- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

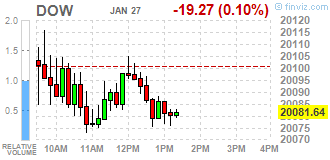

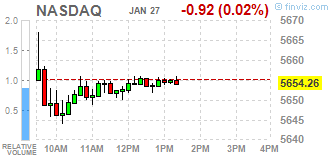

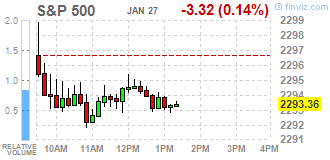

Major U.S. stock-indexes little changed on Friday as investors paused after a recent rally following underwhelming corporate earnings and gross domestic product data. U.S. economic growth slowed more than expected in the fourth quarter, with GDP rising at a 1,9% annual rate, below the 2,2% rise expected by economists and the 3,5% growth pace logged in the third quarter.

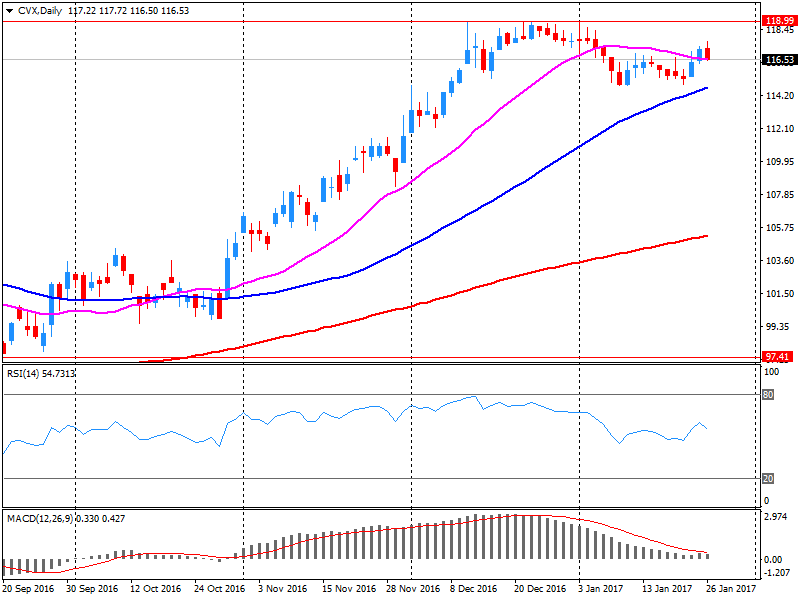

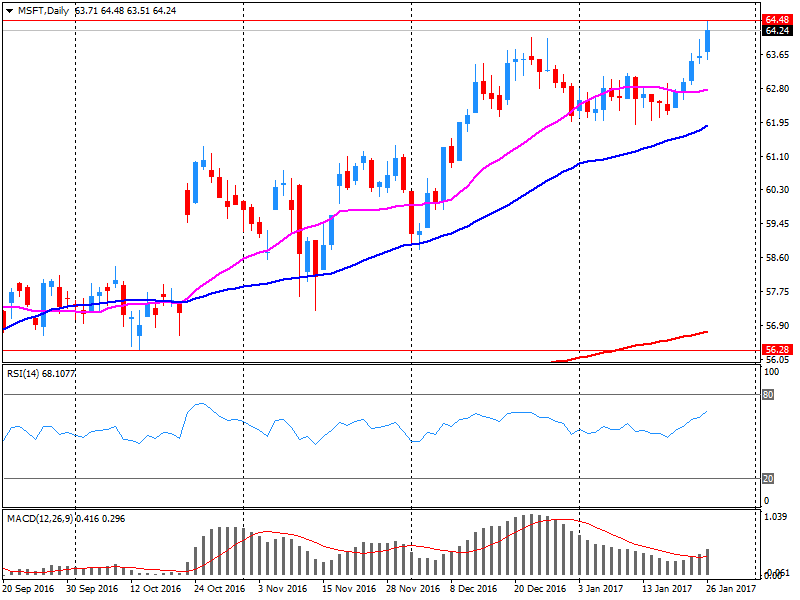

Dow stocks mixed (15 vs 15). Top loser - Chevron Corporation (CVX, -2.47%). Top gainer - Microsoft Corporation (MSFT, +2.25%).

Most of S&P sectors in negative area. Top gainer - Healthcare (+0.6%). Top loser - Basic Materials (-1.0%).

At the moment:

Dow 20012.00 -39.00 -0.19%

S&P 500 2288.75 -5.25 -0.23%

Nasdaq 100 5160.75 +13.00 +0.25%

Oil 52.84 -0.94 -1.75%

Gold 1188.90 -0.90 -0.08%

U.S. 10yr 2.49 -0.01

Polish equity market closed higher on Friday. The broad market measure, the WIG Index, added 0.18%. Sector-wise, food stocks (+2.50%) outperformed, while clothes sector names (-0.81%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, rose by 0.13%. Within the index components, agricultural producer KERNEL (WSE: KER) led the gainers, jumping by 4.22 % as the stock continued to benefit from the announcement the company has successfully placed Eurobonds worth $500 mln this week. It was the first Ukraine's corporate bond issuance since a 2013-14 uprising and separatist conflict plunged the country into economic crisis. Other largest advancers were bank MBANK (WSE: MBK), copper producer KGHM (WSE: KGH), oil refiner PKN ORLEN (WSE: PKN), IT-company ASSECO POLAND (WSE: ACP) and genco PGE (WSE: PGE), adding between 1% and 2.77%. On the other side of the ledger, coking coal miner JSW (WSE: JSW) was the biggest loser, tumbling by 2.94% after significant gains earlier this week. It was followed by bank BZ WBK (WSE: BZW), genco ENEA (WSE: ENA) and thermal coal miner BOGDANKA (WSE: LWB), which fell by 2.49%, 2.26% and 2.09% respectively.

U.S. stock-index futures were flat as investors assessed a slew of important macroeconomic data and the latest earnings reports.

demonstrated caution after the major indices closed at record highs yesterday.

Global Stocks:

Nikkei 19,467.40 +65.01 +0.34%

Hang Seng 23,360.78 -13.39 -0.06%

Shanghai Closed

FTSE 7,169.31 +7.82 +0.11%

CAC 4,843.32 -23.92 -0.49%

DAX 11,822.76 -25.87 -0.22%

Crude $53.61 (-0.32%)

Gold $1,180.70 (-0.78%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 36.4 | 0.10(0.2755%) | 251 |

| ALTRIA GROUP INC. | MO | 70.72 | -0.13(-0.1835%) | 1300 |

| AMERICAN INTERNATIONAL GROUP | AIG | 65.55 | -0.47(-0.7119%) | 400 |

| Apple Inc. | AAPL | 122.06 | 0.12(0.0984%) | 21176 |

| AT&T Inc | T | 41.78 | 0.01(0.0239%) | 2737 |

| Barrick Gold Corporation, NYSE | ABX | 83.52 | 0.28(0.3364%) | 685 |

| Boeing Co | BA | 83.52 | 0.28(0.3364%) | 685 |

| Caterpillar Inc | CAT | 97.37 | 0.15(0.1543%) | 8805 |

| Chevron Corp | CVX | 113.63 | -2.92(-2.5054%) | 137400 |

| Cisco Systems Inc | CSCO | 30.72 | -0.02(-0.0651%) | 2349 |

| Citigroup Inc., NYSE | C | 57.29 | -0.07(-0.122%) | 5710 |

| Exxon Mobil Corp | XOM | 83.52 | 0.28(0.3364%) | 685 |

| Facebook, Inc. | FB | 132.34 | -0.44(-0.3314%) | 108315 |

| Ford Motor Co. | F | 83.52 | 0.28(0.3364%) | 685 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 83.52 | 0.28(0.3364%) | 685 |

| General Electric Co | GE | 30.38 | 0.06(0.1979%) | 14406 |

| General Motors Company, NYSE | GM | 83.52 | 0.28(0.3364%) | 685 |

| Goldman Sachs | GS | 238.67 | -0.91(-0.3798%) | 8401 |

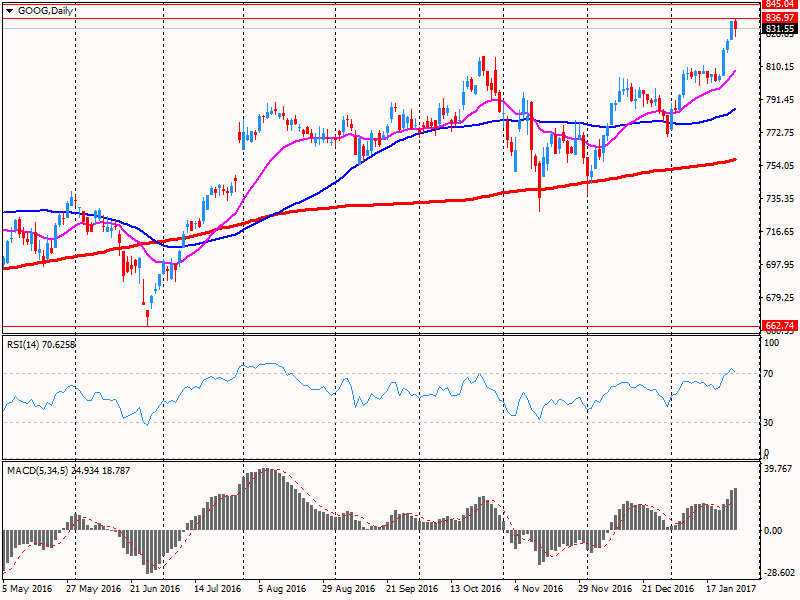

| Google Inc. | GOOG | 826.79 | -5.36(-0.6441%) | 91050 |

| HONEYWELL INTERNATIONAL INC. | HON | 117.11 | -0.86(-0.729%) | 9193 |

| Intel Corp | INTC | 37.94 | 0.38(1.0117%) | 143127 |

| International Business Machines Co... | IBM | 178.16 | -0.50(-0.2799%) | 59066 |

| Johnson & Johnson | JNJ | 112.16 | 0.32(0.2861%) | 1323 |

| JPMorgan Chase and Co | JPM | 86.69 | -0.06(-0.0692%) | 6232 |

| Microsoft Corp | MSFT | 65.09 | 0.82(1.2759%) | 600951 |

| Pfizer Inc | PFE | 31.37 | 0.09(0.2877%) | 2628 |

| Procter & Gamble Co | PG | 86.17 | -0.43(-0.4965%) | 4076 |

| Starbucks Corporation, NASDAQ | SBUX | 30.38 | 0.06(0.1979%) | 14406 |

| Tesla Motors, Inc., NASDAQ | TSLA | 251.65 | -0.86(-0.3406%) | 12377 |

| Twitter, Inc., NYSE | TWTR | 16.96 | 0.15(0.8923%) | 18970 |

| Verizon Communications Inc | VZ | 49.19 | 0.07(0.1425%) | 17571 |

| Visa | V | 83.52 | 0.28(0.3364%) | 685 |

| Wal-Mart Stores Inc | WMT | 67 | 0.27(0.4046%) | 2781 |

| Yahoo! Inc., NASDAQ | YHOO | 122.06 | 0.12(0.0984%) | 21176 |

| Yandex N.V., NASDAQ | YNDX | 23.5 | 0.22(0.945%) | 1127 |

Upgrades:

Microsoft (MSFT) upgraded to Neutral from Sell at Citigroup; target $65

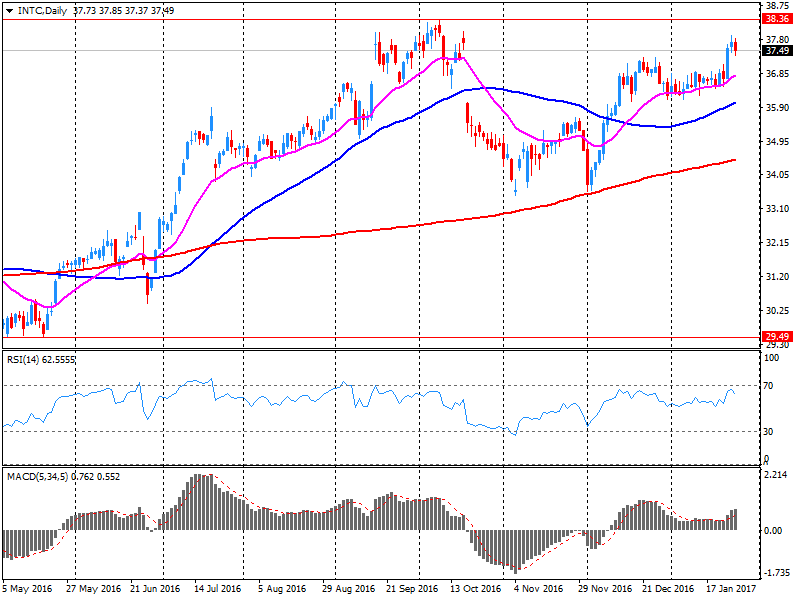

Intel (INTC) upgraded to Equal-Weight from Underweight at Morgan Stanley

Caterpillar (CAT) upgraded to Outperform from Market Perform at Wells Fargo

Ford Motor (F) upgraded to Outperform at RBC Capital Mkts; target raised to $14

Downgrades:

Other:

Microsoft (MSFT) target raised to $71 from $69 at BMO Capital Markets

Microsoft (MSFT) target raised to $71 from $65 at RBC Capital Mkts

Microsoft (MSFT) target raised to $68 from $66 at Stifel

Intel (INTC) target raised to $43 from $42 at Needham

Caterpillar (CAT) target raised to $85 at RBC Capital Mkts

Chevron reported Q4 FY 2016 earnings of $0.22 per share (versus -$0.31 in Q4 FY 2015), missing analysts' consensus estimate of $0.68.

The company's quarterly revenues amounted to $31.497 bln (+7.7% y/y), missing analysts' consensus estimate of $32.962 bln.

CVX fell to $113.13 (-2.93%) in pre-market trading.

Honeywell reported Q4 FY 2016 earnings of $1.74 per share (versus $1.58 in Q4 FY 2015), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $9.985 bln (0% y/y), missing analysts' consensus estimate of $10.149 bln.

HON fell to $116.95 (-0.86%) in pre-market trading.

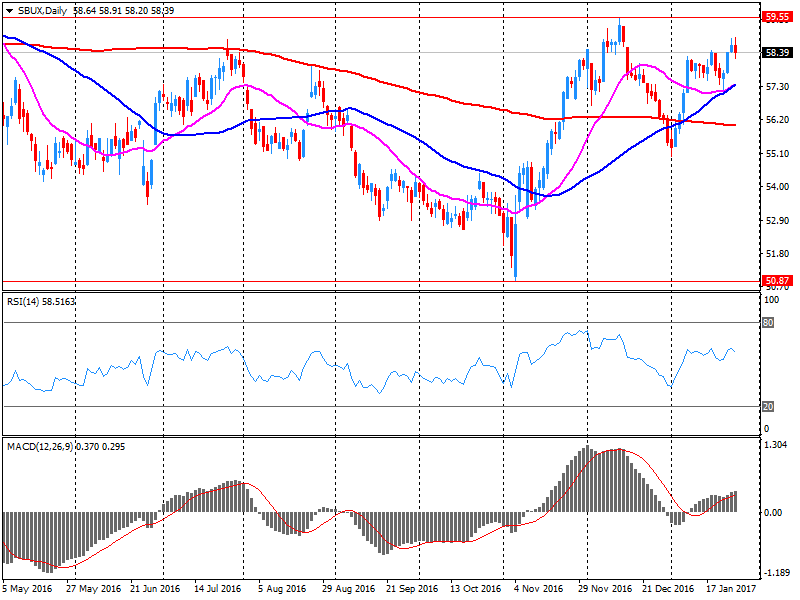

Starbucks reported Q1 FY 2017 earnings of $0.52 per share (versus $0.46 in Q1 FY 2016), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $5.733 bln (+6.7% y/y), missing analysts' consensus estimate of $5.851 bln.

SBUX fell to $55.70 (-4.72%) in pre-market trading.

Microsoft reported Q2 FY 2017 earnings of $0.83 per share (versus $0.78 in Q2 FY 2016), beating analysts' consensus estimate of $0.79.

The company's quarterly revenues amounted to $26.066 bln (+1.5% y/y), beating analysts' consensus estimate of $25.287 bln.

MSFT rose to $65.55 (+1.99%) in pre-market trading.

Intel reported Q4 FY 2016 earnings of $0.79 per share (versus $0.74 in Q4 FY 2015), beating analysts' consensus estimate of $0.75.

The company's quarterly revenues amounted to $16.400 bln (+10.1% y/y), beating analysts' consensus estimate of $15.750 bln.

The company also issued upside guidance for Q1, projecting EPS of $0.65 (versus analysts' consensus estimate of $0.61) and revenues of $14.8 bln (versus analysts' consensus estimate of $14.51 bln). For FY 2017, it forecast EPS of $2.80 (versus analysts' consensus estimate of $2.81) and revenues of $59.5 bln (versus analysts' consensus estimate of $60.85 bln).

INTC rose to $38.00 (+1.17%) in pre-market trading.

Alphabet reported Q4 FY 2016 earnings of $9.36 per share (versus $8.67 in Q4 FY 2015), missing analysts' consensus estimate of $9.62.

The company's quarterly revenues amounted to $26.064 bln (+22.2% y/y), beating analysts' consensus estimate of $25.140 bln.

GOOG fell to $820.99 (-1.34%) in pre-market trading.

European stocks traded mostly in the red zone correcting after strong growth in the previous session. Investors analyzed corporate reports and follow the fluctuations in the currency markets.

Certain influence had statistical data for the euro area. The ECB said that the euro zone's money supply increased significantly in December, accelerating relative to November and exceeded the estimates of experts. At the same time, private sector credit growth also improved, confirming expectations. December monetary aggregate M3 grew by 5.0 percent year on year, after increasing by 4.8 percent in November. Analysts had expected growth to accelerate to 4.9 per cent. In addition, the report showed that, on average over the past three months (to December) M3 monetary aggregate grew by 4.8 per cent, as in the previous 3-month period. Private sector credit volume increased by 2.5% in December after rising 2.4% in November. Adjusted lending to the private sector rose in December by 2.3% compared to 2.2% in November. The annual rate of growth in adjusted lending to households was 2.0% compared to 1.9% in November. Last change coincided with the forecast. At the same time, lending to non-financial corporations expanded by 2.3% compared with an increase of 2.1% in November.

Market participants are also awaiting the outcome of the talks between US President Donald Trump and British Prime Minister Theresa May. Leaders of the two countries should discuss a trade agreement between the United States and Britain. May stated that some of the barriers in trade between the United Kingdom and the United States may be withdrawn. In the case of the United States, with which Britain has close political and economic relations, there is a clear understanding and a desire to conclude an agreement on free trade.

The composite index of the largest companies in the region Stoxx Europe 600 was down 0.45%, to 365.84. However, the index is ready to complete the current week with an increase of 0.90%. The biggest decline demonstrates the banking sector - about 1%.

The capitalization of the Italian bank UniCredit fell 4.4% after the Italian media said that the vice-chairman confirmed that the bank did not sell its stake in Mediobanca. The lender will also launch its capital increase earlier than planned, on February 6, according to reports.

Wartsila shares - Finnish engineering company - rose by 7.2%, following statements on a higher than expected amount of profit and new orders in the last quarter.

At the moment:

FTSE 100 +13.03 7174.52 + 0.18%

DAX -30.43 11818.20 -0.26%

CAC 40 4842.56 -24.68 -0.51%

European stocks on Thursday finished at their highest level in nearly 13 months, supported by a surge in biotech firm Actelion Ltd. and gains for bank stocks. The Stoxx Europe 600 index SXXP, +0.25% rose 0.3% to 367.50, rising for a third straight day and representing the highest close for the pan-European benchmark since Dec. 30, 2015, according to FactSet data.

The Dow Jones Industrial Average on Thursday extended its run into the record books, but the broader market meandered as gains in industrials and consumer-discretionary shares were offset by losses in health-care and consumer-staples.

Investors' renewed enthusiasm for risk continued into Asia-Pacific trading on Friday morning, as equities continued to build on recent gains and the dollar crept upward, breaching 115 yen for the first time this week. The shifts in asset prices have come as investors have had different interpretations of what Trump administration policies will mean in the U.S. and worldwide.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.