- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei +80.84 18894.37 +0.43%

TOPIX +4.76 1513.86 +0.32%

Hang Seng +257.29 23098.26 +1.13%

CSI 300 +13.01 3339.37 +0.39%

Euro Stoxx 50 +8.96 3294.00 +0.27%

FTSE 100 +27.23 7247.61 +0.38%

DAX +59.39 11599.39 +0.51%

CAC 40 -6.29 4853.40 -0.13%

DJIA -22.05 19804.72 -0.11%

S&P 500 +4.00 2271.89 +0.18%

NASDAQ +16.93 5555.66 +0.31%

S&P/TSX -43.51 15397.85 -0.28%

Major US stock indexes closed mostly in positive territory, as the growth of technology companies companies fall leveled retailers. At the same time the Dow fell below zero under the pressure of the basic materials sector shares.

Investors assessed makrostatisticheskie publishing quarterly reports and a number of US companies, as well as preparing for the speech of Fed Chairman Janet Yellen.

As it became known, the consumer prices in the US rose in December as households increased spending on gasoline and rental housing, which led, a sign that inflationary pressures may be growing to the largest growth at an annual rate of 2.5 per year. According to the report, the consumer price index rose 0.3% last month, after rising 0.2% in November. In the 12 months to October, the consumer price index increased by 2.1% - the largest increase year on year in June, 2014. The consumer price index rose by 1.7% in the year to November. The increase was in line with economists' expectations.

The volume of industrial production rose in December for the biggest jump of utilities since 1989, as the temperature dropped throughout the country. The Fed reported that industrial production increased by 0.8% after a downwardly revised decline of 0.7% in November. Economists had forecast an increase of 0.6%.

sentiment index from the National Association of Home Builders fell by 2 points to 67 in January. Even with the reduction, the December reading was still the highest point of the index with the peak of the housing boom time in 2005, and in January was the second largest. Economists had forecast a reading of 69 in January.

However, the Fed's Beige Book showed that the economy continued to grow at a moderate pace in most regions at the end of 2016 and beginning of this year. In addition, the company is optimistic with regards to future growth in 2017. "In many regions they noted that they expect the continuation of labor market recovery in 2017, while the pressure on wages is likely to grow, and job growth will remain at the same level or accelerate", - the report says.

As for the performances Yellen, she said that the US economy is close to maximum employment, and inflation "is moving toward the goal." "The December rate hike reflects confidence that the economic situation will continue to improve. The scale of the next rate increase depends on how the economy will develop. But too long a delay in raising rates is fraught with "unpleasant surprises" in the form of high inflation, instability. Now Fed officials expect rate hikes, "a few times a year" until 2019 "- said Yellen. - Perhaps there is still potential for progress in the labor market. Wage growth is still quite low, and only began to accelerate in recent years. Broader indicators of unemployment is still above doretsessionnyh levels. "

DOW index components closed mostly in the red (16 of 30). Most remaining shares fell UnitedHealth Group, Inc. (UNH, -2.00%). The leader of growth were the shares of American Express Company (AXP, + 1.16%).

Sector S & P index finished the session mixed. Most of the basic materials sector fell (-0.4%). The leader turned out to be the industrial goods sector (+ 0.4%).

At the close:

Dow -0.11% 19,804.68 -22.09

Nasdaq + 0.31% 5,555.66 +16.93

S & P + 0.17% 2,271.85 +3.96

Major U.S. stock-indexes were flat in choppy trading on Wednesday as gains in tech stocks offset a weakness in retail sector, while the Dow was dragged down by healthcare shares. Investors assessed a raft of corporate earnings and economic data, while awaiting Federal Reserve Chair Janet Yellen's speech (at 20:00 GMT).

Almost all of Dow stocks in negative area (20 of 30). Top loser - UnitedHealth Group, Inc. (UNH, -2.58%). Top gainer - 3M Company (MMM, +1.04%).

A majority of S&P sectors in negative area. Top loser - Services (-0.3%). Top gainer - Industrial Goods (+0.4%).

At the moment:

Dow 19786.97 -39.80 -0.20%

S&P 500 2,267.75 -0.14 -0.01%

Nasdaq 100 5,541.17 +2.45 +0.04%

Oil 51.32 -1.16 -2.21%

Gold 1211.50 -1.40 -0.12%

U.S. 10yr 2.39 +0.06

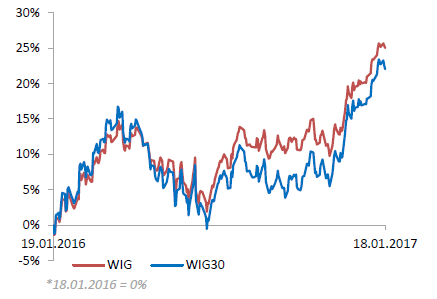

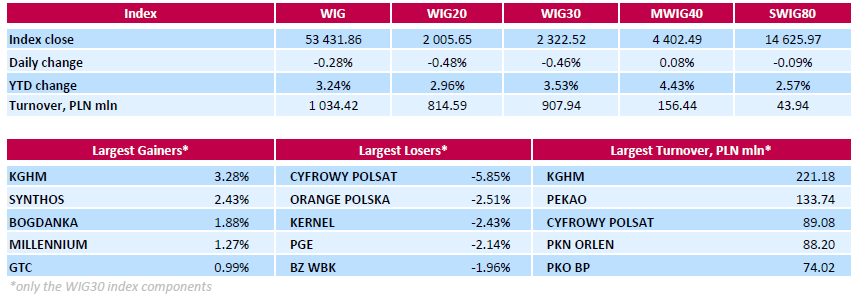

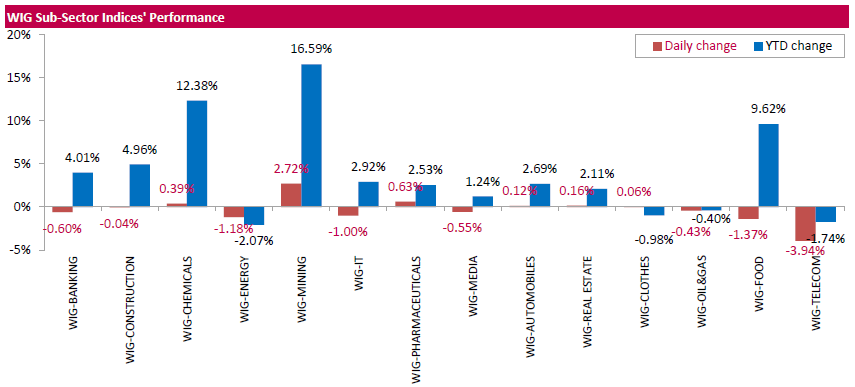

Polish equity market closed lower on Wednesday. The broad market measure, the WIG Index, fell by 0.28%. Sector performance within the WIG Index was mixed. Telecoms (-3.94%) underperformed, while mining (+2.72%) outpaced.

The large-cap stocks' measure, the WIG30 Index, dropped by 0.46%. Within the index components, media group CYFROWY POLSAT (WSE: CPS) was the session's biggest loser, tumbling by 5.85% on news the European Bank for Reconstruction and Development (EBRD) sold a 2.48 percent stake in the company at a small discount to Tuesday's closing price of PLN 25.65. Other largest decliners were telecommunication services provider ORANGE POLSKA (WSE: OPL), agricultural producer KERNEL (WSE: KER) and genco PGE (WSE: PGE), declining by 2.51%, 2.43% and 2.14% respectively. At the same time, property developer GTC (WSE: GTC) led a handful of gainers with a 0.99% advance, followed by clothing retailer LPP (WSE: LPP) and bank PKO BP (WSE: PKO), adding 0.36% and 0.2% respectively.

U.S. stock-index futures rose as investors assessed a raft of corporate earnings and economic data, while awaiting Federal Reserve Chair Janet Yellen's speech (at 20:00 GMT).

Global Stocks:

Nikkei 18,894.37 +80.84 +0.43%

Hang Seng 23,098.26 +257.29 +1.13%

Shanghai 3,113.05 +4.28 +0.14%

FTSE 7,244.42 +24.04 +0.33%

CAC 4,842.80 -16.89 -0.35%

DAX 11,565.70 +25.70 +0.22%

Crude $51.70 (-1.49%)

Gold $1,211.90 (-0.08%)

(company / ticker / price / change ($/%) / volume)

| ALTRIA GROUP INC. | MO | 68.6 | 0.12(0.1752%) | 470 |

| Amazon.com Inc., NASDAQ | AMZN | 806.81 | -2.91(-0.3594%) | 19447 |

| American Express Co | AXP | 76.95 | 0.35(0.4569%) | 1775 |

| AMERICAN INTERNATIONAL GROUP | AIG | 66.09 | 0.03(0.0454%) | 100 |

| Apple Inc. | AAPL | 120.11 | 0.11(0.0917%) | 64607 |

| Barrick Gold Corporation, NYSE | ABX | 17.2 | -0.04(-0.232%) | 53504 |

| Caterpillar Inc | CAT | 92.96 | 0.16(0.1724%) | 1800 |

| Chevron Corp | CVX | 116.24 | -0.04(-0.0344%) | 1153 |

| Cisco Systems Inc | CSCO | 30.03 | 0.04(0.1334%) | 60942 |

| Citigroup Inc., NYSE | C | 58.19 | -0.19(-0.3255%) | 444282 |

| Deere & Company, NYSE | DE | 104.87 | 0.53(0.508%) | 1112 |

| Exxon Mobil Corp | XOM | 87.13 | -0.23(-0.2633%) | 3457 |

| Facebook, Inc. | FB | 128.2 | 0.33(0.2581%) | 79572 |

| Ford Motor Co. | F | 12.51 | 0.10(0.8058%) | 82554 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14.93 | -0.13(-0.8632%) | 13240 |

| General Electric Co | GE | 31.3 | 0.03(0.0959%) | 3529 |

| General Motors Company, NYSE | GM | 37.45 | 0.14(0.3752%) | 300 |

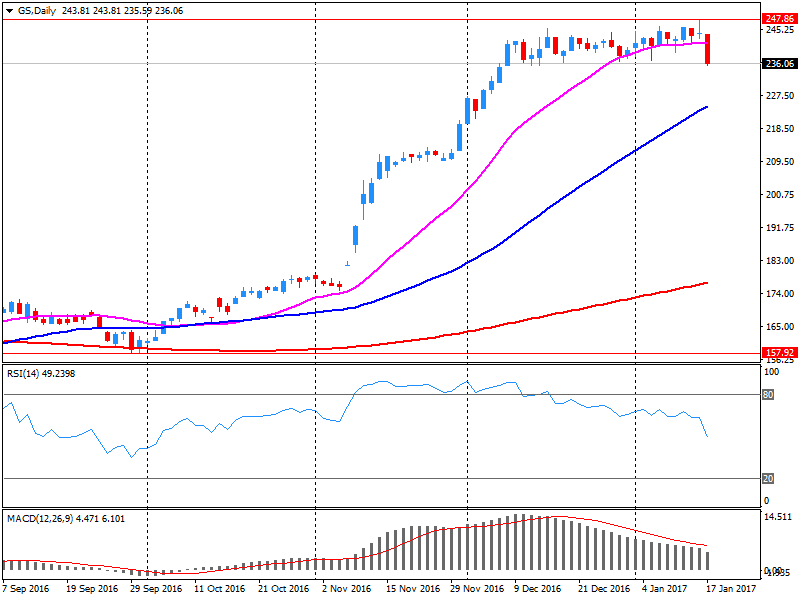

| Goldman Sachs | GS | 236.65 | 0.91(0.386%) | 130621 |

| Intel Corp | INTC | 36.89 | 0.09(0.2446%) | 3195 |

| Johnson & Johnson | JNJ | 115 | 0.13(0.1132%) | 32767 |

| JPMorgan Chase and Co | JPM | 83.95 | 0.40(0.4788%) | 50044 |

| McDonald's Corp | MCD | 122.56 | -0.19(-0.1548%) | 1652 |

| Microsoft Corp | MSFT | 62.65 | 0.12(0.1919%) | 2667 |

| Pfizer Inc | PFE | 32.2 | 0.14(0.4367%) | 74840 |

| Procter & Gamble Co | PG | 84.61 | 0.0695(0.0822%) | 700 |

| Starbucks Corporation, NASDAQ | SBUX | 58.47 | 0.47(0.8103%) | 12459 |

| Tesla Motors, Inc., NASDAQ | TSLA | 237 | 1.42(0.6028%) | 4709 |

| The Coca-Cola Co | KO | 41.3 | 0.08(0.1941%) | 348 |

| Twitter, Inc., NYSE | TWTR | 17.01 | 0.05(0.2948%) | 10862 |

| UnitedHealth Group Inc | UNH | 161.48 | 0.82(0.5104%) | 405 |

| Wal-Mart Stores Inc | WMT | 67.51 | -0.91(-1.33%) | 42493 |

| Walt Disney Co | DIS | 106.95 | -1.02(-0.9447%) | 14895 |

| Yahoo! Inc., NASDAQ | YHOO | 42.08 | 0.09(0.2143%) | 125500 |

| Yandex N.V., NASDAQ | YNDX | 22 | 0.08(0.365%) | 2300 |

Upgrades:

Downgrades:

Walt Disney (DIS) downgraded to Underperform from Market Perform at BMO Capital

Other:

Citigroup reported Q4 FY 2016 earnings of $1.14 per share (versus $1.06 in Q4 FY 2015), beating analysts' consensus estimate of $1.12.

The company's quarterly revenues amounted to $17.012 bln (-7.8% y/y), slightly missing analysts' consensus estimate of $17.260 bln.

C fell to $58.20 (-0.31%) in pre-market trading.

Goldman Sachs reported Q4 FY 2016 earnings of $5.08 per share (versus $4.68 in Q4 FY 2015), beating analysts' consensus estimate of $4.80.

The company's quarterly revenues amounted to $8.170 bln (+12.3% y/y), beating analysts' consensus estimate of $7.803 bln.

GS rose to $237.25 (+0.64%) in pre-market trading.

The morning phase of the session on the Warsaw Stock Exchange did not bring any spectacular decisions and volatility in case of the WIG20 index is practically imperceptible. The only good looks the level of turnover. The market apparently waiting for the solstice.

At the halfway point of the session WIG20 index was at 2015 points (0.00%), the turnover in the segment of the largest companies was amounted to PLN 412 million.

WIG20 index opened at 2018.57 points (+0.16%)

WIG 53737.19 0.29%

WIG30 2341.54 0.36%

mWIG40 4413.70 0.33%

*/ - change to previous close

The Warsaw market started trading from with a slight increase, although fast retraction in the first minutes tool all upward move. Nevertheless, the start may be considered as neutral. For several days the market is in consolidation and investors are waiting for a clear signal as to the further direction, which perhaps will flow from Wall Street.

After fifteen minutes of trading, the WIG index level of 2,012 points (-0.14%).

Tuesday's session on Wall Street ended with a slight discount and the S&P500 index at the end of the day lost 0.3 percent. The causes of this situation can be traced in the currency market, where the pound strengthened against the dollar and also the president-elect commented the strength of the US currency as harmful to the US economy.

In today's calendar will be important macro readings from the US (CPI and industrial production) and the quarterly earnings season, with reports of Goldman Sachs and Citigroup.

On the Warsaw market the WIG20 index is consolidating above the level of 2,000 points and despite yesterday's descent down is still stronger than the underlying market indexes.

European stocks pared losses Tuesday after U.K.'s Prime Minister Theresa May said Britain will break away from the European Union's single market and British lawmakers will be able to vote on Brexit's terms. May, in a highly anticipated speech in London, said Britain does "not seek membership of the single market but the greatest possible access to it," signaling a so-called hard Brexit from the other 27 members of the EU.

U.S. stocks retreated on Tuesday as investors remained cautious in the wake of President-elect Donald Trump's charge that a strong dollar is hurting the economy. "There is a lot going on this week, making investors slightly cautious. For example, the Davos meeting is where a confrontation between globalization and populism is on full display," said Jack Ablin, chief investment officer at BMO Private Bank, referring to the World Economic Forum's annual meeting in the Swiss Alps.

Asian markets were broadly lower Wednesday, following drops overnight in U.S. stocks on worries about the economic impact of the policies of President-elect Donald Trump, who will be inaugurated on Friday.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.