- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei -281.71 18813.53 -1.48%

TOPIX -21.54 1509.10 -1.41%

Hang Seng +122.82 22840.97 +0.54%

CSI 300 +6.91 3326.36 +0.21%

Euro Stoxx 50 -9.49 3285.04 -0.29%

FTSE 100 -106.75 7220.38 -1.46%

DAX -14.71 11540.00 -0.13%

CAC 40 -22.49 4859.69 -0.46%

DJIA -58.96 19826.77 -0.30%

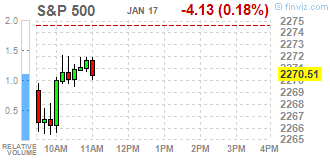

S&P 500 -6.75 2267.89 -0.30%

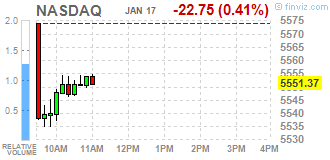

NASDAQ -35.39 5538.73 -0.63%

S&P/TSX -37.93 15441.36 -0.25%

Major US stock indexes closed below zero amid falling shares of conglomerates sector and financial sphere after comments from Donald Trump on the US dollar and speech British Prime Minister Theresa May on the release of the UK plan from the EU structure.

Trump in an interview with Wall Street Journal noted that US companies can not compete with China, "because our currency is too strong. And it's killing us." In addition, Trump has spoken out against the proposed plan by Republicans in Congress on taxes for companies, known as the adjustment of customs duties. It is expected that the plan on the taxation of imports and tax incentives for exports will support the dollar. Overall, his comments led some investors to reconsider expectations for what Trump will soon be able to implement fiscal stimulus and tax cuts.

In addition, as it became known, business activity continued to modestly grow in New York, according to the companies answered in January 2017 in the Empire State Manufacturing Survey. General business conditions index slightly dropped to 6.5. The new orders index fell to 3.1, indicating a slight increase in orders and shipments index remained at 7.3. Inventories rose slightly for the first time in over a year. The conditions in the labor market remained weak, though smaller than in recent months. Manufacturers reported a slight decrease in employment and a number of shorter working weeks.

Meanwhile, investors continue to closely monitor the outgoing financial statements corporate segment. Recall, reports the largest banks on an optimistic note opened the season of quarterly reports in the US on Friday.

DOW index components ended the day mostly in negative territory (18 of 30). Outsider were shares of JPMorgan Chase & Co. (JPM, -3.83%). Most remaining shares increased Wal-Mart Stores, Inc. (WMT, + 2.00%).

Sector S & P index closed mostly in the red. conglomerates (-2.3%) sectors fell most. The leader turned utilities sector (+ 1.0%).

At the close:

Dow -0.28% 19,829.68 -56.05

Nasdaq -0.63% 5,538.73 -35.39

S & P -0.30% 2,267.83 -6.81

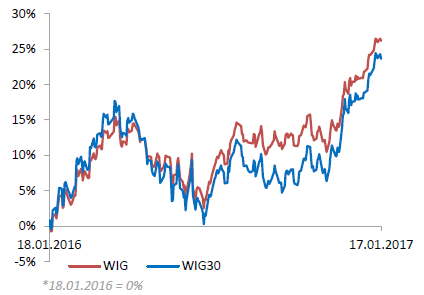

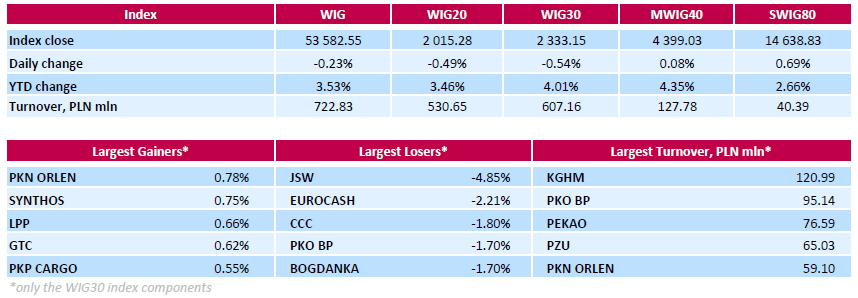

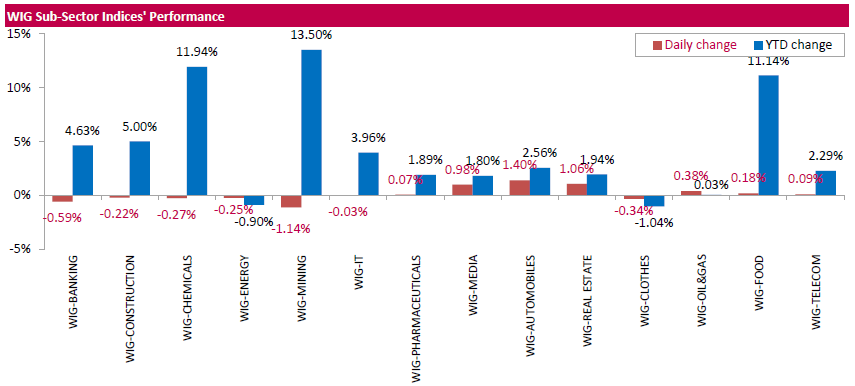

Polish equities closed lower on Tuesday. The broad market measure, the WIG Index, fell by 0.23%. Sector performance within the WIG Index was mixed. Mining sector (-1.14%) fared the worst, while autimobiles (+1.40%) outperformed.

The large-cap stocks' measure, the WIG30 Index, dropped by 0.54%. In the index basket, coking coal miner JSW (WSE: JSW) was the poorest performers, slumping by 4.85%. It was followed by FMCG-wholesaler EUROCASH (WSE: EUR), footwear retailer CCC (WSE: CCC), bank PKO BP (WSE: PKO) and thermal coal miner BOGDANKA (WSE: LWB), tumbling between 1.7% and 2.21% respectively. On the plus side, oil refiner PKN ORLEN (WSE: PKN) topped the outperformers with a gain of 0.78% despite the report the stock suffered a recommendation cut to 'Hold', with target price maintained at PLN 88.5 by analysts of one of Poland's leading brokerage house. Other largest advancers were chemical producer SYNTHOS (WSE: SNS), clothing retailer LPP (WSE: LPP), property developer GTC (WSE: GTC) and railway freight transport operator PKP CARGO (WSE: PKP), returning between 0.55% and 0.78%.

Major U.S. stock-indexes fell on Tuesday, with healthcare and financial stocks coming under pressure, as investors assessed President-elect Donald's Trump's comments on the dollar and drug pricing. U.S. stocks and the dollar have rallied since Trump's election on bets that he would usher in an era of economic growth through fiscal stimulus. However, the rally has hit a speed bump as Trump has provided little detail on his policies.

Most of Dow stocks in positive area (18 of 30). Top gainer - Wal-Mart Stores, Inc. (WMT, +3.05%). Top loser - JPMorgan Chase & Co. (JPM, -2.51%).

Most of S&P sectors in negative area. Top loser - Utilities (+1.2%). Top loser - Healthcare (-0.8%).

At the moment:

Dow 19792.00 -40.00 -0.20%

S&P 500 2266.00 -6.50 -0.29%

Nasdaq 100 5046.25 -15.00 -0.30%

Oil 52.58 +0.21 +0.40%

Gold 1213.30 +17.10 +1.43%

U.S. 10yr 2.38 +0.02

The Americans began the first trading day this week from a discount of 0.29% (the S&P500 index), which after the first transactions started to slightly deeper. The situation on Wall Street has no impact on the behavior of the Warsaw market, where the graph of the WIG20 still is located at a safe distance from the level of 2,0000 points.

An hour before the close of trading the WIG20 index was at the level of 2,018 points (-0.33%).

U.S. stock-index futures fell as investors sought safe-haven assets following President-elect Donald Trump's comments on the dollar and British Prime Minister Theresa May's Brexit speech. Mr. Trump told the Wall Street Journal that U.S. companies could not compete with China "because our currency is too strong. And it's killing us".

Global Stocks:

Nikkei 18,813.53 -281.71 -1.48%

Hang Seng 22,840.97 +122.82 +0.54%

Shanghai 3,108.77 +5.34 +0.17%

FTSE 7,258.29 -68.84 -0.94%

CAC 4,878.56 -3.62 -0.07%

DAX 11,560.42 +5.71 +0.05%

Crude $53.16 (+1.51%)

Gold $1,212.40 (+1.35%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 177.98 | 0.59(0.3326%) | 312 |

| AMERICAN INTERNATIONAL GROUP | AIG | 116.86 | 0.48(0.4124%) | 1203 |

| Apple Inc. | AAPL | 118.65 | -0.39(-0.3276%) | 75586 |

| AT&T Inc | T | 40.97 | 0.01(0.0244%) | 1083 |

| Boeing Co | BA | 177.98 | 0.59(0.3326%) | 312 |

| Caterpillar Inc | CAT | 94.75 | 0.27(0.2858%) | 2216 |

| Chevron Corp | CVX | 116.86 | 0.48(0.4124%) | 1203 |

| Cisco Systems Inc | CSCO | 30.06 | -0.01(-0.0333%) | 818 |

| Citigroup Inc., NYSE | C | 59.22 | -0.41(-0.6876%) | 90772 |

| Deere & Company, NYSE | DE | 177.98 | 0.59(0.3326%) | 312 |

| E. I. du Pont de Nemours and Co | DD | 73.21 | -0.39(-0.5299%) | 162 |

| Exxon Mobil Corp | XOM | 116.86 | 0.48(0.4124%) | 1203 |

| Facebook, Inc. | FB | 116.86 | 0.48(0.4124%) | 1203 |

| FedEx Corporation, NYSE | FDX | 177.98 | 0.59(0.3326%) | 312 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 15.04 | -0.15(-0.9875%) | 44763 |

| General Electric Co | GE | 31.27 | -0.09(-0.287%) | 2469 |

| General Motors Company, NYSE | GM | 177.98 | 0.59(0.3326%) | 312 |

| Goldman Sachs | GS | 243.8 | -0.50(-0.2047%) | 37724 |

| Google Inc. | GOOG | 177.98 | 0.59(0.3326%) | 312 |

| Hewlett-Packard Co. | HPQ | 116.86 | 0.48(0.4124%) | 1203 |

| Home Depot Inc | HD | 135 | -0.04(-0.0296%) | 8498 |

| International Business Machines Co... | IBM | 166.79 | -0.55(-0.3287%) | 1721 |

| International Paper Company | IP | 116.86 | 0.48(0.4124%) | 1203 |

| Johnson & Johnson | JNJ | 116.86 | 0.48(0.4124%) | 1203 |

| JPMorgan Chase and Co | JPM | 85.75 | -0.95(-1.0957%) | 47311 |

| Microsoft Corp | MSFT | 62.58 | -0.12(-0.1914%) | 2894 |

| Nike | NKE | 53.03 | 0.11(0.2079%) | 6335 |

| Pfizer Inc | PFE | 116.86 | 0.48(0.4124%) | 1203 |

| Procter & Gamble Co | PG | 116.86 | 0.48(0.4124%) | 1203 |

| Tesla Motors, Inc., NASDAQ | TSLA | 236.25 | -1.50(-0.6309%) | 16793 |

| The Coca-Cola Co | KO | 40.8 | -0.08(-0.1957%) | 9897 |

| Twitter, Inc., NYSE | TWTR | 17.1 | -0.15(-0.8696%) | 105462 |

| United Technologies Corp | UTX | 110 | -0.22(-0.1996%) | 103 |

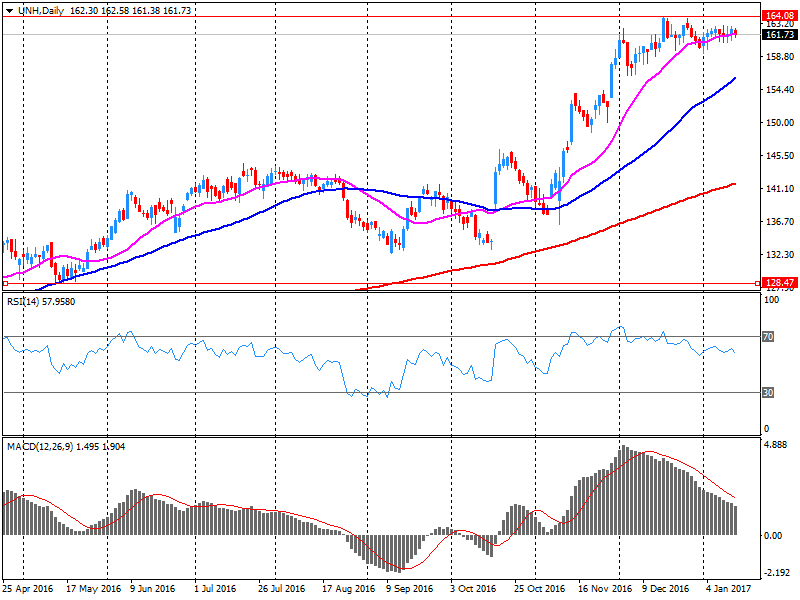

| UnitedHealth Group Inc | UNH | 162.5 | 0.70(0.4326%) | 14824 |

| Verizon Communications Inc | VZ | 52.78 | 0.23(0.4377%) | 3953 |

| Walt Disney Co | DIS | 108.66 | 0.60(0.5553%) | 60225 |

| Yahoo! Inc., NASDAQ | YHOO | 177.98 | 0.59(0.3326%) | 312 |

Upgrades:

Travelers (TRV) upgraded to Outperform from Underperform at Macquarie

American Express (AXP) upgraded to Overweight from Neutral at JP Morgan

Walt Disney (DIS) upgraded to Buy from Neutral at Goldman; target raised to $134 from $109

Downgrades:

Twitter (TWTR) downgraded to Neutral from Buy at UBS; target lowered to $18 from $22

JPMorgan Chase (JPM) downgraded to Mkt Perform from Outperform at Keefe Bruyette

Other:

UnitedHealth reported Q4 FY 2016 earnings of $2.11 per share (versus $1.40 in Q4 FY 2015), beating analysts' consensus estimate of $2.07.

The company's quarterly revenues amounted to $47.523 bln (+9% y/y), generally in-line with analysts' consensus estimate of $47.116 bln.

The company also reaffirmed guidance for FY2017, projecting EPS of $9.30-9.60 (versus analysts' consensus estimate of $9.51) and revenues of $197-199 bln (versus analysts' consensus estimate of $198.69 bln).

UNH rose to $162.00 (+0.12%) in pre-market trading.

In the first half of today's trading the Warsaw Stock Exchange shows noticeable relative strength in relation to core markets. Undoubtedly, it is the impact of the appreciation of the zloty in relation to the dollar.

At the halfway point of today's quotations the WIG20 index was at the level of 2,021 points (-0.17%). The turnover in the segment of the largest companies was amounted to PLN 233 million.

January 17

Before the Open:

UnitedHealth (UNH). Consensus EPS $2.07, Consensus Revenue $47116.42 mln.

January 18

Before the Open:

Citigroup (C). Consensus EPS $1.12, Consensus Revenue $17259.52 mln.

Goldman Sachs (GS). Consensus EPS $4.80, Consensus Revenue $7802.68 mln.

January 19

After the Close:

American Express (AXP). Consensus EPS $0.99, Consensus Revenue $7956.03 mln.

IBM (IBM). Consensus EPS $4.89, Consensus Revenue $21690.90 mln.

January 20

Before the Open:

General Electric (GE). Consensus EPS $0.46, Consensus Revenue $33668.72 mln.

WIG20 index opened at 2026.40 points (+0.06%)

WIG 53716.09 0.02

WIG30 2344.14 -0.08

mWIG40 4394.47 -0.03

*/ - change to previous close

The cash market in Warsaw began trading with a modest increase and at a pretty good turnover focused on the shares of KGHM, which according to our earlier expectations are losing due to falling prices on the copper market. The chart of the WIG20 index is still at a safe distance from the level of 2,000 points, although the mood in the environment is unfavorable.

After fifteen minutes of trade WIG20 index it was at 2,018 points (-0.34%).

Yesterday's session on the Warsaw market ended favorably compared to European markets where got cheaper shares of automotive companies and banks in response to the announcement of Donald Trump as to raise tariffs on cars produced in Europe and the downgrade of Italy rating.

Today, after the one-day break, to the game return the Americans, what will affect the normalization of volatility and activity in global markets. Despite the yesterday's lack of trading on Wall Street, there were some changes in the currency market and raw materials. Copper become less cheaper, what may affect the opening in Warsaw and the stronger yen has its impact on the Japanese Nikkei, which lost in the morning approx. 1.5 percent.

The key event today will be the speech of British prime minister Theresa May on Brexit. In the macro calendar there is also reading of the German ZEW index and the results of other companies in the US.

European stocks slumped Monday, with auto makers and banks losing ground as investors mulled policy signals coming from the U.K. and the U.S. In Frankfurt, auto makers weighed on the DAX 30 DAX, -0.64% which dropped 0.6% to end at 11,554.71. Volkswagen AG VOW3, -2.25% VLKAY, -0.91% fell 2.2%, Daimler AG DAI, -1.90% gave up 1.5%, and BMW AG BMW, -1.12% also shed 1.5%. Those moves came after U.S. President-elect Donald Trump, in an interview with European newspapers, reiterated his call for a 35% import tax on cars built in Mexico that will be exported to the U.S.

Asian stocks and the pound sagged on Tuesday as investors waited for British Prime Minister Theresa May to lay out plans to exit the European Union, which traders fear will see Britain lose access to the bloc's single market. Britain will not seek a Brexit deal that leaves it "half in, half out" of the EU, May will say later in the day, according to her office, in a speech setting out her 12 priorities for upcoming divorce talks with the bloc.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.