- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

- Japan’s Tokyo CPI inflation fell below forecasts early Friday.

- US data confounded rate-hungry investors on Thursday.

- Markets await BoJ rate call, US PCE Price Index figures.

Japan’s Tokyo Consumer Price Inflation (CPI) inflation printed well below expectations early Friday, which will complicate the Bank of Japan’s (BoJ) upcoming rate call and Monetary Policy Report, due during the Pacific market session.

Tokyo CPI inflation rose only 1.8% on an annualized basis in April, well below the previous print of 2.6%. Markets were broadly expecting Tokyo inflation to hold steady over the period.

Read more: Tokyo Consumer Price Index rises 1.8% YoY in April vs. 2.6% expected

US Gross Domestic Product (GDP) also eased faster than expected, prompting discouragement in risk appetite on Thursday. Further complicating matters, US Personal Consumption Expenditure (PCE) inflation remained stubbornly higher in the first quarter than investors hoping for Federal Reserve (Fed) rate cuts were hoping for.

US PCE Price Index inflation will deliver a fine-tuned look at US inflation later Friday. US MoM Core PCE Price Index numbers for March are forecast to hold steady at 0.3%.

With the Japanese Yen (JPY) trading into multi-year lows across the board, the BoJ is expected to begin weighing market interventions. According to reporting by Nikkei, the Japanese central bank is expected to discuss intervention options to help bolster the battered Yen.

USD/JPY technical outlook

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

The USD/JPY pair is on pace to close bullish for a fourth consecutive month, and is up 10.4% in 2024.

USD/JPY hourly chart

USD/JPY daily chart

The headline Tokyo Consumer Price Index (CPI) for April rose 1.8% YoY, compared to a 2.6% rise in the previous reading, the Statistics Bureau of Japan showed on Friday. Meanwhile, the Tokyo CPI ex Fresh Food, Energy increased 1.8% YoY versus 2.7% expected and the previous reading of 2.9% rise.

Additionally, Tokyo CPI ex Fresh Food rose 1.6% for the said month, below the market consensus of 2.4%.

Market reaction

As of writing, the USD/JPY pair was down 0.01% on the day at 155.63.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

- USD/CAD remains on the defensive around 1.3655 on Friday amid the weaker USD.

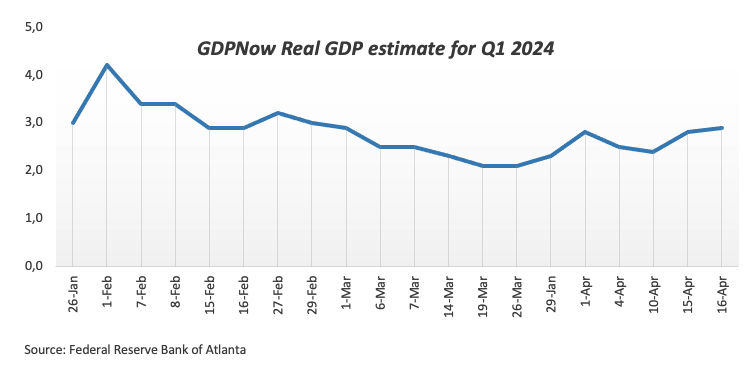

- US GDP number expanded by 1.6% on an annualized basis in Q1 2024, compared to 3.4% growth in Q4 2023.

- The weaker Canadian Retail Sales data triggered speculation that the BoC might start cutting interest rates in June.

The USD/CAD pair extends its downside near 1.3655 on Friday during the early Asian session. The decline of the US Dollar (USD) to the two-week lows around the mid-105.00s exerts some selling pressure on the pair. Investors now shift their focus to the release of US Personal Consumption Expenditures (PCE) Price Index data, due later on Friday.

The US economy grew at its slowest pace in nearly two years in the first quarter (Q1) of 2024 as prices rose at a faster pace, the Commerce Department revealed on Thursday. The first estimate of US Gross Domestic Product (GDP) grew by 1.6% on an annualized basis in the January-March period, compared to a 3.4% growth in Q4 2023. This reading came in below the market consensus of 2.5%. Additionally, US Personal Consumption Expenditures Prices rose at an annualized rate of 3.4% in Q1, nearly double the 1.8% pace recorded in Q4 2023.

The weaker-than-expected GDP growth and hotter-than-expected inflation weigh on the Greenback and create a headwind for USD/CAD. The markets expect the US Federal Reserve (Fed) to begin the first rate cuts in September, with traders now pointing to just one rate cut in 2024 following the GDP data, according to the CME FedWatch tool.

On the Loonie front, the weaker Canadian Retail Sales data on Wednesday triggered speculation that the Bank of Canada (BoC) might start cutting interest rates at its next meeting in June, which might drag the Canadian Dollar (CAD) lower. Nonetheless, the rebound of crude oil prices provides some support to the CAD, as Canada is the largest crude oil exporter to the United States (US).

- The Bank of Japan is set to hold interest rates after its first hike since 2007 in March.

- The focus will be on BoJ’s updated forecasts and Governor Kazuo Ueda’s press conference.

- The volatility around the Japanese Yen could spike on the BoJ policy announcements.

The Bank of Japan (BoJ) is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.

The BoJ hiked the interest rate for the first time in 17 years in March, lifting Japan out of the negative interest rate policy (NIRP) for the first time since 2016.

What to expect from the BoJ interest rate decision?

With a steady policy widely expected, the markets’ attention will remain on the BoJ’s quarterly inflation and growth forecasts and the probable changes in the policy statement for fresh hints on the timing of the Bank’s next rate increase.

Markets are expecting the BoJ to hike rates again this year, with odds split between the chance of a lift-off in July, or sometime in the October-December quarter, according to Reuters.

Kyodo News Agency reported on Friday, citing sources familiar with the BoJ thinking, that the Japanese central bank is mulling an upward revision to its inflation outlook for fiscal year 2024 from the current 2.4%. The bank is also seen raising its forecast for fiscal year 2025 from 1.8% to around 2.0% while forecasting Japan's core inflation to be around 2% in fiscal 2026, the sources added.

These expectations hold even as Japan’s core Consumer Price Index (CPI) – a measure excluding fresh food and energy costs closely watched by the BoJ – moderated to 2.9% in March after increasing 3.2% in February. It was the first time since November 2022 that core inflation fell below 3%.

Easing price pressures in Japan fail to deter the BoJ’s path forward on interest rates, as the recent depreciation of the Japanese Yen (JPY) is likely to significantly push up inflation. Further, the BoJ focus remains on the potential increases in the services inflation and wages to determine the appropriate time for the next rate hike.

Japanese firms offered their biggest wage hikes in 33 years this year but the inflation-adjusted real wages have continued to decline for nearly two years.

When asked about the possibility of further rate hikes this year, in an interview with the Asahi newspaper earlier this month, BoJ Governor Kazuo Ueda said that "it's dependent on data.” "We'll adjust interest rates according to the distance towards sustainably and stably hitting 2% inflation”, Ueda added.

On Tuesday, Governor Ueda said that the BoJ will raise rates again if trend inflation accelerates toward its 2% target as expected. Japan's Weighted Median Inflation Index, a key measure of the country’s trend inflation, rose at its slowest pace in 11 months to 1.3% in March, the latest data published by the Bank of Japan (BoJ) showed on Tuesday.

Governor Ueda’s remarks imply that the central bank is shifting to a more discretionary approach in setting policy. The BoJ could remain on track to deliver another rate hike this year as it gathers more confidence that Japan will sustainably achieve its 2% price target. Therefore, the country’s trend inflation, wage growth and consumption data will hold more importance than the central bank’s quarterly inflation projections in determining the Bank’s future interest rate decisions.

Analysts at BBH preview the BoJ policy announcements, noting that “we are sticking to our view that the BoJ tightening cycle will remain very modest. The market agrees and is pricing in only 20 bp of tightening in 2024 and 50 bp over the next two years. Such a modest cycle would likely keep upward pressure on USD/JPY.”

“Updated macro forecasts will be released. Reports emerged suggesting the BoJ may raise its inflation forecast for FY2024 from 2.4% currently at this meeting. However, March CPI data last week came in lower than expected and suggests falling price pressures, so the revision is likely to be minor,” the analysts explained.

How could the Bank of Japan interest rate decision affect USD/JPY?

If the BoJ policy statement delivers a hawkish tone, indicating that the next rate hike could be as early as July, the Japanese Yen is likely to see a fresh upswing against the US Dollar (USD). The USD/JPY pair would then initiate a corrective downtrend toward the 150.00 level.

On the other hand, if the central bank suggests that they would cautiously monitor the likelihood of achieving 2% trend inflation to gauge the next rate increase, it could be read as dovish. In such a case, the Japanese Yen could crash to a new 34-year low against the US Dollar.

It’s worth noting that the Japanese Yen tends to weaken on BoJ decision days. It has done so for eight straight and nine of the past ten meetings, per BBH Analysts.

From a technical perspective, Dhwani, Senior Analyst at FXStreet, notes: “Amid extremely overbought Relative Strength Index (RSI) conditions on the daily chart, a USD/JPY correction seems long overdue. Should a hawkish BoJ guidance spark a Japanese Yen rally, the pair will pull back sharply toward the 21-day Simple Moving Average (SMA) at 153.19. Ahead of that level, the April 23 low of 154.55 could challenge bearish commitments. If the corrective decline gains traction, USD/JPY could accelerate toward the 50-day SMA at 151.28.”

“On the flip side, the relentless vertical rise could extend toward 156.50, with buyers aiming for the 160.00 level predicted by a senior Liberal Democratic Party official to be a probable intervention point for the Japanese authorities,” Dhwani adds.

Economic Indicator

BoJ Interest Rate Decision

The Bank of Japan (BoJ) announces its interest rate decision after each of the Bank’s eight scheduled annual meetings. Generally, if the BoJ is hawkish about the inflationary outlook of the economy and raises interest rates it is bullish for the Japanese Yen (JPY). Likewise, if the BoJ has a dovish view on the Japanese economy and keeps interest rates unchanged, or cuts them, it is usually bearish for JPY.

Read more.Next release: Fri Apr 26, 2024 03:00

Frequency: Irregular

Consensus: 0.1%

Previous: 0%

Source: Bank of Japan

Bank of Japan FAQs

The Bank of Japan (BoJ) is the Japanese central bank, which sets monetary policy in the country. Its mandate is to issue banknotes and carry out currency and monetary control to ensure price stability, which means an inflation target of around 2%.

The Bank of Japan has embarked in an ultra-loose monetary policy since 2013 in order to stimulate the economy and fuel inflation amid a low-inflationary environment. The bank’s policy is based on Quantitative and Qualitative Easing (QQE), or printing notes to buy assets such as government or corporate bonds to provide liquidity. In 2016, the bank doubled down on its strategy and further loosened policy by first introducing negative interest rates and then directly controlling the yield of its 10-year government bonds.

The Bank’s massive stimulus has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation. The BoJ’s policy of holding down rates has led to a widening differential with other currencies, dragging down the value of the Yen.

A weaker Yen and the spike in global energy prices have led to an increase in Japanese inflation, which has exceeded the BoJ’s 2% target. Still, the Bank judges that the sustainable and stable achievement of the 2% target has not yet come in sight, so any sudden change in the current policy looks unlikely.

- EUR/USD whipped on Thursday after mixed US data plagued markets.

- US GDP slowed faster than expected, but PCE inflation measures warn of still-high prices.

- US PCE Price Index figures due during Friday's US market session.

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

US Gross Domestic Product (GDP) eased more than expected on Thursday, with annualized Q1 growth slowing to 1.6% compared to the previous 3.4%, and well below the forecast 2.5%. Easing growth is a boon for investors hoping for an accelerated pace of rate cuts from the Federal Reserve (Fed), but too much too fast could send negative knock-on effects throughout the US economy.

Hopes for rate cuts were further eroded after US Personal Consumption Expenditure (PCE) inflation accelerated again in the first quarter, with Q1 PCE rising 3.4% compared to the previous quarter’s 1.7%. Still-high inflation is reducing market hopes for rate cuts, sending risk appetite into a tailspin during the US trading session before markets staged a determined but limited recovery.

Friday brings mostly low-tier European data, and markets will be turning to face US PCE Price Index figures for March as investors look for a more fine-tuned look at the US’ inflation outlook. Core MoM PCE Price Index figures in March are expected to hold steady at 0.3%, with the annualized figure forecast to tick down slightly to 2.6% from 2.8%.

EUR/USD technical outlook

EUR/USD churns just north of the 200-hour Exponential Moving Average (EMA) at 1.0690, but Euro bidders are scrambling to keep the pair propped up beyond the 1.0700 handle. A near-term supply zone is priced in between 1.0880 and 1.0860, keeping interim bullish expectations pinned to the low side.

A recent drop below the 200-day EMA at 1.0795 threatens to crimp bullish sentiment despite a technical floor priced in near 1.0600.

EUR/USD hourly chart

EUR/USD daily chart

- AUD/USD steady after a 0.33% gain Thursday, spurred by US GDP and rising inflation.

- Market now expects the first Fed rate cut in November, not September, based on latest economic data.

- Investors eye upcoming Australia PPI and US Core PCE figures for more market direction.

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518, virtually unchanged.

AUD/USD reflects continued market reaction to US data

Wall Street ended Thursday’s session with losses, which usually could’ve affected the Forex markets, but it didn’t. The US Dollar is under pressure following the release of a softer-than-expected GDP report, which, coupled with a surprise on a higher Core Personal Consumption Expenditure Price Index (PCE) on a quarterly basis, spurred investors to priced out rate cuts by the Fed.

Market pricing for the Fed's first 25 basis point (bps) rate cut was pushed back from September to November.

Other US data revealed that the labor market is still solid. There were 207 K Americans filing for unemployment claims, below estimates of 214K and the previous reading of 212 K.

AUD/USD traders sent the pair sliding towards its daily low of 0.6485 before recovering some ground. As Friday’s session begins, they will be eyeing the release of the Producer Price Index (PPI) in Australia and the US Core PCE figures on a monthly basis during the North American session.

AUD/USD Price Analysis: Technical outlook

Despite registering gain for the fourth straight day, the AUD/USD remains bearishly biased, with price action at 0.6525 below the 50 and 200-day moving averages (DMAs). If bulls gather momentum and push prices above that level, up next would be the 100-DMA at 0.6585, standing on their way to 0.6600. Conversely, further weakness could drag the pair below 0.6500. This paves the way for subsequent losses, with the next key support level at 0.6442, followed by the year-to-date (YTD) low at 0.6362.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

ANZ's New Zealand Roy Morgan Consumer Confidence slipped another 4 points to 82.1 in April, declining to the indicator's lowest levels since 2008. Despite the decline, New Zealand consumer confidence remains higher than it did at the height of the pandemic.

Consumer inflation expectations eased to 4.4% from 4.5%, though housing price inflation expectations increased to 3.5% from 3.4%.

Market reaction

NZD/USD continues to trade in a tight but rough range as markets gear up for the early Friday session, stuck near the 0.5950 level.

About the ANZ Roy Morgan Consumer Confidence

The Consumer Confidence released by the ANZ is a leading index that measures the level of consumer confidence in economic activity. A high level of consumer confidence stimulates economic expansion while a low level drives to economic downturn. A high reading is seen as positive (or bullish) for the NZD, while a low reading is seen as negative (or bearish).

- The daily chart reveals a bearish bias for the NZD/USD pair underlined by its positioning below major SMAs.

- For bullish traction to take place, buyers must reclaim control over the 20-day SMA SMAs.

- Indicators on the daily chart recovered.

The NZD/USD pair stands at 0.5949, registering daily gains on Thursday’s session. The prevailing outlook, as presented on the daily chart, shows a strong bearish control as the Kiwi continues to trade below the significant Simple Moving Averages (SMAs). Minor upticks visible in the short term do not suggest a meaningful trend reversal. For a bullish revival, bears must cede control to the buyers who would then need to gain the upper hand over the key 20-day SMA to start talking.

On the daily chart, The Relative Strength Index (RSI) for the NZD/USD pair continues within a negative trend territory. However, some signals of possible market correction exist as the RSI values hint at upward momentum. Simultaneously, the Moving Average Convergence Divergence (MACD) shows rising green bars, indicating buyers are gradually edging in against the sellers, lending positive momentum to the market.

NZD/USD daily chart

Moving on to the hourly chart, the RSI also persists in a negative trend, but the latest hour displays an upswing, carrying the indicator above the 50 mark which, paired with decreasing red bars on the MACD histogram, might suggest a short-term trend reversal or correction.

NZD/USD hourly chart

Assessing the overall landscape, the NZD/USD is in a definitive downtrend, underpinned by its position below the 20, 100, and 200-day Simple Moving Averages (SMAs). This situation suggests a prolonged bearish momentum as both short-term and long-term traders are selling the pair. Thursday's price movement raises another red flag as an attempted recovery by buyers has been rejected at the 20-day SMA at the 0.5960 level, suggesting a lack of bullish conviction and the potential for further downside. With these considerations, the outlook remains tilted in favor of sellers.

- EUR/USD rises due to US GDP shortfall and elevated inflation data.

- Technical resistance near 50 and 200-day MAs at 1.0805/07; 100-DMA at 1.0848 next hurdle.

- Downside below 1.0694 could retest year's low at 1.0601, possibly extending to 1.0516.

On Thursday, the Euro rose against the US Dollar after US economic data portrayed the economy as weaker than expected. At the same time, the inflation figure prompted investors to price out the Federal Reserve's rate cuts in 2024. At the time of writing, the EUR/USD trades at 1.0729, up by 0.29%.

EUR/USD Price Analysis: Technical outlook

From a technical standpoint, the EUR/USD remains bearishly biased, but in the short term, it could test the confluence of the 50 and 200-day moving averages (DMAs) at 1.0805/07. If buyers clear that stir resistance, buyers must crack the 100-DMA at 1.0848. Subsequent gains are seen above that level, with the 1.0900 mark up next.

On the flip side, if EUR/USD sellers drag the spot price below the February 14 low of 1.0694, that would pave the way toward the year-to-date (YTD) low of 1.0601, followed by the November 1, 2023, intermediate support at 1.0516.

EUR/USD Price Action – Daily Chart

- The daily RSI shows strong buying momentum for the NZD/JPY, moving deep in positive territory.

- Parallelly, the daily MACD indicates green bars on a rising tendency, suggesting growing buying traction.

- A possible market correction may be imminent, as the daily RSI reaches near-overbought conditions.

- A slight decline in the hourly indicators signals a pause in buyers' at least for Thursday’s session.

The NZD/JPY pair has shown a bullish performance, upheld by strong buying momentum over past trading sessions. Although it stands at 92.55, a high since February, signs of a potential market shift are emerging as indicators are near overbought territory.

Based on the daily chart, the Relative Strength Index (RSI) indicates increasing bullish momentum, having moved from a negative territory into positive conditions during the previous session and it resides near the 70 threshold. Concurrently, the Moving Average Convergence Divergence (MACD) shows rising green bars, indicating a developing positive momentum. Nonetheless, the RSI nearing overbought conditions provides a warning about the potential for market correction.

NZD/JPY daily chart

On the hourly chart, the RSI moved steadily upwards from a negative to a positive trend. However, recent RSI levels are slightly lower as they seem to be correcting overbought conditions noted earlier in the session.

NZD/JPY hourly chart

In a broader context, the placement of the NZD/JPY relative to its Simple Moving Average (SMA), the cross pair is trading above its 20, 100, and 200-day SMA, suggestive of an upward trajectory. This positioning supports both short-term buy opportunities and a favorable long-term outlook, affirming a sustained long-term bullishness for the NZD/JPY.

In a broader context, the placement of the NZD/JPY relative to its Simple Moving Average (SMA), the cross pair is trading above its 20, 100, and 200-day SMA, suggestive of an upward trajectory. This positioning supports both short-term buy opportunities and a favorable long-term outlook, affirming a sustained long-term bullishness for the NZD/JPY.

- GBP/USD gains over 0.40%, rebounding from daily lows after US Q1 economic growth underperforms expectations.

- Mixed signals from the US economy support Sterling's rise.

- Technical outlook: Key resistance at 1.2559 with potential to target April 9 high at 1.2709 if upward momentum continues.

The Pound Sterling resumed its advance against the US Dollar, climbing more than 0.40% and trading at 1.2518. During the day, the GBP/USD bounced off daily lows of 1.2450 following the release of mixed economic data from the United States. The US economy in Q1 2024 grew below estimates, which would warrant easing monetary policy. But prices edging up spurred investors' reaction to priced-out rate cuts in 2024.

GBP/USD Price Analysis: Technical outlook

The GBP/USD is aiming up sharply, though it remains bearishly biased. Although the major remains far from the latest cycle high, if buyers regain some key resistance levels, that would ultimately expose the April 9 high at 1.2709, the latest cycle high.

Therefore, the GBP/USD first resistance would be the 200-day moving average (DMA) at 1.2559. A breach of the latter will expose the 1.2600 figure, followed by the 50 and 100-DMAs, each a 1.2624 and 1.2647. Once those levels are surpassed, the April 9 high would be up next.

On the other hand, if GBP/USD slumps below 1.2500, that would keep the downtrend intact and pave the way to re-test the year-to-date (YTD) low of 1.2299.

GBP/USD Price Action – Daily Chart

- GBP/JPY inches into multi-year highs as Yen softens further.

- Odds are increasing of BoJ verbal intervention spilling over into actual intervention.

- Tokyo CPI inflation, BoJ rate call approach on Friday.

The GBP/JPY pushed into fresh multi-year highs on Thursday as the pair grinds towards the 195.00 handle. The Japanese Yen (JPY) continues to weaken across the broader FX market, prompting increasing rhetoric from the Bank of Japan (BoJ) regarding direct intervention in currency markets to shore up the beleaguered JPY. The BoJ is expected to discuss intervention on the Yen’s behalf at their latest policy meeting, slated for Friday.

Japan’s Tokyo Consumer Price Index (CPI) inflation will be printing early Friday, and markets expect Japan’s leading inflation indicator to hold steady at 2.6% for the year ended in April. Core-core Tokyo CPI inflation (headline inflation less volatile food and energy prices) is expected to tick down slightly to 2.7% over the same period from the previous 2.9%.

The BoJ’s latest Interest Rate Decision and Monetary Policy Statement are also expected early Friday, where markets will look out for signals of FXC intervention from the BoJ. Markets will also look for any announced changes to the BoJ’s bond-buying program.

A press conference headed by BoJ Governor Kazuo Ueda is expected following the BoJ’s latest rate call.

GBP/JPY technical outlook

The Guppy has accelerated out of a recent technical range to approach the 195.00 handle, and the pair knocked into a fresh multi-year high. Further bullish momentum will carry the GBP/JPY into record highs, while downside pullbacks will look for a technical floor at 192.70.

The GBP/JPY is set to close for a third straight green day, and daily candles continue to hold well above the 200-day Exponential Moving Average (EMA) at 185.08.

GBP/JPY hourly chart

GBP/JPY daily chart

- Gold prices climb following US Q1 GDP results falling below expectations.

- Sharp increase in Q1 inflation to 3.7% tempers expectations for immediate Fed rate cuts and underpins higher Treasury yields.

- Fed officials maintain cautious stance on monetary policy, echoing concerns over persistent inflation pressure.

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States (US). GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Federal Reserve (Fed) could lower borrowing costs. However, inflation for the same period jumped sharply, which would delay interest rate cuts by the Fed.

XAU/USD trades at $2,330 after bouncing off daily lows of $2,305 amid higher US Treasury yields, courtesy of the reacceleration of inflation. As expected by analysts, the US economy would slow down in 2024, but it missed the mark by a full percentage point in the first quarter. That would keep the “soft landing” narrative in place, but underlying inflation for Q1 2024 rose by 3.7% QoQ, above estimates and crushing the 2% registered in the last quarter of 2023.

This justified Fed officials' change of stance last week. Chairman Jerome Powell gave the green light when he commented, "Recent data shows lack of further progress on inflation this year.”

Those words were echoed by a slew of policymakers, most significantly by the ultra-dovish Chicago Fed President, Austan Goolsbee, who said, “Fed's current restrictive monetary policy is appropriate.”

Daily digest market movers: Gold price climbs amid highs US yields, soft USD

- Gold advance continues even though US Treasury yields advance. The US 10-year note yield is up six basis points (bps) at 4.706%, while US real yields, which closely correlate inversely with the golden metal, are also up by the same amount, at 2.296%.

- A softer Greenback also underpins the yellow metal. The US Dollar Index (DXY) is down 0.22% at 105.59.

- US GDP for Q1 2024 expanded by 1.6% QoQ, below estimates of 2.5%, and trailed Q4 2023’s 3.4%. The core Personal Consumption Expenditure Price Index (PCE) for the same period rose 3.7%, crushing estimates of a 3.4% increase and up from 2% in the previous reading.

- In addition, the US labor market remains strong. Initial Jobless Claims for the week ending April 20 missed estimates of 214K, coming at 207K, less than the previous reading.

- Upcoming Q1 GDP data and core PCE inflation figures will provide key insights into the possible timing of the Fed's interest rate reductions. The core PCE, the Fed’s preferred measure of inflation, is expected to maintain a steady monthly growth of 0.3%. Additionally, the annual core PCE rate is anticipated to decrease to 2.6% from 2.8% in February.

- Data from the Chicago Board of Trade (CBOT) suggests that traders expect the fed funds rate to finish 2024 at 5.035%, up from 4.98% on Wednesday.

Technical analysis: Gold price hovers near $2,330 as buyers take a breather

Gold price edges up, but it’s facing resistance at $2,337, the April 24 high. A breach of the latter will expose the psychological $2,350 figure, followed by the $2,400 mark. Subsequent gains lie once that supply zone is cleared, followed by the April 19 high at $2,417, followed by the all-time high of $2,431.

On the flip side, if the XAU/USD price dips below the April 15 daily low of $2,324, that would pave the way to test $2,300. A breach of the latter would expose the April 23 low of $2,229, followed by the March 21 high at $2,222.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- The daily RSI for AUD/JPY reveals that the bulls are in charge, approaching overbought conditions.

- Despite the hourly MACD indicating a short-term dip, the RSI highlights the buyers' dominance.

- As the cross jumped to multi-year highs, the buyers might eventually run out of gas.

The AUD/JPY exhibits substantial bullish momentum, standing at the 101.39 level and showing an encouraging 0.54% rally. The dominance of bullish trends is evident but a healthy correction might be necessary for the buyers to conquer additional ground.

On the daily chart, the Relative Strength Index (RSI) reveals a positive momentum, with the latest reading nearing the overbought condition. The Moving Average Convergence Divergence (MACD) supports this, printing green bars.

AUD/JPY daily chart

Shifting the attention to the hourly chart, the MACD paints a different picture with its red bars, signaling that in this timeframe, buyers might have already become exhausted. However, the RSI readings suggest steady, positive momentum with figures hovering above 50, apart from a brief dip to 48.

AUD/JPY hourly chart

The AUD/JPY also demonstrates a bullish stance in the broader picture as it positions itself above the 20, 100, and 200-day Simple Moving Averages (SMA). So all signals points to a clear bullish stance, but traders should be alert that if daily indicators reach overbought conditions, the pair may see some healthy downside to consolidate gains.

- Dow Jones backslides over 500 points as investors balk at inflation complications.

- US GDP eased quicker than expected, jostling risk appetite.

- Equity recovery is under way, but remains limited.

The Dow Jones hit its lowest bids in a week after US Gross Domestic Product (GDP) figures missed forecasts and US Core Personal Consumption Expenditures (PCE) inflation came in higher than expected. Slowing growth is a boon for investors seeking an accelerated path towards rate cuts from the Federal Reserve (Fed), but sticky inflation continues to vex hopes for an early Fed rate trim.

Read more: US GDP expands less that expected in Q1

US GDP for the annualized first quarter grew by 1.6%, well below the forecast decline to 2.5% from the previous 3.4%. It represents the slowest pace of GDP growth since September of 2022, but an uptick in Core PCE in Q1 kicked the legs out from beneath rate cut hopes. Q1 Core PCE rebounded to 3.7%, climbing over the previous 2.0% and overshooting the forecast 3.4%. Headline PCE inflation also overshot, printing at 3.4% versus the previous 1.8% as inflation remains hotter than investors hoped.

Dow Jones news

The Dow Jones plunged into negative territory for the week, knocking below 37,800.00 and declining over 550 points on the sour US data prints. A slow, grinding equity recovery is underway in the US trading session, but the Dow Jones remains firmly off of the day’s early peak bids near 38,450.00.

Around two-thirds of the individual securities that comprise the Dow Jones are in the red on Thursday, with International Business Machines Corp. (IMB) leading the charge down. IBM is down over 8% at the time of writing, declining to $168.77 per share. IBM is closely followed by Caterpillar Inc. (CAT), down around 6.5% on the day and trading near $340.12. The DJIA’s top gainer on Thursday is Merck & Co Inc. (MRK), climbing nearly 3% to trade into $130.63 per share.

Dow Jones technical outlook

The Dow Jones declined 1.82% top-to-bottom on Thursday, hitting a seven-day low of 37,745.54 and turning negative for the week. Despite the major equity index reclaiming nearly half of the day’s declines, the DJIA remains well back from the day’s peaks at 38,446.43.

Despite the Dow Jones on pace for a second down day in a row, the index is still firmly planted in bull country, trading well above the 200-day Exponential Moving Average (EMA) at 36,700.41.

Dow Jones five-minute chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

The continuation of the downward bias hurt the Greenback and prompted the USD Index (DXY) to recede to multi-day lows following disheartening GDP readings and higher inflation prints, all prior to Friday’s release of PCE data.

Here is what you need to know on Friday, April 26:

The USD Index (DXY) revisited the mid-105.00s amidst rising yields and the dominating appetite for the risk complex. On April 26, inflation readings measured by the PCE will be at the centre of the debate, seconded by Personal Income, Personal Spending, and the final Michigan Consumer Sentiment for the month of April.

EUR/USD advanced further north of the 1.0700 barrier amidst the persistent selling pressure around the US Dollar. There will be no data releases in the euro docket at the end of the week.

GBP/USD extended further its weekly recovery and reclaimed the area well past 1.2500 the figure. The GfK Consumer Confidence gauge is only expected on April 26.

USD/JPY maintained its bullish mood well in place and rose to fresh tops around 155.75 prior to the BoJ gathering. The BoJ meets and releases its Quarterly Outlook Report on April 26.

AUD/USD traded with gains for the fourth consecutive session and flirted once again with the key 200-day SMA near 0.6530. The Australian calendar will be empty on April 26.

Extra losses sparked the second day in a row of losses in WTI prices in response to the resurgence of demand fears and the likelihood of a tighter-for-longer Fed.

Gold advanced decently after three straight daily declines on the back of rising geopolitical jitters and higher-than-expected US inflation. Silver, in the meantime, seems to have embarked on a consolidative range underpinned by the $27.00 region so far.

- Mexican Peso depreciates by over 0.5% against US Dollar, reacting to unexpected inflation reacceleration in the US.

- US GDP growth for Q1 2024 falls short of forecasts at 1.6%, but a sharp increase in core PCE inflation to 3.7% boosts US yields.

- The rise in US yields and recalibrated Fed rate cut expectations drove USD/MXN to a weekly high of 17.38.

The Mexican Peso (MXN) fell during the North American session on Thursday, depreciating more than 0.5% against the US Dollar following the release of the Gross Domestic Product (GDP) in the United States (US) for the first quarter of 2024, which was weaker than expected. At the same time, the US Bureau of Economic Analysis (BEA) revealed that inflation for the same period increased sharply, spurring a jump in US Treasury yields, and weighed on the Mexican currency. At the time of writing, the USD/MXN trades at 17.18 after bouncing off a daily low of 17.01.

Thursday’s main driver for the Mexican Peso was US data. GDP for the first quarter missed estimates of 2.5% QoQ and expanded by 1.6%. By itself, that warranted US Dollar weakness, but digging deeper into the US BEA report, the core Personal Consumption Expenditure (PCE) price index for Q1 on a quarterly basis rose by 3.7%, higher than the expected 3.4% and up from 2%.

Market participants ditched the Mexican Peso as the USD/MXN rallied sharply, refreshing weekly highs at 17.38. US Treasury yields skyrocketed, while investors had priced out interest rate cuts by the US Federal Reserve (Fed) in 2024.

The data spooked investors of the emerging market currency. Speculation that the interest rate differential between Mexico and the US would likely shrink has spurred outflows from the Peso toward the Greenback.

Daily digest market movers: Mexican Peso depreciates as US inflation picks up

- Mexico’s inflation report on Wednesday capped the USD/MXN advance. Even though mid-month inflation rose by 4.63% YoY, above March’s reading and estimates of 4.48%, the Core readings slowed sharply to 4.39% YoY as projected, down from 4.69%. Despite being a mixed reading, core prices are beginning to cool down, depicting a clear downtrend in inflation.

- Citibanamex Survey showed that most analysts expect Banxico to hold rates unchanged at the May meeting. The median foresees a rate cut in June, while they estimate the main reference rate to end at 10.00%, up from 9.63% previously.

- Banxico Governor Victoria Rodriguez Ceja said that service inflation is not slowing as expected. She added that the Peso’s strength has helped to temper inflationary pressure and lower imported goods. She emphasized that Banxico would remain data-dependent.

- Mexico’s economy is faring well as Economic Activity expanded in February compared to January’s data. Figures increased by 1.4% MoM and 4.4% YoY in the second month of the year, up from January’s 0.9% and 1.9% expansion, respectively.

- Other data in the US showed that the labor market remains tight as Initial Jobless Claims for the week ending April 20 missed estimates of 214K, coming at 207K, less than the previous reading.

- Data from the Chicago Board of Trade (CBOT) suggests that traders expect the Fed funds rate to finish 2024 at 5.035%, up from 4.98% on Wednesday.

Technical analysis: Mexican Peso on backfoot as USD/MXN rallies toward 200-day SMA

The Mexican Peso downtrend continues as the USD/MXN has cleared the 200-day Simple Moving Average (SMA) at 17.16. The rally was capped at the January 23 swing high of 17.38. The exotic pair has retreated since then.

If USD/MXN sellers drag spot prices below the 200-day SMA, look for a retest of the 17.00 figure. Subsequent losses are seen, once cleared, with the next support being the 50-day SMA at 16.81 before challenging last year’s low of 16.62.

On the other hand, if buyers achieve a daily close above the 200-day SMA, look for another test of 17.38. A breach of the latter will expose the 18.00 figure, followed by the year-to-date (YTD) high at 17.92.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- Canadian Dollar trapped near familiar levels, gives mixed performance.

- Canada absent from the economic calendar until next week’s GDP.

- US GDP comes in soft, but PCE hints at still high inflation.

The Canadian Dollar (CAD) spread on Thursday, giving a mixed performance and sticking close to familiar technical levels after US data printed in both directions early in the US market session. US Gross Domestic Product (GDP) eased more than expected, a boon for investors looking for rate cuts from the US Federal Reserve (Fed). However, inflation continues to be a major sticking point for rate cut hopes after US Personal Consumption Expenditure (PCE) inflation climbed even higher than expected.

Canada is absent from the economic calendar for the remainder of the trading week. The next piece of useful Canadian economic data will be next Tuesday’s Canadian MoM GDP for February. Canada’s S&P Global Manufacturing Purchasing Managers Index (PMI) will also print next Wednesday.

Daily digest market movers: Canadian Dollar lacks momentum after US data fails to deliver clean picture

- Annualized US GDP for the first quarter eased to 1.6%, declining from the previous 3.4% and falling well short of the forecast of 2.5%.

- Read more: US GDP expands less that expected in Q1

- Rapidly slowing GDP is a welcome boon for investors desperate for rate cuts from Fed. However, US PCE inflation in Q1 rose to 3.7%, vaulting over forecast of 3.4% and accelerating from previous 2.0%.

- Rising inflation will keep Fed hobbled on rate cuts, markets churn on mixed print.

- Friday’s US PCE Price Index will draw additional attention after Thursday’s gloomy bellwether.

- March’s MoM US PCE Price Index is expected to hold steady at 0.3%, while the YoY figure is expected to tick down to 2.6% from 2.8%.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.15% | -0.24% | -0.06% | -0.10% | 0.22% | 0.00% | -0.04% | |

| EUR | 0.17% | -0.05% | 0.11% | 0.07% | 0.39% | 0.16% | 0.13% | |

| GBP | 0.23% | 0.08% | 0.17% | 0.15% | 0.47% | 0.21% | 0.20% | |

| CAD | 0.11% | -0.06% | -0.13% | -0.01% | 0.30% | 0.09% | 0.05% | |

| AUD | 0.10% | -0.05% | -0.12% | 0.04% | 0.31% | 0.09% | 0.06% | |

| JPY | -0.21% | -0.35% | -0.44% | -0.28% | -0.31% | -0.22% | -0.26% | |

| NZD | 0.04% | -0.12% | -0.20% | -0.04% | -0.07% | 0.25% | 0.02% | |

| CHF | 0.04% | -0.12% | -0.20% | -0.04% | -0.05% | 0.28% | 0.01% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical analysis: Canadian Dollar trades steady but mixed

The Canadian Dollar (CAD) is getting pushed into the middle on Thursday, trading flat to within a quarter of a percent across the major currency board during the US market session. The CAD sees a meager tenth of a percent gain against the US Dollar (USD). The Japanese Yen (JPY) is down a quarter of a percent against the Canadian Dollar as the market’s worst-performing currency on the day.

The CAD continues to trade within a tight range near the 1.3700 handle against the US Dollar, and the USD/CAD has priced in a near-term price floor near 1.3660. A topside break is hampered by the 200-hour Exponential Moving Average (EMA) at 1.3710, and a heavy supply zone rests just below current price action below 1.3600.

USD/CAD hourly chart

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- US Q1 GDP reveals reduced expansion at 1.6% YoY.

- On the positive side, weekly Jobless Claims come in strong.

- Friday’s PCE data from March will dictate the pace of DXY in the short term.

The US Dollar Index (DXY) is seen trading mildly down at 105.75 on Thursday and struggling to gain more ground following its extended rally in April. The Index weakened following Gross Domestic Product (GDP) data from Q1, but losses may be limited after strong labor market data was reported during the European session.

The US economy remains resilient but is expected to grow at a slower pace due to inflation and higher interest rates. The Federal Reserve (Fed) remains firm on its stance and seems to not want to rush to start easing and market hawkish adjustments provide a cushion to the USD. Personal Consumption Expenditures (PCE) data from March will likely affect those investors’ expectations.

Daily digest market movers: DXY down after GDP data

- The Bureau of Economic Analysis’s (BEA) initial estimate revealed a 1.6% YoY annualized expansion in the US Gross Domestic Product (GDP) for January-March.

- GDP figures were below market predictions of a 2.5% annual rise, lagging behind 3.4% YoY growth in Q4 2023.

- The US Department of Labor showed a decrease of 5K in Initial Jobless Claims for the week ending April 20, resulting in a total of 207K Initial Jobless Claims.

- The weekly decline in Initial Jobless Claims surpassed market forecasts, which projected 214K claims, a clear improvement from the prior week's total of 212K.

- Regarding expectations on the Fed, markets bet on 20% odds of a June rate cut. A potential Fed rate cut in July or even September isn't fully assumed either, pointing to strong confidence in ongoing US economic performance that justifies the delay of the easing cycle.

DXY technical analysis: DXY shifts into neutral gear, bears lurk despite bullish undertones

The indicators on the daily chart portray a mixed stance for the DXY. The flat position of the Relative Strength Index (RSI) in positive territory resonates with stagnant buying momentum. Moreover, the decreasing green bars of the Moving Average Convergence Divergence (MACD) reflect a fading bullish sentiment, signaling potential weakness in the near future.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- EUR/JPY surges to levels not seen since August 2008, capitalizing on a broader Yen weakness.

- Technical indicators suggest potential for further advances after clearing resistance at 165.30, towards the 169.47 high of August 2008.

- Downside risks remain once EUR/JPY retreats below the recent high of 166.22.

The Euro rallied to a near 16-year high against the Japanese Yen, hitting levels last seen in August 2008, with the latter remaining the laggard in the FX space. Data from the United States (US) prompted investors to buy the Greenback, which sent USD/JPY to refresh multi-year highs. Therefore, the EUR/JPY followed suit and trades at 166.67, gaining more than 0.20%.

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY is bullish-biased after consolidating since mid-March below the 165.30s area, previously guarded by March’s 20 high at 165.33. The uptrend resumed toward the 166.00 mark, yet once buyers cleared that hurdle, extending the move to 167.00.

Nevertheless, the EUR/JPY has retreated as buyers take a breather. The momentum its on their side, as shown by the Relative Strength Index (RSI) standing at 68.80, shy of signaling the pair is overbought.

If buyers clear 167.00, that will exacerbate a rally to challenge August’s 2008 monthly high at 169.47, ahead of the psychological 170.00 barrier.

On the other hand, if sellers drag the exchange rate below 166.22 April 24 daily high, that could open the door to sliding toward the March 20 high of 165.33. Subsequent losses beyond this support target the confluence of the Tenkan and Kijun-Sen at 164.83/64.

EUR/JPY Price Action – Daily Chart

- AUD/USD falls back down below 0.6500 after US Q1 GDP data reveals persistent price pressures.

- The pair reverses the strong rally that has characterized price action over the past week.

- The Fed is now seen not cutting interest rates till September whilst the consensus for the RBA is November.

AUD/USD trades back below 0.6500 on Thursday, after peaking at 0.6539 earlier in the day. The sudden decline comes after the release of US first quarter GDP data which showed persistent price pressures within the US economy despite an overall slowdown in economic growth.

US preliminary Gross Domestic Product Annualized rose 1.7% in Q1 which was below estimates of 2.5% and the previous quarter's 3.4% reading, according to data from the US Bureau of Economic Analysis, on Thursday.

Yet the US Dollar noted gains across the board following the data, as a key gauge of inflation in the GDP data – the preliminary Gross Domestic Product Price Index for Q1 – showed a rise of 3.1% in prices, which was substantially higher than the 1.7% of the previous quarter.

The GDP price index data suggests stubbornly high inflation in the US economy that will probably lead the Federal Reserve (Fed) to keep interest rates higher for longer. Higher interest rates are in turn positive for USD (negative for AUD/USD) since they attract great inflows of foreign capital.

In addition, the higher-than-expected Core Personal Consumption Expenditures in Q1, which is also a measure of inflation, showed a 3.7% rise QoQ compared to estimates of 3.4% and a previous reading of 2.0%.

After the release of the GDP data, a first interest-rate cut from the Federal Reserve is now not seen until September 2024, carrying a 58.2% probability.

Other relevant data for the US Dollar showed Initial Jobless Claims falling slightly to 207K from 212K when a rise to 214K had been expected, and Pending Home Sales coming in at 3.4% in March, easily beating estimates of 0.3% and February’s 1.6%.

AUD/USD rallied strongly on Wednesday following the release of stickier-than-expected Australian Consumer Price Index (CPI) data for Q1.

The CPI showed a 3.6% rise in Q1 instead of the 3.4% the market had expected. The price stickiness reflected in the data suggests the Reserve Bank of Australia (RBA) will be less likely to cut interest rates in the near-term.

The RBA is still seen as the last major G10 central bank to cut interest rates, according to analysts at Rabobank. A fact, that is providing a backdraught for AUD/USD.

The consensus is for the RBA to cut interest rates in November, however, some analysts, such as those at TD Securities have revised that view and now do not a first rate-cut until February 2025 .

- Silver price may have formed a Bear Flag pattern on the 4-hour chart.

- The pattern suggests a continuation of the bearish trend to targets substantially lower.

- Support from a relic of long-term support and resistance at $25.80 is likely to provide a floor for any sell-off.

Silver (XAG/USD) price may have formed a Bear Flag pattern on the 4-hour chart which bodes ill for the precious metal’s price going forward.

4-hour Chart

After forming a multiple shouldered Head and Shoulders (H&S) topping pattern at the $30.00 highs of mid-April, Silver price declined to the initial target for the pattern at $26.70. This target was the conservative estimate for the pattern, calculated by taking the height of the H&S and extrapolating the distance by its 0.618 Fibonacci ratio from the neckline underpinning the pattern lower.

After bouncing from a temporary floor at $26.70 Silver price has consolidated forming a rectangle pattern. Taken together with the prior sharp decline the whole formation resembles a Bear Flag pattern.

According to technical lore, the expected move down from a Bear Flag equals the length of the preceding “pole” or a Fibonacci ratio of the pole. In this case the pole is the decline that followed the completion of the H&S pattern.

The Fibonacci 0.618 ratio of the pole on Silver, when extrapolated lower, gives a conservative target at $26.31. If Silver price falls the whole length of the pole (Fib. 1.000), however, it will reach a more "optimistic" target of $25.53.

Tough support from a long-term upper range boundary line at $25.80, however, is likely to offer support before Silver price reaches the lower target for the Bear Flag.

A break below the $26.69 low of April 23 would be required to confirm a breakdown of the Bear Flag towards its targets.

- Initial Jobless Claims in the US decreased by 5,000 in the week ending April 20.

- US Dollar Index clings to modest daily gains above 105.50.

There were 207,000 initial jobless claims in the week ending April 20, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 212,000 and came in better than the market expectation of 214,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1.2% and the 4-week moving average stood at 213,250, a decrease of 1,250 from the previous week's unrevised average.

"The advance number for seasonally adjusted insured unemployment during the week ending April 13 was 1,781,000, a decrease of 15,000 from the previous week's revised level," the publication read.

Market reaction

The US Dollar Index clings to modest daily gains slightly below 106.00 after these data.

- Oil briefly spikes after US weekly EIA data showed a big decline in stockpiles.

- WTI Oil snaps $83, but faces resistance to break back above it again.

- The US Dollar Index retreats further, forming a bearish pattern.

Oil prices edge up on Thursday as traders digest the US Crude Inventory release, which was taken as bullish for near-term prices. Overall, the release showed a chunky draw of 6.368 million barrels, which puts the US inventory at its lowest level since January 19 by 453.6 million barrels. This might trigger some buying from the US Energy Department in order to build up stockpiles again ahead of the next heating season.

The US Dollar Index (DXY) has fallen in a bearish pattern. For a third day in a row, the index is posting lower highs and lower lows on the daily chart. This could point to a gruesome correction ahead, and with preliminary US Gross Domestic Product (GDP) release on Thursday and the Personal Consumption Expenditures (PCE) Price Index on Friday, catalysts are enough to trigger that breakdown.

Crude Oil (WTI) trades at $82.71 and Brent Crude at $87.11 at the time of writing.

Oil news and market movers: Restocking

- Fuel distillate Inventories (gasoil and jet fuel) at the Asian distribution hub of Singapore rose to the highest level since July 2021, according to official data released Thursday, Bloomberg reports.

- Chinese refiners are heading to Venezuela for cheap Oil. Venezuela is offering the discount after the US reimposed sanctions on the South American country.

- Some more details on the Crude stockpile number from the Energy Information Administration (EIA):

- US Gulf Coast refineries are processing the most crude since 2019 ahead of the summer driving season.

- The 6.368 million barrel drawdown in US crude inventories was unexpected – consensus was for a 1.6 million barrel buildup – as refineries ramp up Oil processing following maintenance and exports pick up.

- US Exports ticked above 5 million barrels a day amid robust outflow to Europe.

Oil Technical Analysis: US shooting itself in the foot

Oil prices are set for some buying pressure with US refiners and traders getting ready for the summer season. That always coincides with a lot of travel, be it via airspace (flights) or car (gasoline). With the recent chunky drawdown and nearly lowest level for the year in Crude stockpiles, refiners might ramp up prices.

With geopolitical tensions lingering and the US crude stockpile in low levels, the November 3 high at $83.34 and the $90 handle are the first key levels on the upside. One small barrier in the way is $89.64, the peak from October 20. In case of further escalating tensions, expect even September’s peak at $94 to become a possibility.

On the downside, the October 6 low at $80.63 is the next candidate as a pivotal support level. Below that level, the 55-day and the 200-day Simple Moving Averages (SMAs) at $80.37 and $79.67 should halt any further downturn.

US WTI Crude Oil: Daily Chart

- The USD/JPY extends its uptrend despite verbal intervention from the Minister of Finance.

- The wide differential between US and Japanese interest rates is seen as a major factor contributing to the rise.

- The idea that a lot is already priced into the US Dollar could limit USD/JPY upside.

The USD/JPY trades higher on Thursday, rising into the mid 155.00s, on the back of a recent step-rise in US Treasury Bond yields as the pair shrugs off yet more verbal intervention from the Japanese Finance Minister (MOF) Sunichi Suzuki.

USD/JPY is pressured higher by the wide differential between US and Japanese interest rates, with the US Federal Reserve (Fed) setting the Fed Funds Rate at 5.25% - 5-50% and the Bank of Japan (BoJ) its cash rate at 0.0% - 0.1%. The huge advantage of parking capital in US Dollars (USD) compared to Japanese Yen (JPY) is a constant bullish factor for USD/JPY.

In a statement to Parliament on Thursday, Sunichi Suzuki reiterated the tired phrase that the Finance Ministry would be “watching FX market closely” and “will take appropriate measures” if the Yen depreciates further. Yet his attempts at verbal intervention seem to be losing force with each repetition as the pair pushed higher regardless. Analysts remain skeptical about the impact even of direct intervention on the pair.

“Even actual interventions, if they came, would hardly make a lasting impression on the market, because the MOF's firepower is limited,” says Antje Praefcke, FX Analyst at Commerzbank.

For any lasting effect on the valuation of the Yen, the MOF’s interventions would have to be accompanied by interest rate hikes from the BoJ.

“..interventions would have to be flanked by a credible monetary policy on the part of the BoJ, i.e. a regular cycle of interest rate hikes, in order to be convincing, otherwise they would just be "leaning against the wind" anyway. However, since we do not believe in a rate hike cycle, we simply lack the arguments for a rising JPY,” says Praefcke.

BoJ meeting on the radar

Approaching quickly down the road is the next BoJ policy meeting which is scheduled for 3.00 GMT on Friday morning, but the market does not expect a change in policy so soon after the BoJ hiked interest rates in March. At most Ueda and his team are expected to raise their inflation forecasts.

“The BOJ may raise slightly its 2024 core inflation projections implying greater room to tighten policy and can offer JPY near-term support,” says Brown Brothers Harriman (BBH) in a report.

Core inflation (ex fresh food) in March tracked at 2.6% versus the 2.4% forecast by the BoJ and “core of core” inflation (ex fresh food and energy) at 2.9% versus the 1.9% forecast by the bank.

Tokyo Consumer Price Index (CPI) data, released a few hours prior to the BoJ meeting, could impact deliberations, if it varies substantially from consensus. However, the overall view is that the BoJ is unlikely to actually alter policy much given trend inflation remains below its 2.0% target.

“We are sticking to our view that the BOJ tightening cycle will be modest because underlying inflation in Japan is trending lower. The swap market implies 25 bps of rate hikes in 2024 and 50 bps over the next two years,” says BBH.

US Dollar “already has a lot priced in” – Commerzbank

USD/JPY may be limited in its scope for upside, however, by the fact USD “already has a lot priced in”, according to analysts at Commerzbank.

This is particularly in regards to the acute shift in market expectations regarding the future course of interest rates in the US.

Since the Federal Reserve’s (Fed) March meeting markets have consistently pushed back the date when the Fed is expected to begin cutting interest rates.

This recalibration of the future path of interest rates has now been fully priced in, according to Commerzbank’s Praefcke, and in the absence of more catalysts, makes USD more vulnerable to “bad news” than “good news”.

“..a lot is already priced into the Dollar, such as a soft landing of the economy or a Fed that will only cut the key interest rate much later than previously thought,” says Praefcke.

“It is becoming increasingly difficult for the Dollar to benefit from facts and figures that underpin this expectation (a delay in future rate cuts); on the contrary, it tends to react sensitively when the market has doubts about its current expectation in the face of not-so-good data. The Dollar is gradually running out of steam, although it is currently the undisputed most popular currency and is likely to remain so,” adds the analyst.

If her view is valid it could color the FX market reaction to US first quarter GDP data out on Thursday. Even a better-than-expected result may not push USD/JPY that much higher, whilst a weaker-than-expected result could see the pair drop back more substantially.

- NZD/USD rises to 0.5960 as US Dollar exhibits a weak footing ahead of US Q1 GDP data.

- The consensus shows that the US economy expanded by 2.5% in the January-March period.

- The New Zealand Dollar moves higher on improved demand for risk-perceived currencies.

The NZD/USD pair extends its winning streak for the fourth trading session on Thursday. The Kiwi asset movers higher to 0.5960 as the US Dollar falls further amid concerns over United States economic outlook due to a sharp decline in new business inflows in April, showed by S&P Global preliminary PMI report. The US Dollar Index (DXY), which tracks the US Dollar’s value against six major currencies, drops to 10-day low near 105.50.

Downside move in the US Dollar has improved demand for risk-sensitive currencies. However, the market sentiment remains uncertain as investors turn attention to the preliminary US Q1 GDP data, which will be published at 12:30 GMT. The US economy is projected to have grown at a moderate pace of 2.5% against 3.4% growth witnessed in the final quarter of the last year.