- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

Major U.S. stock-indexes hit record highs on Black Friday, helped by gains in consumer stocks at the start of the crucial holiday shopping season. Since the U.S. election, the three main U.S. indexes have hit all-time highs and closed at record levels multiple times in the past few days, most recently on Wednesday, when industrials boosted the Dow and S&P to record-high closes.

Most of Dow stocks in positive area (22 of 30). Top gainer - Cisco Systems, Inc. (CSCO, +1.40%). Top loser - Caterpillar Inc. (CAT, -0.63%).

Most S&P sectors in positive area. Top gainer - Conglomerates (+1.3%). Top loser - Basic Materials (-0.7%).

At the moment:

Dow 19106.00 +52.00 +0.27%

S&P 500 2207.50 +6.75 +0.31%

Nasdaq 100 4866.50 +17.00 +0.35%

Oil 46.34 -1.62 -3.38%

Gold 1180.40 -8.90 -0.75%

U.S. 10yr 2.38 +0.02

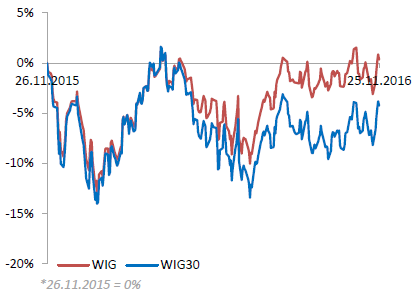

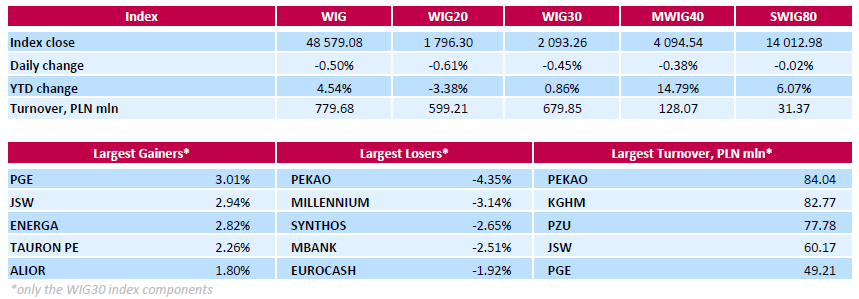

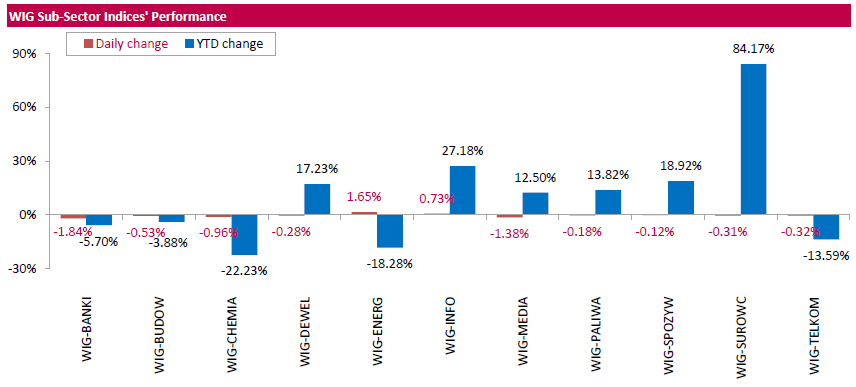

Polish equity market retreated on Friday. The broad market benchmark, the WIG index, fell by 0.5%. The WIG sub-sector indices were mainly lower with banking sector (-1.84%) underperforming.

The large-cap stocks' measure, the WIG30 Index, dropped by0.45%. In the WIG30 index basket, banking name PEKAO (WSE: PEO) was hit the hardest, down 4.35%. Poland's deputy prime minister Mateusz Morawiecki stated that the Polish state-run insurer PZU (WSE: PZU; +1.46%) and Polish Development Fund (PFR) are in the final stage of talks with Italy's UniCredit over buying its stake in PEKAO. Other largest decliners were chemical producer SYNTHOS (WSE: SNS) and two banks MILLENNIUM (WSE: MIL) and MBANK (WSE: MBK), which lost between 2.51% and 3.14%. On the other side of the ledger, gencos PGE (WSE: PGE) and ENERGA (WSE: ENG) were among the biggest advancers, climbing by a respective 3.01% and 2.82%, as Poland's energy minister Krzysztof Tchorzewski stated the country's state-run utilities will not be expected to invest more money to support the country's troubled coal mining firms.

In the afternoon phase of today's session, the descent of the WIG20 index under 1,800 points was deepened by a dozen points and the level of today's decline is proportional to market optimism on the previous sessions of the week. Than for a new impetus to the fight against resistance we may count only in the new week, but after today's hesitance the market probably will hide again in the middle of a few weeks consolidation. One of the biggest outsiders in the first line of companies today is Bank Pekao (WSE: PEO) the valuation of which losing more than 4 per cent.

The opening on Wall Street maintains the S&P500 index above the level of 2,200 points, although we get the feeling that above this level bulls running out of arguments to continue trading.

On the threshold of the last trading hours this week the WIG20 index was at 1,793 points (-0.75%).

U.S. stock-index futures advanced. The S&P 500 and the Dow were poised to hit record highs on Black Friday, with the focus on retailers at the start of the crucial holiday shopping season.

Global Stocks:

Nikkei 18,381.22 +47.81 +0.26%

Hang Seng 22,723.45 +114.96 +0.51%

Shanghai 3,261.49 +19.76 +0.61%

FTSE 6,837.87 +8.67 +0.13%

CAC 4,536.90 -5.66 -0.12%

DAX 10,676.28 -12.98 -0.12%

Crude $47.54 (-0.88%)

Gold $1,186.50 (-0.24%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 31.5 | -0.01(-0.0317%) | 3582 |

| ALTRIA GROUP INC. | MO | 64.21 | 0.19(0.2968%) | 177200 |

| Amazon.com Inc., NASDAQ | AMZN | 785.4 | 5.28(0.6768%) | 25400 |

| Apple Inc. | AAPL | 111.12 | -0.11(-0.0989%) | 20877 |

| AT&T Inc | T | 38.97 | 0.24(0.6197%) | 11893 |

| Boeing Co | BA | 150 | 0.26(0.1736%) | 702 |

| Caterpillar Inc | CAT | 96.49 | 0.31(0.3223%) | 16910 |

| Chevron Corp | CVX | 110.6 | -0.40(-0.3604%) | 3210 |

| Cisco Systems Inc | CSCO | 29.65 | -0.06(-0.202%) | 1340 |

| Citigroup Inc., NYSE | C | 56.9 | 0.21(0.3704%) | 10656 |

| Deere & Company, NYSE | DE | 101.62 | -0.55(-0.5383%) | 16308 |

| Exxon Mobil Corp | XOM | 86.31 | -0.61(-0.7018%) | 278 |

| Facebook, Inc. | FB | 121.06 | 0.22(0.1821%) | 76920 |

| Ford Motor Co. | F | 86.31 | -0.61(-0.7018%) | 278 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 16.34 | 0.13(0.802%) | 1175264 |

| General Electric Co | GE | 31.39 | 0.05(0.1595%) | 2300 |

| General Motors Company, NYSE | GM | 33.83 | -0.03(-0.0886%) | 1130 |

| Goldman Sachs | GS | 212.26 | -0.05(-0.0236%) | 3042 |

| Google Inc. | GOOG | 764.9 | 3.91(0.5138%) | 2715 |

| HONEYWELL INTERNATIONAL INC. | HON | 86.31 | -0.61(-0.7018%) | 278 |

| Intel Corp | INTC | 35.25 | 0.05(0.142%) | 3428 |

| International Business Machines Co... | IBM | 161.84 | -0.14(-0.0864%) | 240 |

| Johnson & Johnson | JNJ | 113.5 | 0.43(0.3803%) | 863 |

| JPMorgan Chase and Co | JPM | 79 | 0.14(0.1775%) | 3029 |

| Merck & Co Inc | MRK | 61.8 | 0.16(0.2596%) | 1711 |

| Microsoft Corp | MSFT | 60.42 | 0.02(0.0331%) | 4998 |

| Nike | NKE | 51.5 | 0.16(0.3116%) | 3346 |

| Pfizer Inc | PFE | 31.6 | 0.18(0.5729%) | 20055 |

| Procter & Gamble Co | PG | 82.86 | 0.18(0.2177%) | 269216 |

| Starbucks Corporation, NASDAQ | SBUX | 57.63 | 0.04(0.0695%) | 283 |

| Tesla Motors, Inc., NASDAQ | TSLA | 193.75 | 0.61(0.3158%) | 4449 |

| The Coca-Cola Co | KO | 41.15 | 0.03(0.073%) | 396076 |

| Twitter, Inc., NYSE | TWTR | 18.28 | 0.06(0.3293%) | 5460 |

| Verizon Communications Inc | VZ | 50.36 | 0.13(0.2588%) | 925 |

| Visa | V | 79.8 | 0.23(0.2891%) | 1200 |

| Wal-Mart Stores Inc | WMT | 71.35 | 0.52(0.7342%) | 157158 |

| Walt Disney Co | DIS | 98.59 | 0.33(0.3358%) | 8858 |

| Yahoo! Inc., NASDAQ | YHOO | 41.1 | 0.14(0.3418%) | 3430 |

Upgrades:

Deere (DE) upgraded to Neutral from Underperform at Longbow

Downgrades:

Other:

Deere (DE) target raised to $98 from $80 at RBC Capital Mkts

The decline of oil prices had a negative impact on the securities of the energy sector, while shares of Italian lenders put pressure on the index of the banking sector in Europe.

The composite index of the largest companies in the region Stoxx Europe 600 fell by 0.08% to 341.57 points. The indicator increased by 0.7% since the beginning of this week.

European oil and gas companies index sank 0.71% as oil prices dropped more than 1% on the back of a strong dollar.

Mining shares are mixed amid falling prices for oil and copper, as well as the rise of the value of gold.

Shares of Royal Dutch Shell and BP fell 0.5%.

Shares of Rio Tinto rose 1%, Randgold Resources +1,2%, Glencore - have fallen in price 0,2%, Boliden -0.5%.

Shares of Italian banks fell by 0.45% due to concerns about the outcome of the referendum on the reform of the Constitution, which may collapse the government of the reformist Prime Minister Matteo Renzi. European banking index fell by 0.55%. the referendum will be held Dec 4

At the same time, the health sector index rose 0.61%.

Support to the sector had a sharp rally of Swiss biotech company Actelion after news that Johnson & Johnson made its takeover attempt. Actelion shares rose nearly 9% and ready to show the maximum one-day rise since mid-2014.

Daily Mail shares fell 3,7% after Barclays lowered to "underperform".

At the moment:

FTSE 6827.59 -1.61 -0.02%

DAX 10681.69 -7.57 -0.07%

CAC 4536.98 -5.58 -0.12%

The session in Warsaw due to limited activity of the global players have to be calm, but slowly this baseline scenario faces a growing risk. We descend on minima session with a fall of the WIG20 by about 1 percent. The combination of meeting the WIG20 index with the levels of resistance and the upper limit of consolidation together with neutral attitude of core markets have given mix, which turned out to be stronger on the side of local factors. The market clearly hesitated at the height of 1,800 points and at this stage ignores even the strengthening of the zloty against the dollar and the euro.

After a few better sessions the WSE returns today to the relative weakness of that we have had in many months.

At the halfway point of today's quotations, the WIG20 index was st the level of 1,788 points (-1,03%).

Yesterday's holiday in the US and the lack of quotations on Wall Street causes that this morning in Europe is not going to be particularly exciting. Quiet trading is also seen in Asia.

The contracts on the S&P500 recorded now cosmetic loss. Minimally shifts appear on the currency market, where Eurodollar gaining 0.1 percent. Today's macro calendar does not contain critical data, so we may assume that in the environment there will be little change until the game will join players from the USA.

On the Warsaw market last four sessions were successful for the WIG20 index. Yesterday's rise in the absence of Wall Street indicates that the market is optimistic. However, from the point of view of technical analysis, resistance zone located above the level of 1810 points may encouraged to take profits.

Warsaw index since almost half of a year is moving in a trend channel with a horizontal limits set roughly at about 1,700 points from the bottom and 1,800 points from the top. So a really strong impulse is necessary to break the index out this template behavior. Such negative impulse could be unfavorable for the Prime Minister Renzi decision of the Italian referendum on December 4. In turn, the positive would be a classic rally of St. Claus on global stock markets, which, in fact we have not seen in three years.

European stocks scored modest gains Thursday, with mining shares battling against dollar strength during a quieter-than-usual session with U.S. markets closed for the Thanksgiving holiday. "The usual Thanksgiving calm has descended across markets, as European investors reconcile themselves to a day of low volumes and quiet trading," said Chris Beauchamp, chief market analyst at IG, in an note.

U.S. stock futures edged up on Thursday, as traders focused on their Thanksgiving Day celebrations rather than making big bets. U.S. stock markets and the bond market are closed Thursday for the holiday, and equity trading hours will be shortened on Friday.

Asian share markets were broadly higher early Friday, with Japan's Nikkei leading after the yen hit a fresh eight-month low against the dollar, helping boost the competitiveness of the country's exports.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.