- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei +63.23 19364.67 +0.33%

TOPIX +8.09 1550.40 +0.52%

Hang Seng +190.50 22935.35 +0.84%

CSI 300 -23.77 3334.50 -0.71%

Euro Stoxx 50 +1.73 3307.94 +0.05%

FTSE 100 +15.02 7290.49 +0.21%

DAX +62.87 11646.17 +0.54%

CAC 40 +0.48 4888.71 +0.01%

DJIA +98.75 19954.28 +0.50%

S&P 500 +6.42 2275.32 +0.28%

NASDAQ +11.83 5563.65 +0.21%

S&P/TSX +65.26 15491.54 +0.42%

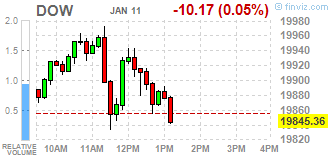

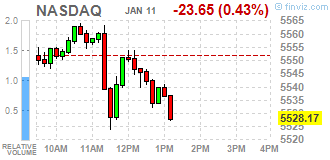

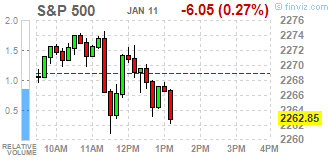

Major U.S. stock-indexes slipped to session lows, before recovering ground, on Wednesday as drug stocks took a beating after Donald Trump's comments on drug pricing in his first formal news conference after his election victory. The President-elect lashed out at pharmaceutical companies, saying they were "getting away with murder" by charging high drug prices. Drug pricing has become a lightning rod for criticism with several drugmakers coming under federal investigation for price gouging.

Most of Dow stocks in positive area (18 of 30). Top gainer - Merck & Co., Inc. (MRK, +1.75%). Top loser - Pfizer Inc. (PFE, -2.78%). Most of S&P sectors also in positive area. Top gainer - Basic Materials (+1.0%). Top loser - Healthcare (-1.7%).

At the moment:

Dow 19807.00 +19.00 +0.10%

S&P 500 2261.75 -2.00 -0.09%

Nasdaq 100 5022.50 -8.75 -0.17%

Oil 52.57 +1.75 +3.44%

Gold 1194.20 +8.70 +0.73%

U.S. 10yr 2.34 -0.04

Polish equities continued to grow for the third consecutive day on Wednesday. The broad market measure, the WIG Index, added 0.56%. The WIG sub-sector indices were mainly higher with mining stock gauge (+4.84%) outperforming.

The large-cap stocks' measure, the WIG30 Index, advanced 0.72%. In the index basket, agricultural producer KERNEL (WSE: KER), chemical producer GRUPA AZOTY (WSE: ATT) and copper producer KGHM (WSE: KGH) were the strongest performers, jumping by 6.34%, 5.97% and 5.64%. Other major outperformers were coking coal miner JSW (WSE: JSW), FMCG-wholesaler EUROCASH (WSE: EUR), chemical producers SYNTHOS (WSE: SNS) and videogame developer CD PROJEKT (WSE: CDR), which added between 2.74% and 3.3%. On the other side of the ledger, oil refiner PKN ORLEN (WSE: PKN) fared the worst, tumbling by 3.22%. It was followed by oil and gas producer PGNIG (WSE: PGN), genco ENERGA (WSE: ENG), developing sector name GTC (WSE: GTC) and thermal coal miner BOGDANKA (WSE: LWB), which lost between 1.02% and 1.91%.

Wall Street began sessions at neutral levels but the Warsaw WIG20 index fell to daily minima. The distance to the round level of 2,000 points is still safe and may give a chance for a little rest after an excellent start of the year and relatively more powerful than other markets behavior.

An hour before the close of trading the WIG20 index was at the level of 2,015 points (-0,40%).

U.S. stock-index futures were flat as investors awaited the U.S. President-elect Donald Trump's news conference and the start of earnings season in the U.S.

Global Stocks:

Nikkei 19,364.67 +63.23 +0.33%

Hang Seng 22,935.35 +190.50 +0.84%

Shanghai 3,137.42 -24.25 -0.77%

FTSE 7,294.29 +18.82 +0.26%

CAC 4,891.06 +2.83 +0.06%

DAX 11,616.58 +33.28 +0.29%

Crude $51.12 (+0.59%)

Gold $1,187.80 (+0.19%)

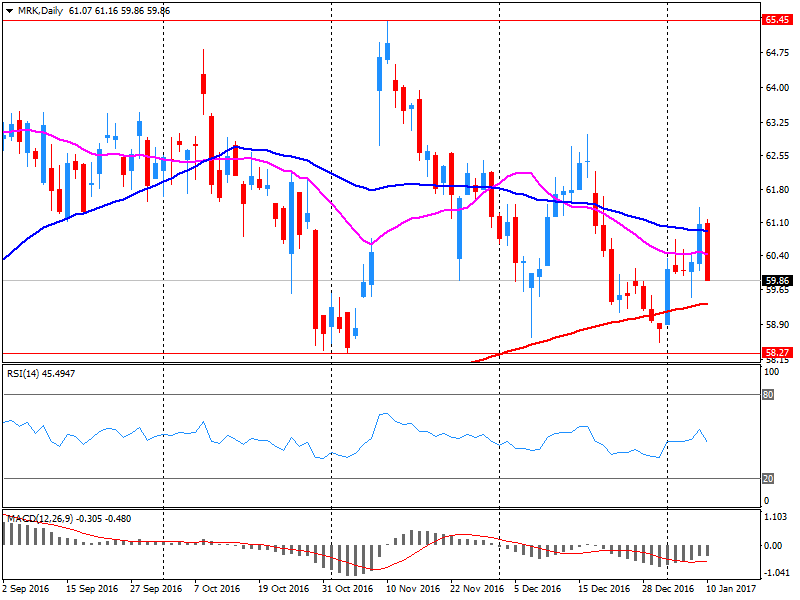

Shares of pharmaceutical company Merck (MRK) show a strong growth in premarket trading. The reason for rise in price of securities, as reported by CNNMoney, is the fact that on Tuesday night, the company reported that the US Food and Drug Administration (US Food and Drug Administration) is considering an accelerated approval of the drug for the treatment of lung cancer, Keytruda.

MRK shares rose to $ 61.65 (+ 2.89%).

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 31 | 0.02(0.0646%) | 117 |

| Amazon.com Inc., NASDAQ | AMZN | 795.3 | -0.60(-0.0754%) | 8394 |

| Apple Inc. | AAPL | 118.82 | -0.29(-0.2435%) | 50704 |

| AT&T Inc | T | 40.6 | -0.21(-0.5146%) | 13549 |

| Barrick Gold Corporation, NYSE | ABX | 16.82 | 0.02(0.119%) | 14508 |

| Boeing Co | BA | 158.45 | -0.62(-0.3898%) | 365 |

| Caterpillar Inc | CAT | 94.01 | 0.18(0.1918%) | 2046 |

| Citigroup Inc., NYSE | C | 59.6 | -0.63(-1.046%) | 62897 |

| Deere & Company, NYSE | DE | 106.19 | 1.30(1.2394%) | 400 |

| Exxon Mobil Corp | XOM | 85.57 | -0.36(-0.4189%) | 23699 |

| FedEx Corporation, NYSE | FDX | 188 | -0.42(-0.2229%) | 158 |

| Ford Motor Co. | F | 12.77 | -0.08(-0.6226%) | 174760 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 15.49 | -0.06(-0.3859%) | 71163 |

| General Electric Co | GE | 31.27 | -0.10(-0.3188%) | 21382 |

| General Motors Company, NYSE | GM | 37.44 | 0.09(0.241%) | 9075 |

| Goldman Sachs | GS | 242.02 | -0.55(-0.2267%) | 2191 |

| Google Inc. | GOOG | 806.06 | 1.27(0.1578%) | 333 |

| Intel Corp | INTC | 36.49 | -0.05(-0.1368%) | 1775 |

| International Paper Company | IP | 54 | 0.22(0.4091%) | 137 |

| JPMorgan Chase and Co | JPM | 86.3 | -0.13(-0.1504%) | 8449 |

| McDonald's Corp | MCD | 120.85 | 0.60(0.499%) | 639 |

| Merck & Co Inc | MRK | 61.84 | 1.92(3.2043%) | 64163 |

| Microsoft Corp | MSFT | 62.78 | 0.16(0.2555%) | 2473 |

| Nike | NKE | 53.2 | 0.09(0.1695%) | 2238 |

| Pfizer Inc | PFE | 33.3 | -0.14(-0.4187%) | 656 |

| Procter & Gamble Co | PG | 83.89 | 0.40(0.4791%) | 447 |

| Tesla Motors, Inc., NASDAQ | TSLA | 228.88 | -0.99(-0.4307%) | 7983 |

| The Coca-Cola Co | KO | 41.08 | 0.04(0.0975%) | 986 |

| Twitter, Inc., NYSE | TWTR | 17.42 | 0.05(0.2879%) | 28653 |

| Verizon Communications Inc | VZ | 52.58 | -0.18(-0.3412%) | 203 |

| Visa | V | 81.46 | 0.15(0.1845%) | 375 |

| Walt Disney Co | DIS | 108.15 | -0.23(-0.2122%) | 3008 |

| Yahoo! Inc., NASDAQ | YHOO | 42.34 | 0.04(0.0946%) | 2877 |

| Yandex N.V., NASDAQ | YNDX | 21.45 | -0.12(-0.5563%) | 3300 |

Upgrades:

Downgrades:

Exxon Mobil (XOM) downgraded to Market Perform from Outperform at Wells Fargo

AT&T (T) downgraded to Hold from Buy at Deutsche Bank

Bank of America (BAC) downgraded to Neutral at UBS

Citigroup (C) downgraded to Sell at UBS

Other:

JPMorgan Chase (JPM) initiated with a Buy at UBS

Microsoft (MSFT) initiated with an Outperform at Wells Fargo

Goldman Sachs (GS) target raised to $225 from $200 at Citigroup; Sell

Bank of America (BAC) target raised to $26 from $19 at Citigroup

Alphabet A (GOOGL) target lowered to $1100 from $1120 at Credit Suisse

Amazon (AMZN) target lowered to $950 from $1000 at Credit Suisse

The forenoon phase of session brought a favorable for the demand side settlement. The German DAX recovered from earlier losses and is growing by almost 0.3 percent. The Warsaw market took advantage of the atmosphere of the environment and picked up the WIG20 index to area of 2,033 points. The contracts on the S&P500 does not indicate a strong opening in the US, the same into the second half of the session markets are entering market with a slightly less optimism.

At the halfway point of today's quotations the WIG20 index was at the level of 2,027 points (+0,17%), the turnover in the segment of the largest companies was amounted to PLN 360 million.

WIG20 index opened at 2024.89 points (+0.06%)*

WIG 53515.63 0.20%

WIG30 2337.09 0.23%

mWIG40 4323.10 0.15%

*/ - change to previous close

The Warsaw spot market started the day from increases regardless of the slightly discount behavior in European markets. However the turnover is low and is mainly focused on heavily played yesterday KGHM. Shares of KGHM have more than half of the turnover in the WIG20.

After fifteen minutes of trading the WIG20 index was at the level of 2,027 points (+0,18%).

The US stock markets ended Tuesday's session with cosmetic change, however, for the Nasdaq Comp. index slight increases were sufficient to establish another record. The Dow Jones Industrial dropped at the closing of 0.16 percent, the S&P 500 remained unchanged and the Nasdaq Composite went up by 0.36 percent . Investors are awaiting Wednesday's conference president-elect Donald Trump and the beginning of the season of quarterly results, which starts on Friday from publishing the results of three banks - JPMorgan Chase & Co., Wells Fargo & Company and Bank of America.

A slight decrease in the valuation of derivatives on US indices may result in revocation at the start of the European markets. The Warsaw market in recent days emphasizes his independence. Breaking by the WIG20 the level of 2,000 points marks the end of consolidation between 2,000 and 1,650 points and the growth potential indicates a level of 2,350 points, hence the optimism with which the market wants to grow despite the relatively weaker behavior of environment.

European stocks closed in positive territory Tuesday, shaking off nagging anxieties over the health of Italy's banking system, which gave investors pause for much of the session. A turnaround in bank shares helped to focus a mini turnaround for the European benchmark as shares in lenders cut losses or turned slightly positive late Tuesday.

U.S. stocks ended mixed on Tuesday as Nasdaq closed at a record high for a fourth session while the Dow Jones Industrial Average's push toward 20,000 was again thwarted. Jeffrey Gundlach of DoubleLine Capital earlier told Fox Business that U.S. equities seem very expensive and that stocks are likely to rise moderately from the current level but top off around Donald Trump's inauguration as U.S. president.

Asian shares hit a bump on their 2017 dream run on Tuesday, hurt by doubts over a recent global oil curb deal, and apprehensions ahead of U.S. President-elect Donald Trump's first news conference since his election victory.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.