- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei -327.51 19041.34 -1.69%

TOPIX -22.10 1521.67 -1.43%

FTSE 100 -19.33 7099.15 -0.27%

DAX -146.58 11535.31 -1.25%

CAC 40 -35.74 4748.90 -0.75%

DJIA -107.04 19864.09 -0.54%

S&P 500 -2.03 2278.87 -0.09%

NASDAQ +1.07 5614.79 +0.02%

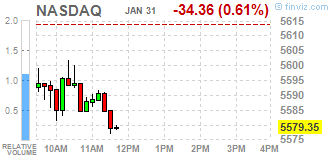

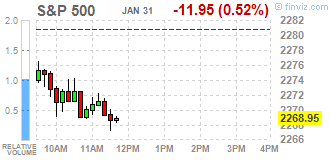

Major US stock indexes continued to fall on Tuesday, weighed down by a decrease in the technological and financial sectors, amid disappointing weak consumer confidence data.

The data from the Conference Board showed that consumer confidence indicator decreased moderately by the end of January, reaching 111.8 points (1985 = 100) compared to 113.3 points in December (revised from 113.7 points). Analysts predicted that the figure will be 113.0 points.

Market participants, who not so long ago pushed Wall Street to record highs on expectations of new financial incentives under the new administration, disappointed because of the insulating Trump policy, including restrictions on entry into the United States.

In addition, as it became known today, to compensate for the costs of civilian workers increased by 0.5%, seasonally adjusted, 3-month period ending in December 2016. US Bureau of Labor Statistics reported that the salary (which is about 70% reimbursement of expenses) increased by 0.5%, and bonuses (which make up the remaining 30% compensation) increased by 0.4%.

At the same time, house prices rose strongly in November, with the increase in prices did not show any signs of slowing down, even after mortgage rates began to rise during the month. House Price Index from the S & P / Case-Shiller, covering the whole country, increased by 5.6% in the 12 months ended in November, slightly above the revised growth of 5.5% compared to the previous year, which was reported in October.

Oil prices rose slightly, reacted to the news of a sharp reduction in OPEC oil production, as well as the weakening of the dollar across the board. Reuters survey showed that the volume of oil production by OPEC countries fell by more than 1 million. Barrels per day in January. Recall, the Organization of Petroleum Exporting Countries agreed to cut production by about 1.2 million. Barrels per day from January 1, to maintain prices and reduce oversupply.

DOW index components closed mostly in the red (22 of 30). Most remaining shares tumbled The Goldman Sachs Group, Inc. (GS, -1.87%). leaders of growth were shares of Pfizer Inc. (PFE, + 1.20%).

Almost all sectors of the S & P ended the session in negative territory. Most of the basic materials sector fell (-1.9%). The leader turned out to be the health sector (+ 2.0%).

At the close:

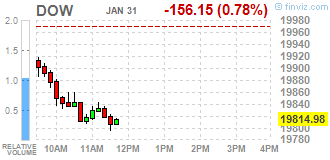

Dow -0.53% 19,864.94 -106.19

Nasdaq + 0.02% 5,614.79 +1.08

S & P -0.09% 2,278.91 -1.99

Major U.S. stock-indexes extended losses in late morning trade on Tuesday, weighed down by technology and industrial stocks, amid disappointing earnings and weak consumer confidence data. The selling comes a day after Wall Street suffered its worst day of 2017, as investors turned wary about the consequences of President Donald Trump's isolationist policies such as curbing travel to the United States.

Most of Dow stocks in negative area (25 of 30). Top loser - The Goldman Sachs Group, Inc. (GS, -1.78%). Top gainer - Merck & Co., Inc. (MRK, +0.63%).

Almost all S&P sectors also in negative area. Top loser - Utilities (+1.0%). Top loser - Services (-0.8%).

At the moment:

Dow 19730.00 -158.00 -0.79%

S&P 500 2262.75 -13.25 -0.58%

Nasdaq 100 5085.25 -39.25 -0.77%

Oil 53.43 +0.80 +1.52%

Gold 1214.70 +18.70 +1.56%

U.S. 10yr 2.44 -0.05

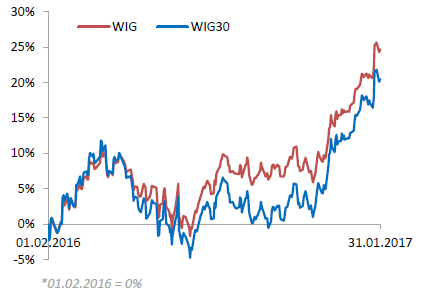

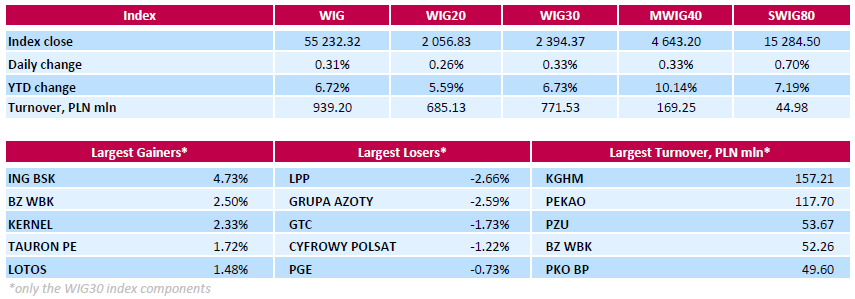

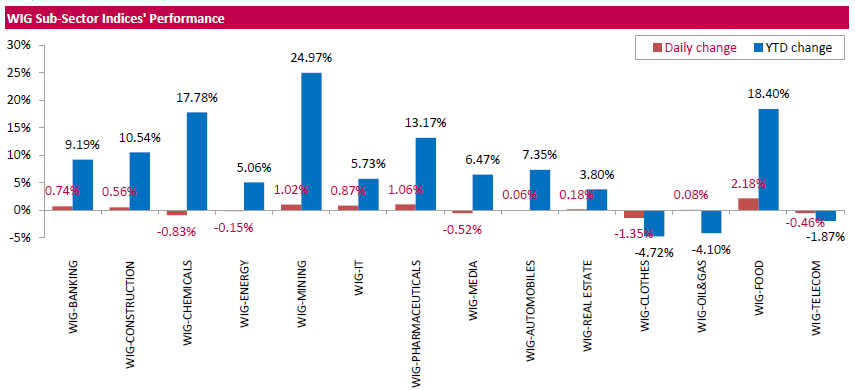

Polish equity market closed higher on Tuesday. The broad market measure, the WIG index, added 0.31%. Sector-wise, food stocks (+2.18%) fared the best, while clothes sector names (-1.35%) fell the most.

The large-cap benchmark, the WIG30 Index, rose by 0.33%. Within the index components, the gainers were led by banking sector name ING BSK (WSE: ING), which jumped by 4.73%, recovering after a 5.4% drop, recorded in the previous two days. Other major advancers were bank BZ WBK (WSE: BZW), agricultural producer KERNEL (WSE: KER) and genco TAURON PE (WSE: TPE), climbing by 2.5%, 2.33% and 1.72% respectively. The former was supported by the bank's CEO Michal Gajewski statement that the BZ WBK's loan portfolio increased by 7.9% in 2016 to PLN 107.9 bln in 2016. In addition, Mr. Gajewski expressed hope that the bank would outperform the 3.7% loan book growth forecast for the market in 2017. On the other side of the ledger, clothing retailer LPP (WSE: LPP) topped the list of the decliners with a 2.66% drop, followed by chemical producer GRUPA AZOTY (WSE: ATT) and property developer GTC (WSE: GTC), falling by 2.59% and 1.73% respectively.

The market in the US started on 0.28% minus (The S&P500 index) which after the first transaction has been slightly offset. Unfortunately, a weak Chicago PMI reading intensified the process of weakening of the dollar and contributed to the reduction of US indexes.

An hour before the close of trading WIG20 index was at the level of 2,061 points (+ 0.47%)

U.S. stock-index futures fell as investors focused on President Donald Trump's policies that could prove detrimental to the markets.

Global Stocks:

Nikkei 19,041.34 -327.51 -1.69%

Hang Seng - Closed

Shanghai - Closed

FTSE 7,156.82 +38.34 +0.54%

CAC 4,802.58 +17.94 +0.37%

DAX 11,695.95 +14.06 +0.12%

Crude $52.90 (+0.51%)

Gold $1,204.20 (+0.92%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 35.88 | -0.67(-1.8331%) | 850 |

| ALTRIA GROUP INC. | MO | 798.52 | -3.80(-0.4736%) | 6059 |

| Amazon.com Inc., NASDAQ | AMZN | 165.65 | 0.08(0.0483%) | 738 |

| American Express Co | AXP | 233.3 | -0.60(-0.2565%) | 1228 |

| Apple Inc. | AAPL | 121.21 | -0.42(-0.3453%) | 88347 |

| AT&T Inc | T | 41.7 | -0.12(-0.2869%) | 491 |

| Barrick Gold Corporation, NYSE | ABX | 18.36 | 0.35(1.9434%) | 53506 |

| Boeing Co | BA | 165.65 | 0.08(0.0483%) | 738 |

| Chevron Corp | CVX | 111 | -0.82(-0.7333%) | 1876 |

| Cisco Systems Inc | CSCO | 165.65 | 0.08(0.0483%) | 738 |

| Citigroup Inc., NYSE | C | 233.3 | -0.60(-0.2565%) | 1228 |

| Deere & Company, NYSE | DE | 106.49 | -0.57(-0.5324%) | 402 |

| E. I. du Pont de Nemours and Co | DD | 165.65 | 0.08(0.0483%) | 738 |

| Exxon Mobil Corp | XOM | 85.05 | 0.19(0.2239%) | 117711 |

| Facebook, Inc. | FB | 130.54 | -0.44(-0.3359%) | 36288 |

| FedEx Corporation, NYSE | FDX | 190.42 | -2.83(-1.4644%) | 3341 |

| Ford Motor Co. | F | 61.4 | -0.03(-0.0488%) | 275 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 16.62 | 0.37(2.2769%) | 187238 |

| General Electric Co | GE | 233.3 | -0.60(-0.2565%) | 1228 |

| General Motors Company, NYSE | GM | 233.3 | -0.60(-0.2565%) | 1228 |

| Goldman Sachs | GS | 233.3 | -0.60(-0.2565%) | 1228 |

| Google Inc. | GOOG | 798.52 | -3.80(-0.4736%) | 6059 |

| Hewlett-Packard Co. | HPQ | 165.65 | 0.08(0.0483%) | 738 |

| HONEYWELL INTERNATIONAL INC. | HON | 118.52 | -0.59(-0.4953%) | 1452 |

| Intel Corp | INTC | 37.5 | 0.08(0.2138%) | 384 |

| International Business Machines Co... | IBM | 175.51 | -0.29(-0.165%) | 654 |

| JPMorgan Chase and Co | JPM | 85.69 | -0.34(-0.3952%) | 4693 |

| Merck & Co Inc | MRK | 61.4 | -0.03(-0.0488%) | 275 |

| Microsoft Corp | MSFT | 61.4 | -0.03(-0.0488%) | 275 |

| Nike | NKE | 51.84 | -1.24(-2.3361%) | 163727 |

| Pfizer Inc | PFE | 31.06 | -0.25(-0.7985%) | 97712 |

| Tesla Motors, Inc., NASDAQ | TSLA | 249.16 | -1.47(-0.5865%) | 7055 |

| Travelers Companies Inc | TRV | 233.3 | -0.60(-0.2565%) | 1228 |

| Twitter, Inc., NYSE | TWTR | 16.9 | -0.04(-0.2361%) | 13181 |

| United Technologies Corp | UTX | 165.65 | 0.08(0.0483%) | 738 |

| UnitedHealth Group Inc | UNH | 162 | -0.09(-0.0555%) | 725 |

| Verizon Communications Inc | VZ | 49.31 | -0.06(-0.1215%) | 1816 |

| Visa | V | 82.66 | -1.04(-1.2425%) | 17961 |

| Wal-Mart Stores Inc | WMT | 66.36 | -0.06(-0.0903%) | 6423 |

| Yahoo! Inc., NASDAQ | YHOO | 798.52 | -3.80(-0.4736%) | 6059 |

| Yandex N.V., NASDAQ | YNDX | 798.52 | -3.80(-0.4736%) | 6059 |

Upgrades:

Downgrades:

Other:

AT&T (T) initiated with a Hold at Evercore ISI

Verizon (VZ) initiated with a Hold at Evercore ISI

Apple (AAPL) target lowered to $164 from $173 at Maxim Group

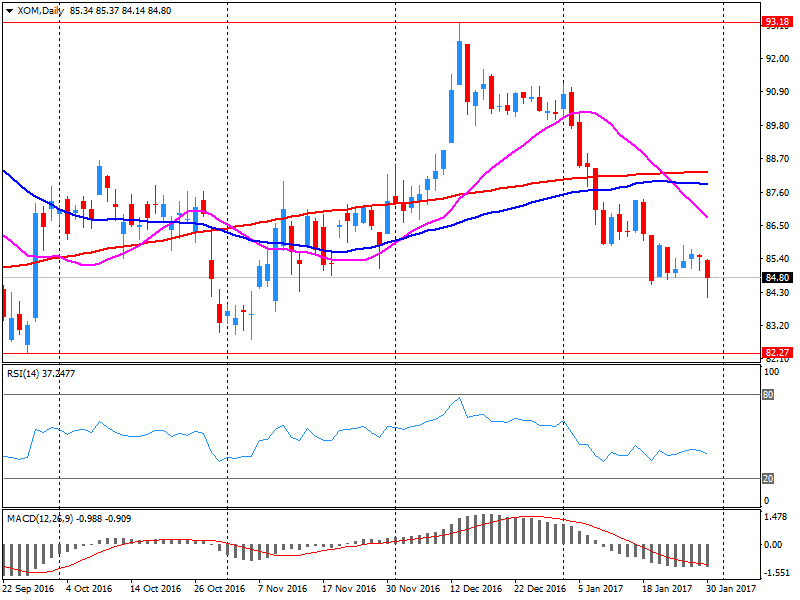

Exxon Mobil reported Q4 FY 2016 earnings of $0.41 per share (versus $0.67 in Q4 FY 2015), missing analysts' consensus estimate of $0.71..

The company's quarterly revenues amounted to $61.016 bln (+2% y/y), generally in-line with analysts' consensus estimate of $60.905 bln.

XOM fell to $84.78 (-0.09%) in pre-market trading.

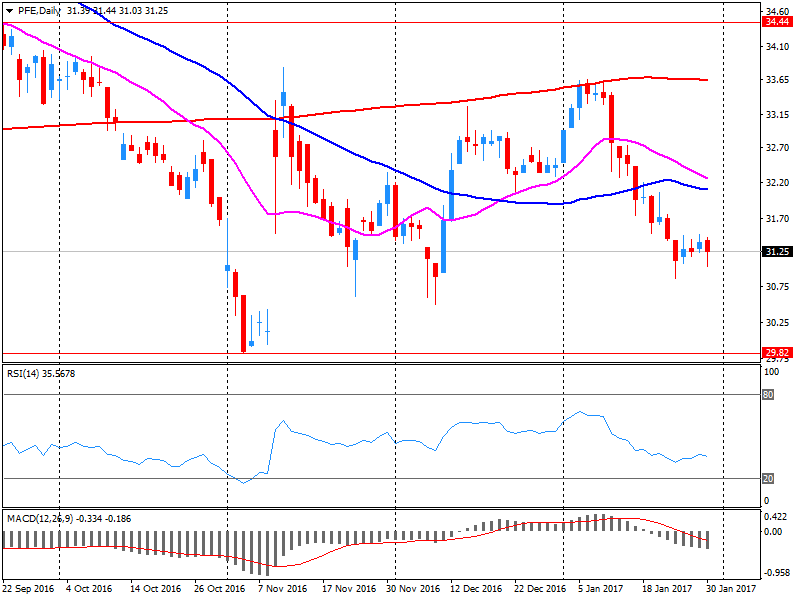

Pfizer reported Q4 FY 2016 earnings of $0.47 per share (versus $0.53 in Q4 FY 2015), missing analysts' consensus estimate of $0.51.

The company's quarterly revenues amounted to $13.627 bln (-3% y/y), generally in-line with analysts' consensus estimate of $13.690 bln.

The company also issued in-line guidance for FY 2017, projecting EPS of 2.50-2.60 (versus analysts' consensus estimate of $2.60) and revenues of $52-54 bln (versus analysts' consensus estimate of $54.86 bln).

PFE fell to $30.88 (-1.37%) in pre-market trading.

The first hour of today's trading has brought improvement in the climate on European markets, including Warsaw. The reading of the dynamics of Polish GDP surprised slightly positive and was amounted (according to preliminary estimates) of 2.8% compared to the expected level of 2.7%. Stronger was the consumption and investment decline has slowed, which sounds well for the start of this year. The most important is that in the first three quarters of the previous year GDP growth has surprised negatively, and now we have a positive message.

Readings of GDP in the euro zone also had a positive surprise. GDP growth rate of euro area countries in the fourth quarter was 1.8%, which is the result of slightly better-than-expected at 1.7%. At the same time the annualized growth was 2%, which is slightly better result than in the US. The market for the readings came with the reserve and on major European stock exchanges rises remain moderate.

At the halfway point of quotations the WIG20 index was at the level of 2,066 points (+0,73%).

WIG20 index opened at 2052.23 points (+0.04%)*

WIG 55104.36 0.08%

WIG30 2389.38 0.12%

mWIG40 4629.88 0.04%

*/ - change to previous close

The cash market began the last day of the month from cosmetics increase at a moderate turnover, traditionally concentrated on the shares of KGHM and the increased interest in shares of Polimex (WSE: PXM), which in recent days also has become the norm. In Germany the DAX opened with a modest increase, leading to a peaceful start of the European part of today's trading. Due to the last day of the month and the related date of assets valuation, the preferred scenario for today is growth.

After fifteen minutes of trading the WIG20 index was at the level of 2,052 points (+0,06%).

Monday's session on the New York stock exchange ended with declines in major indices. At the close the Dow Jones Industrial fell by 0.61 percent, the Nasdaq Composite lost 0.83 percent and the S&P 500 went down by 0.60 percent. Investors are still negatively react to the presidential decree to limit immigration.

The Asian markets are dominated by declines. The weaker yen does not support the Tokyo Stock Exchange, although the main impact on the Nikkei's discount of 1.7% has probably the passive attitude of the BoJ, which left its policy unchanged. Today's macro calendar doesn't contain any deeper content. An important may be the initial estimate of GDP growth for Poland in around 2016 and the level of the US index regarding consumer confidence - the Conference Board. This week the market is waiting for quarterly reports of large technology companies. Today, the results will give Apple, Facebook tomorrow and Amazon on Thursday.

European stocks finished with their biggest drop in two months Monday, with airlines and other leisure shares taking a hit after the Trump administration suspended entry by citizens of seven Muslim-majority countries into the U.S.

U.S. stocks posted their biggest decline for 2017 as investors fretted over the negative implications of President Donald Trump's decision to temporarily halt immigrants from certain countries with large numbers of Muslims. There are also concerns that the fast pace of executive orders from the new president could sow more confusion and uncertainty in the market going forward.

The Asia-Pacific markets that were open for business during the Lunar New Year holiday extended their declines Tuesday, tracking moves overnight in the U.S., as investor risk aversion around President Donald Trump's immigration policy kicked in. The losses marked a turn from the gains racked up in global equity markets last week, when the Dow Jones Industrial Average crossed the 20,000 point line for the first time ever; the Nikkei also reached multiweek highs.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.