- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei 225 16,998.91 +35.30 +0.21%

Shanghai Composite 3,085.32 +1.45 +0.05%

S&P/ASX 200 5,435.36 +24.61 +0.45%

FTSE 100 7,021.92 +21.86 +0.31%

CAC 40 4,520.30 +11.39 +0.25%

Xetra DAX 10,645.68 +14.13 +0.13%

S&P 500 2,144.29 +4.69 +0.22%

Dow Jones Industrial Average 18,202.62 +40.68 +0.22%

S&P/TSX Composite 14,840.49 +88.24 +0.60%

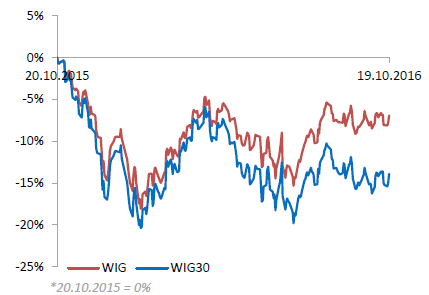

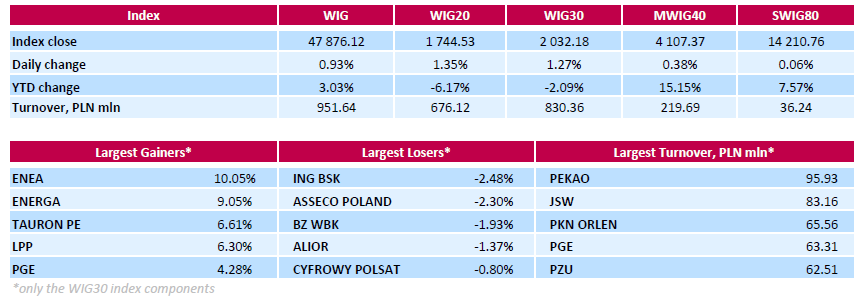

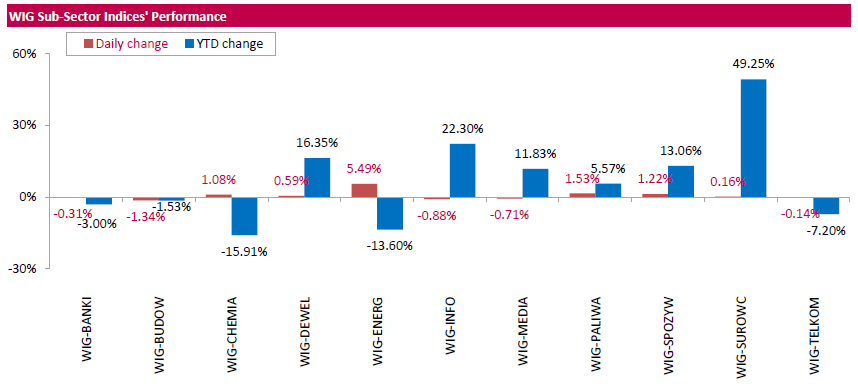

Polish equity market closed higher on Wednesday. The broad market measure, the WIG index, added 0.93%. Sector performance within the WIG Index was mixed. Utilities stocks (+5.49%) were the strongest group, while construction sector names (-1.34%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, surged by 1.27%. A majority of the index components rose. All four energy generating sector's names ENEA (WSE: ENA), ENERGA (WSE: ENG), TAURON (WSE: TPE) and PGE (WSE: PGE) delivered solid advances, climbing by 4.28%-10.05%, helped by the announcement the Energy Minister Krzysztof Tchorzewski stated he did not see a need of raising capital in state-run utilities this year to get extra taxes from them. Recall, Poland's government plan, which was announced in September, implied raising capital in utilities by increasing the nominal value of their shares, which triggers the need of paying of flat-rate income tax of 19 percent on the increased nominal value. Thermal coal miner BOGDANKA (WSE: LWB) as well as two retailers LPP (WSE: LPP) and CCC (WSE: CCC) also recorded significant gains, up 4.06%, 6.3% and 3.45% respectively. On the other side of the ledger, IT-company ASSECO POLAND (WSE: ACP) and three banking names ING BSK (WSE: ING), BZ WBK (WSE: BZW) and ALIOR (WSE: ALR) bank were the major laggards, losing 1.37%-2.48%.

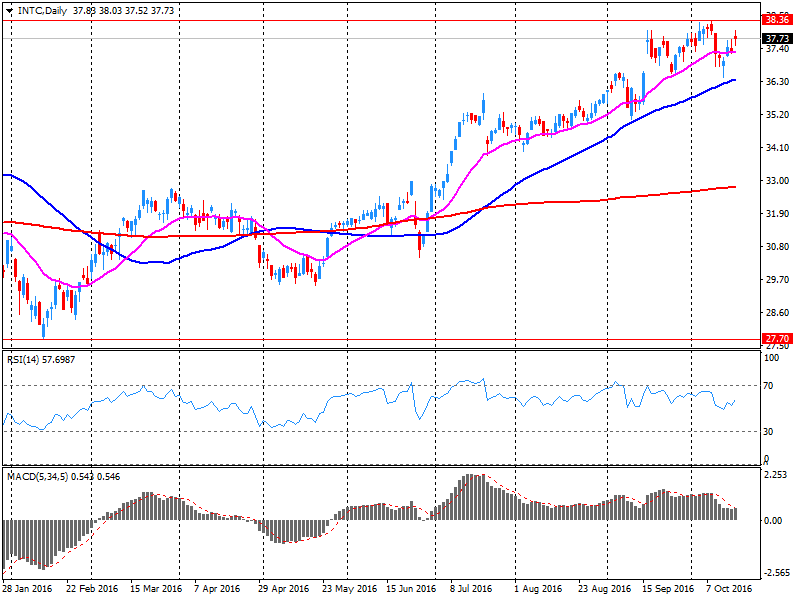

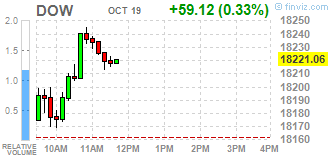

Major U.S. stock-indexes little changed on Wednesday as gains in energy and financial stocks were offset by a drop in technology shares, led by Intel. Intel (INTC) fell 4,7%, the biggest drag on all three indexes, after the chipmaker's disappointing current-quarter revenue forecast.

Most of Dow stocks in positive area (20 of 30). Top gainer - Chevron Corporation (CVX, +1.44%). Top loser - Intel Corporation (INTC, -5.60%).

Most of S&P sectors also in positive area. Top gainer - Basic Materials (+1.2%). Top loser - Healthcare (-0.3%).

At the moment:

Dow 18136.00 +72.00 +0.40%

S&P 500 2138.75 +6.75 +0.32%

Nasdaq 100 4831.00 +4.00 +0.08%

Oil 52.05 +1.43 +2.82%

Gold 1272.90 +10.00 +0.79%

U.S. 10yr 1.74 -0.01

U.S. stock-index futures edged higher amid corporate earnings and as crude oil rose for a second day.

Global Stocks:

Nikkei 16,998.91 +35.30 +0.21%

Hang Seng 23,304.97 -89.42 -0.38%

Shanghai 3,085.32 +1.45 +0.05%

FTSE 7,000.60 +0.54 +0.01%

CAC 4,512.91 +4.00 +0.09%

DAX 10,644.37 +12.82 +0.12%

Crude $51.00 (+1.41%)

Gold $1272.40 (+0.75%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 26.54 | 0.03(0.1132%) | 967 |

| ALTRIA GROUP INC. | MO | 62.65 | -0.01(-0.016%) | 505 |

| Amazon.com Inc., NASDAQ | AMZN | 821 | 3.35(0.4097%) | 8609 |

| American Express Co | AXP | 60.45 | 0.37(0.6158%) | 1407 |

| Apple Inc. | AAPL | 117.41 | -0.06(-0.0511%) | 135776 |

| AT&T Inc | T | 39.37 | 0.01(0.0254%) | 665 |

| Barrick Gold Corporation, NYSE | ABX | 16.64 | 0.27(1.6494%) | 64432 |

| Chevron Corp | CVX | 102.3 | 0.51(0.501%) | 948 |

| Citigroup Inc., NYSE | C | 49.13 | 0.14(0.2858%) | 1310 |

| Facebook, Inc. | FB | 128.71 | 0.14(0.1089%) | 33032 |

| Ford Motor Co. | F | 11.9 | 0.01(0.0841%) | 8248 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 9.85 | 0.13(1.3375%) | 38358 |

| General Electric Co | GE | 29 | 0.02(0.069%) | 2922 |

| Goldman Sachs | GS | 172.78 | 0.15(0.0869%) | 4830 |

| Google Inc. | GOOG | 797.94 | 2.68(0.337%) | 2023 |

| Intel Corp | INTC | 36 | -1.75(-4.6358%) | 1468938 |

| International Business Machines Co... | IBM | 151 | 0.28(0.1858%) | 1852 |

| Johnson & Johnson | JNJ | 115.5 | 0.09(0.078%) | 4961 |

| JPMorgan Chase and Co | JPM | 67.85 | 0.15(0.2216%) | 3800 |

| McDonald's Corp | MCD | 112.04 | 0.79(0.7101%) | 701 |

| Microsoft Corp | MSFT | 57.5 | -0.16(-0.2775%) | 19746 |

| Nike | NKE | 51.31 | 0.09(0.1757%) | 120 |

| Pfizer Inc | PFE | 32.99 | 0.30(0.9177%) | 4444 |

| Procter & Gamble Co | PG | 87 | 0.2195(0.2529%) | 1276 |

| Starbucks Corporation, NASDAQ | SBUX | 52.9 | 0.29(0.5512%) | 7287 |

| Tesla Motors, Inc., NASDAQ | TSLA | 199.5 | 0.40(0.2009%) | 14337 |

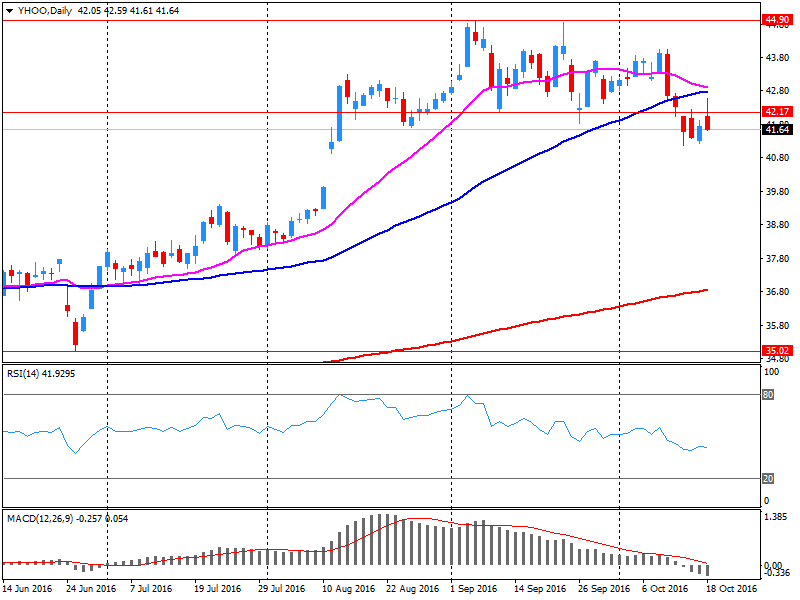

| The Coca-Cola Co | KO | 42.05 | 0.08(0.1906%) | 1200 |

| Twitter, Inc., NYSE | TWTR | 16.9 | 0.07(0.4159%) | 84153 |

| UnitedHealth Group Inc | UNH | 143.35 | -0.04(-0.0279%) | 157 |

| Verizon Communications Inc | VZ | 50.11 | -0.16(-0.3183%) | 1191 |

| Visa | V | 81.6 | 0.02(0.0245%) | 1578 |

| Walt Disney Co | DIS | 91 | -0.17(-0.1865%) | 810 |

| Yahoo! Inc., NASDAQ | YHOO | 42.11 | 0.43(1.0317%) | 8385 |

| Yandex N.V., NASDAQ | YNDX | 20 | 0.26(1.3171%) | 1100 |

Upgrades:

Twitter (TWTR) upgraded to Hold from Sell at Loop Capital

Downgrades:

Other:

Intel (INTC) target lowered to $37 from $38 at RBC Capital

Intel (INTC) target lowered to $42 from $43 at Needham

Yahoo! (YHOO) target raised to $48 from $44 at Susquehanna

Yahoo! (YHOO) target raised to $42 from $38 at Mizuho

Yahoo! (YHOO) target raised to $45 from $39 at RBC Capital

Goldman Sachs (GS) target raised to $170 from $160 at RBC Capital

Hewlett Packard Enterprise (HPE) target raised to $26 at Needham

Starbucks (SBUX) target lowered to $64 at RBC Capital Mkts

UnitedHealth (UNH) target raised to $169 at Mizuho

DuPont (DD) initiated with a Buy at Nomura

Yahoo! reported Q3 FY 2016 earnings of $0.20 per share (versus $0.15 in Q3 FY 2015), beating analysts' consensus estimate of $0.14.

The company's quarterly revenues amounted to $0.857 bln (-14.6% y/y), slightly missing analysts' consensus estimate of $0.861 bln.

The company issued downside guidance for Q4, projecting Q4 revenues of $0.88-0.92 bln versus analysts' consensus estimate of $0.939 bln.

YHOO rose to $42.20 (+1.25%) in pre-market trading.

Intel reported Q3 FY 2016 earnings of $0.80 per share (versus $0.64 in Q3 FY 2015), beating analysts' consensus estimate of $0.72.

The company's quarterly revenues amounted to $15.778 bln (+9.1% y/y), beating analysts' consensus estimate of $15.605 bln.

The company also issued in-line guidance for Q4, projecting Q4 revenues of $15.2-16.2 bln versus analysts' consensus estimate of $15.88 bln; gross margin 63% +/- a couple percent. This revenue forecast is lower than the average seasonal increase for the fourth quarter.

INTC fell to $36.10 (-4.34%) in pre-market trading.

European stock indices show a negative trend, as investors assessed mixed Chinese statistical data, as well as preparing for the ECB meeting. However, some support had moderate increase in oil prices.

As expected, China's GDP grew by 6.7% in the 3rd quarter. A similar increase was observed in the 2nd quarter. However, although the pace of growth was in line with expectations, the signs of the weakness of exports and investments was recorded together with the growth in sales of new homes. These promote the growth of fears of further slowdown. Early next year pressure on the economy will increase, since the real estate market cycle will go on the decline.

The composite index of the largest companies in the region Stoxx Europe 600 trading lower by 0.2 percent. Yesterday the index recorded the maximum increase in nearly a month on optimism that monetary policy will remain favorable for growth.

Shares of Reckitt Benckiser Group fell 2.7 percent after the company reported disappointing figures in terms of sales in the third quarter.

Quotes of Travis Perkins Plc fell 5.1 percent as adjusted annual earnings forecast was slightly below consensus.

The cost of ASML Holding NV shares rose 3.9 percent after Europe's biggest maker of semiconductor equipment announced the updated projections of profitability in the 4th quarter, which exceeded analysts' expectations.

Carrefour share rose 1.6 percent as France's largest retailer reported higher earnings in the third quarter, than experts predicted.

At the moment:

FTSE 100 -7.81 -0.11% 6992.25

DAX -19.49 10612.06 -0.18%

CAC 40 -4.86 4504.05 -0.11%

European stocks slumped Monday, led by a pullback in oil shares, as investors entered the trading week with the dollar sitting at a seven-month high while they waited to hear what's next for monetary policy at the European Central Bank.

U.S. stocks on Tuesday gained as the latest round of corporate earnings came in ahead of Wall Street's estimates, helping to buoy market sentiment. The S&P 500 SPX, +0.62% rose 13 points, or 0.6%, to finish at 2,139 while the Dow Jones Industrial Average DJIA, +0.42% climbed 75 points, or 0.4%, to close at 18,161. The Nasdaq Composite COMP, +0.85% advanced 44 points, or 0.9%, to finish at 5,243. Closely watched companies like Goldman Sachs Group Inc. GS, +2.15% Netflix Inc.

Asian shares were broadly higher early Wednesday, tracking overnight gains on Wall Street, while key data out of China met market expectations. The world's second-biggest economy expanded 6.7% in the third quarter from a year earlier, matching growth in the previous quarter, official data showed Wednesday. The figure was also in line with a forecast by economists polled by The Wall Street Journal.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.