- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

Major US stock indices fell slightly on Friday after data showed that the economy grew at its weakest pace in three years in the first quarter. Gross domestic product grew by 0.7% on an annualized basis, below the 1.1% level estimated by economists, as consumer spending barely increased, and enterprises less invested in inventories. In the fourth quarter, the US economy grew by 2.1%.

In addition, Chicago's purchasing managers' index rose to 58.3 in April from 57.7 in March, the highest level since January 2015. Optimism among firms in terms of doing business grew for the third month in a row. Three of the five components of the index led to an increase in April, while production and unfulfilled orders declined.

The cost of oil has slightly increased after the day before the price reached a monthly minimum. Investors bought oil at lower prices ahead of the OPEC meeting next month, at which producers can approve the extension of the oil production pact. Most analysts polled by Reuters expect that the deal between the Organization of Petroleum Exporting Countries and non-OPEC producers, concluded in December 2016, will be extended until the end of this year. Analysts also said that the demand and supply on the oil market could return to the balance sheet by the end of this year, if the deal to reduce production is extended.

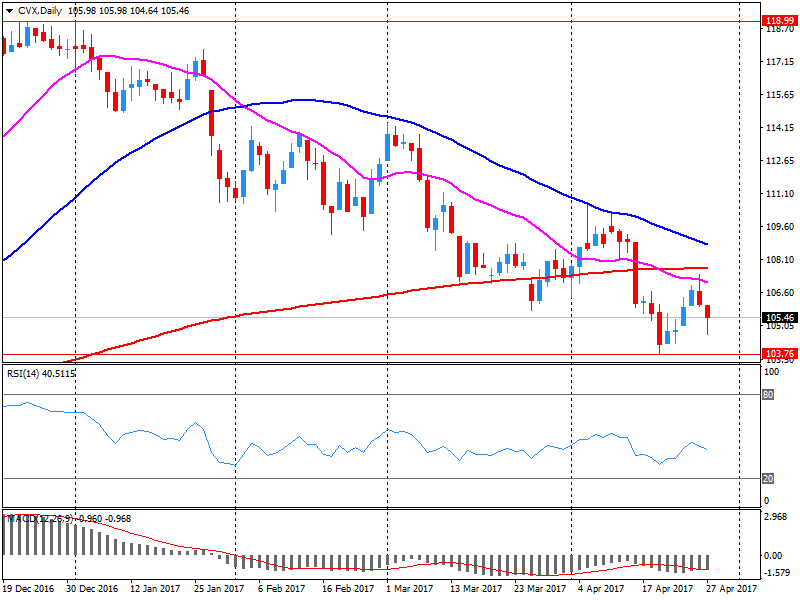

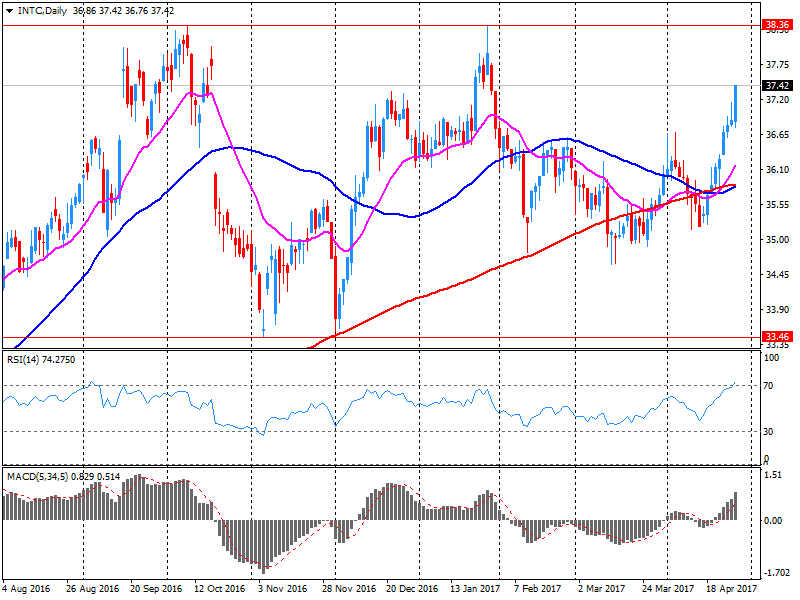

Most components of the DOW index finished trading in the red (21 out of 30). The most fell shares of Intel Corporation (INTC, -3.57%). The leader of growth was shares of Chevron Corporation (CVX, + 1.04%).

Most sectors of the S & P index showed a decline. The financial sector fell most of all (-0.7%). The leader of growth was the technological sector (+ 0.4%).

At this moment:

Dow -0.20% 20.940.30 -41.03

Nasdaq -0.02% 6,047.61 -1.33

S & P -0.19% 2,384.15 -4.62

U.S. stock-index futures were little changed as investors assessed a large batch of earnings reports and preliminary data on U.S. Q1 GDP.

Stocks:

Nikkei 19,196.74 -55.13 -0.29%

Hang Seng 24,615.13 -83.35 -0.34%

Shanghai 3,154.57 +2.38 +0.08%

FTSE 7,209.31 -27.86 -0.38%

CAC 5,280.99 +9.29 +0.18%

DAX 12,445.94 +2.15 +0.02%

Crude $49.59 (+1.27%)

Gold $1,267.70 (+0.14%)

(company / ticker / price / change ($/%) / volume)

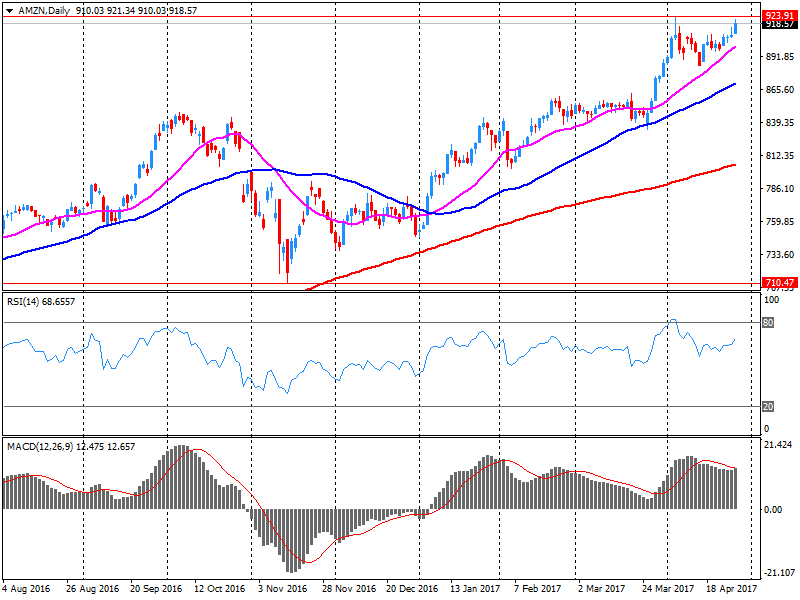

| Amazon.com Inc., NASDAQ | AMZN | 947.5 | 29.12(3.17%) | 132782 |

| Apple Inc. | AAPL | 143.9 | 0.11(0.08%) | 659277 |

| AT&T Inc | T | 40.02 | 0.11(0.28%) | 2250 |

| Barrick Gold Corporation, NYSE | ABX | 16.83 | 0.12(0.72%) | 68783 |

| Boeing Co | BA | 183.2 | -0.02(-0.01%) | 146 |

| Caterpillar Inc | CAT | 102.7 | 0.02(0.02%) | 4079 |

| Chevron Corp | CVX | 108.05 | 2.58(2.45%) | 23123 |

| Cisco Systems Inc | CSCO | 33.85 | 0.10(0.30%) | 5206 |

| Deere & Company, NYSE | DE | 111.69 | 0.51(0.46%) | 1669 |

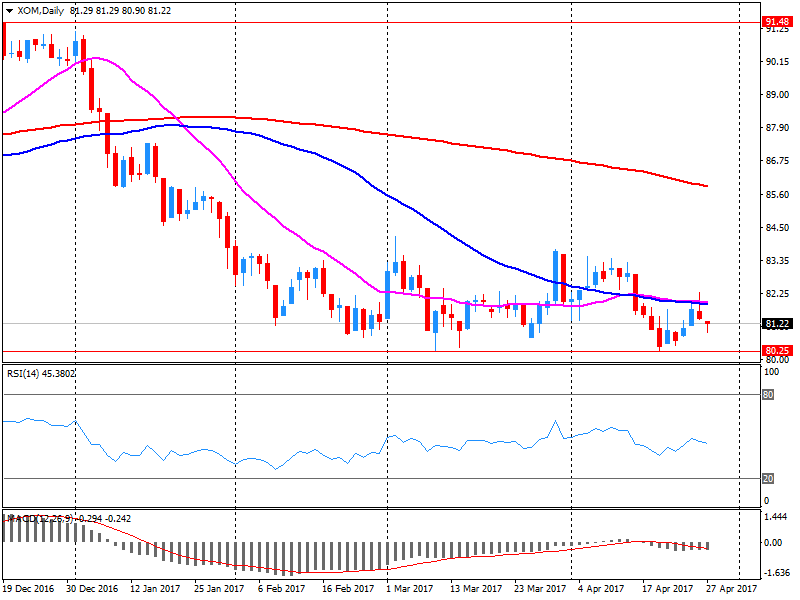

| Exxon Mobil Corp | XOM | 82.69 | 1.43(1.76%) | 106920 |

| Facebook, Inc. | FB | 149.15 | 1.45(0.98%) | 120599 |

| Ford Motor Co. | F | 11.49 | 0.02(0.17%) | 45062 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.18 | 0.17(1.31%) | 10140 |

| General Electric Co | GE | 29.19 | 0.11(0.38%) | 24637 |

| General Motors Company, NYSE | GM | 34.8 | 0.26(0.75%) | 768758 |

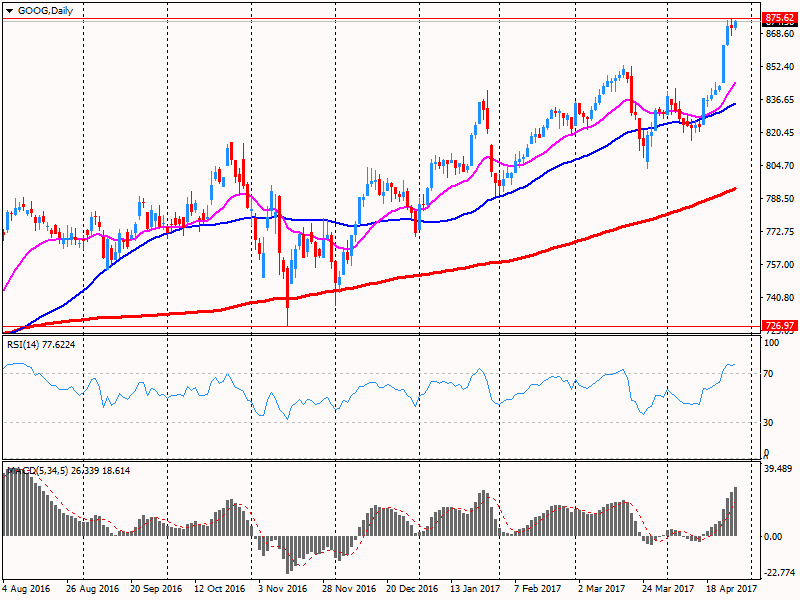

| Google Inc. | GOOG | 907.6 | 33.35(3.81%) | 15070 |

| Home Depot Inc | HD | 156.4 | 0.28(0.18%) | 408 |

| HONEYWELL INTERNATIONAL INC. | HON | 134.25 | 4.37(3.36%) | 51526 |

| Intel Corp | INTC | 36.5 | -0.93(-2.48%) | 317196 |

| International Business Machines Co... | IBM | 160.6 | 0.28(0.17%) | 1409 |

| Johnson & Johnson | JNJ | 124.51 | 0.77(0.62%) | 130 |

| JPMorgan Chase and Co | JPM | 87.78 | 0.17(0.19%) | 6810 |

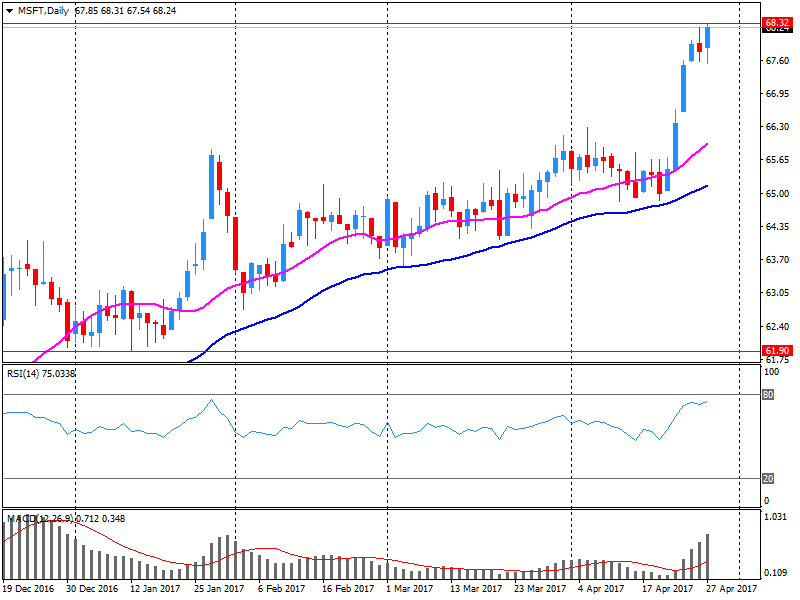

| Microsoft Corp | MSFT | 68.25 | -0.02(-0.03%) | 383171 |

| Nike | NKE | 55.5 | 0.03(0.05%) | 200 |

| Pfizer Inc | PFE | 33.92 | 0.06(0.18%) | 325 |

| Procter & Gamble Co | PG | 87.48 | -0.21(-0.24%) | 300 |

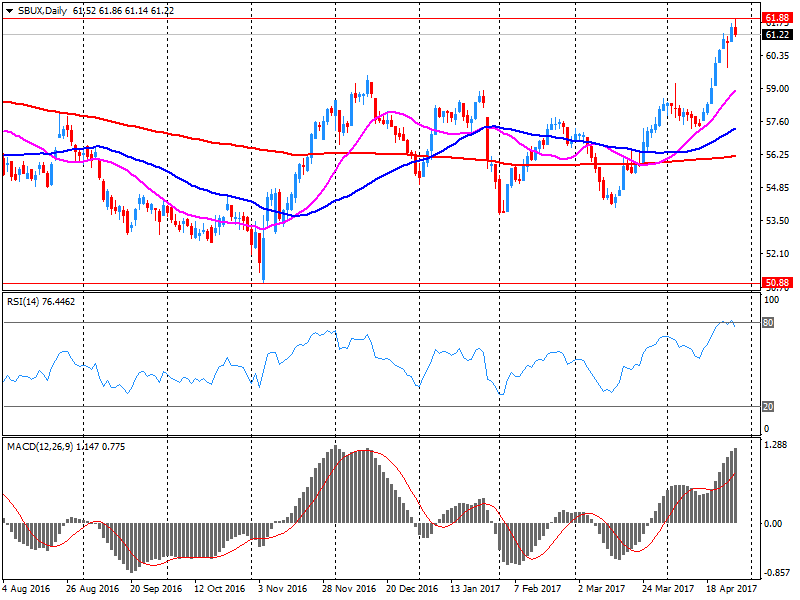

| Starbucks Corporation, NASDAQ | SBUX | 58.8 | -2.50(-4.08%) | 443009 |

| Tesla Motors, Inc., NASDAQ | TSLA | 309.81 | 1.18(0.38%) | 12695 |

| The Coca-Cola Co | KO | 43.06 | 0.05(0.12%) | 828 |

| Twitter, Inc., NYSE | TWTR | 16.54 | -0.07(-0.42%) | 40895 |

| Verizon Communications Inc | VZ | 46.79 | 0.12(0.26%) | 8348 |

| Visa | V | 91.5 | -0.10(-0.11%) | 334 |

| Walt Disney Co | DIS | 116 | 0.16(0.14%) | 228 |

| Yahoo! Inc., NASDAQ | YHOO | 48.4 | 0.04(0.08%) | 687 |

| Yandex N.V., NASDAQ | YNDX | 27.2 | -0.20(-0.73%) | 1820 |

Chevron (CVX) reported Q1 FY 2017 earnings of $1.41 per share (versus -$0.39 in Q1 FY 2016), beating analysts' consensus estimate of $0.87.

The company's quarterly revenues amounted to $33.421 bln (+42% y/y), missing analysts' consensus estimate of $34.046 bln.

CVX rose to $107.98 (+2.38%) in pre-market trading.

Upgrades:

Downgrades:

Amazon (AMZN) downgraded to Sector Weight from Overweight at Pacific Crest/KeyBanc Capital Mkts

Other:

Alphabet A (GOOGL) target raised to $1050 from $1025 at RBC Capital Mkts

Alphabet A (GOOGL) target raised to $725 from $700 at Wedbush

Alphabet A (GOOGL) target raised to $990 from $950 at Pivotal Research Group

Amazon (AMZN) target raised to $1100 from $900 at RBC Capital Mkts

Microsoft (MSFT) target raised to $75 from $71 at BMO Capital Markets

Microsoft (MSFT) target raised to $77 from $72 at RBC Capital Mkts

Starbucks (SBUX) reiterated at an Outperform at RBC Capital Mkts;target $66

Starbucks (SBUX) reiterated at an Outperform at Wedbush;target $65

Facebook (FB) target raised to Facebook (FB) at Needham

Exxon Mobil (XOM) reported Q1 FY 2017 earnings of $0.95 per share (versus $0.43 in Q1 FY 2016), beating analysts' consensus estimate of $0.87.

The company's quarterly revenues amounted to $63.287 bln (29.9% y/y), missing analysts' consensus estimate of $64.877 bln.

XOM rose to $82.40 (+1.40%) in pre-market trading.

General Motors (GM) reported Q1 FY 2017 earnings of $1.70 per share (versus $1.26 in Q1 FY 2016), beating analysts' consensus estimate of $1.47.

The company's quarterly revenues amounted to $41.200 bln (+10.6% y/y), beating analysts' consensus estimate of $37.376 bln.

GM rose to $35.10 (+1.62%) in pre-market trading.

Microsoft (MSFT) reported Q3 FY 2017 earnings of $0.73 per share (versus $0.62 in Q3 FY 2016), beating analysts' consensus estimate of $0.70.

The company's quarterly revenues amounted to $23.557 bln (+6.3% y/y), generally in-line with analysts' consensus estimate of $23.623 bln.

MSFT rose to $68.58 (+0.45%) in pre-market trading.

Starbucks (SBUX) reported Q1 FY 2017 earnings of $0.45 per share (versus $0.39 in Q1 FY 2016), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $5.294 bln (+7.3% y/y), missing analysts' consensus estimate of $5.418 bln.

SBUX fell to $58.45 (-4.65%) in pre-market trading.

Intel (INTC) reported Q1 FY 2017 earnings of $0.66 per share (versus $0.54 in Q1 FY 2016), beating analysts' consensus estimate of $0.65.

The company's quarterly revenues amounted to $14.796 bln (+8% y/y), generally in-line with analysts' consensus estimate of $14.805 bln.

INTC fell to $35.92 (-4.03%) in pre-market trading.

Amazon (AMZN) reported Q1 FY 2017 earnings of $1.48 per share (versus $1.07 in Q1 FY 2016), beating analysts' consensus estimate of $1.10.

The company's quarterly revenues amounted to $35.714 bln (+22.6% y/y), beating analysts' consensus estimate of $35.310 bln.

AMZN rose to $953.50 (+3.82%) in pre-market trading.

Alphabet (GOOG) reported Q1 FY 2017 earnings of $7.73 per share (versus $7.50 in Q1 FY 2016), beating analysts' consensus estimate of $7.38.

The company's quarterly revenues amounted to $24.750 bln (+22.2% y/y), beating analysts' consensus estimate of $24.176 bln.

GOOG rose to $909.97 (+4.09%) in pre-market trading.

U.K. stocks finished with losses Thursday, with a rallying pound helping to push the blue-chips market lower for the first time in four sessions, but Lloyds Banking Group PLC gained following the lender's well-received earnings report.

The Nasdaq Composite closed at a record Thursday, during an busy day of corporate quarterly results, but the broader market ended in neutral territory as a slump in energy and questions about President Donald Trump's tax plan weighed on Wall Street.

Major stock indexes in Asia fell slightly on Friday, mirroring Wall Street's cautious sentiment on risk taking, though strong earnings results from tech companies saw shares in the sector rise. The market-friendly result of the first round of elections in France helped the region start the week strongly, but stocks have given back some of their gains as investors refocused on local drivers.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.