- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei 225 18,162.94 +56.92 +0.31%

Shanghai Composite 3,249.58 +31.43 +0.98%

S&P/ASX 200 5,413.33 0.00 0.00%

FTSE 100 6,819.72 +41.76 +0.62%

CAC 40 4,548.35 +18.77 +0.41%

Xetra DAX 10,713.85 +28.72 +0.27%

S&P 500 2,202.94 +4.76 +0.22%

Dow Jones Industrial Average 19,023.87 +67.18 +0.35%

S&P/TSX Composite 15,100.38 +60.51 +0.40%

Major US stock indexes again finished trading at record highs. Dow crossed 19,000 points, the S & P 500 broke through 2200 points mark for the first time in history, due to the ongoing rally because of the election of Donald Trump, the US president.

In addition, as it became known, home sales in the US secondary market rose in October to its highest level in more than 9.5 years, against the backdrop of pent-up demand, offering more evidence of accelerating economic growth in the fourth quarter, but the recent spike in mortgage rates may slow Activity in the housing market. The National Association of Realtors reported that home sales in the secondary market increased by 2.0% to an annual rate of 5.6 million units, the highest level of sales pace since February 2007. The September figure was revised up to 5.49 million units from a previously reported 5.47 million units.

However, the report submitted by the Federal Reserve Bank of Richmond showed that activity in the manufacturing sector in the region has improved in November, beating analysts' estimates, and peaking in July. According to the report, the November index of manufacturing activity rose to +4 points versus -4 points in October. It was predicted that the figure will be 1 point. Recall value greater than 0 indicates the improvement of conditions in the manufacturing sector, while below 0 indicates worsening conditions. The data are taken from a survey of about 100 manufacturers in the Richmond area.

Oil prices held above $ 48 on speculation that OPEC will be able to reach an agreement to limit the production of next week. On the eve of the representative of Libya's OPEC Mohammed Own ended positively described the first day of the two-day meeting of the expert group of the cartel. In addition, OPEC sources said that the cartel experts have made some progress in the course of the first day of talks on the details of the Algerian agreements. Some of the agency's interlocutors also expressed optimism about the prospects for the conclusion of the final to limit production level agreement.

DOW index components closed mostly in positive territory (24 of 30). Most remaining shares rose Verizon Communications Inc. (VZ, + 2.55%). Outsider were shares of Visa Inc. (V, -2.11%).

Most of the S & P sectors recorded increase. The leader turned out to be the basic materials sector (+ 0.9%). the health sector fell the most (-1.6%).

At the close:

Dow + 0.35% 19,023.67 +66.98

Nasdaq + 0.33% 5,386.35 +17.49

S & P + 0.21% 2,202.90 +4.72

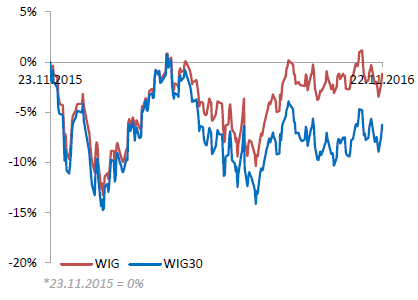

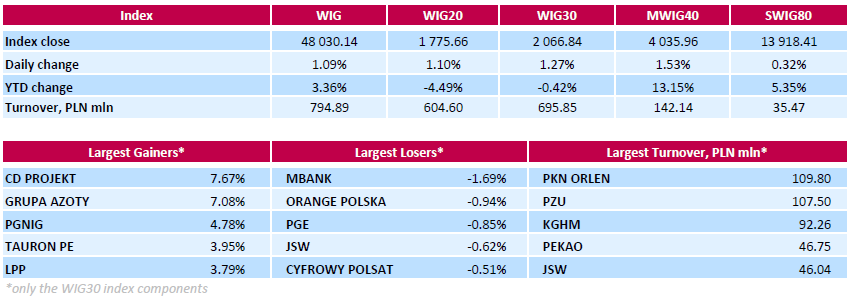

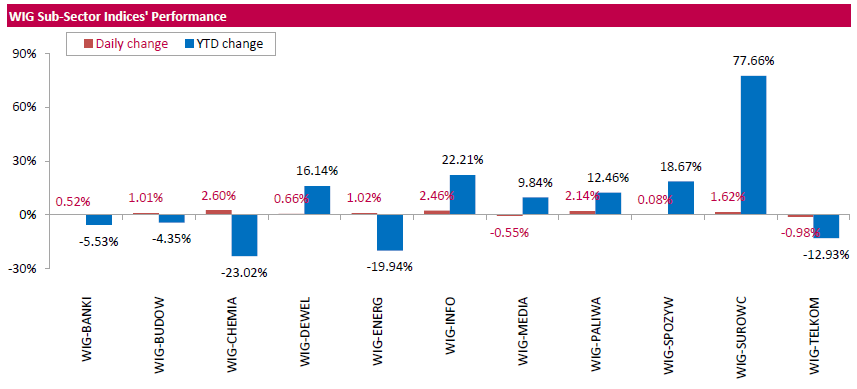

Polish equity market closed higher on Tuesday. The broad market measure, the WIG index, rose by 1.09%. Sector performance within the WIG was mainly positive as nine sectors recorded advances, with chemicals (+2.60%) outpacing.

The large-cap stocks added 1.27%, as measured by the WIG30 Index. In the index basket, the advancers pack was led by videogame developer CD PROJEKT (WSE: CDR) with gains of 7.67%, followed by chemical producer GRUPA AZOTY (WSE: ATT), which surged by 7.08%. Quotations of oil and gas producer PGNIG (WSE: PGN), genco TAURON PE (WSE: TPE) and clothing retailer LPP (WSE: LPP) also were on upstream, climbing by 4.78%, 3.95% and 3.79% respectively. On the contrary, banking name MBANK (WSE: MBK), telecommunication services provider ORANGE POLSKA (WSE: OPL) and genco PGE (WSE: PGE) were the weakest performers, suffering losses of 1.69%, 0.94% and 0.85% respectively.

Major U.S. stock-indexes hit records highs for the second straight day on Tuesday, with the Dow topping 19,000 points and the S&P 500 moving past 2,200 points for the first time ever as the Donald Trump-fueled rally continued. Trump's pro-growth policies, including promises of tax cuts, higher spending on infrastructure and simpler regulations in the banking and healthcare industries, have led a rally, especially in those sectors, since the election on Nov 8.

Most of Dow stocks in positive area (18 of 30). Top gainer - Verizon Communications Inc. (VZ, +1.95%). Ещз дщыук - Johnson & Johnson (JNJ, -2.17%).

Most S&P sectors in positive area. Top gainer - Basic Materials (+0.6%). Top loser - Healthcare (-1.5%).

At the moment:

Dow 18951.00 +41.00 +0.22%

S&P 500 2196.25 +3.25 +0.15%

Nasdaq 100 4870.00 +16.00 +0.33%

Oil 48.33 +0.09 +0.19%

Gold 1208.40 -1.40 -0.12%

U.S. 10yr 2.32 -0.02

The Dow Jones Industrial Average breached 19000 for the first time early Tuesday, a day after major U.S. stock indexes hit a series of records.

The blue-chip index was recently up 47 points, or 0.3%, at 19004. The S&P 500 added 0.2%, and the Nasdaq Composite gained 0.3%. The three indexes, plus the small-cap Russell 2000, all closed at records Monday, says Dow Jones Newswire.

The afternoon trading phase brought not much to the settled already picture of the market. The optimism before the opening on Wall Street pulled quotations in Europe, although levels of resistance have not been punctured.

At the opening of the US exchanges the demand side continues to maintain the advantage and the major indexes are rising by approx. 0.2-0.5%.

Trading in Warsaw is focused mainly on maintaining existing achievements with the participation of commodity companies or companies dependent on commodity prices. The volatility so far is only 14 points.

An hour before the close of the session the WIG20 was at the level of 1,774 points (+1,06%).

U.S. stock-index futures gained, supported by strong commodity prices and the lingering effects of the post-election rally.

Global Stocks:

Nikkei 18,162.94 +56.92 +0.31%

Hang Seng 22,678.07 +320.29 +1.43%

Shanghai 3,249.58 +31.43 +0.98%

FTSE 6,832.12 +54.16 +0.80%

CAC 4,561.57 +31.99 +0.71%

DAX 10,742.54 +57.41 +0.54%

Crude $48.11 (-0.27%)

Gold $1,213.30 (+0.29%)

As reported by the company on its website, Volkswagen Board of Directors approved the program TRANSFORM 2025+, which will set the course for the development of the brand over the next decade and beyond.

According to the report, the new strategy aims at a better positioning of the brand in different regions and sectors, thanks to a significant improvement in efficiency and productivity. At the same time, the brand intends to carry out a major investment in the use of electric transport and connectivity.

The strategy foresees the following:

- Consistent restructuring of the core business and the development of new directions. By 2025 the company hopes to win the leading role in the electric segment, with annual sales of one million electric vehicles.

- A return to sustainable, profitable growth. The Board expects that the operating margin will rise to 6% by 2025.

- Billions of dollars in investment. Over the next few years, the Volkswagen brand will keep its investments stable at around € 4.5 billion, the main directions of investment - electric development. The brand intends to develop its own digital platform.

Upgrades:

Downgrades:

Other:

Ford Motor (F) initiated with a Sell at Berenberg

General Motors (GM) initiated with a Sell at Berenberg

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 31.05 | 0.36(1.173%) | 3327 |

| Amazon.com Inc., NASDAQ | AMZN | 786 | 6.00(0.7692%) | 62795 |

| American Express Co | AXP | 71.99 | 0.45(0.629%) | 208 |

| Apple Inc. | AAPL | 111.82 | 0.09(0.0806%) | 112343 |

| AT&T Inc | T | 37.87 | 0.13(0.3445%) | 15944 |

| Barrick Gold Corporation, NYSE | ABX | 15.49 | 0.10(0.6498%) | 28789 |

| Boeing Co | BA | 148.76 | 1.74(1.1835%) | 616 |

| Caterpillar Inc | CAT | 93.21 | 0.31(0.3337%) | 21894 |

| Chevron Corp | CVX | 110 | -0.18(-0.1634%) | 12786 |

| Cisco Systems Inc | CSCO | 30.13 | 0.08(0.2662%) | 1261 |

| Citigroup Inc., NYSE | C | 55.51 | -0.03(-0.054%) | 24931 |

| Deere & Company, NYSE | DE | 92.62 | 0.32(0.3467%) | 225 |

| Exxon Mobil Corp | XOM | 86.4 | -0.09(-0.1041%) | 4848 |

| Facebook, Inc. | FB | 122.1 | 0.33(0.271%) | 168207 |

| Ford Motor Co. | F | 11.81 | 0.02(0.1696%) | 22641 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14.85 | 0.34(2.3432%) | 514059 |

| General Motors Company, NYSE | GM | 33.22 | 0.21(0.6362%) | 387 |

| Goldman Sachs | GS | 211.38 | 0.30(0.1421%) | 3787 |

| Google Inc. | GOOG | 771.74 | 2.54(0.3302%) | 7661 |

| Hewlett-Packard Co. | HPQ | 16.2 | 0.20(1.25%) | 900 |

| Intel Corp | INTC | 35 | 0.02(0.0572%) | 7912 |

| Johnson & Johnson | JNJ | 114.5 | -0.50(-0.4348%) | 11133 |

| JPMorgan Chase and Co | JPM | 78.29 | 0.24(0.3075%) | 3175 |

| Merck & Co Inc | MRK | 61.93 | -0.37(-0.5939%) | 515 |

| Microsoft Corp | MSFT | 60.99 | 0.13(0.2136%) | 6215 |

| Nike | NKE | 51.4 | 0.12(0.234%) | 806 |

| Pfizer Inc | PFE | 31.72 | 0.15(0.4751%) | 14721 |

| Procter & Gamble Co | PG | 83.13 | 0.49(0.5929%) | 828 |

| Starbucks Corporation, NASDAQ | SBUX | 56.19 | 0.09(0.1604%) | 1495 |

| Tesla Motors, Inc., NASDAQ | TSLA | 184.8 | 0.28(0.1517%) | 14497 |

| The Coca-Cola Co | KO | 41.35 | -0.01(-0.0242%) | 6582 |

| Twitter, Inc., NYSE | TWTR | 18.72 | 0.12(0.6452%) | 35577 |

| Verizon Communications Inc | VZ | 48.45 | 0.14(0.2898%) | 2118 |

| Visa | V | 81.9 | 0.21(0.2571%) | 1412 |

| Wal-Mart Stores Inc | WMT | 69.62 | 0.25(0.3604%) | 13015 |

| Walt Disney Co | DIS | 97.6 | -0.03(-0.0307%) | 517 |

| Yahoo! Inc., NASDAQ | YHOO | 41.31 | 0.20(0.4865%) | 300 |

| Yandex N.V., NASDAQ | YNDX | 18.77 | 0.17(0.914%) | 6553 |

The first half of today's session was the picture of a pretty good trade. We may see, however, that a large increase from the beginning of the session, raises some problems with maintaining of this output. Our market has already repeatedly show that far more good is to climb slower than dynamic jump, which later forces more of work on its maintenance than magnification. Optimism in Warsaw matches well with preserving of the environment. Major European indices are right at the important resistance levels and today once again are trying to attack them using commodity companies. One drawback may be today the size of the market, which together with the last hour volatility indicates the drift of the market in the side area.

On the halfway point of the session the WIG20 index was at the level of 1,774 points (+1,03%). The turnover was amounted to PLN 290 million.

WIG20 index opened at 1765.41 points (+0.52%)*

WIG 47838.77 0.69%

WIG30 2059.44 0.91%

mWIG40 3985.87 0.27%

*/ - change to previous close

The future contracts December series (FW20Z1620) started the day of substantial increases by 0.8% to 1,770 points. Contracts on the German DAX gained at the opening on a smaller scale the order of 0.4%.

The cash market began with the growth gap with still good turnover and concentration on of raw materials companies. The boosters is growing fast and the main index goes above exponential average of 21 sessions.

After fifteen minutes of trading the Warsaw index of the largest companies reached the level of 1,777 points (+ 1.18%).

Indexes on Wall Street ended Monday's session with increases and subsequent historical peaks of trading. The Dow Jones Industrial at the end of the day gained 0.47 percent, the S&P 500 rose by 0.75 percent and the Nasdaq Composite gained 0.89 percent. The leaders on Monday's growth on Wall Street were oil companies in the wake of rising prices of oil. The market is optimistic due to the belief that Trump is able to move the economy back on faster than Hillary Clinton track.

Yesterday's weakening of the dollar and higher commodity prices led to a recovery in the segment of emerging markets and our market was exceptionally strongly benefited from this fact. Today morning rising prices of copper and oil. Indexes in Asia are gaining in value, especially as regards to emerging countries, as in Japan booster is modest and reaches 0.3%. We may also see increasing the valuation of contracts for the S&P500 index, where the psychological barrier of 2,200 points was defeated.

Today's macro calendar remains quite empty, ends the period of publication of results and approaching Thanksgiving Day. Listing on the Warsaw market should start positively. Later, much more will depend on whether the adverse for emerging markets trends in the dollar and bond's yields begin to turn away, as it did yesterday.

Europe's main equity benchmark finished slightly higher Monday, as gains for energy and mining stocks offset drops by Italian banks and U.K. manufacturer Essentra PLC. Italy is holding a constitutional referendum on Dec. 4, and a defeat for Prime Minister Mateo Renzi's Democratic Party would make it more difficult for the government to pass reforms, potentially prompting Renzi to dissolve his government.

U.S. stocks closed higher at fresh records Monday, aided by a jump in oil prices and a pullback in the dollar, giving the Dow industrials, S&P 500 and Nasdaq their third simultaneous all-time closing highs this year. The last time all three indexes closed at record highs at the same time was two sessions back in mid-August, and before then had not occurred since 1999.

Asian shares were broadly higher early Tuesday, with the Australian market rising to a one-month high, as oil prices rallied on expectations that key oil-producing countries will agree to a deal to slash production.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.