- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

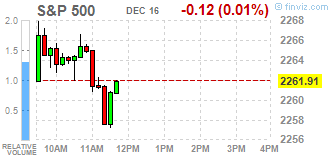

Major U.S. stock-indexes little changed on Friday. The Fed sees three rate hikes next year instead of the two foreseen in September, partly as a result of the expected economic benefits under President-elect Donald Trump.

Most of Dow stocks in negative area (17 of 30). Top gainer - General Electric Company (GE, +1.17%). Top loser - Intel Corporation (INTC, -1.36%).

All S&P sectors in positive area. Top gainer - Conglomerates (+1.5%). Top loser - Technology (-0.5%).

At the moment:

Dow 19811.00 +8.00 +0.04%

S&P 500 2255.75 -2.75 -0.12%

Nasdaq 100 4921.75 -13.00 -0.26%

Oil 53.00 +1.03 +1.98%

Gold 1140.50 +10.70 +0.95%

U.S. 10yr 2.58 +0.00

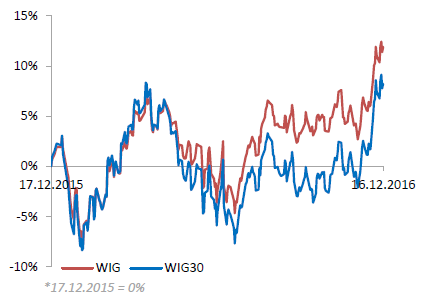

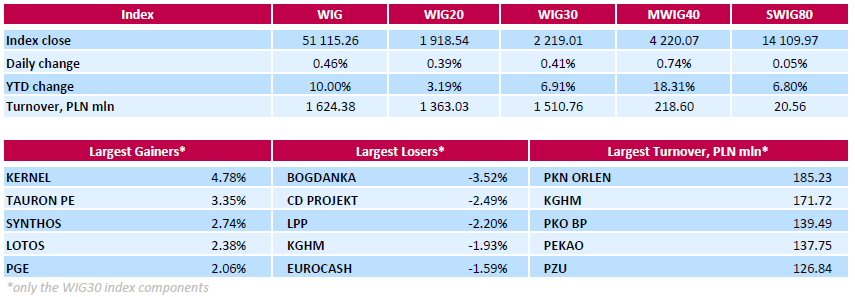

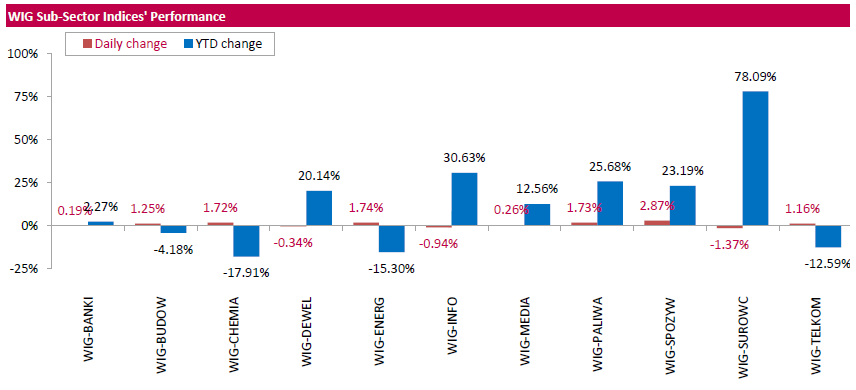

Polish equity market closed higher on Friday. The broad market measure, the WIG Index, surged by 0.46%. The WIG sub-sector indices were mainly higher with food stocks (+2.87%) outperforming.

The large-cap stocks' measure, the WIG30 Index, advanced 0.41%. Nearly 2/3 of all index components returned gains, with the way up led by agricultural producer KERNEL (WSE: KER), genco TAURON PE (WSE: TPE), chemical producer SYNTHOS (WSE: SNS) and oil refiner LOTOS (WSE: LTS), which added between 2.38% and 4.78%. On the other side of the ledger, thermal coal miner BOGDANKA (WSE: LWB), videogame developer CD PROJEKT (WSE: CDR) and clothing retailer LPP (WSE: LPP) topped decliners' list, falling by 3.52%, 2.49% and 2.2% respectively.

Wall Street began from a slight increase, although the scale of change suggests that we will see a replication scenario for the last days. The whole week of trading in America shows consolidation but the bulls have the chance of a successful closing of the next week, which is important due to adverse for market shares statement of Fed.

On 15:50 (Warsaw time) on the Warsaw market has started the last 60 minutes of continuous trading, which will be decisive to determine the settlement price of the December series.

Into this last hour of trading the WIG20 enter on the level of 1,917 points (+ 0.32%).

U.S. stock-index futures rose slightly, approaching to the pre-Fed levels.

Global Stocks:

Nikkei 19,401.15 +127.36 +0.66%

Hang Seng 22,020.75 -38.65 -0.18%

Shanghai 3,124.03 +6.35 +0.20%

FTSE 7,008.03 +9.02 +0.13%

CAC 4,832.98 +13.75 +0.29%

DAX 11,400.89 +34.49 +0.30%

Crude $51.28 (+0.75%)

Gold $1,135.40 (+0.50%)

(company / ticker / price / change ($/%) / volume)

| Amazon.com Inc., NASDAQ | AMZN | 763.5 | 2.50(0.3285%) | 9115 |

| American Express Co | AXP | 75.12 | 0.18(0.2402%) | 500 |

| Apple Inc. | AAPL | 116.4 | 0.58(0.5008%) | 125217 |

| Barrick Gold Corporation, NYSE | ABX | 14.2 | 0.20(1.4286%) | 68595 |

| Boeing Co | BA | 153.59 | -0.18(-0.1171%) | 225 |

| Caterpillar Inc | CAT | 94.86 | 0.33(0.3491%) | 1079 |

| Citigroup Inc., NYSE | C | 60.6 | 0.37(0.6143%) | 5989 |

| Exxon Mobil Corp | XOM | 91.26 | 0.37(0.4071%) | 4070 |

| Facebook, Inc. | FB | 120.87 | 0.30(0.2488%) | 23274 |

| Ford Motor Co. | F | 12.67 | 0.09(0.7154%) | 14806 |

| General Electric Co | GE | 31.61 | 0.35(1.1196%) | 71927 |

| Goldman Sachs | GS | 244.09 | 1.09(0.4486%) | 5570 |

| Google Inc. | GOOG | 801 | 3.15(0.3948%) | 1004 |

| Home Depot Inc | HD | 136.13 | 0.29(0.2135%) | 2395 |

| HONEYWELL INTERNATIONAL INC. | HON | 113.56 | -2.78(-2.3895%) | 12568 |

| Intel Corp | INTC | 36.68 | -0.11(-0.299%) | 2254 |

| International Business Machines Co... | IBM | 169.1 | 1.08(0.6428%) | 1718 |

| JPMorgan Chase and Co | JPM | 86.39 | 0.39(0.4535%) | 10923 |

| Merck & Co Inc | MRK | 62.75 | 0.38(0.6093%) | 3286 |

| Microsoft Corp | MSFT | 62.72 | 0.14(0.2237%) | 990 |

| Nike | NKE | 51.63 | 0.34(0.6629%) | 14782 |

| Pfizer Inc | PFE | 33 | 0.25(0.7634%) | 4408 |

| Procter & Gamble Co | PG | 84.8 | 0.12(0.1417%) | 1419 |

| Tesla Motors, Inc., NASDAQ | TSLA | 199.45 | 1.87(0.9465%) | 5488 |

| The Coca-Cola Co | KO | 41.4 | -0.15(-0.361%) | 32825 |

| Twitter, Inc., NYSE | TWTR | 18.87 | 0.08(0.4258%) | 44674 |

| UnitedHealth Group Inc | UNH | 160.73 | 0.11(0.0685%) | 685 |

| Walt Disney Co | DIS | 104.67 | 0.28(0.2682%) | 3460 |

| Yahoo! Inc., NASDAQ | YHOO | 38.79 | 0.38(0.9893%) | 7310 |

| Yandex N.V., NASDAQ | YNDX | 20.82 | 0.24(1.1662%) | 17541 |

Upgrades:

General Electric (GE) upgraded to Outperform from Mkt Perform at Bernstein

Downgrades:

Coca-Cola (KO) downgraded to Equal-Weight from Overweight at Morgan Stanley

Other:

Apple (AAPL) resumed with a Overweight at Piper Jaffray; target $155

FedEx (FDX) target raised to $240 at Cowen

The morning part of today's trading on the Warsaw market ended for the WIG20 index with minor changes and with a modest level of turnover. The course of today's trading indicates more waiting for the final hour than a consolidation after the last increases.

At the halfway point of the session, the WIG20 index was on the level of 1,913 points (+0,12%). The turnover in the segment of blue-chips was amounted to PLN 267 million.

European stocks traded higher, near the highest level since January, helped by growth in the health sector and telecommunications. At the same time, lower banks shares inhibits the rally.

Certain influence on the dynamics of trade had statistical data for the euro area. The final report, submitted by Statistics agency Eurostat showed that in November, consumer prices in the euro area fell by 0.1% after rising 0.2% in October. However, the decline in prices has confirmed the expectations of experts. Meanwhile, the growth rate of annual inflation accelerated to 0.6% from 0.5% in the previous month. Core CPI, which excludes energy and food prices, rose 0.8% year on year, confirming the forecasts and coincided with the previous estimate. Recall that in October the index also increased by 0.8%. Among EU countries, annual inflation rose in November by 0.6% after rising 0.5% in October. A year earlier the rate was at 0.1%. The report also stated that the bigest increase in prices in the euro area (in annual terms) was seen in restaurants and cafes (+ 0.07%). Expenses for the rent increased by 0.04%. The cost of tobacco products also increased by 0.04%.

The composite index of the largest companies in the region Stoxx Europe 600 is trading with an increase of 0.29 percent. Over the past two weeks, the index rose nearly 6 percent .

Shares of Banca Monte dei Paschi di Siena increased by 0.7 per cent after receiving regulatory approval to extend the bond exchange program. However, experts note that the concerns about the need for government intervention remain.

At the moment:

FTSE 100 +13.36 7012.30 + 0.19%

DAX +52.38 11418.78 + 0.46%

CAC 40 +26.77 4846.00 + 0.56%

WIG20 index opened at 1913.05 points (+0.10%)*

WIG 50982.38 0.20%

WIG30 2215.75 0.27%

mWIG40 4200.84 0.28%

*/ - change to previous close

Investors in Europe started the day from virtually neutral level. In the Warsaw market, we have to deal with the optimism and after the first transactions the WIG20 index rose by 0.5 percent. For the bulls helps the stronger zloty, but the turnover does not look impressive. After fifteen minutes of trading WIG20 index reached 1,919 points (+ 0.44%).

Indices on the New York stock markets rose slightly on Thursday after the release of good macroeconomic data from the US economy. Oil remained largely unchanged. Heavily fell quotations of gold. Rising yields of the US bonds. The dollar is the strongest since 2003. The Dow Jones Industrial at closing increased by 0.3 percent, the S&P500 by 0.39 percent while the Nasdaq Comp. went up by 0.37 per cent.

From the perspective of European markets, the most important element is light withdrawal on Wall Street in the second half of the day which may result in a similar withdrawal in Europe.

It must be remembered that today the world is facing a session with the settlement of derivatives, so part of the trade will be disturbed by players from futures markets.

There is no important elements in the macro calendar today.

Third Friday in December is also the day of settlement of derivative in Warsaw. Usually the market may be muted in anticipation of the final hour of the session and the festival of basket orders, which not only disturb the image of activity during the day, but also discourage entry into the game before the time of miracles. Thus, for reliable technical trade we have to wait until the next week.

European stocks on Thursday closed just shy of a 2016 high as bank shares rallied and the euro sank after the U.S. Federal Reserve signaled a faster pace of interest-rate hikes than previously mapped out. But shares in mining companies fell as the U.S. dollar continued its post-Fed surge. The dollar's jump came partly at the expense of the shared currency, which traded at 14-year lows against the greenback.

U.S. stocks closed higher Thursday, but off their intraday highs, as investors adjusted to the Federal Reserve's plan for a faster path of interest-rate increases in 2017. After a pullback following the Fed decision Wednesday, stock-market indexes resumed their post-election march higher.

Asian shares steadied on Friday, tracking U.S. gains, with financials leading Japan's stock market to a fresh high for the year. Japan financials are benefiting from rising yields for global government bonds, in which they invest heavily.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.