- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei -65.93 18910.78 -0.35%

TOPIX -4.27 1516.15 -0.28%

Hang Seng -16.67 23331.57 -0.07%

CSI 300 -7.53 3365.68 -0.22%

Euro Stoxx 50 -2.60 3235.71 -0.08%

FTSE 100 +14.07 7186.22 +0.20%

DAX +39.60 11549.44 +0.34%

CAC 40 -23.61 4754.47 -0.49%

DJIA +37.87 20090.29 +0.19%

S&P 500 +0.52 2293.08 +0.02%

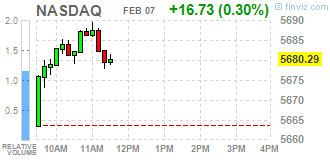

NASDAQ +10.67 5674.22 +0.19%

S&P/TSX +41.86 15498.80 +0.27%

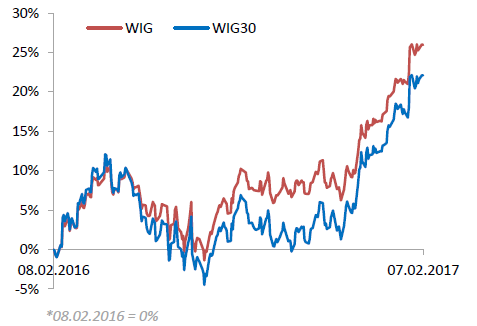

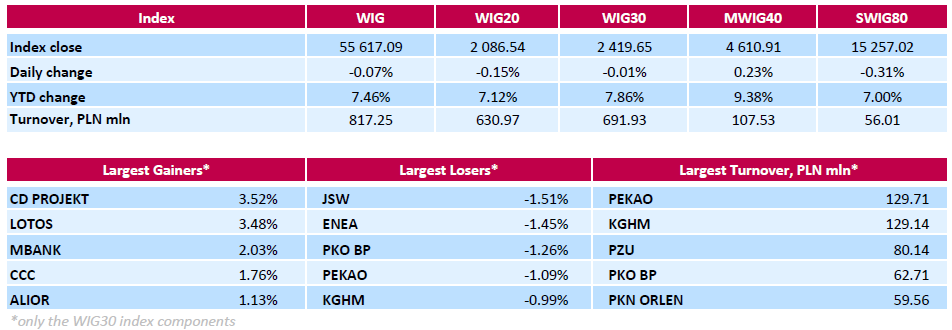

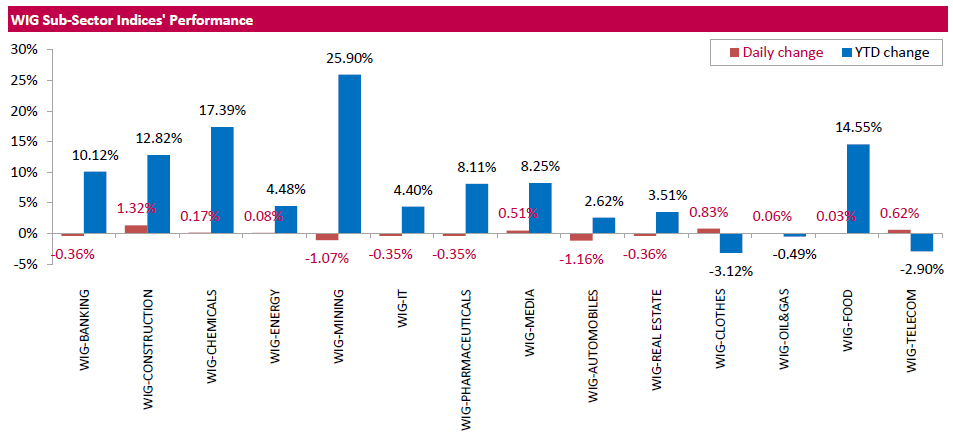

Polish equity market closed flat on Tuesday. The broad market measure, the WIG index, edged down 0.07%. From a sector perspective, automobiles stocks fared the worst, dropping by 1.16%. On the contrary, the best-performing group was construction, gaining 1.32%.

The large-cap stocks' measure, the WIG30 Index, inched down 0.01%. In the index basket, coking coal miner JSW (WSE: JSW), genco ENEA (WSE: ENA), copper producer KGHM (WSE: KGH) and two banking names PKO BP (WSE: PKO) and PEKAO (WSE: PEO) were the weakest performers, dropping by 0.99%- 1.51%. At the same time, videogame developer CD PROJEKT (WSE: CDR) and oil refiner LOTOS (WSE: LTS) recorded the strongest daily results, soaring by 3.52% and 3.48% respectively. The former announced the release of the latest update to its game GWENT: The Witcher Card Game, which is currently available in closed beta. The later continued to appreciate following yesterday's report the company's management estimated its FY 2016 EBITDA at PLN 2.8 bln, up 119% y/y. Other major gainers were bank MBANK (WSE: MBK), footwear retailer CCC (WSE: CCC) and bank ALIOR (WSE: ALR), adding 2.03% 1.76% and 1.13% respectively.

Major U.S. stock-indexes slightly rose on Tuesday. Investors are assessing corporate earnings to see if stock valuations are justified after a post-election rally drove U.S. equities to record highs. Fourth-quarter earnings are estimated to have risen 8,1% - the best in nine quarters.

Most of Dow stocks in positive area (20 of 30). Top loser - Chevron Corporation (CVX, -0.98%). Top gainer - The Boeing Company (BA, +1.83%).

All S&P sectors in positive area. Top gainer - Industrial goods (+0.4%). Top loser - Basic Materials (-0.7%).

At the moment:

Dow 20017.00 +45.00 +0.23%

S&P 500 2289.00 +2.50 +0.11%

Nasdaq 100 5181.50 +23.75 +0.46%

Oil 52.12 -0.89 -1.68%

Gold 1235.80 +3.70 +0.30%

U.S. 10yr 2.40 -0.01

The market in the United States opened with an increase of 0.18%, which also means a return to the vicinity of the Friday's closing and close to the record levels. We may see that the European political unrest is unnoticed on the Wall Street, and investors are still under the influence of potential policies Donald Trump, the latest of which - related to the deregulation has been received positively. The Warsaw indices in the last hour before closing are also on the green side of the market.

U.S. stock-index futures rose as investors analyzed a raft of earnings and economic data.

Global Stocks:

Nikkei 18,910.78 -65.93 -0.35%

Hang Seng 23,331.57 -16.67 -0.07%

Shanghai 3,153.65 -3.33 -0.11%

FTSE 7,221.96 +49.81 +0.69%

CAC 4,774.74 -3.34 -0.07%

DAX 11,575.37 +65.53 +0.57%

Crude $52.73 (-0.53%)

Gold $1,231.00 (-0.09%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 38.15 | 0.40(1.0596%) | 15811 |

| ALTRIA GROUP INC. | MO | 71.5 | 0.21(0.2946%) | 1328 |

| Amazon.com Inc., NASDAQ | AMZN | 806.95 | -0.69(-0.0854%) | 13970 |

| AMERICAN INTERNATIONAL GROUP | AIG | 64.99 | 0.09(0.1387%) | 100 |

| Apple Inc. | AAPL | 130.52 | 0.23(0.1765%) | 75882 |

| Barrick Gold Corporation, NYSE | ABX | 19.22 | -0.20(-1.0299%) | 91855 |

| Caterpillar Inc | CAT | 94.12 | 1.25(1.346%) | 32230 |

| Cisco Systems Inc | CSCO | 31.37 | 0.07(0.2236%) | 9907 |

| Citigroup Inc., NYSE | C | 58.05 | 0.41(0.7113%) | 2131 |

| Deere & Company, NYSE | DE | 108.89 | 0.83(0.7681%) | 111 |

| E. I. du Pont de Nemours and Co | DD | 76.38 | 0.09(0.118%) | 200 |

| Exxon Mobil Corp | XOM | 83.2 | -0.11(-0.132%) | 7624 |

| Facebook, Inc. | FB | 132.25 | 0.19(0.1439%) | 59369 |

| FedEx Corporation, NYSE | FDX | 188.38 | 0.18(0.0956%) | 161 |

| Ford Motor Co. | F | 12.46 | -0.06(-0.4792%) | 132097 |

| General Electric Co | GE | 29.74 | 0.08(0.2697%) | 16405 |

| General Motors Company, NYSE | GM | 36.45 | -0.38(-1.0318%) | 870329 |

| Goldman Sachs | GS | 241.4 | 1.42(0.5917%) | 6400 |

| Google Inc. | GOOG | 802.64 | 1.30(0.1622%) | 2241 |

| Intel Corp | INTC | 36.43 | 0.16(0.4411%) | 13761 |

| International Business Machines Co... | IBM | 176 | 0.14(0.0796%) | 2517 |

| International Paper Company | IP | 51.66 | 0.06(0.1163%) | 294 |

| Johnson & Johnson | JNJ | 113.6 | 0.20(0.1764%) | 1104 |

| JPMorgan Chase and Co | JPM | 87.19 | 0.42(0.484%) | 4478 |

| Merck & Co Inc | MRK | 64.95 | 0.01(0.0154%) | 1283 |

| Microsoft Corp | MSFT | 63.79 | 0.15(0.2357%) | 12018 |

| Nike | NKE | 52.91 | 0.11(0.2083%) | 707 |

| Pfizer Inc | PFE | 32.3 | 0.07(0.2172%) | 2851 |

| Starbucks Corporation, NASDAQ | SBUX | 55.6 | 0.12(0.2163%) | 1114 |

| Tesla Motors, Inc., NASDAQ | TSLA | 258.49 | 0.72(0.2793%) | 27458 |

| The Coca-Cola Co | KO | 41.63 | 0.07(0.1684%) | 4066 |

| Twitter, Inc., NYSE | TWTR | 18.12 | 0.19(1.0597%) | 174408 |

| Verizon Communications Inc | VZ | 48.1 | 0.07(0.1457%) | 2718 |

| Visa | V | 86.28 | 0.45(0.5243%) | 5304 |

| Wal-Mart Stores Inc | WMT | 66.85 | 0.45(0.6777%) | 172 |

| Walt Disney Co | DIS | 109.75 | 0.18(0.1643%) | 14944 |

| Yahoo! Inc., NASDAQ | YHOO | 44.64 | 0.22(0.4953%) | 1545 |

| Yandex N.V., NASDAQ | YNDX | 23.19 | 0.18(0.7823%) | 536 |

Upgrades:

Caterpillar (CAT) upgraded to Overweight from Equal Weight at Barclays

Downgrades:

Other:

UnitedHealth (UNH) initiated with a Overweight at Cantor Fitzgerald; target $200

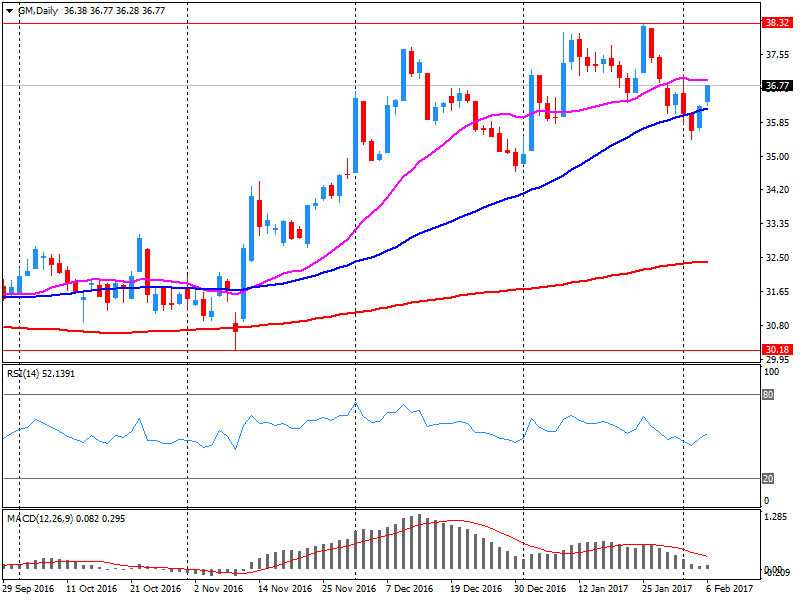

General Motors reported Q4 FY 2016 earnings of $1.28 per share (versus $1.39 in Q4 FY 2015), beating analysts' consensus estimate of $1.17.

The company's quarterly revenues amounted to $41.231 bln (+9.2% y/y), beating analysts' consensus estimate of $40.082 bln.

The company also reaffirmed guidance for FY 2017, projecting EPS of $6.00-6.50 versus analysts' consensus estimate of $6.14.

GM rose to $37.40 (+1.55%) in pre-market trading.

WIG20 index opened at 2089.06 points (-0.03%)*

WIG 55606.83 -0.09%

WIG30 2416.44 -0.14%

mWIG40 4593.44 -0.15%

*/ - change to previous close

The cash market opened with slight decrease at fairly modest turnover. The environment is also dominated by the color red, but discounts are cosmetic. In the following minutes, the control was taken by the supply side and after fifteen minutes of trading the WIG20 index reported the level of 2,080 points (-0.44%).

The US stock markets began the week with light falls. The causes may be sought in the fact that the promises of Donald Trump on growth, which supported post-election boom, exhausted its potential, and the market is waiting for the specifics of the business plan of the new US president.

In the morning in Asia we may also see slight declines. Morning mood in Europe is therefore close to neutral and promises a calm opening of trading.

The Warsaw index of the largest companies approached the level of 2,100 points, while small and medium-sized companies on the WSE behave well also.

European stocks finished lower Monday, with election-related worries prompting investors to step away from equities, while downbeat developments left shares of Volkswagen AG and Ryanair Holdings PLC in the red. Stocks found no relief Monday after European Central Bank President Mario Draghi reiterated his stance that monetary stimulus will be available if warranted for the eurozone economy.

Stocks closed lower Monday following a mixed bag of earnings and continued friction against President Donald Trump implementing a wave of executive orders last week. The Dow Jones Industrial Average DJIA, -0.09% fell 19.04 points, or 0.1%, to finish at 20,052.42, with shares of Verizon Communications Inc. VZ, -1.13% and Home Depot Inc. HD, -1.08% weighing on the average.

Appetite for Asian stocks and the euro ebbed on Tuesday as a rising tide of economic and political concerns added to anxiety over expectations China's foreign exchange reserves fell again in January. But some economists said reserves may have actually risen due to tighter controls on moving money out of the country, as well the impact of a weaker dollar. Nevertheless, as foreign exchange reserves linger at around $3 trillion, concerns remain over the speed at which China has depleted its cash resources to defend the currency.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.