- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

S&P/ASX 200 5,552.78 +5.56 +0.10%

SHANGHAI COMP 3,306.54 -46.42 -1.38%

HANG SENG 24,852.07 +44.79 +0.18%

FTSE 100 6,825.94 +14.33 +0.21%

CAC 40 4,610.94 -13.27 -0.29%

DAX 10,710.97 +82.39 +0.78%

Dow -189.67 17,197.54 -1.09%

Nasdaq -43.51 4,637.99 -0.93%

S&P -27.08 2,002.47 -1.33%

Stock indices closed mixed as Greek bank stocks weighed on markets. Greek bank stocks declined as investors remained cautious amid concerns over Greece's future policy. Syriza party won the country's parliament elections on Sunday. The party has pledged to renegotiate the terms of the country's €240 billion euro financial bailout and to reverse many of the austerity measures.

The Gfk German consumer confidence index increased to 9.3 in February from 9.0 in January, beating forecasts for a rise to 9.1. That was the highest level since November 2001.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,825.94 +14.33 +0.21%

DAX 10,710.97 +82.39 +0.78%

CAC 40 4,610.94 -13.27 -0.29%

Dow 17,457.56 +70.35 +0.40%

Nasdaq 4,737.14 +55.64 +1.19%

S&P 500 2,041.33 +11.78 +0.58%

10 Year Yield 1.81% -0.02 --

Gold $1,285.60 -6.10 -0.47%

Oil $45.11 -1.12 -2.42%

U.S. stock-index futures advanced as Apple Inc. and Yahoo! Inc. rallied while investors awaited a Federal Reserve decision on interest rates.

Global markets:

Nikkei 17,795.73 +27.43 +0.15%

Hang Seng 24,861.81 +54.53 +0.22%

Shanghai Composite 3,306.54 -46.42 -1.38%

FTSE 6,804.22 -7.39 -0.11%

CAC 4,604.17 -20.04 -0.43%

DAX 10,662.48 +33.90 +0.32%

Crude oil $45.33 (-1.95%)

Gold $1288.00 (-0.29%)

(company / ticker / price / change, % / volume)

| International Business Machines Co... | IBM | 154.00 | +0.21% | 35.8K |

| General Motors Company, NYSE | GM | 33.50 | +0.24% | 104.2K |

| ALTRIA GROUP INC. | MO | 54.73 | +0.31% | 0.1K |

| Starbucks Corporation, NASDAQ | SBUX | 88.62 | +0.32% | 30.4K |

| The Coca-Cola Co | KO | 42.53 | +0.33% | 203.0K |

| Procter & Gamble Co | PG | 86.79 | +0.35% | 20.8K |

| American Express Co | AXP | 82.71 | +0.38% | 1.8K |

| Microsoft Corp | MSFT | 42.83 | +0.40% | 144.7K |

| Nike | NKE | 94.90 | +0.42% | 1.1K |

| Citigroup Inc., NYSE | C | 48.52 | +0.43% | 87.6K |

| General Electric Co | GE | 24.49 | +0.45% | 358.7K |

| McDonald's Corp | MCD | 89.97 | +0.45% | 10.0K |

| Johnson & Johnson | JNJ | 102.57 | +0.47% | 512.2K |

| 3M Co | MMM | 164.45 | +0.50% | 1.6K |

| JPMorgan Chase and Co | JPM | 56.48 | +0.50% | 3.4K |

| Deere & Company, NYSE | DE | 86.50 | +0.53% | 0.3K |

| UnitedHealth Group Inc | UNH | 110.60 | +0.54% | 0.4K |

| Wal-Mart Stores Inc | WMT | 88.00 | +0.54% | 36.2K |

| Tesla Motors, Inc., NASDAQ | TSLA | 207.14 | +0.56% | 3.8K |

| Goldman Sachs | GS | 177.50 | +0.57% | 33.9K |

| Verizon Communications Inc | VZ | 46.62 | +0.58% | 7.9K |

| Merck & Co Inc | MRK | 62.94 | +0.61% | 0.5K |

| Walt Disney Co | DIS | 94.57 | +0.64% | 2.0K |

| Caterpillar Inc | CAT | 80.40 | +0.69% | 8.0K |

| Home Depot Inc | HD | 105.90 | +0.70% | 1.9K |

| Intel Corp | INTC | 34.45 | +0.78% | 401.7K |

| Google Inc. | GOOG | 522.95 | +0.83% | 7.9K |

| United Technologies Corp | UTX | 120.30 | +0.96% | 1.0K |

| Amazon.com Inc., NASDAQ | AMZN | 310.00 | +1.06% | 3.8K |

| ALCOA INC. | AA | 16.10 | +1.13% | 12.0K |

| Ford Motor Co. | F | 14.87 | +1.16% | 21.7K |

| AT&T Inc | T | 33.21 | +1.22% | 118.7K |

| Cisco Systems Inc | CSCO | 27.30 | +1.49% | 725.4K |

| Facebook, Inc. | FB | 76.97 | +1.57% | 186.8K |

| Boeing Co | BA | 136.45 | +3.00% | 214.0K |

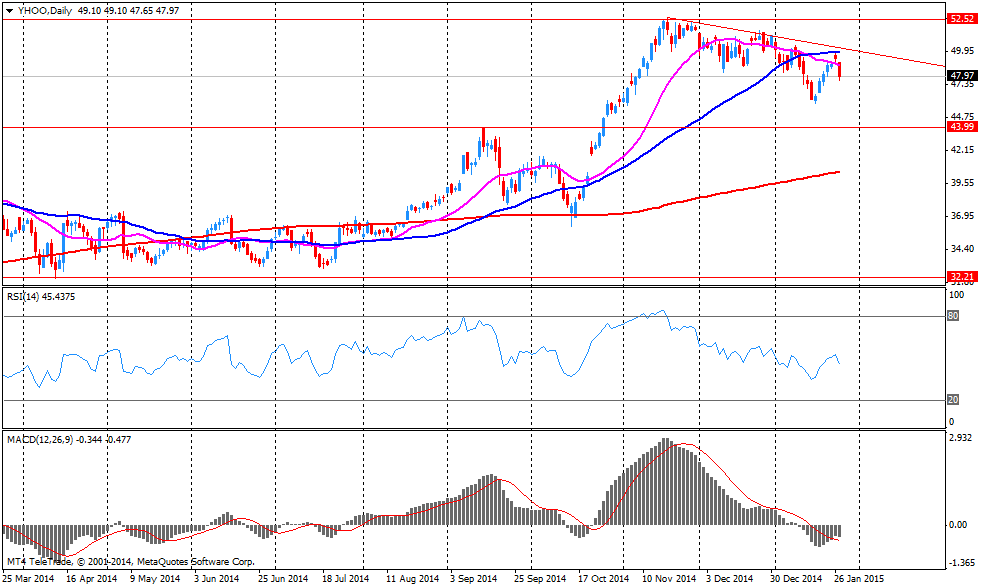

| Yahoo! Inc., NASDAQ | YHOO | 50.13 | +4.46% | 2.5M |

| Apple Inc. | AAPL | 117.84 | +7.97% | 3.9M |

| Yandex N.V., NASDAQ | YNDX | 16.21 | 0.00% | 0.3K |

| Exxon Mobil Corp | XOM | 90.90 | -0.05% | 199.9K |

| Pfizer Inc | PFE | 32.58 | -0.06% | 73.9K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 18.36 | -0.11% | 9.5K |

| Chevron Corp | CVX | 108.05 | -0.19% | 19.3K |

| Twitter, Inc., NYSE | TWTR | 38.80 | -0.31% | 104.4K |

| E. I. du Pont de Nemours and Co | DD | 72.90 | -0.38% | 145.2K |

| Hewlett-Packard Co. | HPQ | 38.56 | -0.72% | 83.1K |

| Barrick Gold Corporation, NYSE | ABX | 13.00 | -0.84% | 126.8K |

Upgrades:

Caterpillar (CAT) upgraded to Neutral from Underweight at JP Morgan, target lowered to $78 from $80

Downgrades:

Caterpillar (CAT) downgraded to Underweight from Neutral at Atlantic Equities

Other:

Apple (AAPL) target raised to $140 from $135 at Evercore ISI

Apple (AAPL) target raised to $160 from $143 at Cantor Fitzgerald

Apple (AAPL) target raised to $115 from $113 at Cowen

3M (MMM) target raised to $180 from $167 at FBR Capital

Yahoo! (YHOO) target raised to $59 from $50 at Evercore ISI

Yahoo! (YHOO) target raised at Cowen to $60 from $38

Yahoo! (YHOO) target raised to $61 from $53 at Jefferies

Caterpillar (CAT) target lowered to $84 from $100 at RBC Capital Mkts

Boeing (BA) earned $2.31 per share in the fourth quarter, beating analysts' estimate of $2.10. Revenue in the fourth quarter increased 2.9% year-over-year to $24.47 billion, exceeding analysts' estimate of $23.90 billion.

The company released its forecasts for fiscal year 2015. EPS is expected to be $8.20-$8.40 (analysts' estimate: $8.65), while revenue is expected to be $94.5-$96.5 billion in fiscal year 2015 (analysts' estimate: $93.37 billion).

Boeing (BA) shares increased to $137.00 (+3.41%) prior to the opening bell.

Yahoo! (YHOO) earned $0.30 per share (excluding non-recurring items) in the fourth quarter, beating analysts' estimate of $0.29. Revenue in the fourth quarter decreased 1.7% year-over-year to $1.18 billion, in line with analysts' estimate.

The company announces plan to spin off about a 15% Alibaba Group (BABA) stake. The spinoff is expected to complete by the end of 2015.

Yahoo! (YHOO) shares rose to $50.45 (+5.13%) prior to the opening bell.

AT&T (T) earned $0.55 per share (excluding non-recurring items) in the fourth quarter, in line with analysts' estimate. Revenue in the fourth quarter increased 3.8% year-over-year to $34.44 billion, beating analysts' estimate of $34.30 billion.

AT&T (T) shares increased to $33.20 (+1.19%) prior to the opening bell.

Apple (AAPL) earned $3.06 per share in the first fiscal quarter, beating analysts' estimate of $2.60. Revenue in the first fiscal quarter increased 29.5% year-over-year to $74.60 billion, exceeding analysts' estimate of $67.53 billion. Gross margin was 39.9%, exceeding the company's estimate of 37,5%-38,5% and analysts' estimate of 38.4%.

The company released its forecasts for the second quarter. Revenue is expected to be $52.0-$55.0 billion in the second quarter (analysts' estimate: $53.75 billion), while gross margin is expected to be 38.5%-39.5% billion (analysts' estimate: 38.7%).

Apple (AAPL) shares increased to $118.69 (+8.75%) prior to the opening bell.

European indices could not hold on to early gains and turn negative. Published corporate earnings were mixed. Greek shares slump following the victory of the left-wing anti-austerity party Syriza and are down 10% this week.

Earlier today data on Germany's Gfk Consumer Confidence Survey for December showed a reading above estimates with 9.3 points compared to 9.0 in the previous month. Analysts expected an increase to 9.1 points.

The FTSE 100 index is currently trading +0.05% quoted at 6,808.11 points. Germany's DAX 30 lost -0.05% trading at 10,623.75, below its all-time high at 10,810.57 hit on Tuesday. France's CAC 40 shed early gains, currently trading at 4,613.162 points, -0.23%.

Today all eyes will be on the Federal Open Market Committee Statement following the FED's interest rate decision at 19:00 GMT - after European trading hours. The FOMC is expected to retain the "patient" approach to rise benchmark interest rates. The wording of the FOMC statement will be closely watched to get further indications on when the FED is going to raise benchmark interest rates from near zero levels. It's the first statement after the SNB's move to scrap the exchange floor for the franc and after the ECB announced quantitative easing.

European indices continue to rise after a pause with good corporate results boosting sentiment almost reversing previous losses. Recently markets were supported by the unprecedented economic stimulus program known as quantitative easing unveiled on the 22nd by the ECB. The influence of the outcome of the Greek elections on the markets was limited.

Data on Germany's Gfk Consumer Confidence Survey for December showed a reading above estimates with 9.3 points compared to 9.0 in the previous month. Analysts expected an increase to 9.1 points.

The FTSE 100 index is currently trading +0.24% quoted at 6,827.84 points. Germany's DAX 30 added +0.51% trading at 10,682.36, below its all-time high at 10,810.57 points hit on Tuesday. France's CAC 40 rose by +0.30%, currently trading at 4,638.19 points.

Today all eyes will be on the Federal Open Market Committee Statement following the FED's interest rate decision at 19:00 GMT - after European trading hours. The FOMC is expected to retain the "patient" approach to rise benchmark interest rates.

U.S. markets closed lower on Tuesday after a mixed set of U.S. data, including soft spending data and disappointing earnings. The DOW JONES index lost -1.65%, closing at 17,387.21. The S&P 500 declined by -1.34% with a final quote of 2,029.55 points. Apple and Yahoo rallied in post-market trading on corporate news.

The consumer confidence index for the U.S. rose to 102.9 in January from 93.1 in December, exceeding expectations for a rise to 94.4. U.S. durable goods orders dropped 3.4% in December, missing expectations for a 0.5% increase, after a 2.1% decline in November. The decline was driven by falling orders for computers, metals and electrical equipment. The S&P/Case-Shiller home price index increased 4.3% in November, missing expectations for a 4.5% rise, after a 4.5% gain in October. That was the slowest pace since October 2012.

Today investors look ahead to the Federal Open Market Committee Statement following the FED's interest rate decision at 19:00 GMT.

Chinese stock markets were mixed on Wednesday. Hong Kong's Hang Seng is trading +0.22% at 24,862.41 points. China's Shanghai Composite closed at 3,306.54 points -1.38%.

Japan's Nikkei rose on Wednesday to one-month highs, closing +0.15% with a final quote of 17,795.73 reversing early losses caused by mixed U.S. data and profit taking. A weaker Japanese yen supported exporter shares.

(index / closing price / change items /% change)

TOPIX 1,426.38 +24.30 +1.73%

SHANGHAI COMP 3,354.36 -28.82 -0.85%

HANG SENG 24,807.28 -102.62 -0.41%

FTSE 100 6,811.61 -40.79 -0.60%

CAC 40 4,624.21 -50.92 -1.09%

Xetra DAX 10,628.58 -169.75 -1.57%

S&P 500 2,029.55 -27.54 -1.34%

NASDAQ Composite 4,681.5 -90.27 -1.89%

Dow Jones 17,387.21 -291.49 -1.65%

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.