- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei +177.88 19072.25 +0.94%

TOPIX +14.29 1528.15 +0.94%

Hang Seng -48.30 23049.96 -0.21%

CSI 300 -10.08 3329.29 -0.30%

Nikkei +177.88 19072.25 +0.94%

TOPIX +14.29 1528.15 +0.94%

Hang Seng -48.30 23049.96 -0.21%

CSI 300 -10.08 3329.29 -0.30%

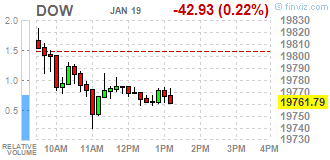

DJIA -72.32 19732.40 -0.37%

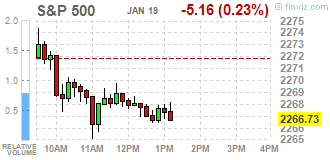

S&P 500 -8.20 2263.69 -0.36%

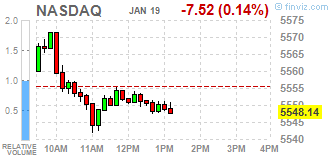

NASDAQ -15.57 5540.08 -0.28%

S&P/TSX +11.96 15409.81 +0.08%

Major US stock indexes fell slightly, with the Dow recorded its fifth consecutive fall-session as investors stayed away from risky trades before the deposition of Donald Trump as president on Friday.

As revealed today the report submitted by the Philadelphia Fed business activity index in the manufacturing sector rose in January, reaching 23.6 points compared to 21.5 points in December. Economists had expected a decline of this indicator to 15.8 points. Recall, the index represents the results of a survey of manufacturers in Philadelphia for their attitude to the current economic situation. The indicator is published just before the ISM index of purchasing managers, and may give an idea of how will an indicator of business activity at the national level. Readings above zero indicate expansion in the sector.

In addition, after reporting a sharp drop in US housing starts in the previous month, the Commerce Department released a report on Thursday, reflecting that the tabs of new homes showed significant recovery in December. The Commerce Department reported that the establishment of new homes rose by 11.3 percent to an annual rate of 1.226 million in December from a revised level of 1.102 million in November.

However, initial applications for unemployment benefits unexpectedly fell for the week of 14 January, according to a report published by the Department of Labor. The number of initial applications for unemployment benefits dropped to 234,000, down 15,000 from a revised level of the previous week's 249,000.

DOW index components closed mostly in the red (23 of 30). Most remaining shares fell Exxon Mobil Corporation (XOM, -1.94%). leaders of growth were shares of The Boeing Company (BA, + 0.77%).

Sector S & P index ended the session mostly in the red. Most utilities sector fell (-1.0%). The leader turned conglomerates sector (+ 0.5%).

At the close:

Dow -0.37% 19,731.99 -72.73

Nasdaq -0.28% 5,540.08 -15.58

S & P -0.36% 2,263.69 -8.20

Major U.S. stock-indexes slightly fell on Thursday, with the Dow on track to mark its fifth day of losses as investors stayed away from making risky bets ahead of Donald Trump's swearing-in as president on Friday. The markets are also digesting a clutch of information including the European Central Bank's decision to maintain its monetary policy, while awaiting a speech by Federal Reserve Chair Janet Yellen. After hitting a series of record highs in a post-election rally, Wall Street has been trading in a tight range as investors look for more details on Trump's policies.

Most of Dow stocks in negative area (18 of 30). Top gainer - Exxon Mobil Corporation (XOM, -1.56%). Top loser - UnitedHealth Group Incorporated (UNH, +1.01%).

Most of S&P sectors in negative area. Top loser - Conglomerates (+1.0%). Top loser - Basic Materials (-0.7%).

At the moment:

Dow 19704.00 -31.00 -0.16%

S&P 500 2262.75 -3.75 -0.17%

Nasdaq 100 5056.25 +1.75 +0.03%

Oil 52.00 +0.11 +0.21%

Gold 1199.80 -12.30 -1.01%

U.S. 10yr 2.49 +0.10

Polish equity market closed higher on Thursday. The broad market measure, the WIG Index, surged by 0.42%. The WIG sub-sector indices were mainly higher with media stocks (+1.24%) outperforming.

The large-cap stocks' measure, the WIG30 Index, rose 0.52%. 2/3 of all index components returned gains, with the way up led by coking coal miner JSW (WSE: JSW), which rose 2.88%, partly erasing a 6% drop recorded in the first two sessions of the week. It was reported that stockpile of coal at Polish mines fell to around 1 mln tonnes as of end of December compared to almost 6 mln tonnes in 2015 on the back of mines shutdowns, geological problems and increased demand due to freezing temperatures. Other major advancers were videogame developer CD PROJEKT (WSE: CDR), chemical producer GRUPA AZOTY (WSE: ATT) and three banking names BZ WBK (WSE: BZW), MBANK (WSE: MBK) and ALIOR (WSE: ALR), which added between 1.77% and 2.37%. On the other side of the ledger, IT-company ASSECO POLAND (WSE: ACP) and genco TAURON PE (WSE: TPE) topped the decliners' list, falling by 2.04%, and 1.78% respectively.

The market in the US began the listing on cosmetic pros. During the last few sessions the supply can not takes advantage and the market is in consolidation with limited volatility and with generating medium-term positive signals. Such signals can come along with the first action of Donald Trump as president.

An hour before the close of trading the WIG20 index was at the level of 2,014 points (+ 0.43%).

U.S. stock-index futures were little changed as investors prefered to be cautious ahead of Donald Trump's inauguration, scheduled to be held on Friday. Market participants also assessed a raft of economic data, including statistics on US housing market and initial jobless claims.

Global Stocks:

Nikkei 19,072.25 +177.88 +0.94%

Hang Seng 23,049.96 -48.30 -0.21%

Shanghai 3,101.70 -11.31 -0.36%

FTSE 7,217.66 -29.95 -0.41%

CAC 4,855.46 +2.06 +0.04%

DAX 11,600.83 +1.44 +0.01%

Crude $51.50 з(+0.82%)

Gold $1,200.90 (-0.92%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 34.42 | -0.39(-1.1204%) | 2010 |

| ALTRIA GROUP INC. | MO | 69.04 | -0.12(-0.1735%) | 1309 |

| Amazon.com Inc., NASDAQ | AMZN | 809.55 | 2.07(0.2564%) | 11460 |

| American Express Co | AXP | 77.79 | 0.30(0.3871%) | 12220 |

| Apple Inc. | AAPL | 119.51 | -0.48(-0.40%) | 174289 |

| Barrick Gold Corporation, NYSE | ABX | 16.72 | -0.10(-0.5945%) | 36722 |

| Caterpillar Inc | CAT | 93.25 | -0.08(-0.0857%) | 2110 |

| Citigroup Inc., NYSE | C | 57.45 | 0.06(0.1045%) | 14226 |

| Exxon Mobil Corp | XOM | 85.87 | -0.41(-0.4752%) | 6912 |

| Facebook, Inc. | FB | 128.18 | 0.26(0.2032%) | 69985 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 15.11 | -0.13(-0.853%) | 15008 |

| Goldman Sachs | GS | 234.2 | -0.09(-0.0384%) | 4283 |

| Hewlett-Packard Co. | HPQ | 14.8 | 0.22(1.5089%) | 6504 |

| International Business Machines Co... | IBM | 166.6 | -0.20(-0.1199%) | 2116 |

| JPMorgan Chase and Co | JPM | 83.9 | -0.04(-0.0477%) | 14125 |

| McDonald's Corp | MCD | 122.44 | -0.27(-0.22%) | 238 |

| Microsoft Corp | MSFT | 62.31 | -0.19(-0.304%) | 1152 |

| Nike | NKE | 53.4 | 0.13(0.244%) | 13572 |

| Pfizer Inc | PFE | 32 | -0.03(-0.0937%) | 781 |

| Procter & Gamble Co | PG | 84.89 | -0.04(-0.0471%) | 461 |

| Tesla Motors, Inc., NASDAQ | TSLA | 248 | 9.64(4.0443%) | 185938 |

| The Coca-Cola Co | KO | 41.05 | -0.24(-0.5813%) | 23002 |

| UnitedHealth Group Inc | UNH | 157.13 | -0.61(-0.3867%) | 482 |

| Verizon Communications Inc | VZ | 52.5 | 0.25(0.4785%) | 11425 |

| Wal-Mart Stores Inc | WMT | 68 | -0.11(-0.1615%) | 164 |

| Walt Disney Co | DIS | 107.95 | -0.21(-0.1942%) | 1046 |

| Yahoo! Inc., NASDAQ | YHOO | 42.13 | 0.10(0.2379%) | 621 |

| Yandex N.V., NASDAQ | YNDX | 21.91 | -0.05(-0.2277%) | 544 |

Upgrades:

HP (HPQ) upgraded to Buy from Neutral at UBS

Tesla Motors (TSLA) upgraded to Overweight from Equal Weight at Morgan Stanley; target $305

Downgrades:

Coca-Cola (KO) downgraded to Market Perform from Outperform at Wells Fargo

Exxon Mobil (XOM) downgraded to Sell from Neutral at UBS

Other:

Apple (AAPL) target raised to $140 from $125 at BofA/Merrill

NIKE (NKE) initiated with a Underperform at CLSA

Verizon (VZ) initiated with a Buy at HSBC Securities

The first half of the session on the Warsaw Stock Exchange was uneventful and the level of variation is small. On the European markets are beginning to dominate correction mood. It is clear that investors are waiting for the 14:30 hour (Warsaw time) when will start a press conference after the ECB meeting. The most important is the rhetoric of the president as a major change in politics itself no one expects.

WIG20 index opened at 2005.60 points (0.00%)*

WIG 53505.27 0.14%

WIG30 2325.22 0.12%

mWIG40 4410.74 0.19%

*/ - change to previous close

The cash market (the WIG20 index) started the day almost at the point of yesterday's close, with the turnover concentrated on the shares of KGHM and PZU. The German DAX gaining cosmetically. The beginning of trading looks therefore very quiet.

After fifteen minutes ot the session, the WIG20 index was at level of 2,007 points (+ 0.10%).

The major US stock indexes ended Wednesday's without significant changes. The Dow Jones Industrial dropped at the closing of 0.11 percent, the S&P 500 rose by 0.18 percent and the Nasdaq Composite gained 0.31 percent. The focus of investors were on the results of companies. Despite the higher-than-expected earnings in the fourth quarter of Goldman Sachs and Citigroup, their quotations were below the line. Yesterday's evening speech by Janet Yellen, who confirmed the intention of further rate hikes in the US, strengthened the dollar. In Asia, the mood is mixed, the Japanese Nikkei rose nearly 1 percent after the strengthening of the dollar. In Europe we wait for a calm start of trading with a certain expectation for an afternoon conference of the ECB. Investors do not expect a deeper content, although the last speech of Mario Draghi weaken the euro.

European stocks on Wednesday wrapped up trading with a tepid gain during a up-and-down session, as investors sifted through corporate updates, including better-than-anticipated results from ASML Holding NV.

U.S. stocks rose moderately on Wednesday as gains in financials offset weakness in telecommunications shares but the Dow Jones Industrial Average bucked the trend to close at its lowest of 2017. The S&P 500 SPX, +0.18% gained 4 points, or 0.2%, to close at 2,271. The Dow Jones Industrial Average DJIA, -0.11% shed 22 points, or 0.1%, to end at 19,804 while the Nasdaq Composite Index COMP, +0.31% rose 16 points, or 0.3%, to close at 5,555. Major indexes traded within a tight range as sentiment remained subdued ahead of President-elect Donald Trump's inauguration on Friday.

Investors in Asian stocks broadly maintained caution ahead of President-elect Donald Trump's inauguration, though Japanese equities rallied Thursday as the dollar strengthened overnight amid comments from Federal Reserve Chairwoman Janet Yellen that were interpreted hawkishly.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.