- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei 225 19,494.53 0.00 0.00%

Shanghai Composite 3,102.48 -15.61 -0.50%

S&P/ASX 200 5,591.08 0.00 0.00%

FTSE 100 7,043.96 +26.80 +0.38%

CAC 40 4,849.89 +27.12 +0.56%

Xetra DAX 11,464.74 +38.04 +0.33%

S&P 500 2,270.76 +8.23 +0.36%

Dow Jones Industrial Average 19,974.62 +91.56 +0.46%

S&P/TSX Composite 15,292.96 +23.11 +0.15%

Major US stock indexes rose on Tuesday, with the Dow hit a record high against the background of growth of Goldman Sachs (GS), which gave the biggest boost blue-chip index. The market reacted calmly to the deadly attacks in Germany and Turkey, as well as fire at the Islamic center of Zurich in Switzerland. Trading activity in the market is low and likely to remain so, as many market participants go on vacation.

Market participants are focused on the promises of the newly elected President of the United States, Donald Trump and prospects of the Fed's monetary policy in 2017. Recall, at its last meeting, which ended on Wednesday, 14 December, the regulator will not only increase the interest for the first time this year (by 0.25 percentage points to 0.50% -0.75%), but also improved predictions about the pace of rate hikes in the next year: at the moment it predicted three raises rates by 25 bps against two waiting at previous meetings. Optimism added as a comment yesterday Fed Chairman Janet Yellen relatively labor market prospects in the US and accelerating inflation. Ms. Yellen said that the labor market has improved his fortune to the most severe in a decade, wage growth has increased, which has helped to increase inflation expectations and the expectations of the Fed interest rates.

It is also worth noting that after the closure of the trading session is expected to publish quarterly reports FedEx (FDX) and Nike (NKE).

DOW index components closed mostly in positive territory (21 of 30). Most remaining shares rose NIKE, Inc. (NKE, + 1.72%). Outsider were shares of Merck & Co., Inc. (MRK, -1.05%).

Almost all sectors of the S & P ended the session in positive territory. The leader turned out to be the financial sector (+ 0.7%). Decreased only utilities sector (-0.1%).

At the close:

Dow + 0.46% 19,973.73 +90.67

Nasdaq + 0.49% 5,483.94 +26.50

S & P + 0.36% 2,270.73 +8.20

Polish equity market closed higher on Tuesday. The broad market measure, the WIG Index, rose by 0.7%. The WIG sub-sector indices were mainly higher with materials (+3.29%) outperforming.

The large-cap stocks' measure, the WIG30 Index, surged by 0.97%. A majority of the index components returned gains, with the way up led by oil and gas producer PGNIG (WSE: PGN), which soared by 6.04%. Other major advancers were coking coal miner JSW (WSE: JSW) and two genco TAURON PE (WSE TPE) and PGE (WSE: PGE), which added between 4.03% and 5.8%. Among few decliners, two oil refiners PKN ORLEN (WSE: PKN) and LOTOS (WSE: LTS) were the weakest performers, tumbling by 2.75% and 1.73% respectively, weighted down by analyst downgrade.

Major U.S. stock-indexes rose on Tuesday. Financial stocks pushed the Dow to a record high, Goldman Sachs (GS), which was up 1,2%, gave the biggest boost to the blue-chip index. U.S. stocks have been on a tear since the November 8 presidential election, with the S&P rising nearly 6 percent on bets that President-elect Donald Trump's plans for deregulation and infrastructure spending will boost the economy.

Most of Dow stocks in positive area (17 of 30). Top gainer - Caterpillar Inc. (CAT, +1.81%). Top loser - Pfizer Inc. (PFE, -0.70%).

All S&P sectors in positive area. Top gainer - Conglomerates (+0.9%).

At the moment:

Dow 19911.00 +74.00 +0.37%

S&P 500 2267.75 +7.75 +0.34%

Nasdaq 100 4958.25 +19.50 +0.39%

Oil 53.62 +0.56 +1.06%

Gold 1129.00 -13.70 -1.20%

U.S. 10yr 2.58 +0.04

The market in the United States opens with an increase of 0.22%, which is fully consistent with the behavior of the futures market. It helps increase in oil prices, which de facto also improved climate around the Stock Exchange and listed on the Warsaw mining companies. On Wall Street still we are seeing consolidation and aversion to discounts should be considered as a bulls success. Slowly we enter the Christmas period, and then the end of the year, which in principle would be positive for shareholders.

An hour before the end of today's trading the WIG20 index was at the level of 1,940 points (+0.79%).

U.S. stock-index futures advanced as markets reacted calmly to deadly attacks in Germany and Turkey, and a shooting at an Islamic center in Zurich, Switzerland.

Global Stocks:

Nikkei 19,494.53 +102.93 +0.53%

Hang Seng 21,729.06 -103.62 -0.47%

Shanghai 3,102.48 -15.61 -0.50%

FTSE 7,040.13 +22.97 +0.33%

CAC 4,845.24 +22.47 +0.47%

DAX 11,452.24 +25.54 +0.22%

Crude $53.44 (+0.72%)

Gold $1,130.50 (-1.07%)

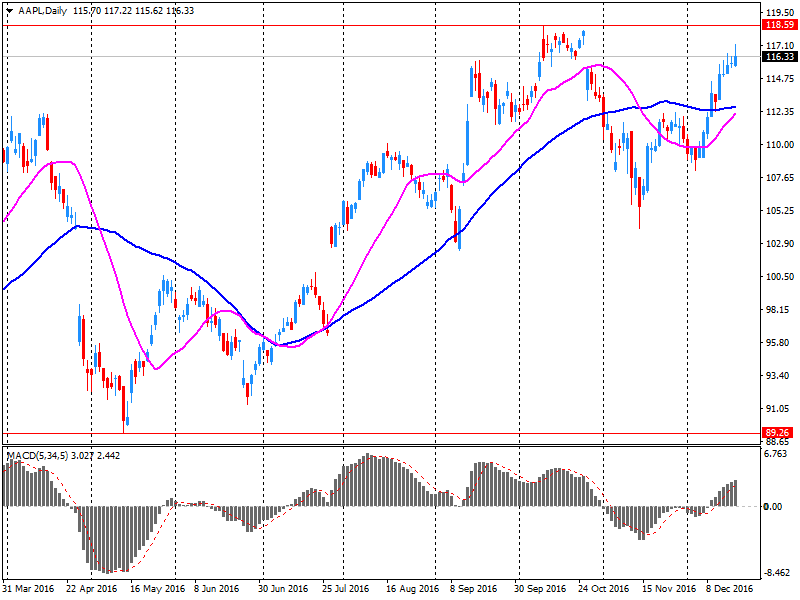

According to WSJ, citing two senior government officials, Apple has discussed with the Indian government the ability to manufacture its products in the country as it seeks to increase sales and presence there.

In a letter to the government the company outlined its plans and financial measures it needs to achieve them, officials said. After that, representatives of the Ministry of Commerce held a meeting to discuss the matter.

A spokesman for Apple has not responded on the WSJ information.

The implementation of the process of production will enable Apple to open its own stores in India, which will help promote its brand in the country with the fastest growing smartphone market, where its share at the moment is less than 5%.

Indian smartphone market is expected to surpass the US market, and will be the second largest in the world after China, according to research firm IDC. Over the years, sales in China have fueled the growth of Apple, but now it slows down the pace.

AAPL shares rose in premarket trading to $ 116.80 (+ 0.14%).

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 29.76 | 0.47(1.6046%) | 937 |

| ALTRIA GROUP INC. | MO | 67.31 | 0.16(0.2383%) | 513088 |

| Amazon.com Inc., NASDAQ | AMZN | 768.6 | 2.60(0.3394%) | 15273 |

| Apple Inc. | AAPL | 116.75 | 0.11(0.0943%) | 83778 |

| AT&T Inc | T | 42.22 | 0.10(0.2374%) | 4397 |

| Barrick Gold Corporation, NYSE | ABX | 14.04 | -0.20(-1.4045%) | 127784 |

| Boeing Co | BA | 156.5 | 0.32(0.2049%) | 3619 |

| Caterpillar Inc | CAT | 93.55 | 0.84(0.9061%) | 6614 |

| Citigroup Inc., NYSE | C | 59.99 | 0.33(0.5531%) | 54083 |

| Exxon Mobil Corp | XOM | 90.8 | 0.38(0.4203%) | 26215 |

| Facebook, Inc. | FB | 119.31 | 0.07(0.0587%) | 68506 |

| FedEx Corporation, NYSE | FDX | 198.5 | 0.88(0.4453%) | 3315 |

| Ford Motor Co. | F | 12.7 | 0.04(0.316%) | 28614 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.64 | 0.09(0.6642%) | 55976 |

| General Electric Co | GE | 31.98 | 0.06(0.188%) | 18109 |

| Goldman Sachs | GS | 240 | 0.93(0.389%) | 9909 |

| Intel Corp | INTC | 36.99 | 0.10(0.2711%) | 43632 |

| JPMorgan Chase and Co | JPM | 85.78 | 0.35(0.4097%) | 23419 |

| McDonald's Corp | MCD | 123.25 | 0.26(0.2114%) | 7955 |

| Microsoft Corp | MSFT | 63.77 | 0.15(0.2358%) | 61987 |

| Nike | NKE | 51.15 | 0.30(0.59%) | 18514 |

| Pfizer Inc | PFE | 32.85 | 0.02(0.0609%) | 34676 |

| Tesla Motors, Inc., NASDAQ | TSLA | 203.58 | 0.85(0.4193%) | 7444 |

| Twitter, Inc., NYSE | TWTR | 18.3 | 0.06(0.3289%) | 19991 |

| Walt Disney Co | DIS | 105.7 | 0.40(0.3799%) | 16185 |

| Yandex N.V., NASDAQ | YNDX | 20.16 | 0.20(1.002%) | 16600 |

Upgrades:

Caterpillar (CAT) upgraded to Positive from Mixed at OTR Global

Downgrades:

Other:

The first half of today's session on the Warsaw market has brought breakout to new highs in case of the largest companies index. The environment is clearly calmer and thus, like yesterday, the Warsaw Stock Exchange stands out positively.

At the halfway point of today's quotations the WIG20 index was at the level 1,941 points (+0,90%) and the turnover in the segment of the largest companies was amounted to PLN 270 million.

Stock indices in Europe are trading without major dynamics. The market has a burst of activity in mergers and acquisitions (M & A).

The composite index of the largest companies in the region Stoxx Europe 600 rose 0,2%, to 360.43 points.

Mediaset shares soared 17% on the information that the French Vivendi SA intends to increase its stake in the Italian broadcasting company founded and controlled by former Italian Prime Minister Silvio Berlusconi, to 30%.

The cost of Lloyds Banking Group shares increased by 1%. The Bank said it was buying British credit card issuer MBNA Ltd. at the FIA Jersey Holdings Ltd., owned by Bank of America, for 1.9 billion pounds ($ 2.4 billion) in cash.

Share of Italian banks rose on the information that the government will offer 20 billion euros to support the most troubled banks.

Shares of Monte dei Paschi rose 1,1%, Banca Popolare di Milano +2,6%, UniCredit +2%.

The Italian Government, in spite of the appeal to the Parliament, is still hoping that will be able to avoid the infusion of taxpayers' money in the troubled banking sector. This will depend on the ability of Monte dei Paschi, the third by market capitalization in the country to implement a plan of recapitalization of 5 billion euros by the end of the year, writes FT.

Meanwhile, the shares of mining companies decline after falling prices for base metals.

Randgold Resources fell 1,2%, Glencore - 0,7%, BHP Billiton - 0.5%.

Shares of individual transport companies and tourism sector react negatively to reports about the murder of the Russian ambassador in Turkey and the death of people in Berlin as a result of a truck collison, suspected terorist attack.

Thus, the value of International Consolidated Airlines Group (IAG), which includes British Airways, fell 0,5%, InterContinental Hotels Group - also by 0.5%.

At the moment:

FTSE 7013.00 -4.16 -0.06%

DAX 11432.75 6.05 0.05%

CAC 4837.91 15.14 0.31%

WIG20 index opened at 1929.47 points (+0.25%)*

WIG 51294.59 0.32%

WIG30 2230.90 0.47%

mWIG40 4195.52 0.14%

*/ - change to previous close

Cash market opens with an increase of 0.25% with the turnover clearly focused on the GTC. Yesterday's session was so successful that roused appetites for more. The environment is clearly calmer and the German DAX lost slightly in value.

After fifteen minutes of trading WIG20 index was at the level of 1,938 points (+0.74%).

Monday's session on the New York stock markets brought slight increases in the major indexes. At the close the Dow Jones Industrial rose by 0.20 percent, Nasdaq Composite was firmer by 0.37 percent and the S&P500 gained 0.20 percent.

In yesterday's speech Janett Yellen, the head of the Fed, assessed that the US currently has the strongest job market in a decade, and there are signs of accelerating wage growth.

At the opening of Europe may be of importance yesterday evening events, it is a coup in Berlin, where the truck drove into the crowd of people and the assassination of the Russian ambassador in Ankara. It is increasing geopolitical tension, but investors after previous similar events are more immune.

In Asian markets, the Nikkei gained approx. 0.5% and on other parquets are dominates by the red colour, which in China is slightly higher and the stock market index in Shanghai loses approx. 0.9%. The US futures are stable in the morning and so it should begin sessions in Europe.

European stock markets dropped from a 2016 high on Monday, with the recent rally in banks on pause as troubled lender Banca Monte dei Paschi di Siena SpA made a last-ditch effort to avoid a state bailout. Banks have been a major factor in the recent rally, rising on hopes for a resolution to the Italian banking crisis and tracking sharp gains in the U.S. financial services sector.

U.S. stocks advanced tepidly on Monday with investors somewhat reluctant to make big bets in a preholiday week while the main benchmarks were sitting near all-time highs set last week. Trading volumes were thinner than usual, with the New York Stock Exchange reporting volume at 60% of the 30-year average, according to FactSet. After a mild knee-jerk reaction to news of the assassination of the Russian ambassador to Turkey, markets resumed their climb to close modestly higher.

A strong outlook on the U.S. economy by U.S. Federal Reserve chair Janet Yellen and positive economic data from Germany lifted Asian shares Tuesday, even as traders reacted to the attacks in Berlin and Turkey. Speaking at the University of Baltimore's midyear commencement ceremony Monday, Yellen said recent improvements in the economy have created one of the strongest job markets in years for graduates.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.