- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Index | Change items | Closing price | % change |

| Nikkei | -167.91 | 22544.84 | -0.74% |

| TOPIX | -7.61 | 1768.15 | -0.43% |

| CSI 300 | -6.15 | 3515.08 | -0.17% |

| KOSPI | -1.48 | 2293.51 | -0.06% |

| FTSE 100 | -0.46 | 7700.85 | -0.01% |

| DAX | -62.20 | 12798.20 | -0.48% |

| CAC 40 | -20.54 | 5491.22 | -0.37% |

| DJIA | -144.23 | 25306.83 | -0.57% |

| S&P 500 | -16.22 | 2802.60 | -0.58% |

| NASDAQ | -107.41 | 7630.00 | -1.39% |

The main US stock indices dropped noticeably, as disappointing forecasts from technological and Internet companies caused concern about the continued growth of the high-tech sector.

Investors also attracted some attention from the US. The National Association of Realtors reported that in June, as a whole, unfinished transactions for the sale of housing increased in all four major regions, but overall activity fell behind the level of the previous year for the sixth month in a row. The index of unfinished housing transactions (PHSI), the forecast figure based on the signing of contracts, rose by 0.9% to 106.9 in June from 105.9 in May.

However, data provided by the Federal Reserve Bank of Dallas, showed that in July, the business activity of Texas producers moderately deteriorated, but it turned out to be higher than the experts' forecasts. According to the report, the Dallas Federal Reserve's production index in July fell to 32.3 points from 36.5 points in June. Analysts had expected the index to fall to 31.0 points.

Quotes of oil rose on Monday, helped by the weakening of the US dollar and the continued cautiousness of investors regarding the prospects for supply.

Most components DOW completed the auction mixed (15 in the black, 15 in the red). Leader of the growth were shares of Merck & Co., Inc. (MRK, + 2.14%). Outsider were shares of Visa Inc. (V, -2.90%).

Almost all S & P sectors recorded a decline. The biggest drop was shown by the technological sector (-1.6%). Only the commodity sector grew (+ 0.5%).

At closing:

Dow 25,306.83 -144.23 -0.57%

S&P 500 2,802.60 -16.22 -0.58%

Nasdaq 100 7,630.00 -107.42 -1.39%

U.S. stock-index futures were flat on Monday, as investors remained cautious ahead of the policy meetings of the central banks in the U.S., Japan and the U.K later this week. Meanwhile, Caterpillar's (CAT) solid Q2 earnings report provided some support to the market.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 22,544.84 | -167.91 | -0.74% |

| Hang Seng | 28,733.13 | -71.15 | -0.25% |

| Shanghai | 2,870.06 | -3.53 | -0.12% |

| S&P/ASX | 6,278.40 | -21.80 | -0.35% |

| FTSE | 7,712.03 | +10.72 | +0.14% |

| CAC | 5,505.85 | -5.91 | -0.11% |

| DAX | 12,841.68 | -18.72 | -0.15% |

| Crude | $69.94 | | +1.82% |

| Gold | $1,231.40 | | -0.11% |

(company / ticker / price / change ($/%) / volume)

| ALTRIA GROUP INC. | MO | 57.74 | -0.16(-0.28%) | 3253 |

| Amazon.com Inc., NASDAQ | AMZN | 1,826.00 | 8.73(0.48%) | 44993 |

| American Express Co | AXP | 102.4 | -1.45(-1.40%) | 6799 |

| Barrick Gold Corporation, NYSE | ABX | 11.15 | -0.08(-0.71%) | 10330 |

| Caterpillar Inc | CAT | 146.35 | 3.79(2.66%) | 370724 |

| Chevron Corp | CVX | 126.72 | 0.75(0.60%) | 1690 |

| Cisco Systems Inc | CSCO | 42.34 | -0.23(-0.54%) | 14775 |

| Citigroup Inc., NYSE | C | 71.59 | -0.10(-0.14%) | 1572 |

| Deere & Company, NYSE | DE | 142 | 1.20(0.85%) | 515 |

| General Motors Company, NYSE | GM | 37.6 | 0.07(0.19%) | 9132 |

| Goldman Sachs | GS | 238 | 0.36(0.15%) | 1770 |

| Intel Corp | INTC | 47.61 | -0.07(-0.15%) | 71990 |

| International Business Machines Co... | IBM | 145.37 | 0.22(0.15%) | 1654 |

| International Paper Company | IP | 52 | -0.02(-0.04%) | 500 |

| Johnson & Johnson | JNJ | 131.51 | -0.04(-0.03%) | 421 |

| JPMorgan Chase and Co | JPM | 116.17 | 0.14(0.12%) | 7039 |

| Pfizer Inc | PFE | 38.4 | -0.01(-0.03%) | 11620 |

| Starbucks Corporation, NASDAQ | SBUX | 52.15 | -0.00(-0.00%) | 4989 |

| Tesla Motors, Inc., NASDAQ | TSLA | 296 | -1.18(-0.40%) | 63640 |

| Twitter, Inc., NYSE | TWTR | 34.27 | 0.15(0.44%) | 497154 |

| Verizon Communications Inc | VZ | 52 | -0.01(-0.02%) | 1499 |

IBM (IBM) resumed with a Market Perform at Wells Fargo

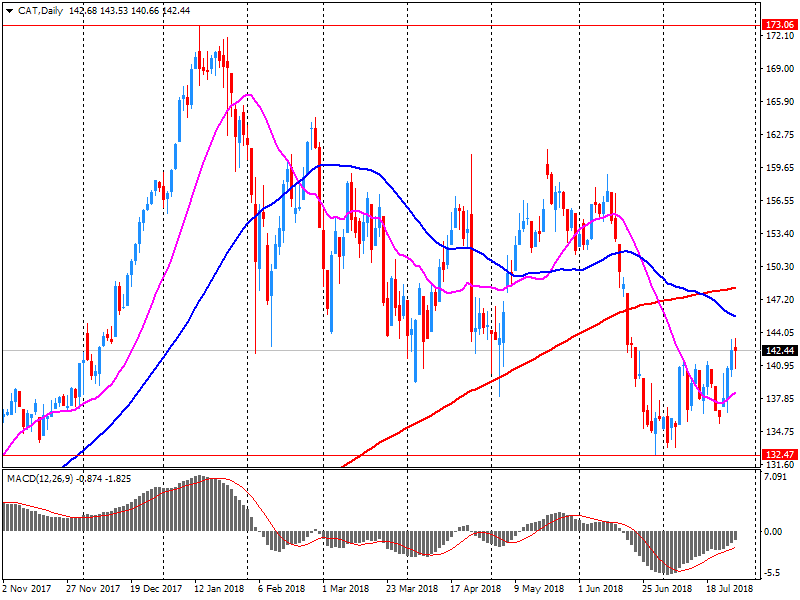

Caterpillar (CAT) reported Q2 FY 2018 earnings of $2.97 per share (versus $1.49 in Q2 FY 2017), beating analysts' consensus estimate of $2.74.

The company's quarterly revenues amounted to $14.011 bln (+23.7% y/y), generally in-line with analysts' consensus estimate of $14.085 bln.

The company also issued upside guidance for FY 2018, projecting EPS of $11.00-12.00 versus analysts' consensus estimate of $10.75 and its prior guidance of $10.25-11.25.

CAT rose to $146.90 (+3.04%) in pre-market trading.

July 30

Before the Open:

Caterpillar (CAT). Consensus EPS $2.74, Consensus Revenues $14085.13 mln.

July 31

Before the Open:

Arconic (ARNC). Consensus EPS $0.29, Consensus Revenues $3492.46 mln.

Pfizer (PFE). Consensus EPS $0.74, Consensus Revenues $13298.15 mln.

Procter & Gamble (PG). Consensus EPS $0.90, Consensus Revenues $16516.51 mln.

After the Close:

Apple (AAPL). Consensus EPS $2.18, Consensus Revenues $52430.11 mln.

August 1

After the Close:

Tesla (TSLA). Consensus EPS -$2.78, Consensus Revenues $3939.84 mln.

August 2

Before the Open:

DowDuPont (DWDP). Consensus EPS $1.30, Consensus Revenues $23614.14 mln.

After the Close:

American Intl (AIG). Consensus EPS $1.21, Consensus Revenues $11707.22 mln.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.