- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei -103.04 18787.99 -0.55%

TOPIX -8.30 1506.33 -0.55%

Hang Seng +51.34 22949.86 +0.22%

CSI 300 +0.37 3364.45 +0.01%

Euro Stoxx 50 +8.49 3281.53 +0.26%

FTSE 100 -0.84 7150.34 -0.01%

DAX +49.19 11594.94 +0.43%

CAC 40 +8.62 4830.03 +0.18%

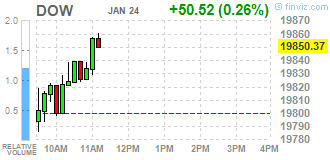

DJIA +112.86 19912.71 +0.57%

S&P 500 +14.87 2280.07 +0.66%

NASDAQ +48.01 5600.96 +0.86%

S&P/TSX +130.56 15610.69 +0.84%

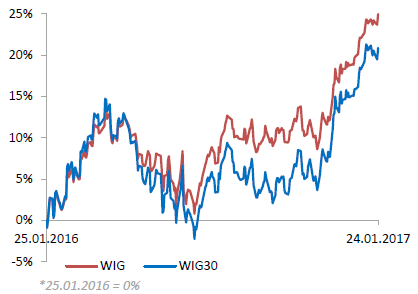

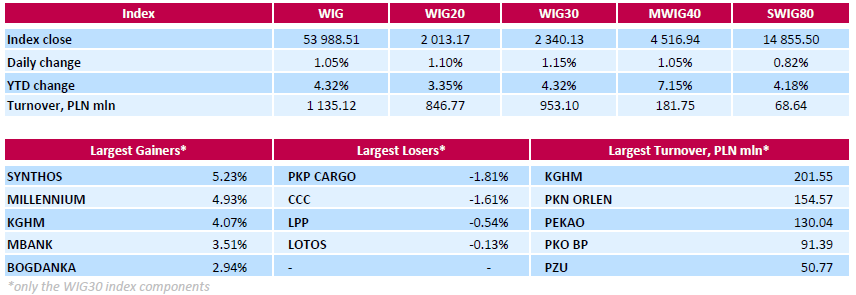

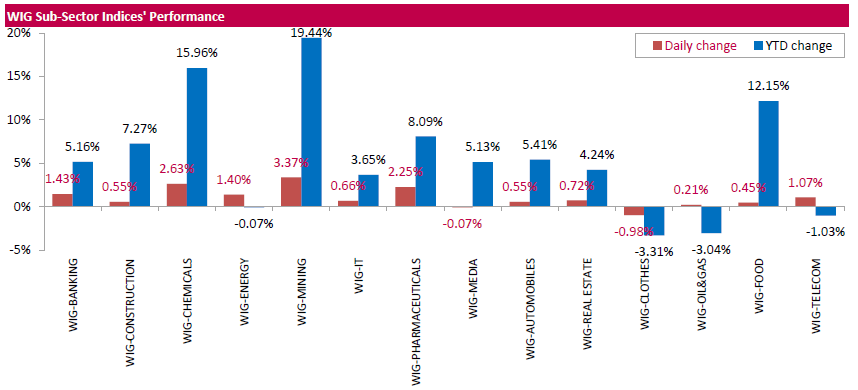

Polish equity market closed higher on Monday. The broad market measure, the WIG Index, surged by 1.05%. Except for clothes (-0.98%) and media (-0.07%), every sector in the WIG Index rose, with mining (+3.37%) outperforming.

The large-cap stocks' measure, the WIG30 Index, rose by 1.15%. There were only four decliners among the index components. Railway freight transport operator PKP CARGO (WSE: PKP) was the worst-performing name, tumbling by 1.81%. Other laggards were oil refiner LOTOS (WSE: LTS) and two retailers LPP (WSE: LPP) and CCC (WSE: CCC), losing between 0.13% and 1.61%. At the same time, chemical producer SYNTHOS (WSE: SNS) became the strongest performer with a 5.23% gain, supported by a target price hike by analysts of a regional investment bank. It was followed by copper producer KGHM (WSE: KGH), jumping by 4.07% as well as two banks MILLENNIUM (WSE: MIL) and MBANK (WSE: MBK), advancing by 4.93% and 2.94% respectively, as the both banks announced they saw no need to seek fresh capital despite authorities recommendation for banks to put more capital aside if they hold foreign exchange-denominated mortgages. Among other major outperformers were also thermal coal miner BOGDANKA (WSE: LWB) and genco TAURON PE (WSE: TPE), gaining 2.94% and 2.87% respectively. The former was helped by the announcement that the company's coal production reached 9 mln tons in 2016, that was at the upper end of the planned range of 8.5-9 mln tonnes. Elsewhere, it was reported that agricultural producer KERNEL (WSE: KER) had set final guidance for a benchmark five-year US dollar bond at 9% (+/-12.5bp), to price in range. Thus, the Ukrainian holding, rated B+/B, began marketing the notes at 9.25-9.50%. Order books are over $2 bln on the 144A/Reg S deal, which will price today via lead managers ING and JP Morgan. The KER stock added 0.36% on the back of this announcement.

Major U.S. stock-indexes higher on Tuesday as investors assessed quarterly earnings, while seeking clarity on President Donald Trump's economic policies. With earnings gathering pace, investors are hoping that corporate performance can justify market valuations, given the recent rally that drove Wall Street to record highs.

Most of Dow stocks in positive area (20 of 30). Top gainer - E. I. du Pont de Nemours and Company (DD, +3.29%). Top loser - Verizon Communications Inc. (VZ, -4.37%).

Almost all of S&P sectors in positive area. Top gainer - Basic Materials (+1.1%). Top loser - Healthcare (-1.0%).

At the moment:

Dow 19764.00 +29.00 +0.15%

S&P 500 2265.50 +3.50 +0.15%

Nasdaq 100 5072.50 +9.00 +0.18%

Oil 53.36 +0.61 +1.16%

Gold 1214.20 -1.40 -0.12%

U.S. 10yr 2.43 +0.03

U.S. stock-index futures were flat, as investors assessed quarterly earnings reports of a batch of high-profile companies.

Global Stocks:

Nikkei 18,787.99 -103.04 -0.55%

Hang Seng 22,949.86 +51.34 +0.22%

Shanghai 3,143.09 +6.32 +0.20%

FTSE 7,163.23 +12.05 +0.17%

CAC4,822.84 +1.43 +0.03%

DAX 11,572.30 +26.55 +0.23%

Crude $53.16 (+0.78%)

Gold $1,213.30 (-0.19%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 176.7 | -1.81(-1.014%) | 15137 |

| ALCOA INC. | AA | 36.85 | 0.56(1.5431%) | 42516 |

| ALTRIA GROUP INC. | MO | 70.65 | 0.10(0.1417%) | 980 |

| Amazon.com Inc., NASDAQ | AMZN | 820.05 | 2.17(0.2653%) | 13245 |

| American Express Co | AXP | 76.13 | 0.16(0.2106%) | 1399 |

| Apple Inc. | AAPL | 119.46 | -0.62(-0.5163%) | 162520 |

| AT&T Inc | T | 41.4 | -0.60(-1.4286%) | 105678 |

| Barrick Gold Corporation, NYSE | ABX | 17.78 | -0.04(-0.2245%) | 67855 |

| Boeing Co | BA | 157.59 | -0.25(-0.1584%) | 5017 |

| Caterpillar Inc | CAT | 94.71 | 0.25(0.2647%) | 3131 |

| Chevron Corp | CVX | 115 | -0.39(-0.338%) | 315 |

| Cisco Systems Inc | CSCO | 30.34 | 0.07(0.2313%) | 2742 |

| Citigroup Inc., NYSE | C | 55.95 | 0.27(0.4849%) | 10551 |

| E. I. du Pont de Nemours and Co | DD | 72.28 | -0.50(-0.687%) | 5786 |

| Exxon Mobil Corp | XOM | 85.15 | 0.18(0.2118%) | 5166 |

| Facebook, Inc. | FB | 129.26 | 0.33(0.2559%) | 78841 |

| Ford Motor Co. | F | 12.35 | 0.04(0.3249%) | 66707 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 16.23 | 0.51(3.2443%) | 327665 |

| General Electric Co | GE | 29.83 | 0.08(0.2689%) | 21051 |

| General Motors Company, NYSE | GM | 36.87 | 0.22(0.6003%) | 6216 |

| Goldman Sachs | GS | 233.37 | 0.70(0.3009%) | 2279 |

| Google Inc. | GOOG | 821.29 | 1.98(0.2417%) | 2846 |

| Home Depot Inc | HD | 138.54 | 0.47(0.3404%) | 2445 |

| Intel Corp | INTC | 36.83 | 0.06(0.1632%) | 2429 |

| International Business Machines Co... | IBM | 171.22 | 0.19(0.1111%) | 1987 |

| Johnson & Johnson | JNJ | 112.38 | -1.53(-1.3432%) | 70051 |

| JPMorgan Chase and Co | JPM | 83.91 | 0.20(0.2389%) | 4936 |

| McDonald's Corp | MCD | 121.47 | 0.09(0.0741%) | 358 |

| Merck & Co Inc | MRK | 62.1 | 0.29(0.4692%) | 892 |

| Microsoft Corp | MSFT | 63.1 | 0.14(0.2224%) | 8570 |

| Pfizer Inc | PFE | 31.54 | 0.08(0.2543%) | 5500 |

| Procter & Gamble Co | PG | 87.3 | 0.34(0.391%) | 1728 |

| Starbucks Corporation, NASDAQ | SBUX | 57.9 | 0.14(0.2424%) | 1456 |

| Tesla Motors, Inc., NASDAQ | TSLA | 249.8 | 0.88(0.3535%) | 14179 |

| The Coca-Cola Co | KO | 41.44 | 0.01(0.0241%) | 3772 |

| Travelers Companies Inc | TRV | 118.58 | 0.54(0.4575%) | 16442 |

| Twitter, Inc., NYSE | TWTR | 16.65 | 0.04(0.2408%) | 3254 |

| United Technologies Corp | UTX | 110.16 | -0.18(-0.1631%) | 885 |

| Verizon Communications Inc | VZ | 50.7 | -1.71(-3.2627%) | 600819 |

| Wal-Mart Stores Inc | WMT | 66.71 | 0.06(0.09%) | 510 |

| Walt Disney Co | DIS | 107.19 | 0.07(0.0653%) | 1530 |

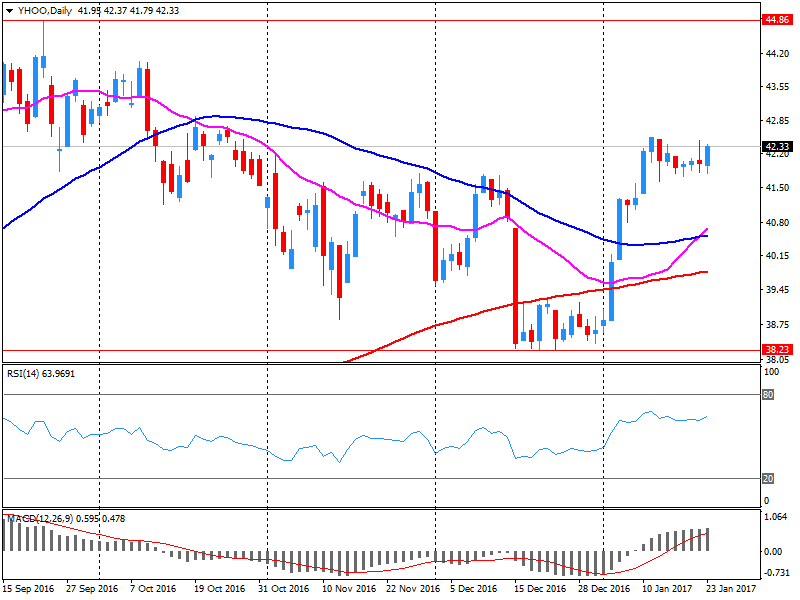

| Yahoo! Inc., NASDAQ | YHOO | 43.65 | 1.25(2.9481%) | 847487 |

| Yandex N.V., NASDAQ | YNDX | 22.28 | 0.19(0.8601%) | 100 |

Upgrades:

Downgrades:

Apple (AAPL) downgraded to Equal Weight from Overweight at Barclays; target to $117 from $119

Other:

Deere (DE) initiated with a Sell at Berenberg; target $90

Yahoo! (YHOO) target lowered to $43 from $45 at RBC Capital

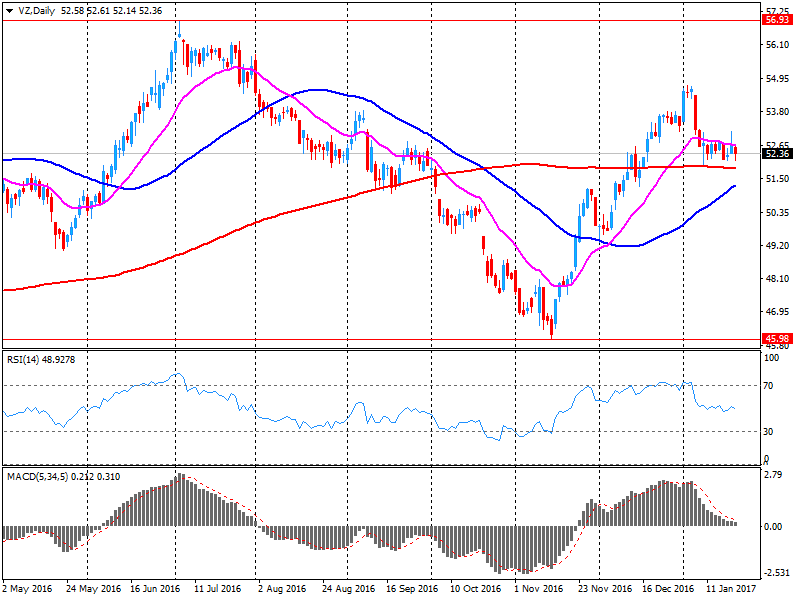

Verizon reported Q4 FY 2016 earnings of $0.86 per share (versus $0.89 in Q4 FY 2015), missing analysts' consensus estimate of $0.89.

The company's quarterly revenues amounted to $32.340 bln (-5.6% y/y), generally in-line with analysts' consensus estimate of $32.123 bln.

VZ fell to $51.00 (-2.69%) in pre-market trading.

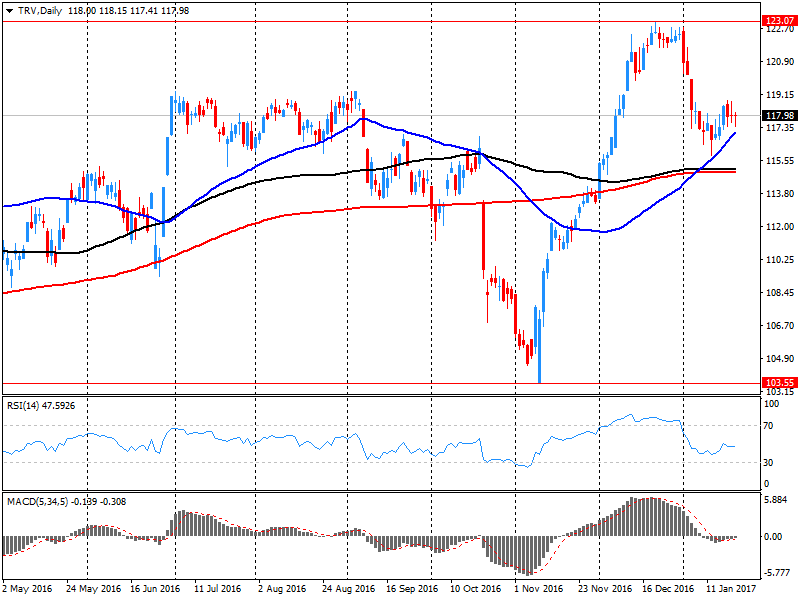

Travelers reported Q4 FY 2016 earnings of $3.20 per share (versus $2.90 in Q4 FY 2015), beating analysts' consensus estimate of $2.81.

The company's quarterly revenues amounted to $7.193 bln (+7.7% y/y), beating analysts' consensus estimate of $6.177 bln.

TRV fell to $118.00 (-0.03%) in pre-market trading.

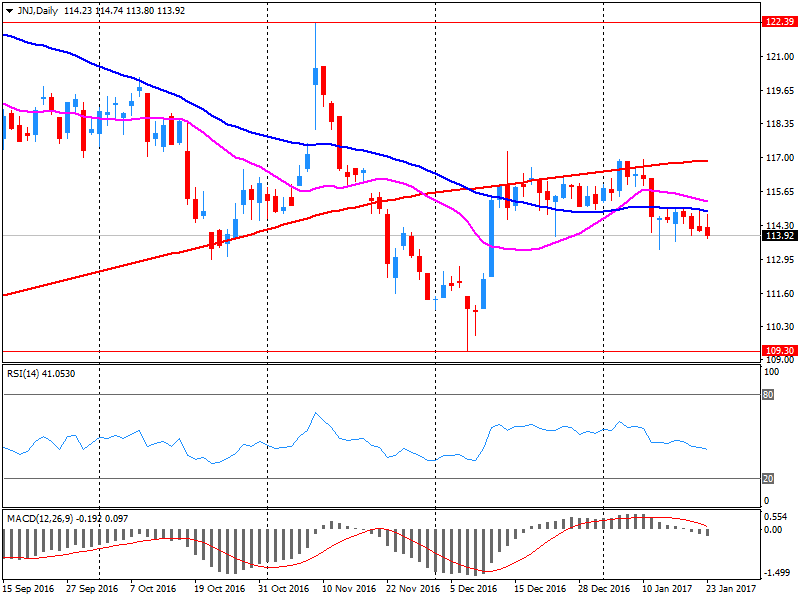

Johnson & Johnson reported Q4 FY 2016 earnings of $1.58 per share (versus $1.44 in Q4 FY 2015), beating analysts' consensus estimate of $1.56.

The company's quarterly revenues amounted to $18.106 bln (+1.7% y/y), generally in-line with analysts' consensus estimate of $18.260 bln.

The company also issued downside guidance for FY 2017, projecting EPS of $6.93-7.08 (versus analysts' consensus estimate of $7.12) and revenues of $74.1-74.8 bln (versus analysts' consensus estimate of $75.13 bln).

JNJ fell to $112.28 (-1.43%) in pre-market trading.

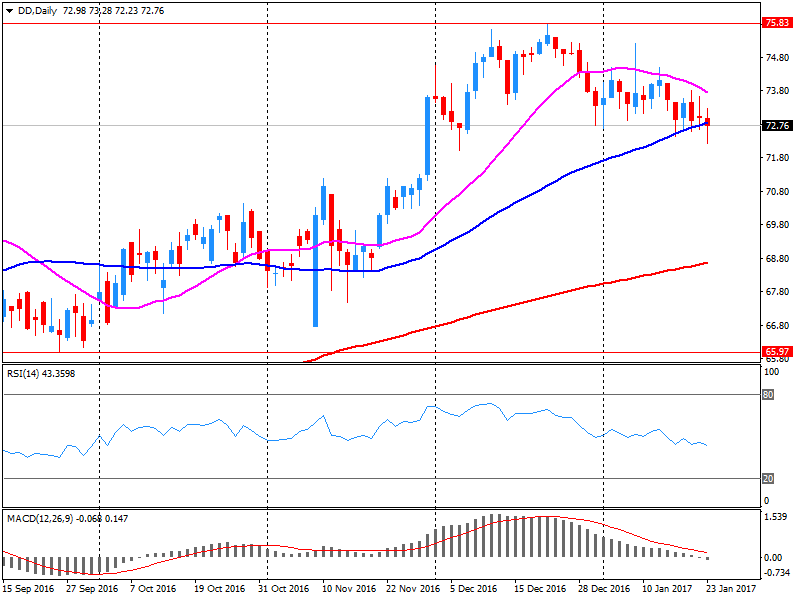

DuPont reported Q4 FY 2016 earnings of $0.51 per share (versus $0.27 in Q4 FY 2015), beating analysts' consensus estimate of $0.42.

The company's quarterly revenues amounted to $5.211 bln (-1.7% y/y), slightly missing analysts' consensus estimate of $5.265 bln.

The company also issued guidance for Q1, projecting EPS of $1.36 (+8% y/y), while analysts forecast Q1 EPS of $1.41.

DD fell to $72.50 (-0.38%)in pre-market trading.

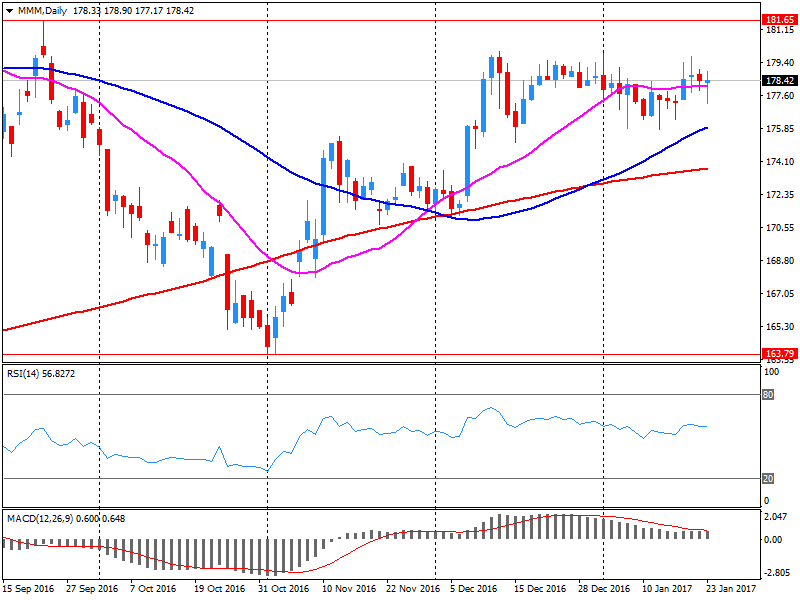

3M reported Q4 FY 2016 earnings of $1.88 per share (versus $1.80 in Q4 FY 2015), beating analysts' consensus estimate of $1.87.

The company's quarterly revenues amounted to $7.329 bln (+0.4% y/y), generally in-line with analysts' consensus estimate of $7.338 bln.

The company also reaffirmed guidance for FY 2017, projecting EPS of $8.45-8.80 (versus analysts' consensus estimate of $8.62) and organic sales growth at +1-3%.

MMM rose to $179.00 (+0.27%) in pre-market trading.

Yahoo! reported Q4 FY 2016 earnings of $0.25 per share (versus $0.13 in Q4 FY 2015), beating analysts' consensus estimate of $0.21.

The company's quarterly revenues amounted to $0.960 bln (-4.2% y/y), beating analysts' consensus estimate of $0.908 bln.

YHOO rose to $43.95 (+3.66%) in pre-market trading.

European stocks closed in the red Monday as equity investors got their first chance to react to President Donald Trump's inauguration speech, seen as taking a protectionist tone.

U.S. stocks closed down Monday, but off session lows of the day as investors wrestled with uncertainty over the policies of President Donald Trump and as a batch of corporate quarterly results came out mixed.

Asian shares were lacking direction early Tuesday, as the overnight decision by the U.S. to pull out of a regional trade pact, as well as increased protectionist rhetoric, have largely been priced in by the market.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.