- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei +210.10 19289.43 +1.10%

TOPIX +18.20 1537.41 +1.20%

Hang Seng +122.49 24578.43 +0.50%

CSI 300 +4.35 3445.78 +0.13%

Euro Stoxx 50 -4.45 3578.71 -0.12%

FTSE 100 +13.08 7288.72 +0.18%

DAX +5.76 12472.80 +0.05%

CAC 40 +10.00 5287.88 +0.19%

DJIA -21.03 20975.09 -0.10%

S&P 500 -1.16 2387.45 -0.05%

NASDAQ -0.26 6025.23 +0.00%

S&P/TSX -95.65 15649.54 -0.61%

Major US stock indices fell slightly on Wednesday, responding to details of the tax reform plan of the US President's administration Trump.

According to the plan, the maximum tax rate for individuals will be reduced to 35% from the current 39.6%. In addition, together 7 tax categories for individuals will now be 3 categories - with rates of 10%, 25% and 35%. The plan also implies a reduction in the tax rate for the company to 15% from 35%. The tax rate on income for companies on individual declarations will also be reduced to 15% (now these revenues are subject to separate tax rates). At the same time, it is planned to abolish the targeted tax deductions that were mostly used by the richest, as well as the inheritance tax and the minimum alternative tax. The plan also includes tax breaks for American families, especially middle-income families, and a doubling of the standard tax deduction that Americans can claim for reimbursement from the budget. In addition, it is planned to reduce taxes for families with children and expenses for dependent care.

Investors also evaluated the quarterly reports of companies such as Arconic (ARNC), Twitter (TWTR), United Tech (UTX), Procter & Gamble (PG), AT & T (T) and Boeing (BA).

Companies from the S & P 500 index so far reported on profits for the first quarter, which in aggregate exceeded the consensus estimates by 6.8%. If the current growth rate of earnings per share of companies from the S & P 500 will hold, they will become the strongest since the end of 2011, according to FactSet.

Most components of the DOW index finished trading in different directions (15 in negative territory, 15 in positive territory). The leader of growth was shares United Technologies Corporation (UTX, + 1.32%). Most fell shares The Procter & Gamble Company (PG, -2.60%).

The S & P index sector also finished trading mixed. The growth leader was the conglomerate sector (+ 0.5%). Most fell sector of consumer goods (-0.6%).

At closing:

DJIA -0.08% 20.978.93 -17.19

Nasdaq -0.00% 6,025.23 -0.26

S & P -0.04% 2,387.70 -0.91

U.S. stock-index futures were little changed amid a flood of corporate earnings, while investors awaited President Donald Trump's plan on tax reform.

Stocks:

Nikkei 19,289.43 +210.10 +1.10%

Hang Seng 24,578.43 +122.49 +0.50%

Shanghai 3,140.85 +6.28 +0.20%

FTSE 7,271.97 -3.67 -0.05%

CAC 5,281.02 +3.14 +0.06%

DAX 12,463.57 -3.47 -0.03%

Crude $49.11 (-0.91%)

Gold $1,265.40 (-0.14%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 35.99 | -0.50(-1.37%) | 4278 |

| Amazon.com Inc., NASDAQ | AMZN | 909.5 | 1.88(0.21%) | 24520 |

| Apple Inc. | AAPL | 144.55 | 0.02(0.01%) | 149600 |

| AT&T Inc | T | 39.9 | -0.04(-0.10%) | 86414 |

| Barrick Gold Corporation, NYSE | ABX | 17.04 | 0.15(0.89%) | 210095 |

| Boeing Co | BA | 181 | -2.51(-1.37%) | 47346 |

| Caterpillar Inc | CAT | 104 | -0.42(-0.40%) | 38980 |

| Chevron Corp | CVX | 106.51 | -0.22(-0.21%) | 4561 |

| Cisco Systems Inc | CSCO | 33.49 | 0.07(0.21%) | 28716 |

| Citigroup Inc., NYSE | C | 59.96 | -0.25(-0.42%) | 17823 |

| E. I. du Pont de Nemours and Co | DD | 82.1 | -0.11(-0.13%) | 4747 |

| Exxon Mobil Corp | XOM | 81.42 | -0.31(-0.38%) | 64017 |

| Facebook, Inc. | FB | 146.8 | 0.31(0.21%) | 53658 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.93 | -0.17(-1.30%) | 35911 |

| General Electric Co | GE | 29.49 | 0.04(0.14%) | 147602 |

| General Motors Company, NYSE | GM | 34 | 0.01(0.03%) | 2100 |

| Goldman Sachs | GS | 226.1 | -0.53(-0.23%) | 6417 |

| Intel Corp | INTC | 36.98 | 0.11(0.30%) | 186897 |

| International Business Machines Co... | IBM | 160.58 | 0.19(0.12%) | 7680 |

| JPMorgan Chase and Co | JPM | 88.33 | 0.07(0.08%) | 31715 |

| McDonald's Corp | MCD | 141.45 | -0.25(-0.18%) | 20485 |

| Microsoft Corp | MSFT | 68.12 | 0.20(0.29%) | 60830 |

| Pfizer Inc | PFE | 33.82 | 0.06(0.18%) | 36177 |

| Procter & Gamble Co | PG | 89 | -1.00(-1.11%) | 26584 |

| Starbucks Corporation, NASDAQ | SBUX | 61.04 | 0.08(0.13%) | 9842 |

| Tesla Motors, Inc., NASDAQ | TSLA | 312.22 | -1.57(-0.50%) | 37419 |

| The Coca-Cola Co | KO | 43 | -0.11(-0.26%) | 26203 |

| Twitter, Inc., NYSE | TWTR | 15.95 | 1.29(8.80%) | 7819500 |

| United Technologies Corp | UTX | 117.87 | 1.00(0.86%) | 15659 |

| Visa | V | 91.8 | -0.31(-0.34%) | 52189 |

| Wal-Mart Stores Inc | WMT | 75.06 | 0.01(0.01%) | 46302 |

| Yandex N.V., NASDAQ | YNDX | 24.03 | 0.11(0.46%) | 12727 |

Upgrades:

Downgrades:

Other:

McDonald's (MCD) target raised to $150 from $140 at Telsey Advisory Group

3M (MMM) target raised to $202 from $190 at Stifel

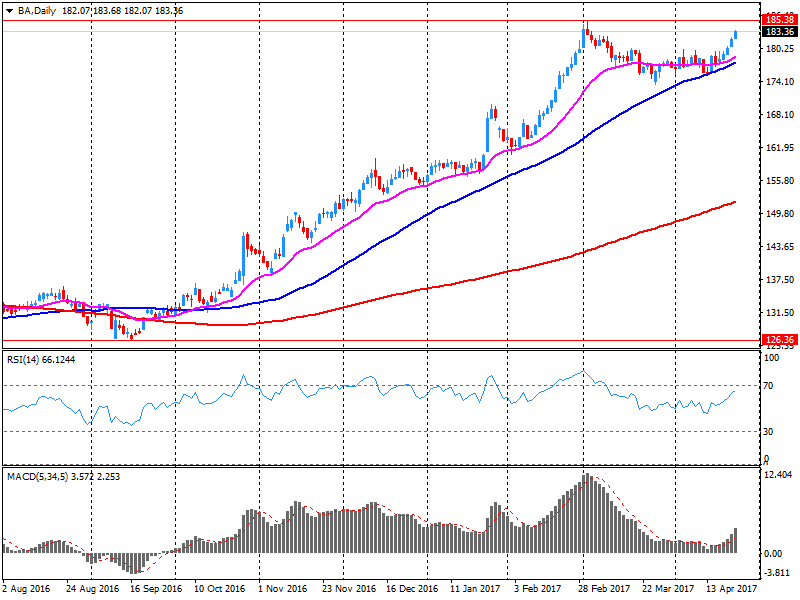

Boeing (BA) reported Q1 FY 2017 earnings of $2.01 per share (versus $1.74 in Q1 FY 2016), beating analysts' consensus estimate of $1.91.

The company's quarterly revenues amounted to $20.976 bln (-7.3% y/y), missing analysts' consensus estimate of $21.266 bln.

BA fell to $182.80 (-0.39%) in pre-market trading.

Procter & Gamble (PG) reported Q3 FY 2017 earnings of $0.96 per share (versus $0.86 in Q3 FY 2016), beating analysts' consensus estimate of $0.94.

The company's quarterly revenues amounted to $15.605 bln (-1% y/y), slightly below analysts' consensus estimate of $15.705 bln.

PG fell to $89.07 (-1.03%) in pre-market trading.

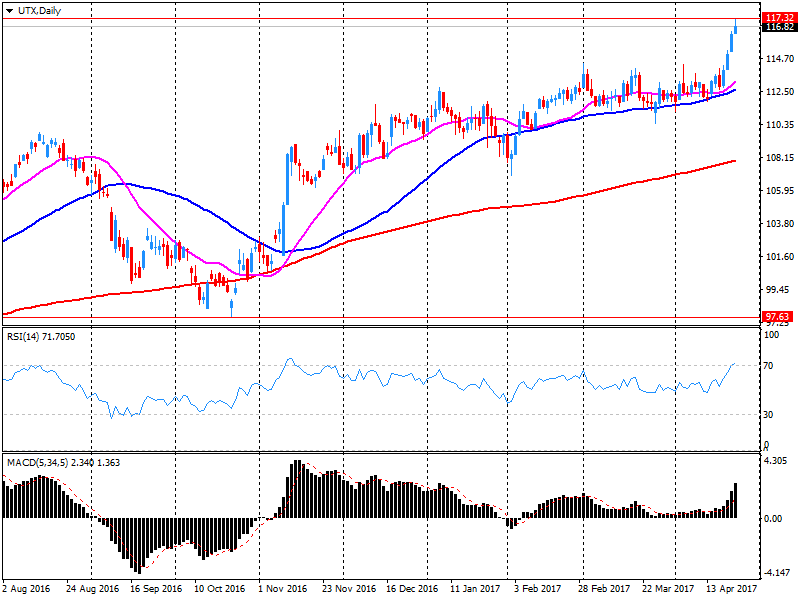

United Tech (UTX) reported Q1 FY 2017 earnings of $1.48 per share (versus $1.47 in Q1 FY 2016), beating analysts' consensus estimate of $1.39.

The company's quarterly revenues amounted to $13.815 bln (+3.4% y/y), beating analysts' consensus estimate of $13.501 bln.

UTX rose to $117.90 (+0.88%) in pre-market trading.

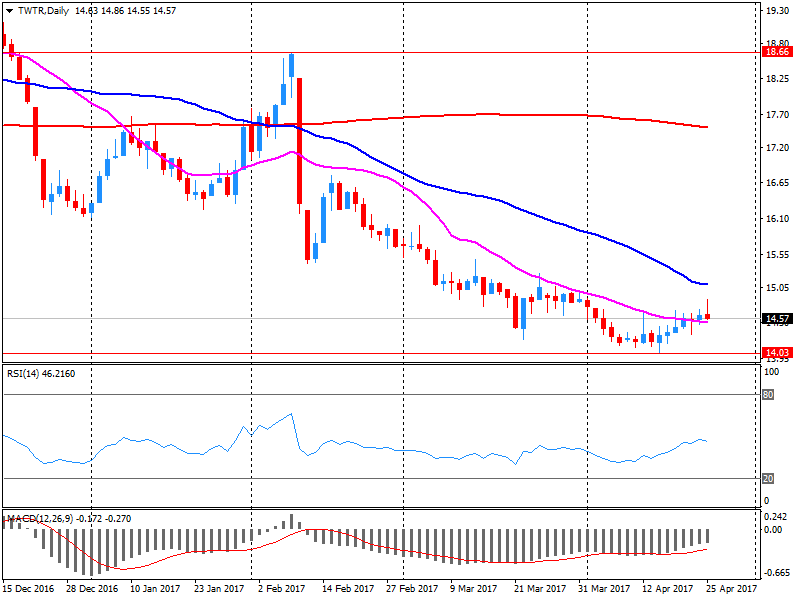

Twitter (TWTR) reported Q1 FY 2017 earnings of $0.11 per share (versus $0.15 in Q1 FY 2016), beating analysts' consensus estimate of $0.01.

The company's quarterly revenues amounted to $0.548 bln (-7.8% y/y), beating analysts' consensus estimate of $0.513 bln.

TWTR rose to $16.03 (+9.35%) in pre-market trading.

AT&T (T) reported Q1 FY 2017 earnings of $0.74 per share (versus $0.72 in Q1 FY 2016), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $39.400 bln (-2.8% y/y), missing analysts' consensus estimate of $40.500 bln.

T rose to $40.01 (+0.18%) in pre-market trading.

Arconic (ARNC) reported Q1 FY 2017 earnings of $0.33 per share, beating analysts' consensus estimate of $0.24.

The company's quarterly revenues amounted to $3.055 bln (-4.3% y/y), beating analysts' consensus estimate of $2.996 bln.

ARNC rose to $28.00 (+3.78%) in pre-market trading.

European stocks higher Tuesday, with French stocks closing at a nine-year high as relief over a potentially market-friendly outcome in France's presidential election continued to boost sentiment.

The U.S. stock market extended its rally Tuesday, with the Dow jumping by triple-digits and the Nasdaq closing above 6,000 for the first time ever, as investors welcomed upbeat earnings and the possibility of corporate tax cuts. "Today is one of the busiest days in terms of corporate earnings releases, with 36 companies reporting before and after the market and so far earnings have been strong," said Michael Antonelli, equity sales trader at Robert W. Baird & Co.

Equities in Asia extended gains for a third session early Wednesday as sustained political optimism, currency tailwinds and the growing prospect of a U.S. tax overhaul whetted appetite for risk. Sparked by the success of centrist, market-friendly French presidential candidate Emmanuel Macron in the first round of the election on Sunday, investors have shed prevote caution and piled into risk assets.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.