading indicators (LEI) from the Conference Board increased by 0.5 percent to 109.8 (2016 = 100), after an unchanged value in May and growth of 0.4% in April. "LEI increased in June, indicating continued steady growth in the US economy," said Ataman Ozildirim, director of business cycles and growth research at the Conference Board. "The broad growth of leading indicators, with the exception of housing permits, which once again declined, does not imply a significant slowdown in growth in the short term."

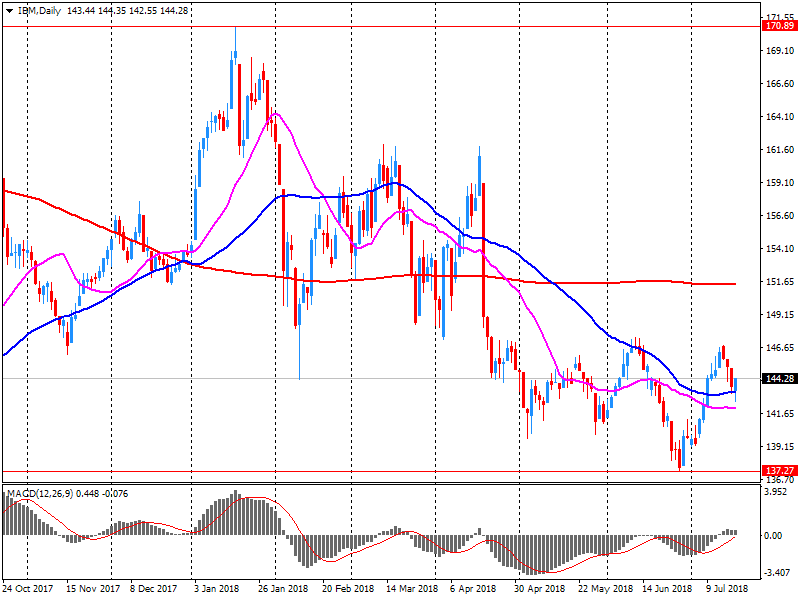

Most of the components of DOW finished trading in the red (21 of 30). The leader of growth was the shares of International Business Machines Corporation (IBM, + 3.25%). Outsider were the shares of The Travelers Companies, Inc. (TRV, -3.81%).

Most S & P sectors recorded a decline. The largest decline was shown by the financial sector (-0.8%). The utilities sector grew most (+ 0.7%).

At closing:

Dow 25,064.50 -134.79 -0.53%

S&P 500 2,804.49 -11.13 -0.40%

Nasdaq 100 7,825.30 -29.15 -0.37%

U.S. stock-index futures fell on Thursday, as investors assessed mixed bag of earnings.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 22,764.68 | -29.51 | -0.13% |

| Hang Seng | 28,010.86 | -106.56 | -0.38% |

| Shanghai | 2,772.98 | -14.28 | -0.51% |

| S&P/ASX | 6,262.70 | +17.60 | +0.28% |

| FTSE | 7,690.33 | +14.05 | +0.18% |

| CAC | 5,424.51 | -22.93 | -0.42% |

| DAX | 12,710.52 | -55.42 | -0.43% |

| Crude | $68.23 | | -0.77% |

| Gold | $1,212.20 | | -1.28% |

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 47.2 | -0.76(-1.58%) | 6952 |

| ALTRIA GROUP INC. | MO | 56.6 | -0.83(-1.45%) | 46377 |

| Amazon.com Inc., NASDAQ | AMZN | 1,830.50 | -12.42(-0.67%) | 39060 |

| American Express Co | AXP | 99.59 | -3.39(-3.29%) | 8003 |

| Apple Inc. | AAPL | 190 | -0.40(-0.21%) | 112676 |

| AT&T Inc | T | 31.74 | 0.03(0.09%) | 12620 |

| Barrick Gold Corporation, NYSE | ABX | 12.23 | -0.29(-2.32%) | 24226 |

| Boeing Co | BA | 359 | -1.23(-0.34%) | 4806 |

| Caterpillar Inc | CAT | 139.15 | -1.11(-0.79%) | 3516 |

| Chevron Corp | CVX | 120.5 | -1.03(-0.85%) | 960 |

| Cisco Systems Inc | CSCO | 42.75 | 0.54(1.28%) | 64551 |

| Citigroup Inc., NYSE | C | 69.55 | -0.30(-0.43%) | 21485 |

| Deere & Company, NYSE | DE | 139.5 | 0.29(0.21%) | 530 |

| Exxon Mobil Corp | XOM | 81.65 | -0.57(-0.69%) | 1664 |

| Facebook, Inc. | FB | 208.75 | -0.61(-0.29%) | 48995 |

| Ford Motor Co. | F | 10.89 | 0.02(0.18%) | 55428 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 16.47 | -0.61(-3.57%) | 117655 |

| General Electric Co | GE | 13.73 | -0.02(-0.15%) | 28792 |

| General Motors Company, NYSE | GM | 39.95 | 0.08(0.20%) | 4454 |

| Goldman Sachs | GS | 231 | -0.24(-0.10%) | 3224 |

| Google Inc. | GOOG | 1,190.49 | -5.39(-0.45%) | 3299 |

| Intel Corp | INTC | 51.55 | -0.17(-0.33%) | 36549 |

| International Business Machines Co... | IBM | 147.6 | 3.08(2.13%) | 125199 |

| Johnson & Johnson | JNJ | 127.3 | -0.50(-0.39%) | 500 |

| JPMorgan Chase and Co | JPM | 111.15 | -0.38(-0.34%) | 12212 |

| McDonald's Corp | MCD | 157.5 | -0.43(-0.27%) | 1009 |

| Microsoft Corp | MSFT | 104.85 | -0.27(-0.26%) | 106453 |

| Nike | NKE | 76.1 | -0.49(-0.64%) | 5800 |

| Pfizer Inc | PFE | 37.56 | -0.10(-0.27%) | 1635 |

| Procter & Gamble Co | PG | 78.28 | -0.72(-0.91%) | 6477 |

| Starbucks Corporation, NASDAQ | SBUX | 51.01 | -0.14(-0.27%) | 2152 |

| Tesla Motors, Inc., NASDAQ | TSLA | 316.8 | -7.05(-2.18%) | 119494 |

| The Coca-Cola Co | KO | 45 | -0.12(-0.27%) | 110 |

| Travelers Companies Inc | TRV | 126 | -4.00(-3.08%) | 3689 |

| Twitter, Inc., NYSE | TWTR | 43.13 | -0.21(-0.48%) | 66189 |

| UnitedHealth Group Inc | UNH | 255.5 | 0.08(0.03%) | 722 |

| Verizon Communications Inc | VZ | 51 | -0.14(-0.27%) | 4262 |

| Visa | V | 141.38 | 0.48(0.34%) | 11528 |

| Wal-Mart Stores Inc | WMT | 87.9 | -0.17(-0.19%) | 700 |

| Walt Disney Co | DIS | 111.1 | 0.41(0.37%) | 16529 |

| Yandex N.V., NASDAQ | YNDX | 37.77 | -0.29(-0.76%) | 5770 |

IBM (IBM) target lowered to $178 from $182 at Stifel

IBM (IBM) target lowered to $172 from $175 at BMO Capital Mkts

IBM (IBM) target lowered to $185 from $198 at Morgan Stanley

IBM (IBM) target lowered to $150 from $160 at Deutsche Bank

Tesla (TSLA) downgraded to Underperform from Hold at Needham

Procter & Gamble (PG) downgraded to Neutral from Buy at UBS

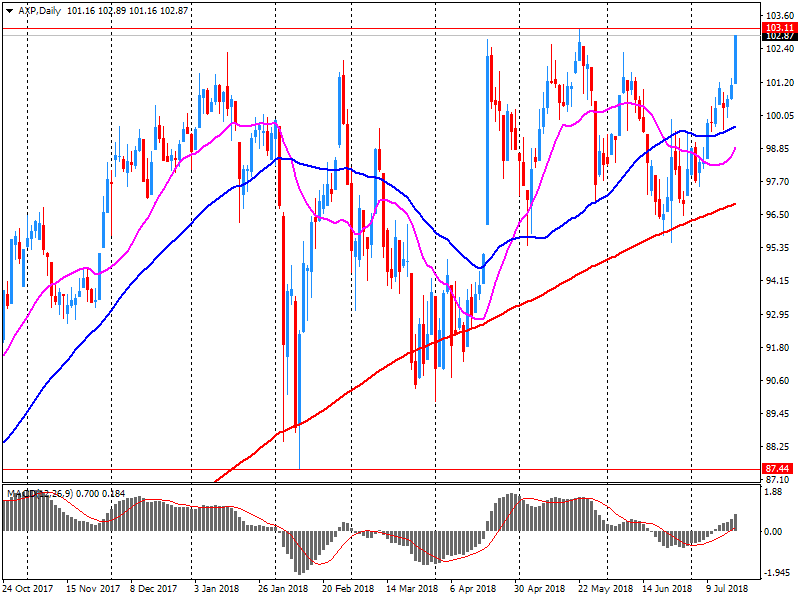

American Express (AXP) reported Q2 FY 2018 earnings of $1.84 per share (versus $1.47 in Q2 FY 2017), beating analysts' consensus estimate of $1.81.

The company's quarterly revenues amounted to $10.002 bln (+9.0% y/y), generally in-line with analysts' consensus estimate of $10.047 bln.

AXP closed Wednesday's trading session at $102.98 (+1.81%).

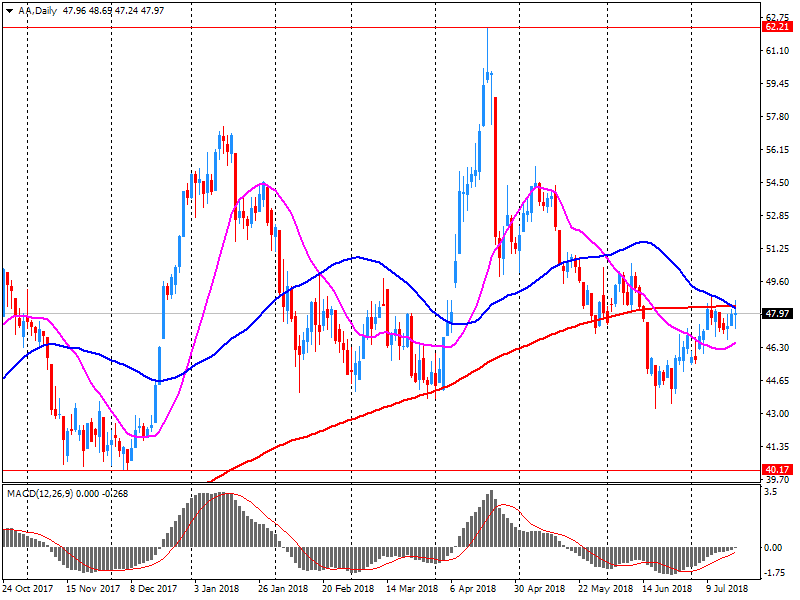

Alcoa (AA) reported Q2 FY 2018 earnings of $1.52 per share (versus $0.62 in Q2 FY 2017), beating analysts' consensus estimate of $1.32.

The company's quarterly revenues amounted to $3.579 bln (+25.2% y/y), beating analysts' consensus estimate of $3.494 bln.

AA closed Wednesday's trading session at $47.96 (-0.12%).

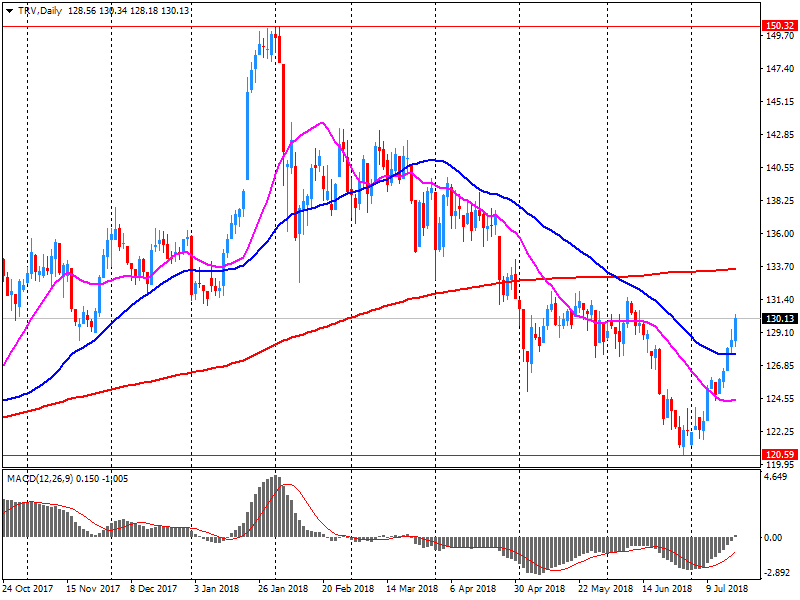

Travelers (TRV) reported Q2 FY 2018 earnings of $1.81 per share (versus $1.92 in Q2 FY 2017), missing analysts' consensus estimate of $2.39.

The company's quarterly revenues amounted to $6.695 bln (+5.4% y/y), generally in-line with analysts' consensus estimate of $6.664 bln.

TRV fell to $127.00 (-2.31%) in pre-market trading.

eBay (EBAY) reported Q2 FY 2018 earnings of $0.53 per share (versus $0.45 in Q2 FY 2017), beating analysts' consensus estimate of $0.51.

The company's quarterly revenues amounted to $2.640 bln (+9.10% y/y), generally in-line with analysts' consensus estimate of $2.662 bln.

The company also issued guidance for Q3, projecting EPS of $0.54-$0.56 (versus analysts' consensus estimate of $0.56) and revenues of $2.64-$2.69 bln (versus analysts' consensus estimate of $2.73 bln).

For the full 2018, the company forecast EPS of $2.28-$2.32 (versus analysts' consensus estimate of $2.27) and revenues of $10.75-$10.85 bln (versus analysts' consensus estimate of $10.95 bln).

EBAY fell to $35.56 (-6.30%) in pre-market trading.

IBM (IBM) reported Q2 FY 2018 earnings of $3.08 per share (versus $2.97 in Q2 FY 2017), beating analysts' consensus estimate of $3.04.

The company's quarterly revenues amounted to $20.003 bln (+3.7% y/y), generally in-line with analysts' consensus estimate of $19.846 bln.

IBM rose to $148.70 (+2.89%) in pre-market trading.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.