- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei +344.89 19402.39 +1.81%

TOPIX +23.43 1545.01 +1.54%

Hang Seng +325.05 23374.17 +1.41%

CSI 300 +12.06 3387.96 +0.36%

Euro Stoxx 50 -7.02 3319.13 -0.21%

FTSE 100 -2.94 7161.49 -0.04%

DAX +42.58 11848.63 +0.36%

CAC 40 -10.43 4867.24 -0.21%

DJIA +32.40 20100.91 +0.16%

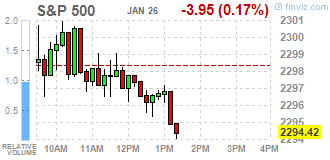

S&P 500 -1.69 2296.68 -0.07%

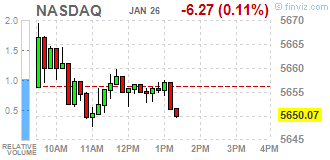

NASDAQ -1.16 5655.18 -0.02%

S&P/TSX -28.32 15615.52 -0.18%

Major U.S. stock indexes little changed on Thursday, after breaching the milestone a day earlier, while losses in tech stocks weighed on the S&P 500 and the Nasdaq Composite indexes. The post-election rally roared back to life this week following optimism over U.S. President Donald Trump's pro-growth initiatives and solid earnings, catapulting the Dow above the historic mark.

Dow stocks mixed (15 vs 15). Top loser - Verizon Communications Inc. (VZ, -1.35%). Top gainer - UnitedHealth Group Incorporated (UNH, +1.31%).

Most of S&P sectors in negative area. Top gainer - Conglomerates (+1.5%). Top loser - Consumer goods (-0.7%).

At the moment:

Dow 20023.00 +20.00 +0.10%

S&P 500 2292.00 -2.00 -0.09%

Nasdaq 100 5154.50 +8.00 +0.16%

Oil 53.70 +0.95 +1.80%

Gold 1189.50 -8.30 -0.69%

U.S. 10yr 2.51 -0.01

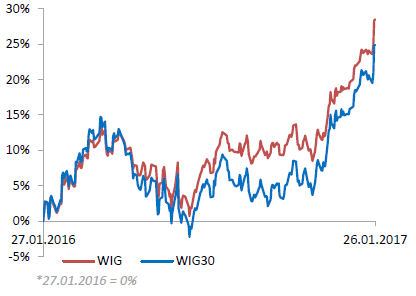

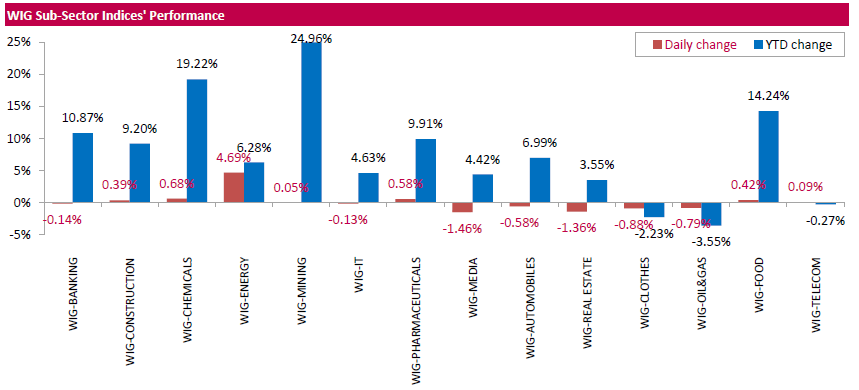

Polish equity market closed slightly higher on Thursday. The broad market measure, the WIG index, added 0.14%. Sector performance within the WIG Index was mixed. Utilities stocks (+4.69%) were the strongest group, while media names (-1.46%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, edged up 0.07%. In the index basket, coking coal producer JSW (WSE: JSW) and four energy generating sector's names ENERGA (WSE: ENG), ENEA (WSE: ENA), PGE (WSE: PGE) and TAURON (WSE: TPE) posted the largest gains, climbing by 2.41%-9.21%. At the same time, bank ING BSK (WSE: ING) was biggest loser, dropping by 3.43%. Other major laggards were footwear retailer CCC (WSE: CCC), bank MBANK (WSE: MBK) and oil refiner PKN ORLEN (WSE: PKN), falling by 1.87%, 1.12% and 1.1% respectively. It should be noted that PKN ORLEN reported that its net profit amounted to PLN 5.261 bln in 2016, up 85.4% y/y. Its total sales volume rose by 2 percent to a record 10 bln liters of fuel. But its revenues fell by 9.9% y/y to PLN 79.553 bln. As a result, its net margin stood at 12.1%, down 5.5 p.p. y/y. The company also said that it expected that its downstream margin might slightly decrease in 2017 compared to the 2016 average.

U.S. stock-index futures were flat as investors demonstraded caution after the major indices closed at record highs yesterday.

Global Stocks:

Nikkei 19,402.39 +344.89 +1.81%

Hang Seng 23,374.17 +325.05 +1.41%

Shanghai 3,159.17 +9.61 +0.31%

FTSE 7,176.48 +12.05 +0.17%

CAC 4,878.65 +0.98 +0.02%

DAX 11,846.34 +40.29 +0.34%

Crude $53.11 (-0.13%)

Gold $1,188.00 (-0.82%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 36.26 | -0.27(-0.7391%) | 4154 |

| ALTRIA GROUP INC. | MO | 71.05 | 0.09(0.1268%) | 817 |

| AMERICAN INTERNATIONAL GROUP | AIG | 60.83 | -0.25(-0.4093%) | 660 |

| Apple Inc. | AAPL | 121.8 | -0.08(-0.0656%) | 31310 |

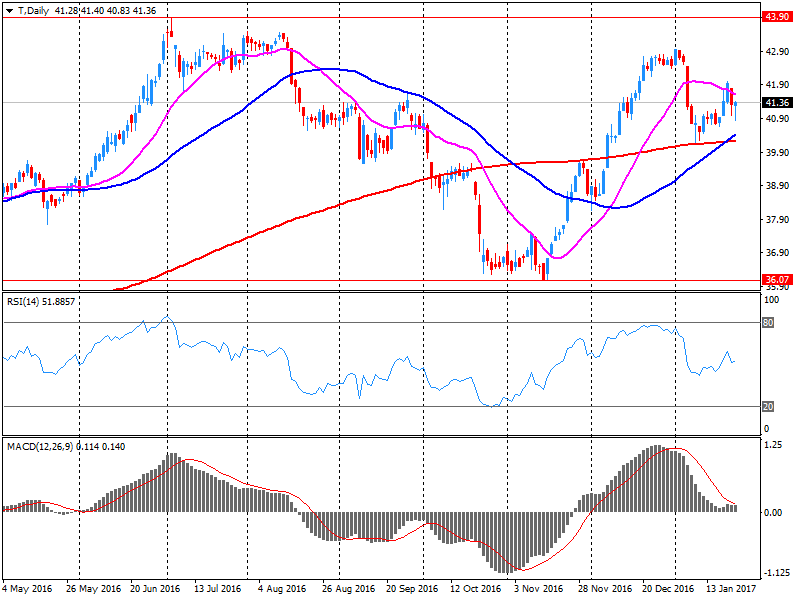

| AT&T Inc | T | 41.25 | -0.14(-0.3382%) | 79178 |

| Barrick Gold Corporation, NYSE | ABX | 87.15 | -0.01(-0.0115%) | 2714 |

| Boeing Co | BA | 167.52 | 0.16(0.0956%) | 1896 |

| Caterpillar Inc | CAT | 97.2 | -0.95(-0.9679%) | 252781 |

| Cisco Systems Inc | CSCO | 30.73 | 0.03(0.0977%) | 1942 |

| Citigroup Inc., NYSE | C | 57.77 | 0.08(0.1387%) | 23388 |

| E. I. du Pont de Nemours and Co | DD | 76.85 | 0.18(0.2348%) | 3890 |

| Exxon Mobil Corp | XOM | 85.62 | 0.28(0.3281%) | 5710 |

| Facebook, Inc. | FB | 131.54 | 0.06(0.0456%) | 88657 |

| FedEx Corporation, NYSE | FDX | 60.83 | -0.25(-0.4093%) | 660 |

| Ford Motor Co. | F | 87.15 | -0.01(-0.0115%) | 2714 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 16.37 | -0.13(-0.7879%) | 253996 |

| General Motors Company, NYSE | GM | 38.41 | 0.13(0.3396%) | 9039 |

| Google Inc. | GOOG | 838.03 | 2.36(0.2824%) | 8491 |

| Home Depot Inc | HD | 139.1 | 1.62(1.1784%) | 610 |

| HONEYWELL INTERNATIONAL INC. | HON | 87.15 | -0.01(-0.0115%) | 2714 |

| Intel Corp | INTC | 37.93 | 0.13(0.3439%) | 73641 |

| International Business Machines Co... | IBM | 178.44 | 0.15(0.0841%) | 1706 |

| Johnson & Johnson | JNJ | 112.25 | -0.55(-0.4876%) | 252223 |

| JPMorgan Chase and Co | JPM | 86.15 | 0.12(0.1395%) | 17237 |

| McDonald's Corp | MCD | 121.51 | -0.28(-0.2299%) | 603 |

| Merck & Co Inc | MRK | 60.83 | -0.25(-0.4093%) | 660 |

| Microsoft Corp | MSFT | 60.83 | -0.25(-0.4093%) | 660 |

| Nike | NKE | 53.89 | 0.03(0.0557%) | 211 |

| Pfizer Inc | PFE | 31.4 | 0.11(0.3515%) | 16978 |

| Procter & Gamble Co | PG | 87.15 | -0.01(-0.0115%) | 2714 |

| Tesla Motors, Inc., NASDAQ | TSLA | 254.3 | -0.17(-0.0668%) | 5939 |

| The Coca-Cola Co | KO | 60.83 | -0.25(-0.4093%) | 660 |

| Travelers Companies Inc | TRV | 60.83 | -0.25(-0.4093%) | 660 |

| Twitter, Inc., NYSE | TWTR | 87.15 | -0.01(-0.0115%) | 2714 |

| United Technologies Corp | UTX | 109.68 | -1.28(-1.1536%) | 296 |

| Visa | V | 84.05 | 0.15(0.1788%) | 221 |

| Yahoo! Inc., NASDAQ | YHOO | 45.06 | 0.12(0.267%) | 2451 |

| Yandex N.V., NASDAQ | YNDX | 23.45 | -0.25(-1.0548%) | 850 |

Upgrades:

Intl Paper (IP) upgraded to Buy from Neutral at Citigroup

Downgrades:

United Tech (UTX) downgraded to a Hold from Buy at Argus

Johnson & Johnson (JNJ) downgraded to Market Perform from Outperform at Wells Fargo

Other:

AT&T (T) target raised to $42 from $39 at RBC Capital Mkts; Sector Perform

AT&T (T) target raised to $44 from $42 at FBR & Co.; Market Perform

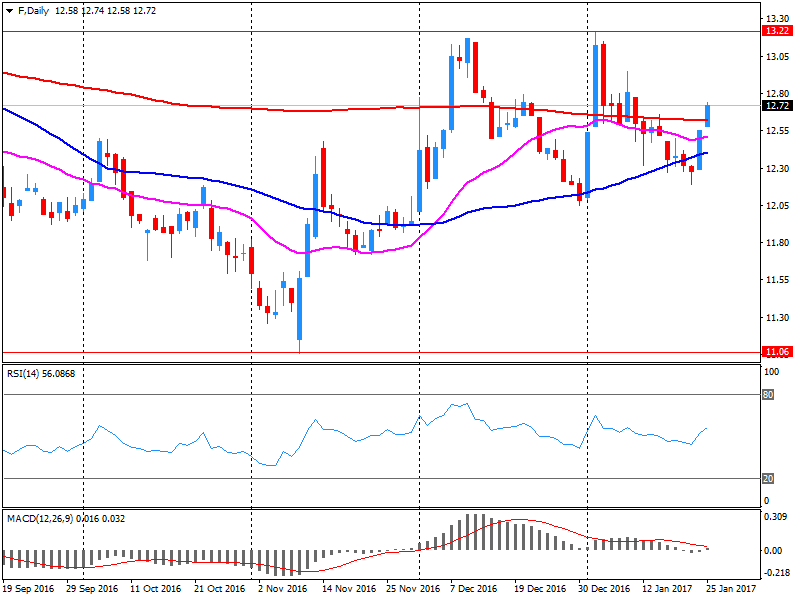

Ford Motor reported Q4 FY 2016 earnings of $0.30 per share (versus $0.58 in Q4 FY 2015), slightly missing analysts' consensus estimate of $0.32.

The company's quarterly revenues amounted to $38.700 bln (+2.10% y/y), beating analysts' consensus estimate of $34.893 bln.

F fell to $12.75 (-0.31%) in pre-market trading.

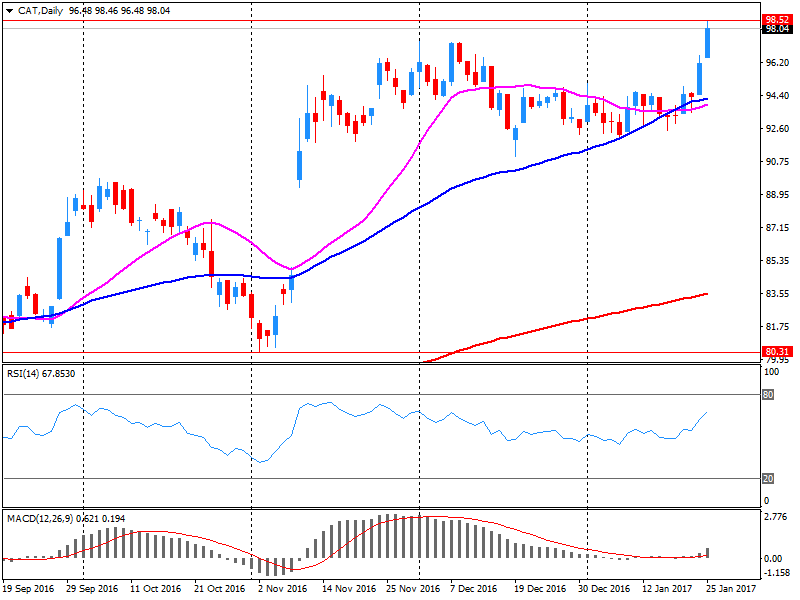

Caterpillar reported Q4 FY 2016 earnings of $0.83 per share (versus $0.74 in Q4 FY 2015), beating analysts' consensus estimate of $0.67.

The company's quarterly revenues amounted to $9.574 bln (-13.2% y/y), missing analysts' consensus estimate of $9.812 bln.

The company also said it slightly lowered its guidance for FY 2017. It now projects EPS of $2.90 (versus analysts' consensus estimate of $3.07) and revenues in a range of $36-39 bln (versus analysts' consensus estimate of $38.3 bln).

CAT fell to $97.19 (-0.98%) in pre-market trading.

AT&T reported Q4 FY 2016 earnings of $0.66 per share (versus $0.63 in Q4 FY 2015), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $41.841 bln (-0.7% y/y), generally in-line with analysts' consensus estimate of $42.011 bln.

T rose to $41.40 (+0.02%) in pre-market trading.

European stocks leapt Wednesday, pushed to their highest in more than a year by optimism over fresh records in the U.S. markets and a rally in bank shares. The Stoxx Europe 600 index SXXP, +1.29% climbed 1.3% to end at 366.59, its highest close since December 2015. The jump also marked the strongest one-day percentage gain since Nov. 9 last year.

The Dow Jones Industrial Average on Wednesday both crossed and closed above the 20,000 level for the first time, while the S&P 500 and Nasdaq Composite also cruised to records after upbeat earnings releases from heavyweights such as Boeing Co. and optimism over the economy.

Asian stock markets were broadly higher early Thursday, tracking overnight gains on Wall Street, with the Dow Jones Industrial Average closing above 20,000 points for the first time ever. The post-election equities rally in the U.S. has been spurred by hopes of fiscal spending, tax cuts and regulation rollback under the administration of President Donald Trump.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.