- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei +106.74 19148.08 +0.56%

TOPIX +6.10 1527.77 +0.40%

Euro Stoxx 50 +28.24 3258.92 +0.87%

FTSE 100 +8.50 7107.65 +0.12%

DAX +124.19 11659.50 +1.08%

CAC 40 +45.68 4794.58 +0.96%

DJIA +26.85 19890.94 +0.14%

S&P 500 +0.68 2279.55 +0.03%

NASDAQ +27.87 5642.65 +0.50%

S&P/TSX +16.43 15402.39 +0.11%

Major US stock indexes finished trading in positive territory thanks to optimistic statistical data on the US, and the reporting of a number of companies, including Apple Inc. At the same time, market participants drew attention to the outcome of the February meeting of the US Federal Reserve.

Data from Automatic Data Processing have shown that employment growth in the US private sector accelerated in January, more than expected. According to the report, in January, the number of employees increased by 246 thousand. People in comparison to the revised downward index for December at the level of 151 thousand. (Originally reported growth of 153 thousand.). Analysts had expected the number of people employed will increase by 165 thousand.

In addition, US producers signaled a strong start in 2017, while the growth of output and new orders accelerated since the end of last year. Improving the business environment is also reflected in the steady rise of the number and the payroll and the steepest increase in stocks of finished goods from the beginning of reference of the index in 2007. The seasonally adjusted PMI manufacturing index reached 55.0 in January, compared with 54.3 in December. The last reading was slightly less than the preliminary estimate of 55.1, and pointed to the fastest productivity growth since March 2015.

However, a report published by the Institute for Supply Management (ISM), showed that in January of activity in the US manufacturing sector has grown considerably, exceeding average forecasts of experts, and reaching the highest level since November, 2014. The PMI for the manufacturing was 56.0 points versus 54.7 points in December. Analysts had expected that this figure will rise to only 55.0 points.

As for the Fed meeting, CBA leaders unanimously voted to keep the federal funds rate by between 0.50% and 0.75%. Investors did not expect that the Fed will take any action, but hoped to get a signal with respect to the plans of the Central Bank to the next meeting. In a statement, the Fed said an improvement in the economy, and indicators of consumer confidence and trust companies. Also, the Fed noted that the risks for the most part the economic outlook are balanced. Central Bank representatives have promised to closely monitor the indicators of inflation, global economic and financial situation.

DOW index components ended the day mostly in negative territory (20 of 30). Most remaining shares fell Microsoft Corporation (MSFT, -1.70%). leaders of growth were shares of Apple Inc. (AAPL, + 6.87%).

Sector S & P Index showed mixed trends. The leader turned out to be the sector of consumer goods (+ 0.9%). Most utilities sector fell (-1.5%).

At the close:

Dow + 0.13% 19,889.05 +24.96

Nasdq + 0.50% 5,642.65 +27.86

S & P + 0.02% 2,279.43 +0.56

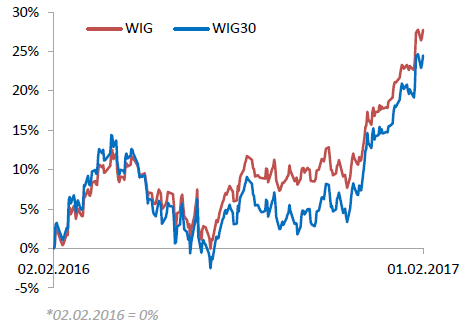

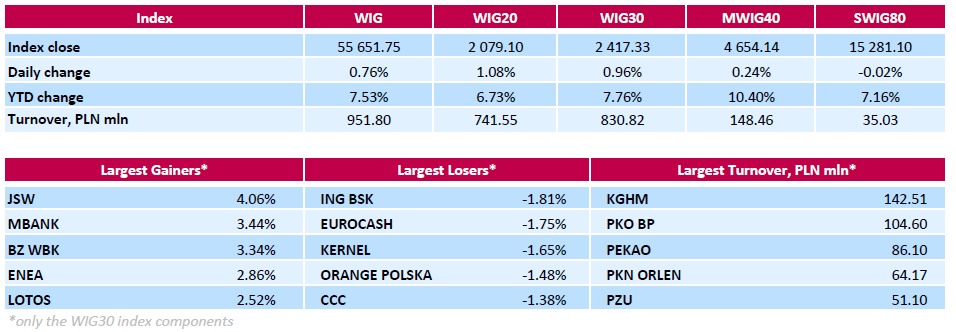

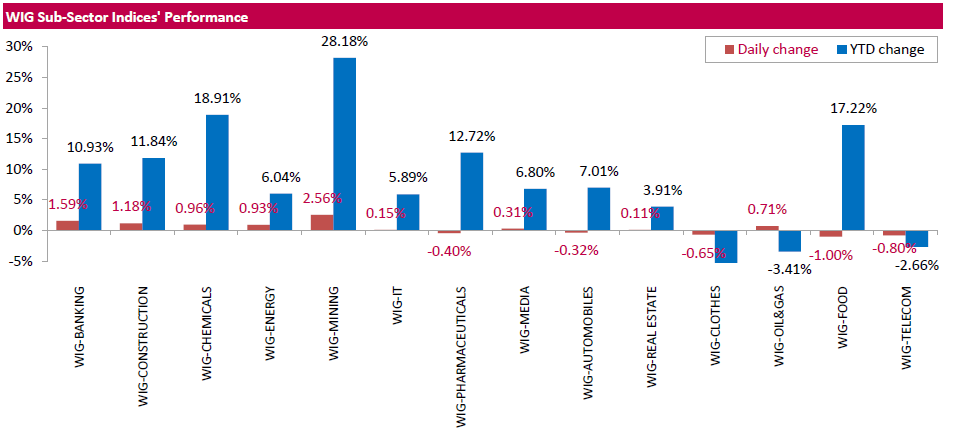

Polish equity market closed higher on Wednesday. The broad measure, the WIG index, added 0.76%. Sector-wise, mining stocks (+2.56%) outperformed, while food names (-1%) recorded the worst result.

The large-cap benchmark, the WIG30 Index, surged by 0.96%. Within the index components, coking coal miner JSW (WSE: JSW) led the advancers, climbing by 4.06%. It was followed by genco ENEA (WSE: ENA), oil refiner LOTOS (WSE: LTS), copper producer KGHM (WSE: KGH) and two banking names MBANK (WSE: MBK) and BZ WBK (WSE: BZW), which gained between 2.3% and 3.44%. On the other side of the ledger, bank ING BSK (WSE: ING) was the weakest performer, tumbling by 1.81%. Other largest decliners were FMCG-wholesaler EUROCASH (WSE: EUR), agricultural producer KERNEL (WSE: KER), telecommunication services provider ORANGE POLSKA (WSE: OPL) and footwear retailer CCC (WSE: CCC), dropping by 1.38%-1.75%. It should be noted that CCC stock fell despite the company reported its revenue boosted by 15.4% y/y to PLN 201 mln in January 2017.

The ADP report from the US labor market was a big positive surprise. The increase in the number of jobs by 246 thousand was considerably higher than forecast at 165 thousand. And this fact has been noted by the market. On currency market we may see the stronger dollar. Similarly reacted shares in the US and Euroland. The German DAX increased growth to 1.5 percent and the Warsaw WIG20 is not left behind.

An hour before the close of trading in Warsaw, the WIG20 index was at the level of 2.086 points (+ 1.47%).

U.S. stock-index futures rose, supported by strong quarterly results from Apple (AAPL), while investors awaited the outcomes of the Federal Reserve's two-day meeting.

Global Stocks:

Nikkei 19,148.08 +106.74 +0.56%

Hang Seng 23,318.39 -42.39 -0.18%

Shanghai - Closed

FTSE 7,143.09 +43.94 +0.62%

CAC 4,814.67 +65.77 +1.38%

DAX 11,681.64 +146.33 +1.27%

Crude $53.23 (+0.80%)

Gold $1,207.70 (-0.31%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 174.53 | -0.29(-0.1659%) | 2221 |

| ALCOA INC. | AA | 111.53 | 0.18(0.1617%) | 1079 |

| American Express Co | AXP | 76.77 | 0.39(0.5106%) | 400 |

| Apple Inc. | AAPL | 174.53 | -0.29(-0.1659%) | 2221 |

| AT&T Inc | T | 42.05 | -0.11(-0.2609%) | 22150 |

| Barrick Gold Corporation, NYSE | ABX | 18.26 | -0.18(-0.9761%) | 53867 |

| Boeing Co | BA | 164.13 | 0.71(0.4345%) | 6327 |

| Caterpillar Inc | CAT | 95.88 | 0.22(0.23%) | 1570 |

| Chevron Corp | CVX | 111.53 | 0.18(0.1617%) | 1079 |

| Cisco Systems Inc | CSCO | 30.69 | -0.03(-0.0977%) | 13751 |

| Citigroup Inc., NYSE | C | 56.4 | 0.57(1.021%) | 22709 |

| Deere & Company, NYSE | DE | 107.3 | 0.25(0.2335%) | 550 |

| E. I. du Pont de Nemours and Co | DD | 75.55 | 0.05(0.0662%) | 810 |

| Exxon Mobil Corp | XOM | 84.17 | 0.28(0.3338%) | 6580 |

| Facebook, Inc. | FB | 131.97 | 1.65(1.2661%) | 320646 |

| FedEx Corporation, NYSE | FDX | 174.53 | -0.29(-0.1659%) | 2221 |

| Ford Motor Co. | F | 12.39 | 0.03(0.2427%) | 85891 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 16.61 | -0.04(-0.2402%) | 100533 |

| General Electric Co | GE | 29.78 | 0.08(0.2694%) | 9533 |

| Goldman Sachs | GS | 230.99 | 1.67(0.7282%) | 20669 |

| Google Inc. | GOOG | 174.53 | -0.29(-0.1659%) | 2221 |

| Hewlett-Packard Co. | HPQ | 174.53 | -0.29(-0.1659%) | 2221 |

| Home Depot Inc | HD | 138.17 | 0.59(0.4288%) | 5055 |

| Intel Corp | INTC | 36.98 | 0.16(0.4345%) | 34644 |

| International Business Machines Co... | IBM | 174.98 | 0.46(0.2636%) | 1679 |

| Johnson & Johnson | JNJ | 113.35 | 0.10(0.0883%) | 2081 |

| JPMorgan Chase and Co | JPM | 85.39 | 0.76(0.898%) | 56196 |

| McDonald's Corp | MCD | 122.61 | 0.04(0.0326%) | 303 |

| Microsoft Corp | MSFT | 64.75 | 0.10(0.1547%) | 80527 |

| Nike | NKE | 53.02 | 0.12(0.2268%) | 4592 |

| Pfizer Inc | PFE | 31.57 | 0.16(0.5094%) | 52564 |

| Starbucks Corporation, NASDAQ | SBUX | 56.4 | 0.57(1.021%) | 22709 |

| Tesla Motors, Inc., NASDAQ | TSLA | 253.52 | 1.59(0.6311%) | 14709 |

| The Coca-Cola Co | KO | 83.05 | 0.34(0.4111%) | 2227 |

| Travelers Companies Inc | TRV | 117.91 | 0.13(0.1104%) | 1570 |

| Twitter, Inc., NYSE | TWTR | 56.4 | 0.57(1.021%) | 22709 |

| United Technologies Corp | UTX | 109.58 | -0.09(-0.0821%) | 1990 |

| UnitedHealth Group Inc | UNH | 83.05 | 0.34(0.4111%) | 2227 |

| Visa | V | 83.05 | 0.34(0.4111%) | 2227 |

| Wal-Mart Stores Inc | WMT | 83.05 | 0.34(0.4111%) | 2227 |

| Walt Disney Co | DIS | 110.92 | 0.27(0.244%) | 3564 |

| Yahoo! Inc., NASDAQ | YHOO | 44.25 | 0.18(0.4084%) | 4517 |

| Yandex N.V., NASDAQ | YNDX | 23.29 | 0.15(0.6482%) | 3615 |

Upgrades:

Downgrades:

Other:

Apple (AAPL) target raised to $135 from $130 at Mizuho

Apple (AAPL) target raised to $140 from $125 at RBC Capital Mkts

Apple (AAPL) target raised to $130 from $115 at Stifel

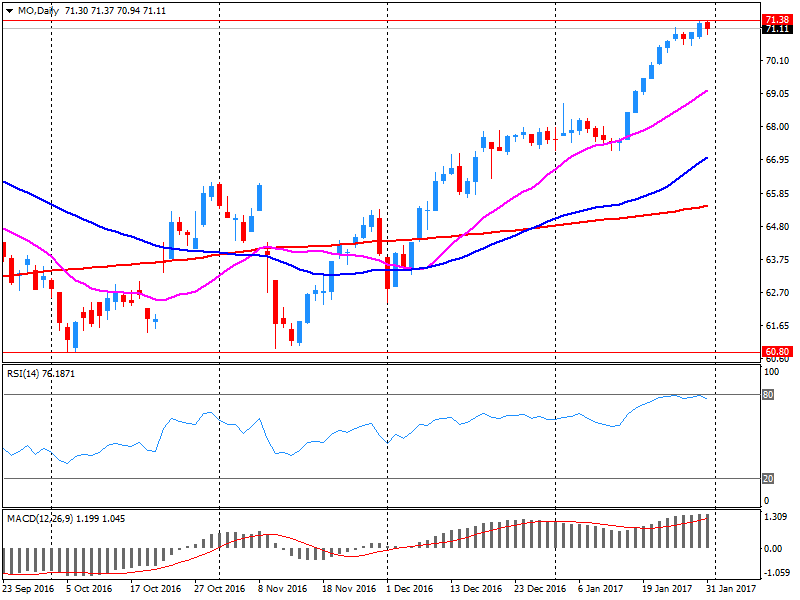

Altria reported Q4 FY 2016 earnings of $0.68 per share (versus $0.67 in Q4 FY 2015), beating analysts' consensus estimate of $0.67.

The company's quarterly revenues amounted to $4.733 bln (+0.1% y/y), missing analysts' consensus estimate of $4.798 bln.

The company also issued downside guidance for FY 2017, projecting EPS of $3.26-3.32 (+7.5-9.5% y/y) versus analysts' consensus estimate of $3.34.

MO fell to $70.11 (-1.5%) in pre-market trading.

The forenoon part of today's session may be divided into two parts, the rapid growth in the first quarter and maintaining growth in the later part of trading. The WIG20 index is trading about 1 percent on plus and almost perfectly mimics the behavior of the German DAX.

At the halfway point of today's quotations the WIG20 index was at the level of 2,077 points (+0,99%).

The stock indices in Western Europe are gaining, investors assess the statistical data from the euro zone and the reporting of large companies.

Procurement Managers Index (PMI) in manufacturing in the 19 euro-zone countries rose to 55.2 - its highest level in nearly six years. The value of the indicator above 50 points indicates strengthening business activity in this sector.

UK PMI for the production sector fell to 55.9 in January from two and a half year high of 56.1 in December. The index was in line with economists' expectations.

The composite index of the largest companies in the region Stoxx Europe 600 rose by 0.85% - to 363.17 points.

The price of Swedish auto maker Volvo jumped 6,4% as the company increased its profit last quarter by almost 2 times.

The market value of Siemens AG increased by 3.4%. Europe's largest industrial conglomerate increased its net profit in the 1st quarter and improved the outlook for the year as a whole.

Shares of Spanish bank BBVA rose 0.7%. The bank's profit in the last quarter fell by 28% - up to 678 million euros, which nevertheless turned out better than expectations (554 million euros).

Wizz Air Holdings reported a fall in net profit in the last quarter by 22%, despite revenue growth of 9%. On this news stock prices in early trading fell by 6.6%.

The capitalization of the Swiss pharmaceutical company Roche Holding AG rose by 1.1% due to an increase in profits in October-December by 8% and revenue by 5%.

Electrolux shares decreased by 1.4%. The company has returned to a profitable level in the 4th quarter, its profit amounted to 1.27 SEK and coincided with market expectations. Meanwhile, its revenue decreased by 1%.

At the moment:

FTSE 7150.34 51.19 0.72%

DAX 11645.41 110.10 0.95%

CAC 4802.53 53.63 1.13%

WIG20 index opened 2065.94 (+0.44%)*

WIG 55603.28 0.67

WIG30 2414.14 0.83

mWIG40 4656.24 0.28

*/ - change to previous close

The Warsaw market, same like European stock exchanges started the day having to rebuild the Wall Street in the second half of yesterday's session. The opening gap at top looks like an attempt to end the four-day correction and put the chart of the WIG20 towards 2,100 points.

After fifteen minutes of trading WIG20 index was at 2,076 points (+ 0.97%).

Most major indices on the New York stock markets closed yesterday's session in the red. The Dow Jones Industrial dropped at the closing of 0.54 percent, the S&P500 went down by 0.09 percent and in the contrast, the Nasdaq Comp. gained 0.02 percent. From the point of view of European markets a slight change of the S&P500 seems to be the most important. After the close of trading in Europe, the index recovered a large portion of earlier losses, which should support increases in Europe.

In the US, after the session, its results published Apple Inc., which recorded in the quarter covering the holidays better than expected sales results.

The beginning of the new month will bring data from the US labor market and the stock exchange today will get reading of ADP report. In addition, today ends the year's first meeting of the monetary authorities in the United States. On the Warsaw market yesterday's increases were supported by the weaken dollar and the appreciation of the zloty, but each of these currencies remain sensitive to what today appears in the FOMC statement.

European stocks ended in the red Tuesday, analysts blaming the selling in part on a surging euro as investors sifted through a mixed round of corporate updates. The benchmark ended with a January loss, giving up ground as the month wrapped up. On Monday, the gauge fell 1.1%, its biggest daily percentage drop since November, retreating alongside U.S. stocks, as some investors were spooked by President Donald Trump's executive order that banned citizens of seven predominantly Muslim countries from entering the U.S.

U.S. stocks trimmed earlier losses but still ended mostly lower on Tuesday, as declines in industrial, technology and financials shares outweighed gains in health-care and utilities sectors. The main indexes still posted a third consecutive round of monthly gains. The selling pressure in early trade came amid signs that momentum following President Donald Trump's election victory in November was fading, and as a January gauge of consumer confidence retreated from its highest level in 15 years.

Asset prices stabilized in Asia-Pacific trading Wednesday after two days of declines for the dollar and equities, as investors position themselves ahead of the Federal Reserve's policy statement. But investor caution persisted.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.