- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei +96.82 19007.60 +0.51%

TOPIX +8.00 1524.15 +0.53%

Hang Seng +153.56 23485.13 +0.66%

CSI 300 +17.61 3383.29 +0.52%

Euro Stoxx 50 +2.33 3238.04 +0.07%

FTSE 100 +2.60 7188.82 +0.04%

DAX -6.06 11543.38 -0.05%

CAC 40 +12.13 4766.60 +0.26%

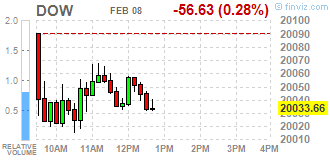

DJIA -35.95 20054.34 -0.18%

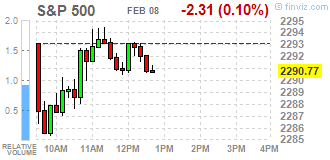

S&P 500 +1.59 2294.67 +0.07%

NASDAQ +8.24 5682.45 +0.15%

S&P/TSX +55.24 15554.04 +0.36%

Major U.S. stock-indexes slightly fell on Wednesday as investors assessed a flood of quarterly earnings reports. More than half of the S&P 500 companies have reported results so far, with their combined earnings estimated to have risen 8,2% - the most in nine quarters.

Most of Dow stocks in positive area (18 of 30). Top loser - The Boeing Company (BA, -1.55%). Top gainer - NIKE, Inc. (NKE, +1.61%).

Most of S&P sectors in negative area. Top gainer - Utilities (+0.8%). Top loser - Conglomerates (-0.8%).

At the moment:

Dow 19985.00 -33.00 -0.16%

S&P 500 2286.75 -1.75 -0.08%

Nasdaq 100 5183.25 +6.50 +0.13%

Oil 52.37 +0.20 +0.38%

Gold 1244.70 +8.60 +0.70%

U.S. 10yr 2.34 -0.05

Polish equity market closed flat on Wednesday. The broad market measure, the WIG Index, edged up 0.05%. Sector performance within the WIG Index was mixed. Clothes sector (+1.25%) outperformed, while telecoms (-1.05%) lagged behind.

The large-cap WIG30 Index inched up 0.05%. Within the index components, bank MBANK (WSE: MBK) was the best-performing name, climbing by 4.9% on the back of better-than-expected Q4 FY 2016 earnings. The bank reported its net profit fell by 5% y/y to PLN 292.5 mln in Q4, but was above analysts' consensus estimate of PLN 263.4 mln. In addition, MBANK's CEO Cezary Stypulkowski stated that the bank is unlikely to pay out dividend from its 2016 profit. Other largest outperformers were videogame developer CD PROJEKT (WSE: CDR), coking coal producer JSW (WSE: JSW) and footwear retailer CCC (WSE: CCC), gaining 2.75%, 1.86% and 1.85% respectively. On the other side of the ledger, media group CYFROWY POLSAT (WSE: CPS) and three gencos TAURON PE (WSE: TPE), ENERGA (WSE: ENG) and ENEA (WSE: ENA) were biggest decliners, tumbling by 1.96%-2.41%.

U.S. stock-index futures were flat as investors focused on corporate earnings reports.

Global Stocks:

Nikkei 19,007.60 +96.82 +0.51%

Hang Seng 23,485.13 +153.56 +0.66%

Shanghai 3,167.45 +14.36 +0.46%

FTSE 7,167.57 -18.65 -0.26%

CAC 4,763.85 +9.38 +0.20%

DAX 11,528.46 -20.98 -0.18%

Crude $51.75 (-0.81%)

Gold $1,241.90 (+0.47%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 37.99 | 0.02(0.0527%) | 4890 |

| ALTRIA GROUP INC. | MO | 72.09 | -0.11(-0.1524%) | 2550 |

| AMERICAN INTERNATIONAL GROUP | AIG | 65 | 0.12(0.185%) | 152 |

| Apple Inc. | AAPL | 131.5 | -0.03(-0.0228%) | 77459 |

| AT&T Inc | T | 41.19 | 0.07(0.1702%) | 4272 |

| Barrick Gold Corporation, NYSE | ABX | 19.52 | 0.19(0.9829%) | 102762 |

| Boeing Co | BA | 165.12 | 0.04(0.0242%) | 3017 |

| Caterpillar Inc | CAT | 93.1 | -0.21(-0.2251%) | 6495 |

| Chevron Corp | CVX | 111.05 | -0.34(-0.3052%) | 656 |

| Citigroup Inc., NYSE | C | 56.9 | -0.29(-0.5071%) | 4742 |

| Exxon Mobil Corp | XOM | 81.97 | -0.05(-0.061%) | 17104 |

| Facebook, Inc. | FB | 132.28 | 0.44(0.3337%) | 77789 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 15.4 | -0.12(-0.7732%) | 169281 |

| General Electric Co | GE | 29.55 | -0.01(-0.0338%) | 3675 |

| Goldman Sachs | GS | 238.23 | -1.39(-0.5801%) | 7767 |

| Google Inc. | GOOG | 807.44 | 0.47(0.0582%) | 2138 |

| Home Depot Inc | HD | 137.5 | 0.85(0.622%) | 1500 |

| Intel Corp | INTC | 36.4 | 0.05(0.1376%) | 1765 |

| International Business Machines Co... | IBM | 177.15 | 0.09(0.0508%) | 4556 |

| JPMorgan Chase and Co | JPM | 86.3 | -0.42(-0.4843%) | 11191 |

| Merck & Co Inc | MRK | 64.15 | -0.05(-0.0779%) | 3165 |

| Microsoft Corp | MSFT | 63.45 | 0.02(0.0315%) | 6812 |

| Pfizer Inc | PFE | 32.18 | 0.10(0.3117%) | 565 |

| Tesla Motors, Inc., NASDAQ | TSLA | 256.98 | -0.50(-0.1942%) | 4544 |

| Travelers Companies Inc | TRV | 117.6 | -0.16(-0.1359%) | 375 |

| Twitter, Inc., NYSE | TWTR | 18.66 | 0.40(2.1906%) | 327843 |

| Verizon Communications Inc | VZ | 48.1 | 0.06(0.1249%) | 1116 |

| Visa | V | 86 | 0.22(0.2565%) | 5979 |

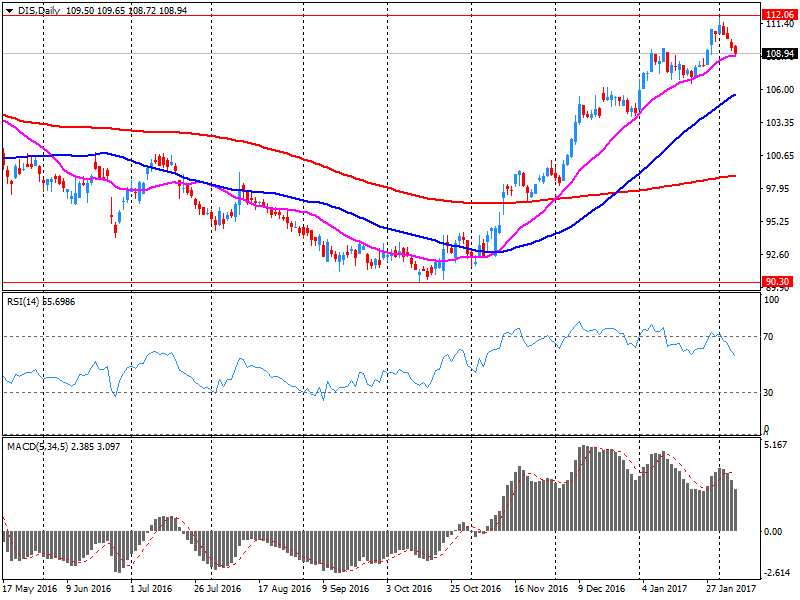

| Walt Disney Co | DIS | 108.95 | -0.05(-0.0459%) | 130399 |

| Yahoo! Inc., NASDAQ | YHOO | 44.56 | 0.19(0.4282%) | 980 |

Upgrades:

Twitter (TWTR) upgraded to Buy at BTIG Research

Downgrades:

Other:

Facebook (FB) added to US 1 List at BofA/Merrill

Walt Disney (DIS) reiterated with an Outperform at RBC Capital Mkts; target $130

Walt Disney (DIS) reiterated with a Hold at Stifel; target $100

Walt Disney (DIS) reiterated with a Hold at Needham

Walt Disney reported Q1 FY 2017 earnings of $1.55 per share (versus $1.63 in Q1 FY 2016), beating analysts' consensus estimate of $1.49.

The company's quarterly revenues amounted to $14.784 bln (-3% y/y), missing analysts' consensus estimate of $15.298 bln.

DIS rose to $109.10 (+0.09%) in pre-market trading.

U.K. stocks closed higher Tuesday, with Rio Tinto PLC among the notable advancers, but BP PLC shares tumbled after some disappointing financial figures from the oil heavyweight.

U.S. stocks closed slightly higher Tuesday, but off session highs, with the Nasdaq notching a new record while oil prices declined and the U.S. trade deficit hit its highest level in four years. The Nasdaq Composite Index COMP, +0.19% rose 10.67 points, or 0.2%, to close at a record of 5,674.22. The index hit an intraday all-time high of 5,689.60 during the session.

Global investors reeled in their risk taking on Wednesday, with many stock markets across Asia drifting lower under the pressure of falling oil prices. Equities in the region kicked off the week positively, but that momentum has flatlined as political uncertainty in Europe and the U.S. lingers.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.