- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

Stock indices traded lower, companies' earnings results and Greece stocks weighed on markets. Siemens AG shares declined 3.1% after the company reported a decrease in first-quarter profit.

Royal Philips NV shares 6.0% after the company reported a 67% drop in annual net profit.

Greek stocks declined as investors remained cautious amid concerns over Greece's future policy. Syriza party won the country's parliament elections on Sunday. The party has pledged to renegotiate the terms of the country's €240 billion euro financial bailout and to reverse many of the austerity measures.

The U.K. gross domestic product (GDP) climbed 0.5% in the fourth quarter, missing expectations for a 0.6% gain, after a 0.7% rise in the third quarter.

On a yearly basis, the U.K. GDP increased 2.7% in the fourth quarter, missing forecasts of a 2.8 rise, after a 2.6% gain in the third quarter.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,811.61 -40.79 -0.60%

DAX 10,628.58 -169.75 -1.57%

CAC 40 4,624.21 -50.92 -1.09%

Dow 17,498.93 -179.77 -1.02%

Nasdaq 4,695.59 -76.17 -1.60%

S&P 500 2,032.58 -24.51 -1.19%

10 Year Yield 1.76% -0.07 --

Gold $1,286.30 +6.90 +0.54%

Oil $45.48 +0.33 +0.73%

U.S. stock-index futures fell as results from Caterpillar Inc. to Microsoft Corp. and DuPont Co. disappointed investors.

Global markets:

Nikkei 17,768.3 +299.78 +1.72%

Hang Seng 24,807.28 -102.62 -0.41%

Shanghai Composite 3,354.36 -28.82 -0.85%

FTSE 6,790.03 -62.37 -0.91%

CAC 4,608.34 -66.79 -1.43%

DAX 10,646.22 -152.11 -1.41%

Crude oil $45.42 (+0.62%)

Gold $1285.60 (+0.48%)

(company / ticker / price / change, % / volume)

| Barrick Gold Corporation, NYSE | ABX | 12.88 | +1.50% | 53.4K |

| AT&T Inc | T | 33.05 | -0.39% | 79.1K |

| Apple Inc. | AAPL | 112.48 | -0.55% | 1.0M |

| UnitedHealth Group Inc | UNH | 110.88 | -0.65% | 3.9K |

| Travelers Companies Inc | TRV | 106.36 | -0.66% | 0.1K |

| American Express Co | AXP | 82.69 | -0.73% | 8.4K |

| Walt Disney Co | DIS | 94.24 | -0.77% | 1.7K |

| Nike | NKE | 95.60 | -0.78% | 6.9K |

| Chevron Corp | CVX | 108.02 | -0.79% | 0.8K |

| Verizon Communications Inc | VZ | 46.59 | -0.79% | 18.3K |

| Exxon Mobil Corp | XOM | 91.01 | -0.82% | 8.0K |

| The Coca-Cola Co | KO | 42.60 | -0.93% | 0.8K |

| Ford Motor Co. | F | 14.93 | -0.99% | 21.4K |

| Johnson & Johnson | JNJ | 101.20 | -1.04% | 5.7K |

| Amazon.com Inc., NASDAQ | AMZN | 306.43 | -1.04% | 4.3K |

| International Business Machines Co... | IBM | 154.70 | -1.06% | 18.6K |

| Pfizer Inc | PFE | 32.45 | -1.07% | 55.6K |

| Home Depot Inc | HD | 105.19 | -1.10% | 0.7K |

| JPMorgan Chase and Co | JPM | 56.11 | -1.16% | 1.4K |

| Boeing Co | BA | 132.40 | -1.25% | 2.8K |

| General Electric Co | GE | 24.27 | -1.30% | 72.2K |

| Citigroup Inc., NYSE | C | 48.25 | -1.31% | 14.4K |

| Cisco Systems Inc | CSCO | 27.60 | -1.32% | 22.0K |

| McDonald's Corp | MCD | 89.45 | -1.35% | 3.2K |

| Goldman Sachs | GS | 177.77 | -1.47% | 1.5K |

| 3M Co | MMM | 161.50 | -1.67% | 13.8K |

| ALCOA INC. | AA | 15.73 | -2.18% | 25.5K |

| Procter & Gamble Co | PG | 87.20 | -2.66% | 107.4K |

| Deere & Company, NYSE | DE | 86.00 | -2.75% | 9.2K |

| E. I. du Pont de Nemours and Co | DD | 72.00 | -2.85% | 3.7K |

| Intel Corp | INTC | 34.69 | -3.11% | 404.1K |

| United Technologies Corp | UTX | 115.00 | -3.16% | 7.0K |

| Caterpillar Inc | CAT | 78.84 | -8.36% | 692.1K |

| Microsoft Corp | MSFT | 42.90 | -8.74% | 5.1M |

Upgrades:

Downgrades:

Microsoft (MSFT) downgraded to Neutral from Buy at Nomura, target lowered to $50 from $56

Microsoft (MSFT) downgraded to Neutral from Overweight at JP Morgan, target lowered to $47 from $53

Other:

Microsoft (MSFT) target lowered to $52 from $54 at Piper Jaffray; Overweight (47.01)

Honeywell (HON) target raised from $106 to $115 at Argus

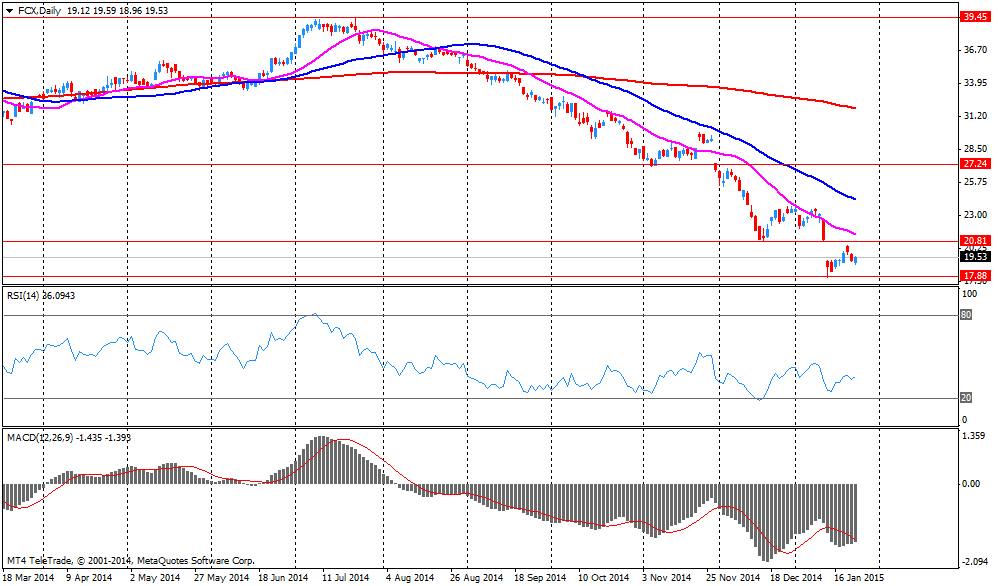

Freeport-McMoRan (FCX) earned $0.25 per share in the fourth quarter, missing analysts' estimate of $0.35. Revenue in the fourth quarter dropped 11.00% year-over-year to $5.24 billion, missing analysts' estimate of $4.89 billion.

The company has taken steps to significantly reduce capital spending due to falling oil prices.

Freeport-McMoRan (FCX) shares decreased to $18.05 (-7.72%) prior to the opening bell.

Pfizer Inc. (PFE) earned $0.55 per share in the fourth quarter, beating analysts' estimate of $0.53. Revenue in the fourth quarter decreased 3.2% year-over-year to $13.12 billion, but beating analysts' estimate of $12.83 billion.

The company released its forecasts for 2015. EPS is expected to be $2.00-$2.10 (analysts' estimate: $2.18), whilerevenue is expected to be $44.5-$46.5 billion in 2015 (analysts' estimate: $47.37 billion).

Pfizer Inc. (PFE) shares declined to $32.30 (-1.52%) prior to the opening bell.

3M (MMM) earned $1.81 per share in the fourth quarter, missing analysts' estimate of $1.80. Revenue in the fourth quarter increased 2.0% year-over-year to $7.72 billion, but missing analysts' estimate of $7.77 billion.

The company released its forecasts for fiscal year 2015. EPS is expected to be $8.00-$8.30 (analysts' estimate:$8.20).

3M (MMM) are not traded prior to the opening bell yet.

United Technologies Corp (UTX) earned $1.62 per share in the fourth quarter, in line with analysts' estimate. Revenue in the fourth quarter increased 1.4% year-over-year to $17.00 billion, but missing analysts' estimate of $17.16 billion.

The company released its forecasts for fiscal year 2015. EPS is expected to be $6.85-$7.05 (analysts' estimate: $7.19), while revenue is expected to be $65.00-$66.00 billion in fiscal year 2015 (analysts' estimate: $66.92 billion).

United Technologies Corp (UTX) shares fell to $115.00 (-3.16%) prior to the opening bell.

DuPont (DD) earned $0.71 per share in the fourth quarter, in line with analysts' estimate. Revenue in the fourth quarter decreased 4.8% year-over-year to $7.38 billion, missing analysts' estimate of $7.79 billion.

The company released its forecasts for fiscal year 2015. EPS is expected to be $4.00-$4.20 (analysts' estimate: $4.47).

DuPont (DD) shares fell to $72.70 (-1.90%) prior to the opening bell.

Caterpillar (CAT) earned $1.35 per share in the fourth quarter, missing analysts' estimate of $1.57. Revenue in the fourth quarter decreased 1.1% year-over-year to $14.24 billion, but exceeding analysts' estimate of $14.18 billion.

The company released its forecasts for fiscal year 2015. EPS is expected to be $4.75 (analysts' estimate: $6.71), while revenue is expected to be $50.00 billion in fiscal year 2015 (analysts' estimate: $54.87 billion).

Caterpillar (CAT) shares decreased to $79.59 (-7.49%) prior to the opening bell.

Procter & Gamble (PG) earned $1.06 per share in the second fiscal quarter, missing analysts' estimate of $1.13. Revenue in the second fiscal quarter decreased 4.4% year-over-year to $20.16 billion, missing analysts' estimate of $20.57 billion.

The company released its forecasts for fiscal year 2015. EPS is expected to be $4.09 (analysts' estimate: $4.17), while revenue is expected to be $77.29-$78.09 billion in fiscal year 2015 (analysts' estimate: $79.04 billion).

Procter & Gamble (PG) shares fell to $87.75 (-2.04%) prior to the opening bell.

Microsoft (MSFT) earned $0.71 per share in the second fiscal quarter, in line with analysts' estimate. Revenue in the second fiscal quarter rose 8.0% year-over-year to $26.47 billion, beating analysts' estimate of $26.27 billion.

Microsoft (MSFT) shares decreased to $43.53 (-7.40%) prior to the opening bell.

Figures on durable goods orders and new-home sales will be delayed as the opening of the U.S. Commerce Department will be delayed by a blizzard.

The U.S. Commerce Department has said it will publish figures on its website.

European indices pause the rally fuelled by the European Central Bank's large scale quantitative easing as investors are cautious after the Greek vote on Sunday. The anti-austerity party Syriza won a decisive victory within 2 seats of the absolute majority. Alexis Tsirpas, the new Prime Minister, has pledged to keep Greece within the monetary union but wants to renegotiate Greek debt. Now all eyes are on the FED's interest rate decision tomorrow to get an indication on when interest rates might rise. Mixed earnings from companies like Siemens and Philips further fuelled market caution.

In the U.K. the preliminary Gross domestic product expanded less-than-expected in the fourth quarter according to the Office for National statistics as construction and production shrank. Consumer demand increased. GDP grew by seasonally adjusted +0.5%, the lowest in a year, in the last quarter of 2014, not meeting forecasts of an increase by +0.6% and less than the previous reading of +0.7%, dampening the economic outlook. Year on year GDP grew +2.7% in the fourth quarter, 0.1% below economist's estimates. An increase of +0.1% compared to the previous quarter.

In today's session the commodity heavy FTSE 100 index is trading -0.51% quoted at 6,817.65. France's CAC 40 lost -1.00% trading at 4,628.21. Germany's DAX 30 is currently trading -1.02% at 10,688.58 points.

European indices pause the rally fuelled by the European Central Bank's large scale quantitative easing as investors are cautious after the Greek vote on Sunday. Now all eyes are on the FED's interest rate decision tomorrow to get an indication on when interest rates might rise.

The FTSE 100 index is currently trading +0.02% quoted at 6,853.92 points. Markets participants await data on U.K's GDP due at 09:30 GMT. Germany's DAX 30 lost -0.20% trading at 10,776.48 close to its all-time highs despite Siemens' disappointing quarterly earnings. France's CAC 40 declined by -0.26%, currently trading at 4,662.85 points.

Markets await a set of important U.S. data starting at 13:30 GMT and EUROFIN meetings starting at 10:00.

U.S. markets closed higher on Monday despite the win of Syriza, the anti-austerity party, in Greek elections as investors deemed a new crisis in the Eurozone less probable and energy stocks added gains. The DOW JONES index added +0.03%, closing at 17,678.70. The S&P 500 gained +0.26% with a final quote of 2,057.09 points. Trading volume was light with many traders leaving early due to the announced massive snow-storm.

Chinese stock markets declined on Tuesday with financial and property shares losing the most o concerns of a slowdown in economic growth. Hong Kong's Hang Seng is trading -0.57% at 24,782.27 points. China's Shanghai Composite closed at 3,354.36 points -0.85%.

Japan's Nikkei rose on Tuesday to one-month highs, closing +1.72% with a final quote of 17,768.30. Machinery makers and financials were among the top performers. Market participants were relieved that the result of the Greek elections did not impact European stock markets as much as anticipated.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.