- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei -37.56 19251.87 -0.19%

TOPIX -0.74 1536.67 -0.05%

Hang Seng +120.05 24698.48 +0.49%

CSI 300 +0.94 3446.72 +0.03%

Euro Stoxx 50 -15.42 3563.29 -0.43%

FTSE 100 -51.55 7237.17 -0.71%

DAX -29.01 12443.79 -0.23%

CAC 40 -16.18 5271.70 -0.31%

DJIA +6.24 20981.33 +0.03%

S&P 500 +1.32 2388.77 +0.06%

NASDAQ +23.71 6048.94 +0.39%

S&P/TSX -143.07 15506.47 -0.91%

Major US stock indexes rose slightly, as a strong increase in the conglomerate sector leveled the collapse in the core materials segment.

Investors shifted the focus from company reporting, the day after the Trump administration announced a tax reform plan.

As it became known today, the number of Americans who recently lost their jobs and applied for unemployment benefits rose last week to a one-month high, although this growth appears to have mainly concentrated in the state of New York. Initial claims for unemployment benefits rose by 14,000 to 257,000 people, the Ministry of Labor said. Economists had expected that initial applications would amount to 245,000 within seven days from April 16 to April 22.

At the same time, new orders for capital goods produced in the US grew less than expected in March, but the second monthly growth in shipments showed an acceleration of investments in business in the first quarter. The Ministry of Commerce said that non-military orders for goods, with the exception of aircraft that are closely monitored as planned business expenses, increased by 0.2% after rising 0.1% in February. Economists forecast an increase of 0.5%.

It also became known that unfinished transactions for the sale of housing fell in March, as stocks continued to decline. The index of unfinished transactions for the sale of housing from the National Association of Realtors fell by 0.8% to 111.4, NAR reported on Thursday. Economists forecast a decrease of 1.0%.

Most components of the DOW index showed an increase (16 out of 30). The growth leader was the shares of The Home Depot, Inc. (HD, + 1.22%). Caterpillar Inc. shares fell more than others. (CAT, -1.88%).

The S & P sector finished the session mostly in positive territory. The growth leader was the conglomerate sector (+ 1.2%). Most of all fell the sector of basic materials (-1.2%).

At closing:

DJIA + 0.03% 20.981.39 +6.30

Nasdaq + 0.39% 6,048.94 +23.71

S & P + 0.06% 2.388.77 +1.32

U.S. stock-index futures advanced amid a slew of quarterly earnings reports, while investors assessed President Donald Trump's tax reform plan.

Stocks:

Nikkei 19,251.87 -37.56 -0.19%

Hang Seng 24,698.48 +120.05 +0.49%

Shanghai 3,152.55 +11.70 +0.37%

FTSE 7,255.70 -33.02 -0.45%

CAC 5,275.54 -12.34 -0.23%

DAX 12,467.51 -5.29 -0.04%

Crude $48.73 (-1.79%)

Gold $1,265.10(+0.07%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 195.5 | 0.50(0.26%) | 578 |

| ALCOA INC. | AA | 35.8 | -0.65(-1.78%) | 284640 |

| ALTRIA GROUP INC. | MO | 71.79 | 0.28(0.39%) | 1136 |

| Amazon.com Inc., NASDAQ | AMZN | 912.2 | 2.91(0.32%) | 13899 |

| American Express Co | AXP | 80.88 | 0.36(0.45%) | 15277 |

| Apple Inc. | AAPL | 143.94 | 0.26(0.18%) | 51003 |

| AT&T Inc | T | 40.47 | 0.03(0.07%) | 765 |

| Boeing Co | BA | 182.7 | 0.99(0.54%) | 584 |

| Caterpillar Inc | CAT | 104.32 | -0.34(-0.32%) | 19969 |

| Cisco Systems Inc | CSCO | 34.25 | 0.85(2.54%) | 250967 |

| Citigroup Inc., NYSE | C | 60.13 | 0.19(0.32%) | 18042 |

| E. I. du Pont de Nemours and Co | DD | 82.32 | 0.71(0.87%) | 150 |

| Exxon Mobil Corp | XOM | 81.3 | -0.10(-0.12%) | 9136 |

| Facebook, Inc. | FB | 146.83 | 0.27(0.18%) | 34018 |

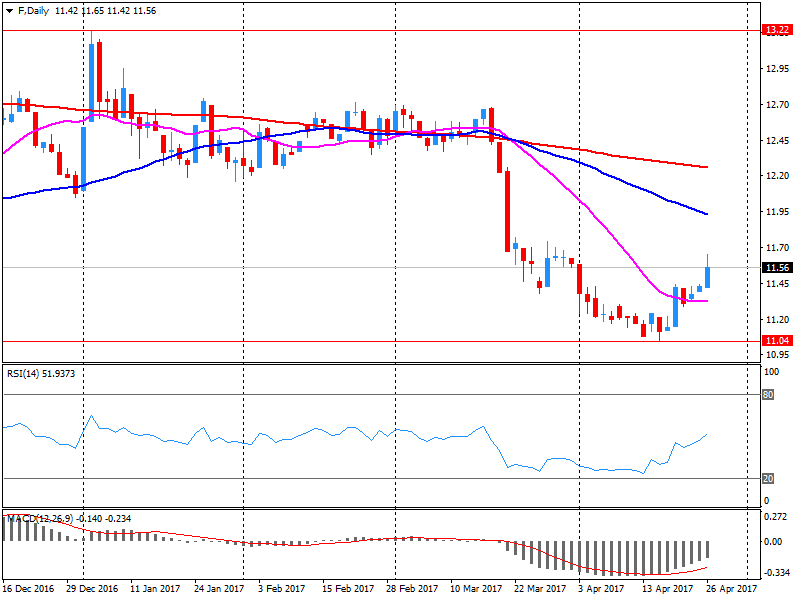

| Ford Motor Co. | F | 11.7 | 0.10(0.86%) | 387308 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.37 | -0.13(-0.96%) | 42710 |

| General Electric Co | GE | 29.33 | 0.07(0.24%) | 15888 |

| General Motors Company, NYSE | GM | 34.65 | 0.27(0.79%) | 15554 |

| Goldman Sachs | GS | 226.65 | 0.45(0.20%) | 5220 |

| Google Inc. | GOOG | 872 | 0.27(0.03%) | 3257 |

| Intel Corp | INTC | 37.02 | 0.09(0.24%) | 14169 |

| International Business Machines Co... | IBM | 160.4 | 0.34(0.21%) | 2026 |

| JPMorgan Chase and Co | JPM | 88.59 | 0.16(0.18%) | 9756 |

| McDonald's Corp | MCD | 141 | 0.16(0.11%) | 4058 |

| Microsoft Corp | MSFT | 68.3 | 0.47(0.69%) | 101740 |

| Nike | NKE | 55.2 | 0.04(0.07%) | 4747 |

| Procter & Gamble Co | PG | 87.87 | 0.13(0.15%) | 6001 |

| Starbucks Corporation, NASDAQ | SBUX | 61.68 | 0.12(0.19%) | 2660 |

| Tesla Motors, Inc., NASDAQ | TSLA | 312.1 | 1.93(0.62%) | 16043 |

| Twitter, Inc., NYSE | TWTR | 15.75 | -0.07(-0.44%) | 106819 |

| Wal-Mart Stores Inc | WMT | 75.25 | -0.18(-0.24%) | 255 |

| Walt Disney Co | DIS | 115.35 | -0.23(-0.20%) | 2084 |

| Yahoo! Inc., NASDAQ | YHOO | 48.05 | -0.21(-0.44%) | 12177 |

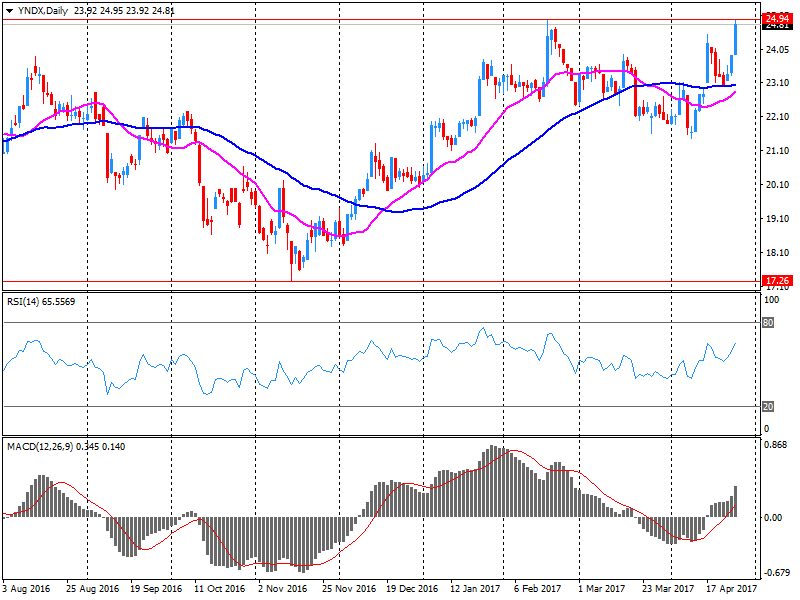

| Yandex N.V., NASDAQ | YNDX | 26.18 | 1.32(5.31%) | 85709 |

Upgrades:

McDonald's (MCD) upgraded to Buy from Hold at Argus

Cisco Systems (CSCO) upgraded to Outperform from Underperform at Credit Suisse

American Express (AXP) upgraded to Neutral from Reduce at Instinet

Downgrades:

Other:

Twitter (TWTR) target raised to $14 from $13 at Wedbush

Microsoft (MSFT) initiated with a Outperform at Credit Suisse; target $80

United Tech (UTX) target raised to $125 from $118 at RBC Capital Mkts

Boeing (BA) target raised to $146 from $138 at RBC Capital Mkts

Ford Motor (F) reported Q1 FY 2017 earnings of $0.39 per share (versus $0.68 in Q1 FY 2016), beating analysts' consensus estimate of $0.34.

The company's quarterly revenues amounted to $36.475 bln (+3.5% y/y), beating analysts' consensus estimate of $34.619 bln.

F rose to $11.85 (+2.16%) in pre-market trading.

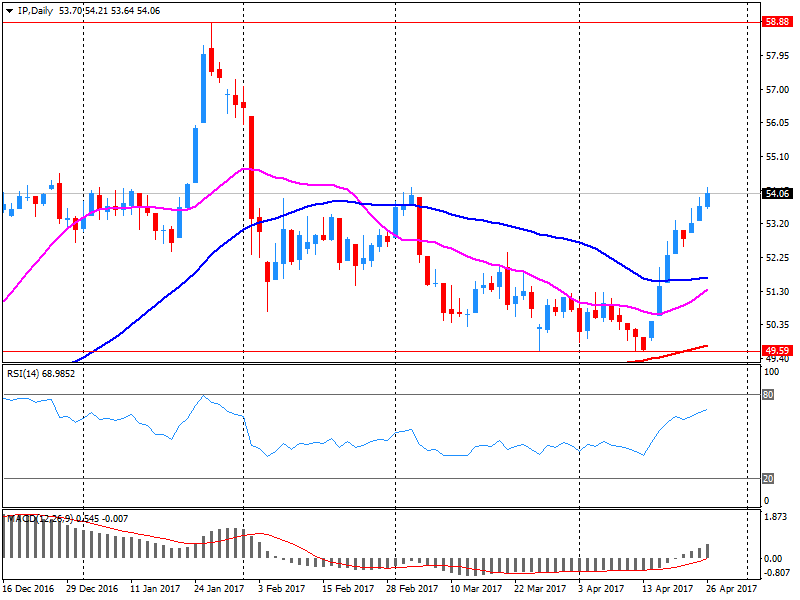

Intl Paper (IP) reported Q1 FY 2017 earnings of $0.60 per share (versus $0.80 in Q1 FY 2016), beating analysts' consensus estimate of $0.56.

The company's quarterly revenues amounted to $5.511 bln (+7.8% y/y), beating analysts' consensus estimate of $5.443 bln.

IP closed Wednesday's trading session at $54.07 (+0.71%).

Yandex N.V. (YNDX) reported Q1 FY 2017 earnings of RUB11.41 per share (versus RUB9.81 in Q1 FY 2016), beating analysts' consensus estimate of RUB9.23.

The company's quarterly revenues amounted to RUB20.652 bln (+25.4% y/y), beating analysts' consensus estimate of RUB20.279 bln.

YNDX rose to $25.65 (+3.18%) in pre-market trading.

European stocks ended a choppy session in positive territory on Wednesday, building on the previous days' rally as investors waited for U.S. President Donald Trump's tax-revamp plan.

U.S. stocks closed little-changed on Wednesday, losing altitude in the final minutes of trade, following a highly anticipated announcement of President Donald Trump's ambitious tax proposal that had helped to fuel a breakout for equities in recent days.

Stock markets in Asia were broadly lower early Thursday, tracking overnight weakness on Wall Street with investors cautious early in the day before the Bank of Japan made its policy statement, in which it maintained its easy monetary policy.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.