- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

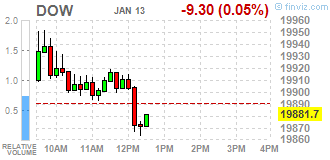

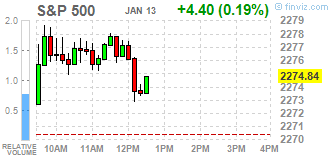

Major U.S. stock-indexes mixed on Friday as strong earnings from large U.S. lenders bode well for the rest of the earnings season. The Dow's gains were comparatively lesser, held back by a drop in consumer stocks after a report showed U.S. retail sales and core retail sales increased less than expected in December. Trading volumes were light ahead of a three-day weekend.

Most of Dow stocks in negative area (18 of 30). Top gainer - Merck & Co., Inc. (MRK, +0.48%). Top loser - E. I. du Pont de Nemours and Company (DD, -0.92%).

Most of S&P sectors in positive area. Top loser - Healthcare (+0.6%). Top gainer - Conglomerates (-0.7%).

At the moment:

Dow 19791.00 -12.00 -0.06%

S&P 500 2268.50 +5.00 +0.22%

Nasdaq 100 5054.25 +19.50 +0.39%

Oil 52.59 -0.42 -0.79%

Gold 1196.70 -3.10 -0.26%

U.S. 10yr 2.41 +0.04

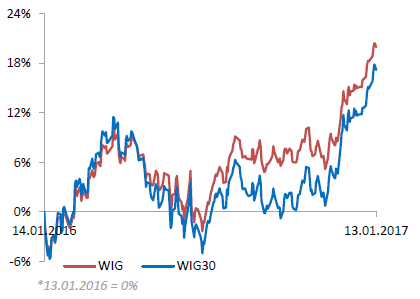

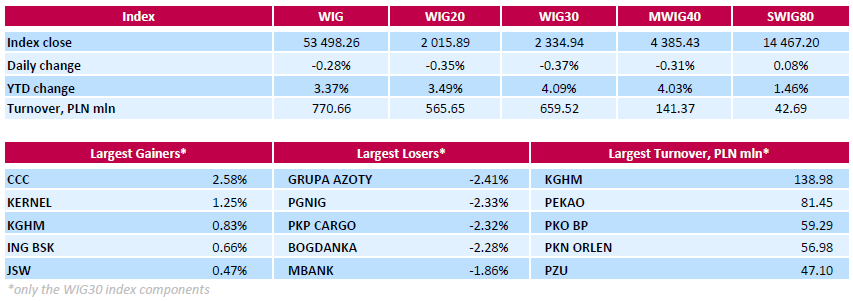

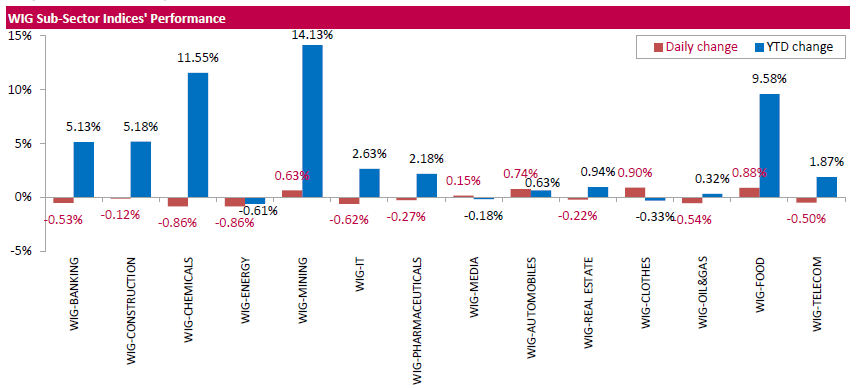

Polish equity market closed lower on Friday. The broad market measure, the WIG index, fell by 0.28%. Most sectors dropped, with chemicals (-0.86%) and energy (-0.86%) underperforming.

The large-cap stocks' gauge, the WIG30 Index, sank by 0.37%. 2/3 of the index components recorded declines. Chemical company GRUPA AZOTY (WSE: ATT) suffered the biggest daily drop, tumbling by 2.41% after significant gains earlier this week. Other largest losers were oil and gas producer PGNIG (WSE: PGN), railway freight transport operator PKP CARGO (WSE: PKP) and thermal coal miner BOGDANKA (WSE: LWB), falling 2.33%, 2.32% and 2.28% respectively. At the same time, footwear retailer CCC (WSE: CCC) and agricultural producer KERNEL (WSE: KER) led a handful of gainers, adding 2.58% and 1.25% respectively. The latter published Q2 operational update, which reviled that the company increased its grain sales by 15% y/y, sunflower oil sales in bulk by 13% y/y and bottled oil sales by almost 17% y/y.

The market on Wall Street took off with optimism, the first transactions surprise positively and the S&P500 index is rising by more than 0.3 percent. This favorable situation has been noticed in Europe. However on the Warsaw Stock Exchange any reaction is not seen. Clearly weaker today the WIG20 seems to be sentenced for decline at the end of the day. But we have to keep in mind the low turnover, which reduces the credibility of discounts.

An hour before the close of trading the WIG20 index was at the level of 2,014 points (-0,43%).

U.S. stock-index futures edged up as investors assessed Q4 earnings reports released by the U.S. largest banks and data on retail sales and PPI for December.

Global Stocks:

Nikkei 19,287.28 +152.58 +0.80%

Hang Seng 22,937.38 +108.36 +0.47%

Shanghai 3,112.33 -6.96 -0.22%

FTSE 7,324.27 +31.90 +0.44%

CAC 4,909.77 +45.80 +0.94%

DAX 11,592.21 +71.17 +0.62%

Crude $52.67 (-0.64%)

Gold $1,198.30 (-0.13%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 32.99 | -0.05(-0.1513%) | 6895 |

| Amazon.com Inc., NASDAQ | AMZN | 814.24 | 0.60(0.0737%) | 19174 |

| American Express Co | AXP | 77 | 0.12(0.1561%) | 500 |

| Apple Inc. | AAPL | 119.18 | -0.07(-0.0587%) | 43520 |

| AT&T Inc | T | 40.97 | -0.04(-0.0975%) | 6141 |

| Barrick Gold Corporation, NYSE | ABX | 16.97 | 0.08(0.4736%) | 24751 |

| Boeing Co | BA | 159 | 0.71(0.4485%) | 7473 |

| Caterpillar Inc | CAT | 94 | 0.01(0.0106%) | 623 |

| Chevron Corp | CVX | 116.01 | -0.15(-0.1291%) | 425 |

| Cisco Systems Inc | CSCO | 30.13 | 0.09(0.2996%) | 513 |

| Citigroup Inc., NYSE | C | 59.05 | -0.18(-0.3039%) | 52505 |

| E. I. du Pont de Nemours and Co | DD | 73.95 | -0.16(-0.2159%) | 100 |

| Exxon Mobil Corp | XOM | 86.35 | 0.01(0.0116%) | 10998 |

| Facebook, Inc. | FB | 127.49 | 0.87(0.6871%) | 211181 |

| Ford Motor Co. | F | 12.61 | 0.02(0.1589%) | 18588 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 15.3 | 0.03(0.1965%) | 64513 |

| General Electric Co | GE | 31.36 | -0.03(-0.0956%) | 3760 |

| Goldman Sachs | GS | 242.88 | -0.96(-0.3937%) | 20395 |

| Google Inc. | GOOG | 808 | 1.64(0.2034%) | 1554 |

| International Business Machines Co... | IBM | 167.5 | -0.45(-0.2679%) | 1714 |

| JPMorgan Chase and Co | JPM | 86.3 | 0.06(0.0696%) | 618492 |

| Merck & Co Inc | MRK | 62.36 | 0.15(0.2411%) | 2660 |

| Microsoft Corp | MSFT | 62.7 | 0.09(0.1437%) | 10499 |

| Procter & Gamble Co | PG | 84 | 0.16(0.1908%) | 1856 |

| Tesla Motors, Inc., NASDAQ | TSLA | 230.14 | 0.55(0.2396%) | 6428 |

| The Coca-Cola Co | KO | 41 | 0.05(0.1221%) | 299 |

| Twitter, Inc., NYSE | TWTR | 17.4 | 0.02(0.1151%) | 4461 |

| Verizon Communications Inc | VZ | 52.96 | 0.28(0.5315%) | 154 |

| Walt Disney Co | DIS | 107.35 | -0.18(-0.1674%) | 1056 |

| Yahoo! Inc., NASDAQ | YHOO | 42.18 | 0.07(0.1662%) | 1602 |

Upgrades:

Facebook (FB) upgraded to Strong Buy from Outperform at Raymond James; target $160

Downgrades:

Credit Suisse (CS) downgraded to Underperform from Neutral at Macquarie

Other:

Merck (MRK) initiated with a Buy at Bryan Garnier

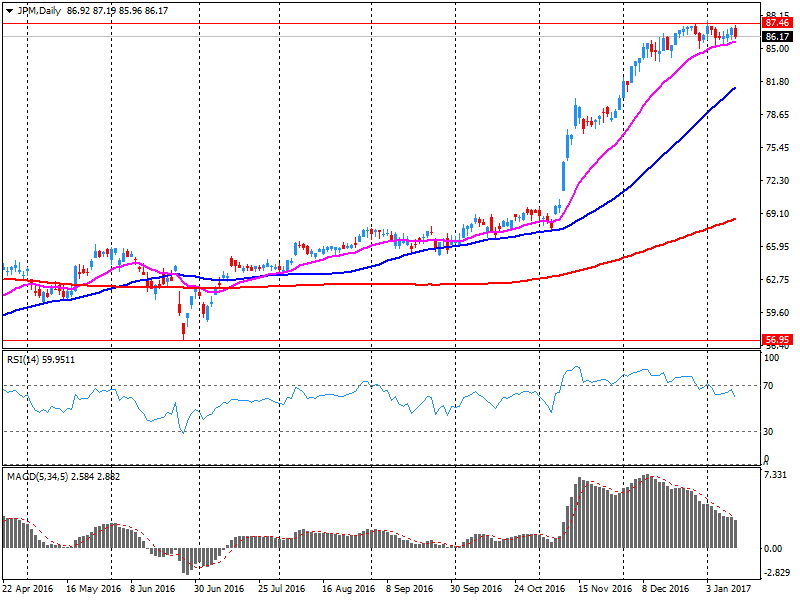

JPMorgan Chase reported Q4 FY 2016 earnings of $1.71 per share (versus $1.32 in Q4 FY 2015), beating analysts' consensus estimate of $1.43.

The company's quarterly revenues amounted to $23.376 bln (+2.1% y/y), generally in-line with analysts' consensus estimate of $23.476 bln.

JPM rose to $86.55 (+0.36%) in pre-market trading.

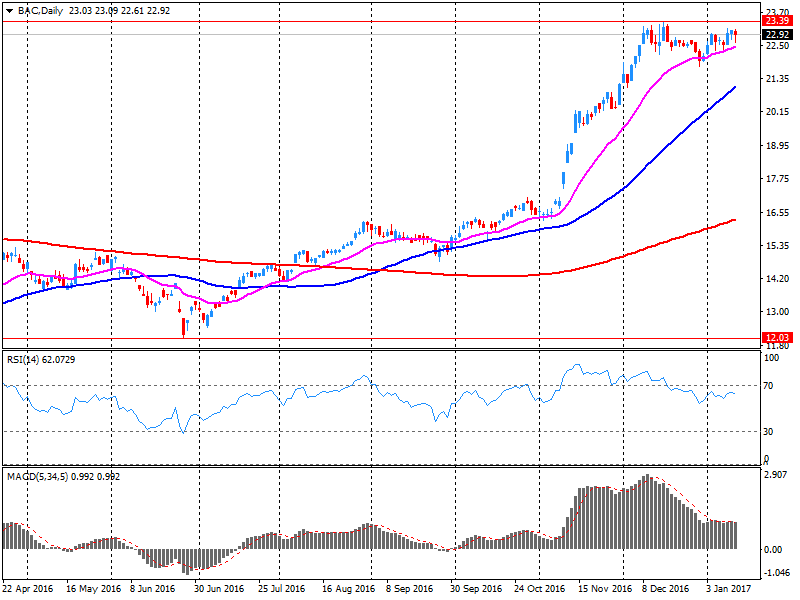

Bank of America reported Q4 FY 2016 earnings of $0.40 per share (versus $0.28 in Q4 FY 2015), beating analysts' consensus estimate of $0.38.

The company's quarterly revenues amounted to $19.990 bln (+2.1% y/y), missing analysts' consensus estimate of $21.058 bln.

Bank of America also increased planned share repuchases for 1H17 by $1.8 bln to $4.3 bln.

BAC fell to $22.74 (-0.79%) in pre-market trading.

The morning part of the session on the Warsaw market was marked by growing correction's mood. The discount in the WIG20 index is limited be reduced level of turnover. Among major companies gain only shares of Pekao (WSE: PEO) and PKO. The fact that the Warsaw market falls the second day in a row should not be surprising after a strong approach up even only in January. Slowly investors begin to move in the direction of Wall Street and the banks' results.

At the halfway point of today's trading the WIG20 index was at the level of 2,013 points (-0,47%) and the turnover in the segment of blue chips was amounted to PLN 260 million.

European stock indices show a moderately positive trend, aided by rise in price of shares of the automotive sector. In addition, investors analyze the latest statistical data from China and the start in the US corporate reporting season.

The data showed that exports from China fell sharply in December due to weak demand, which increased investors' anxiety about the state's second-largest economy in the world. General Customs Administration of China reported that the total volume of foreign trade in December fell by 6.8% per year, amounting to 3,684 billion dollars. The volume of China's exports in December alone totaled 209.4 billion dollars, down 6.1% compared to the same period last year. China's import volume in December was 168.6 billion dollars, a decline of 3.1% per annum. In addition, it was reported on the results of China's exports in 2016 decreased by 7.7%, imports decreased by 5.5% per annum. The volume of China's exports in 2016 amounted to 2.097 billion dollars, and imports US $ 1.587 trillion. The trade surplus for the end of 2016 amounted to 509.9 billion.

Investors are also preparing for the US report season, which starts today.

The composite index of the largest companies in the region Stoxx Europe 600 rose 0.6%, to the level of 364.68. Most sectors and stock exchanges are trading in positive territory.

Automotive segment rose by 0.59 percent despite news that US Environmental Protection Agency accused Fiat Chrysler Automobiles of installing software on cars, underestimating the figures on emissions of harmful substances. However, the automaker rejected these accusations. Currently, shares of Fiat Chrysler Automobiles show an increase of 3.6%.

Renault's capitalization fell by 2.4 percent after reports that the French authorities have launched an investigation against the company, suspecting of manipulation of car exhaust data.

Shares of the health sector are growing, recovering from the comments made earlier this week by US President that pharmaceutical companies "go with murder."

At the moment:

FTSE 100 +20.27 7312.64 + 0.28%

DAX +67.03 11588.07 + 0.58%

CAC 40 +43.61 4907.58 + 0.90%

WIG20 index opened at 2023.01 points (+0.00%)*

WIG 53707.82 0.11%

WIG30 2346.16 0.11%

mWIG40 4402.28 0.07%

*/ - change to previous close

The cash market started the day on a neutral levels and with moderate level of turnover. At the beginning of the session in European markets, as expected, it was considered better yesterday's ending in the US. The session - at least until the entrance Wall Street to the game - promises to be an extension of the two-day suspension. The theme for today is waiting for revisions of Polish rating by Moody's and Fitch agencies.

After fifteen minutes of trading the WIG20 index was at the level of 2,022 points (-0,04%).

Thursday's sessions on the New York stock markets ended with slight declines in the major indexes. At the close the Dow Jones Industrial fell 0.32 percent, Nasdaq Composite went down by 0.29 percent and the S&P 500 lost 0.21 percent. Markets still remain under the influence of Wednesday's Donald Trump press conference, which has not met the expectations of investors.

From the point of view of the European markets this small changes in the indices are positive surprise. When Europe closed the day the S&P 500 lost nearly 1 percent, and close the day giving barely 0.2 percent. We may therefore expect an alignment in Europe, which supports the positive position of the contract for the S&P500.

On the Warsaw market overcome by the WIG20 level of 2,000 points built potential for growth in the region of 2,350 pts., but there were also attempts to profit taking. Market defends itself against a decline under 2,000 pts., however, has not enough power to overcome the region of 2,040 pts.

The impetus for further play likely will flow from the US, where investors will meet today with the first quarterly results. In the plans are among other reports of three major banks. Positive reactions from US investors surely will be noticed in other markets.

European stocks broke a two-day winning run on Thursday, yanked lower by drug makers as U.S. President-elect Donald Trump's comments on the pharma industry continued to bite. Auto stocks also slumped following accusations that Fiat Chrysler doctored its diesel-emissions test.

U.S. stocks rebounded from a sharp morning selloff, but still closed lower Thursday, with the Nasdaq snapping a seven-day winning streak as investors paused before the start of earnings season and a lack of policy detail in President-elect Donald Trump's first formal news conference a day ago. Equity markets have been trading mostly sideways as investors begin to question the run-up in stock prices following the election on Trump's promises of fiscal stimulus.

Many major Asian stocks indexes started lower Friday after modest overnight declines in the U.S., but the Nikkei bucked the trend as the dollar has regained some footing versus the yen. Following broad gains last week, regional equity markets have been choppy this week as liquidity steadily returned following a slowdown during the Christmas season.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.