- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei 225 18,307.04 -49.85 -0.27%

Shanghai Composite 3,283.36 +6.36 +0.19%

S&P/ASX 200 5,457.50 0.00 0.00%

FTSE 100 6,772.00 -27.47 -0.40%

CAC 40 4,551.46 +41.07 +0.91%

Xetra DAX 10,620.49 +37.82 +0.36%

S&P 500 2,204.66 +2.94 +0.13%

Dow Jones Industrial Average 19,121.60 +23.70 +0.12%

S&P/TSX Composite 14,999.81 -15.55 -0.10%

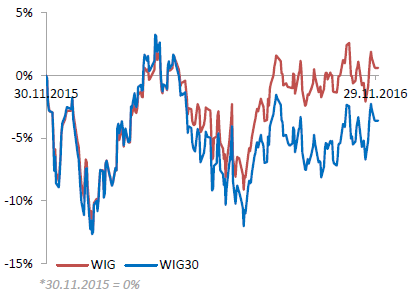

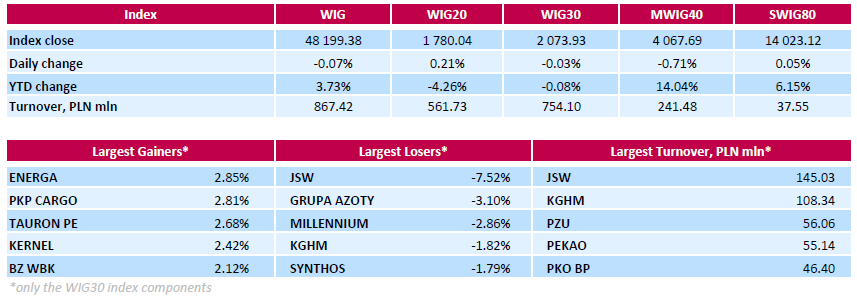

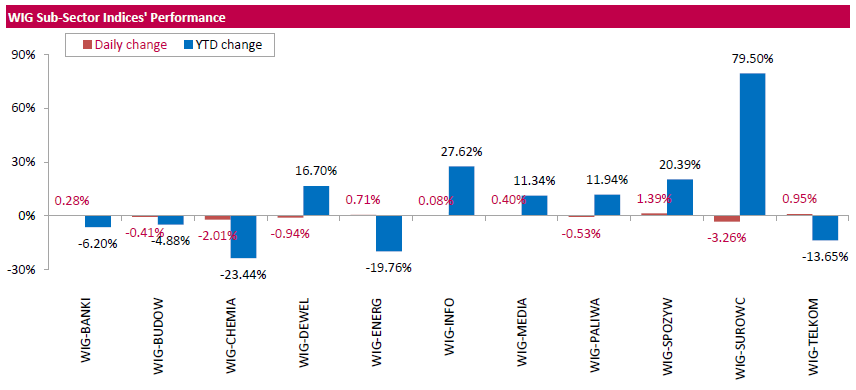

Polish equity market closed flat on Tuesday. The broad market measure, the WIG Index, edged down 0.07%. Sector performance within the WIG Index was mixed. Materials (-3.26%) fell the most, while food sector (+1.39%) fared the best.

The large-cap stocks' measure, the WIG30 Index, inched down 0.03%. In the index basket, coking coal miner JSW (WSE: JSW) topped the decliners' list, tumbling by 7.52%. It was reported that the company's shareholders decided to announce break in proceedings of EGM until December 1. The shareholders were supposed to vote on the transfer of JSW's troubled mine Krupinski to state restructuring company SRK, which will wind it down. Among other major laggards were chemical producer GRUPA AZOTY (WSE: ATT), bank MILLENNIUM (WSE: MIL) and copper producer KGHM (WSE: KGH), plunging by 3.1%, 2.86% and 1.82% respectively. On the other side of the ledger, utilities name ENERGA (WSE: ENG) and railway freight transport operator PKP CARGO (WSE: PKP) led the gainers, jumping by 2.85% and 2.81% respectively.

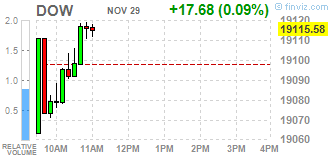

Major U.S. stock-indexes slightly rose on Tuesday as a sharp drop in oil prices weighed on energy stocks, while a rise in healthcare stocks helped limit losses. Oil fell nearly 4% as major exporters struggled to agree to a production freeze to reduce global oversupply ahead of an OPEC meeting on Wednesday.

Most of Dow stocks in positive area (17 of 30). Top gainer - UnitedHealth Group Incorporated (UNH, +3.61%). Top loser - Chevron Corporation (CVX, -1.60%).

Most S&P sectors in positive area. Top gainer - Financials (+0.7%). Top loser - Basic Materials (-1.4%).

At the moment:

Dow 19102.00 +22.00 +0.12%

S&P 500 2204.25 +3.50 +0.16%

Nasdaq 100 4877.25 +16.25 +0.33%

Oil 45.32 -1.76 -3.74%

Gold 1191.30 -2.50 -0.21%

U.S. 10yr 2.34 +0.02

The afternoon data on GDP growth in the US were better than expected, although Wall Street reacted to it carefully. The first transactions show rather stabilizing after yesterday's fall than rise.

The Warsaw market, which reacted by weakening of the WIG20 to this data returned to the levels observed before 14:30. The level of turnover remained stable, which may mean that today's session will confirm the consolidation.

One hour before the close of trading on the Warsaw market, the WIG20 index was at the level 1,774 points (- 0.10%).

U.S. stock-index futures were little changed as investors assessed revised data on the U.S. GDP for the third quarter and awaited tomorrow's crucial oil talks of OPEC members in Vienna.

Global Stocks:

Nikkei 18,307.04 -49.85 -0.27%

Hang Seng 22,737.07 -93.50 -0.41%

Shanghai 3,283.36 +6.36 +0.19%

FTSE 6,760.97 -38.50 -0.57%

CAC 4,538.63 +28.24 +0.63%

DAX 10,595.42 +12.75 +0.12%

Crude $45.72 (-2.89%)

Gold $1,182.00 (-0.74%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 30.21 | -0.65(-2.1063%) | 12300 |

| Amazon.com Inc., NASDAQ | AMZN | 769.37 | 2.60(0.3391%) | 11054 |

| AT&T Inc | T | 39.68 | 0.14(0.3541%) | 7529 |

| Barrick Gold Corporation, NYSE | ABX | 15.05 | -0.35(-2.2727%) | 63015 |

| Caterpillar Inc | CAT | 94.2 | -0.70(-0.7376%) | 4058 |

| Chevron Corp | CVX | 109.74 | -0.76(-0.6878%) | 1550 |

| Cisco Systems Inc | CSCO | 30.1 | 0.18(0.6016%) | 534 |

| Citigroup Inc., NYSE | C | 55.51 | 0.04(0.0721%) | 42745 |

| Deere & Company, NYSE | DE | 101.5 | -0.20(-0.1967%) | 6418 |

| Exxon Mobil Corp | XOM | 85.86 | -0.61(-0.7054%) | 3560 |

| Facebook, Inc. | FB | 120.45 | 0.04(0.0332%) | 25434 |

| Ford Motor Co. | F | 11.95 | 0.03(0.2517%) | 5602 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 15.22 | -0.56(-3.5488%) | 255768 |

| Home Depot Inc | HD | 130.25 | 0.30(0.2309%) | 1000 |

| HONEYWELL INTERNATIONAL INC. | HON | 30.1 | 0.18(0.6016%) | 534 |

| Intel Corp | INTC | 35.66 | 0.15(0.4224%) | 1341 |

| International Business Machines Co... | IBM | 164.25 | -0.27(-0.1641%) | 173 |

| JPMorgan Chase and Co | JPM | 78.78 | 0.46(0.5873%) | 300 |

| McDonald's Corp | MCD | 30.1 | 0.18(0.6016%) | 534 |

| Pfizer Inc | PFE | 31.84 | 0.30(0.9512%) | 24037 |

| Procter & Gamble Co | PG | 83.39 | 0.32(0.3852%) | 425 |

| Starbucks Corporation, NASDAQ | SBUX | 57.79 | 0.20(0.3473%) | 1515 |

| Tesla Motors, Inc., NASDAQ | TSLA | 196.1 | -0.02(-0.0102%) | 7693 |

| The Coca-Cola Co | KO | 41.45 | 0.05(0.1208%) | 5674 |

| Twitter, Inc., NYSE | TWTR | 11.95 | 0.03(0.2517%) | 5602 |

| UnitedHealth Group Inc | UNH | 157.2 | 5.09(3.3463%) | 27685 |

| Verizon Communications Inc | VZ | 51.44 | 0.32(0.626%) | 205 |

| Walt Disney Co | DIS | 99.25 | 0.28(0.2829%) | 6316 |

| Yahoo! Inc., NASDAQ | YHOO | 41.52 | 0.07(0.1689%) | 675 |

Upgrades:

Pfizer (PFE) upgraded to Overweight from Equal Weight at Barclays

Downgrades:

Goldman Sachs (GS) downgraded to Neutral from Buy at Nomura

Johnson & Johnson (JNJ) downgraded to Equal Weight from Overweight at Barclays

Other:

McDonald's (MCD) removed from US Focus List at Credit Suisse; holds Outperform, target $128

Altria (MO) resumed with a Equal-Weight at Morgan Stanley; target $65

The morning trading phase has not brought major changes in the Warsaw market. Low volatility suggests that markets are waiting to enter the game by Americans and data from the US. At the halfway point of today's session, the WIG 20 index was at the level of 1,780 points (+ 0.24%). The turnover in the segment of the largest companies was amounted to PLN 230 million.

WIG20 index opened at 1777.84 points (+0.09%)*

WIG 48300.04 0.14%

WIG30 2076.48 0.09%

mWIG40 4113.80 0.41%

*/ - change to previous close

The future contracts December series on the WIG20 (FW20Z1620) started trading at the point at which ended yesterday. After a weaker Monday, which was marked by profit taking after the recent increases in core markets, today the atmosphere is calm for now. Markets need withdrawal to catch his breath, and maybe this breath was caught yesterday.

The beginning of the session on the cash market was held at a slight plus.

After the first transactions the index of the biggest companies went down. The level of turnover is low. A little a drop in the German DAX by 0.2 percent also does not favor the bulls in Warsaw.

After fifteen minutes of trading the WIG20 index was at the level of 1,771 (-0,25%).

The main indexes of stock exchanges in New York remained in the red yesterday, after being established the historic highs in the past week. Dow Jones Industrial at the end of the day lost 0.28 percent, the S&P 500 fell by 0.53 percent and the Nasdaq Comp. went down by 0.56 percent. The withdrawal of the main indices was accompanied by weakening of the dollar, the strength of which was one element of the bulls rally on Wall Street after the US presidential election. The corrective mood moved also to Asia, where the Nikkei lost 0.3 percent, but futures on the S&P500 are looking for stability.

Serious movements may not be seen as well on the zloty and emerging markets. The Eurodollar recorded modest changes, so the start of the day in Europe can be considered as a stable.

In the macro calendar the highlight of the day is reading of the US GDP. Data recall that this week is an input in the December and meeting of investors with economic indices readings and monthly data from the US labor market. This week will also be interesting because of reports from Europe due to systemic referendum in Italy this weekend. Also important will be the December decision of the European Central Bank on the change in the program of quantitative easing.

The Warsaw market is still in the shadow of the core markets and is dependent on the global relation to the emerging markets. Important is the relationship of the dollar to other currencies and the condition of the zloty against the dollar. From the technical analysis point of view the end of the previous week and the first session of this week clearly show that the market is not ready to break the WIG20 beyond a few weeks of consolidation.

U.K. stocks dropped for the first time in three sessions on Monday, with oil producers among the biggest decliners on growing concerns OPEC will fail to reach an output deal at a closely watched meeting this week.

U.S. stocks closed lower on Monday as investors found few reasons to keep pushing shares higher following an extended rally that took major indexes to a string of records and lifted major indexes for three straight weeks.

Expectations that a production deal among the Organization of the Petroleum Exporting Countries would unravel dominated Asian trade on Monday, adding volatility to regional stocks and currencies.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.