- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei -233.50 18914.58 -1.22%

TOPIX -17.36 1510.41 -1.14%

Hang Seng -133.87 23184.52 -0.57%

FTSE 100 +33.10 7140.75 +0.47%

DAX -31.55 11627.95 -0.27%

CAC 40 -0.29 4794.29 -0.01%

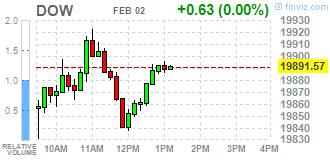

DJIA -6.03 19884.91 -0.03%

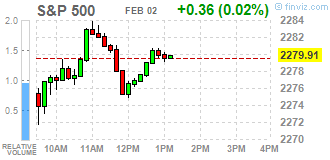

S&P 500 +1.30 2280.85 +0.06%

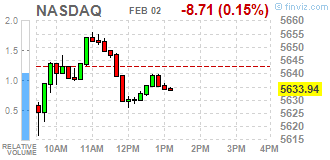

NASDAQ -6.45 5636.20 -0.11%

Major US stock indexes finished trading around as investors on their guard against the latest protectionist decisions President Donald Trump. In recent weeks, Trump's priorities, such as the imposition of travel restrictions to the United States and out of the trade agreement, have caused uncertainty and made them unpredictable for investors.

As it became known today, the number of Americans who applied for unemployment benefits fell more than expected last week, pointing to a tightening of labor market conditions, which should support the economy this year. Primary applications for state unemployment benefits fell by 14,000 and amounted to a seasonally adjusted 246,000 for the week ending January 28, reported Thursday the Ministry of Labour.

However, the report published by Challenger Gray & Christmas Inc, showed that the number of job cuts in the USA in January was 45,934 compared to 33,627 in December. However, compared with the same period of 2016, the number of job cuts decreased significantly (then figure was 75,114).

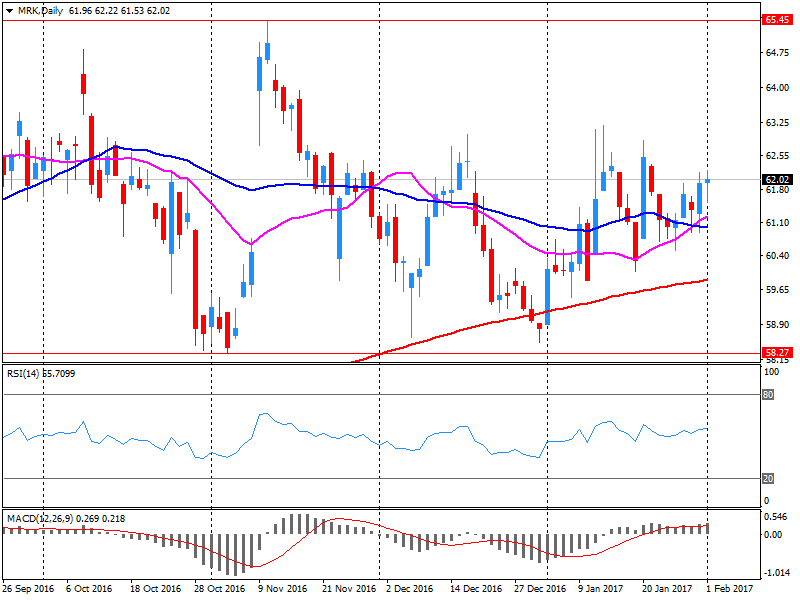

DOW index components closed mostly in the red (17 of 30). Most remaining shares fell Caterpillar Inc. (CAT, -1.46%). leaders of growth were shares of Merck & Co., Inc. (MRK, + 3.19%).

Sector S & P index finished the session mixed. The leader turned utilities sector (+ 0.8%). the health sector fell the most (-0.7%).

At the close:

Dow -0.03% 19,884.98 -5.96

Nasdaq -0.11% 5,636.20 -6.45

S & P + 0.06% 2,280.85 +1.30

Major U.S. stock-indexes little changed on Thursday, as investors turned wary following President Donald Trump's latest protectionist comments. Trump in a meeting with key lawmakers said he would like to speed up talks to either renegotiate or replace the North American Free Trade Agreement (NAFTA). Investors are also assessing possible consequences of Trump's other comments, including labeling a refugee swap agreement with staunch ally Australia as a "dumb deal" and putting Iran "on notice" for firing a ballistic missile.

Most of Dow stocks in negative area (17 of 30). Top loser - UnitedHealth Group Incorporated (UNH, -1.22%). Top gainer - Merck & Co., Inc. (MRK, +2.69%).

S&P sectors mixed. Top loser - Utilities (+0.8%). Top loser - Healthcare (-0.6%).

At the moment:

Dow 19820.00 +4.00 +0.02%

S&P 500 2275.25 +0.75 +0.03%

Nasdaq 100 5140.00 -8.50 -0.17%

Oil 53.65 -0.23 -0.43%

Gold 1217.00 +8.70 +0.72%

U.S. 10yr 2.47 -0.01

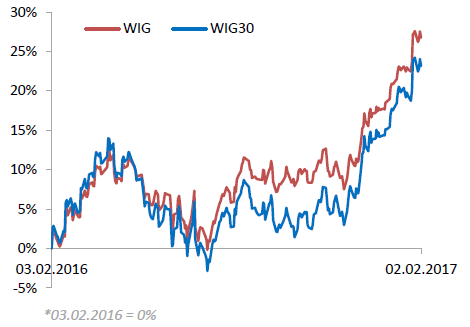

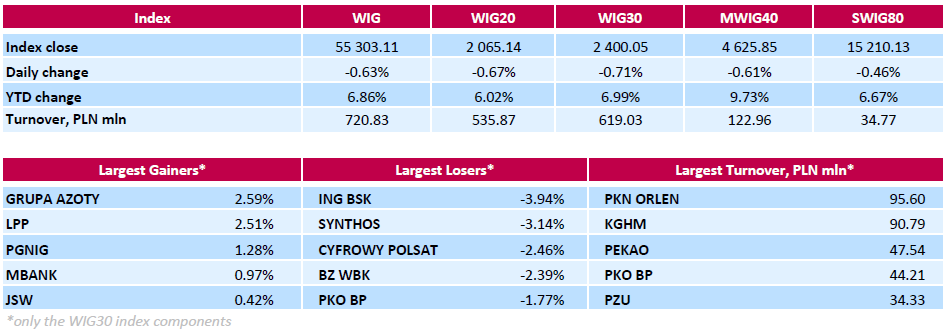

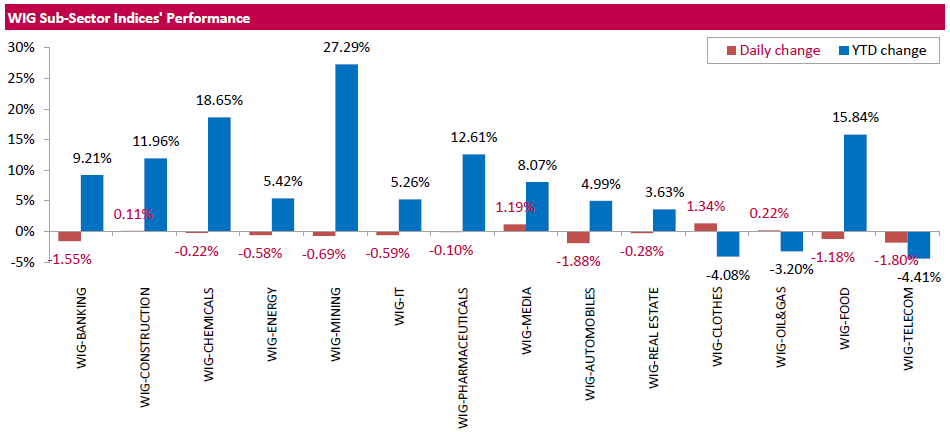

Polish equity market closed lower on Thursday. The broad market measure, the WIG Index, declined by 0.63%. The WIG sub-sector indices mostly closed in negative territory, with WIG-AUTOMOBILES Index (-1.88%) lagging behind.

The large-cap stocks' gauge, the WIG30 Index, fell by 0.71%. A majority of the index components declined, with banking name ING BSK (WSE: ING) underperforming with a 3.94% drop, weighted down by worse-than-forecast Q4 earnings result. The bank reported its net profit amounted to PLN 254.9 mln (+23.9 y/y) in Q4, missing analysts' consensus estimate of PLN 271.8 mln. Other major laggards were chemical producer SYNTHOS (WSE: SNS), media group CYFROWY POLSAT (WSE: CPS) and bank BZ WBK (WSE: BZW), which tumbled by 3.14%, 2.46% and 2.39% respectively. At the same time, chemical producer GRUPA AZOTY (WSE: ATT) and clothing retailer LPP (WSE: LPP) led a handful of gainers, advancing 2.59% and 2.51% respectively. The later was helped by monthly sales report, which revealed the group's revenues totaled about PLN 508 mln in January 2017, up 22% y/y.

Quotations in the US began with discounts. Today's macro data brought little new to the valuations and investors are clearly waiting for tomorrow's monthly report from the labor market. From the Warsaw market today blows boredom and probably this image will be continued to the end of the session.

An hour before the close of trading WIG20 index was at the level of 2,074 points (-0.24%).

U.S. stock-index futures fell after the Federal Reserve gave little insight into whether it would raise interest rates at its next meeting, even as the central bank painted an upbeat picture of the economy.

Global Stocks:

Nikkei 18,914.58 -233.50 -1.22%

Hang Seng 23,184.52 -133.87 -0.57%

Shanghai - Closed

FTSE 7,162.58 +54.93 +0.77%

CAC 4,802.89 +8.31 +0.17%

DAX 11,638.98 -20.52 -0.18%

Crude $54.02 (+0.26%)

Gold $1,225.20 (+1.40%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 36.68 | 0.42(1.1583%) | 9017 |

| ALTRIA GROUP INC. | MO | 71.5 | 0.11(0.1541%) | 2849 |

| Amazon.com Inc., NASDAQ | AMZN | 837 | 4.65(0.5587%) | 45263 |

| Apple Inc. | AAPL | 128.29 | -0.46(-0.3573%) | 170494 |

| AT&T Inc | T | 42 | -0.06(-0.1427%) | 2659 |

| Barrick Gold Corporation, NYSE | ABX | 19 | 0.52(2.8139%) | 154158 |

| Boeing Co | BA | 163.81 | -0.16(-0.0976%) | 2018 |

| Caterpillar Inc | CAT | 95 | -0.11(-0.1157%) | 1266 |

| Chevron Corp | CVX | 111.21 | 0.21(0.1892%) | 1006 |

| Cisco Systems Inc | CSCO | 30.55 | 0.05(0.1639%) | 20174 |

| Citigroup Inc., NYSE | C | 55.35 | -0.54(-0.9662%) | 21505 |

| Deere & Company, NYSE | DE | 107.39 | 0.24(0.224%) | 1000 |

| E. I. du Pont de Nemours and Co | DD | 76.15 | -0.19(-0.2489%) | 600 |

| Exxon Mobil Corp | XOM | 83.08 | 0.14(0.1688%) | 6643 |

| Facebook, Inc. | FB | 134.47 | 1.24(0.9307%) | 1741995 |

| FedEx Corporation, NYSE | FDX | 185.27 | -1.00(-0.5369%) | 164 |

| Ford Motor Co. | F | 12.29 | -0.03(-0.2435%) | 24489 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 16.62 | -0.22(-1.3064%) | 18840 |

| General Electric Co | GE | 29.64 | -0.05(-0.1684%) | 1940 |

| General Motors Company, NYSE | GM | 36.12 | -0.02(-0.0553%) | 1725 |

| Goldman Sachs | GS | 228.67 | -2.00(-0.867%) | 6417 |

| Google Inc. | GOOG | 793.28 | -2.415(-0.3035%) | 2036 |

| Intel Corp | INTC | 36.35 | -0.17(-0.4655%) | 50774 |

| International Business Machines Co... | IBM | 173.82 | -0.47(-0.2697%) | 365 |

| International Paper Company | IP | 55.41 | -1.09(-1.9292%) | 1715 |

| Johnson & Johnson | JNJ | 112.83 | -0.40(-0.3533%) | 710 |

| JPMorgan Chase and Co | JPM | 84.15 | -0.80(-0.9417%) | 13308 |

| McDonald's Corp | MCD | 122.17 | -0.25(-0.2042%) | 201 |

| Merck & Co Inc | MRK | 62.34 | 0.24(0.3865%) | 180948 |

| Microsoft Corp | MSFT | 63.38 | -0.20(-0.3146%) | 35843 |

| Nike | NKE | 52.79 | -0.23(-0.4338%) | 1868 |

| Pfizer Inc | PFE | 31.51 | -0.16(-0.5052%) | 2484 |

| Starbucks Corporation, NASDAQ | SBUX | 53.85 | -0.05(-0.0928%) | 9753 |

| Tesla Motors, Inc., NASDAQ | TSLA | 247.75 | -1.49(-0.5978%) | 11288 |

| The Coca-Cola Co | KO | 41.18 | -0.08(-0.1939%) | 7846 |

| Twitter, Inc., NYSE | TWTR | 17.38 | 0.14(0.8121%) | 57988 |

| United Technologies Corp | UTX | 108.01 | -0.17(-0.1571%) | 1253 |

| Verizon Communications Inc | VZ | 48.46 | 0.07(0.1447%) | 3629 |

| Visa | V | 82.77 | 0.33(0.4003%) | 2291 |

| Wal-Mart Stores Inc | WMT | 66.2 | -0.03(-0.0453%) | 1305 |

| Walt Disney Co | DIS | 111.05 | -0.25(-0.2246%) | 4596 |

| Yandex N.V., NASDAQ | YNDX | 23.43 | 0.07(0.2997%) | 934 |

Upgrades:

Apple (AAPL) upgraded to Hold from Sell at BGC

Alcoa (AA) upgraded to Overweight from Neutral at JP Morgan

Downgrades:

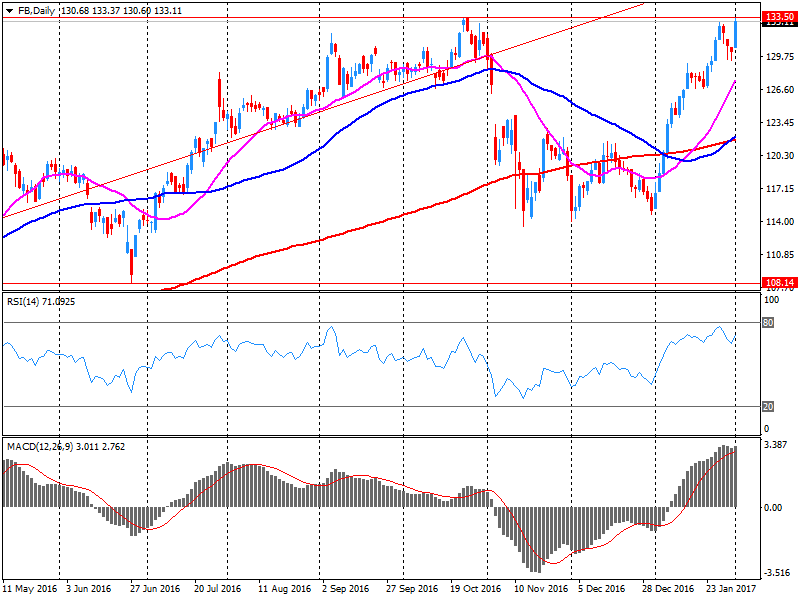

Facebook (FB) downgraded to Hold at Pivotal Research Group; target lowered to $135

Other:

Facebook (FB) target raised to $148 from $146 at Mizuho

Facebook reported Q4 FY 2016 earnings of $1.41 per share (versus $0.79 in Q4 FY 2015), beating analysts' consensus estimate of $1.31.

The company's quarterly revenues amounted to $8.809 bln (+50.8% y/y), beating analysts' consensus estimate of $8.495 bln.

FB rose to $134.40 (+0.88%) in pre-market trading.

Merck reported Q4 FY 2016 earnings of $0.89 per share (versus $0.93 in Q4 FY 2015), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $10.115 bln (-1% y/y), missing analysts' consensus estimate of $10.234 bln.

The company also issued downside guidance for FY 2017, projecting EPS of $3.72-3.87 (versus analysts' consensus estimate of $3.87) and revenues of $38.60-40.10 bln (versus analysts' consensus estimate of $40.19 bln).

MRK fell to $62.00 (-0.16%) in pre-market trading.

Intl Paper reported Q4 FY 2016 earnings of $0.73 per share (versus $0.87 in Q4 FY 2015), beating analysts' consensus estimate of $0.71.

The company's quarterly revenues amounted to $5.381 bln (-1.1% y/y), beating analysts' consensus estimate of $5.320 bln.

IP rose to $57.00 (+0.89%) in pre-market trading.

The first half of today's trading has not brought major changes. Both the Warsaw market and on exchanges Euroland prevail slight descent down. Above-average weakness stands out the banking sector. The level of turnover on both the broad market and the sector's largest companies is mediocre.

After four hours of trading the WIG20 index was at the level of 2,074 points (-0,25%).

WIG20 index opened at 2078.01 points (-0.05%)*

WIG 55633.43 -0.03%

WIG30 2416.41 -0.04%

mWIG40 4653.69 -0.01%

*/ - change to previous close

The cash market (the WIG20 index) started the day from a modest discount of 0.05% with a moderate turnover. The German DAX is falling more than 0.3%, and against this background neutral beginning in Warsaw looks quite good.

After fifteen minutes of trading, the WIG20 index was at the level of 2,078 points (-0,01%).

Wednesday's session on the New York stock markets ended with slight increases in the major indexes. Heavily went up course of Apple (over 6%), which the day before, after the session, presented better than expected the quarterly results.

The Dow Jones Industrial rose at the close of 0.13 percent, the S&P 500 went up by 0.03 percent and the Nasdaq Comp. gained 0.50 percent. The fourth week in a row there was an increase in crude oil inventories in the US.

Important was also the decision of the Federal Open Market Committee. The noticeable was the lack of guidance to raise rates in March, which resulted in a slight weakening of the US currency and an increase in raw material prices.

In the night futures on US indices began to fall , while the Japanese Nikkei lost 1.2% in the morning. Thus, beginning in Europe can present a slightly down.

U.K. stocks closed lower Tuesday, locking in a monthly loss, weighed down in part by a jump in the British pound, though gains by miners helped limit the drop. Pound strength can unsettle U.K. stock investors, as it cuts into profit made overseas by British multinational companies.

U.S. stocks closed up modestly Wednesday after the Federal Reserve stood pat on interest rates and offered a positive view of the economy, while shares of Apple rallied a day after the iPhone maker reported strong earnings. Apple, as the largest U.S. company by market cap, which means it has a heavy weighting in major indexes, was offsetting weakness elsewhere in the market. Seven of the S&P 500's 11 primary sectors were lower on the day, continuing a recent bout of fragility seen this week.

Global investors continued to search for direction Thursday after the U.S. Federal Reserve's latest policy statement, which held interest rates steady, as expected. For weeks, investors have been flipping between optimism and concern. This week started with worry, but the mood became more upbeat, with strong economic data out of the U.S., China and Europe.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.