- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei +63.33 18418.59 +0.35%

TOPIX +5.84 1471.53 +0.40%

Hang Seng -337.12 23924.54 -1.39%

CSI 300 -17.19 3462.63 -0.49%

Euro Stoxx 50 -38.48 3409.78 -1.12%

FTSE 100 -180.09 7147.50 -2.46%

DAX -108.56 12000.44 -0.90%

CAC 40 -80.85 4990.25 -1.59%

DJIA -113.64 20523.28 -0.55%

S&P 500 -6.82 2342.19 -0.29%

NASDAQ -7.31 5849.47 -0.12%

S&P/TSX -62.32 15622.57 -0.40%

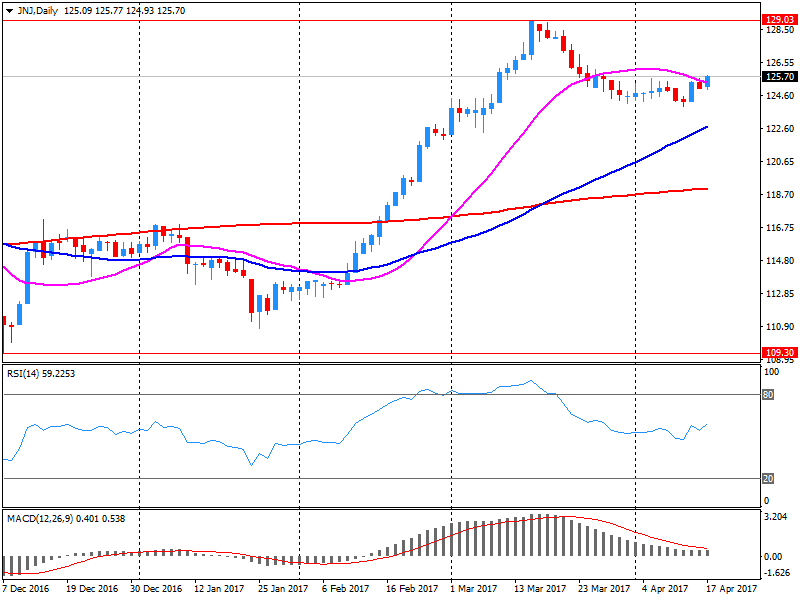

Major US stock indexes declined on Tuesday, as corporate heavyweights Goldman Sachs and Johnson & Johnson disappoint investors with their quarterly results, while geopolitical tensions continued to affect the sentiment of market participants.

In addition, as it became known, in March, US housing construction fell, as the construction of single-family houses in the Midwest recorded the largest decline in three years, probably due to bad weather. The laying of new houses fell by 6.8% to an annual rate of 1.22 million units, the Commerce Ministry said on Tuesday. The laying of new homes for February was revised to 1.30 million units from the previously reported 1.29 million units.

At the same time, the demand for heating increased industrial production in March. The Federal Reserve said that industrial production rose by 0.5% in March, with the increase attributable to record growth in the volume of public utilities. The release of utility services in March rose by a record 8.6%, as colder temperatures returned after warm weather in the first two months of the year, the Fed said.

Quotes of oil moderately decreased, reaching a 2-week low, which was due to news that the volume of oil shale in the US is likely to increase sharply in May. According to the forecasts of the US Energy Ministry, the production of shale oil in the fields of the largest oil and gas producing regions of the USA in May will grow by 124 thousand barrels per day in comparison with April - up to 5.193 million barrels.

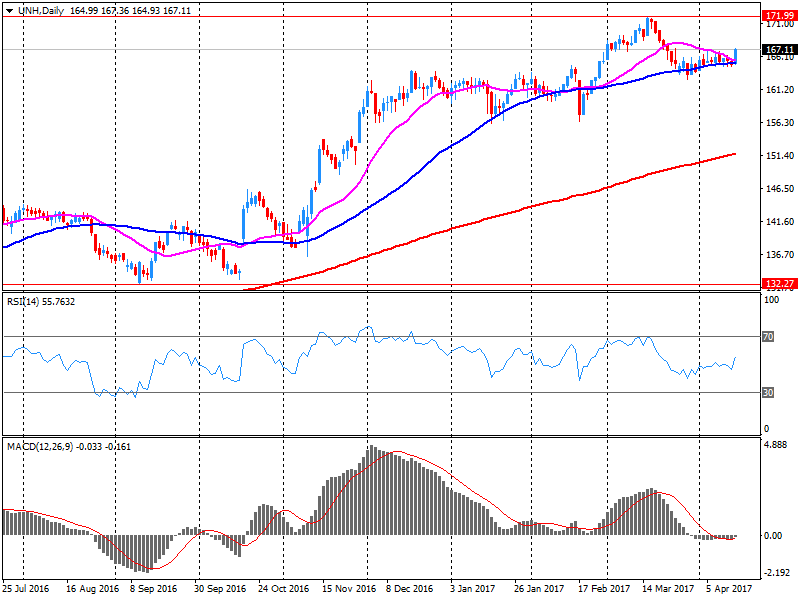

Components of the DOW index finished the session in different directions (16 in negative territory, 14 in positive territory). The Goldman Sachs Group, Inc. fell more than the rest. (GS, -4.72%). The leader of growth was shares UnitedHealth Group Incorporated (UNH, + 1.06%).

Most sectors of the S & P index showed a decline. The main materials sector fell most of all (-0.8%). The growth leader was the conglomerate sector (+ 0.4%).

At closing:

DJIA -0.55% 20,523.96 -112.96

Nasdaq -0.12% 5,849.47 -7.32

S & P -0.29% 2,342.22 -6.79

U.S. stock-index fell as investors weighed a possible delay in tax reforms, while keeping an eye on quarterly earnings and global politics.

Stocks:

Nikkei 18,418.59 +63.33 +0.35%

Hang Seng 23,924.54 -337.12 -1.39%

Shanghai 3,196.60 -25.57 -0.79%

FTSE 7,194.96 -132.63 -1.81%

CAC 5,008.08 -63.02 -1.24%

DAX 12,035.85 -73.15 -0.60%

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 190 | -0.36(-0.19%) | 105 |

| ALCOA INC. | AA | 31.13 | -0.18(-0.57%) | 4167 |

| Amazon.com Inc., NASDAQ | AMZN | 900.01 | -1.98(-0.22%) | 16312 |

| AMERICAN INTERNATIONAL GROUP | AIG | 59.71 | -0.22(-0.37%) | 100 |

| Apple Inc. | AAPL | 141.5 | -0.33(-0.23%) | 52126 |

| AT&T Inc | T | 40.32 | 0.02(0.05%) | 3899 |

| Barrick Gold Corporation, NYSE | ABX | 19.88 | 0.04(0.20%) | 44392 |

| Boeing Co | BA | 179 | -0.02(-0.01%) | 1053 |

| Cisco Systems Inc | CSCO | 32.5 | -0.11(-0.34%) | 1100 |

| Citigroup Inc., NYSE | C | 58.69 | -0.30(-0.51%) | 26677 |

| Exxon Mobil Corp | XOM | 81.28 | -0.30(-0.37%) | 2390 |

| Facebook, Inc. | FB | 141.15 | -0.27(-0.19%) | 32724 |

| Ford Motor Co. | F | 11.15 | 0.02(0.18%) | 84609 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.53 | -0.22(-1.73%) | 135437 |

| General Electric Co | GE | 29.57 | -0.07(-0.24%) | 5194 |

| General Motors Company, NYSE | GM | 33.8 | -0.10(-0.30%) | 1041 |

| Goldman Sachs | GS | 220.22 | -6.04(-2.67%) | 324768 |

| Home Depot Inc | HD | 147.3 | -0.01(-0.01%) | 136 |

| Intel Corp | INTC | 35.45 | -0.03(-0.08%) | 1074 |

| International Business Machines Co... | IBM | 170.55 | -0.55(-0.32%) | 868 |

| Johnson & Johnson | JNJ | 123.92 | -1.80(-1.43%) | 56488 |

| JPMorgan Chase and Co | JPM | 85.39 | -0.47(-0.55%) | 27017 |

| McDonald's Corp | MCD | 131.95 | 0.60(0.46%) | 1928 |

| Merck & Co Inc | MRK | 62.82 | 0.02(0.03%) | 1096 |

| Microsoft Corp | MSFT | 65.3 | -0.18(-0.27%) | 6278 |

| Nike | NKE | 55.93 | -0.31(-0.55%) | 3534 |

| Procter & Gamble Co | PG | 90.3 | -0.09(-0.10%) | 236 |

| Starbucks Corporation, NASDAQ | SBUX | 58.1 | 0.02(0.03%) | 625 |

| Tesla Motors, Inc., NASDAQ | TSLA | 299.46 | -1.98(-0.66%) | 24635 |

| The Coca-Cola Co | KO | 42.83 | -0.24(-0.56%) | 5035 |

| UnitedHealth Group Inc | UNH | 171 | 3.82(2.29%) | 17515 |

| Verizon Communications Inc | VZ | 48.85 | 0.04(0.08%) | 952 |

| Yahoo! Inc., NASDAQ | YHOO | 47.25 | -0.14(-0.30%) | 1400 |

| Yandex N.V., NASDAQ | YNDX | 24 | -0.27(-1.11%) | 985 |

Upgrades:

McDonald's (MCD) upgraded to Outperform from Mkt Perform at Bernstein; target raised to $160 from $129

Downgrades:

Other:

UnitedHealth (UNH) target raised to $200 from $178 at Mizuho

UnitedHealth reported Q1 FY 2017 earnings of $2.37 per share (versus $1.81 in Q1 FY 2016), beating analysts' consensus estimate of $2.17.

The company's quarterly revenues amounted to $48.723 bln (+9.4% y/y), beating analysts' consensus estimate of $48.211 bln.

The company also sued raised guidance for FY 2017, projecting EPS of $9.65-9.85 (versus previously forecast $9.30-9.60 and analysts' consensus estimate of $9.51) and revenues of $200 bln (versus previously forecast $197-199 bln and analysts' consensus estimate of $198.94 bln).

UNH rose to $171.00 (+2.29%) in pre-market trading.

Johnson & Johnson reported Q1 FY 2017 earnings of $1.83 per share (versus $1.68 in Q1 FY 2016), beating analysts' consensus estimate of $1.77.

The company's quarterly revenues amounted to $17.766 bln (+1.6% y/y), missing analysts' consensus estimate of $18.020 bln.

The company also issued guidance for FY 2017, projecting EPS of $7.00-7.15 versus analysts' consensus estimate of $7.08 and revenues of $75.4-76.1 bln versus analysts' consensus estimate of $75.21 bln.

JNJ fell to $124.20 (-1.21%) in pre-market trading.

Goldman Sachs reported Q1 FY 2017 earnings of $5.15 per share (versus $2.68 in Q1 FY 2016), missing analysts' consensus estimate of $5.19.

The company's quarterly revenues amounted to $8.026 bln (+26.6% y/y), missing analysts' consensus estimate of $8.329 bln.

GS fell to $219.25 (-3.10%) in pre-market trading.

Bank of America reported Q1 FY 2017 earnings of $0.41 per share (versus $0.21 in Q1 FY 2016), beating analysts' consensus estimate of $0.35.

The company's quarterly revenues amounted to $22.445 bln (+6.9% y/y), beating analysts' consensus estimate of $21.766 bln.

BAC rose to $23.00 (+0.83%) in pre-market trading.

European stocks slid Thursday, with banks leading the charge south after President Donald Trump's comments about the dollar and interest rates.

U.S. stocks bounced back on Monday to close near session highs, halting three straight sessions of declines for major benchmarks, as banks enjoyed their best daily rally in six weeks.

A stronger dollar and overnight gains in U.S. stocks helped many Asia-Pacific equities as trading returned in full following the Easter Monday holiday. Chinese steel mills are hunting for higher-grade product to minimize their coking-coal needs after prices of metallurgical coal surged because Cyclone Debbie curbed shipments from Australia. Fortescue responded by offering deeper discounts on its iron ore.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.