- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 21-03-2024

Japan’s National Consumer Price Index (CPI) for February climbed to 2.8% YoY from 2.2% in January, according to the latest data released by the Japan Statistics Bureau on Friday.

Further details unveil that the National CPI ex Fresh food arrived at 2.8% YoY in January versus 2.0% prior. The figure was in line with the market consensus.

Market reaction

Following the Japan inflation data, the USD/JPY pair is up 0.02% on the day at 151.65.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

- GBP/USD edges lower to 1.2658 amid the weaker USD.

- The US S&P Global Composite PMI arrived at 52.2 in March vs. 52.5 in February.

- The BoE maintained its interest rates unchanged at 5.25% on Thursday.

- UK February Retail Sales will be due on Friday, which is forecast to fall 0.3% in February.

The GBP/USD pair faces rejection near the 1.2700 mark and holds above the mid-1.2700s during the early Asian session on Friday. The downtick of the major pair is backed by the stronger US Dollar (USD) and the dovish tilt of the Bank of England (BoE). Investors await the UK Retail Sales for fresh impetus, which is expected to fall 0.3% in February. GBP/USD currently trades near 1.2658, down 0.02% on the day.

The BoE kept the interest rate unchanged at 5.25% at its March meeting on Thursday, as widely anticipated. The BoE Governor Andrew Bailey said that the economy is not at a point where the Monetary Policy Committee (MPC) can lower interest rates, but the economy is moving along on the right track. Markets anticipate the UK central bank will need more evidence of moderating wage growth before beginning to cut rates. However, investors maintain bets on BoE rate cuts this year, and the dovish tilt by the BoE policymaker weighs on the Pound Sterling (GBP) and acts as a headwind for the GBP/USD pair.

On the other hand, the Fed held the rate steady at 5.25–5.50% at its March meeting on Wednesday, with the median FOMC projections retaining three cuts in 2024. The markets have priced in around 80% odds that the Fed will cut rates in June, according to the CME FedWatch Tool.

On Thursday, the US S&P Global Composite PMI came in at 52.2 in March from 52.5 in February. Meanwhile, the S&P Global Manufacturing PMI improved to 52.5 from 52.2 in the previous reading, above the market consensus of 51.7. The Services PMI eased to 51.7 in March from the previous reading of 52.3, weaker than the estimation of 52.0.

Moving on, market players will focus on the UK February Retail Sales. Also, Fed Chair Jerome Powell and Michael Barr are set to speak on Friday. Traders will take cues from the data and find trading opportunities around the GBP/USD pair.

- AUD/USD recovers to 0.6571 after dipping, despite central bank actions.

- BoJ hikes, SNB cuts rates, and other central banks are steady.

- Mixed US data: manufacturing up, services, and composite PMIs down.

- Market eyes June Fed cut, post-steady rate projections.

The Australian Dollar (AUD) tumbled against the US Dollar (USD) on Thursday despite refreshing weekly highs at 0.6634, printed losses of 0.25%. However, as Friday’s Asian session begins, the AUD/USD exchanges hands at 0.6571, virtually unchanged as traders brace for the weekend.

Australian Dollar holds near weekly lows amid mixed global monetary policy moves

A tranche of central banks adjusted their monetary policy throughout the weekend, led by the Bank of Japan, the Reserve Bank of Australia, the Federal Reserve, the Bank of England and the Swiss National Bank. Most of them kept rates unchanged, being the outliers of the BoJ and the SNB. The former raised rates for the first time in almost two decades, while the latter was the first major central bank to cut interest rates.

Data-wise, the US economic schedule featured March S&P Global PMIs, with the services and the composite index, missing estimates but standing at expansionary territory. On a positive note, manufacturing activity accelerated to its fastest pace in almost two years. Elsewhere, the US labor market continued to show signs of tightness despite the recent withholding according to February’s Nonfarm Payrolls figures. Initial Jobless Claims for the week ending March 16 fell to 210k versus 212k the week prior.

Aside from this, market participants seem convinced they overreacted post-Federal Reserve’s decision to withhold the federal funds rate (FFR) unchanged at the 5.25%-5.50% range. The Fed Dot-Plots failed to deliver a hawkish stance, keeping three cut rates on the table for 2024, spurring a jump in interest rate cut expectations for June, which sit at around 80%.

On the Aussie’s front, the docket is empty, though proxies like the data from New Zealand would feature the Balance of Trade and Japan’s Consumer Price Index (CPI) for February.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

New Zealand's seasonally-adjusted Trade Balance for the year ended in February rose to $-11.99 billion YoY compared to the previous period's $-12.62 billion, with both Exports and Imports rising in February from January's minor decline.

New Zealand's February Imports saw a meager rise to 6.11 billion, a slight but measurable recovery from January's dip to an 11-month low of 5.9 billion. The rebound in Imports was eclipsed by a firmer recovery in New Zealand's Exports in February, which rebounded to 5.89 billion from January's four-month low of 4.93 billion.

New Zealand's overall merchandise Trade Balance came within a hair of $-12 billion, and January's Trade Balance saw a slight downside revision to $-12.62 billion from the initial print of $-12.5 billion.

February's New Zealand Exports are 16% higher than the same time in 2023, rising $823 million YoY. Goods Imports are also 3.3% higher than at the same time last year, rising $194 million YoY.

Market reaction

The NZD/USD is trading thinly in Friday's early Asia market session, churning just beneath the 0.6050 level after the pair sagged from a failed bid to capture the 0.6100 handle amidst Thursday's broad-market US Dollar recovery.

NZD/USD 5-minute chart

About New Zealand's Trade Balance

Trade balance, released by Statistics New Zealand, is the difference between the value of country's exports and imports, over a period of year. A positive balance means that exports exceed imports, a negative ones means the opposite. Positive trade balance illustrates high competitiveness of country's economy.

- The NZD/USD pair maintains its losing streak, depicting a bearish session on Thursday.

- The RSI for the daily chart points to a growing selling momentum, while MACD prints rising red bars.

- Mimicking the daily chart, the hourly signals flash the ongoing strength of the sellers but with indicators somewhat flat.

The NZD/USD pair is trading lower at around 0.6045, undergoing a 0.33% decline. The currency pair's market sentiment seems to lean towards the bearish side, with sellers maintaining a strong grip. On the hourly chart, the selling pressure eased somewhat but the bears are still present.

On the daily chart, the Relative Strength Index (RSI) remains in negative territory, suggesting that sellers dominate the market. Furthermore, the rising red bars of the Moving Average Convergence Divergence (MACD) histogram indicate growing negative momentum, further supporting this bearish outlook.

NZD/USD daily chart

When reviewing the hourly chart, a similar pattern arises. The RSI still resides in the negative territory, indicating a bearish momentum prevailing in the market. The red bars of the MACD histogram continue to increase in this shorter timeframe, signaling the ongoing strength of the sellers. However, the latter flattened near the oversold indicating that the pair may consolidate the downwards movements ahead of the Asian session. Fundamental factors will be key as they could prompt another leg downwards.

NZD/USD hourly chart

A consistent negative trend is evident across both timeframes after comparing the daily and hourly charts. The RSI and MACD indicators suggest continuing domination by sellers in the NZD/USD pair. Surveying the larger context, the pair falls below the 20, 100, and 200-day Simple Moving Averages (SMAs), adding more evidence to the negative trend depicted in the daily and hourly charts.

- AUD/JPY nears 100.00 after strong Australian job data.

- Above Ichimoku Cloud, moving averages hint bullish trend.

- Resistance at 100.17, 101.00, with 102.84, 2014’s swing high as next target.

- Correction might pull to 99.05 and retreat deeper to 98.53, but bullish sentiment prevails.

The AUD/JPY is virtually unchanged on Thursday in late trading during the North American session. At the time of writing, the pair is 99.62 shy of the 100.00 figure after hitting a ten-year high of 100.17 on positive Aussie jobs data.

AUD/JPY Price Analysis: Technical outlook.

The AUD/JPY daily chart suggests the cross is upward biased, though today’s price action indicates neither buyers nor sellers are gaining the battle. The pair surged past the Ichimoku Cloud (Kumo), signaling a strong uptrend, reinforced by the price exchanging hands above both the Tenkan and Kijun-Sen levels.

The slope of the Senkou Span A aims higher, indicating that further upside is seen. The 100.00 figure is the key resistance level. Once cleared, the next stop would be 100.17 and the 101.00 figure. Up next would be the 2014 high at 102.84.

Nevertheless, due to an overextended market move, the potential for a mean reversion move increases. Even though a pullback to the February 23 swing high at 99.05 isn’t out of cards, the pullback could be capitalized by bulls, as the rally is set to continue. However, a deeper pullback below that level could expose the Tenkan and Kijun-sen levels at 98.53.

AUD/JPY Price Action – Daily Chart

- The Euro’s Fed-fueled rise against the Greenback proved short-lived.

- Fed tips hat to future rate cuts, US Dollar selloff proves temporary.

- European Manufacturing PMI slips, US Services PMI contracts.

The EUR/USD drove headfirst back into familiar territory on Thursday, wit the pair falling three-quarters of a percent through the day to end near 1.0850. Wednesday’s Fed-fueled rally proved to be a whipsaw rather than a break of character for the markets, and the Fiber is pinned firmly back into familiar near-term consolidation territory.

The Euro (EUR) quickly backpedaled in early Thursday trading after European Purchasing Managers Index (PMI) figures for the European continent shook investors awake. As the economic powerhouse of the European Union, Germany’s mixed PMI prints splashed cold water on Euro bidders, with the German March Manufacturing PMI sliding to a five-month low of 41.6 as business activity confidence continues to wither. Germany’s Manufacturing component was expected to tick upwards to 43.1 from 42.5, and the downside print drowned out an uptick in Germany’s Services PMI component, which printed above expectations at 49.8, beating the forecast 49.8 and inches closer towards positive 50.0 territory after last month’s 48.3.

The pan-European HCOB Manufacturing PMI was expected to come in at an even 47.0 versus the previous 46.5, but missed expectations to print on the downside at 45.7.

US data also came in mixed, helping to bolster safe-haven bids into the Greenback. March’s US S&P Global Composite PMI declined slightly to 52.2 from the previous 52.5, with the backslide fueled by a miss for the US Services PMI component. US March Services PMI fell more than expected, printing at 51.7 versus the forecast 52.0 after coming in at 52.3 in February.

The trading week will wrap up on Friday with German IFO Expectations, which are expected to improve slightly to 84.7 from 84.1. On the US side, Friday brings a batch of Federal Reserve (Fed) board member speeches as the black-out period from the latest Fed rate call lifts. Fed Chairman Jerome Powell will be headlining the Fed appearance on Friday, slated to give a speech at 13:00 GMT at a Fed Listens event in Washington, DC.

EUR/USD technical outlook

The EUR/USD fell from the day’s early high of 1.09426, declining eight-tenths of a percent top-to-bottom to touch 1.08546. The pair hit the closing bell on Thursday’s trading window near 1.0857.

The pair is getting mired in the 200-period Exponential Moving Average (EMA) near 1.0864, and Thursday’s bearish turnaround leaves the EUR/USD at risk of chalking in a lower high on the 4-hour charts.

EUR/USD 15-minute chart

EUR/USD 4-hour chart

- Silver prices see a significant drop to $24.75, shedding over 3% in response to a strengthening US Dollar.

- Technical analysis reveals a bearish engulfing pattern, despite a recent 'golden cross', signaling mixed signals for traders.

- The RSI indicates diminishing buying pressure, hinting at a potential bearish swing.

Silver's price plunged on Thursday amidst a risk-off impulse, reinvigorating the US Dollar. Consequently, the grey metal dropped more than $0.70, or 3.15%, as the XAG/USD traded at $24.75 after hitting a daily high of $25.77.

XAG/USD Price Analysis: Technical outlook

Silver is witnessing a downturn, as price action has formed a ‘bearish engulfing’ chart pattern in the last couple of days. Even though the 50-day moving average (DMA) has crossed above the 200-DMA, forming a classic ‘golden cross’ indicating that bulls are gathering steam, momentum suggests the opposite.

The Relative Strength Index (RSI) is hovering just below 60 after peaking around 70, indicating that moderate buying pressure remains. However, the RSI's descent from higher levels suggests that momentum might wane, and bears could gain ground.

The recent pullback has seen the price retreat from resistance near the $26.00 mark. Immediate support is found near December’s 22 high turned support at $24.60, followed by the $24.00 level. A breach of the latter could open a path towards the $23.00 area, marked by the previous cycle lows.

On the other hand, an XAG/USD daily close above $25.00 could pave the way for challenging yearly highs at $25.77, followed by last year’s high at $25.91.

XAG/USD Price Action – Daily Chart

- On the daily chart, indicators are consolidating but the outlook is favoring the bulls.

- The hourly chart gives hints of mounting selling traction with indicators deep in the red.

The NZD/JPY pair is currently trading at 91.60, slightly down in Thursday's session. Bulls hold a strong command over the market, even amidst transient selling pressure, which seems not to have weakened their movement with the pair holding above the 20,100 and 200-day Simple Moving Averages (SMAs).

On the daily chart, the NZD/JPY pair reveals an influx of buyers dominating the market, as indicated by the Relative Strength Index (RSI) progressing towards positive territory. The latest reading at 55, sits in the positive zone, but points down, as indicators consolidate. Meanwhile, the Moving Average Convergence Divergence (MACD) reveals a declining trend with red bars, indicating steady but weakening negative momentum.

NZD/JPY daily chart

The hourly landscape provides a more detailed perspective. The RSI has been fluctuating around the negative territory in the recent hours, dropping to 45 by the last hour. It suggests an increase in selling pressure in the short term compared to the daily setup. The continuous red bars of the MACD affirm this, reflecting the negative momentum represented in the RSI. This implies that the sellers step in as the buyers seem to be taking profits.

NZD/JPY hourly chart

Overall, while bulls are in command of the broad trend, the pair could see some additional selling pressure, as selling momentum is present and buyers might continue taking profits from the last two days' gains.

The risk-off trade returned to the markets on Thursday and lent extra oxygen to the Greenback, as investors continued to adjust to the latest FOMC event and the idea of three rate cuts by the Fed this year. Other than that, the BoE kept rates unchanged and signaled that rate cuts could be down the road.

Here is what you need to know on Friday, March 22:

The USD Index (DXY) traded with robust gains and resumed its uptrend following Wednesday’s post-FOMC decline. There will be no scheduled events on the US docket at the end of the week other than the speeches by FOMC M. Barr and R. Bostic.

EUR/USD succumbed to the Dollar’s advance and retreated to the 1.0850 area, rapidly fading the sharp advance recorded in the previous session. On March 22, Germany will release its IFO Business Climate.

GBP/USD could not sustain a move to levels just beyond 1.2800 the figure and collapsed to the mid-1.2600s following the stronger dollar and the dovish tilt by the BoE. On March 22, Retail Sales will take centre stage across the Channel along with the Gfk Consumer Confidence print.

USD/JPY extended its rally and flirted once again with the YTD tops near 151.80 as market participants continued to sell the yen following the BoJ meeting. On March 22, the domestic calendar includes the Inflation Rate and the weekly readings from Foreign Bond Investment.

A firm labour market report did not prevent AUD/USD from giving away its initial gains, eventually ending the session with modest losses. The RBA’s Consumer Inflation Expectations will be in the limelight on March 21.

Prices of WTI added to Wednesday’s retracement and approached the key $80.00 mark per barrel, losing around $3 since recent peaks north of the $83.00 yardstick.

Prices of gold rose to an all-time high past the $2,220 level per troy ounce, although they ended the session with humble losses amidst the recovery in the Greenback. Silver followed suit and dropped markedly after hitting fresh highs near $25.80 per ounce.

- GBP/USD falls to 1.2659 after BoE's dovish stance.

- BoE holds Bank Rate, hints at future cuts amid shifting views.

- UK inflation drop fuels June BoE rate cut bets.

- US Dollar bolstered by lower unemployment claims and economic strength.

The Pound Sterling tumbles sharply against the US Dollar and prints a new two-week low following major central banks' monetary policy decisions. On Thursday, it was the Bank of England’s (boE) turn to deliver a dovish hold, spurring a U-turn in price action. At the time of writing, the GBP/USD trades at 1.2659, down 0.97%.

Sterling erases Wednesday’s gains on BoE’s dovish pivot

The BoE kept the Bank Rate at 5.25%, with a split vote of 8-1, with no officials expecting a rate hike, and one dissenter that voted for a rate cut. At the previous meeting, policymakers voted 6-3, with two members expecting a rate hike. Given the stance adjustment amongst policymakers, there’s growing consensus on the BoE that the current level of rates is tempering inflationary pressures.

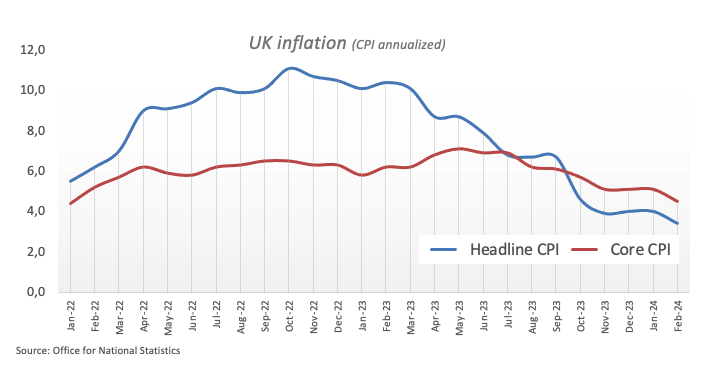

The latest inflation reports in the UK witnessed inflation dipping from 4% to 3.4%. Following the BoE’s decision, money markets are pricing a 75% chance of a rate cut in June, up from 65% earlier in the day.

The Greenback recovered some lost ground following Wednesday's Federal Open Market Committee (FOMC) policy decision. The FOMC kept rates unchanged and didn’t revise its rate cut expectations for 2024 despite printing back-to-back high inflation reports in the US. Regarding those reports, Federal Reserve (Fed) Chair Jerome Powell stated the road to lowering inflation to the Fed’s 2% goal would be bumpy.

The US economic docket revealed that unemployment claims for the last week dipped from 212K to 210K, lower than the 215K estimated. Other data witnessed S&P Global Flash PMI final readings for March mixed, though manufacturing activity improved. Elsewhere, Existing Home Sales jumped from 4 million to 4.38 million, an increase of 9.5%.

GBP/USD Price Analysis: Technical outlook

Given the fundamental outlook, the GBP/USD extended its losses and formed a large ‘bearish engulfing’ candle pattern, increasing the odds for further downside. The Relative Strength Index (RSI) dives further into bearish territory, while the 200-day moving average at 1.2592 is up for grabs. If sellers clear the psychological 1.2600 mark, followed by the 200-DMA, that could pave the way to test 1.2500. On the other hand, if buyers reclaim 1.2700, look for some consolidation.

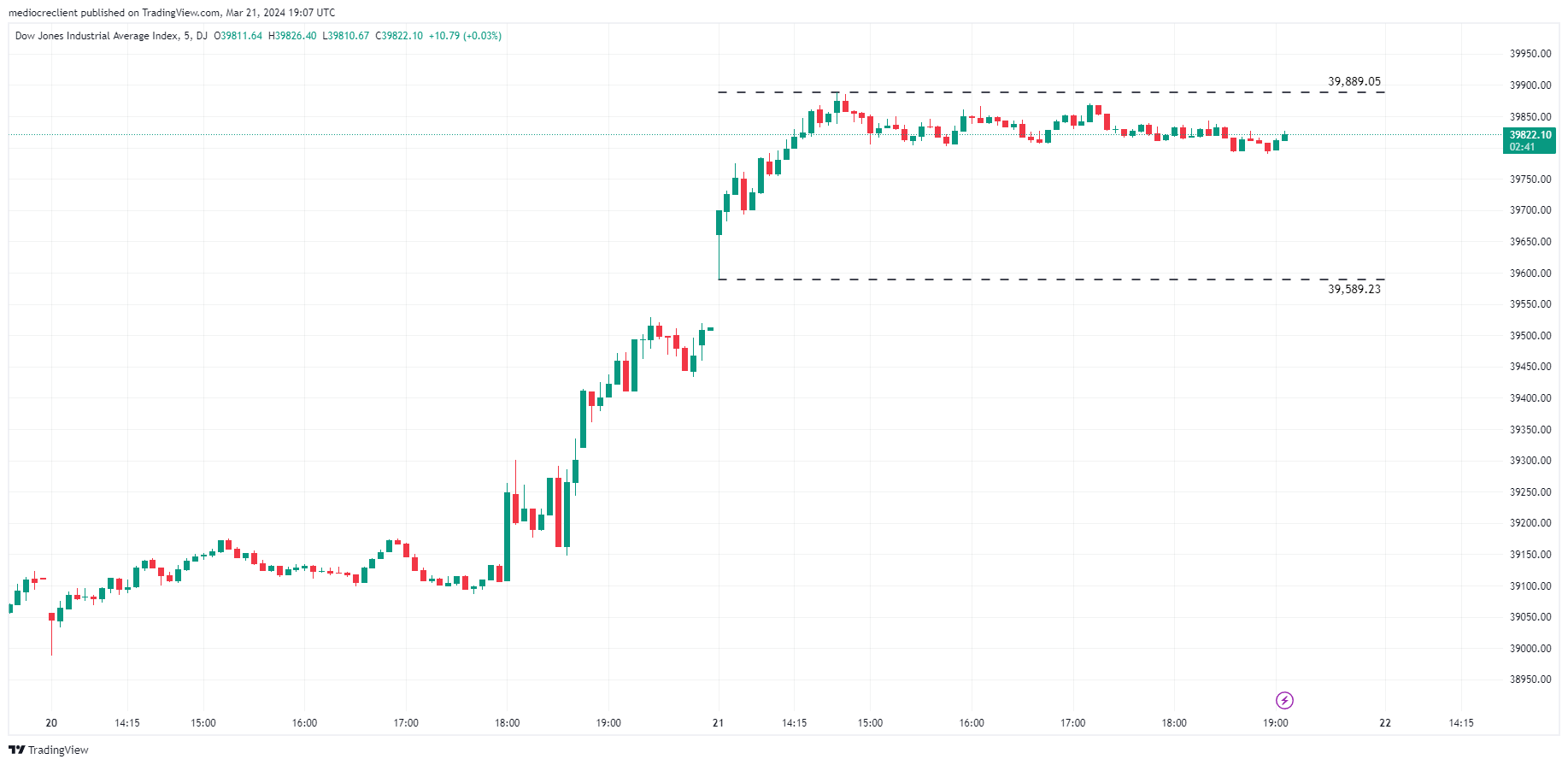

- Dow Jones clips into its second all-time high in two days.

- US equities broadly higher in the back half of the trading week.

- DJIA climbs 0.8% on Thursday as traders extend Fed bid.

The Dow Jones Industrial Average (DJIA) tore into its second all-time high this week, climbing eight-tenths of a percent and tapping a fresh record peak of 39,889.05 as US equities broadly gain ground. Investor confidence is peaking after the Federal Reserve (Fed) held steady on interest rates at the March Federal Open Market Committee (FOMC) rate call on Wednesday. Still, Fed Chairman Jerome Powell nodded at the likelihood of rate cuts to come, sending broad-market risk appetite into the ceiling.

Of the 11 sectors that make up the US equities markets, all but one are in the green on Thursday, led by the Industrials and Financials Sectors, which are up around a percent. On the low side, Communications Services shed further weight, backsliding a third of a percent as investors pare back bets on telecoms.

Dow Jones news

The Dow Jones climbed around 300 points on Thursday as the index bears down on the 40,000.00 major price handle as the equity index trades above 39,800.00. Of the 30 securities listed on the DJIA, only six are in the red on the day, led by Apple Inc. (AAPL), which shed over 4% to trade into $171.00 per share after the US Department of Justice announced it was suing the company on the accusation that Apple’s iPhone ecosystem constitutes a monopoly. The Department of Justice accused Apple of anti-competitive practices in multiple areas of the megacompany’s mobile phone business. The AAPL ticker is down nearly 8% from recent all-time highs at $198.11 set last December.

Goldman Sachs Group Inc. (GS) is leading the charge up the Dow Jones market board on Thursday, climbing 4.25% on the day to trade above $413.00 per share. GS is followed by Home Depot Inc. (HD), which climbed over 2.5% to test $394.40. Caterpillar Inc. (CAT) is up a little over 2% ahead of the day’s market close, testing $364.00 per share.

Dow Jones Industrial Average technical outlook

The Dow Jones kicked off Thursday’s US trading session with a topside gap as investors scrambled to bid up US equities, rallying into a fresh all-time record peak at 39,889.05 before settling into sideways trading between 39,840.00 and 39,820.00. The day’s low was set early in the trading session at 39,589.23.

Sellers looking to close Thursday’s opening bullish gap will need to drag the index below 39,520.00, which would open the Dow Jones up for a further decline into the last swing low into the 38,600.00 region.

Dow Jones Industrial Average 5-minute chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

- Gold prices retrace, experience pullback from recent highs as US Dollar strengthens.

- Risk-off sentiment, lower Gold demand follows Fed announcement on monetary policy.

- Fed cautious on economy, eyes on inflation, labor market.

- US 10-year Treasury yields, Dollar Index rise, both headwinds for Gold prices.

Gold prices (XAU/USD) fell from all-time highs of $2,223 and broke below the $2,200 figure on Thursday, clocking losses of 0.29% as the Greenback stages a comeback while US Treasury yields paired yesterday’s losses. A risk-off impulse and the lack of demand for the yellow metal above the $2,200 mark sponsored XAU/USD’s leg down toward the $2,179 mark.

Financial markets continued to digest the Federal Reserve’s (Fed) dovish hold following its March 21 meeting. Fed Chairman Jerome Powell and his colleagues acknowledged that the economy is robust, the labor market is gradually cooling, and inflation remains high despite decreasing from higher levels last seen in the 1980s.

Fed officials reiterated that they expect three rate cuts in 2024, though policy would stay put unless data suggests the disinflation process is evolving. In the meantime, the US 10-year Treasury yield benchmark note has pared its losses, while the US Dollar Index (DXY) posted gains of 0.58% at 103.98.

Daily digest market movers: Gold price dips as US yields recover

- Jerome Powell emphasized the Fed had made progress on tempering inflation, and despite printing two straight months of higher prices, that hasn’t changed the Fed’s outlook in regard to price stability.

- Fed policymakers kept the Dot Plot unchanged for 2024. Still, the 2025 Dot Plot was revised up from 3.6% to 3.9%.

- For 2024, the Federal Open Market Committee (FOMC) forecasts that the economy will grow 2.1%, up from 1.4%, while the Unemployment Rate will remain at 4%.

- Inflation figures in the United States as measured by the Fed’s favorite gauge for inflation, the Personal Consumption Expenditures (PCE), weren’t changed. They were expected to be at 2.4%, while core PCE is projected to end at 2.6%, up from 2.4%.

- The US economic schedule revealed that Initial Jobless Claims for the week ending March 16 rose by 210K, below estimates of 215K and the prior week’s figures.

- S&P Global PMI figures for the United States were mixed with Services and Composite PMI readings cooling but remaining in expansionary territory. The S&P Global Manufacturing PMI was the outlier, exceeding estimates of 51.7 and the previous reading of 52.2 by jumping to 52.5.

- Existing Home Sales rose by 9.5% from 4 million to 4.38 million.

- According to the CME FedWatch Tool, expectations for a June rate cut stand at 74%, down from 59% at the beginning of the week.

Technical analysis: Gold traders' failure at $2,200 exposed the $2,180 mark

The XAU/USD price has fallen below the $2,200 mark and sits below the previous all-time high of $2,195 as sellers moved in. However, to further extend the yellow metal losses, they must drag prices toward the December 4 high, which turned support at $2,146, before challenging the $2,100 figure.

On the flip side, if buyers push prices toward $2,200, that will expose the current all-time high at $2,223 before aiming toward $2,250.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- The daily RSI was rejected near the overbought region.

- Hourly chart indicators show a shift in short-term dynamics, with sellers gaining ground.

- Despite the signs of potential short-term bearish correction, the pair still holds above key SMAs, denoting an overall bullish trend.

The EUR/JPY pair shows slight losses of 0.26% during Thursday's session. Despite sporadic fluctuations, there is a largely upward trend, indicating a strong position for buyers. Yet, recent subtle signs of selling pressure hint at a potential challenge to the continuity of the bullish trend for the next sessions.

On the daily chart, the Relative Strength Index (RSI) shows an overall positive trend. However, imminent overbought conditions suggest a possible downward retracement could soon emerge as buyers may continue taking profits. In addition, the Moving Average Convergence Divergence (MACD) continues to print green bars, suggesting a steady buying momentum

EUR/JPY daily chart

When examining the hourly chart, the RSI reveals some variability, with the latest reading at 47. This value is notably lower than the daily readings, suggesting that sellers might be gaining some ground in the short term. In addition, the MACD prints red bards which adds arguments to the growing selling pressure on the shorter timeframes.

EUR/JPY hourly chart

When analyzing with Simple Moving Averages (SMAs), the broader scale indicates that, despite a negative outlook in the short term, the pair maintains its position above the 20, 100, 200-day Simple Moving Averages, suggesting that, on a wider scope, the buyers are still firmly in control. However, if the technical correction extends below any of these levels the trend might slowly shift in favor of the seller.

- Canadian Dollar rises, but USD rises faster.

- Canada brings Retail Sales data to fore on Friday.

- US PMIs came in mixed on Thursday.

The Canadian Dollar (CAD) is broadly higher on Thursday, climbing against most of its major currency peers, but the US Dollar (USD) is getting bid higher, faster. Investors are paring back Greenback selling after a Fed-fueled midweek splurge, bolstering the US Dollar across the board.

Canada will return to the economic calendar with meaningful data on Friday. Retail Sales figures for January are expected to decline around half a percent after rising nearly a full percent in December.

Daily digest market movers: US Dollar dominates on US data flows

- US S&P Global Purchasing Managers Index (PMI) figures printed a split on Thursday.

- March’s US Manufacturing PMI rose to 52.5 from the previous 52.2, easily vaulting over the forecasted decline to 51.7.

- The Services PMI for March fell more than expected, declining to 51.7 from the previous month’s 52.3, falling more than the forecast 52.0.

- US Initial Jobless Claims slipped to 210K for the week ended March 15, missing the forecasted increase to 215K from the previous week’s 212K (revised upward from 209K).

- Analysts from Scotiabank have noted that the month of April tends to be the Canadian Dollar’s best-performing month against the Greenback.

- Scotiabank: April is the CAD’s best month of the calendar year against the USD.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the weakest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.71% | 1.03% | 0.45% | 0.39% | 0.61% | 0.71% | 1.50% | |

| EUR | -0.72% | 0.32% | -0.26% | -0.33% | -0.12% | 0.01% | 0.79% | |

| GBP | -1.05% | -0.33% | -0.59% | -0.63% | -0.45% | -0.32% | 0.46% | |

| CAD | -0.47% | 0.26% | 0.59% | -0.05% | 0.13% | 0.26% | 1.04% | |

| AUD | -0.40% | 0.32% | 0.64% | 0.06% | 0.19% | 0.33% | 1.10% | |

| JPY | -0.58% | 0.13% | 0.45% | -0.16% | -0.19% | 0.14% | 0.91% | |

| NZD | -0.71% | 0.00% | 0.32% | -0.26% | -0.33% | -0.10% | 0.80% | |

| CHF | -1.51% | -0.79% | -0.47% | -1.06% | -1.12% | -0.90% | -0.80% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical analysis: US Dollar rebounds, bullish CAD gets outperformed

The Canadian Dollar (CAD) is broadly higher on Thursday, gaining ground against nearly all of its major currency peers despite falling around four-tenths of a percent against the US Dollar. The CAD is struggling to hold flat against the day’s other over-performing currency, the Australian Dollar (AUD).

The USD/CAD is on the rise in Thursday trading, cutting in approximately 0.6% in bullish momentum bottom-to-top. The pair caught a bounce from the 1.3460 region, reclaiming the familiar 1.3500 handle in intraday trading.

Thursday’s recovery etches in a technical rejection from the 200-day Simple Moving Average (SMA) at 1.3485. A rangebound USD/CAD pattern looks set to continue in the near term.

USD/CAD hourly chart

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- Mexican Peso weakens as investors eye Banxico policy decision on Thursday.

- Mexico’s retail sales data indicate cautious consumer spending, setting stage for Banxico's potential 25 bps rate cut.

- Banxico rate cut may shrink US-Mexico rate gap, possibly nudging USD/MXN near 17.00.

- Decision might not be unanimous as Deputy Governors Espinosa and Heath expressed concerns over persistent inflation.

The Mexican Peso begins the session on the defensive against the US Dollar as investors prepare for the Bank of Mexico (Banxico) monetary policy decision. Most analysts expect a 25-basis-point rate cut, which would lower reference rates to 11.00%. The USD/MXN pair exchanges hands at a 16.74 for a gain of 0.4%.

Mexico’s economic docket featured retail sales for February, which improved on a monthly basis, yet suggests consumers are spending less. In the 12 months to January, sales missed estimates and plunged sharply. Later at 19:00 GMT, the Banxico Governing Council led by Governor Victoria Rodriguez Ceja will likely cut rates for the first time since mid-2021.

The decision is expected to be split, as two Deputy Governors, Irene Espinosa and Jonathan Heath, expressed their disagreement with easing policy, adding that inflation remains high and stubbornly stickier than expected. Although February’s inflation cooled from 4.88% to 4.40% and core figures decreased from 4.76% to 4.64%, external factors could trigger a second wave of inflation.

In the meantime, traders continued to digest the latest monetary policy decision by the Federal Reserve, which held rates unchanged and kept their projections for three 25 bps rate cuts toward year end. Although revising the federal funds rate (FFR) level upward to 3.9%, the Fed’s decision was perceived as dovish.

Given the backdrop, if Banxico lowers rates, that would decrease the interest rate spread between the US and Mexico, bolstering the USD/MXN, which could hit 17.00 following the decision.

Daily digest market movers: Mexican Peso weakens as reduction of rate differentials looms

- Mexico’s Retail Sales fell -0.6% MoM in January, missing estimates of 0.4% expansion but better than December’s data. Yearly figures plummeted from -0.2% to -0.8%, smashing projections for a 1.2% expansion.

- Mexico’s economic data released in the week:

- Aggregate Demand rose by 0.3% QoQ in Q4, up from 0%. On an annual basis, it decelerated from 2.7% to 2.6%.

- Private Spending on a quarterly basis slowed from 1.2% to 0.9%. On a yearly basis, it improved from 4.3% to 5.1%.

- The slowdown in Mexico’s economy is one of the main reasons that Banxico is eyeing the first cut. Mexico’s central bank expects the economy to grow 2.8% YoY in 2024, down from 3%, but maintains its 1.5% prior call for 2025.

- The US economic schedule revealed that Initial Jobless Claims for the week ending March 16 rose by 210K, below estimates of 215K and the prior week’s figures.

- S&P Global PMI figures for the United States were mixed, with Services and Composite PMI readings cooling but remaining in expansionary territory. The S&P Global Manufacturing PMI was the outlier, exceeding estimates of 51.7 and the previous reading of 52.2 by jumping to 52.5.

- Existing Home Sales rose by 9.5% from 4 million to 4.38 million.

- The latest inflation figures in the United States prompted investors to price in a less dovish stance. Money market futures have adjusted their rate cut expectations to be more in line with the Fed's as they foresee theFFR at 4.71% toward the end of the year. Analysts estimate the Fed will not change its FFR level until June or later.

Technical analysis: Mexican Peso treads water as USD/MXN accelerates to 16.80

As mentioned on Wednesday, “the USD/MXN is neutral to downwardly biased after buyers lifted the exchange rate to a weekly high of 16.94 before retreating beneath 16.80.” However, with the Mexican Central Bank decision looming, a quarter percentage rate cut could lift the exotic pair and break key resistance levels.

The first resistance would be the March 19 cycle high at 16.94, followed by the psychological 17.00 figure. Up next would be a busy area of dynamic supply zones, led by the 50-day Simple Moving Average (SMA) at 17.01, the 100-day SMA at 17.12 and the 200-day SMA at 17.20.

On the other hand, sellers must drag the exchange rate below the current year-to-date low of 16.64 before challenging last year’s low of 16.62.

USD/MXN Price Action – Daily Chart

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- The DXY index bottomed at weekly lows and managed to trim Wednesday’s losses

- The Fed's stance seems slightly dovish, unmistakably resisting overreaction to two months of hot inflation.

- S&P PMIs came in mixed, Jobless Claims figures came in stronger than expected.

The US Dollar Index (DXY) is currently trading at 103.80, marking a 0.50% increase, almost trimming all of Wednesday’s losses. The Greenback gained ground after mixed S&P preliminary PMIs from March and strong weekly Jobless Claims.

The overriding consensus is a start to an easing cycle in June and the timing of the next cut will be dictated by incoming data. With recent hot inflation figures, the Fed revised its inflation projections higher. However, Jerome Powell confirmed there will be no overreaction from the bank. This consideration pushed the Fed's stance more dovish, implying a less aggressive approach toward rates. The Dot Plot showed that the median rate prediction by the end of this year remains at 4.6%.

Daily digest market movers: DXY is trending higher near 103.80, finding its footing after a post-FOMC sell-off

- S&P Global's initial Purchasing Managers Survey for March showed a slight decrease in the Services PMI, dropping from 52.3 to 51.7.

- Conversely, there was an increase in the Manufacturing PMI, rising from 52.2 to 52.5. The Composite PMI, which stood at 52.5 in February, showed a slight dip to 52.2.

- Initial Jobless Claims for the week ending March 15 came in at 210K, lower than the 215K expected.

- After the FOMC's decision, US Treasury bond yields are increasing with the 2-year yield trading at 4.59%, the 5-year at 4.25%, and the 10-year at 4.27%.

DXY technical analysis: DXY displays bullish momentum, trims Wednesday’s losses

The technical outlook for DXY reflects a recovering bullish momentum. This viewpoint is primarily driven by the rising slope and positive territory of the Relative Strength Index (RSI), which signals increasing buying pressure. In addition, the augmentation of green bars in the histogram of the Moving Average Convergence Divergence (MACD) signifies that buying momentum is mounting.

In addition, the index recovered above the convergence of the 20, 100, and 200-day Simple Moving Averages (SMAs), further reinforcing a resilient bullish traction. If the DXY manages to stay above the 103.50-70 area, the outlook will be bright for the DXY.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

The US Federal Reserve is moving closer to cutting interest rates. A first move at the meeting in June is still likely if the next inflation data show progress, economists at Commerzbank say.

Fed wants to gain more certainty that inflation has really been beaten

While the Fed is moving towards lowering interest rates, it still needs more certainty that inflation will fall to 2% in the longer term. After the latest surprisingly high data, it is unlikely to have this confidence at its next meeting on May 1. The earliest date for a first rate cut is, therefore, the meeting in June, where we expect a move of 25 basis points as before. However, if the next inflation report is clearly disappointing again, the Fed could wait longer.

In any case, we only see relatively limited potential for rate cuts totalling 125 basis points which would bring the upper bound of the target range to 4.25% in spring 2025. The reason is that inflation is likely to remain above target in the longer term due to the tight labor market and structural factors that boost inflation such as the worsening demographics and increased protectionism.

Across the major currencies, the Canadian Dollar (CAD) appears to have one of the strongest seasonal reactions around this time of the year, economists at Scotiabank say.

USD typically strengthens in Q1 but loses ground through Q2 and Q3 before recovering

DXY patterns over the past 30-plus years suggest the USD typically strengthens in Q1 but loses ground through Q2 and Q3 before recovering, briefly and somewhat choppily, in Q4. That evolution is roughly reflected in the average rise and fall of US (10Y) bond yields over the course of the calendar year coincidentally.

April is the CAD’s best month of the calendar year against the USD and its firmer tone typically extends through May and June. The CAD averages a return of just over 1% in the April month against the USD and has strengthened 68% of the time since the 1990s.

CAD-supportive trends are reflected across asset classes. April is one of the strongest months of the year for the S&P 500, with an average return of just under 2%. April also typically heralds the start of a three-month jump in crude oil prices (with combined monthly gains through April-June over 10%).

Gains in stocks and commodities would provide the CAD with some support in the next few weeks and may help slow losses against a generally strong USD. But a significant improvement in the CAD undertone would likely require a USD-negative catalyst that is a bit harder to envisage right now.

- GBP/JPY pulls back from extremes after the recent bout of Yen weakness.

- The Pound Sterling weakens after the BoE distribution of voting shows no-one voted for a hike.

- Japanese PMI data shows steady progress higher, UK data is mixed.

GBP/JPY is down over half a percent on Thursday, trading in the 192.000s, after a combination of the results of the Bank of England (BoE) policy meeting and weaker-than-expected UK PMI data, weighed on the Pound Sterling (GBP).

An improvement in Japanese data, meanwhile, may have helped staunch the recent hemorrhaging experienced by the Yen (JPY). The Jibun Bank Manufacturing Purchasing Manager Indices (PMI) showed upticks in both Manufacturing and Services sectors in March.

From a technical perspective, GBP/JPY looks overstretched after breaking out of the top of a Rising Wedge pattern on overbought momentum, according to the Relative Strength Index (RSI). A negative close on Thursday could signal an exit from overbought RSI, providing traders with a sell signal.

Pound Sterling to Japanese Yen: Daily chart

BoE voting distribution shows dovish shift

The Bank of England left interest rates unchanged at 5.25% at its meeting on Thursday, as was widely expected. The distribution of votes, however, changed from the previous meeting with zero officials voting for a hike instead of the one before. The majority of eight board members voted for no-change – one more than the seven of the previous meeting – and only one voted for a cut in interest rates, as before.

The Pound Sterling was hit by the lack of any BoE officials voting to raise interest rates, since higher interest rates are a positive factor for currencies because they attract greater inflows of foreign capital.

In Japan the opposite happened after the Bank of Japan (BoJ) raised interest rates, at its March meeting. Strangely the move failed to support the Yen. Reasons given were that it was widely telegraphed prior to the meeting, and that at between 0.0% and 0.1% interest rates in Japan are still very low compared to other major economies and unlikely to rise much in the future. This suggests the Yen will continue to be used as a funding currency – borrowed to purchase higher yielding peers.

Purchasing Manager Indices show mixed results

The UK S&P Global/CIPS Composite PMI in March came out lower-than-expected at 52.9 when 53.1 had been forecast, from 53.0 previously, on Thursday. The data weighed on GBP.

UK Services PMI undershot expectations of remaining at 53.8, dropping to 53.4.

Manufacturing was the bright spot, actually rising to 49.9 when 47.8 had been forecast from 47.5 previous.

In Japan the Jibun Bank Manufacturing PMI rose to 48.2 in March from 47.2 previously and Services PMI rose to 54.9 from 52.9.

Technical Analysis: Upside break seems unsustainable

GBP/JPY sees an upside break above the wedge pattern’s highs but the move looks unsustainable and price is already reversing. A bearish close on Thursday would form a Two Bar reversal pattern on the daily chart – a fairly reliable indicator of more weakness to come.

The RSI will probably exit overbought, another bearish sign. A break back inside the Wedge, confirmed by a decisive move below the upper trendline currently at 191.50, would probably signal further downside.

Pound Sterling to Japanese Yen: Daily chart

Often a reversal from an overshooting extreme, as is the case with GBP/JPY is a reliable signal to sell. When prices reach bullish extremes and overshoot their trendlines they often reverse sharply and move down quickly.

Economists at Commerzbank review Wednesday’s FOMC meeting and its implications for the US Dollar (USD).

The story may be the same, but the tone has changed

We can probably conclude that the story has remained the same, i.e. the Fed still wants to wait for inflation to return to its target on a sustained basis. The new projections are also consistent with this.

The only thing that has changed is Powell's tone: while he sounded very hawkish in January, this time he sounded much more neutral. This assessment of a more neutral Fed may change again as FOMC members speak in the coming days, but for now, the market is right to be wary of too much Dollar strength.

Gold has risen above $2,200 for the first time on a dovish Fed. Economists at MUFG Bank analyze the yellow metal’s outlook.

Short-term moves will remain tied to data potentially influencing Fed decision-making

Gold has leaped above $2,200 for the first time after the Fed maintained its outlook for three cuts this year, suggesting it is not alarmed by a recent uptick in inflation.

The FOMC left the target range for the federal funds rate unchanged at its March meeting. The median dot in the Summary of Economic Projections continued to show 75 bps of cuts in 2024. The median dots for 2025 and 2026 were each revised 25 bps higher, to 3.875% and 3.125%, respectively. The median dot for 2026 remained modestly above the median longer run dot, which edged up to 2.6%.

We continue to believe that the short-term moves will remain tied to data potentially influencing Fed decision-making while downside to the price will be limited by robust support from the other two channels (supportive central bank demand and bullion’s role as the geopolitical hedge of last resort).

- NZD/USD falls sharply to 0.6060 as the US Dollar sees a sharp recovery.

- The S&P Global reports that preliminary Manufacturing PMI surprisingly rose to 52.5 in March.

- The Q4 NZ GDP shows that the economy was in a technical recession in the second half of 2023.

The NZD/USD pair surrenders its intraday gains and turns negative in the early New York session on Thursday. The Kiwi asset falls back as the US Dollar rebounds sharply from its five-day low of 0.6060. The US Dollar Index (DXY) rises strongly to 103.76 as the Federal Reserve (Fed) has revised United States Gross Domestic Product (GDP) forecasts higher for 2024.

Fed’s latest economic projections indicate that the US economy will grow by 2.1% in 2024, upwardly revised from December’s projections of 1.4%. An upbeat economic outlook bodes well for the domestic currency.

Meanwhile, the S&P Global has reported mixed preliminary PMI data for March. The agency shows that the Manufacturing PMI surprisingly rose to 52.5 from the former reading of 52.2. Investors anticipated the factory PMI to decline to 51.7. The Services PMI that represents the service sector, which accounts for two-thirds of the economy, falls at a higher pace to 51.7 from expectations of 52.0 and the former reading of 52.3.

The appeal for risk-perceived assets has weakened despite firm market expectations for the Fed to reduce interest rates after the June policy meeting. The CME FedWatch tool shows that there is a little over 74% chance that a rate cut will be announced in June, which is significantly up from the 59% recorded before the Fed’s meeting.

On the Kiwi front, Statz NZ has reported that the economy was in a technical recession in the second half of 2023. The Q4 Gross Domestic Product (GDP) for 2023 surprisingly contracted by 0.1%, while investors projected the economy to have grown at a similar pace. In the third quarter of 2023, the NZ economy also contracted by 0.3%. A weak NZ economic outlook could force the Reserve Bank of New Zealand (RBNZ) to consider early rate cuts.

GBP/USD slid a bit on the BoE policy announcement, likely reflecting the shift in the voting bias. Economists at TD Securities analyze the Pound Sterling (GBP) outlook.

Cable set to move to 1.3000 in Q2

As universally expected, the MPC opted for a hold today, leaving Bank Rate at 5.25%. The vote was 8-1, with both Mann and Haskel switching to a hold vote. The language in the statement was broadly the same as in February, though we noted a slightly more dovish lean on inflation developments and a possible opening up for a May cut.

We think markets were generally looking for something like a copy and paste job from the last meeting. In turn, the voting shift from 2/6/1 to 8/1 has likely disrupted some short-term positioning. That said, we would fade the knee-jerk reaction, as the second order effects of central banks cuts are likely more important than the cuts themselves for FX. Easing financial conditions and improving growth prospects should continue to weigh on the USD in Q2/Q3.

For GBP/USD, we could see trend line support come in around 1.2700 in the near term. We would use dips as buying opportunities as we forecast a move to 1.3000 in Q2.

- AUD/USD declines back down to the 0.6580s.

- Aussie employment data and Fed meeting outcome had boosted the pair early on Thursday.

- Upbeat US data saw AUD/USD fall back down, however, during the US session.

AUD/USD trades back down at the lows of the day, during the US session on Thursday, after a batch of relatively strong American data helped the US Dollar (USD) claw back lost ground.

The pair had been rising after the Australian Dollar (AUD) got a boost from data showing an unexpected fall in Australian unemployment and a much higher-than-expected increase in the number of people in employment down under.

The release of US PMI data for March, Initial Jobless Claims and the Philadelphia Fed Manufacturing Index all supported the USD and saw the pair fall back close to the day’s lows in the 0.6580s.

US S&P Global Composite PMI came out at 52.2, holding above the 50 level that distinguishes expansion from contraction. US Manufacturing PMI came out at 52.5, beating estimates and previous figures. Services PMI, however, undershot expectations and previous results, coming out at 51.7 in March.

The Philadelphia Fed Manufacturing Survey came out higher than estimated at 3.2, and Initial Jobless Claims at 210K were lower than the 215K forecast.

AUD/USD rallied on Wednesday, triggered by US Dollar (USD) weakness after the Federal Reserve (Fed) March policy meeting.

At the meeting the Fed reaffirmed they would still be cutting interest rates by roughly three quarters of a percent in 2024 despite speculation they would reduce rate cuts because of recent warmer-than-expected inflation reading.

Early on Thursday the pair continued rising after it was revealed Australia added 116,500 new employees in February and saw its Unemployment Rate fall to 3.7% from 4.1%, according to data from the Australian Bureau of Statistics.

The figures beat economists expectations of a 40,000 increase in employees and unemployment at 4.0%.

The data supports the outlook for the Australian economy, is likely indicative of higher wage inflation going forward and suggests the Reserve Bank of Australia (RBA) will have to keep interest rates higher for longer. Higher interest rates are positive for currencies as they attract greater inflows of foreign capital.

The technical picture shows the AUD/USD pair oscillating in a range between roughly 0.6480 and 0.6650.

Australian Dollar versus US Dollar: 4-hour chart

The pair is currently turning around at the range highs and looking vulnerable to selling off.

A continued move lower could see it return to the base of the range. Alternatively a break above the 0.6668 highs would provide confirmation of a higher high and the formation of a bullish short-term trend.

- S&P Global Manufacturing and Services PMIs both arrived above 50 in early March.

- US Dollar Index stays in positive territory above 103.50.

Business activity in the US private sector continued to expand at a healthy pace in early March, with the S&P Global Composite PMI coming in at 52.2. This reading came in slightly below the February's 52.5.

S&P Global Manufacturing PMI improved to 52.5 from 52.2 in the same period, while S&P Global Services PMI edged lower to 51.7 from 52.3.

Commenting on the survey's findings, “further expansions of both manufacturing and service sector output in March helped close off the US economy’s strongest quarter since the second quarter of last year," said Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

"The survey data point to another quarter of robust GDP growth accompanied by sustained hiring as companies continue to report new order growth," Williamson added. “A steepening rise in costs, combined with strengthened pricing power amid the recent upturn in demand, meant inflationary pressures gathered pace again in March."

Market reaction

The US Dollar continued to gather strength after the PMI data. The US Dollar Index was last seen rising 0.35% on the day at 103.72.

The value of the Swiss Franc (CHF) has dropped 1.2% after the SNB’s ‘surprise’ rate cut. Economists at Rabobank analyze CHF outlook.

EUR/CHF six-month forecast of 0.9800 brought forward to a three-month view

The SNB’s decision to cut rates this month will likely further the probability that the CHF could be used as a funding currency particularly if the SNB signals that it is prepared to match ECB rate cuts this year.

While there are several fronts from which demand for safe-haven could re-appear over the medium term and we do expect that volatility will rise towards the end of the year with the US election. That said, for now the CHF is likely to remain soft.

We have brought forward our previous EUR/CHF six-month forecast of 0.9800 to a three-month view.

- EUR/GBP rebounds after the BoE meeting shows no board members voting for a rate hike.

- Previously one member had held out for an interest rate hike.

- UK PMI data also shows overall fall in Composite and Services, although Manufacturing recovers.

EUR/GBP is trading up by almost three tenths of a percent on Thursday in the 0.8560s after the outcome of the Bank of England (BoE) meeting and overall weaker-than-expected British PMI data, weighed on the Pound Sterling (GBP) side of the pair.

The Bank of England left interest rates unchanged at 5.25% at its meeting on Thursday but the distribution of votes changed to show none of the officials voting for an interest rate hike. This was a change from the one who voted for a hike at the last meeting. Instead the majority of eight board members voted for no-change – one more than the previous meeting – and only one voted for a cut in interest rates, as before.

The Pound Sterling was hit by the lack of any BoE officials voting to raise interest rates, since higher interest rates are a positive factor for currencies because they attract greater inflows of foreign capital.

Both Eurozone and UK PMI data for March showed overall cracks in the outlook. In the case of the UK, the S&P Global/CIPS Composite PMI came out lower-than-expected at 52.9 when 53.1 had been forecast from 53.0 previously.

UK Services PMI undershot expectations of remaining at 53.8, dropping to 53.4. Manufacturing actually beat expectations at 49.9 when 47.8 had been forecast from 47.5 previous.

In the Eurozone, the HCOB Composite PMI rose to 49.9 thereby beating estimates of 49.7 and the previous February reading of 49.2.

Eurozone HCOB Manufacturing PMI in March fell to 45.7, declining deeper into contractionary territory (below 50) than had been predicted. Economists had estimated a more buoyant rise to 47.0 from 46.5 previously.

Euro area HCOB Services PMI rose to 51.1 in March, beating estimates of 50.5 from 50.2 previous, according to data from S&P Global.

Europe's economic powerhouse Germany, meanwhile, revealed a similar trend, with German HCOB Manufacturing PMI declining to 41.6 which was below estimates of 43.1 and February's 42.5. It too showed unexpected gains, however, in both Services component and the Composite number.

Economists at BBH analyze US Dollar’s outlook after the perceived dovish Fed hold.

The Fed is unlikely to deliver 75 bps of rate cuts this year

For 2024, the Fed’s new funds rate projection continues to imply 75 bps of rate cuts despite higher GDP growth estimate (2.1% versus 1.4%) and higher core PCE inflation forecast (2.6% versus 2.4%). The combination of expected lower policy rates, stronger growth, and higher underlying inflation bodes well for risk assets and is weighing on USD.

In our view, the outcome of the Fed March policy meeting is not a dovish slam dunk. First, there was no indication from the Fed that it had gained greater confidence that inflation is moving sustainably towards 2%. Second, the median Fed funds rate projections for 2025 and 2026 were both lifted by 25bps to 3.875% and 3.125%, while the longer-term funds rate forecast is roughly 6bps higher at 2.6%. Third, the 2024 funds rate estimate was just one dove away from a hawkish shift.

Importantly, we doubt the Fed will deliver 75 bps of rate cuts this year in part because of the encouraging US economic growth outlook. As such, USD downside is limited.

USD mixed on the day. Economists at Scotiabank analyze Greenback’s outlook.

US Dollar prone to more softness after FOMC

With the risk of a more hawkish Fed removed the pathway to a somewhat softer USD seems to be a little clearer – if only to correct some of its recent gains that developed around concerns that hot CPI data recently could shift the Fed’s perspective on the rate outlook.

The DXY closed negatively Wednesday, losing ground broadly and signaling a technical reversal in its recent strength. The USD’s performance so far today has been mixed, however. But USD gains are not enough – at this point – to ward off more losses in response to the FOMC decision and lower US yields.

The DXY is at risk of easing a further 0.75%-1% in the near term, at least.

- Initial Jobless Claims in the US decreased by 2,000 in the week ending March 16.

- US Dollar Index clings to modest daily gains above 103.50.

There were 210,000 initial jobless claims in the week ending March 16, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 212,000 (revised from 209,000) and came in better than the market expectation of 215,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1.2% and the 4-week moving average stood at 211,250, an increase of 2,500 from the previous week's revised average.

"The advance number for seasonally adjusted insured unemployment during the week ending March 9 was 1,807,000, an increase of 4,000 from the previous week's revised level," the publication read.

Market reaction

The US Dollar Index clings to modest daily gains above 103.50 in the early American session.

USD/CAD is steady on Thursday. Economists at Scotiabank analyze the pair’s outlook.

Short-term spot trends are somewhat mixed

Lower US rates and narrower US/Canada spreads are supportive of a somewhat firmer CAD in the near term and the CAD-positive turn in seasonal trends into Q2 remains something to keep in mind.

On the one hand, the USD’s tumble from the low 1.3600 area on Wednesday marks another, clear rejection of 1.3600+ on the short-term chart which should really mean spot gravitates to retest the range low at 1.3420 at least. On the other, intraday patterns indicate a firm rebound in the USD from the intraday low which may mean the USD pushes back up to the low/ mid-1.3500 area before renewed selling pressure emerges.

The 1.3600/1.3610 looks very firm resistance now and a low close on the week for the USD should drive more losses and a deeper correction of the USD’s Q1 strength in the weeks ahead.

- The US Dollar recovers on Thursday after its brief moment of weakness on Wednesday.

- Traders were surprised by the dovish Fed, which continued to anticipate three rate cuts this year.

- The US Dollar Index fell to the lower end of 103.00 before staging a rebound.

The US Dollar (USD) is entering a patch of volatility after markets got caught by surprise on Wednesday when the release of the Fed monetary policy decision revealed that the Federal Open Market Committee (FOMC) is still committed to cut interest rates three times this year. Markets had already repriced their stance to just two cuts ahead of the Fed event. The repricing of the Fed statement resulted in ample US Dollar weakness, with equities rallying substantially higher.

On the economic data front, Thursday’s points could not come at a better time. With the preliminary Purchasing Manager Index (PMI) numbers to be released, markets can get confirmation if the Fed is right to stick to three cuts. A continuing strong economy could result in the Fed tuning down its rate cut expectations to only two or one cut in order to keep control of inflation as firm demand tends to fuel inflation.

Daily digest market movers: Fed view to be confirmed by data