- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 16-07-2012

The next target for growth is the level of $ 1.2300, which is the MA (200) for H1.

European stocks rose for a second day, extending the Stoxx Europe 600 Index’s longest stretch of weekly gains in more than two years, as manufacturing in the New York region expanded more than forecast.

German Chancellor Angela Merkel said yesterday she hadn’t softened her stance at last month’s summit in Brussels and that a so-called banking union involving a bloc-wide financial overseer will have to include joint oversight on a “new level.”

National benchmark indexes rose in 11 of the 18 western European markets today. Sweden’s OMX Stockholm 30 increased 0.7 percent and Germany’s DAX climbed 0.1, while the U.K.’s FTSE 100 and France’s CAC 40 fell less than 0.1 percent.

SEB rallied 8.2 percent to 49 kronor, the biggest increase since May 2010. The Stockholm-based bank said second-quarter net income declined to 3.01 billion kronor ($427 million) from 3.36 billion kronor a year earlier, exceeding the average estimate of 13 analysts.

G4S slid 8.7 percent to 254.6 pence as the company estimated its loss on the Olympics contract will be 35 million pounds to 50 million pounds. The U.K. government had to assign 3,500 extra soldiers to Olympic venues last week as G4S said it couldn’t train enough guards.

The dollar fell against the yen and erased gains versus the euro after U.S. retail sales unexpectedly fell for a third month, adding to speculation the Federal Reserve will take further steps to bolster the economy.

The euro reached a six-week low against the yen as the inflation rate in the currency region last month matched the lowest since February 2011. The yen rose versus most of its major counterparts as the Dollar Index erased gains before Fed Chairman Ben S. Bernanke testifies to Congress tomorrow on the state of the economy.

The Dollar Index erased gains after a Commerce Department report showed U.S. retail sales dropped 0.5 percent in June. The gauge, which Intercontinental Exchange Inc. uses to track the greenback against the currencies of six major U.S. trading partners, fell 0.1 percent to 83.235. It increased 0.4 percent earlier.

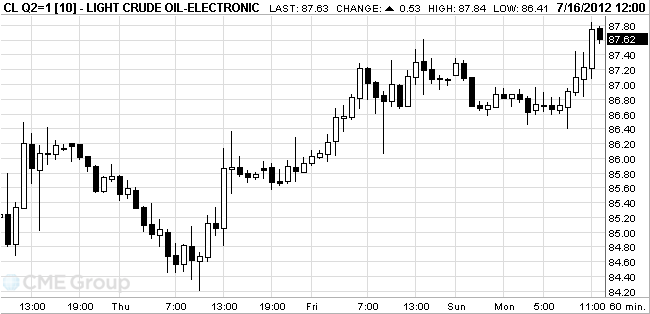

Oil rose for a fourth day as manufacturing in the New York region expanded in July at a faster pace than anticipated.

Futures advanced as much as 0.8 percent as the Federal Reserve Bank of New York’s general economic index, the Empire State Index, rose to 7.4 following a 2.3 increase in June. Oil also moved higher as U.S. stocks reduced losses and the dollar fell against the euro.

Oil for August delivery traded at range of $86,41 - $87,84 on the New York Mercantile Exchange. The contract rose 1.2 percent to $87.10 on July 13, the highest close since July 5. Prices have fallen 11 percent this year.

Brent crude for August settlement gained $1, or 1 percent, to $103.40 a barrel on the London-based ICE Futures Europe exchange. The contract expires today. The more-active September contract rose $1.25, or 1.2 percent, to $102.67.

Resistance of 3:1618 (resistance line from Jun 6)

Resistance of 2:1610 (area of Jul 6 high)

Resistance of 1:1600 (area of Jul 10 high)

Current Price: 1594.10

Support 1:1579 (session low)

Support 2:1560 (support line from May 16)

Support 3: 1548 (low of June)

Gold prices have played suffered losses early in the session after the released worse than expected data on retail sales have weakened the dollar.

For example, in U.S. retail sales in June fell by 0.5%, expected 0.2%.

Earlier, gold became cheaper amid fears of debt crisis and the growth of the eurozone government bond yields peripherals.

European Central Bank President Mario Draghi was made for the losses accruing to the bondholders most affected Spanish savings banks, the newspaper reported Wall Street Journal. However, the finance ministers of the eurozone declined his offer, fearing a negative reaction of financial markets, the article says. The ECB declined to comment on the report.

August gold futures on the COMEX today rose to 1593.8 dollars per ounce after falling to the level of 1577.2 dollars per ounce.

Resistance 3:91,70 (50,0% FIBO 106,10-77,20, Jun 29 high)

Resistance 2:88,70 (Jul 5 high)

Resistance 1:87,40 (Jul 13 high)

Current Price: 86.92

Support 1:85,70 (MA (200) for H1)

Support 2:83,40 (Jul 10 low)

Support 3:81,80 (Jul 2 low)

Resistance of 3:1410 (high of May)

Resistance of 2:1375 (high of July)

Resistance 1:1352 / 56 (area of Jul 10 and 13 highs)

Current Price: 1344.00

Support 1:1343 (session low)

Support 2:1330 (Jul 13 low)

Support 3:1320 (Jul 12 low, 50,0% FIBO 1265-1375)

EUR/USD $1.2200, $1.2250, $1.2300, $1.2325, $1.2350

USD/JPY Y79.25

GBP/USD $1.5500

AUD/USD $1.0190, $1.0300

EUR/AUD A$1.2000

U.S. stock-index futures maintained losses on the data that showed an unexpected decrease in retail sales.

U.S. stocks rose last week as a rally in JPMorgan Chase & Co. and speculation China will boost stimulus measures tempered concern about earnings and the global economy.

China’s Premier Wen Jiabao warned the momentum for a recovery in economic growth isn’t yet in place and that “difficulties” may persist for a while.

Global Stocks:

Hang Seng 19,121.34 +28.71 +0.15%

Shanghai Composite 2,147.96 -37.94 -1.74%

FTSE 5,664.53 -1.60 -0.03%

CAC 3,169.93 -10.88 -0.34%

DAX 6,546.06 -11.04 -0.17%

Crude oil $87.02 (-0,09%)

Gold $1588.60 (-0.21%)

3M (MMM) upgraded to Overweight from Equal-Weight at Morgan Stanley.

General Electric (GE) downgraded to Equal-Weight from Overweight at Morgan Stanley.

Exxon Mobil (XOM) downgraded to Hold from Buy at Deutsche Bank.

During the session, the euro fell below $ 1.22 against the dollar after German Chancellor Angela Merkel said she had not softened his position on the measures for the five EU countries that have requested international assistance. Also on the depreciation of the affected data from the EU. The rate of inflation in the euro zone was 2.4% in June, unchanged from last month. Indekc investor confidence in Germany, the region's largest economy, fell to -20 this month to -16.9 in June. Also, the data showed that the surplus in trade balance seasonally adjusted increase in May.

The euro fell to a six-week low against the yen after data on inflation in Europe in June pointed to signs of stagnation in June, which adds to concerns about the fact that the EU economy could enter into a state of recessive second time in three years.

The pound against the dollar during the entire session is rapidly declining, but in the last couple of hours a couple of shows a slight increase on the eve of release of data on retail sales in the U.S., which is expected to grow.

EUR/USD: during the European session, the pair fell to 1.2182 level, after which followed a small adjustment and the decline continued

GBP/USD: value pair fell to 1.5517, slightly recovered and continued to fall

USD/JPY: during the session at least a couple of updated Friday, reaching the values of 78.90 and now shows a slight increase

At 12:30 GMT, Canada will report the volume of transactions in foreign securities in May. At 12:30 GMT the U.S. manufacturing index released Empire Manufacturing for July, and report on changes in retail sales for June. At the same time becomes aware of change in retail sales, excluding auto sales in June, and the change of volume of retail trade sales, excluding cars and fuel for the month of June. Finish the day at 14:00 GMT U.S. data on the change in stocks in commercial warehouses for May.

EUR/USD

Offers $1.2300, $1.2240, $1.2220

Bids $1.2180, $1.2170/65, $1.2160/50, $1.2125/20

AUD/USD

Offers $1.0350, $1.0300, $1.0250

Bids $1.0200, $1.0180/75, $1.0150, $1.0125/20, $1.0110

GBP/USD

Offers $1.5650, $1.5600/20, $1.5545/55,

Bids $1.5505/495, $1.5480/70, $1.5455/40

EUR/GBP

Offers stg0.8010, stg0.8000/05, stg0.7980/85, stg0.7950, stg0.7910/20, stg0.7885/90

Bids stg0.7810/00

EUR/JPY

Offers Y98.00, Y97.70/75, Y97.50, Y97.30/35, Y97.00

Bids Y96.00, Y95.50, Y95.00

USD/JPY

Offers Y80.00, Y79.75/80, Y79.50, Y79.30/40

Bids Y78.50

Resistance 3: Y79.55 (MA (200) for H1, July 5 low)

Resistance 2: Y79.30 (MA(100) for H1)

Resistance 1: Y79.12 (July 11 low)

Current price: Y78.99

Support 1: Y78.78 (June 20 low)

Support 2: Y78.60 (June 15 low)

Support 3: Y78.10 (June 5 low)

Resistance 3: Chf1.0000 (psychological level)

Resistance 2: Chf0.9910 (December 2010 high)

Resistance 1: Chf0.9875 (July 13 high)

Current price: Chf0.9856

Support 1: Chf0.9785 (session low)

Support 2: Chf0.9765 (July 11 low)

Support 3: Chf0.9735 (July 10 low)

Resistance 3: $ 1.5645 (76.4% at FIBO ($ 1.5395-$ 1.5722), July 2 low)

Resistance 2: $ 1.5625 (July 5 high)

Resistance 1: $ 1.5595 (session high)

Current Price: $ 1.5537

Support 1: $ 1.5505 (MA (100) for H1, July 5 low)

Support 2: $ 1.5460/70 (23.6% of FIBO ($ 1.5395-$ 1.5722), July 6 low)

Support 3: $ 1.5395 (July 12 low)

Resistance 3: $ 1.2365 (38.2% of FIBO ($ 1.2163-$ 1.2695), July 5 low)

Resistance 2: $ 1.2335 (July 10 high)

Resistance 1: $ 1.2275 (session high)

Current Price: $ 1.2194

Support 1: $ 1.2165 (July 12 low)

Support 2: $ 1.2116 (June 2010 low)

Support 3: $ 1.2000 (psychological level)

Macroeconomic data on euro area consumer price index showed no increase in inflation. However, markets continue to be under pressure from the debt crisis in the eurozone.

We also learned that the public debt of Italy, in May increased by 17.1 billion euros to 1.966 billion euros.

The focus is market data on retail sales in the U.S., which will be published today at 12:30 GMT, and is also expected this week, corporate accountability, and the speech of the U.S. Federal Reserve Chairman Ben Bernanke. At the moment:

FTSE 100 5,653.37 -12.76 -0.23%

CAC 40 3,171.25 -9.56 -0.30%

DAX 6,544.18 -12.92 -0.20%

Shares of the Swedish bank SEB's second largest lender in the Baltic countries grew by 6.7% after earnings exceeded the income of the bank's analysts' estimates. G4S Plc shares have fallen by 7%, as the world's largest security company said it may be subject to loss of $ 78 million in connection with the failure to provide enough security guards to ensure the safety of the Olympic Games.

EUR/USD $1.2175, $1.2200, $1.2250, $1.2300, $1.2325, $1.2350

USD/JPY Y79.25, Y79.70, Y80.00

GBP/USD $1.5500, $1.5490, $1.5450

AUD/USD $1.0150, $1.0165, $1.0190, $1.0300

EUR/AUD A$1.2000

Asian stocks rose after Premier Wen Jiabao said China will increase measures to support growth in the world’s second-largest economy. Gains were limited amid concern about falling profits for Asian companies.

Nikkei 225 8,724.12 +4.11 +0.05%

S&P/ASX 200 4,105.1 +22.85 +0.56%

Shanghai Composite 2,147.96 -37.93 -1.74%

Guangzhou R&F Properties Ltd., a developer in the southern Chinese city, advanced 4.9 percent in Hong Kong.

Whitehaven Coal Ltd. soared 18 percent after Australian mining magnate Nathan Tinkler offered to buy out the rest of the coal producer.

Daekyung Machinery & Engineering Co. fell 8.3 percent in Seoul after a shipmaker dropped its bid for the chemical machinery maker.

ZTE Corp., a Chinese telecommunications equipment maker, slumped 16 percent after saying first-half profit may plunge 80 percent.

00:00 Japan Bank holiday

The euro traded 0.7 percent from its lowest level in two years before reports this week that may show stagnating inflation and weakening confidence in the currency bloc as the deepening sovereign crisis curbs growth. Figures from the European Union’s statistics office today may show the annual rate of inflation in the euro area remained at 2.4 percent in June, according to the median forecast in a Bloomberg News survey. That would be unchanged from an initial estimate on June 29 and the reading for May.

The 17-nation currency weakened versus most of its major peers after German Chancellor Angela Merkel said she hasn’t softened her stance on measures to stem debt contagion that’s prompted five euro states to seek international aid. Merkel said yesterday in an interview with broadcaster ZDF in Berlin that a banking union involving a financial overseer for the euro area will have to include joint oversight on a “new level.” German lawmakers are scheduled to debate aid to recapitalize Spanish banks this week.

Demand for the Australian and New Zealand dollars was supported as Asian shares rose and on prospects central banks will add to measures to prop up growth.

EUR / USD: during the Asian session the pair fell, retreating from Friday's high.

GBP / USD: during the Asian session the pair fell, retreating from Friday's high.

USD / JPY: during the Asian session the pair fell to Friday's low.

European data for Monday starts at 0700GMT with services sector sales/employment and industrial orders data from Spain. Later on, at 0900GMT, EMU data includes the flash HICP for June and trade data for May, while also in Europe Monday, the Bank of Portugal is due to publish the Official Bulletin. US data starts at 1230GMT with retail sales and the NY Fed Empire State Survey.

On Friday the euro has risen sharply with no apparent reason. The opinion of market participants on this issue are divided: some say that this has happened to the rumors of currency purchases Austrian bank, others argue that this was due to the displacement of short positions. Well so does this one certainly can not say now. Now the euro is trading cautiously in the area reached maximum values. Significant movement also spread to other currency pairs.

The pound against the dollar during the entire session is rapidly declining, and is now trading near the maximum on July 11.

The course of the Australian dollar against the U.S. dollar during the day surprised by stable growth, while cutting off more than 80% of the losses that he suffered. The increase was caused by weak China GDP data, which are of concern regarding the prospects of the economy.

The yen strengthened during the session, and updated with a minimum of 11 July. Who is the course a little bit back from the minimum values, and shows a slight increase.

Asian stocks rose, with the benchmark index poised to snap six days of losses, on speculation policy makers will do more to support growth after China reported the slowest expansion in three years, South Korea cut its outlook and Singapore said its economy shrank.

Nikkei 225 8,724.12 +4.11 +0.05%

Hang Seng 19,092.63 +67.52 +0.35%

S&P/ASX 200 4,082.25 +14.28 +0.35%

Shanghai Composite 2,185.9 +0.40 +0.02%

Hyundai Motor Co., South Korea’s biggest carmaker, rose 3.4 percent after workers agreed to resume wage negotiations, averting a threatened a strike.

Belle International Holdings Ltd., a women’s shoe retailer that gets most of its revenue from China, climbed 3.8 percent in Hong Kong after reporting sales jumped.

Dentsu Inc., a Japanese advertising company, sank 7 percent after agreeing to buy Britain’s Aegis Group Plc.

Chinese airlines rose after the Shanghai Daily reported the government may set up investment companies to buy airline stakes

European stocks rose for a sixth week as China’s slowest expansion in three years fueled speculation policy makers will add to stimulus measures and Italy’s borrowing costs fell at an auction.

Storebrand ASA (STB), Norway’s second-largest publicly traded insurer, rallied 8.2 percent after saying it will meet capital requirements without selling shares. Temenos Group AG (TEMN) rebounded 5.9 percent. PSA Peugeot Citroen (UG) slumped to the lowest price since at least 1989 over concerns that the French government may step in after Europe’s second-largest carmaker announced plans to close a factory and cut jobs.

The Stoxx Europe 600 Index added 1.3 percent to 256.26 at the close of trading.

National benchmark indexes gained in all of the 18 western- European (SXXP) markets except Iceland.

FTSE 100 5,666.13 +57.88 +1.03% CAC 40 3,180.81 +45.63 +1.46% DAX 6,557.1 +137.75 +2.15%

Italian borrowing costs fell at an auction today, hours after Moody’s Investors Service downgraded the country’s bond rating by two levels to Baa2 from A3 and reiterated its negative outlook, citing the worsening political and economic situation.

Storebrand, Norway’s second-largest publicly traded insurer, rallied 8.2 percent to 24.01 kroner. The company said it will cut costs by at least 400 million kroner ($66 million) by 2014 and meet stricter European capital requirements without selling new shares.

Temenos Group AG gained 5.9 percent to 10.85 francs. The banking-software maker plunged the most in 3 1/2 years yesterday as it cut its revenue-growth forecast and said its chief executive officer will step down.

Deutsche Telekom AG (DTE) gained 5.7 percent to 9.18 euros after Credit Suisse Group AG raised its rating on the company’s shares to neutral from underperform.

Elisa Oyj (ELI1V), Finland’s largest wireless carrier by subscribers, jumped 5.7 percent to 16.80 euros as second-quarter sales of 389 million euros beat the average 384.2 million-euro analyst estimate.

Nokia Oyj (NOK1V) fell 2.5 percent to 1.51 euros after the mobile- phone maker struggling to recover lost market share said it will close two of its four regional distribution centers in China as part of a restructuring plan it announced last month to halt mounting losses from plunging smartphone sales. Nokia on June 14 said it would cut as many as 10,000 jobs globally and close facilities.

Deutsche Bank AG slipped 1.9 percent to 25.60 euros and Bankia SA declined 7 percent to 65.1 euro cents.

Booker Group Plc (BOK), the largest U.K. food wholesaler, slumped 2.6 percent to 88.95 pence after Shore Capital Group Ltd. cut the stock to sell from hold.

U.S. stock indices ended the session in the area of maximum values

Indices provide support for the expectations of new measures by the Chinese government to stimulate the national economy, the power of the shares of banking institutions, after the return of one of the largest banks in the U.S. and the world JPMorgan Chase and Co (JPM) was

better than expected, and reduced fears of worsening debt crisis in Europe.

Today's statistics showed that by the end of the 2nd quarter of China's GDP grew by 7.6% year on year. The average forecast was at 7.9% after rising 8.1% in the previous quarter. Data on China's GDP growth expectations have led market participants about the new measures by the Chinese government to stimulate the growth of national economy. Against this background of increased commodity prices.

Today, a representative of the Spanish government announced the decision to reduce spending in 2012. It has also been said about the decision to increase the competitiveness of the economy, administrative reform, pension reform.

In the composition of all components of the DOW index with the exception of shares Hewlett-Packard Company (HPQ, -2.07%) are in positive territory. Show the greatest growth stocks:

JPMorgan Chase & Co. (JPM, +5.79%)

Bank of America Corporation (BAC, +4.21%)

Caterpillar Inc. (CAT, +2.83%)

Microsoft Corporation (MSFT, 2.72%)

At the same time, support for the shares JPMorgan (JPM) has issued a quarterly report.

The reason for selling shares of HPQ is a published report of a competitor in the market of printers Lexmark International Inc., Which has reduced its forecasts for sales and earnings for the second quarter.

Note that the last report, Gartner noted decrease in sales in the PC market, where HP is still a major player.

Branches in the context of the S & P 500 all sectors demonstrate a positive trend. Maximum growth demonstrates the financial sector (+2.0%) and the conglomerate sector (+1.9%).

At the time of closure:

Dow 12,767.74 +194.47 +1.55%

Nasdaq 2,908.36 +42.17 +1.47%

S & P500 1,356.14 +21.38 +1.60%

Resistance 3: Y79.95 (Jul 12 high)

Resistance 2: Y79.50/55 (MA (50) D1, MA (200) H1)

Resistance 1: Y79.25 (session high)

Current price: Y79.09

Support 1: Y79.00 (MA (200) D1)

Support 2: Y78.80 (Jun 20 low)

Support 3: Y78.60 (Jun 15 low)

Resistance 3: Chf1.0000 (psychological level)

Resistance 2: Chf0.9915 (Oct 10 high 2010)

Resistance 1: Chf0.9875 (Jul 13 high)

Current price: Chf0.9810

Support 1: Chf0.9790 (session low)

Support 2: Chf0.9735 (Jul 10 low, MA (200) H1)

Support 3: Chf0.9685 (Jul 6 low)

Resistance 3: $ 1.5720 (Jul 2 high)

Resistance 2: $ 1.5655 (MA (50) D1)

Resistance 1: $ 1.5595 (session high)

Current Price: $ 1.5570

Support 1: $ 1.5530 (MA (200) H1)

Support 2: $ 1.5455 (high of the U.S. session on Jul 13)

Support 3: $ 1.5390 (Jul 12 low)

Resistance 3: $ 1.2400 (Jul 6 high)

Resistance 2: $ 1.2335 (Jul 10 high, MA (200) H1)

Resistance 1: $ 1.2260 (session high)

Current Price: $ 1.2239

Support 1: $ 1.2160 (Jul 12 low)

Support 2: $ 1.2100 (psychological level)

Support 3: $ 1.2040 (Jun 10 low 2010)

00:00 Japan Bank holiday -

07:15 Switzerland Industrial Production (QoQ) Quarter I +8.0% -7.5%

07:15 Switzerland Industrial Production (YoY) Quarter I -1.4% 0.0%

09:00 Eurozone Harmonized CPI June -0.1% 0.0%

09:00 Eurozone Harmonized CPI, Y/Y (finally) June +2.4% +2.4%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y June +1.6% +1.6%

09:00 Eurozone Trade Balance s.a. May 6.2 4.8

12:30 Canada Foreign investment in Canadian securities May 10.20 13.51

12:30 U.S. Retail sales June -0.2% +0.1%

12:30 U.S. Retail sales excluding auto June -0.4% +0.1%

12:30 U.S. NY Fed Empire State manufacturing index July 2.29 3.90

14:00 U.S. Business inventories May +0.4% +0.2%

22:45 New Zealand CPI, q/q Quarter II +0.5% +0.5%

22:45 New Zealand CPI, y/y Quarter II +1.6% +1.1%

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.