- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

- DXY retains the previous day’s pullback from 20-year high.

- Softer chatters over economic slowdown, repeated comments from central bankers help trigger risk-on mood.

- Pre-NFP anxiety, headlines from China also contribute to the DXY pullback.

US Dollar Index (DXY) bulls take a breather around the 20-year high as the quote extends the previous day’s pullback to attack 107.00 during Friday’s Asian session. in doing so, the US dollar gauge versus the six major currencies portrays the market’s consolidation ahead of the key US employment data for June.

In addition to the pre-NFP paring of gains, the market players also benefit from the recent improvement in the risk appetite and drag the US dollar down. That said, repeated comments from the major central bankers and efforts to tame recession fears join headlines from China to help improve the mood.

China is up for $220 billion of stimulus with unprecedented bond sales, per Bloomberg. On the same line was news that diplomats from the US and China are up for meeting personally after the latest virtual meeting cited progress in trade talks. With this, Beijing is optimistic that it can help ease the US its inflation problem by solving the supply-chain riddle, the same gained fewer accolades from the experts though.

Fed speakers, CEO of the Federal Reserve Bank of St. Louis. James Bullard stated, per Reuters, “We've got a good chance at a soft landing.” Additionally, Federal Reserve Governor Christopher Waller said inflation is way too high and does not seem to be easing and the Fed has to apply a more restrictive policy.

Mixed data from the US also weighed on the DXY as US Initial Jobless Claims rose by 4,000 to 235,000 in the week ending July 2, versus 230,000 expected. With this, the 4-week moving average number was 232,500, up 750 from the previous week's average. Further, the US goods and services deficit narrowed by $1.1 billion to $85.5 billion in May, marking the smallest monthly deficit in 2022.

Against this backdrop, the US Treasury yields regain upside momentum and the Wall Street benchmarks closed with gains. However, the S&P 500 Futures print mild losses by the press time.

Technical analysis

Doji candlestick at the multi-year high joins overbought RSI conditions to challenge DXY bulls. The pullback, however, remains elusive until breaking the previous resistance line from May 13, close to 106.30 by the press time.

US inflation expectations, as per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, bounced off the lowest levels since September 2021 by the end of Thursday’s North American session. That said, the inflation gauge recently flashed the 2.33% mark, reversing from the previous day’s multi-month low of 2.29%.

The recently improved inflation expectations fail to defy the recession fears signaled by the inversion of the 2-year and the 10-year Treasury yield curve. That said, the US 2-year Treasury yields are higher around 3.02% while the 10-year bond coupon seesaws near 3.0% at the latest.

The upbeat prints of inflation expectations appear to weigh on the market sentiment and can help the US dollar to remain firm.

It’s worth noting that the US Dollar Index (DXY) retreated from the 20-year high the previous day, even if the daily loss was almost negligible.

Also read: Nonfarm Payrolls Preview: Three dollar-positive scenarios, only one negative one

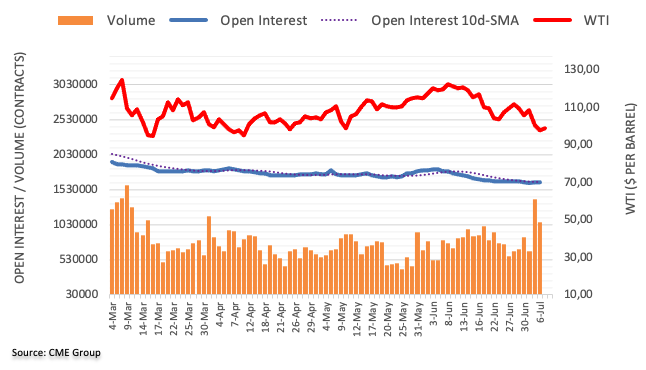

- WTI crude oil prices pare the biggest daily jump in two months.

- Impending bear cross on MACD, RSI retreats hints at further weakness.

- Adjacent support line tests bears, multiple hurdles stand tall to probe buyers.

WTI crude oil struggles to extend the previous day’s rebound from a three-month low during Friday’s sluggish Asian session. In doing so, the black gold keeps the pullback from the 100-HMA while taking rounds to $99.75 by the press time.

Given the recent RSI retreat from the overbought territory, not to forget the looming bear cross of the MACD line with the signal line, the energy benchmark is expected to stretch the latest pullback.

However, immediate support around $98.70 could serve as a trigger for the commodity’s fresh selling towards the recently marked multi-day low of $93.20.

Following that, March’s low of $92.35 could act as the last defense of bulls before directing the quote to the October 2021 high near $85.00.

On the flip side, recovery remains elusive below the 100-HMA level surrounding $101.75.

Even if the quote crosses the 100-HMA, a convergence of the 200-HMA and 61.8% Fibonacci retracement of the June 29 to July 06 downturn, near $105.00-105.30, could challenge the WTI bulls.

Also likely to test the energy benchmark’s upside momentum is the one-week-old descending resistance line, close to $106.80 by the press time.

WTI: Hourly chart

Trend: Further weakness expected

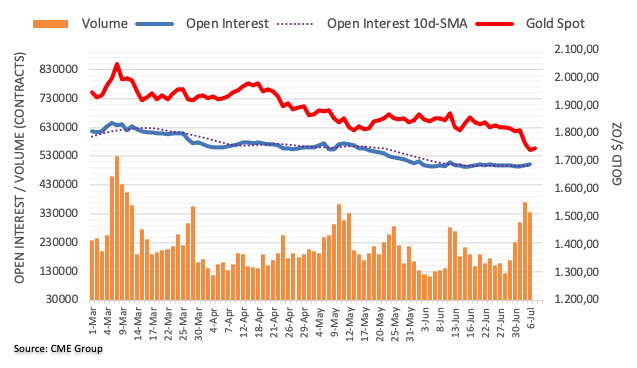

- Gold price is witnessing a muted performance as investors await US NFP.

- The DXY is expected to surrender the critical support of 107.00.

- The US employment data is expected to display a vulnerable performance.

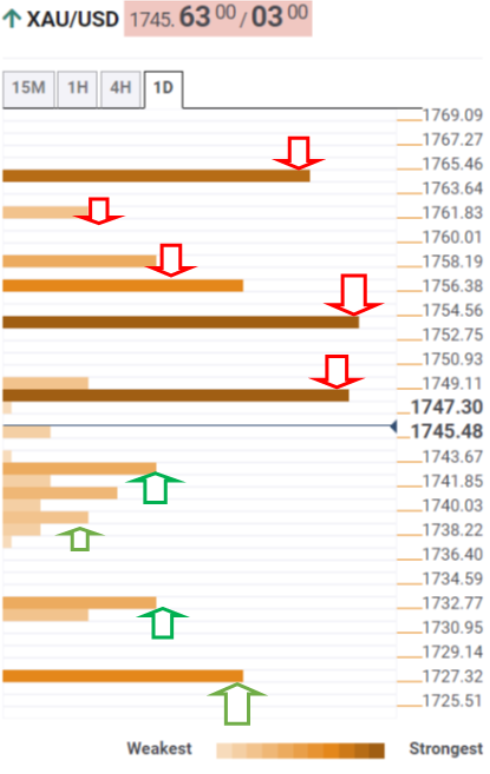

Gold price (XAU/USD) is displaying a lackluster performance in the early Tokyo session. The precious metal is juggling in a minute range of $1,738.79-1,741.16 as the US dollar index (DXY) is trading subdued ahead of the US Nonfarm Payrolls (NFP). On a broader note, the bright metal has turned sideways after a sheer downside move. The absence of recovery signals in the asset is hinting at more downside potential.

Meanwhile, the DXY is likely to surrender the critical support of 107.00 as the asset is displaying exhaustion signals after failing to print a fresh 19-year high. The asset attempted to surpass Wednesday’s high at 107.26, however, a failure on the same is pushing the asset lower.

In today’s session, the release of the US NFP will provide decisive guidance to the gold prices. A preliminary estimate for the US NFP is 270k, lower than the prior print of 390k. While the Unemployment Rate will remain stable at 3.6%. It is worth noting that the economy is maintaining its full employment levels consecutively for the past eight months, which will keep the DXY underpinned.

Gold technical analysis

The gold prices are going through the phase of inventory distribution on an hourly scale. Considering the prior downside moves, a follow-up decline is expected in the counter after the downside break of the consolidation formed in a $1,736.55-1,748.77 range. The precious metal has failed to sustain above the 21-period Exponential Moving Average (EMA) at $1,742.50, which signals the strength of the greenback bulls. Also, the 50-EMA at $1,751.80 is declining, which adds to the downside filters. The Relative Strength Index (RSI) (14) is on the verge of surrendering the support of 40.00, which will fetch a fresh downside fall in the asset.

Gold hourly chart

- USD/CHF retains five-day uptrend, grinds higher of late.

- Risk appetite improved amid absence of fresh catalyst to amplify recession woes.

- Softer data, pre-NFP consolidation also played their roles to adjust market moves.

- US jobs report for June will be important considering hopes of 0.75% rate hike.

USD/CHF grinds higher as the bulls poke the 50-DMA hurdle surrounding 0.9740 for the third consecutive day during Friday’s Asian session. The Swiss currency (CHF) pair recently benefited from the improvement in the market sentiment, as well as the firmer US dollar, ahead of the key US jobs report for June.

Risk-aversion eased the previous day as major policymakers repeated previous comments while trying to tame the recession fears. Also keeping the market hopeful were headlines concerning China and mixed data from the US.

China is up for $220 billion of stimulus with unprecedented bond sales, per Bloomberg. On the same line was news that diplomats from the US and China are up for meeting personally after the latest virtual meeting cited progress in trade talks. With this, Beijing is optimistic that it can help ease the US its inflation problem by solving the supply-chain riddle, the same gained fewer accolades from the experts though.

Talking about the data, US Initial Jobless Claims rose by 4,000 to 235,000 in the week ending July 2, versus 230,000 expected. With this, the 4-week moving average number was 232,500, up 750 from the previous week's average. Further, the US goods and services deficit narrowed by $1.1 billion to $85.5 billion in May, marking the smallest monthly deficit in 2022.

Elsewhere, Fed speakers, CEO of the Federal Reserve Bank of St. Louis. James Bullard stated, per Reuters, “We've got a good chance at a soft landing.” Additionally, Federal Reserve Governor Christopher Waller said inflation is way too high and does not seem to be easing and the Fed has to apply a more restrictive policy.

Amid these plays, the US Treasury yields regain upside momentum and the Wall Street benchmarks closed with gains. However, the S&P 500 Futures print mild losses by the press time.

Moving on, risk catalysts are important for the USD/CHF pair traders to watch ahead of the US employment data. the monthly increase in jobs since April last year, by easing to 268K from 390K for June while the Unemployment Rate is likely to stay unchanged at 3.6% for the said month.

Also read: Nonfarm Payrolls Preview: Three dollar-positive scenarios, only one negative one

Technical analysis

50-DMA challenges USD/CHF bulls around 0.9740 since Wednesday. Given the recently firmer RSI, the odds of the pair’s upside break to the aforementioned hurdle appear high.

“China’s Ministry of Finance is considering allowing local governments to sell 1.5 trillion yuan ($220 billion) of special bonds in the second half of this year, an unprecedented acceleration of infrastructure funding aimed at shoring up the country’s beleaguered economy,” said Bloomberg on Thursday.

More to come

- USD/CAD has displayed a gradual downside move after failing to cross the yearly high at 1.3083.

- The consensus for the employment data by the US and Canada is on the lower side.

- A meaningful recovery in the oil prices over the last two days has supported the loonie bulls.

The USD/CAD pair has witnessed a corrective phase to near the critical support of 1.2960. A corrective move in the asset is followed by greenback bulls’ failure to cross Wednesday’s high at 1.3083. The asset is hovering near the crucial support of 1.2960 and may likely remain vulnerable ahead of the employment data from the US and Canada.

Considering the estimates, the US economy has created 270k jobs in June, lower than the prior release of 390k. The jobless rate may remain stable at around 3.6%. What investors will focus on is the Average Hourly Earnings, as their lower recording against the soaring price pressures will trim the consumer confidence significantly and henceforth the demand for durable goods.

Meanwhile, the US dollar index (DXY) is displaying downside risks after testing the fresh 19-year high at 107.26. The DXY is displaying a subdued performance as lower US NFP won’t allow the Federal Reserve (Fed) to announce bumper rate hikes in a presumptuous manner.

On the loonie front, Statistics Canada is likely to report a Net Change in Employment at 22.5K, lower than the former release of 39.8k. The Unemployment Rate is seen as stable at 5.1%. This will have a substantial impact on the loonie bulls.

The loonie bulls are also performing on recovery in the oil prices. At the press time, oil prices have corrected minutely below $100.00, however, the asset has recovered significantly from the low of $93.20 recorded on Wednesday.

- GBP/USD stays on the front foot inside a bullish chart pattern after rising the most in three weeks.

- Immediate descending trend line challenge buyers ahead of the 1.2155-60 key resistance.

- 20-DMA adds strength to the upside barrier, sellers have a bumpy road to the south.

GBP/USD buyers attack a two-week-old resistance line while extending the previous day’s run-up to Friday’s Asian session. That said, the Cable pair picks up bids to 1.2030 after rising the most in nearly three weeks. In doing so, the quote remains inside a two-month-long falling wedge bullish chart pattern.

Considering the quote’s rebound from the stated bullish formation’s support line, coupled with an improvement in the RSI (14), the latest rebound is expected to overcome the immediate hurdle surrounding 1.2030-35.

The same could propel the pair towards the wedge’s resistance line, also nearing the 20-DMA, around 1.2155-60 key hurdle.

Should the GBP/USD prices rally beyond 1.2160, it could confirm the theoretical run-up beyond 1.2800. However, the highs marked during mid-June and May, respectively around 1.2410 and 1.2665 could challenge the upside momentum.

On the contrary, pullback moves may take a breather near the 1.2000 psychological magnet before revisiting the recent multi-month low of 1.1876.

However, the lower line of the stated wedge, at 1.1861 by the press time, will challenge the GBP/USD bears afterward.

GBP/USD: Daily chart

Trend: Further recovery expected

- The EUR/JPY accumulates losses of 2% in the week.

- Despite an upbeat market sentiment, the EUR/JPY could not rally, weighed by the EU’s energy crisis.

- EUR/JPY to tumble towards 137.00 on buyers unable to reclaim 139.00.

The EUR/JPY keeps tumbling despite an upbeat market sentiment, courtesy of fading recession fears, as US Fed policymakers reiterated recession worries are overblown. At 138.20, the EUR/JPY is barely up 0.11% as the Asian Pacific session begins.

EU energy prices and slower economic growth are a headwind for the EUR/JPY

Futures in Asia are pointing towards a higher open. During the week, concerns of a worldwide recession were the narrative around the financial markets. Nevertheless, on Thursday, Fed’s Waller and Bullard dismissed those fears regarding the US, and both backed a 75 bps rate hike to the Federal funds rate in July.

Talking about the euro area, high energy prices, and the slowing economic path, as depicted by S&P Global PMIs in the bloc about to enter the contractionary territory, weighed on the EUR/JPY.

In the meantime, the EUR/JPY Thursday’s price action depicts the pair was under selling pressure but consolidated around the 138.00-139.00 area, as the Japanese yen weakened throughout the day.

EUR/JPY Daily chart

The cross-currency pair tumbled below the 50 -day EMA around 139.00 on Tuesday, opening the door for further losses. Sellers capitalized on that, dragging the pair towards the weekly low at 137.26, but in the end, the EUR/JPY settled above the 138.00 mark. Meanwhile, with oscillators in bearish territory and EUR/JPY exchange rate below the 20 and 50-day EMA, the EUR/JPY might be headed to the downside.

Therefore, the EUR/JPY’s first support would be the July 6 daily low at 137.26. Break below will expose the May 23 daily high-turned-support at 136.79, followed by a test of the 100-day EMA at 136.00.

EUR/JPY Key Technical Levels

- EUR/USD holds lower grounds at 20-year bottom after five-day downtrend.

- Downbeat German/Eurozone data, unimpressive ECB Meeting Accounts favor sellers.

- Recession fears, mixed US data and Fedspeak defended the USD even as market sentiment improved.

- No major data insight ahead of US jobs report for June, risk catalysts are the key.

EUR/USD fails to cheer the improvement in the market’s mood as it remains depressed around a two-decade low, refreshed the previous day around 1.0150, during Friday’s initial Asian session. In doing so the major currency pair portrays the market’s anxiety ahead of the key US Nonfarm Payrolls (NFP) data.

Market sentiment improved on Thursday as major policymakers repeated previous comments while trying to tame the recession fears. Also keeping the market hopeful were headlines concerning China and mixed data, mostly down from Eurozone and Germany.

That said, diplomats from the US and China are up for meeting personally after the latest virtual meeting cited progress in trade talks. With this, Beijing is optimistic that it can help ease the US its inflation problem by solving the supply-chain riddle, the same gained fewer accolades from the experts though.

On a different page, the upcoming earnings season and recovery in the US Treasury yields also helped to improve the risk profile but failed to propel the EUR/USD prices amid louder economic pessimism in the bloc, mainly due to the energy crisis.

Talking about the data, US Initial Jobless Claims rose by 4,000 to 235,000 in the week ending July 2, versus 230,000 expected. With this, the 4-week moving average number was 232,500, up 750 from the previous week's average. Further, the US goods and services deficit narrowed by $1.1 billion to $85.5 billion in May, marking the smallest monthly deficit in 2022.

On the other hand, German Industrial Production eased on MoM to 0.2%, while improving on YoY to -1.5% whereas the European Central Bank (ECB) Monetary Policy Meeting Accounts highlighted inflation fears and mentioned that some members discussed the need for higher rate hikes. Even so, the emphasis was to deliver 0.25% increase in July.

Elsewhere, ECB Governing Council member Yannis Stournaras noted on Thursday that they are not observing excessive wage demand in Europe, as reported by Reuters. Further, ECB policymaker and Governor of the Central Bank of Cyprus Constantinos Herodotou said that they are not targeting exchange rates while adding that they do take their impact on inflation into account.

In the case of the Fed speakers, CEO of the Federal Reserve Bank of St. Louis. James Bullard stated, per Reuters, “We've got a good chance at a soft landing.” Additionally, Federal Reserve Governor Christopher Waller said inflation is way too high and does not seem to be easing and the Fed has to apply a more restrictive policy.

To sum up, the recent pause in the risk-off mood isn’t a sign of improvement and fails to help the EUR/USD prices ahead of the US jobs report for June. Forecasts suggest the headline US Nonfarm Payrolls (NFP) is expected to post the smallest monthly increase in jobs since April last year, by easing to 268K from 390K for June while the Unemployment Rate is likely to stay unchanged at 3.6% for the said month.

Also read: Nonfarm Payrolls Preview: Three dollar-positive scenarios, only one negative one

Technical analysis

Unless bouncing back beyond June’s low 1.0360, EUR/USD remains vulnerable to testing 1.0000 psychological magnet. The oversold RSI conditions, however, hint at a corrective pullback.

- AUD/USD is likely to display more gains above 0.6850 as the US NFP may display a downbeat performance.

- Lower US Average Hourly Earnings will hurt the paychecks of the households.

- Australia’s upbeat Trade Balance has strengthened aussie against the greenback.

The AUD/USD pair has turned sideways after facing minor resistance around 0.6850 in the late New York session. The asset is likely to extend its recovery and may surpass Thursday’s high at 0.6848 as investors are expecting downbeat US Nonfarm Payrolls (NFP) data.

As per the market consensus, the US economy has added 270k jobs in the labor market, significantly lower than the former release of 390k. Alongside, the Unemployment Rate may remain stable at 3.6%. It is worth noting that the generation of lower employment opportunities by the US economy doesn’t resemble a slowdown. The labor market has reached full employment levels and therefore, less room is available for the creation of more job opportunities.

Apart from that, investors' focus will remain on the Average Hourly Earnings, which will remain flat at 5.2%. The inflation rate in the US economy has jumped to 8.6% while the growth in the wage prices is not lucrative. This may reduce the ‘paychecks’ of the households and eventually their aggregate demand quantity-wise for durable goods. Also this week, the US ISM Services New Orders Index data remained vulnerable, which adds to the downside filters for the overall demand.

On the aussie front, the upbeat Trade Balance data has supported the antipodean. The monthly economic data landed at 15,965M, higher than the estimates of 10,725M and the prior release of 13,248M. Next week, the aussie employment data will remain in focus.

- The AUD/JPY erased Wednesday’s losses on investors’ renewed optimism as Fed officials downplayed a recessionary scenario.

- The cross-currency pair rallied more than 100 pips in the day, breaking above the 93.00 mark.

- AUD/JPY buyers’ failure at 93.40 might open the door for further losses.

The AUD/JPY rises on investors’ positive mood, trimming Wednesday’s losses, up by almost 1% as the New York session ends. At the time of writing, the AUD/JPY is trading at 93.00.

Sentiment remains upbeat as the Asian Pacific session begins, as Fed speakers downplayed recession feats, seeing a soft landing as achievable. Policymakers backed a 75 bps rate increase in July of the Federal funds rate (FFR) while also noting that the US economy is strong.

The AUD/JPY Thursday’s price action shows the pair began trading around 92.20 before dipping toward the daily low at 91.89 during the Asian session. However, European and North American traders sent the cross rallying above the 93.00 figure as the day progressed.

AUD/JPY Daily chart

The daily chart shows that the AUD/JPY is upward biased. However, a rising wedge, already broken the downside, might put a lid on the AUD/JPY jump from weekly lows. Also, on its way north, the confluence of the 20-day EMA, with the July 4 high around the 93.28-93.38 area, would be difficult to overcome, but If AUD/JPY achieves it, it will clear the way for further upside. Therefore, the AUD/JPY’s first resistance would be the July 5 high of around 93.98, followed by the rising wedge’s bottom trendline around 94.80.

Otherwise, the AUD/JPY first support would be the 92.00 figure. A breach of the latter would expose the July 6 daily low at91.52, followed by a challenge of the 100-day EMA at 90.68.

AUD/JPY Key Technical Levels

- NZD/USD is perched in the higher end of the 0.6100 area.

- The focus is on the downside for the session ahead before NFP.

NZD/USD is staring out in Asia on the backfoot in the upper quarter of the 0.6100 area and below the highs of the prior day with a focus on the New York session's low of 0.6162 for the coming Tokyo session.

The driver in the forex space is the US dollar which will come under the micro scope in the coming day with a focus o the US economy as investors await the jobs data ahead of next week'S Consumer Price Index next week. This will all go towards the sentiment that is building around the Federal Reserve when policymakers next meet on July 26-27.

The strength of Nonfarm Payrolls on Friday will help investors to assess the pace of the rise in wages. Analysts at TD Securities explained that employment likely continued to advance firmly in June but at a more moderate pace after three consecutive job gains of around 400k in March-May.

Meanwhile, analysts at ANZ Bank explained that, ''once we are past US jobs data tonight, local factors are likely to rise to the fore heading into next week’s Reserve Bank of New Zealand MPS – and they really have no choice but to be hawkish given the inflation backdrop; that may harm the NZD given hard landing fears?''

- The GBP/JPY reaches a fresh two-day high at around 163.62.

- Investors’ optimism augmented their appetite for risk-sensitive currencies like the pound.

- GBP/JPY Price Analysis: Unless buyers reclaim 164.60, a re-test towards the 100-day EMA near 160.90 is on the cards.

The GBP/JPY erases Wednesday’s losses and soars on Thursday amidst a risk-on impulse that augmented appetite for riskier assets, meaning safe-haven peers sustaining losses. At 163.49, the GBP/JPY is trading at fresh two-day highs, up almost 1%.

Wall Street is set to finish Thursday’s session in the green, up between 1.14% and 2.22%. Recession fears that the US Federal Reserve would be unable to curb inflation without tipping the US economy into contractionary territory faded. Meanwhile, Fed officials reiterated that a 75 bps rate hike in July is the base case scenario while adding that the US economy is solid.

On Thursday, the GBP/JPY’s price action illustrates the pair opening around 162.00, followed by a dip towards the middle of the 161.00-162.00 area, and then rallying more than 150 pips, reaching a daily high at around 163.62. However, as the New York session ended, the cross-currency pair settled at around 163.52.

GBP/JPY Daily chart

The daily chart shows that the GBP/JPY is upward biased, though oscillators at negative territory might open the door for a reversal move. The RSI at 48 is still below the 50-midline; unless it breaches the latter, a retracement towards the 100-day EMA around 160.87 is on the cards. If buyers want to resume the uptrend, they must reclaim above the 20-day EMA at 164.56.

Otherwise, the GBP/JPY first support would be the 163.00 mark. Break below will expose the 50-day EMA at 162.76, followed by a fall towards the 100-day EMA at 160.87.

GBP/JPY Key Technical Levels

- Gold is correcting from a significant sell-off in the week ahead of NFP.

- The bulls eye a 50% mean reversion but it all comes down to key data on Friday.

The gold price is consolidatred and flat on the day, oscillating around $1,739 after edging up from a nine-month low early on Thursday. The precious metal has climbed from a low of $1,736.58 and has reached a high of $1,749.13 on the day as markets get set for Friday's US Nonfarm Payrolls data.

The data on Friday will be keenly eyed and the gold price will send on it. The yellow metal has been pressured on the back of recession fears and weak stock markets that have seen investors move into the US dollar and bonds instead. With that being said, Wall Street benchmarks have climbed rose on Thursday, as investors reacted positively to the previous day's commentary from Federal Reserve offices that the aggressive pace of interest rate hikes could be tempered if growth suffered.

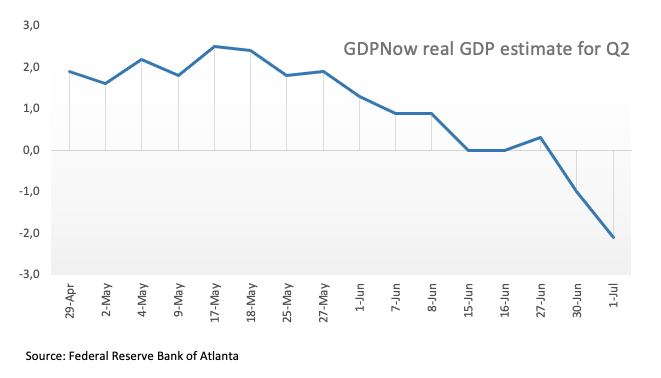

Meanwhile, the dollar index (DXY), which measures the currency against six counterparts, fell after Wednesday's peak of 107.27, a level not seen since late 2002. Investors are weighing the risks of a recession and whether interest rate hikes will be paused as global demand is under pressure. The Atlanta Fed's GDPNow model estimates seasonally adjusted GDP growth on an annual basis in the second quarter was -2.1%.

Minutes from the central bank's June policy meeting, where the Fed raised interest rates by a surprise 75 basis points, showed on Wednesday a firm restatement of its intent to get prices under control. Nevertheless, there was an acknowledgement that the risk of rate increases having a "larger-than-anticipated" impact on economic growth and judged that an increase of 50 or 75 basis points would likely be appropriate at the policy meeting in July.

For Friday, US Nonfarm Payrolls are expected to rise by 268,000 in June after an increase of 390,000 jobs in May, while the unemployment rate is expected to hold steady just above the pre-pandemic level. ''We expect employment to have continued to recover in February following the unexpectedly strong January report—despite the Omicron-led surge in COVID cases,'' analysts at TD Securities explained.

''That said, we look for some of last month's boost to fizzle, though to a still firm job growth pace. Wage growth likely slowed to a still strong 0.5% m/m, as the lower-wage workers affected by Omicron in January returned to work.''The analysts at TDS explained that a miss on the headline might provide a knee-jerk USD pullback, reflecting hopes of further dialling back of central bank hawkishness.''

Gold technical analysis

Gold is trading below the rising supporting trendline on the monthly time frame but the critical fractal lows are located at $1,676.

Meanwhile, in the prior day's analysis, it was acknowledged in the above chart that the price has been reaching a key area on the daily chart where bulls were expected to emerge from. A correction to mitigate the imbalance of bids in this sell-off could see the yellow metal correct with a 50% mean reversion on the cards:

What you need to take care of on Friday, July 8:

Financial markets were quieter on Thursday as risk-aversion paused, limiting the dollar’s strength. Global indexes closed in the green, although US Treasury yields soared as the focus remained on recession prospects.

The EUR/USD pair fell to a fresh 20-year low of 1.0143, pressured by the soft German data and the European Central June meeting Accounts. The Governing Council agreed it needed to preserve its credibility “by showing its resolve.” Some members still wanted to keep the door open for a larger rate hike in the July meeting, although President Christine Lagarde affirmed multiple times the hike would be 25 bps.

GBP/USD settled at 1.2020, helped by Prime Minister Boris Johnson's resignation. Following two days of political turmoil, Johnson finally stepped back as Conservative Party leader. He will remain in his charge until September when a replacement will be announced.

Commodity-linked currencies gained against the greenback, helped by the positive tone of equities. AUD/USD trades around 0.6840, while USD/CAD is down to 1.2970.

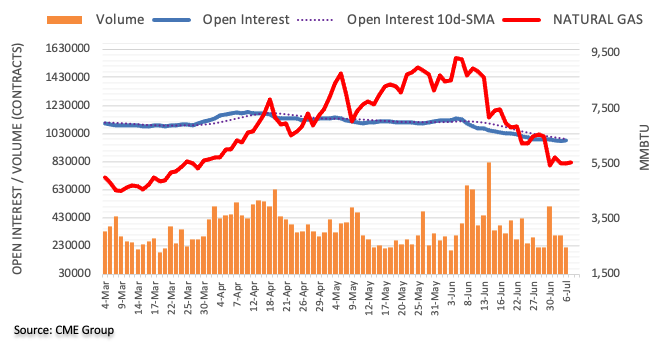

Crude oil prices were up, although modestly. The barrel of WTI is trading at $102.60 a barrel. US gas prices skyrocketed after the release of the EIA stocks report.

The greenback advanced vs the Swiss Franc, with the pair now at 0.9740. The USD/JPY pair remained within familiar levels, now trading at 136.00.

Overall, concerns about inflation and slowing economic growth remained as the main market motor. There are no changes to the gloom outlook, and risk aversion can soon return.

The focus on Friday will be on the US Nonfarm Payrolls report.

Like this article? Help us with some feedback by answering this survey:

- US crude oil prices, also known as WTI, reclaim the $100 figure on supply issues.

- Russia’s halt of a Kazaks terminal cut supply by 1.2 million BPD.

- WTI Price Analysis: Buyers stepped in around $95.00, eyeing the 100-DMA at around $107.00.

Oil prices rise on Thursday, jumping from weekly lows around $95.13, as the greenback retraces from two-year highs and recession fears abate. At the time of writing, Western Texas Intermediate (WTI) is trading at $102.71, rising almost 5%.

Crude oil prices advance sharply, bolstered by a weaker US dollar

Sentiment remains positive amongst investors. US equities are trading in positive territory while the greenback remains soft, a tailwind for oil prices. Also, Russia’s ordering a halt to a key Kazakh export terminal that usually loads 1.24 million barrels a day in July sparked supply fears amongst traders, spurring a rise in prices.

In the meantime, US energy inventories showed that Gasoline stockpiles fell, as reported by the US EIA on Wednesday. US crude stockpiles increased more than expected as inventories rose 8.23 million barrels last week.

WTI Thursday’s price action depicts that crude prices opened around $98.00 but slid near July’s 6 low around $95.09, but rose sharply, towards a daily high at around $104.45. However, an upslope previous support trendline turned resistance, exerted downward pressure on the black gold, which, although gaining, trades off the highs, above the $100 mark.

WTI Price Analysis: Technical outlook

On Wednesday, WTI prices fell towards the 200-day moving average around $93.50, but the downward move was capped by April’s 22 daily low at $95.34, though the price reached $95.13, bouncing later, and closing above July’s 5 $97.46 daily low.

Nevertheless, oil is upward biased, and a re-test of the $107.00 mark is on the cards. Oil’s first resistance would be $103.00. A breach of the latter will expose July’s 7 high at $104.45, followed by $105.00, and then the 100-DMA at around $107.04.

- USD/JPY bulls have moved in on the 136 area with eyes on slightly higher highs.

- The prospects for the daily char's bearish head & shoulders are eyed.

As per the pre-Topkyo analysis on Thursday, USD/JPY Price Analysis: Bears step on advances above 136.00, the pair dropped in for a brief spell in the 135.50s before claiming all the way back above 136.00. The bulls have reclaimed the area but for how long?

USD/JPY prior analysis, H1 chart

It was noted that the hourly candle has all of the makings for a strong bearish close with a focus on the 135.50s.

However, following a trip to the downside, the pair has crept higher with a high of 136.22 so far. Thus now begs the question,'' where now?''

It could be argued that a bearish head and shoulders are being formed on the daily chart:

This leaves prospects of higher, but limited moves for the day ahead on the four-hour chart:

CEO of the Federal Reserve Bank of St. Louis. James Bullard is crossing the wires and has said that rather than stagflation, a better bet is growth will slow to trend and that inflation will come under control rapidly.

Key comments

The labor market could cool off a little and still be strong.

We've got a good chance at a soft landing.

- The UK Prime Minister Boris Johnson resigned from his post and will remain until a new PM is elected.

- The greenback is trading soft amidst an increase in risk appetite.

- BoE’s Pill and Mann support a faster pace of rate hikes.

- Fed’s Waller backs 75 bps increases and added that the US economy is strong.

After a rough week in UK politics, the British pound reclaimed the 1.2000 level as UK Prime Minister Boris Johnson announced he would resign in autumn. However, he would remain as Prime Minister and announced that his government would not seek new policies or changes and would be left to the new PM. At the time of writing, the GBP/USD is trading at 1.2000.

GBP/USD advances on a soft US dollar, US Initial Jobless Claims rise

US equities remain positive during the day, reflecting recession fears waning and investors’ positive mood. Meanwhile, US Treasury yields rise, and the greenback retracts from 2-year highs, a tailwind for the GBP/USD. The US Dollar Index, a measure of the greenback’s value vs. its peers, has recovered some, up 013%, back above the 107.000 mark.

The financial markets have been in turmoil over the week. On Wednesday, the Federal Reserve revealed June’s monetary policy minutes, which showed the central bank’s pledging to tackle inflation, even at the expense of slower economic growth. Policymakers reiterated a 50 or 75 bps for the July meeting, and if inflation persists, they will take a “more restrictive” monetary policy stance.

In the meantime, Huw Pill, the Bank of England Chief Economist, said that he would consider a fast pace of interest rate rises to tackle high inflation from becoming entrenched. Also, Catherine Mann, a member of the BoE’s Monetary Policy Committee (MPC), said that she saw a case for faster rate hikes.

At the time of writing, Fed speakers are crossing the wires. St. Louis Fed President James Bullard said the US economic output is expected to continue expanding through 2022. At the same time, Fed’s Governor Christopher Waller backed a 75 bps rate hike in July and would like to step back to a 50 bps increase in September. Waller added that fears of a recession are overblown and that the US economy is strong.

The US economic docket reported Jobless Claims for the week ending on July 2. The figures came higher than expected, though the labor market showed moderation. Furthermore, the Balance of Trade shrank the deficit from -$86.7 billion to -$85.5 billion, spurred by a jump in exports.

What to watch

The US calendar on Friday will feature the New York Fed President John Williams crossing newswires and June’s Nonfarm Payrolls report, expected at 268K, from 390K in the previous reading. A subcomponent to look at is Average Hourly Earnings, expected at 5%, lower than May’s 5.2%.

GBP/USD Key Technical Levels

Federal Reserve's Christopher Waller (voter, hawk), who has been speaking at a virtual NABE event, said inflation is way too high and does not seem to be easing and the Fed has to ply more restrictive policy, Reuters reported.

He supports a 75bp rate hike at the July meeting and said the markets are already expecting hikes so let’s front-load rate hikes.

*Waller said that moves after the July rate hike will put the Fed into a more restrictive policy, so a 50bps hike in September is what he would favor. He added that recession worries are "overblown".

- Positive risk sentiment, Canadian trade data and crude oil prices favor the loonie.

- USD/CAD rejected again from above 1.3050.

- US and Canadian employment reports are due on Friday.

The USD/CAD dropped further during the American session and printed a fresh daily low at 1.2960. An improvement in risk sentiment weighed on the pair ahead of the key economic data.

Markets recovers, dollar retreats

Data released in Canada showed an unexpected sharp widening in the trade surplus that helped the loonie. Also, higher equity prices contribute to weakening the dollar. The Dow Jones is up by 0.85% and the S&P 500 gains 1.19%. Commodity prices are also higher. Crude oil prices are up by more than 5%, adding to CAD strength.

Traders will continue to look at market sentiment as a key driver in USD/CAD’s price action. On Friday, economic data will also play a critical role. Employment numbers are due in both, Canada and the US.

Another failure above 1.3000

The USD/CAD once again was rejected from above 1.3050 like what happened in May and June. The ongoing correction below 1.2960 could extend to the 20-day Simple Moving Average at 1.2930.

On the upside, the dollar faces immediate resistance at 1.3015, followed by 1.3045. A daily close well above 1.3050 should open the doors to more gains.

- Australia’s Trade Balance surplus, China’s stimulus, and a soft US dollar propelled the AUD/USD higher.

- US Initial Jobless Claims rose more than expected, showing moderation in the labor market.

- Fed’s Waller and St. Louis Fed President Bullard to cross wires later.

The Australian dollar erases Wednesday’s losses and is rising towards the June 14 swing low at around 0.6850, but has faced some resistance and retraced some 25 pips towards the 0.6820s region. At 0.6839, the AUD/USD portrays an upbeat market mood, which augments the appetite for riskier assets.

AUD/USD is rising on positive sentiment, higher Iron ore prices and a soft US dollar

Worldwide equities are trading in the green, bolstered by waning recession fears and China’s allowing local governments to issue $220 USD billion of debt in an infrastructure program to boost 2022 GDP. Meanwhile, a senior US official at the Secretary of State said that Secretary Blinken would not announce lifting tariffs to China’s products at his meeting with a Chines Foreign Minister.

The AUD/USD got bolstered by positive data in the Asian session. Australia’s Trade Balance printed a 9.5% MoM surplus in May, exceeding expectations, fueled by a jump in coal, coke, and briquette exports. Also, Iron Ore prices uptick to $115.14 a ton, a tailwind for the Aussie.

That said, the AUD/USD rose above the 0.6800 mark and extended its gains to print the daily high around the R2 daily pivot at 0.6848.

Meanwhile, the US calendar reported Jobless Claims for the week ending on July 2. The figures came higher than expected, though the labor market showed moderation. Furthermore, the Balance of Trade shrank the deficit from -$86.7 billion to -$85.5 billion, spurred by a jump in exports.

What to watch

The US calendar will feature Fed speakers in the week ahead, with Christopher Waller and St. Louis Fed President James Bullard, on Thursday. By Friday, the New York Fed President John Williams would cross wires, and the US Nonfarm Payrolls report for June will shed some light regarding the labor market conditions. Traders should also note the Average Hourly Earnings to check for hints of a wage-price spiral that could keep US inflation higher.

AUD/USD Key Technical Levels

Bank of England Chief Economist Huw Pill said on Thursday that he would be willing to adopt a faster pace of policy tightening if needed, as reported by Reuters.

"My focus of attention will be on indications of more persistent inflationary pressures," Pill added.

Earlier in the day, BOE policymaker Catherine Mann argued that the uncertainty about the inflation process was strengthening the case for front-loading interest rate rises.

Market reaction

The British pound edged slightly higher against its major rivals on these hawkish comments. As of writing, the GBP/USD pair was trading at 1.2007, where it was up 0.65% on a daily basis.

The US trade gap narrowed to the smallest deficit in six months as export growth outpaced imports for the second consecutive month, point out analysts at Wells Fargo. They see that the tide is turning on domestic demand, which should continue to quell import growth from the breakneck pace that took place throughout the pandemic.

Key Quotes:

“As domestic demand for goods continues to roll over, however, overall import growth should continue to cool. Total goods imports remain a whopping 42% above pre-pandemic February 2020 levels as of May (chart). The need to restock inventory and obtain seasonal product ahead of the holiday season will keep imports rolling in, but we expect import growth to cool from the breakneck pace seen throughout the pandemic which helped meet rapid demand for consumer goods.”

“Crude oil represented the largest dollar gain of both exports (+$1.1 billion) and imports (+$950 million) in May, but as with most economic data today, we must consider these gains in the context of higher prices.”

“More broadly, the real U.S. goods trade deficit widened to $116.6 billion in May. After adjusting for higher prices, both real goods exports and imports declined, but exports did so at a faster rate, slipping 1.3% compared to the 0.7% drop in real goods imports. Still, the trade data for April and May positions net exports to provide a sizable positive contribution to headline growth in the second quarter, likely somewhere around a 1.0 percentage point contribution to top-line.”

“With domestic demand having outpaced demand in many of America's major trading partners throughout the pandemic, Q2 will mark the first time in seven quarters trade has positively contributed to headline growth.”

According to the Federal Reserve Bank of Atlanta's GDPNow model, the US economy is expected to contract by 1.9% in the second quarter, up slightly from the July 1 forecast of -2.1%.

"After this week's releases from the Institute for Supply Management, the US Census Bureau, and the US Bureau of Economic Analysis, the nowcasts of second-quarter real personal consumption expenditures growth and real gross private domestic investment growth increased from 0.8% and -15.1%, respectively, to 1.3% and -14.9%, respectively, while the nowcast of the contribution of the change in real net exports to second-quarter GDP growth decreased from 0.38 percentage points to 0.21 percentage points," Atlanta Fed explained in its publication.

Market reaction

The greenback preserves its strength after this report and the US Dollar Index was last seen rising 0.05% on the day at 107.10.

Data released on Thursday showed an increase in the trade surpluses from CAD 2.17 billion to 5.32 billion in May. Analysts at CIBC warn the increase could be temporary considering it was driven in part by a strengthening in oil prices which has reversed more recently.

Key Quotes:

“The goods trade surplus widened sharply in May, although the move was driven in part by a strengthening in oil prices which has reversed more recently. The $5.3bn surplus was up from a revised $2.2bn in April (prior $1.5bn), was the widest since August 2008 and was well above the consensus forecast. On the services side, the deficit narrowed slightly from $1.3bn in April to $1.1bn in May. That left the overall trade surplus at $4.2bn, from $900mn in the prior month.”

“Today's sharp widening in the Canadian trade surplus could be as good as it gets for now, given that energy prices have fallen relative to where they stood in May and that imports will likely rebound ahead alongside the reopening in China. However, some of the strength in non-energy exports, such as potash, copper and other metals/minerals could persist if Canadian companies are able to raise production and offset some of the holes left in the global supply chain by the sanctions imposed on Russia following its invasion of Ukraine.”

- The yellow metal got bolstered by an upbeat sentiment and a soft US dollar.

- Gold’s recovery might be short-lived as US Treasury yields rise, a headwind for XAUUSD’s prices.

- Gold Price Forecast (XAUUSD): Could uptick towards $1760 before continuing to the downside.

Gold (XAUUSD) spot bounces off the multi-month lows at around $1730s and grinds higher during the North American session as recession fears fade, and investors cheered China’s stimulus. At the time of writing, XAUUSD is trading at $1741.48 a troy ounce, slightly up 0.17%.

Positive sentiment and a soft greenback boosts gold's demand

Global equities are rallying, while the Fed’s last monetary policy minutes further cemented the case for a 75 bps rate hike in July, and the greenback recedes from 2-year highs, as shown by the US Dollar Index, back below the 107.000 figure. The yellow metal price jumped as relief, though any upward moves might be capped by rising US Treasury yields, with the US 10-year yield rising four bps, at 2.970%.

On Monday, rumors that the US might lift tariffs on China’s products remain as that. A Senior US Department of State said that no announcement is expected from Secretary Blinken at his meeting with China’s Foreign Minister Wang Yi. Earlier during the Asian session, according to Bloomberg, China was considering allowing local governments to sell $220 billion of special bonds in an infrastructure program, shifting sentiment positively, which weighed on the US dollar.

In the meantime, the US economic docket unveiled the Initial Jobless Claims for the week ending on July 2, which rose by 235K, higher than the 230K, and 4K more than the 231K in the previous week. The report shows some moderation in the tight labor market, as claims spiked the most since January. At the same time, the Balance of Trade showed the deficit contracted to -$85.5 billion, vs. -$86.7B in the previous month, courtesy of an uptick in Exports.

In the week ahead, the US calendar will feature Fed speakers, with Christopher Waller and St. Louis Fed President James Bullard. On Friday, the US Nonfarm Payrolls report, and the New York Fed President John Williams.

Gold Price Forecast (XAUUSD): Technical outlook

From the daily chart perspective, the XAUUSD bias is downwards. However, oscillators meandering around the oversold territory, with RSI at 27.27, might open the door for traders to book profits ahead into the weekend. If that scenario plays out, the XAUUSD’s first resistance would be December 15, 2021, low at $1752.35, followed by the July 5 daily low at $1763.82, before resuming to the downside.

- ECB minutes show some members want to keep the door open to a larger increase in July.

- Markets hold onto gains, S&P 500 up by 1.09%.

- EUR/USD heads for lowest daily close since December 11, 2002.

The EUR/USD failed to hold onto daily gain and fell to test the 1.0160 area. A weaker euro pushed the pair to the downside despite a recovery in equity prices.

The immediate support is the 1.0160 area and a break lower would expose 1.0120. On an intraday basis, a recovery above 1.0190 should help the euro return to 1.0200. The next resistance levels are located at 1.0220 followed by 1.0235.

EUR/USD unable to recover

Despite the improvement in market sentiment, that continues to be among the weakest currencies and facing forecasts of a slide to parity in EUR/USD. Doubts about the anti-fragmentation instrument weigh on the euro. The US Dollar Index is falling marginally hovering around 107.00.

US yields are higher supporting the greenback. The US 10-year yield stands at 2.99%, and the 30-year at 3.17%. The Dow Jones rises by 0.95% and the S&P 500 gains 1.22%.

The European Central Bank released the minutes from its latest meeting. According to economists at Commerzbank, the document revealed strong discontent among members regarding the inflation outlook. “Given the reasoning of Council members at the June meeting, a 50 basis point increase in policy rates cannot be ruled out at the upcoming July meeting. We are sticking to 25 basis points in our baseline scenario mainly because a majority of recent statements by Council members still signals this.”

In the US, economic data showed an increase in Initial Jobless Claims and a narrower trade deficit in May. The numbers were ignored by market participants. On Friday, the official employment report is due. Market consensus is for an increase of 270K in jobs and the unemployment rate to remain at 3.6%. “Recession has dominated market psychology. A stronger payrolls report will challenge the risk of that near-term. We look for this to add to USD resilience particularly with EURUSD inevitably en route to parity,” said analysts at TD Securities.

Technical levels

European Central Bank (ECB) Governing Council member Yannis Stournaras noted on Thursday that they are not observing excessive wage demand in Europe, as reported by Reuters.

In the meantime, ECB policymaker and Governor of the Central Bank of Cyprus Constantinos Herodotou said that they are not targeting exchange rates while adding that they do take their impact on inflation into account.

Market reaction

The shared currency stays on the back foot following these comments and the EUR/USD pair was last seen posting small daily losses at 1.0172.

The US Bureau of Labor Statistics (BLS) will release the May jobs report on Friday, July 8 at 12:30 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of 10 major banks regarding the upcoming employment data.

Expectations are for a 270K rise in Nonfarm Payrolls following the 390K increase in May. Meanwhile, the Unemployment Rate is set to remain unchanged at 3.6%.

NBF

“Payrolls may have increased 225K. The household survey is expected to show a similar gain, a development which could leave the unemployment rate unchanged at 3.6%, assuming a one-tick increase in the participation rate to 62.4%.”

RBC Economics

“We expect an increase of 300K jobs in the US in June fuelled by the recovery in close-contact service industries. As in Canada, tight labour markets will continue to limit employment growth. The unemployment rate is expected to hold steady at 3.6%.”

Commerzbank

“We expect an increase of a still solid 250K. That said, it is probably only a matter of time before bad numbers come from the labor market as well.”

CIBC

“A slowdown in the interest-sensitive construction and real estate sectors could have combined with worries about domestic demand, as inflation erodes purchasing power, to slow hiring to 200K in the US in June. With a rise in the participation rate possible, the unemployment rate could have remained at 3.6%, which could also reflect slower job growth in the household survey, as it’s closer to its pre-pandemic level than its payrolls counterpart. Wage growth likely continued at a 0.3% monthly pace, well below growth in prices. We’re below the consensus which could be negative for the USD and see bond yields fall.”

TDS

“Employment likely continued to advance firmly in June but at a more moderate pace after three consecutive job gains of around 400K in March-May. We also look for the UE rate to stay unchanged at 3.6% for a fourth straight month, and for wage growth to remain steady at 0.3% MoM (5.0% YoY).”

ING

“We think payrolls may grow somewhere in the 250-300K range, which should still be enough to keep the unemployment rate at 3.6% and wages continuing to tick higher. For us to seriously consider changing our July Fed call we would need to see payrolls growth fall with the unemployment rate moving a couple of tenths higher and wage growth showing signs of stagnating. Even then we would still probably need to see a surprisingly large decline in inflation the following week.”

SocGen

“Employment gains are slowing, and we view this as inevitable as more of the unemployed have found jobs and the unemployment rate has dropped well below 4%. Strong employment, however, is how we interpret an increase of nearly 300K jobs in a month. Trucking, delivery, food services and healthcare remain areas of recovery and growth for job markets. We expect the unemployment rate to edge back down to 3.5% for June, possibly very soon. A rising labor force participation rate (more people entering the labor force) is one pro-growth factor that can steady the unemployment rate, preventing a decline, even when the economy is strong. Later, as businesses reduce their demand for labor, smaller job gains are why the unemployment rate stabilizes or begins to rise.”

Deutsche Bank

“We expect payrolls to slow to 225K but with unemployment falling a tenth to 3.5%.”

Citibank

“Citi: 290K, prior: 390K; Private Payrolls – Citi: 240K, prior: 333k; Average Hourly Earnings MoM – Citi: 0.4%, prior: 0.3%; Average Hourly Earnings YoY – Citi: 5.1%, prior: 5.2%; Unemployment Rate – Citi: 3.5%, prior: 3.6%. We expect a continued slowing in the average monthly pace of job gains, with 290K jobs added in June. This would still be a strong monthly increase, but in line with expectations that job growth should slow over the course of this year. Much of this expectation has been based on the idea that lack of supply of workers will limit the pace of hiring but the impact of weaker growth expectations could also start to weigh on demand for workers.”

Wells Fargo

“We forecast NFP to rise 240K in June and look for the unemployment rate to hold steady at 3.6%. Labor demand is showing signs of topping out, albeit at an elevated level, as evidenced by the job openings rate hovering around 7.0% since the beginning of the year. With a larger pool of available candidates, small business compensation plans have softened. We forecast average hourly earnings to rise 0.3% month-over-month in June.”

- USD/TRY extends further the breakout of the 17.00 level.

- The lira remains weak in line with the rest of the risk complex.

- Current Account and End Year CPI Forecast next on Friday.

Another day, another drop in the Turkish lira, and this time lifting USD/TRY further north of the recently broken 17.00 yardstick.

USD/TRY up on stronger dollar

USD/TRY advances for the sixth session in a row so far, gaining already 8% since the lows near the 16.00 neighbourhood on June 27 in response to the Turkish banking watchdog (BDDK) announcement of a ban on lira loans to certain companies with strong FX positions.

In the meantime, the strong upside momentum in the greenback continues to heavily weigh on the risk complex and the EM FX universe, putting TRY under extra selling pressure.

No releases on Thursday in Türkiye should leave all the attention to Friday’s publication of May’s Current Account and End Year CPI Forecast for the month of July.

It is worth recalling that markets in Türkiye will close earlier on Friday in observance of the Eid-al-Adha holiday.

What to look for around TRY

USD/TRY keeps heading north – and the lira continues to give away gains - after bottoming out in the 16.00 zone in late June, as investors appear to have already digested the latest announcement by the BDDK.

So far, the lira’s price action is expected to keep gyrating around the performance of energy prices, the broad risk appetite trends, the Fed’s rate path and the developments from the war in Ukraine.

In addition, the effects of this new measure aimed at supporting the de-dolarization of the economy will also have its say, at least in the very short term.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating, real interest rates remain entrenched in negative figures and the political pressure to keep the CBRT biased towards low interest rates remain omnipresent.

Key events in Türkiye this week: Inflation Rate, Producer Prices (Monday) – Current Account, End Year CPI Forecast (Friday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.32% at 17.2441 and faces the immediate target at 17.3759 (2022 high June 23) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level). On the other hand, a breach of 16.0365 (monthly low June 27) would pave the way for a test of 15.6684 (low May 23) and finally 15.4281 (100-day SMA).

- Silver edged higher on Thursday and moved further away from a two-year low touched overnight.

- Last week’s breakdown through descending trend-channel support still favours bearish traders.

- Oversold RSI on the daily chart warrants some caution before positioning for any further decline.

Silver gained some positive traction on Thursday and built on the previous day's modest rebound from sub-$19.00 levels or a two-year low. The XAG/USD held on to its gains through the early North American session and was last seen trading near the daily high, just below the mid-$19.00s.

Given last week's convincing breakthrough a nearly one-month-old descending channel, the bias remains tilted in favour of bearish traders. That said, RSI (14) on the daily chart is still flashing oversold conditions and warrants some caution before positioning for any further losses.

This makes it prudent to wait for some near-term consolidation or a further recovery before the XAG/USD resumes its downward trajectory. Hence, any subsequent move up is more likely to remain capped near the descending channel support breakpoint, around the $20.00 psychological mark.

The said handle is followed by the weekly high, around the $20.20 region, which if cleared decisively would suggest that the XAG/USD has formed a near-term bottom and prompt some short-covering. Spot prices might then accelerate the recovery towards the $20.65 horizontal resistance.

On the flip side, the $19.25-$19.20 area now seems to protect the immediate downside ahead of the YTD low, around the $19.00-$18.90 region. Some follow-through selling would make the XAG/USD vulnerable to testing the $18.00 mark before eventually dropping to the $17.65 support zone.

Silver 4-hour chart

-637927989206329530.png)

Key levels to watch

The Bank of England (BOE) should have heightened awareness of the roles of the sterling at the time of high inflation, BOE policymaker Catherine Mann said on Thursday, as reported by Reuters.

"In the near term, tighter US monetary policy tends to boost UK inflation because of the weaker pound," Mann further elaborated. "A robust policy response to avoid near-term augmentation of inflation dynamics is appropriate in today's environment."

Market reaction

The GBP/USD pair edged slightly higher on these comments and was last seen gaining 0.5% on the day at 1.1988.

- NZD/USD staged modest recovery from the YTD low and snapped a two-day losing streak.

- A positive risk tone prompted some USD profit-taking and benefitted the risk-sensitive kiwi.

- The technical setup supports prospects for an extension of a well-established bearish trend.

The NZD/USD pair gained some positive traction on Wednesday and moved away from the YTD low touched earlier this week. The uptick assisted spot prices to snap a two-day losing streak, though lacked bullish conviction and stalled just ahead of the 0.6200 round-figure mark.

A slight recovery in the global risk sentiment prompted some profit-taking around the safe-haven US dollar and extended support to the risk-sensitive kiwi. That said, the prospects for more aggressive Fed rate hikes helped limit the USD downfall and capped gains for the NZD/USD pair.

Looking at the broader picture, the recent decline witnessed over the past three weeks or so has been along a downward sloping channel and point to a well-established short-term bearish trend. Moreover, bearish oscillators on the daily chart are still away from being in the oversold territory.

The technical set-up suggests that any subsequent move up might still be seen as a selling opportunity and runs the risk of fizzling out quickly. Hence, any subsequent move up is likely to remain capped near the descending channel resistance, currently around the 0.6225 region.

The said barrier is followed by the 0.6260 supply zone, which now coincides with the 100-period SMA on the 4-hour chart and should act as a key pivotal point. Sustained strength beyond would indicate that the NZD/USD pair has formed a near-term bottom and trigger a short-covering move.

On the flip side, the 0.6135-0.6125 region (YTD low) now seems to protect the immediate downside ahead of the descending channel support, just ahead of the 0.6100 mark. A convincing break below would be seen as a fresh trigger for bearish traders and pave the way for further losses.

NZD/USD 4-hour chart

-637927967637954032.png)

Key levels to watch

Bank of England (BOE) policymaker Catherine Mann noted on Thursday that they are seeing very high inflation expectations over a one-year horizon in the UK, as reported by Reuters.

"High inflation expectations may feed into inflation today," Mann added. "The uncertainty about inflation process strengthens the case for front-loading interest rate rises."

Market reaction

These comments don't seem to be having a significant impact on the British pound's performance against its major rivals. As of writing, the GBP/USD pair was up 0.3% on a daily basis at 1.1965.

S&P 500 is edging higher. However, analysts at Credit Suisse look for key resistance at 3946/70 to cap the market to keep the short-term risks skewed lower over the next two-four weeks.

Technical indicators point to further weakness on a 2-4 week horizon

“S&P 500 is expected to remain capped below the top of this trend channel at 3946/70, with further short-term weakness over the next 2-4 weeks.”

“Support is seen at 3842/39, below which would open up a retest of the 3637/33 low 2022 low. We note that the next support below here is seen at 3600/3594, then the key 50% retracement support at 3522/3500, which now coincides with the bottom of the aforementioned trend channel.”

“Resistance is seen at 3946, then the bottom of the price gap from June and the channel top at 3970/74, which we look to cap to maintain the short-term downward pressure on equity markets. A break would significantly improve the short-term technical outlook, with the next key resistance seen at 4017/19, then 4074/4088, which includes the 63-day average.”

- EUR/USD’s bullish attempt runs out of gas near 1.0220.

- Further retracements look likely in the near term.

EUR/USD climbs as high as the 1.0220 region, although the move lacks follow through.

The pair’s bearish stance stays everything but abated for the time being. Against that, there is a minor support level at 1.0060 (low December 11 2002) prior to a test of the key parity area.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.1078.

EUR/USD daily chart

- Goods and services deficit in the US narrowed at a softer pace than expected in May.

- US Dollar Index holds steady at around 107.00.

The data published by the US Census Bureau showed on Thursday that the goods and services deficit narrowed by $1.1 billion to $85.5 billion in May. This reading came in slightly higher than the market expectation for a deficit of $85 billion.

"May exports were $255.9 billion, $3.0 billion more than April exports," the publication further read. "May imports were $341.4 billion, $1.9 billion more than April imports."

Market reaction

This report doesn't seem to be having a noticeable impact on the dollar's performance against its rivals. As of writing, the US Dollar Index was posting small daily losses at 106.95.

- Initial Jobless Claims rose by 4,000 in the week ending July 2.

- US Dollar Index consolidates weekly gains near 107.00 after the data.

There were 235,000 initial jobless claims in the week ending July 2, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 231,000 and came in slightly higher than the market expectation of 230,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1% and the 4-week moving average was 232,500, an increase of 750 from the previous week's average.

"The advance number for seasonally adjusted insured unemployment during the week ending June 25 was 1,375,000, an increase of 51,000 from the previous week's revised level," the publication read.

Market reaction

The US Dollar Index showed no immediate reaction to these figures and was last seen moving sideways around 107.00.

- USD/JPY edged lower on Thursday amid a modest USD pullback from a two-decade high.

- A positive risk tone undermined the safe-haven JPY and acted as a tailwind for the pair.

- The divergent Fed-BoJ policy stance supports prospects for the emergence of dip-buying.

The USD/JPY pair attracted some selling on Thursday and retreated nearly 70 pips from the daily high, around the 136.20 region. The pair remained on the defensive through the early North American session and was last seen hovering near the lower end of its intraday trading range, just above mid-135.00s.

Following the recent strong bullish run to a 20-year peak, modest US dollar profit-taking turned out to be a key factor that exerted downward pressure on the USD/JPY pair. The downside, however, remains cushioned amid a recovery in the risk sentiment, which tends to undermine the safe-haven Japanese yen.

Reports indicated that China is looking at a $220 billion fiscal stimulus program in the second half of 2022 to shake off the ongoing real estate crisis and revive consumer demand in the economy. This boosted investors' confidence, which was evident from a generally positive tone around the equity markets.

Apart from this, the divergent monetary policy stance adopted by the Federal Reserve and the Bank of Japan supports prospects for the emergence of some dip-buying around the USD/JPY pair. In fact, the June FOMC meeting minutes indicated that another 50 or 75 bps rate hike is likely at the July meeting.

In contrast, the BoJ is expected to retain its ultra-low interest rate policy at the next meeting later this month. Meanwhile, the prospects for a more aggressive policy tightening by the Fed, along with reduced safe-haven demand, lifted the US Treasury bond yields, which further validates the positive outlook.

On the economic data front, the US Weekly Initial Jobless Claims unexpectedly rose to 235K during the week ended July 1 as against the 230K anticipated. The data failed to provide any meaningful impetus to the USD/JPY pair, though the fundamental backdrop seems tilted in favour of bullish traders.

Technical levels to watch

Gold bugs are falling like dominoes. Economists at TD Securities highlight that the yellow metal could suffer a major capitulation event.

Price slump catalyzes massive CTA shot acquisiton program

“We see evidence that the steepest outflows from broad commodity funds since the covid crisis may be catalyzing a series of cascading liquidations from various speculative groups. This argues for substantial downside for gold in coming sessions as participants are forced to sell in a vacuum.”

“Indiscriminate selling by broad commodity funds has weighed on price action in gold. Moreover, it has likely catalyzed a massive CTA selling program as trend followers respond to deteriorating momentum.”

“We have cautioned that the substantial size accumulated by proprietary traders during the pandemic appears complacent. In a liquidation vacuum, these positions are now vulnerable.”

- DXY retreats from recent cycle tops near 107.30 (July 7).

- Overbought conditions spark the current technical drop.

DXY comes under selling pressure following four consecutive daily advances and revisits the sub-107.00 area on Thursday.

Further upside in the dollar remains in store in the short-term horizon, however. Against that, the index could now look to revisit the December 2002 top at 107.31 ahead of the October 2002 high at 108.74.

As long as the 4-month line near 102.60 holds the downside, the near-term outlook for the index should remain constructive.

In addition, the broader bullish view remains in place while above the 200-day SMA at 98.39.

Of note, however, is that the index trades in the overbought territory and it therefore could extend the corrective decline to, initially, the 105.80 region (high June 15).

DXY daily chart

- A combination of factors dragged EUR/GBP to a nearly four-week low on Thursday.

- Recession fears continued weighing on the shared currency and acted as a headwind.

- Reduced political uncertainty lifted sterling and further contributed to the selling bias.

The EUR/GBP cross prolonged its recent pullback from the 0.8680 region and continued losing ground for the fourth successive day on Wednesday. The downward trajectory dragged spot prices to a nearly four-week low, with bears now awaiting sustained weakness below the 0.8500 psychological mark.

The shared currency continued with its relative underperformance amid the ongoing energy crisis in Europe, which could drag the region's economy faster and deeper into recession. The market worries were further fueled by European Commission chief Ursula von der Leyen's warning on Wednesday, saying that the EU needs to make emergency plans to prepare for a complete cut-off of Russian gas.

On the other hand, the British pound drew some support from modest US dollar pullback from a two-decade high and the prospect of reduced political uncertainty. In the latest development, UK Prime Minister Boris Johnson announced his resignation, marking the end of the recent political drama in the country. Johnson's departure, however, was almost a certainty and largely priced in by markets.

Furthermore, investors remain worried that the UK government's controversial Northern Ireland Protocol Bill could trigger a trade war with the European Union. Apart from this, expectations that the Bank of England would adopt a gradual approach towards raising interest rates amid growing recession fears acted as a headwind for sterling. This, in turn, should limit losses for the EUR/GBP cross.

Hence, any subsequent downfall is more likely to find decent support near a technically significant 200-day SMA, currently around the 0.8445 region, which should act as a strong base for the EUR/GBP cross. That said, a convincing break below would be seen as a fresh trigger for bearish traders and set the stage for a further near-term depreciating move.

Technical levels to watch

The accounts of the European Central Bank's (ECB) June policy meeting showed on Thursday that Governing Council members agreed the revised medium-term inflation outlook required further steps to be taken in normalising monetary policy.

Key takeaways as summarized by Reuters

"Members agreed that it was imperative for the ECB to preserve its credibility by showing its resolve."

"Members saw important differences, however, with price pressures in the United States more related to overheating domestic demand and those in the euro area reflecting, to a larger extent, imported inflation."

"Determined action was judged to be needed."

"If the monetary policy stance were normalised too slowly, monetary policy risked adding to demand pressures."

"Question was raised whether the assumptions behind the baseline were too benign."

"Most measures of longer-term inflation expectations appeared to be still broadly anchored."

"Risk that there would eventually be a deterioration in employment."

"It was generally considered that stagflation was an unlikely outcome."

"Inflationary pressures from re-opening in the tourism sector, which had been prominent in the may figures, were likely to continue in the coming months as tourism opened up more widely."

"Necessary to avoid gradualism being seen as precluding interest rate steps in excess of 25 basis points.."

"Taking the indirect effects of energy prices out of the core inflation projection would result in a 2.0% projection for core inflation in 2024."

"Necessary to look beyond negotiated wage growth and consider all elements affecting actual wage growth."

"Gradualism should not necessarily be interpreted as slow action in small steps."

"Remark was made that a normalisation of monetary policy according to the rate path currently priced by markets, which was already included in the technical assumptions, would not be sufficient to bring inflation back to 2% over the medium term."

"A number of members expressed an initial preference for keeping the door open for a larger hike at the July meeting."

"The implied “delay” in raising interest rates should, in principle, be offset by implementing a larger rate hike in July or by indicating more explicitly the possibility of a larger interest rate move later in the third quarter."

Market reaction

The shared currency failed to benefit from the ECB's publication and was last seen posting small daily gains at 1.0185.

- EUR/JPY attempts a mild rebound following Wednesday’s pullback.

- Immediately to the downside appears the 100-day SMA.

EUR/JPY manages to regain some composure and advances beyond 139.00 the figure, although gains did not stick so far.

The cross now faces prospects for extra decline after breaking below the 4-month support line, today around 139.45. That said, the next contention appears at the July low at 137.26 (July 6) ahead of the 100-day SMA, today at 135.93.

In the longer run, the constructive stance in the cross remains well propped up by the 200-day SMA at 133.03.

EUR/JPY daily chart

In a statement delivered outside Number 10 Downing Street on Thursday, British Prime Minister Boris Johnson announced his resignation, saying that it was clear the Conservative Party needed a new leader.

Key takeaways

"The timetable will be announced next week."

"I will serve until there is a new leader in place."

"The reason I have fought so hard is because I felt it was my duty."

"I am immensely proud of my achievements."

"We will continue to back Ukraine."

"The economic scene is difficult."

"It is painful not to see my term through."

"In politics no one is indispensable."

Market reaction

The GBP/USD pair showed no immediate reaction to this development and was last seen rising 0.4% on the day at 1.1980.

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting comment on the recent interest rate decision by the BNM.

Key Takeaways

“Bank Negara Malaysia (BNM) delivered a back-to-back interest rate hike for the first time since 2010 today (6 Jul) with the Overnight Policy Rate (OPR) rising by 25bps to 2.25%. The decision was in line with market expectations, whereby 18 (including us) out of 19 polled by Bloomberg expected a 25bps hike while one expected no change.”

“In the latest monetary policy statement (MPS), BNM continued to cast a positive view on Malaysia’s economy despite rising global headwinds. Malaysia’s economy showed signs of firmer growth supported by the transition to endemicity, easing of restrictions and reopening of international borders. BNM signaled that headline inflation may be higher in some months due to base effect from electricity prices. However, upward inflation pressures are expected to be partly contained by existing price controls, fuel subsidies, and continued spare capacity.”

“BNM reiterated a ‘measured and gradual’ rate hike path going forward and its pledge to keep the OPR ‘accommodative and supportive of growth’ in the latest MPS. The current growth and inflation dynamics would allow BNM to deliver another 25bps rate hike at the next MPC meeting on 7-8 Sep. We maintain our OPR target at 2.50% by year-end, and 3.00% by mid-2023.”

The Chinese economy is recovering but the foundation for recovery is not solid yet, Chinese Premier Li Keqiang told the state media on Thursday, as reported by Reuters.

"We will keep economic operations within a reasonable range," Li added. "China will keep opening up no matter how the international situation changes."

Market reaction

These comments were largely ignored by market participants. As of writing, US stock index futures were up between 0.3% and 0.4% on the day, suggesting that Wall Street's main indexes are likely to open in positive territory.

The European Central Bank (ECB) is still working on the details of the new anti-fragmentation tool, Bloomberg reported on Thursday.

ECB policymakers are said to not show certainty that the new tool will be ready by the next policy meeting on July 21st.

Market reaction