- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei +269.51 19057.50 +1.43%

TOPIX +15.25 1521.58 +1.01%

Hang Seng +99.26 23049.12 +0.43%

CSI 300 +11.45 3375.90 +0.34%

Euro Stoxx 50 +44.62 3326.15 +1.36%

FTSE 100 +14.09 7164.43 +0.20%

DAX +211.11 11806.05 +1.82%

CAC 40 +47.64 4877.67 +0.99%

DJIA +155.80 20068.51 +0.78%

S&P 500 +18.30 2298.37 +0.80%

NASDAQ +55.38 5656.34 +0.99%

S&P/TSX +33.15 15643.84 +0.21%

Major U.S. stock-indexes higher in midday trading after hitting 20,000 for the first time on Wednesday as strong earnings and President Donald Trump's pro-growth initiatives reignited a post-election rally. Trump has made several business-friendly decisions since taking office on Friday, including signing executive orders to reduce regulatory burden on domestic manufacturers and clearing the way for the construction of two oil pipelines.

Most of Dow stocks in positive area (24 of 30). Top loser - United Technologies Corporation (UTX, -0.87%). Top gainer - The Boeing Company (BA, +4.99%).

All of S&P sectors in positive area. Top gainer - Industrial Goods (+1.2%).

At the moment:

Dow 20005.00 +161.00 +0.81%

S&P 500 2292.25 +17.75 +0.78%

Nasdaq 100 5144.25 +48.00 +0.94%

Oil 53.06 -0.12 -0.23%

Gold 1196.70 -14.10 -1.16%

U.S. 10yr 2.53 +0.06

Polish equity market enjoyed a strong run on Wednesday amid global rally. The broad market measure, the WIG index, rose by 2.77%. All sectors in the WIG gained, with banking stocks (+5.57%) outperforming.

The large-cap stocks' measure, the WIG30 Index, surged by 3.23%. Oil refiner LOTOS (WSE:LTS) was the sole decliner among the index components. It lost 0.61%. At the same time, all six constituents, belonging to the banking sector, were among the session's best performers with MBANK (WSE: MBK) and BZ WBK (WSE: BZW) outpacing with advances of 7.35% and 6.97%. MBANK's CEO, Cezary Stypulkowski, told the local media that there is no room to pay dividend on 2016 results. BZ WBK announced better-than-expected Q4 earnings. The bank unveiled its net earnings stood at PLN 460.9 mln in Q4, while analysts' had forecast PLN 426.1 mln. Coking coal producer JSW (WSE: JSW), footwear retailer CCC (WSE: CCC) and copper producer KGHM (WSE: KGH) also were among growth leaders, jumping by 7.08%, 4.85% and 4.29% respectively.

U.S. stock-index futures rose amid earnings results.

Global Stocks:

Nikkei 19,057.50 +269.51 +1.43%

Hang Seng 23,049.12 +99.26 +0.43%

Shanghai 3,149.43 +6.88 +0.22%

FTSE 7,182.11 +31.77 +0.44%

CAC 4,882.80 +52.77 +1.09%

DAX 11,784.25 +189.31 +1.63%

Crude $52.71 (-0.88%)

Gold $1,203.50 (-0.60%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 38.37 | 0.87(2.32%) | 352365 |

| ALTRIA GROUP INC. | MO | 70.94 | 0.18(0.2544%) | 5687 |

| Amazon.com Inc., NASDAQ | AMZN | 827.2 | 4.76(0.5788%) | 22782 |

| American Express Co | AXP | 235.5 | 1.82(0.7788%) | 19788 |

| AMERICAN INTERNATIONAL GROUP | AIG | 235.5 | 1.82(0.7788%) | 19788 |

| Apple Inc. | AAPL | 138.5 | 0.44(0.3187%) | 663 |

| AT&T Inc | T | 41.41 | 0.05(0.1209%) | 6313 |

| Barrick Gold Corporation, NYSE | ABX | 138.5 | 0.44(0.3187%) | 663 |

| Boeing Co | BA | 162.8 | 2.25(1.4014%) | 79537 |

| Caterpillar Inc | CAT | 97.6 | 1.36(1.4131%) | 15111 |

| Cisco Systems Inc | CSCO | 30.79 | 0.19(0.6209%) | 13806 |

| Citigroup Inc., NYSE | C | 57.46 | 0.72(1.2689%) | 69142 |

| E. I. du Pont de Nemours and Co | DD | 76.15 | 0.10(0.1315%) | 2390 |

| Facebook, Inc. | FB | 129.71 | 0.34(0.2628%) | 101700 |

| FedEx Corporation, NYSE | FDX | 191.75 | 0.14(0.0731%) | 510 |

| Ford Motor Co. | F | 235.5 | 1.82(0.7788%) | 19788 |

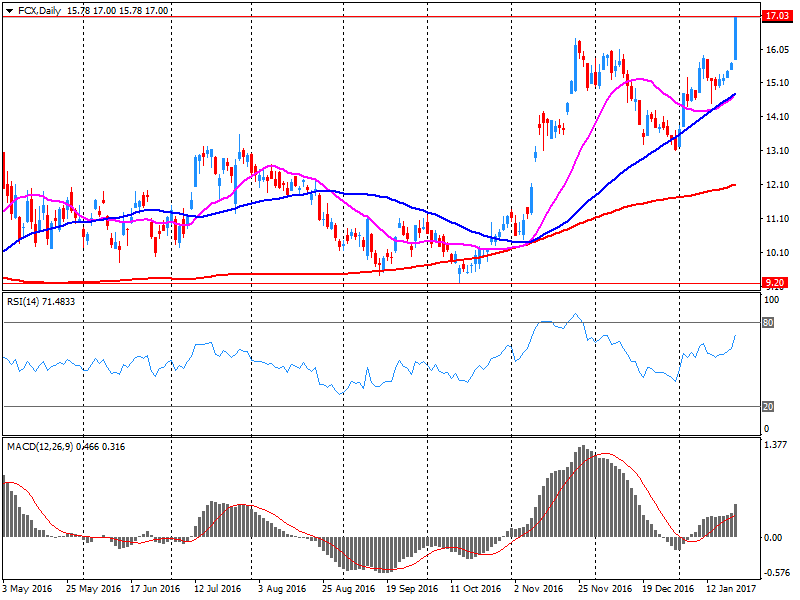

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 16.59 | -0.43(-2.5264%) | 2499401 |

| General Electric Co | GE | 30.19 | 0.19(0.6333%) | 54620 |

| General Motors Company, NYSE | GM | 37.56 | 0.56(1.5135%) | 12988 |

| Goldman Sachs | GS | 235.5 | 1.82(0.7788%) | 19788 |

| Google Inc. | GOOG | 829 | 5.13(0.6227%) | 5371 |

| Hewlett-Packard Co. | HPQ | 15.16 | -0.01(-0.0659%) | 1998 |

| Home Depot Inc | HD | 138.5 | 0.44(0.3187%) | 663 |

| Intel Corp | INTC | 235.5 | 1.82(0.7788%) | 19788 |

| International Business Machines Co... | IBM | 176.3 | 0.40(0.2274%) | 4748 |

| International Paper Company | IP | 56.2 | 0.30(0.5367%) | 2500 |

| Johnson & Johnson | JNJ | 76.15 | 0.10(0.1315%) | 2390 |

| Merck & Co Inc | MRK | 235.5 | 1.82(0.7788%) | 19788 |

| Microsoft Corp | MSFT | 63.97 | 0.45(0.7084%) | 21236 |

| Nike | NKE | 53.54 | 0.09(0.1684%) | 906 |

| Pfizer Inc | PFE | 235.5 | 1.82(0.7788%) | 19788 |

| Procter & Gamble Co | PG | 88 | 0.14(0.1593%) | 2877 |

| Tesla Motors, Inc., NASDAQ | TSLA | 257.75 | 3.14(1.2333%) | 40819 |

| The Coca-Cola Co | KO | 235.5 | 1.82(0.7788%) | 19788 |

| Twitter, Inc., NYSE | TWTR | 56.2 | 0.30(0.5367%) | 2500 |

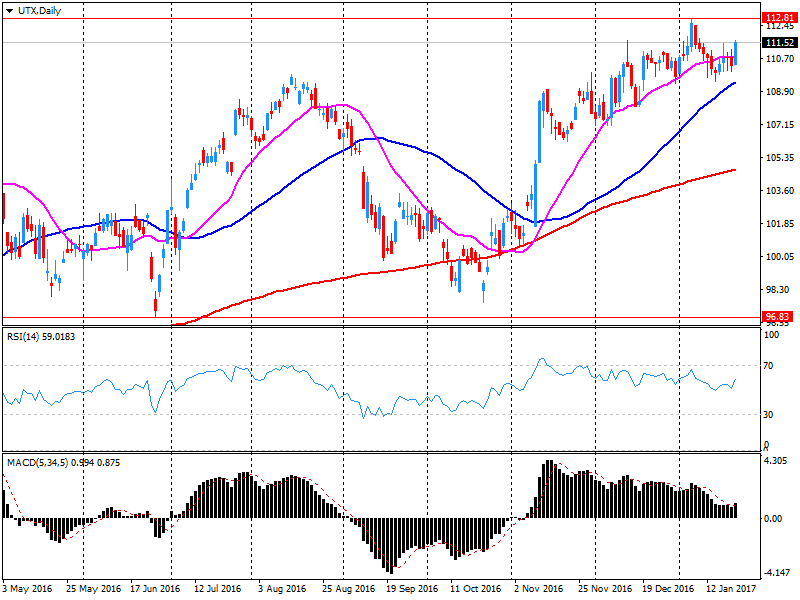

| United Technologies Corp | UTX | 138.5 | 0.44(0.3187%) | 663 |

| UnitedHealth Group Inc | UNH | 235.5 | 1.82(0.7788%) | 19788 |

| Verizon Communications Inc | VZ | 76.15 | 0.10(0.1315%) | 2390 |

| Wal-Mart Stores Inc | WMT | 67.58 | 0.18(0.2671%) | 828 |

| Walt Disney Co | DIS | 108.2 | 0.30(0.278%) | 2492 |

| Yahoo! Inc., NASDAQ | YHOO | 235.5 | 1.82(0.7788%) | 19788 |

| Yandex N.V., NASDAQ | YNDX | 23.15 | -0.04(-0.1725%) | 2552 |

Upgrades:

Intl Paper (IP) upgraded to an Outperform from Market Perform at BMO Capital

Alcoa (AA) upgraded to Hold from Sell at Deutsche Bank

Alcoa (AA) upgraded to Buy from Neutral at Citigroup

Downgrades:

Verizon (VZ) downgraded to Mkt Perform from Outperform at Raymond James

Verizon (VZ) downgraded to Sector Perform at RBC Capital Mkts; target lowered to $51

Verizon (VZ) downgraded to Mkt Perform from Outperform at FBR & Co; target $52

Other:

3M (MMM) target raised to $190 from $187 at Stifel

Johnson & Johnson (JNJ) target lowered to $128 from $133 at RBC Capital Mkts

Wal-Mart (WMT) initiated with a Market Perform at Wells Fargo

Alcoa reported Q4 FY 2016 earnings of $0.14 per share, missing analysts' consensus estimate of $0.24.

The company's quarterly revenues amounted to $2.537 bln (+3.5% y/y), beating analysts' consensus estimate of $2.366 bln.

AA rose to $38.46 (+2.56%) in pre-market trading.

Freeport-McMoRan reported Q4 FY 2016 earnings of $0.25 per share (versus -$0.02 in Q4 FY 2015), missing analysts' consensus estimate of $0.33.

The company's quarterly revenues amounted to $4.377 bln (+24.5% y/y), generally in-line with analysts' consensus estimate of $4.336 bln.

FCX fell to $16.58 (-2.59%) in pre-market trading.

Boeing reported Q4 FY 2016 earnings of $2.47 per share (versus $1.60 in Q4 FY 2015), beating analysts' consensus estimate of $2.33.

The company's quarterly revenues amounted to $23.286 bln (-1.2% y/y), generally in-line with analysts' consensus estimate of $23.129 bln.

The company also issued guidance for FY 2017, projecting EPS of $9.10-9.30 (versus analysts' consensus estimate of $9.27) and revenues of $90.5-92.5 bln (versus analysts' consensus estimate of $92.83 bln).

BA rose to $161.65 (+0.69%) in pre-market trading.

United Tech reported Q4 FY 2016 earnings of $1.56 per share (versus $1.53 in Q4 FY 2015), coinciding with analysts' consensus estimate.

The company's quarterly revenues amounted to $14.659 bln (+2.5% y/y), being generally in-line with analysts' consensus estimate of $14.710 bln.

The company also reaffirmed guidance for FY 2017, projecting EPS of $6.30-6.60 (versus analysts' consensus estimate of $6.56) and revenues of +1-3% y/y to $57.5-59.0 bln (versus analysts' consensus estimate of $58.8 bln).

UTX closed Tuesday's trading session at $111.61 (+1.15%).

European stocks finished modestly higher Tuesday after Britain's top court ruled the U.K. government must consult lawmakers before starting the Brexit process. The pan-European benchmark remained largely steady after the U.K. Supreme Court in an 8-3 decision upheld a High Court ruling from November. That ruling said an Act of Parliament is needed before the British government can invoke Article 50, the beginning of the process for Britain to exit the European Union.

The S&P 500 and the Nasdaq Composite closed at new records on Tuesday while the Dow Jones Industrial Average resumed its march toward the psychologically-important 20,000, finishing less than 90 points away from the elusive milestone. Gains for stocks came after a solid round of corporate earnings boosted investor sentiment, providing a catalsyt after mostly lackluster trading following President Donald Trump's inauguration on Friday.

Asian shares climbed on improved risk sentiment from both regional economic data and overnight gains in the U.S. for both stocks and the dollar. The greenback, though, has reversed some of that advance versus the yen, trading around ¥113.45 after nearly reaching ¥114 in early Asian trading.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.