- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Index | Change items | Closing price | % change |

| Nikkei | +8.88 | 22553.72 | +0.04% |

| TOPIX | -14.86 | 1753.29 | -0.84% |

| CSI 300 | +2.58 | 3517.66 | +0.07% |

| KOSPI | +1.75 | 2295.26 | +0.08% |

| FTSE 100 | +47.91 | 7748.76 | +0.62% |

| DAX | +7.30 | 12805.50 | +0.06% |

| CAC 40 | +20.08 | 5511.30 | +0.37% |

| DJIA | +108.36 | 25415.19 | +0.43% |

| S&P 500 | +13.69 | 2816.29 | +0.49% |

| NASDAQ | +41.79 | 7671.79 | +0.55% |

The main US stock indexes have moderately grown, as the shares of the technology sector recovered, as well as amid news that the United States and China are trying to resume negotiations to prevent a trade war between the two largest economies of the world.

In addition, the focus was on the US. As it became known, in June, consumer spending in the US increased significantly, as households spent more on restaurants and housing, creating a solid base for the economy, which is steadily rising in the third quarter, while inflation is growing moderately. The Commerce Department reported that consumer spending, accounting for more than two-thirds of US economic activity, rose 0.4% last month. Data for May were revised to show that consumer spending rose 0.5% instead of the previously noted 0.2% increase. The growth in consumer spending last month was in line with the expectations of economists.

Meanwhile, the national housing price index from S & P / Case-Shiller, covering all nine census regions in the US, reported an annual increase of 6.4% in May, the same as in the previous month. The annual increase in the composite index for 10 megacities was 6.1% in May against 6.4% in the previous month. The index for 20 megacities published an increase of 6.5% compared to the previous year, compared with 6.7% in the previous month.

In addition, the Conference Board's consumer confidence index rose moderately in July, after a slight decline in June. The index is now 127.4 (1985 = 100), compared with 127.1 in June. The index of the current situation improved from 161.7 to 165.9, while the index of expectations fell from 104.0 to 101.7.

Most DOW components recorded a rise (19 out of 30). The leader of the growth were shares of 3M Company (MMM, + 3.43%). Outsider were the shares of Walgreens Boots Alliance, Inc. (WBA, -2.17%).

Almost all sectors of S & P completed the auction in positive territory. The industrial goods sector grew most (+ 2.0%). The decrease was shown only by the financial sector (-0.3%).

At closing:

Dow 25,415.19 +108.36 +0.43%

S&P 500 2,816.29 +13.69 +0.49%

Nasdaq 100 7,671.79 +41.78 +0.55%

U.S. stock-index futures rose moderately on Tuesday, as tech stocks rebounded after a sell-off in the previous session, triggered by concerns about their further growth.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 22,553.72 | +8.88 | +0.04% |

| Hang Seng | 28,583.01 | -150.12 | -0.52% |

| Shanghai | 2,876.40 | +7.35 | +0.26% |

| S&P/ASX | 6,280.20 | +1.80 | +0.03% |

| FTSE | 7,756.89 | +56.04 | +0.73% |

| CAC | 5,501.62 | +10.40 | +0.19% |

| DAX | 12,771.10 | -27.10 | -0.21% |

| Crude | $69.74 | | -0.56% |

| Gold | $1,229.20 | | -0.19% |

(company / ticker / price / change ($/%) / volume)

| Amazon.com Inc., NASDAQ | AMZN | 1,793.68 | 14.46(0.81%) | 35422 |

| American Express Co | AXP | 101 | 0.15(0.15%) | 222 |

| Apple Inc. | AAPL | 190.6 | 0.69(0.36%) | 118656 |

| AT&T Inc | T | 32.06 | 0.06(0.19%) | 46018 |

| Boeing Co | BA | 353.09 | 2.03(0.58%) | 3480 |

| Chevron Corp | CVX | 128 | 0.17(0.13%) | 293 |

| Exxon Mobil Corp | XOM | 81.8 | 0.06(0.07%) | 3072 |

| Facebook, Inc. | FB | 171.3 | 0.24(0.14%) | 143700 |

| General Electric Co | GE | 13.17 | 0.01(0.08%) | 57590 |

| Google Inc. | GOOG | 1,223.79 | 4.05(0.33%) | 4448 |

| Intel Corp | INTC | 47.95 | 0.26(0.55%) | 54266 |

| JPMorgan Chase and Co | JPM | 116.74 | 0.01(0.01%) | 5305 |

| Merck & Co Inc | MRK | 65 | 0.19(0.29%) | 2417 |

| Nike | NKE | 76 | 0.04(0.05%) | 1083 |

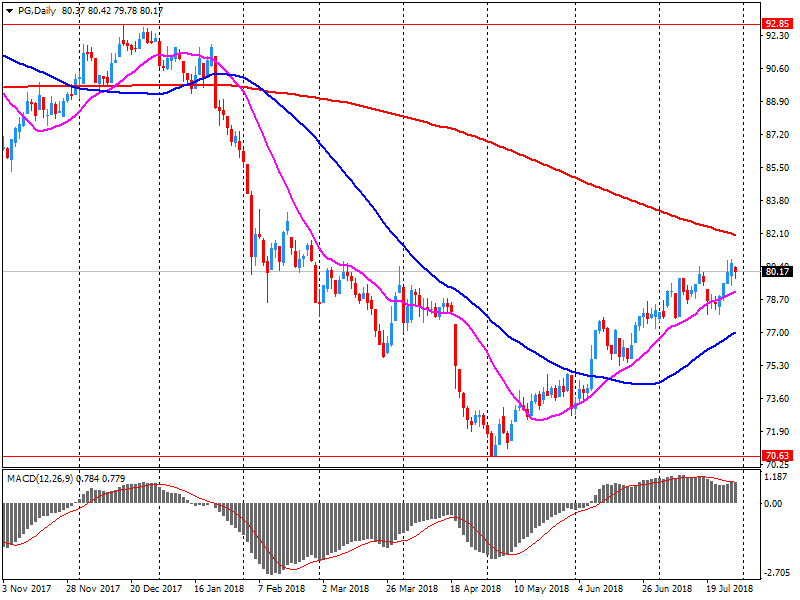

| Procter & Gamble Co | PG | 79 | -1.20(-1.50%) | 128290 |

| Twitter, Inc., NYSE | TWTR | 31.88 | 0.50(1.59%) | 356513 |

| Visa | V | 137.35 | 0.87(0.64%) | 3553 |

| Wal-Mart Stores Inc | WMT | 89 | 0.12(0.14%) | 681 |

| Yandex N.V., NASDAQ | YNDX | 36.37 | 0.67(1.88%) | 9763 |

Caterpillar (CAT) downgraded to Equal Weight from Overweight at Barclays

Arconic (ARNC) reported Q2 FY 2018 earnings of $0.37 per share (versus $0.32 in Q2 FY 2017), beating analysts' consensus estimate of $0.29.

The company's quarterly revenues amounted to $3.573 bln (+9.6% y/y), beating analysts' consensus estimate of $3.492 bln.

The company also reaffirmed guidance for FY 2018, projecting EPS of $1.17-1.27 versus analysts' consensus estimate of $1.23 and revenues of $13.7-14.0 bln versus analysts' consensus estimate of $13.85 bln.

ARNC rose to $21.65 (+3.79%) in pre-market trading.

Procter & Gamble (PG) reported Q4 FY 2018 earnings of $0.94 per share (versus $0.85 in Q4 FY 2017), beating analysts' consensus estimate of $0.90.

The company's quarterly revenues amounted to $16.503 bln (+2.6% y/y), generally in-line with analysts' consensus estimate of $16.517 bln.

The company also issued guidance for FY 2019, projecting EPS of $4.35-4.56 versus analysts' consensus estimate of $4.39 and revenues of ~$66.8-67.5 bln versus analysts' consensus estimate of $67.74 bln.

PG fell to $78.30 (-2.37%) in pre-market trading.

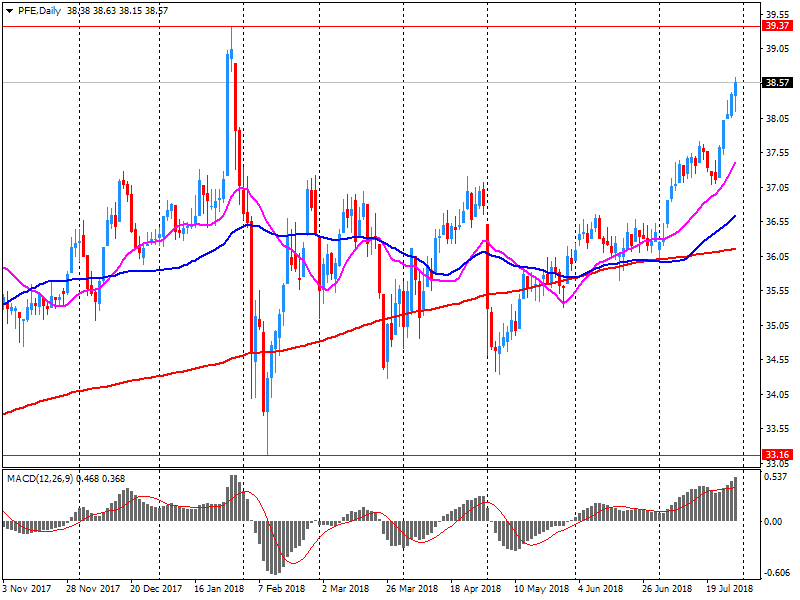

Pfizer (PFE) reported Q2 FY 2018 earnings of $0.81 per share (versus $0.67 in Q2 FY 2017), beating analysts' consensus estimate of $0.74.

The company's quarterly revenues amounted to $13.466 bln (+4.4% y/y), beating analysts' consensus estimate of $13.298 bln.

The company also issued guidance for FY 2018, projecting EPS of $2.95-3.05 (compared to its prior guidance of $2.90-3.00 and analysts' consensus estimate of $2.95) and revenues of $53-55 bln (compared to its prior guidance of $53.5-55.5 bln and analysts' consensus estimate of $54.25 bln).

PFE fell to $38.50 (-0.23%) in pre-market trading.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.