- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

Major US stock indices fell slightly on Friday, as investors held back from taking risky deals on the eve of the first round of the presidential elections in France.

In addition, as it became known today, adjusted for seasonality, the preliminary composite PMI release index from Markit in the US fell to 52.7 in April, compared to 53.0 in March, signaling a further slowdown in production growth in the private sector. The latest reading pointed to the weakest growth since September 2016. The modest growth in the private sector reflected a loss of momentum in the economy of the services sector (preliminary index was 52.5 in April), and manufacturing (preliminary index was 53.4).

At the same time, home sales in the secondary market in the US increased more than expected in March, to the highest level in the last ten years, as more homes appeared on the market and they were quickly bought up by consumers. The National Association of Realtors said on Friday that the volume of home sales in the secondary market grew by 4.4 percent and, subject to seasonal adjustment, reached 5.71 million units last month. Economists forecast sales growth of 2.5% to 5.60 million units in March.

Most components of the DOW index closed in the red (16 of 30). More shares fell shares Verizon Communications Inc. (VZ, -2.33%). The leader of growth was shares of Microsoft Corporation (MSFT, + 1.47%).

Most sectors of the S & P index showed a decline. The conglomerate sector fell most of all (-0.7%). The leader of growth was the utilities sector (+ 0.6%).

At closing:

Dow -0.15% 20.547.76 -30.95

Nasdaq -0.11% 5,910.52 -6.26

S & P -0.30% 2,348.70 -7.14

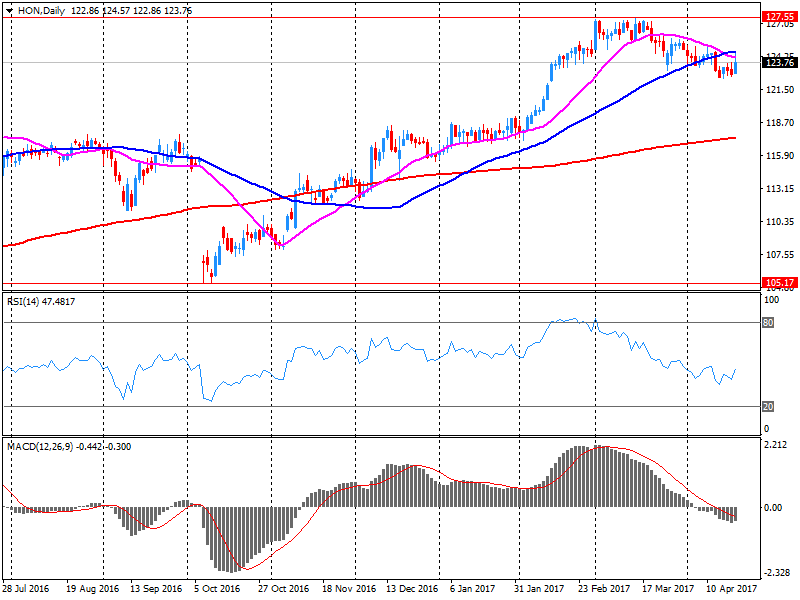

U.S. stock-index rose slightly as, despite positive earnings reports from Visa (V), General Electric (GE) and Honeywell (HON), investors preferred not to make big bets ahead of the first round of the French presidential elections over the weekend.

Stocks:

Nikkei 18,620.75 +190.26 +1.03%

Hang Seng 24,042.02 -14.96 -0.06%

Shanghai 3,173.15 +1.05 +0.03%

FTSE 7,123.83 +5.29 +0.07%

CAC 5,068.41 -9.50 -0.19%

DAX 12,080.12 +52.80 +0.44%

Crude $50.71 (0.00%)

Gold $1,284.10 (+0.02%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 32.43 | 0.39(1.22%) | 2703 |

| Amazon.com Inc., NASDAQ | AMZN | 904.5 | 2.44(0.27%) | 3482 |

| Apple Inc. | AAPL | 142.51 | 0.07(0.05%) | 26431 |

| Barrick Gold Corporation, NYSE | ABX | 19.27 | 0.07(0.36%) | 21119 |

| Boeing Co | BA | 179.6 | 0.30(0.17%) | 1200 |

| Citigroup Inc., NYSE | C | 58.5 | 0.09(0.15%) | 7234 |

| Exxon Mobil Corp | XOM | 81.1 | 0.09(0.11%) | 2079 |

| Facebook, Inc. | FB | 143.93 | 0.13(0.09%) | 15378 |

| Ford Motor Co. | F | 11.49 | 0.02(0.17%) | 18370 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.78 | 0.27(2.16%) | 112556 |

| General Electric Co | GE | 30.57 | 0.30(0.99%) | 1803892 |

| General Motors Company, NYSE | GM | 34.15 | 0.05(0.15%) | 1677 |

| Goldman Sachs | GS | 218.5 | 0.44(0.20%) | 2065 |

| Google Inc. | GOOG | 841.1 | -0.55(-0.07%) | 1114 |

| HONEYWELL INTERNATIONAL INC. | HON | 127.6 | 3.83(3.09%) | 11221 |

| International Business Machines Co... | IBM | 162.75 | 0.45(0.28%) | 950 |

| Johnson & Johnson | JNJ | 122 | 0.13(0.11%) | 235 |

| JPMorgan Chase and Co | JPM | 85.75 | 0.20(0.23%) | 1874 |

| McDonald's Corp | MCD | 133.64 | 0.37(0.28%) | 164 |

| Microsoft Corp | MSFT | 65.55 | 0.05(0.08%) | 491 |

| Pfizer Inc | PFE | 33.7 | -0.04(-0.12%) | 361 |

| Procter & Gamble Co | PG | 89.3 | -0.03(-0.03%) | 331 |

| Starbucks Corporation, NASDAQ | SBUX | 60.28 | 0.20(0.33%) | 4738 |

| Tesla Motors, Inc., NASDAQ | TSLA | 302.48 | -0.03(-0.01%) | 19200 |

| The Coca-Cola Co | KO | 43.04 | -0.05(-0.12%) | 936 |

| Twitter, Inc., NYSE | TWTR | 14.67 | 0.02(0.14%) | 8273 |

| UnitedHealth Group Inc | UNH | 171.8 | 0.26(0.15%) | 301 |

| Verizon Communications Inc | VZ | 48.28 | -0.13(-0.27%) | 16306 |

| Visa | V | 93.21 | 2.06(2.26%) | 93599 |

| Wal-Mart Stores Inc | WMT | 74.73 | -0.07(-0.09%) | 153 |

| Walt Disney Co | DIS | 114.81 | 0.02(0.02%) | 2213 |

| Yahoo! Inc., NASDAQ | YHOO | 47.68 | 0.01(0.02%) | 1058 |

| Yandex N.V., NASDAQ | YNDX | 23.6 | 0.29(1.24%) | 5600 |

Upgrades:

Downgrades:

Verizon (VZ) downgraded to Hold from Buy at Argus

Other:

McDonald's (MCD) initiated with an Outperform at BMO Capital

McDonald's (MCD) target raised to $140 from $136 at Telsey Advisory Group

Honeywell (HON) reported Q1 FY 2017 earnings of $1.66 per share (versus $1.53 in Q1 FY 2016), beating analysts' consensus estimate of $1.64.

The company's quarterly revenues amounted to $9.492 bln (-0.3% y/y), beating analysts' consensus estimate of $9.329 bln.

The company also issued in-line guidance for FY 2017, projecting EPS of $6.90-7.10 versus beating analysts' consensus estimate of $7.03.

HON rose to $127.86 (+3.30%) in pre-market trading.

General Electric (GE) reported Q1 FY 2017 earnings of $0.21 per share (versus $0.21 in Q1 FY 2016), beating analysts' consensus estimate of $0.17.

The company's quarterly revenues amounted to $27.660 bln (-0.7% y/y), beating analysts' consensus estimate of $26.371 bln.

The company also reaffirmed guidance for FY 2017, projecting EPS of $1.60-1.70 versus analysts' consensus estimate of $1.63.

GE

rose to $30.45 (+0.59%) in pre-market trading.

Visa (V) reported Q2 FY 2017 earnings of $0.86 per share (versus $0.68 in Q2 FY 2016), beating analysts' consensus estimate of $0.79.

The company's quarterly revenues amounted to $4.477 bln (+23.5% y/y), beating analysts' consensus estimate of $4.291 bln.

The company also reported its Board authorized a new $5.0 billion class A common stock share repurchase program.

V rose to $93.60 (+2.69%) in pre-market trading.

French stocks leapt by the most in seven weeks Thursday, ending higher as gains for Publicis Groupe SA and Pernod Ricard SA helped relieve pressure from concerns over the outcome of Sunday's first-round presidential election vote. The pan-European index was held back by declines in the oil and gas and utility sectors, but the industrial, financial and technology groups printed gains.

The stock market ended with solid gains Thursday, with the Nasdaq closing at a record, as investors welcomed a deluge of stronger-than-expected corporate earnings reports and economic data. Comments by Treasury Secretary Steven Mnuchin, who said that President Donald Trump's tax overhaul plans aren't linked to the outcome of a health care bill, also bolstered sentiment, analysts said.

Stock markets across Asia were higher early Friday, catching an updraft from overnight gains in the U.S. as investors positioned themselves ahead of the start of the French presidential election. Markets were calm following a suspected terrorist attack in Paris overnight that left at least one police officer dead, three days before the election.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.