- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei -99.93 18907.67 -0.53%

TOPIX -10.60 1513.55 -0.70%

Hang Seng +40.01 23525.14 +0.17%

CSI 300 +13.00 3396.29 +0.38%

Euro Stoxx 50 +39.75 3277.79 +1.23%

FTSE 100 +40.68 7229.50 +0.57%

DAX +99.48 11642.86 +0.86%

CAC 40 +59.64 4826.24 +1.25%

DJIA +118.06 20172.40 +0.59%

S&P 500 +13.20 2307.87 +0.58%

NASDAQ +32.73 5715.18 +0.58%

S&P/TSX +63.26 15617.30 +0.41%

Major U.S. stock-indexes rose on Thursday, helped by higher oil prices. Oil prices rose more than 0,8%, rising for the second straight day, supported by an unexpected draw in U.S. gasoline inventories. The fourth-quarter earnings season has been largely upbeat, with combined earnings of S&P 500 companies estimated to have risen 8,3%, the highest in nine quarters. However, Wall Street's reaction to corporate earnings has been muted as investors remain cautious given the recent run-up in the market and policy uncertainty under newly elected President Donald Trump.

Most of Dow stocks in positive area (27 of 30). Top loser - The Coca-Cola Company (KO, -2.00%). Top gainer - NIKE, Inc. (NKE, +2.58%).

Most of S&P sectors in positive area. Top gainer - Financials (+0.8%). Top loser - Utilities (-0.4%).

At the moment:

Dow 20142.00 +140.00 +0.70%

S&P 500 2305.50 +15.25 +0.67%

Nasdaq 100 5214.50 +23.25 +0.45%

Oil 52.80 +0.46 +0.88%

Gold 1234.90 -4.60 -0.37%

U.S. 10yr 2.38 +0.02

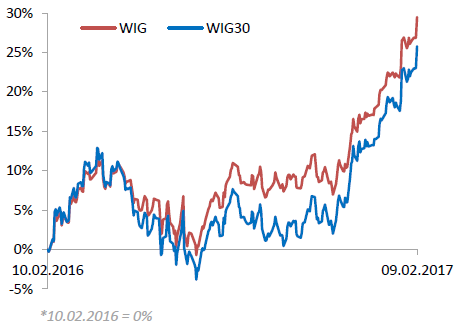

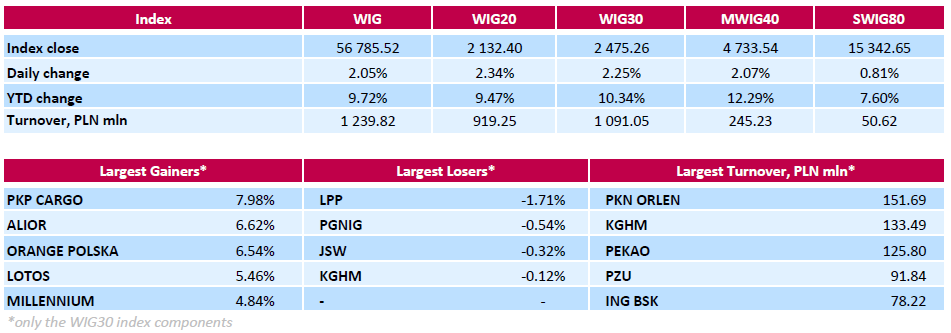

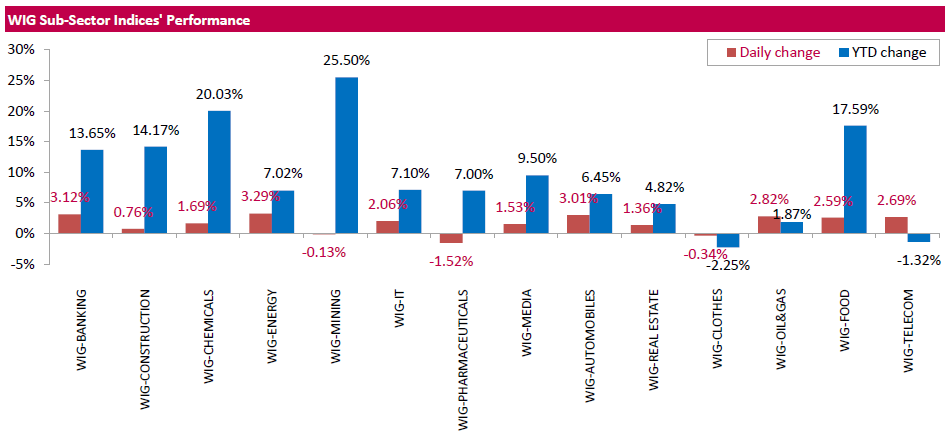

Polish equity closed higher on Thursday. The broad market measure, the WIG Index, surged by 2.05%. The WIG sub-sector indices were mainly higher with energy stocks measure (+3.29%) outperforming.

The large-cap stocks' benchmark, the WIG30 Index, rose by 2.25%. There were only four decliners among the index components. Clothing retailer LPP (WSE: LPP) posted the sharpest decline, sliding down 1.71%. It was followed by oil and gas producer PGNIG (WSE: PGN), coking coal producer JSW (WSE: JSW) and copper producer KGHM (WSE: KGH), falling by 0.54%, 0.32% and 0.12% respectively. On the plus side, railway freight transport operator PKP CARGO (WSE: PKP) topped the list of outperformers, climbing by 7.98%. Other major gainers were bank ALIOR (WSE: ALR), telecommunication services provider ORANGE POLSKA (WSE: OPL) and oil refiner LOTOS (WSE: LTS), climbing by 6.62%, 6.54% and 5.46% .respectively. Elsewhere, bank PEKAO (WSE: PEO) added 2.76%, supported by better-than-expected Q4 earnings. The bank posted net profit of PLN 494.7 mln (+13% y/y) versus analysts' consensus estimate of PLN 478.5 mln.

The US market started trading with a rise of 0.13% (the S&P500 index) and after the first transactions slightly went up. The market is still close to historic highs and at these levels no much happens in terms of volatility and the level of turnover. In our market dynamic growth turned into a lateral movement and bulls still have the situation under control.

An hour before the close of trading in Warsaw the WIG20 index was at the level of 2,128 points (+2,17%).

U.S. stock-index futures were flat as investors focused on corporate earnings reports.

Global Stocks:

Nikkei 18,907.67 -99.93 -0.53%

Hang Seng 23,525.14 +40.01 +0.17%

Shanghai 3,183.79 +16.81 +0.53%

FTSE 7,195.99 +7.17 +0.10%

CAC 4,792.64 +26.04 +0.55%

DAX 11,581.80 +38.42 +0.33%

Crude $52.90 (+1.07%)

Gold $1,241.30 (+0.17%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 37.45 | -0.09(-0.2397%) | 1250 |

| Amazon.com Inc., NASDAQ | AMZN | 821.89 | 2.18(0.2659%) | 7323 |

| American Express Co | AXP | 77.88 | 0.08(0.1028%) | 228 |

| AMERICAN INTERNATIONAL GROUP | AIG | 64.99 | 0.08(0.1232%) | 300 |

| Apple Inc. | AAPL | 131.7 | 0.23(0.1749%) | 144326 |

| Barrick Gold Corporation, NYSE | ABX | 19.56 | -0.03(-0.1531%) | 63720 |

| Boeing Co | BA | 165.12 | 1.31(0.7997%) | 5852 |

| Caterpillar Inc | CAT | 93.1 | 0.19(0.2045%) | 2084 |

| Chevron Corp | CVX | 111.5 | -0.08(-0.0717%) | 3700 |

| Cisco Systems Inc | CSCO | 31.35 | 0.08(0.2558%) | 1425 |

| Citigroup Inc., NYSE | C | 56.65 | 0.33(0.5859%) | 9578 |

| Deere & Company, NYSE | DE | 107.96 | -0.45(-0.4151%) | 600 |

| Exxon Mobil Corp | XOM | 81.8 | 0.32(0.3927%) | 8785 |

| Facebook, Inc. | FB | 134.55 | 0.35(0.2608%) | 95762 |

| Ford Motor Co. | F | 12.37 | -0.01(-0.0808%) | 18321 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 15.33 | -0.20(-1.2878%) | 73187 |

| General Electric Co | GE | 29.59 | 0.16(0.5437%) | 33579 |

| General Motors Company, NYSE | GM | 35.04 | -0.10(-0.2846%) | 6505 |

| Goldman Sachs | GS | 238.75 | 1.02(0.4291%) | 954 |

| Google Inc. | GOOG | 810.05 | 1.67(0.2066%) | 769 |

| International Business Machines Co... | IBM | 176.58 | 0.41(0.2327%) | 392 |

| International Paper Company | IP | 53.64 | 0.54(1.0169%) | 125 |

| JPMorgan Chase and Co | JPM | 86.25 | 0.29(0.3374%) | 5075 |

| Microsoft Corp | MSFT | 63.47 | 0.13(0.2052%) | 4494 |

| Nike | NKE | 53.85 | -0.03(-0.0557%) | 998 |

| Pfizer Inc | PFE | 32.3 | 0.16(0.4978%) | 3257 |

| Procter & Gamble Co | PG | 88.35 | 0.02(0.0226%) | 603 |

| Starbucks Corporation, NASDAQ | SBUX | 55.09 | -0.13(-0.2354%) | 1125 |

| Tesla Motors, Inc., NASDAQ | TSLA | 266.95 | 4.87(1.8582%) | 252229 |

| Twitter, Inc., NYSE | TWTR | 16.87 | -1.85(-9.8825%) | 8263003 |

| UnitedHealth Group Inc | UNH | 160.5 | 0.19(0.1185%) | 107 |

| Verizon Communications Inc | VZ | 48.45 | 0.08(0.1654%) | 2096 |

| Visa | V | 85.5 | 0.41(0.4818%) | 535 |

| Walt Disney Co | DIS | 109.18 | 0.18(0.1651%) | 6138 |

| Yahoo! Inc., NASDAQ | YHOO | 45 | -0.07(-0.1553%) | 258 |

| Yandex N.V., NASDAQ | YNDX | 22.93 | -0.12(-0.5206%) | 1799 |

Upgrades:

Downgrades:

Other:

Freeport-McMoRan (FCX) resumed with Neutral at JP Morgan

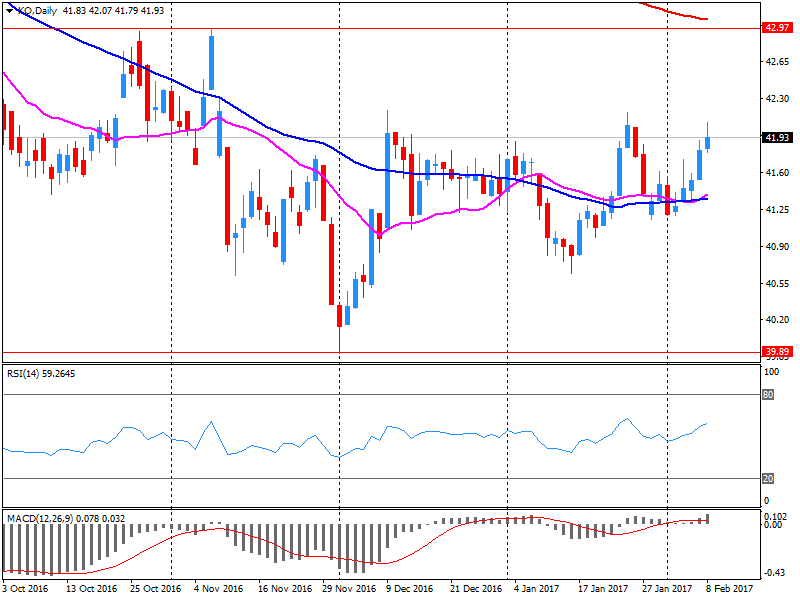

Coca-Cola reported Q4 FY 2016 earnings of $0.37 per share (versus $0.38 in Q4 FY 2015), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $9.409 bln (-5.9% y/y), beating analysts' consensus estimate of $9.170 bln.

The company also issued downside guidance for FY 2017, projecting EPS of $1.83-1.89 (-4% - -1% y/y) versus analysts' consensus estimate of $1.97.

KO fell to $41.20 (-1.95%) in pre-market trading.

Twitter reported Q4 FY 2016 earnings of $0.16 per share (versus $0.16 in Q4 FY 2015), beating analysts' consensus estimate of $0.12.

The company's quarterly revenues amounted to $0.717 bln (+0.9% y/y), missing analysts' consensus estimate of $0.739 bln.

The company also confirmed expectations that its revenue growth would continue to lag audience growth in 2017 and could now be further impacted by escalating competition for digital ad spending and the re-evaluation of the company's revenue product feature portfolio.

TWTR fell to $16.73 (-10.63%) in pre-market trading.

The long-awaited overcome of the resistance at 2,100 points in case of the WIG20 index strengthened the demand side and we may also see that to the game enters a new capital, which benefits from breaking. The chart of the WIG20 index steadily climbing to the top and the Warsaw Stock Exchange is today the strongest market in Europe.

Major European parquets, ie. France and Germany, returned to session highs which also strengthens increases in Warsaw. Additionally, in the US shot up the valuation of contracts on the S&P500.

At the halfway point of today's quotations the WIG20 index was at the level of 2,130 points (+2,26%) and the turnover among the largest companies was amounted to PLN 440 million.

WIG20 index opened at 2092.88 points (+0.44%)*

WIG 55902.82 0.47%

WIG30 2433.60 0.53%

mWIG40 4655.15 0.38%

*/ - change to previous close

The Warsaw spot market began trading from fairly sizeable increase with a good attitude and outstanding turnover of Pekao (WSE: PEO), which published better than expected results for the fourth quarter and announced a dividend payment of PLN 8.68 zł per share (dividend yield 6.38 percent in relation to yesterday's closing price).

Very good looks also German DAX which increased by more than 0.4%. The morning promises thinking about getting the level of 2,100 points in case of the WIG20 index.

After fifteen minutes of trading WIG20 index was at 2,094 points (+0,45%)

Wednesday's session on the New York stock exchange has brought small variations in the major indexes. No publication of macroeconomic data, except for the weekly crude oil inventories in the US, focused market attention on the results of companies. Tomorrow will begin a two-day meeting Donald Trump with Japan Prime Minister, where will be discussed a number of topics, including very important for the US trade issues and currencies.

Contracts in the US are stable after yesterday's neutral session and in Asia, beside of falling the Nikkei, dominate rather increases. This means a quiet start of the European markets.

The main index of the Warsaw Stock Exchange, the WIG20, remains in consolidation and, at least in the morning, there are no arguments for leaving it.

European stocks finished modestly higher Wednesday, but post-earnings drops by Maersk and Tullow Oil and a decline in oil prices kept stronger gains in check. U.S. government data out Wednesday afternoon showed a surge in supplies, to 13.8 million barrels compared with expectations of a rise of 2.5 million barrels, but oil prices managed to shake off earlier declines of more than 1% as European equity trading closed.

The Dow industrials closed lower Wednesday as financial stocks continued their slide on the week, while the S&P 500 closed fractionally higher and the Nasdaq scored a new record.

Asian stocks were mildly higher Thursday as investors sought trading cues, even as Japan's Nikkei Stock Average was pressured lower by the yen's strength overnight. "We sort of need a trigger," said Christoffer Moltke-Leth, director of global sales trading at Saxo Capital Markets. "I think [the market] will be driven very much by individual company news....It will be a stock picker's market."

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.