- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 07-03-2023

- USD/CHF has stabilized above 0.9400 amid the risk-off mood underpinned due to hawkish Fed Powell’s remarks.

- Extremely hawkish Fed Powell’s remarks have confirmed that fears of persistent inflation are genuine.

- SNB Jordan said that the appreciation of the Swiss Franc has protected them from imported inflation

The USD/CHF pair has shifted its auction above the round-level resistance of 0.9400 after a whooping upside momentum post extremely hawkish remarks from Federal Reserve (Fed) chair Jerome Powell. The Swiss franc asset is expected to resume its upside journey towards the critical resistance of 0.9435 as investors have underpinned the risk aversion theme amid solid chances of more rates from the Fed that previously anticipated.

S&P500 futures are displaying nominal gains after a bearish Tuesday, portraying a dead cat bounce in the overall risk-off mood. The US Dollar Index (DXY) has refreshed its three-month high above 105.60 as the risk appetite of the market participants have squeezed dramatically. The USD Index is expected to remain in action ahead of the United States Automatic Data Processing (ADP) Employment Change (Feb) data.

Hawkish remarks from Fed chair Jerome Powell while addressing Congress have confirmed that fears of persistent inflation in the US economy are genuine and chances of rate pause are not in the picture. Fed’s Powell has confirmed that the central bank is prepared for more rates than previously estimated to bring down inflationary pressures.

Incoming data from the US economy is critically resilient, which is capable of halting the declining trend of inflation. Therefore, more rates are highly required to tame stubborn inflation.

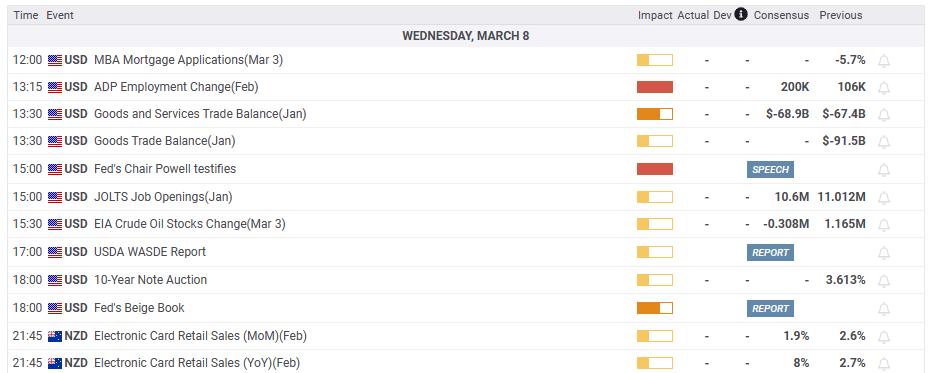

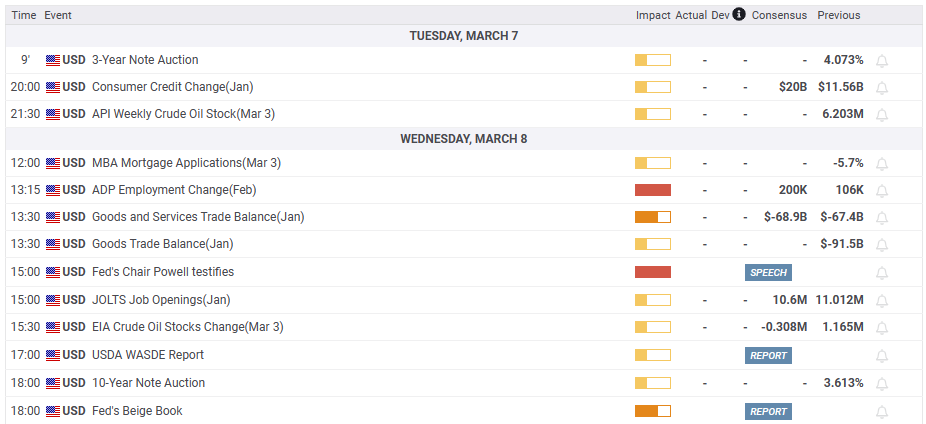

Investors will get more clarity after the release of the US ADP Employment data. The street is anticipating a jump in employment numbers by 200K in February, higher than January’s figure of 106K.

On the Swiss Franc front, Swiss National Bank (SNB) Chairman Thomas J. Jordan stated the inflation in Switzerland is low in international comparison but above the price stability target of the SNB. He explained that the appreciation of the Swiss Franc has protected them from imported inflation.

On Monday, Swiss headline Consumer Price Index (CPI) (Feb) landed at 3.4% YoY and the core CPI that excludes oil and food prices were recorded at 2.4% YoY.

- USD/CAD seesaws around four-month high, remains sidelined after rising the most since late September 2022.

- Hawkish comments from Fed Chair Powell, downbeat Oil price propels Loonie price.

- Expectations of no change in interest rates from Bank of Canada adds strength to the upside momentum.

- Powell’s Testimony 2.0, US ADP Employment Change also appear important for clear directions.

USD/CAD bulls take a breather around the highest levels since early November 2022, following the biggest daily jump in five months. That said, the Loonie pair seesaws around 1.3750 as traders appear cautious ahead of the Bank of Canada (BoC) Interest Rate Decision on Wednesday.

Hawkish comments from Federal Reserve (Fed) Chairman Jerome Powell in his Semi-Annual Testimony to the US Congress propelled the USD/CAD prices late Tuesday. That said, policymaker surprised markets by showing readiness for more rate hikes and bolstered the bets of a 50 bps Fed rate hike in March.

With the “higher for longer” Fed rate expectations back on the table, the market’s risk appetite roiled and weighed on the commodity prices, while also fueling the US Dollar Index (DXY). It should be noted that Wall Street closed in the red and the US Treasury bond yields remained firmer with the two-year counterpart flashing the highest levels since 2007.

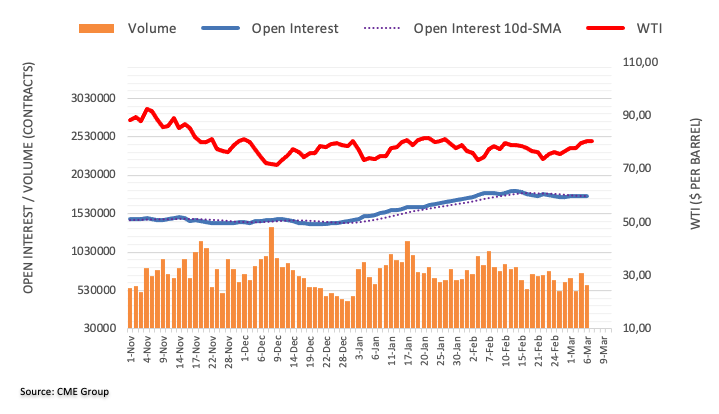

The risk-aversion wave joined fresh US-China tensions to exert more downside pressure on the WTI crude oil prices, Canada’s key export. It should be noted that the slump in the Oil price ignored a surprise draw in the Weekly Crude Oil Stock details from the American Petroleum Institute (API), an industry source. That said, the WTI crude oil marked the heaviest daily slump in two months the previous day, making rounds to $77.20-30 during the early hours of Wednesday.

Looking forward, the BoC’s pause in the rate hike trajectory will be crucial to watch and can propel the USD/CAD prices further if the inaction is likely to be stretched forward. It’s worth noting, however, that a surprise rate hike won’t be taken lightly and can allow the Loonie pair to consolidate the previous day’s heavy gains.

Also read: Bank of Canada Preview: Canadian Dollar set to climb on hawkish hold, market positioning

Apart from the BoC, Canadian Trade Balance for February and the US ADP Employment Change, the early signal for Friday’s US Nonfarm Payrolls (NFP), will be in focus. Furthermore, the second round of Fed Chair Jerome Powell’s testimony, this time in front of the US House of Representatives Financial Services Committee, will also be crucial to watch for clear directions.

Technical analysis

A one-month-old ascending resistance line joins the overbought RSI (14) line to challenge USD/CAD bulls around 1.3775.

- AUD/JPY is looking for a cushion around 90.20 despite less-hawkish remarks from RBA Lowe.

- The RBA may pause its aggressive rate hike cycle amid the presence of signs of inflation softening.

- Last BoJ Kuroda’s monetary policy announcement is likely to be dovish.

The AUD/JPY pair is building a firm cushion around 90.20 in the early Asian session. The risk barometer is displaying signs of exhaustion in the downside momentum. It seems that the cross is building ground for a fresh move ahead of the interest rate decision by the Bank of Japan (BoJ), which is scheduled for Friday.

Meanwhile, commentary from Reserve Bank of Australia (RBA) Governor Philip Lowe has failed to trigger any reaction from the Australian Dollar. RBA Lowe cited “The central bank is closer to pausing its aggressive cycle of rate increases as the policy is now in the restrictive territory and there are signs the economy was responding.” However, economists at ANZ Bank believe that the RBA will deliver more hikes in April and May to a peak of 4.1%.

On Tuesday, the RBA said, “Monthly Consumer Price Index (CPI) indicator is confirming a peak in Australian inflation.” The statement came after a fifth consecutive 25 basis points (bps) rate hike announcement by RBA Lowe, which pushed the Official Cash Rate (OCR) to 3.60%

Investors should be aware of the fact that Australia’s monthly CPI (Jan) dropped to 7.4% from the former release of 8.4%.

Apart from that, RBA Lowe has said “China reopening is positive for our economy,” while also adding that no particular implications for inflation from China reopening. It is worth noting that Australia is a leading trading partner of China and the upbeat Chinese economic outlook also supports the Australian Dollar.

Meanwhile, investors in Tokyo are preparing for the BoJ monetary policy meeting scheduled for Friday. This will be the last monetary policy meeting to be announced by BoJ Governor Haruhiko Kuroda and maintenance of expansionary policy is highly expected.

The street is skeptical about tweaking yield curve control (YCC) further as the majority of inflationary pressures in the Japanese economy are coming from international forces and wages and domestic demand seems incapable of keeping the inflation rate above 2%.

- WTI drops more than 4% or more than $3.00 pb on Tuesday.

- Powell opened the door for faster rate hikes and higher terminal rates.

- China’s reopening put a lid on WTI’s fall, at around the 20-day EMA at $77.21.

Western Texas Intermediate (WTI) collapsed 4% on Tuesday, following hawkish remarks by the US Federal Reserve (Fed) Chair Jerome Powell at an appearance in the US Senate. The US Dollar (USD) rose, and US Treasury bond yields, mainly 2s, reached the 5% threshold. At the time of typing, WTI is exchanging hands at $77.17 PB.

WTI dropped on Fed Powell’s remarks, though it was capped by future demand

Jerome Powell, the Federal Reserve Chair, said the Fed needs to increase rates above previous forecasts. Powell added that the US central bank would be ready to hike rates in large increments if upcoming data was solid.

The US Dollar Index (DXY), a gauge for the buck’s value vs. six currencies, advances more than 1%, at 105.597, a headwind for the US Dollar denominated commodity.

Oil prices tumbled earlier on China’s data, with Exports shrinking 6.8% YoY, lower than the previous reading. Imports were 10.2% weaker, worst than December figures at 7.5%, less than a year earlier.

However, WTI’s fall was capped by speculations of an oil shortage. According to the US Energy Information Administration (EIA), US crude production and demand will increase in 2023 as Chinese travel drives consumption.

WIT Technical levels

Federal Reserve (Fed) Chairman Jerome Powell’s hawkish surprise pushed multiple market players, including BlackRock, to inflate their Fed rate forecasts and back the “higher for longer” concerns.

“The US Federal Reserve could raise interest rates to 6% and keep them there for an extended period of time to fight inflation,” said Rick Rieder, chief investment officer of global fixed income at BlackRock, the world’s largest asset manager per Reuters.

"We think there’s a reasonable chance that the Fed will have to bring the Fed Funds rate to 6%, and then keep it there for an extended period to slow the economy and get inflation down to near 2%," adds BlackRock’s Rieder.

The news also quotes Goldman Sachs as saying in a note on Tuesday that it had raised its forecast for the so-called terminal rate by 25 basis points to a range of 5.5%-5.75%.

Elsewhere, Jeffrey Gundlach, Wall Street's bond king and Founder and Chief Executive Officer of DoubleLine Capital, also backs the hawkish Fed bias by saying, “Fed is 'very likely' to hike rates by half point this month,” per CNBC.

Also read: Forex Today: Dollar bulls welcome hawkish Powell, volatility to stay

- GBP/USD has taken a sigh of relief after a nosedive move near 1.1825, more downside looks inevitable.

- Fed Powell’s extremely hawkish remarks on interest rate guidance have spooked market sentiment.

- A breakdown of crucial support after a Double Top formation has confirmed a bearish reversal.

The GBP/USD pair has turned sideways around 1.1825 in the early Asian session after a nosedive move from the psychological resistance of 1.2000. The downside bias in the Cable looks not over yet as the currencies have to bear the volatility associated with the US Automatic Data Processing (ADP) Employment Change (Feb) after sheer volatility inspired by the commentary from Federal Reserve (Fed) chair Jerome Powell.

S&P500 futures were heavily dumped by investors as more rates from the Federal Reserve (Fed) have made the US economy prone to recession. A dismal US economic outlook sent the US Dollar Index (DXY) to a fresh three-month high at 105.65. The return delivered on 10-year US Treasury bonds is around 3.97%.

The remarks from Fed Powell in his testimony before Congress forced investors to underpin the risk aversion theme. Powell said the “ultimate level of interest rates is likely to be higher than previously anticipated,” after the “latest economic data have come in stronger than expected.”

GBP/USD has delivered a breakdown of the Double Top chart pattern formed on a daily scale plotted from December 15 high at 1.2447. A slippage below the horizontal support placed from January 06 low at 1.1841 confirms a bearish reversal.

The 50-period Exponential Moving Average (EMA) at 1.2064 is acting as a major barricade for the Pound Sterling.

Meanwhile, the Relative Strength Index (RSI) (14) has slipped below 40.00 for the first time in the past one month. More downside looks inevitable as the RSI (14) is not showing any sign of divergence and oversold.

Should the Cable break below the round-level support of 1.1800, US Dollar bulls will drag the asset further toward November 17 low at 1.17633 followed by November 14 low around 1.1700.

On the flip side, a move above February 24 high at 1.2040 will drive the asset toward February 23 high around 1.2080. A breach of the latter will expose the asset to February 21 high around 1.2140.

GBP/USD daily chart

Reserve Bank of Australia's governor, Phillip Lowe, adds some more comments while speaking at the Australian Financial Review Business Summit in Sydney early Wednesday. The policymaker said, “China reopening is positive for our economy,” while also adding that no particular implications for inflation from China reopening.

Also read: RBA’s Lowe: Closer To Pausing On Rate Hikes

Additional comments

We will have a completely open mind at board meetings.

Nuances on policy change from month to month on the data.

Recent data on balance were softer.

AUD/USD remains depressed

AUD/USD fails to react to the dovish comments as it seesaws around the four-month low, last seen marking mild losses near 0.6585 on intraday during early Wednesday.

Also read: AUD/USD stays pressured at four-month low under 0.6600 as RBA’s Lowe sounds dovish

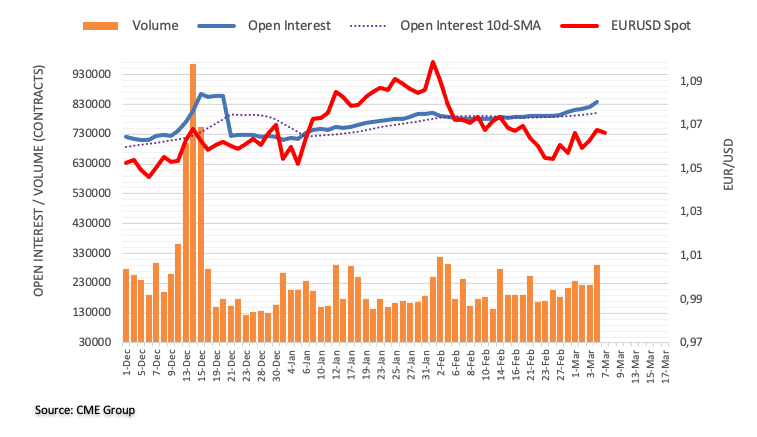

- EUR/USD bears take a breather after posting the biggest daily slump since late September 2022.

- Failure to cross a fortnight-long horizontal resistance joins bearish MACD signals to favor Euro sellers.

- Upward-sloping support line from early January 2023 appears the last defense of EUR/USD buyers.

- Bulls need validation from 200-SMA to retake control.

EUR/USD remains pressured around the lowest levels in a week, making rounds to 1.0550-45 after falling the most in nearly 3.5 months the previous day. That said, the major currency pair snapped a two-day winning streak while posting a U-turn from the 13-day-long horizontal hurdle, as well as pleasing the bears, the previous day.

Not only the quote’s U-turn from the short-term key horizontal resistance, around 1.0690-700 but the bearish MACD signals and sustained trading below the 200-SMA also keeps the EUR/USD sellers hopeful.

That said, an upward-sloping support line from early January, currently around 1.0540, appears the immediate challenge for the Euro bears to tackle.

Following that, the previous monthly low surrounding 1.0530 may act as an intermediate halt during the fall towards the January 2023 bottom of 1.0483.

In a case where EUR/USD remains bearish past 1.0483, a late December 2022 trough near 1.0445 could act as an extra downside filter.

On the flip side, a clear break of the aforementioned horizontal hurdle near 1.0690-700 becomes necessary to convince the Euro buyers.

Even so, the 200-bar Simple Moving Average (SMA), close to 1.0735 by the press time, could act as a validation point for the EUR/USD pair’s further advances.

EUR/USD: Four-hour chart

Trend: Further downside expected

- EUR/GBP climbed above 0.8900 and a one-month-old downslope trendline.

- EUR/GBP Price Analysis: Upward biased, at the brisk of cracking 0.9000.

The EUR/GBP soars past the 0.8900 psychological price level, hitting a three-week high of 0.8925. However, buyers could not lift the exchange rate towards the YTD high at 0.8978 but held to solid gains of 1.06%. At the time of writing, the EUR/GBP is trading at 0.6918.

EUR/GBP Price action

The EUR/GBP rallied on the back of fundamental news from the United States (US). The US Federal Reserve (Fed) Chair Jerome Powell commented that rates would peak higher than foreseen and added larger size hikes are back in the table.

Therefore, the EUR/GBP rallied above a one-month-old resistance trendline, which, once cleared, opened the door towards 0.8900. For a bullish continuation, the EUR/GBP must claim the February 17 high of 0.8928. Once cleared, the EUR/GBP next stop would be the YTD high at 0.8978 before testing the 0.9000 area.

As an alternate scenario, the EUR/GBP first support would be 0.8920, followed by the 0.8900 figure. Once the EUR/GBP clears that area, the cross could dive towards the 20-day EMA at 0.8854.

EUR/GBP Daily chart

EUR/GBP Technical levels

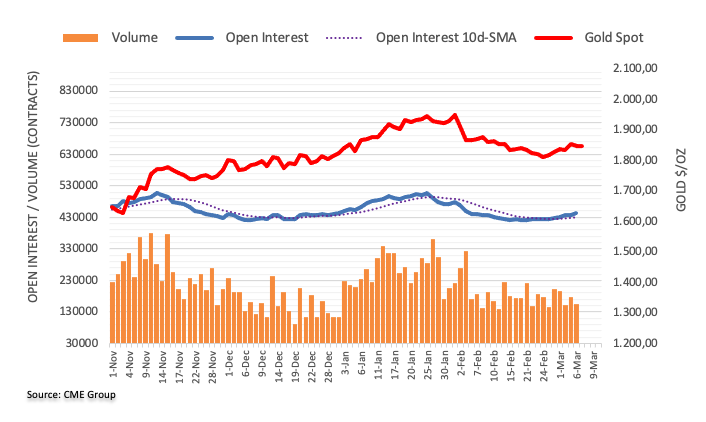

- Gold price has been dumped by investors on extremely hawkish Fed Powell’s commentary.

- S&P500 plummeted on Tuesday as more rates from the Fed confirm a United States recession.

- Gold price looks set to re-test an eight-day low at $1,804.00 amid a dismal market mood.

Gold price (XAU/USD) has witnessed an intense sell-off from the market participants as Federal Reserve (Fed) chair Jerome Powell, in his testimony before Congress, has confirmed that the central bank is prepared for more rates than previously anticipated. Considering the fact that consumer spending is resilient and the labor market is extremely tight, the Fed has no other option than to make monetary tools more restrictive.

S&P500 plummeted on Tuesday as more rates from the Fed confirm a United States recession, portraying a dismal market mood. The US Dollar Index (DXY) received exceptionally high bids as investors underpinned the risk-aversion theme. The USD Index has refreshed its three-month high at 105.65. The 10-year US Treasury yields have failed to catch the 4.0% resistance despite the extremely hawkish stance from Fed chair Jerome Powell.

This was the first commentary from Fed Powell after a less-than-anticipated decline in US Consumer Price Index and unusual solid payroll data for January. It shows that fears of persistent inflation are certain and the Fed is ready to gear up the terminal rate ahead. As per the CME FedWatch tool, the chances of 50 basis points (bps) rate hike have scaled above 70%.

For further guidance, US Automatic Data Processing (ADP) Employment Change (Feb) will remain in focus. According to the estimates, the US economy has added fresh payrolls by 200K in the labor market, higher than the former release of 106K.

Gold technical analysis

Gold price is declining towards the eight-day low support placed from February 28 low at $1,804.70. A break below the same would drag it further toward the horizontal support plotted from December 15 low at $1,773.90. The mighty 200-period Exponential Moving Average (EMA) at $1,850.88 has acted as a major barricade for the Gold bulls.

Tuesday’s sell-off in the Gold price has pushed the Relative Strength Index (RSI) (14) into the bearish range of 20.00-40.00, which indicates more weakness ahead.

Gold four-hour chart

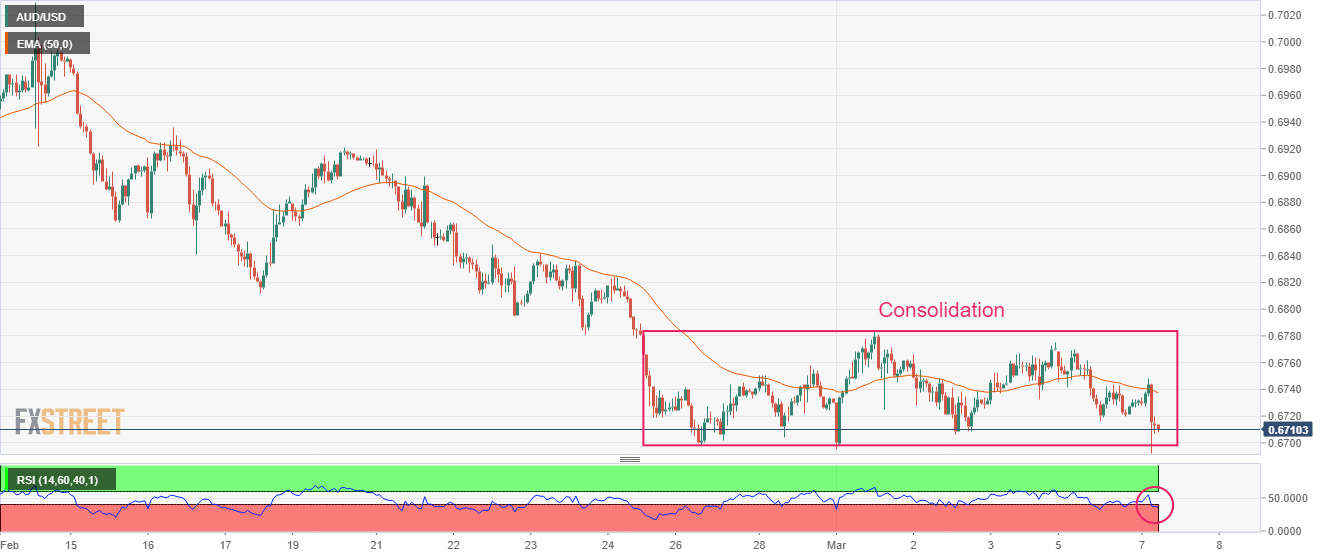

- AUD/USD licks its wounds at multi-day low after falling the most in a month.

- RBA’s Lowe hints at a pause in rate hike after the central bank signalled peak in inflation.

- Fed’s Powell appears hawkish and bolstered case for 50 bp rate hike in March.

- Challenges to sentiment from China exert more downside pressure on Aussie price.

AUD/USD holds lower grounds near 0.6585-80, the lowest levels since early November 2022, showing little reaction to Reserve Bank of Australia (RBA) Governor Philip Lowe’s dovish remarks during early Wednesday. The reason could be linked to the previous day’s RBA statement that already revealed the dovish bias of the Aussie central bank, as well as the bear’s taking of a breather after posting the biggest daily slump in a month.

RBA’s Lowe said on Wednesday that it was closer to pausing its aggressive cycle of rate increases as the policy was now in the restrictive territory and there were signs the economy was responding.

Also read: RBA’s Lowe: Closer To Pausing On Rate Hikes

On Tuesday, RBA matched market forecasts of lifting the benchmark interest rate by 25 basis points (bps) to 3.60%. The Aussie central bank even said that the RBA expects further monetary tightening will be needed. However, the RBA Statement said that the Consumer Price Index (CPI) indicator hints at the inflation peak and seemed to have weighed on the AUD/USD prices upon the announcements.

More importantly, hawkish comments from Federal Reserve (Fed) Chairman Jerome Powell in his Semi-Annual Testimony to the US Congress propelled the market’s risk-off mood, as well as the bets of a 50 bp Fed rate hike in March, which in turn drowned the AUD/USD prices.

It’s worth noting that the fresh US-China tensions are an extra burden for the risk-barometer pair helping in weighing on the price at the multi-day low. The anticipated meeting of the US and Taiwanese Officials could be cited as the key reason for the same. On the same line, China’s new Foreign Minister, Qin Gang, said that they resolutely oppose all forms of hegemony, cold war mentality. The same indirectly criticizes the US pressure and criticism for the China-Russia ties and escalated the fears of a fresh round of Sino-American tensions. Further, Financial Times (FT) headlines suggesting China’s lowest growth target in decades signals a new era of caution.

Amid these plays, Wall Street closed in the red and the US Treasury bond yields were firmer to underpin the US Dollar’s safe-haven demand, which in turn pleased the AUD/USD bears.

Looking ahead, the round of Fed Chair Jerome Powell and the US ADP Employment Change, the early signal for Friday’s US Nonfarm Payrolls (NFP) will be in focus. Also important to watch will be the risk catalysts surrounding China and the movements of the bond market.

Technical analysis

A clear downside break of a one-month-old descending support line, now immediate resistance around 0.6625, directs AUD/USD towards the October 2022 peak surrounding 0.6545.

RBA’s Lowe: Closer To Pausing On Rate Hikes

Morew to come..

- USD/JPY bulls eye a break of the 200 DMA on the back of firm US Dollar prospects.

- A break of the 200 DMA opens risk of a significant run higher.

USD/JPY is bid with The DXY index, a measure of the US Dollar vs. a basket of currencies including the Yen, vaulting 105 the figure in a move that started out from 104.43 and kept going until 105.435.

, Federal Reserve's chair Jerome Powell said that the US central bank will stay the course until the job is done. However, Fed's Powell added that the ultimate level of interest rates is likely to be higher than previously anticipated. Federal Reserve's chairman Jerome Powell also said that the Fed is prepared to increase the pace of rate hikes if data indicates it is warranted:

"The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated. If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes."

This has left a bullish bias on the charts as follows:

USD/JPY H1 chart

After a series of failed breakouts, both ways, the bulls are breaking out of the upside channel resistance as a fresh wave of longs enters the market, Day 1 or D1 longs.

Bulls eye the 200 DMA as shown as a line on the hourly graph above. A break of there, neat 137.50 opens the risk of a significant recovery higher as follows:

USD/JPY daily chart

- NZD/USD dropped 85 pips of 1.38% in Tuesday’s session on hawkish comments by Fed officials.

- The US Federal Reserve Chair Jerome Powell commented that higher rates are needed and opened the door for aggressive tightening.

- NZD/USD Price Analysis: A break below 0.6100 will pave the way toward 0.6000.

NZD/USD plummets as the New York session wanes following the US Federal Reserve Chairman Jerome Powell’s testimony at the US Senate. Powell rattled equity markets as it shifted toward a hawkish stance and turned sentiment sour. Therefore, the NZD/USD is dropping 1.29% and exchanges hands at 0.6114.

NZD weakens on an aggressive Fed that bolstered the USD

Wall Street closed with losses following Powell’s speech. The US Fed Chair commented that the US central bank would increase rates at larger sizes if needed. Powell added, “The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated.”

The US economy showed improvement in January, as wholesale trade rose by 1.0% MoM, beating forecasts. Stock levels dropped 0.4%, matching what the market expected.

Money market futures are beginning to reprice an aggressive Fed, as shown by the CME FedWatch Tool, with odds that the Fed would hike 50 bps at 70.5% at the upcoming meeting. Consequently, the US Dollar Index (DXY) hit a fresh nine-week high at 105.654, gaining more than 1%. The US 10-year bond yields pierced the 4% threshold before retreating to 3.972%.

The NZD/USD tumbled to new YTD lows of 0.6103, and levels last reached on November 21, 2022. The NZD/USD collapsed from around 0.6190s toward the day’s low when Powell’s headlines crossed news screens.

On the New Zealand (NZ) front, the kiwi was slightly bolstered by the Reserve Bank of Australia’s (RBA) 25 bps interest rate increase, which was perceived as a “dovish” hike. Data-wise, the latest Global Dairy Trade (GDT) in the NZ docket showed that most dairy products cooled down, except for whole milk powder. The GDT Price Index fell 0.7%, shrugging off analysts’ expectations of higher prices.

NZD/USD Technical analysis

The NZD/USD daily chart portrays the pair as bearish-biased, further cemented by oscillators with negative readings. A death cross is confirmed, with the 50-day Exponential Moving Average (EMA) crossing below the 200-day EMA, which would warrant further downside in the NZD/USD.

Once the NZD/USD tumbles below 0.6100, that would exacerbate a fall toward the November 17 low at 0.6064. A breach of the latter would clear the path towards 0.6000.

What to watch?

- USD/CHF bulls still in play but there are prospects of a meanwhile correction.

- Bears eye the 61.8% Fibonacci target to the downside.

The US Dollar smashed a three-month month high against a basket of currencies on Tuesday due to the uber-hawkish rhetoric from Federal Reserve Chair Jerome Powell.

Powell explained that the US central bank is likely to raise rates more than previously expected and warned that the process of getting inflation back to 2% has "a long way to go."

This has seen USD/CHF fly and test a key resistance area ahead of channel resistance as follows:

USD/CHF daily chart

There is plenty of upward momentum in this daily channel with 0.9450 eyed ahead of 0.9500.

USD/CHF H4 chart

At this juncture, we have prospects of a correction but it may take some doing to really impact the demand that we have seen on the Fed's revived hawkish rhetoric.

USD/CHF H1 chart

The bulls are still in play as we can see on the lower time frame and the bears will need to get onto the backside of the micro bullish trendline with 0.9400 as a key support ad structure point. The above chart offers a bearish scenario and price flow that could occur on a break of such structure with the 61.8 Fibonacci target level eye near 0.9340.

Here is what you need to know on Wednesday, March 8:

In a hearing before the US Senate, Federal Reserve (Fed) Chair Jerome Powell spoke about the possibility of largest interest rate hikes given the latest round of US economic data have come in stronger than expected and warned that inflationary pressures are higher than anticipated. His comments increased expectations of a 50 basis points rate hike at the March meeting. Wall Street tumbled and the US Dollar jumped.

The US Dollar heads into the Asian session still with impulse, despite overbought readings. It appears to be looking for a new equilibrium, but the rally is exposed to the incoming US data, which includes the ADP private sector employment report on Wednesday and Nonfarm payrolls on Friday. Those events could add volatility across financial markets. Powell will testify again before the US Congress. Will he attempt to cool down Tuesday’s message?

Powell’s remarks hit market sentiment. Major US indexes dropped around 1.50%, the VIX soared by more than 4%. The US 2-year Treasury yield rose above 5% for the first time since 2007. Crude oil prices tumbled by nearly 4%. Cryptocurrencies fell moderately, with Bitcoin holding near $22,000.

EUR/USD is testing 1.0550 after trading near 1.0700 a day ago, while GBP/USD fell to the lowest level in almost four months at 1.1830. The pound was also affected by the deterioration in market sentiment. EUR/GBP rose to weekly highs above 0.8900.

USD/CAD broke above the crucial 1.3700 area. On Wednesday, the Bank of Canada will have its monetary policy meeting, with rates expected to remain unchanged.

The Australian Dollar was among the worst performers after the Reserve Bank of Australia (RBA) meeting. The RBA raised rates by 25 bps as expected but said inflation may have peaked. RBA Governor Philip Lowe will speak on Wednesday, with analysts looking for fresh guidance. AUD/USD broke below 0.6700, extending losses below 0.6600. The pair is under pressure after the soft message from the RBA and the Dollar’s rally.

USD/JPY jumped and is trading above around 137.00 and near the 200-day Simple Moving Average (SMA). Despite falling versus the Greenback, the Japanese Yen performed well against other currencies, supported by risk aversion. On Thursday, Bank of Japan Governor Haruhiko Kuroda will preside his last monetary policy meeting.

Like this article? Help us with some feedback by answering this survey:

- EUR/USD has been falling throughout the day on the back of an uber-hawkish Fed.

- Fed's Powell testified to Congress and the US Dollar took-off.

EUR/USD keeps falling as we move into late US trade in what has been a maximum drop in the single currency following uber-hawkish rhetoric from the Federal Reserve's chairman on Tuesday who testified to Congress.

The main words that got the US Dollar going coming from the Fed's chair Powell were, "the latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated. If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes."

As a consequence, the yield on the US 10-year Treasury note rose to 4% before easing back to 3.96%, remaining marginally below the three-month high of 4.07% touched on March 2nd as investors assessed the pace of future rate hikes by the Federal Reserve. This gave the greenback a boost. The DXY index, a measure of the US Dollar vs. a basket of currencies, vaulted 105 the figure in a move that started out from 104.43 and kept going until 105.435.

Meanwhile, the Euro is likely to be hamstrung as Germany may still suffer a technical recession in Q4 2022/Q1 2023. However, analysts at Rabobank argued that ''at least more recent data are indicating resilience in the economy.'' On the other hand, the analysts also said, ‘resilient’ is not ‘strong’ and ''the market is facing these data releases with longer EUR positions than at the end of last year. This suggests that the hawkish rhetoric of the ECB may struggle to coax the EUR significantly higher particularly given the recent buoyancy of the greenback.''

Of note, inflation remains stubbornly high in the Euro Area which was evident from the February inflation numbers. Officials, such as ECB's Pierre Wunsch indicated that it was not unreasonable to expect ECB to hike to 4%. ECB policymaker Klaas Knot said on Tuesday that the ECB can be expected to keep raising interest rates for “quite some time” after March. Knot said that the current pace of hikes could continue into May if underlying inflation does not materially abate. “Once we see a clear, decisive turn in underlying inflation dynamics, I expect the ECB to move to smaller steps.”

Knot also argued that inflation appears to have peaked. The sharp decrease in energy prices seen over the last months could bring down headline inflation even faster than what the ECB is projecting, the policymaker added. He does not see a recession in the winter and pointed out that the slowdown in economic growth seems “even more shallow, short-lived than expected”.

Swiss National Bank (SNB) Chairman Thomas Jordan is crossing the wires on Tuesday and stated the inflation in Switzerland is low in international comparison but above the price stability target of the SNB. On Monday, data showed the Consumer Price Index reached in February 3.4% YoY and the core CPI at 2.4% YoY. He explained that the appreciation of the Swiss Franc has protected them from imported inflation.

The monetary policy conducted by the SNB is still “too loose”, according to Jordan. They do not rule out more tightening.

“We are ready to sell currencies”, said the SBN Chairman. He explained that they can use interest rates and also currency intervention to get the right monetary conditions in order to achieve price stability.

Market reaction

The Swiss Franc appreciated modestly with Jordan’s comments. The USD/CHF moved off highs and trimmed losses during the last hour. The pair peaked at 0.9417 boosted by a rally of the US Dollar following Fed Chair Powell’s testimony and recently pulled back under 0.9400. EUR/CHF turned negative and fell to test daily lows around 0.9920/25.

- Silver, XAG/USD is under pressure as US Dollar rallies.

- Federal Reserve Powell strikes an uber-hawkish tone to Congress.

Silver has dropped like the heavyweight that it is, breaking through a couple of layers of key support following uber rhetoric from the Federal Reserve's chairman, Jerome Powell on Tuesday. At the time of writing, Silver, or XAG/USD, is down some 4.26% after falling from a high of $21.1412 to a low of $20.0853.

In remarks to Congress, Federal Reserve's chair Jerome Powell said that the US central bank will stay the course until the job is done. He also said that the ultimate level of interest rates is likely to be higher than previously anticipated, adding that the Fed is and will be prepared to increase the pace of rate hikes if data indicates it is warranted:

"The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated. If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes."

Meanwhile, Fed funds futures traders have now raised bets that the Fed will hike rates by 50 basis points at its March 21-22 meeting to 56% and a 25 basis points increase is now seen as just a 44% likelihood. Traders are now also pricing for the rate to peak at 5.57% in September and the US Dollar is firmly bid as result.

As a consequence, the DXY index, a measure of the US Dollar vs. a basket of currencies, vaulted 105 the figure in a move that started out from 104.43 and kept going until 105.435. The yield on the US 10-year Treasury note rose to 4% before easing back to 3.96%, remaining marginally below the three-month high of 4.07% touched on March 2nd as investors assessed the pace of future rate hikes by the Federal Reserve.

- USD/CAD climbs past the 1.3700 figure on Powell’s hawkish stance,

- USD/CAD Price Analysis: Buyers are eyeing 1.3800 after trading at 4-month highs.

The USD/CAD rallied to fresh YTD highs at 1.3743 on the US Federal Reserve’s (Fed) Chair Jerome Powell’s comments. Powell added that inflation is high and the Fed could tighten monetary conditions faster depending on the incoming data. Therefore, the USD/CAD jumped from around 1.3670. A the time of writing, the USD/CAD exchanges hands at 1.3744.

USD/CAD Price action

The USD/CAD has extended its gains past the 130 pips in the day, with bulls eyeing to test the November 3 high, which confluences with an upslope trendline that passes around 1.3808. If the USD/CAD pierces the latter, that wound put into play a test of 2022 high at 1.3977. But first, buyers need to reclaim 1.3900, followed by the latter and the psychological 1.4000 mark.

In an alternate scenario, the USD/CAD first support would be the 1.3700 figure for a bearish continuation, followed by the prior’s YTD high at 1.3685. Once cleared, the USD/CAD next support would be March 3, daily low at 1.3550.

It should be noted that the Relative Strength Index (RSI) in bullish territory suggests that bulls are in charge, further cemented by the Rate of Change (RoC) aiming higher.

USD/CAD Daily chart

USD/CAD Technical levels

European Central Bank (ECB) policymaker Klaas Knot said on Tuesday that the ECB can be expected to keep raising interest rates for “quite some time” after March. According to him, the current pace of hikes could continue into May if underlying inflation does not materially abate. “Once we see a clear, decisive turn in underlying inflation dynamics, I expect the ECB to move to smaller steps.”

Knot mentioned that inflation appears to have peaked. The sharp decrease in energy prices seen over the last months could bring down headline inflation even faster than what the ECB is projecting, the policymaker added. He does not see a recession in the winter and pointed out that the slowdown in economic growth seems “even more shallow, short-lived than expected”.

Market reaction

Trades have all their attention on the effects of Fed Chair Powell’s remarks. The EUR/USD is sharply lower trading at 1.0565, while EUR/GBP is at two-week highs above 0.8900.

- AUD/USD bears move in due to the divergence between the Reserve Bank of Australia and the Federal Reserve.

- Federal Reserve's chairman Jerome Powell strikes an uber-hawkish tone in his testimony to Congress.

- The Reserve Bank of Australia has toned down its rhetoric, leaning more dovish

Risk assets are under immense pressure on Tuesday which is weighing on the high beta currencies such as the Australian Dollar. AUD is down a whopping 2% on the day after dropping like a stone from 0.6661 US session highs to a low of 0.6591 thus far vs. the US Dollar, the lowest since Nov. 22. AUD/USD's high for the day, however, was up at 0.6747 before markets started to position for possible hawkish rhetoric from Federal Reserve Chair Jerome Powell's testimony to Congress in US trade.

Hawkish rhetoric was what the market's got and stubborn investors holding their bets against the US Dollar were taken to the cleaners. The DXY index, a measure of the US Dollar vs. a basket of currencies, vaulted 105 the figure in a move that started out from 104.43 and kept going until 105.435. The trigger?

Reserve Bank of Australia and Federal Reserve divergence

In recent trade, Federal Reserve's chair Jerome Powell said that the US central bank will stay the course until the job is done. However, Fed's Powell added that the ultimate level of interest rates is likely to be higher than previously anticipated. Federal Reserve's chairman Jerome Powell also said that the Fed is prepared to increase the pace of rate hikes if data indicates it is warranted:

"The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated. If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes."

Federal Reserve's chairman Jerome Powell's comments come after the bank slowed the pace of its tightening to 25 basis points at its last two meetings, following larger hikes last year. Fed funds futures traders have now raised bets that the Fed will hike rates by 50 basis points at its March 21-22 meeting to 56% and a 25 basis points increase is now seen as just a 44% likelihood. Traders are now also pricing for the rate to peak at 5.57% in September and the US Dollar is firmly bid as result.

Meanwhile, prior to Federal Reserve's chairman Jerome Powell's hawkish testimony, the Reserve Bank of Australia, RBA, had already sawn the seed for a disparity between the Aussie and US Dollar. AUD was the weakest G10-performing currency due to what was perceived as a move towards a more dovish stance from the RBA at Tuesday's interest rate meeting.

The Reserve Bank of Australia's policy-makers hiked interest rates by 25 bps. This was the 10th consecutive tightening but there was a switch up in the language which motivated the market to position for the possibility of a lower peak in rates which in turn weighed on AUD. The RBA has put down the foundations for a forthcoming pause in policy moves.

''In our view, the Fed is set to stick with its hawkish guidance for now suggesting that AUD/USD could remain on the back foot into the middle of the year,'' analysts at Rabobank said.

''That said, on a relative basis, the Australian economy remains fairly well positioned in terms of growth and we expect AUD/USD to pick up some ground in the latter part of the year,'' the analysts argued, adding that this forecast assumes that Fed rates have peaked by then.

AUD/USD technical analysis

In prior AUD/USD analysis, it was explained that the downside scenario in a break of AUD/USD support opened risk to a test of the 0.6580s and then the 0.6520s:

AUD/USD update

AD/USD was coiled below the 200 DMA and on the break of support near 0.6700, the bears moved in and ground into 0.6650 orders that made way for a strong impulse down into the 0.6590s that guards the 0.6580s.

From here, we may see a correction in AUD/USD into the shorts before further downside:

AUD/USD H4 & H1 charts

- GBP/USD nosedived more than 150 pips and fell from 1.2000 to 1.1840s.

- Hawkish commentary by the US Federal Reserve Chair Jerome Powell at the Senate keeps investors assessing a 50 bps hike in March.

- GBP/USD Price Analysis: A breach of the YTD low at 1.1841 could drag the pair towards the 1.1800 figure.

GBP/USD plunges over 100 pips as the US Federal Reserve (Fed) Chairman Jerome Powell testifies at the US Senate on Tuesday. The US Dollar is rising despite US Treasury bond yields dropping. At the time of writing, the GBP/USD is trading at 1.1854 after hitting a daily high of 1.2065.

Powell's appearance at the US Senate rocked the boat and bolstered the US Dollar

In prepared remarks for his appearance at the US Senate, the Federal Reserve Chair Jerome Powell commented that the Fed is ready to increase the speed of rate hikes. Powell added, “The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated.”

The US Dollar Index (DXY), a gauge of the buck’s value against its peers, hit a fresh nine-week high at 105.435 before retracing to current levels of 105.421, up 0.86% in the day. US Treasury bond yields, namely the 10-year yield, pierced the 4% threshold before resting at 3.968%.

The GBP/USD dived from around 1.2000 toward the daily low of 1.1848 as Powell’s Q&A with US Senators ended. However, the GBP/USD meanders around 1.1860s.

The swaps market indicated that bond traders adjusted their expectations for interest rates and now think that a more significant increase of half a point is more probable than a smaller one of a quarter point for the Fed’s meeting on March 22.

On the UK front, Catherine Mann, a monetary policy member of the Bank of England (BoE), commented that the Pound Sterling (GBP) could face downward pressure if traders had not priced in hawkish comments by the Federal Reserve. She said in an interview that the weakness in the value of the GBP was “significant for inflation,” which has fallen from 11.1 in October though it remained above 10% in January.

GBP/USD Technical analysis

Following Powell’s remarks, the GBP/USD distanced from the daily Exponential Moving Averages (EMAs) as bears moved in aggressively, dragging the major nearby the YTD low of 1.1841. Additionally, the Relative Strength Index (RSI) remains in bearish territory, while volatility increased as portrayed by the Rate of Change (RoC).

Therefore, the GBP/USD path of least resistance is downwards, and its first support would be the YTD low at 1.1841. Break below, and the 1.1800 figure would be tested before diving to the October 27 daily high-turned-support at 1.1645.

What to watch?

FOMC Chairman Jerome Powell testifies on the Semi-annual Monetary Policy Report before the US Senate Banking Committee.

Key quotes

"Hard to make case we have overtightened."

"We need to continue to tighten, we are very mindful of lags."

"We don't think we need a significant increase in the unemployment rate."

"But will need softening in labor market to get to 2%."

"Social costs of failure are very, very high."

"If inflation were to continue that would become the psychology."

"If we fail, it would mean an up and down economy."

"Capital allocation is also difficult in that type of world."

Market reaction

The US Dollar Index continues to push higher and was last seen rising 1.05% on the day at 105.38.

FOMC Chairman Jerome Powell testifies on the Semi-annual Monetary Policy Report before the US Senate Banking Committee.

Key quotes

"We don't think we need to see a sharp rise in unemployment to get inflation under control."

"We are not targeting a higher unemployment rate."

"4.5% unemployment rate is still well better than most times historically."

"No obvious candidate that could replace dollar as world's reserve currency."

"Size of corporate profits can affect the inflation rate."

"Without large increase in productivity you would not be able to sustain high wage inflation over the longer term but could in short term."

"Some softening in labor market will need to happen to get inflation under control."

"Overall data on labor market shows it is extremely tight and contributing to inflation."

"What we are seeing in economy is mostly about supply chain problems and blockages."

"When that gets fixed, corporate profit margins will come down."

Market reaction

The US Dollar's bullish rally remains intact with the US Dollar Index rising more than 1% on the day at 105.40 following these comments.

FOMC Chairman Jerome Powell testifies on the Semi-annual Monetary Policy Report before the US Senate Banking Committee.

Key quotes

"Nothing about data suggests we've tightened too much; rather suggests we have more work to do."

"Data so far suggests we'll have a higher terminal rate in our next Summary of Economic Projections."

"Inflation is extremely high and hurting working people of this country badly."

"We are taking only measures we have to bring inflation down."

"Working people will not be better off if we don't get inflation down."

Market reaction

The US Dollar rally continues during Powell's testimony with the US Dollar Index rising nearly 1% on the day at 105.30.

FOMC Chairman Jerome Powell testifies on the Semi-annual Monetary Policy Report before the US Senate Banking Committee.

Key quotes

"Not big spike in business debt generally."

"However, there are pockets of concern including upcoming refinancing."

"We are watching that carefully."

"In terms of commercial real estate, occupancy of office space is remarkably low."

"Over time that space will be changed into condos."

"Most big banks though don't have a lot of exposure to commercial real estate."

"We carefully monitor small and medium size banks' exposure to commercial real estate."

"Fed is very strongly committed to tailoring regulations for banks."

Market reaction

The US Dollar Index clings to impressive daily gains during Powell's testimony and was last seen rising 0.9% on the day at 105.22.

- USD/MXN is aiming aggressively higher on Fed Chair Powell’s comments.

- Federal Reserve Chair Jerome Powell added that the pace of rate hikes could increase based on incoming data.

- USD/MXN Price Analysis: Begins to approach the 20-day EMA at 18.3533.

The Mexican Peso (MXN) weakened sharply on hawkish remarks by the US Federal Reserve (Fed) Chair Jerome Powell has opened the door for a “faster pace” of rate hikes, which strengthened the US Dollar (USD). Therefore, the USD/MXN is surging more than 0.97%, climbing from daily lows of 17.9664. At the time of writing, the USD/MXN pair is trading at 18.1432, volatile, in the North American session.

USD/MXN surges more than 1500 pips or 0.94% on Fed hawkish comments

In an appearance at the United States (US) Congress, Fed Chair Jerome Powell commented that the Fed will have to increase rates more and faster. He also said, “The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated.”

Powell stated that even though inflation is moderating, “the process of getting inflation back down to 2% has a long way to go and is likely to be bumpy.” On its Q&A with US Senators, Chair Powell commented that core inflation has not come down as fast as hoped and emphasized that it has “a long way to go.”

The US Dollar Index (DXY), which tracks the greenback’s value against a basket of six currencies, is climbing 0.70%, up at 105.023. At the same time, the US 10-year Treasury bond yield reached a high of 4.005% before retreating to current levels at 3.960%.

The docket featured consumer confidence on the Mexican front, which improved from 44.3 to 44.8 in February. The same report highlighted that the financial situation for households has deteriorated to 56.1, while consumers commented that they are more likely to make large purchases.

USD/MXN Technical analysis

As of writing, the USD/MXN is forming a morning star candle pattern, further cementing the case that the USD/MXN could have bottomed around the $17.90 area. The USD/MXN has jumped to fresh three-day highs above March’s 3 high of 18.1208 while the Fed Chair Powells Q&A is underway.

Although in bearish territory, the Relative Strength Index (RSI) is surging toward the 50-mid line, showing that buying pressure is increasing. In addition, the Rate of Change (RoC), from being negative, shifted gears and portrays that bulls are gathering momentum, so further upside in the near term is warranted.

The USD/MXN first resistance would be the MTD high at 18.3296. A breach of the latter will expose the 20-day Exponential Moving Average (EMA) at 18.3556, followed by 18.5000, which, once cleared, would pave the way toward the 100-day EMA At 18.6975.

USD/MXN Technical Levels

Economists at TD Securities discuss the Bank of Canada (BoC) interest rate decision and their implications for the USD/CAD pair.

Hawkish (10%)

“Bank lifts overnight rate to 4.75%, abandoning its conditional pause. Statement notes that overheated labour market has introduced upside risks to its outlook, and that pace of job growth has cleared the high bar for additional tightening. New guidance does not rule out further hikes. USD/CAD -0.80%”

Less Hawkish (10%)

“Bank leaves overnight rate unchanged at 4.50%, with outlook evolving in line with January MPR. Statement notes flat print on Q4 GDP, but economy remains in excess demand. Bank also notes that surging labour market has lowered bar to resume tightening, and shifts its guidance from a conditional pause to a more balanced data-dependent stance. USD/CAD -0.20%”

Base-Case (80%)

“Bank leaves the overnight rate unchanged at 4.50%, with a short policy statement that echos its message from January. Bank cites flat print on Q4 GDP as evidence that higher rates are working to slow demand. Bank also notes that inflation outlook has evolved in line with MPR, with only a cursory mention of labour market strength. Minor tweaks to forward guidance to amplify conditional nature of pause. USD/CAD +0.10%”

- Powell says the Fed is prepared to increase the pace of rate hikes if needed.

- US Dollar jumps amid growing expectations of a larger rate hike from the Fed.

- XAU/USD to remain under pressure while under $1,820/oz.

Gold price accelerated to the downside following the release of Fed Chair Powell's remarks. XAU/USD bottomed at $1,815, the lowest level in a week. It is falling almost $30 on Tuesday, the worst day in a month.

US Dollar jumps on Powell

Federal Reserve Chairman Jerome Powell mentioned in prepared remarks that strong economic data will likely lead to higher interest rates than previously thought, in order to curb inflation.

The speech was seen as hawkish by market participants. The odds of a 50 basis points rate hike jumped. According to interest-rate futures tracked by CME Group, market-implied probabilities of a 50 bps increase at the March FOMC meeting rose from nearly 30% to 50%.

Jerome Powell Live: Fed Chair delivers hawkish testimony in US Senate

US Treasury bonds collapsed. The US 10-year yield rose from nearly 3.94% to above 4% and then pulled back; the 2-year yield hit at 4.97%, the highest level since 2008.

Gold prices extended the decline even as US yields moved off lows, affected by a stronger US Dollar and risk aversion. Silver is losing 4%, trading at $20.19, the lowest level in four months.

Technical levels

FOMC Chairman Jerome Powell testifies on the Semi-annual Monetary Policy Report before the US Senate Banking Committee.

Key quotes

"We are seeing goods inflation coming down for some time now."

"Housing services inflation coming down is in the pipeline for the next 6–12 months."

"But core services ex-housing is where the challenge is now."

"We can't impact that sector without affecting others."

"Our tools are powerful but blunt."

"Wages have been moderating without softening in labor market."

"We have many unusual factors affecting inflation and we don't think anyone knows how this is going to play out."

Market reaction

The US Dollar Index retreated slightly following the initial upsurge but holds comfortably in positive territory. As of writing, the pair was up 0.77% on the day at 105.10.

FOMC Chairman Jerome Powell testifies on the Semi-annual Monetary Policy Report before the US Senate Banking Committee.

Key quotes

"Congress needs to raise the debt ceiling."

"Failing to do so, the consequences could be extraordinarily adverse and do longstanding harm."

"Fed will do what it can to restore price stability while preserving maximum employment."

"Fed is not in conflict right now on its dual mandate."

"There could be a time when our mandates are in conflict."

"We are very far from price stability mandate."

"We are not trying to raise the unemployment rate."

"We are trying to realign supply and demand through a bunch of channels including job openings."

"We are trying to create disinflation."

Market reaction

The US Dollar Index retreated slightly following the initial upsurge but holds comfortably in positive territory. As of writing, the pair was up 0.77% on the day at 105.10.

FOMC Chairman Jerome Powell testifies on the Semi-annual Monetary Policy Report before the US Senate Banking Committee.

Key quotes

"There is mismatch between supply and demand; we still see that in the goods sector, you also see it in the labor market."

"We will keep capital requirements strong."

"We have the tools to get inflation down over time."

"We will achieve 2% inflation goal."

"Core inflation has not come down as fast as we hoped, has a long way to go."

Market reaction

The US Dollar Index clings to strong daily gains at around 105.00 following these comments.

Last week, Gold gained 2.5% to reach $1,855. This week, Gold’s direction is likely to be determined by today’s testimony by Fed Chair Powell and the US labour market data on Friday, strategists at Commerzbank report.

Interest rates are expected to peak at 5.5%

“According to the Fed Fund Futures, interest rates are expected to peak at 5.5%. Powell would have to adopt a very hawkish tone and labour market data would have to surprise significantly to the upside again for expectations to be ramped up any higher. In this scenario, Gold would come under pressure again – but otherwise, it looks as if it has completed its correction.”

“Interest rate expectations would need to fall again for prices to rise, yet neither Powell nor the labour market data are likely to send out any such signals.”

The Mexican Peso continues to power ahead. Economists at ING expect the USD/MXN to continue its move downward.

Nearshoring in action

“Late February saw Tesla announce that its next gigafactory would be built in Mexico, potentially delivering $5bn of Foreign Direct Investment (FDI). Typically, Mexico sees $30-32bn of FDI inflow per year, so the Tesla news is a big deal. The welcome FDI news comes on top of the MXN providing one of the highest risk-adjusted yields in the world, backed by a local central bank, Banxico, matching the Federal Reserve hike-for-hike.”

“It will probably take either a financial crisis in core markets or Banxico refusing to hike any further to reverse MXN strength.”

“USD/MXN – 1M 18.20 3M 18.10 6M 18.00 12M 17.75”

- Fed Powell: Ready to increase pace of rate hikes if incoming data suggests faster tightening is warranted.

- Markets see hawkish bias in Powell’s remarks, US Dollar soars.

- EUR/USD tumbles more than 50 pips.

The EUR/USD lost more than 50 pips after the release of Fed Chair Powell's remarks. The pair is trading under 1.0600, under pressure as the US Dollar soars across the board.

Fed Chair Jerome Powell said in his prepared remarks that the central bank is ready to increase the pace of rate hikes. He added that the strength of the economy suggests that the terminal rate will be higher than previously anticipated. "Long way to go on getting inflation back down, road likely to be bumpy”.

Powell is testifying on Tuesday in the US Congress in front of the Senate Committee on Banking, Housing and Urban Affairs. He is presenting the “The Semi-Annual Monetary Policy Report to Congress” and will take questions from lawmakers. On Wednesday, he will be back to testify in front of the House of Representatives Committee on Financial Services.

Jerome Powell Speech Live: All about Fed Chair US Senate testimony

Immediately after the release, the US Dollar jumped across the board and US yields rocketed. The US 10-year yield rose from 3.92% reaching levels above 4%, while the 2-year hit 4.97%, the highest since 2007.

EUR/USD dropped from near 1.0650 to as low as 1.0585, the lowest level since Friday. The next support is seen at 1.0560/65 and below attention would turn to February lows around 1.0530. A recovery above 1.0640 would alleviate the bearish pressure.

Volatility is set to remain elevated over the next minutes, with markets digesting Powell’s initial remarks and later, taking questions from lawmakers.

Technical levels

- USD/JPY rallies sharply on hawkish remarks of Federal Reserve Chair Powell.

- Powell: “the ultimate level of interest rates is likely to be higher than previously anticipated.”

- USD/JPY Price Analysis: The pair is neutral upwards, but it could reach 137.00 in the near term.

The USD/JPY climbs 0.63% on Tuesday as the US Federal Reserve (Fed) Chair Jerome Powell’s testimony began at the United States (US) Congress. Sentiment shifted sour after US equities opened in the green. Nevertheless, as Powell took the stand, he rocked the boar. At the time of writing, the USD/JPY is exchanging hands at 136.87.

USD/JPY aims toward 136.90s on Powell’s hawkish speech

In a speech prepared by the Federal Reserve Chair Powell, he said that the Fed would need to raise rates more than expected and that the pace of rate hikes could increase. He added, “The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated.”

Powell reiterated that even though inflation is moderating, “the process of getting inflation back down to 2% has a long way to go and is likely to be bumpy.”

The US Dollar Index (DXY), a measure of the buck’s value against a basket of peers, is rallying 0.84%, up at 105.161. At the same time, the US 10-year Treasury bond yield recovered its lost ground and is back above the 4% threshold, a headwind for the USD/JPY.

Once Powell’s speech crossed the screens, the USD/JPY jumped towards daily highs at 136.90 after meandering around 136.20.

On the Japanese front, in its final policy meeting with Governor Haruhiko Kuroda this week, Japan’s central bank will maintain its very loose monetary stance. Tuesday’s data showed that real wages in Japan fell the most in nine years in January amidst four-decade-high inflation squeezing Japanese purchasing power.

Also read: Powell speech: Prepared to increase pace of rate hikes

USD/JPY Technical analysis

From a daily chart perspective, the USD/JPY remains neutral to upward biased. A decisive break above the YTD high at 137.10 would provide the USD/JPY fresh impetus towards the December 20 high of 137.48. Once cleared, the USD/JPY would rally toward the December 15 high of 138.15, followed by the 139.00 figure. On the flip side, if the USD/JPY turns bearish, the major could fall as low as March’s 6 low of 135.36 before testing the 135.00 threshold.

USD/JPY Technical levels

Below are the key takeaways from FOMC Chairman Jerome Powell's prepared statement for delivery at the Semi-annual Monetary Policy Report testimony before the US Senate Banking Committee.

Key quotes

"If totality of incoming data indicates faster tightening is warranted, we are prepared to increase pace of rate hikes."

"Ultimate level of interest rates likely to be higher than previously anticipated."

"Will continue to make our decisions meeting by meeting, based on totality of incoming data and implications for outlook for growth and inflation."

"Some of strength in overall January data likely reflects unseasonably warm weather."

"Little sign of disinflation so far in core services excluding housing."

"To get inflation back down to 2% need lower inflation in core services ex housing and very likely some softening in labor market."

"Ongoing increases in policy rate likely appropriate in order for stance to be sufficiently restrictive to get inflation back to 2% over time."

"Long way to go on getting inflation back down, road likely to be bumpy."

"We still stay the course until job is done."

Market reaction

The US Dollar Index shot higher with the initial reaction and was last seen rising 0.6% on the day at 104.92.

The AUD is the weakest G10 performing currency following what was perceived as a shift in tone from the RBA at today’s meeting. Economists at Rabobank expect the AUD/USD pair to remain under pressure near term but the Aussie is set to pick up some ground in the latter part of the year.

Change in tone

“As expected, policy-makers hiked interest rates by 25 bps. However, a change in language in the RBA’s statement meant that the market now sees the possibility of a lower peak in rates and the potential for a forthcoming pause in policy moves.”

“In our view, the Fed is set to stick with its hawkish guidance for now suggesting that AUD/USD could remain on the back foot into the middle of the year. That said, on a relative basis, the Australian economy remains fairly well positioned in terms of growth and we expect AUD/USD to pick up some ground in the latter part of the year. This forecast assumes that Fed rates have peaked by then.”

“We have adjusted our AUD/USD modestly lower and see risk of dips to 0.66 on a one to three-month view.”

“Our forecast of a move back to 0.70 at the end of the year assumes Fed funds will peak at 5.5% this year in line with our current house view.”

- EUR/USD comes under some selling pressure near 1.0650.

- The pair’s bullish attempt falters once again ahead of 1.0700.

EUR/USD triggered a corrective knee-jerk following another attempt to test/surpass the 1.0700 neighbourhood on Tuesday.

The resumption of the buying interest should encourage the pair to challenge and leave behind the 1.0700 region as well as the provisional 55-day SMA (1.0716) to allow for a potential visit to the weekly top at 1.0804 (February 14).

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0326.

EUR/USD daily chart

The CAD weakened against the USD over the past month. Economists at ING expect the USD/CAD pair to slide below the 1.30 level in the second half of the year.

BoC to stay put

“We expect no more hikes by the BoC given a worsening outlook for the property market and the broader economy.”

“When adding an energy commodity bloc that is struggling to rebound and the very low exposure to the good China story, it seems likely that CAD won’t be at the forefront of a risk rally.”

“USD/CAD below 1.30 is still what we expect to see in the second half of 2023, but that should mostly reflect a broad improvement in risk sentiment and USD weakness rather than idiosyncratic CAD strength.”

- DXY leaves behind two consecutive sessions with losses.

- Extra losses look likely on a breakdown of the 104.00 zone.

DXY regains some composure and prints decent gains near 104.70 on Tuesday.

So far, the continuation of the range bound theme seems the most likely scenario in the very near term for the index. In the meantime, the dollar needs to clear the February peak at 105.35 (February 27) to allow for extra recovery and a potential challenge of the 2023 top at 105.63 (January 6).

On the downside, the loss of the 104.00 region should likely spark a deeper pullback to, initially, the 55-day SMA, today at 103.45.

In the longer run, while below the 200-day SMA at 106.56, the outlook for the index remains negative.

DXY daily chart

- Market participants await the release of Fed Chair Powell's opening statement.

- US Dollar strengthens while Treasury yields remain steady.

- XAU/USD corrects further to the downside after being rejected from above $1,850.

Gold prices dropped further ahead of Federal Reserve Chair Jerome Powell's testimony on Capitol Hill as the US Dollar strengthened. XAU/USD bottomed at $1,831/oz, the lowest level since Thursday. Price remains near the lows, moving with a bearish bias.

Federal Reserve Chairman Jerome Powell will testify before the Senate Banking Committee at 15:00 GMT, but his initial remarks are expected to be released earlier. Ahead of that, the US Dollar is rising across the board while US yields stay steady.

Jerome Powell Speech Preview: Fed Chair testifies in US Congress

The US 10-year yield stands at 3.94% and the 2-year at 4.87%. Wall Street futures point to a positive opening with modest gains. Despite steady yields and marginally higher stocks, Gold is under pressure. Silver is also falling, at a more pronounced pace. XAG/USD bottomed at $20.65, the lowest level in a week, and it traded at $20.68, down 1.66% for the day.

On Monday, XAU/USD peaked at $1,858 the highest level since February 15 but it failed to hold above $1,850 and also dropped back under the 20-day Simple Moving Average. The immediate support stands at $1,830 followed by the $1,820 zone. On the upside, Gold would recover strength above $1,845. The next key resistance is located around $1,860.

Technical levels

While equity markets continue to rally, the key to the end of the bear market may be in the fundamentals, Mike Wilson, Chief Investment Officer and Chief US Equity Strategist for Morgan Stanley, reports.

Bear market is not over

“There is plenty of bullish and bearish fodder in the technicals in our view, and one will need to take a view on the fundamentals to decide this bear market for stocks is over.”

“Our view remains the same, the bear market is not over, but we acknowledge that Friday's price action may push out the next leg lower for a few more weeks.”

GBP/USD has been sluggish near 1.20. Economists at ING expect the pair to remain under pressure for now before recovering to 1.23/1.25 by the summer.

BoE tightening could be coming to a close

“Unlike the Federal Reserve (+75 bps) and European Central Bank (+100 bps), we think the Bank of England may only have 25 bps more of tightening left to do – taking Bank Rate to 4.25%. This is partly because more equivocal speeches from BoE officials and key survey data suggest tightness in the UK labour market is abating.”

“Our game plan sees GBP/USD staying soft through March on the strong Dollar (1.1850 the potential and outside risk to 1.1650), before broader Dollar weakness sees cable return to 1.23/1.25 this summer.”

“A difficult equity environment could also challenge Sterling.”

- AUD/USD dives to a fresh YTD low on Tuesday and is pressured by a combination of factors.

- A dovish assessment of the RBA policy statement weighs heavily on the domestic currency.

- Hawkish Fed expectations underpin the USD and contribute to the steep intraday downfall.

- Acceptance below 0.6700 aggravates bearish pressure ahead of Fed Chair Powell’s testimony.

The AUD/USD pair comes under intense selling pressure on Tuesday and drops to its lowest level since late December heading into the North American session. The pair is currently placed around the 0.66600.6665 region, down nearly 1% for the day, and seems vulnerable to decline further.

The Australian Dollar is turning out to be the worst-performing G10 currency amid a dovish assessment of the Reserve Bank of Australia's (RBA) policy statement, which, along with renewed US Dollar buying, exerts heavy pressure on the AUD/USD pair. In fact, the Australian central bank earlier this Tuesday raised its cash rate to the highest level since June 2012, though signalled that it might be nearing the end of its rate-hiking cycle. The speculations were fueled by the accompanying policy statement, wherein the RBA changed a reference from “further increases in rates” to “further tightening of monetary policy” would be needed.

In contrast, the Federal Reserve is universally expected to stick to its hawkish stance and keep interest rates higher for longer to tame stubbornly high inflation. This, in turn, continues to act as a tailwind for the Greeback, which further contributes to the heavily offered tone surrounding the AUD/USD pair. The steep intraday decline, meanwhile, confirms a breakdown below a one-week-old trading range support, around the 0.6690 zone, and further aggravates the bearish pressure. This, along with China's more conservative outlook for 2023 GDP growth, suggests that the path of least resistance for the China-proxy Aussie is to the downside.

Bearish traders, however, might take a breather and refrain from placing fresh bets ahead of Fed Chair Jerome Powell's semi-annual testimony before the Senate Banking Committee, due later during the North American session. Investors will look for fresh cues about the Fed's future rate-hike path, which will play a key role in influencing the near-term USD price dynamics and determine the next leg of a directional move for the AUD/USD pair. Nevertheless, the fundamental backdrop seems tilted firmly in favour of bearish traders. Hence, any meaningful recovery attempt might still be seen as a selling opportunity and remain capped.

Technical levels to watch

- EUR/JPY adds to the positive start of the week above 145.00.

- Beyond the YTD high near 1456.60 the pair should meet 146.70.

EUR/JPY advances for the second session in a row and manages to surpass the key 145.00 barrier on Tuesday.

The continuation of the current upside momentum faces the next hurdle at the 2023 high at 145.56 (March 2). The breakout of this level could motivate the cross challenge the December 2022 top at 146.72 (December 15) prior to the 2022 high at 148.40 (October 21 2022).

In the meantime, while above the 200-day SMA, today at 141.70, the outlook for the cross is expected to remain positive.

EUR/JPY daily chart

EUR/CHF popped back above parity last week but slipped below 0.9950 again on Monday. The 0.9840/0.9830 area is crucial support, analysts at Société Générale report.

New high for core inflation cements 50 bps at next SNB meeting

“CPI again surprised to the upside in February. This could seal another increase in the policy rate of 50 bps at the meeting in two weeks. The headline rate was unchanged at 3.2% YoY but core CPI drifted up to a new high of 2.4% from 2.2%.”

“Currently, a pullback is taking shape however 50-DMA at 0.9920 should be first support.”

“In case the pair overcomes 1.0040, the bounce could extend towards January high of 1.0100 and 1.0220.”

“Only if recent low at 0.9840/0.9830 gets violated would there be a risk of a deeper downtrend.”

- Jerome Powell testimony in the US Congress will be a top-tier market moving event.

- New clues on the Federal Reserve interest rate hike path are awaited.

- US Dollar, stock markets and other asset classes could see big swings on Fed Chair words.

Jerome Powell, Chairman of the Federal Reserve System, will testify on March 7 in the US Congress, in front of the Senate Committe on Banking, Housing and Urban Affairs. The hearing, entitled as “The Semi-Annual Monetary Policy Report to the Congress”, will start at 15:00 GMT (10:00 US Eastern Standard Time), and it will have the full attention of all financial market players.

Jerome Powell, Federal Reserve Chaiman, will deliver a key speech today in front of the US Senate

Jerome Powell is expected to address the main takeaways of the semi-annual Federal Reserve Monetary Policy Report, published last Friday. In that report, the Fed mentioned that “ongoing increased in the fed funds rate target are necessary” and that “bringing inflation back to 2% likely requires a period of below-trend growth, and some softening of labor market conditions.”

Expect US representatives in the Senate to inquire Powell in a long Q&A session about the future path of interest rates and how will the Fed assess how much more monetary policy tightening is needed. Markets could see strong moves to the US Dollar, US Treasury bond yields, stock markets and all asset classes, including Gold price and all major currency pairs, during Powell’s testimony.

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

- USD/CAD regains positive traction on Tuesday and draws support from a combination of factors.

- Retreating Crude Oil prices undermines the Loonie and acts as a tailwind amid fresh USD buying.

- The fundamental backdrop favours bulls; the focus remains glued to Fed Chair Powell’s testimony.

The USD/CAD pair attracts fresh buying near the 1.3600 round-figure mark on Tuesday and builds on its steady intraday ascent through the mid-European session. The momentum lifts spot prices to a fresh daily top, around the 1.3645 region in the last hour, and is sponsored by a combination of factors.

Crude Oil prices retreat from the highest level since late January touched this Tuesday amid fading optimism about a strong fuel demand recovery in China. In fact, data released earlier today showed a contraction in China's crude imports in January and February, which, to a larger extent, overshadows supply concerns and weighs on the black liquid. This, in turn, undermines the commodity-linked Loonie, which, along with the emergence of fresh US Dollar buying, is seen lending support to the USD/CAD pair.

Growing acceptance that the Federal Reserve will continue to tighten its monetary policy and keep rates higher for longer acts as a tailwind for the Greenback. The bets were reaffirmed by the incoming US macro data, which indicated that inflation isn't coming down quite as fast as hoped and pointed to an economy that remains resilient despite rising borrowing costs. Moreover, a slew of FOMC officials backed the case for higher rate hikes and opened the door for a 50bps lift-off at the March policy meeting.

Hence, the focus will remain glued to Fed Chair Jerome Powell's semi-annual testimony before the Senate Banking Committee, due later during the North American session. Heading into the key event risk, some repositioning trade is seen dragging the US Treasury bond yields lower. This, along with a stable performance around the equity markets, might hold back traders from placing aggressive bullish bets around the safe-haven buck and keep a lid on any meaningful upside for the USD/CAD pair.

The Bank of Canada (BoC), meanwhile, had signalled in January a likely pause in its tightening cycle and is now expected to leave rates unchanged at the upcoming policy meeting on Wednesday. This, in turn, suggests that the path of least resistance for the USD/CAD pair is to the upside. Some follow-through buying beyond the February swing high, around the 1.3665 region, will reaffirm the near-term positive outlook and allow spot prices to make a fresh attempt to conquer the 1.3700 round-figure mark.

Technical levels to watch

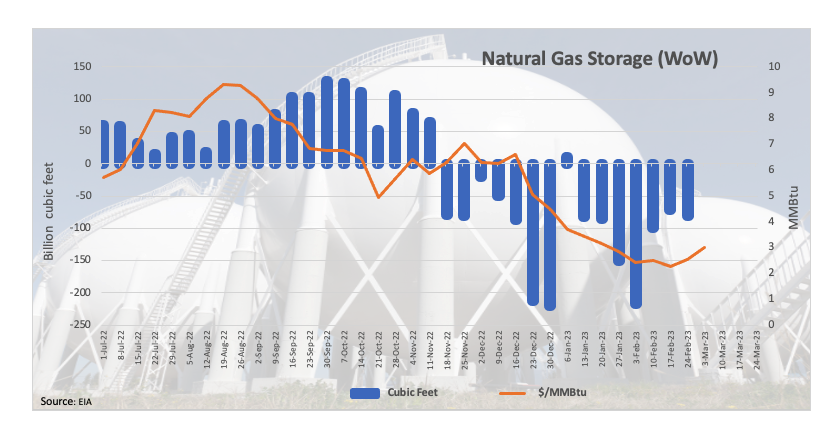

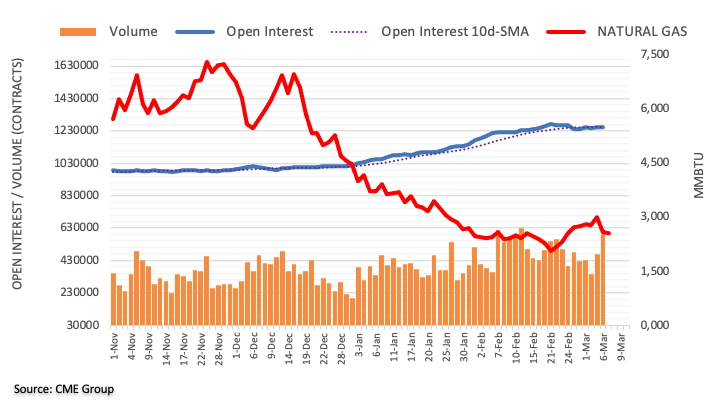

Prices of the MMBtu of natural gas keeps the inconclusive price action around the $2.60 region on Tuesday, or the lower end of the weekly range, following the strong pullback recorded at the beginning of the week.

Indeed, and after hitting multi-week peaks just above the key $3.00 mark on March 3, prices of the commodity resumed the downtrend in response to reports that confirmed that a milder weather lies ahead, which in turn undermined the expected outlook for heating demand.