- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei 225 17,235.50 +236.59 +1.39%

Shanghai Composite 3,084.76 +0.0366 0.00%

S&P/ASX 200 5,442.14 +6.78 +0.12%

FTSE 100 7,026.90 +4.98 +0.07%

CAC 40 4,540.12 +19.82 +0.44%

Xetra DAX 10,701.39 +55.71 +0.52%

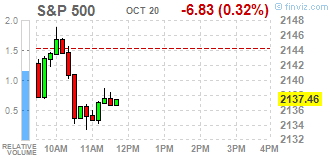

S&P 500 2,141.34 -2.95 -0.14%

Dow Jones Industrial Average 18,162.35 -40.27 -0.22%

S&P/TSX Composite 14,847.92 +7.43 +0.05%

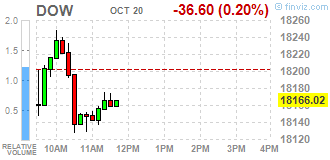

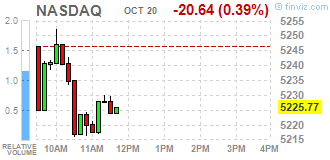

Major U.S. stock-indexes slightly fell on Thursday as weak earnings from index heavyweights such as Verizon dented optimism about the earnings season and as a drop in oil prices weighed on energy stocks.

Most of Dow stocks in negative area (21 of 30). Top gainer - American Express Company (AXP, +8.96%). Top loser - The Travelers Companies, Inc. (TRV, -4.87%).

Almost all S&P sectors also in negative area. Top gainer - Healthcare (+0.4%). Top loser - Technology (-0.5%).

At the moment:

Dow 18088.00 -37.00 -0.20%

S&P 500 2131.50 -6.50 -0.30%

Nasdaq 100 4813.75 -16.50 -0.34%

Oil 50.80 -1.02 -1.97%

Gold 1266.50 -3.40 -0.27%

U.S. 10yr 1.74 -0.01

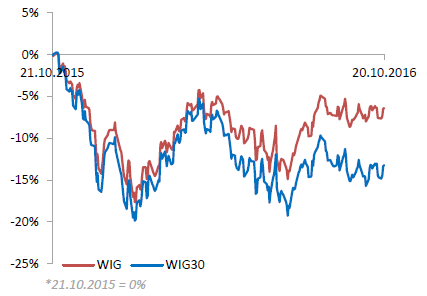

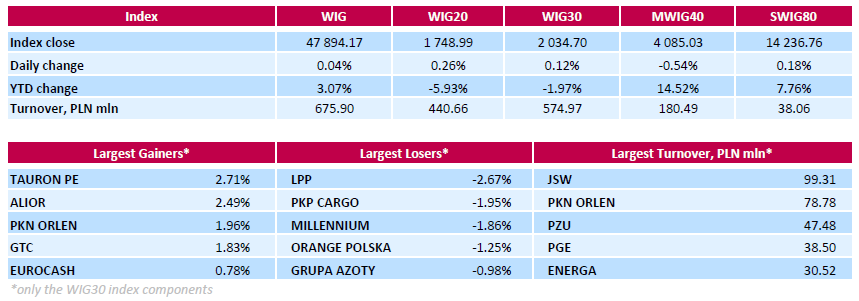

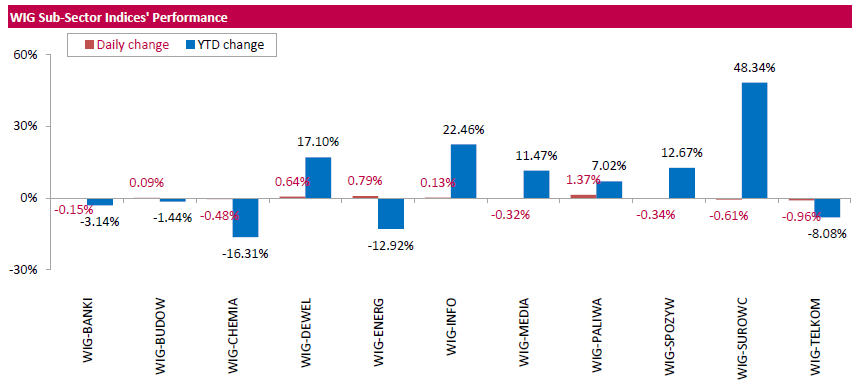

Polish equity market closed flat on Thursday. The broad market benchmark, the WIG Index, edged up 0.04%. Sector performance in the WIG Index was mixed. Oil and gas sector (+1.37%) recorded the biggest gains, while telecoms (-0.96%) lagged behind.

The large-cap stocks measure, the WIG30 Index, rose by 0.12%. In the index basket, genco TAURON (WSE: TPE) and bank ALIOR (WSE: ALR) were the best-performing names, advancing by 2.71% and 2.49% respectively. They were followed by oil refiner PKN ORLEN (WSE: PKN) and property developer GTC (WSE: GTC), gaining 1.96% and 1.83% respectively. On the other side of the ledge, clothing retailer LPP (WSE: LPP) demonstrated the worst performance, tumbling by 2.67%. Other major decliners were railway freight transport operator PKP CARGO (WSE: PKP), bank MILLENNIUM (WSE: MIL) and telecommunication services provider ORANGE POLSKA (WSE: OPL), which lost between 1.25% and 1.95%.

U.S. stock-index futures slipped on concern that European Central Bank stimulus won't jump-start growth in the region's economy, while mixed earnings reports from American companies provided little direction.

Global Stocks:

Nikkei 17,235.50 +236.59 +1.39%

Hang Seng 23,374.40 +69.43 +0.30%

Shanghai 3,084.76 +0.0366 0.00%

FTSE 7,000.04 -21.88 -0.31%

CAC 4,501.15 -19.15 -0.42%

DAX 10,598.52 -47.16 -0.44%

Crude $51.08 (-1.43%)

Gold $1272.80 (+0.23%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 26.9 | -0.14(-0.5178%) | 13337 |

| Amazon.com Inc., NASDAQ | AMZN | 814.5 | -3.19(-0.3901%) | 15909 |

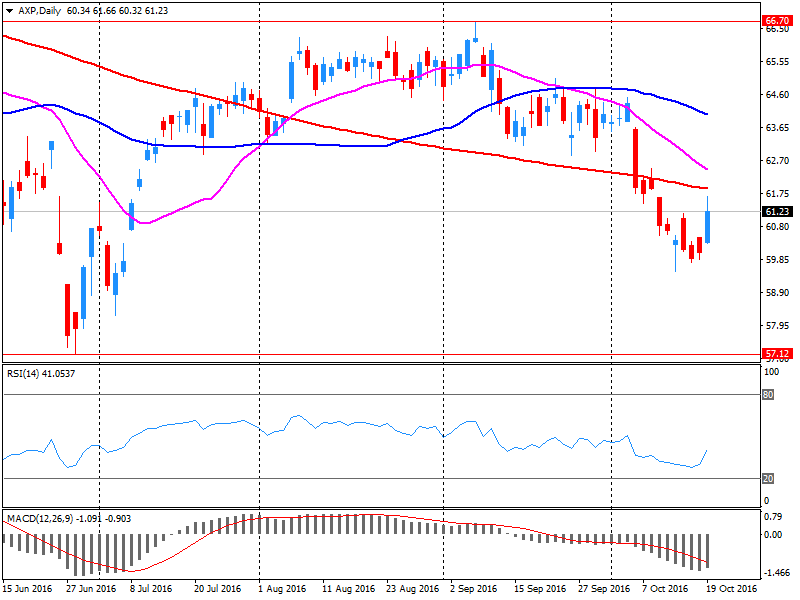

| American Express Co | AXP | 65.25 | 4.00(6.5306%) | 310959 |

| Apple Inc. | AAPL | 116.91 | -0.21(-0.1793%) | 60447 |

| AT&T Inc | T | 38.94 | -0.44(-1.1173%) | 183346 |

| Boeing Co | BA | 136.1 | -0.08(-0.0587%) | 6763 |

| Caterpillar Inc | CAT | 87 | -0.23(-0.2637%) | 9175 |

| Cisco Systems Inc | CSCO | 30.4 | 0.05(0.1647%) | 211 |

| Citigroup Inc., NYSE | C | 49.4 | -0.08(-0.1617%) | 11792 |

| Exxon Mobil Corp | XOM | 86.9 | -0.27(-0.3097%) | 4308 |

| Facebook, Inc. | FB | 129.99 | -0.12(-0.0922%) | 126330 |

| Ford Motor Co. | F | 12 | -0.01(-0.0833%) | 29783 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 9.95 | -0.07(-0.6986%) | 12688 |

| General Electric Co | GE | 29.11 | 0.05(0.1721%) | 11235 |

| General Motors Company, NYSE | GM | 32 | 0.15(0.471%) | 1500 |

| Goldman Sachs | GS | 173.8 | -0.71(-0.4069%) | 2995 |

| Google Inc. | GOOG | 800.89 | -0.67(-0.0836%) | 4791 |

| Home Depot Inc | HD | 126.5 | 0.61(0.4845%) | 115 |

| Intel Corp | INTC | 35.44 | -0.07(-0.1971%) | 76726 |

| International Business Machines Co... | IBM | 151.35 | 0.09(0.0595%) | 965 |

| International Paper Company | IP | 47.83 | -0.45(-0.9321%) | 1000 |

| Johnson & Johnson | JNJ | 114.64 | 0.05(0.0436%) | 2893 |

| JPMorgan Chase and Co | JPM | 68.2 | -0.15(-0.2195%) | 6055 |

| McDonald's Corp | MCD | 111.22 | -0.04(-0.036%) | 295 |

| Microsoft Corp | MSFT | 57.6 | 0.07(0.1217%) | 24245 |

| Nike | NKE | 51.99 | 0.19(0.3668%) | 750 |

| Pfizer Inc | PFE | 32.55 | -0.05(-0.1534%) | 602 |

| Procter & Gamble Co | PG | 85.48 | -0.06(-0.0701%) | 2515 |

| Starbucks Corporation, NASDAQ | SBUX | 53.39 | 0.24(0.4516%) | 1106 |

| Tesla Motors, Inc., NASDAQ | TSLA | 201.1 | -2.46(-1.2085%) | 60340 |

| The Coca-Cola Co | KO | 41.95 | -0.10(-0.2378%) | 7721 |

| Travelers Companies Inc | TRV | 113.13 | -3.10(-2.6671%) | 1175 |

| Twitter, Inc., NYSE | TWTR | 17.05 | -0.02(-0.1172%) | 22951 |

| Verizon Communications Inc | VZ | 49.25 | -1.13(-2.243%) | 478649 |

| Visa | V | 83.03 | 0.22(0.2657%) | 14988 |

| Wal-Mart Stores Inc | WMT | 69 | 0.11(0.1597%) | 765 |

| Walt Disney Co | DIS | 91.75 | -0.18(-0.1958%) | 2662 |

| Yahoo! Inc., NASDAQ | YHOO | 42.78 | 0.05(0.117%) | 2614 |

| Yandex N.V., NASDAQ | YNDX | 19.86 | 0.01(0.0504%) | 1000 |

Upgrades:

American Express (AXP) upgraded to Neutral from Underperform at BofA/Merrill

Downgrades:

Goldman Sachs (GS) downgraded to Neutral from Buy at Guggenheim

Other:

American Express (AXP) target lowered to $52 from $57 at RBC Capital

Travelers reported Q3 FY 2016 earnings of $2.40 per share (versus $2.93 in Q3 FY 2015), beating analysts' consensus estimate of $2.36.

The company's quarterly revenues amounted to $6.389 bln (+3.2% y/y), beating analysts' consensus estimate of $6.210 bln.

TRV fell to $114.00 (-1.92%) in pre-market trading.

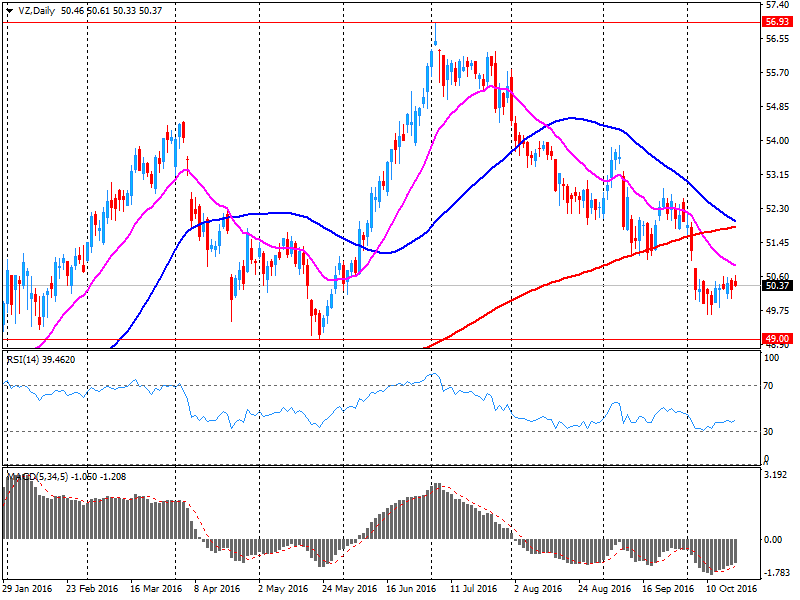

Verizon reported Q3 FY 2016 earnings of $1.01 per share (versus $1.04 in Q3 FY 2015), beating analysts' consensus estimate of $0.99.

The company's quarterly revenues amounted to $30.937 bln (-6.7% y/y), missing analysts' consensus estimate of $31.066 bln.

VZ fell to $49.12 (-2.50%) in pre-market trading.

American Express reported Q3 FY 2016 earnings of $1.24 per share (versus $1.24 in Q3 FY 2015), beating analysts' consensus estimate of $0.96.

The company's quarterly revenues amounted to $7.774 bln (-5.1% y/y), slightly beating analysts' consensus estimate of $7.713 bln.

The company also raised its FY2016 EPS forecast to $5.90-6.00 from $5.40-5.70 versus analysts' consensus estimate of $5.60. It reaffirmed guidance for FY2017, projecting EPS of at least $5.60 versus analysts' consensus estimate of $5.55.

AXP rose to $65.05 (+6.20%) in pre-market trading.

European stocks remain near the opening level, move associated with the ECB meeting. In addition, investors continue to closely monitor the corporate reporting.

According to the forecast, ECB will leave the benchmark interest rate at zero and the deposit rate will remain at around -0.4%, while the marginal rate will remain at 0.25%. Most economists also expect that the Central Bank will hint at the possibility of extending the QE program, but a decision is unlikely to take place before December. "The tone of the ECB's statements probably signals a tendency to soft policy. We believe that the Central Bank refutes information about folding QE program until December and will not disclose details of the extension of the program. Perhaps in December, the ECB will extend the QE program until September 2017 and will adjust its structure ", - stated Bank of America Merrill Lynch.

The composite index of the largest companies in the region Stoxx Europe 600 trading lower by 0.05 percent. VStoxx Index, which measures the predicted volatility is dropping the third day in a row, and is now trading near a month low.

Capitalization of Publicis Groupe SA fell 6 percent after a report showed that the income of the French advertising company has not justified forecasts of experts in the 3rd quarter.

GEA Group has collapsed by 19 per cent, as the German engineering group said it expects a decrease in sales by the end of 2016.

Shares of Nestle SA fell 0.8 percent as the world's largest food company lowered its annual sales forecast.

The price Actelion shares It fell 3.1 percent after an improved outlook for the Swiss drugmaker earnings did not meet estimates.

Deutsche Lufthansa AG rose 7.8 percent after raising its forecast for airline profits.

At the moment:

FTSE 100 -4.46 7017.46 -0.06

DAX +28.73 10674.41 + 0.27%

CAC 40 +12.40 4532.70 + 0.27%

U.K. stocks reversed course to finish higher Wednesday, supported by a rally in oil prices, but Travis Perkins PLC shares were hammered as the building products supplier flagged rough conditions stemming from the Brexit referendum. Oil extended its rally after the U.S. Energy Information Administration unexpectedly reported that weekly domestic crude supplies dropped by 5.2 million barrels. Analysts polled by S&P Global Platts expected a climb of 2.5 million barrel climb.

U.S. stocks closed higher for a second session Wednesday, boosted by a rally in the energy sector and stronger-than-expected quarterly results from Morgan Stanley. The Federal Reserve's Beige Book, an anecdotal economic survey, also indicated that the U.S. economy continues its modest, albeit steady, expansion.

Asian stocks advanced on Thursday, propelled by strong U.S. earnings and oil prices near a 15-month high, as the third and final U.S. presidential debate before the Nov. 8 election ended. In the final debate between Republican presidential candidate Donald Trump and Democrat Hillary Clinton, Trump tried to reverse the momentum in an election that polls show is tilting away from him.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.