- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei 225 18,356.89 -24.33 -0.13%

Shanghai Composite 3,277.10 +15.16 +0.46%

S&P/ASX 200 5,464.40 0.00 0.00%

FTSE 100 6,799.47 -41.28 -0.60%

CAC 40 4,510.39 -39.88 -0.88%

Xetra DAX 10,582.67 -116.60 -1.09%

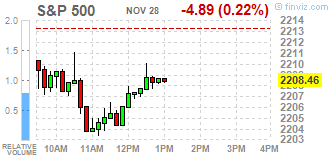

S&P 500 2,201.72 -11.63 -0.53%

Dow Jones Industrial Average 19,097.90 -54.24 -0.28%

S&P/TSX Composite 15,015.36 -60.08 -0.40%

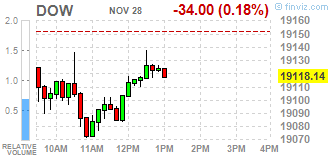

Major U.S. stock-indexes lower on Monday, weighed down by financial and consumer discretionary stocks, as some investors cashed in following a record-setting week. The three major U.S. indexes closed higher for the third week in a row on Friday, with the S&P 500 notching its seventh record close since 8 of Nov. Oil prices bounced back in volatile trading after falling as much as 2,5% as the market reacted to the shaky prospect of major producers being able to agree output cuts at a meeting on Wednesday.

Most of Dow stocks in negative area (19 of 30). Top gainer - Verizon Communications Inc. (VZ, +0.79%). Top loser - UnitedHealth Group Incorporated (UNH, -1.09%).

Most of S&P sectors also in negative area. Top gainer - Utilities (+1.5%). Top loser - Basic Materials (-1.1%).

At the moment:

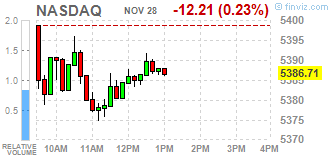

Dow 19095.00 -49.00 -0.26%

S&P 500 2206.75 -4.50 -0.20%

Nasdaq 100 4872.50 +4.00 +0.08%

Oil 47.26 +1.20 +2.61%

Gold 1188.50 +10.10 +0.86%

U.S. 10yr 2.33 -0.04

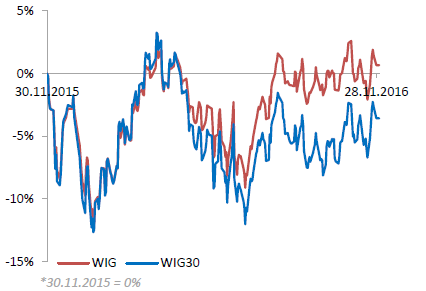

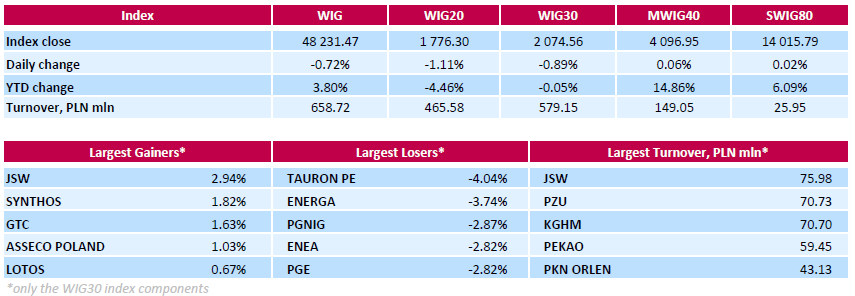

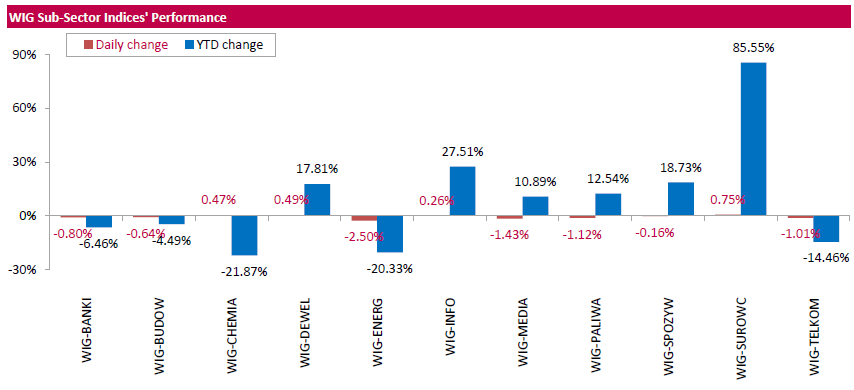

Polish equities closed lower on Monday. The broad market benchmark, the WIG Index, lost 0.72%. Sector performance within the WIG Index was mixed. Utilities (-2.50%) fell the most, while materials (+0.75%) fared the best.

The large-cap stocks plunged by 0.89%, as measured by the WIG30 Index. Within the index components, four utilities names TAURON PE (WSE: TPE), PGE (WSE: PGE), ENEA (WSE: ENA) and ENERGA (WSE: ENG) were among the major laggards, tumbling between 2.82% and 4.04%. Other biggest decliners were oil and gas producer PGNIG (WSE: PGN), bank MBANK (WSE: MBK) and FMCG-wholesaler EUROCASH (WSE: EUR), which lost 2.87%, 2.23% and 2.22% respectively. On the other side of the ledger, coking coal miner JSW (WSE: JSW) topped the list of gainers with a 2.94% advance, followed by chemical producer SYNTHOS (WSE: SNS) and property developer GTC (WSE: GTC), which rose by 1.82% and 1.63%.

The weakening of the zloty, fall in the valuation of the Eurodollar and the end of the fall in bonds yields is a mix prejudicial to our market, same like for the emerging markets sector.

Therefore, the supply is spreading and the index of the largest companies in the afternoon phase of the session remained near session lows. The weaker today is the energy sector, where, as we may see, on any durable rise is still hard.

The market in the United States opened with decrease of less than 0.2%, which during the first trades increasing slightly.

An hour before the end of trading in Warsaw, the WIG20 index was at the level of 1,777 points (-1,04%).

U.S. stock-index futures fell as the Donald Trump effect lost its sway over global financial markets and investors shifted to new risks, including those related to upcoming official gathering of OPEC and constitutional referendum in Italy.

Global Stocks:

Nikkei 18,356.89 -24.33 -0.13%

Hang Seng 22,830.57 +107.12 +0.47%

Shanghai 3,277.10 +15.16 +0.46%

FTSE 6,809.86 -30.89 -0.45%

CAC 4,524.18 -26.09 -0.57%

DAX 10,621.83 -77.44 -0.72%

Crude $46.39 (+0.72%)

Gold $1,187.30 (+0.76%)

(company / ticker / price / change ($/%) / volume)

| Amazon.com Inc., NASDAQ | AMZN | 776.55 | -3.82(-0.4895%) | 17854 |

| Apple Inc. | AAPL | 111.57 | -0.22(-0.1968%) | 34240 |

| AT&T Inc | T | 39.15 | -0.06(-0.153%) | 1675 |

| Barrick Gold Corporation, NYSE | ABX | 14.99 | 0.25(1.6961%) | 67052 |

| Boeing Co | BA | 148.81 | -1.23(-0.8198%) | 2173 |

| Chevron Corp | CVX | 110.8 | -0.20(-0.1802%) | 1629 |

| Cisco Systems Inc | CSCO | 30.11 | 0.02(0.0665%) | 20883 |

| Citigroup Inc., NYSE | C | 56.25 | -0.53(-0.9334%) | 16037 |

| Deere & Company, NYSE | DE | 103.5 | -0.42(-0.4042%) | 3791 |

| Exxon Mobil Corp | XOM | 86.5 | -0.62(-0.7117%) | 7920 |

| Facebook, Inc. | FB | 119.9 | -0.48(-0.3987%) | 34831 |

| FedEx Corporation, NYSE | FDX | 191.15 | -0.38(-0.1984%) | 1025 |

| Ford Motor Co. | F | 12.01 | -0.03(-0.2492%) | 19795 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 15.83 | -0.17(-1.0625%) | 186101 |

| General Electric Co | GE | 31.22 | -0.22(-0.6997%) | 8617 |

| Goldman Sachs | GS | 210.2 | -1.18(-0.5582%) | 4632 |

| Google Inc. | GOOG | 758.5 | -3.18(-0.4175%) | 1329 |

| Home Depot Inc | HD | 131.28 | -0.29(-0.2204%) | 530 |

| Intel Corp | INTC | 35.2 | -0.24(-0.6772%) | 7489 |

| International Business Machines Co... | IBM | 162.6 | -0.54(-0.331%) | 439 |

| Johnson & Johnson | JNJ | 114.4 | 0.27(0.2366%) | 1115 |

| JPMorgan Chase and Co | JPM | 78.25 | -0.58(-0.7358%) | 8724 |

| McDonald's Corp | MCD | 120.52 | -0.14(-0.116%) | 405 |

| Merck & Co Inc | MRK | 62.23 | 0.02(0.0321%) | 495 |

| Microsoft Corp | MSFT | 60.41 | -0.12(-0.1982%) | 4383 |

| Nike | NKE | 51.84 | 0.32(0.6211%) | 2214 |

| Pfizer Inc | PFE | 31.6 | -0.09(-0.284%) | 3112 |

| Tesla Motors, Inc., NASDAQ | TSLA | 196 | -0.65(-0.3305%) | 3856 |

| The Coca-Cola Co | KO | 41.68 | 0.15(0.3612%) | 374 |

| Twitter, Inc., NYSE | TWTR | 17.94 | -0.12(-0.6644%) | 32897 |

| Verizon Communications Inc | VZ | 50.49 | -0.18(-0.3552%) | 3873 |

| Visa | V | 80.02 | -0.11(-0.1373%) | 637 |

| Wal-Mart Stores Inc | WMT | 71.18 | -0.05(-0.0702%) | 1926 |

| Walt Disney Co | DIS | 98.6 | -0.22(-0.2226%) | 6105 |

| Yandex N.V., NASDAQ | YNDX | 18.71 | 0.08(0.4294%) | 900 |

Upgrades:

Deere (DE) upgraded to Neutral from Underweight at Piper Jaffray

Downgrades:

Citigroup (C) downgraded to Hold from Buy at Jefferies

Other:

The first half of today's trading has not brought more activity, which at the halfway point of the session amounted to approx. PLN 300 million registered for the whole market and in the segment of blue chips approx. PLN 200 million.

Changing of prices looks also negative in the wake of decreasing contracts in the US and a weak attitude of the European environment, where the DAX went down almost 0,9%. The mood in Europe broke down, among others, under the influence of return of concerns about the result of the Italian referendum.

In today's report Organization for Economic Co-operation and Development (OECD) lowered its forecast regarding growth of Polish Gross Domestic Product in 2016 to 2.6 percent against 3.0 percent projected in June.

In the middle of today's session the WIG20 index was at the level of 1,781 points (-0.82%).

European stocks traded in the red zone, in response to growing concerns about the risks to the financial stability of the Italian creditors before the referendum. The negative dynamics of the oil market also put preasure.

On December 4 the Italians will vote on the issue of constitutional reform. Prime Minister Renzi says will strengthen the future government by limiting the powers of the Senate. This vote is seen by experts as defining for the political fate of Renzi. He has previously warned he could resign if the Italians would say "no" to the reforms. Opinion polls show that the majority of Italians are against the constitutional changes, which, as the economists say, Italy desperately needs, if it wants the government to optimize and accelerate the growth of the economy.

Certain influence on the dynamics of trade have data for the euro area. The ECB said that the money supply increased at a slower pace, while private sector loan growth has improved in October. According to the data, the M3 monetary aggregate up to October rose by 4.4 percent year on year, after increasing by 5.1 percent in September. On average over the past three months (to October) the growth rate of monetary aggregate M3 amounted to 4.8 percent. Private sector credit volume increased by 2.3 percent, after rising 2 percent in September. Annual growth of loans to households remained stable in October - at the level of 1.8 percent. At the same time, lending to non-financial corporations has increased by 2.1 percent compared to 2 percent increase in September.

The composite index of the largest companies in the region Stoxx Europe 600 dropped 0.63 percent. The trading volume today is 14 percent lower than the average of 30 days.

The capitalization of UniCredit SpA and Banca Monte dei Paschi fell more than 3.8 percent after Financial Times reported that up to eight Italian banks may fail in the event of the defeat of Prime Minister Matteo Renzi on constitutional referendum

Against this background, the Italian MIB Index has fallen by 1.6 percent, which is one of the worst results in Western European markets.

Shares of Royal Bank of Scotland fell 2.8 percent amid reports that the bank may face difficulties when trying to sell Williams & Glyn.

Eni SpA shares and Tullow Oil Plc fell more than 1 percent, as oil prices fell below $ 46 per barrel.

At the moment:

FTSE 100 6801.95 -38.80 -0.57%

DAX -80.11 10619.16 -0.75%

CAC 40 4522.52 -27.75 -0.61%

WIG20 index opened at 1794.64 points (-0.09%)*

WIG 48602.54 0.05%

WIG30 2092.84 -0.02%

mWIG40 4102.98 0.21%

*/ - change to previous close

The cash market (the WIG 20 index) opens from a discount of 0.09% to 1,794 points with the turnover traditionally focused on the KGHM shares, which are also the only one among the blue chips that today stand out positively and noticeably increase in value. The German DAX opened at a discount of 0.4%, which is a poor result, but at the same time reflecting the decreasing level of contracts in the United States. We may see that the developed markets represent somewhat weaker form. For the Warsaw market at that moment the weaker dollar helps to maintain a relatively neutral posture, but still below the level of 1,800 points.

After fifteen minutes of trading the WIG20 index was at the level of 1,790 points (-0,34%).

Ahead of us the new week, which will start the new month - December. The beginning of a new month means the monthly report from the US labor market, the last before the expected December's interest rate hike in the United States and a series of PMI / ISM for the manufacturing sector.

However, the most attention attracts the OPEC meeting. On Friday afternoon Saudi Arabia said that will not participate in the meeting scheduled for today with the producers outside the cartel of oil. In addition, on Sunday, Minister of oil of this country stated that the reduction of production is not needed, due to the expected balance of the market next year. This resulted in a sharp drop in oil prices on Friday and today they remain at lower levels. This caused a correction in yields of US bonds and the dollar. As a result we may see a good performance of Asian parquets this morning as well as markets of developing countries, which with further increase in the price of copper should also be good news for the Warsaw Stock Exchange.

For the Warsaw market will be important to fight the psychological level of 1,800 points by the WIG20 index.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.