- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei +203.45 19079.33 +1.08%

TOPIX +16.02 1519.21 +1.07%

Hang Seng +316.46 24455.94 +1.31%

CSI 300 +10.05 3441.43 +0.29%

Euro Stoxx 50 +5.78 3583.16 +0.16%

FTSE 100 +10.96 7275.64 +0.15%

DAX +12.06 12467.04 +0.10%

CAC 40 +9.03 5277.88 +0.17%

DJIA +232.23 20996.12 +1.12%

S&P 500 +14.46 2388.61 +0.61%

NASDAQ +41.67 6025.49 +0.70%

S&P/TSX +32.73 15745.19 +0.21%

Major US stock indexes finished trading in positive territory, and Nasdaq for the first time in history reached a mark of 6,000 points, which was supported by strong corporate reports and the promise of President Donald Trump about the implementation of a major tax reform plan.

In addition, as it became known, in February, house prices for one family accelerated more rapidly than expected in February, which was caused by low housing stocks. The combined index S & P CoreLogic Case-Shiller for 20 megacities rose in February by 5.9% compared to the previous year, after a 5.7% growth in January. The results of February exceeded the forecast for the increase by 5.7 percent and were the biggest increase in annual terms since July 2014.

In addition, the index of consumer confidence from the Conference Board, which increased in March, declined in April. Now the index is 120.3 (1985 = 100), compared with 124.9 in March. The index of the current situation decreased from 143.9 to 140.6, and the index of expectations fell from 112.3 last month to 106.7.

At the same time, sales of new single-family homes in the US rose to an eight-month high in March, pointing to the strength of the economy, despite the apparent sharp slowdown in growth in the first quarter. The Commerce Department reported that sales of new buildings jumped 5.8% to a seasonally adjusted annual rate of 621,000 units last month, the highest level since July 2016. Sales of new buildings grew by 15.6% compared to March 2016. Economists predicted that sales of new buildings, which account for about 9.8 percent of total housing sales, will drop to 583,000 units.

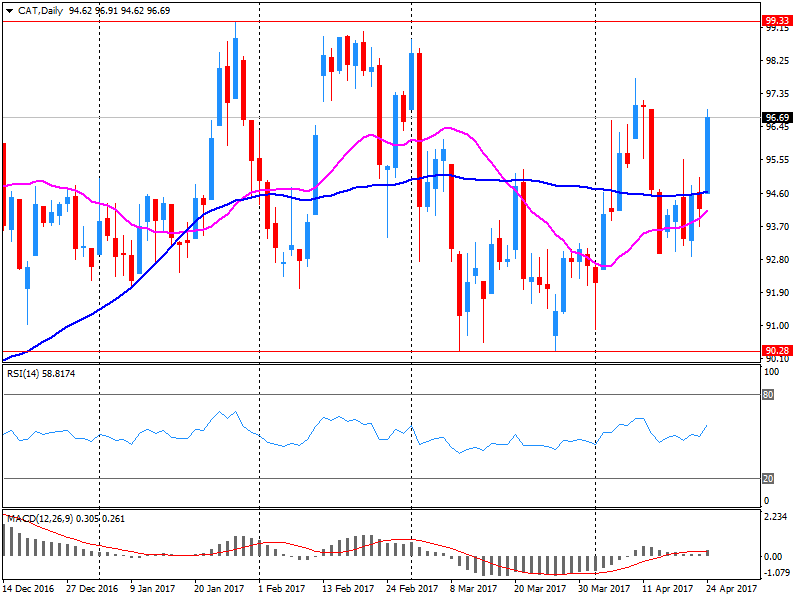

Most components of the DOW index recorded a rise (26 out of 30). Caterpillar Inc. (CAT, + 8.30%) was the growth leader. More fell shares Verizon Communications Inc. (VZ, -0.58%).

All sectors of the S & P index finished trading in positive territory. The leader of growth was the sector of basic materials (+ 0.9%).

At closing:

DJIA + 1.12% 20,995.78 +231.89

Nasdaq + 0.70% 6,025.49 +41.67

S & P + 0.61% 2,388.56 +14.41

U.S. stock-index rallied as investors continued to cheer the results of Sunday's first-round presidential election in France, assessed quarterly earnings, and prepared for "a big tax reform and tax reduction" announcement by Trump on Wednesday.

Stocks:

Nikkei 19,079.33 +203.45 +1.08%

Hang Seng 24,455.94 +316.46 +1.31%

Shanghai 3,135.40 +5.87 +0.19%

FTSE 7,280.37 +15.69 +0.22%

CAC 5,286.63 +17.78 +0.34%

DAX 12,471.91 +16.93 +0.14%

Crude $49.12 (-0.22%)

Gold $1,269.30 (-0.64%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 193.35 | -0.88(-0.45%) | 61326 |

| ALCOA INC. | AA | 34.5 | 1.19(3.57%) | 20537 |

| ALTRIA GROUP INC. | MO | 72.65 | 0.10(0.14%) | 350 |

| Amazon.com Inc., NASDAQ | AMZN | 905 | -2.41(-0.27%) | 35751 |

| American Express Co | AXP | 80.95 | 0.50(0.62%) | 5007 |

| Apple Inc. | AAPL | 144.15 | 0.51(0.36%) | 41403 |

| AT&T Inc | T | 40.04 | 0.02(0.05%) | 6407 |

| Barrick Gold Corporation, NYSE | ABX | 18.38 | -0.66(-3.47%) | 65288 |

| Caterpillar Inc | CAT | 103.2 | 6.39(6.60%) | 479880 |

| Cisco Systems Inc | CSCO | 33.37 | 0.09(0.27%) | 300 |

| Citigroup Inc., NYSE | C | 60 | 0.56(0.94%) | 37103 |

| Deere & Company, NYSE | DE | 111.85 | 1.60(1.45%) | 1662 |

| E. I. du Pont de Nemours and Co | DD | 81.1 | 1.73(2.18%) | 11289 |

| Exxon Mobil Corp | XOM | 81.5 | 0.39(0.48%) | 142 |

| Facebook, Inc. | FB | 145.9 | 0.43(0.30%) | 85250 |

| Ford Motor Co. | F | 11.45 | 0.02(0.18%) | 4850 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.55 | 0.32(2.62%) | 112002 |

| General Electric Co | GE | 29.38 | -0.17(-0.58%) | 166762 |

| General Motors Company, NYSE | GM | 34.06 | 0.15(0.44%) | 2352 |

| Goldman Sachs | GS | 224.95 | 1.73(0.78%) | 8506 |

| Google Inc. | GOOG | 866.5 | 3.74(0.43%) | 4391 |

| Home Depot Inc | HD | 152.59 | 0.70(0.46%) | 1415 |

| HONEYWELL INTERNATIONAL INC. | HON | 130 | 0.21(0.16%) | 1425 |

| Intel Corp | INTC | 36.84 | 0.09(0.24%) | 4350 |

| International Business Machines Co... | IBM | 161.25 | 0.50(0.31%) | 690 |

| JPMorgan Chase and Co | JPM | 88.25 | 0.75(0.86%) | 34537 |

| McDonald's Corp | MCD | 137.88 | 3.65(2.72%) | 119756 |

| Microsoft Corp | MSFT | 67.7 | 0.17(0.25%) | 23344 |

| Nike | NKE | 55.5 | 0.03(0.05%) | 4827 |

| Pfizer Inc | PFE | 33.78 | 0.04(0.12%) | 210 |

| Procter & Gamble Co | PG | 89.73 | 0.18(0.20%) | 2032 |

| Starbucks Corporation, NASDAQ | SBUX | 60.85 | -0.26(-0.43%) | 29392 |

| Tesla Motors, Inc., NASDAQ | TSLA | 308.68 | 0.65(0.21%) | 11577 |

| The Coca-Cola Co | KO | 43.15 | -0.13(-0.30%) | 44867 |

| Twitter, Inc., NYSE | TWTR | 14.75 | 0.04(0.27%) | 31456 |

| United Technologies Corp | UTX | 117.1 | 0.78(0.67%) | 2787 |

| UnitedHealth Group Inc | UNH | 172.65 | 0.32(0.19%) | 500 |

| Verizon Communications Inc | VZ | 47.07 | 0.02(0.04%) | 3148 |

| Visa | V | 91.9 | 0.05(0.05%) | 1329 |

| Wal-Mart Stores Inc | WMT | 75 | 0.22(0.29%) | 1026 |

| Yahoo! Inc., NASDAQ | YHOO | 48.31 | 0.16(0.33%) | 1251 |

| Yandex N.V., NASDAQ | YNDX | 23.59 | 0.21(0.90%) | 2206 |

Upgrades:

American Express (AXP) upgraded to Buy from Neutral at Guggenheim

JPMorgan Chase (JPM) upgraded to Buy from Neutral at Guggenheim

Downgrades:

General Electric (GE) downgraded to Neutral from Buy at BofA/Merrill

Amazon (AMZN) downgraded to Mkt Perform from Outperform at Raymond James

Other:

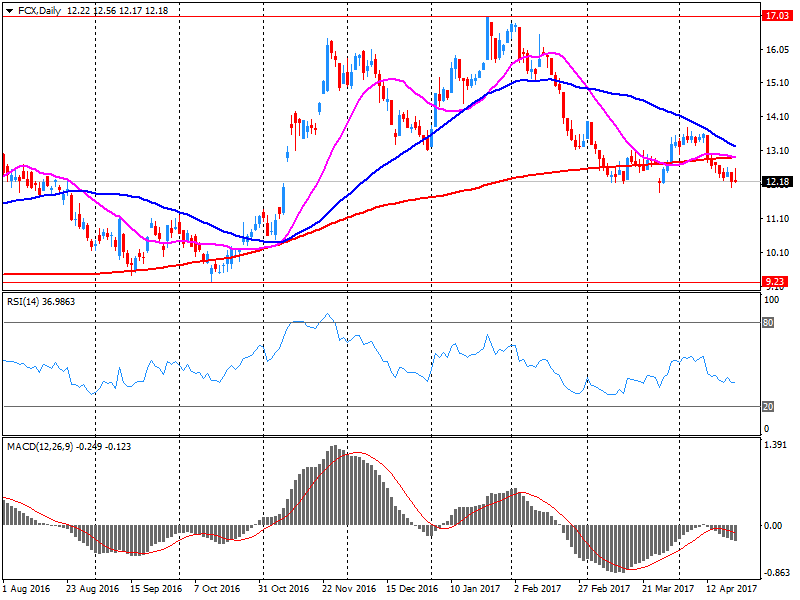

Freeport-McMoRan (FCX) reported Q1 FY 2017 earnings of $0.15 per share (versus -$0.16 in Q1 FY 2016), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $3.341 bln (-5.3% y/y), missing analysts' consensus estimate of $3.509 bln.

FCX rose to $12.48 (+2.04%) in pre-market trading.

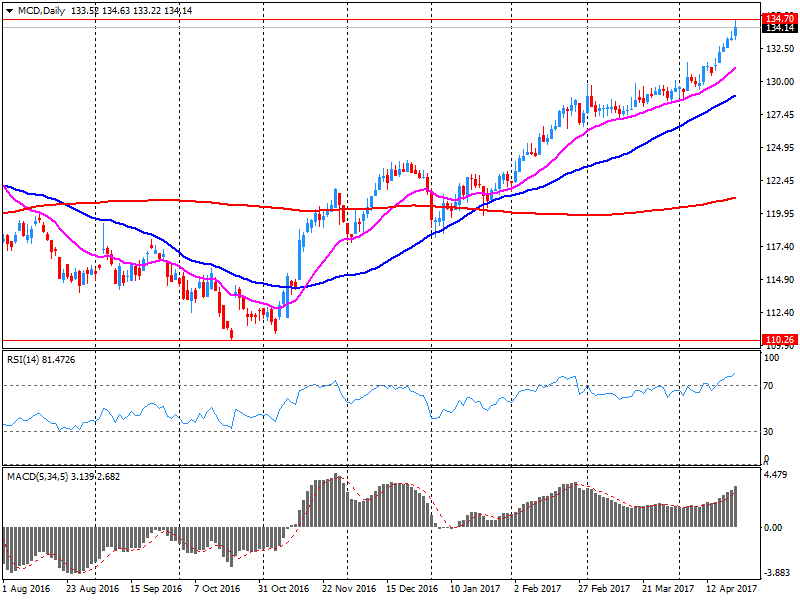

McDonald's (MCD) reported Q1 FY 2017 earnings of $1.47 per share (versus $1.23 in Q1 FY 2016), beating analysts' consensus estimate of $1.33.

The company's quarterly revenues amounted to $5.676 bln (-3.9% y/y), beating analysts' consensus estimate of $5.528 bln.

MCD rose to $137.75 (+2.62%) in pre-market trading.

Caterpillar (CAT) reported Q1 FY 2017 earnings of $1.28 per share (versus $0.67 in Q1 FY 2016), beating analysts' consensus estimate of $0.63.

The company's quarterly revenues amounted to $9.822 bln (+3.8% y/y), beating analysts' consensus estimate of $9.271 bln.

CAT rose to $101.70 (+5.05%) in pre-market trading.

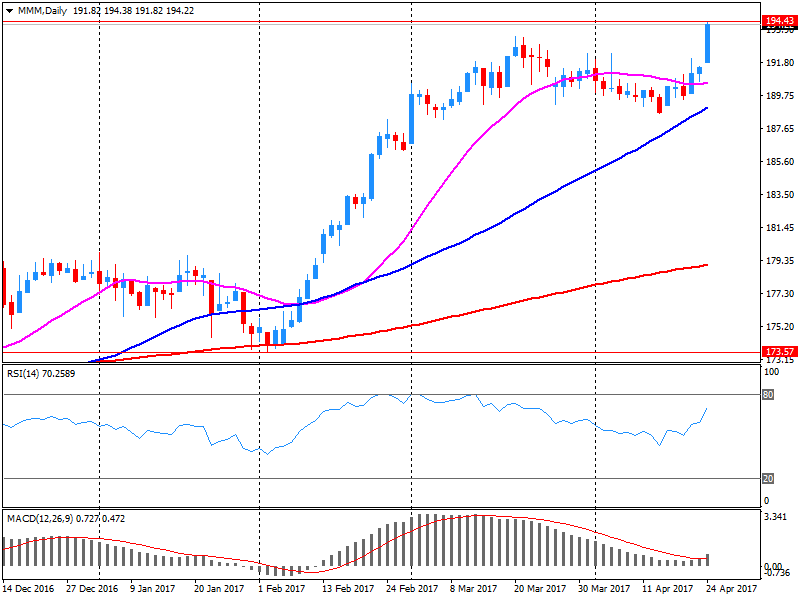

3M (MMM) reported Q1 FY 2017 earnings of $2.16 per share (versus $1.95 in Q1 FY 2016), beating analysts' consensus estimate of $2.06.

The company's quarterly revenues amounted to $7.685 bln (+3.7% y/y), beating analysts' consensus estimate of $7.480 bln.

MMM rose to $198.87 (+2.39%) in pre-market trading.

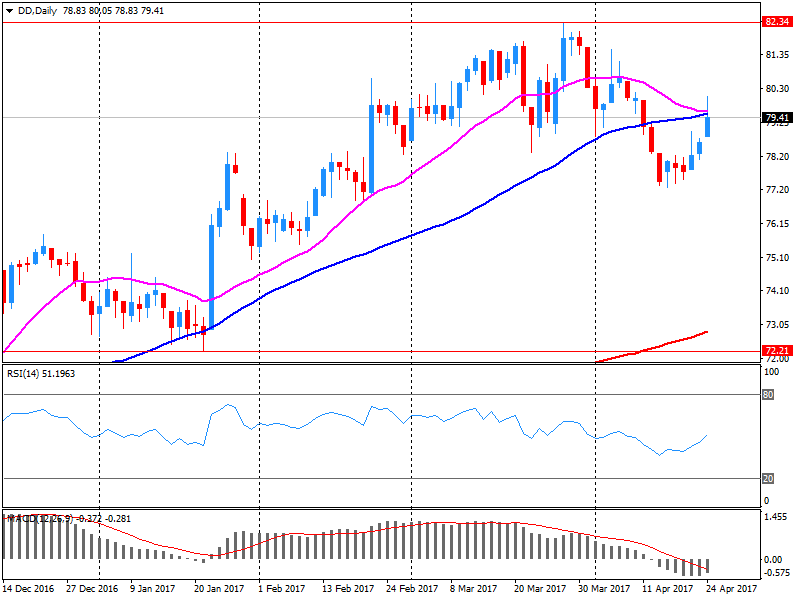

DuPont (DD) reported Q1 FY 2017 earnings of $1.64 per share (versus $1.26 in Q1 FY 2016), beating analysts' consensus estimate of $1.39.

The company's quarterly revenues amounted to $7.743 bln (+4.6% y/y), beating analysts' consensus estimate of $7.501 bln.

DD rose to $80.00 (+0.79%) in pre-market trading.

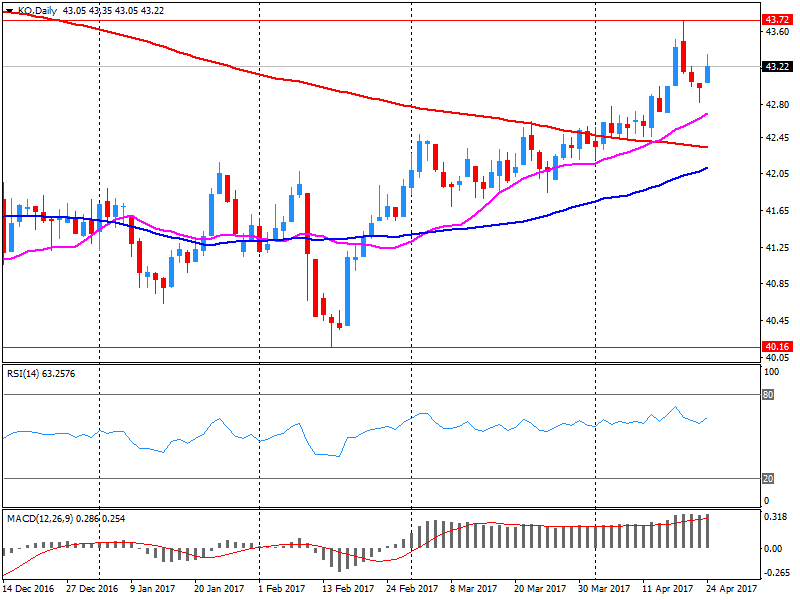

Coca-Cola (KO) reported Q1 FY 2017 earnings of $0.43 per share (versus $0.45 in Q1 FY 2016), missing analysts' consensus estimate of $0.44.

The company's quarterly revenues amounted to $9.118 bln (-11.3% y/y), beating analysts' consensus estimate of $8.851 bln.

KO fell to $43.19 (-0.21%) in pre-market trading.

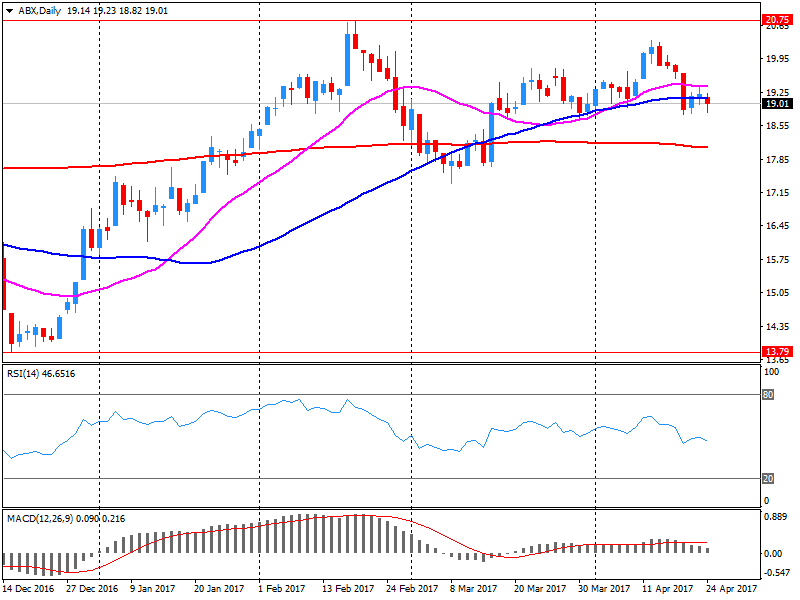

Barrick Gold (ABX) reported Q1 FY 2017 earnings of $0.14 per share (versus $0.11 in Q1 FY 2016), missing analysts' consensus estimate of $0.21.

The company's quarterly revenues amounted to $1.993 bln (+3.3% y/y), missing analysts' consensus estimate of $2.221 bln.

ABX fell to $18.44 (-3.15%) in pre-market trading.

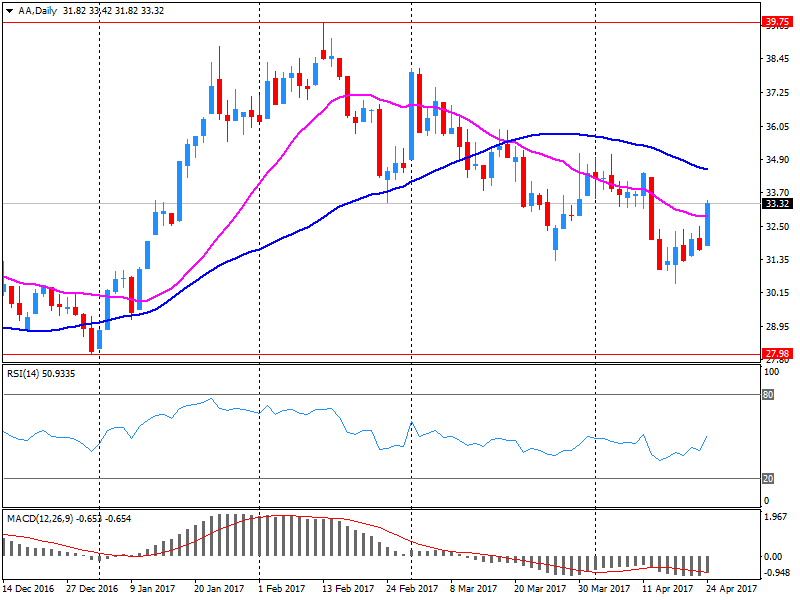

Alcoa (AA) reported Q1 FY 2017 earnings of $0.63 per share (versus $0.07 in Q1 FY 2016), beating analysts' consensus estimate of $0.48.

The company's quarterly revenues amounted to $2.655 bln (+24.7% y/y), missing analysts' consensus estimate of $2.962 bln.

AA rose to $34.50 (+3.57%) in pre-market trading.

Bank stocks lighted up across Europe on Monday, collectively closing at a 16-month high as investors cheered the prospect of market-friendly Emmanuel Macron becoming France's next president. Macron-a former investment banker-is expected to win the May 7 runoff election against far-right candidate Marine Le Pen, who's pledged to hold a referendum on France's membership in the European Union if she were elected president.

U.S. stocks rallied to finish higher Monday, with major indexes advancing more than 1% and the tech-heavy Nasdaq scoring a record high close following a strong showing by centrist Emmanuel Macron in the French presidential election, which averted fears of a euroskeptic-only runoff.

Asian stocks were widely higher for a second day after the French presidential election, but gains again trailed those logged overnight in Europe and the U.S. Meanwhile, investors in Asia are on North Korea watch. Tuesday marks the 85th anniversary of the founding of North Korea's army, and North Korea observers have speculated that the county would test a nuclear device or missile.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.