- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei -229.97 19134.70 -1.19%

TOPIX -14.99 1535.41 -0.97%

Hang Seng -106.33 22829.02 -0.46%

Euro Stoxx 50 -21.24 3286.70 -0.64%

FTSE 100 +1.88 7292.37 +0.03%

DAX -125.13 11521.04 -1.07%

CAC 40 -24.74 4863.97 -0.51%

DJIA -63.28 19891.00 -0.32%

S&P 500 -4.88 2270.44 -0.21%

NASDAQ -16.16 5547.49 -0.29%

S&P/TSX -73.38 15418.16 -0.47%

The Polish equity market closed lower on Thursday. The broad-market measure, the WIG Index, fell by 0.11%. Sector performance in the WIG Index was mixed. Clothes sector names (-1.32%) fared the worst, while food stocks (+3.98%) recorded the biggest gains.

The large-cap stocks' measure, the WIG30 Index, lost 0.2%. In the index basket, insurer PZU (WSE: PZU) declined the most, down 2.32%, followed by bank PKO BP (WSE: PKO), footwear retailer CCC (WSE: CCC) and ), FMCG-wholesaler EUROCASH (WSE: EUR), losing 2.31%, 2.07% and 2.04% respectively. At the same time, agricultural producer KERNEL (WSE: KER) continued to extend gains for the second straight day, jumping by another impressive 6.34%. Other major outperformers were railway freight transport operator PKP CARGO (WSE: PKP), copper producer KGHM (WSE: KGH) and two banking sector names MBANK (WSE: MBK) and BZ WBK (WSE: BZW), which added between 2.13% and 3.66%.

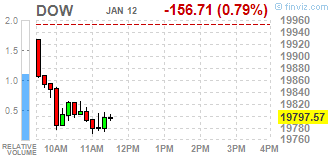

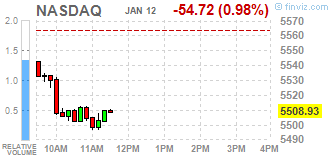

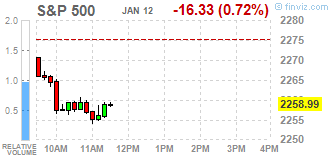

Major U.S. stock-indexes indexes got off to their worst start this year on Thursday after Donald Trump gave little clarity on his promises for economic growth that had powered a record-breaking rally on Wall Street for two months. The U.S. President-elect, in his first news conference on Wednesday, gave no details on tax cuts or infrastructure spending, and instead lashed out at U.S. spy agencies and news agencies over what he called a 'phony' Russia dossier. He also blasted pharmaceutical companies over high drug prices, causing health stocks to snap a six-day winning streak and a wobble in Wall Street.

Most of Dow stocks in negative area (28 of 30). Top gainer - Merck & Co., Inc. (MRK, +1.05%). Top loser - Microsoft Corporation (MSFT, -1.79%).

All S&P sectors in negative area. Top loser - Industrial goods (-1.3%).

At the moment:

Dow 19716.00 -161.00 -0.81%

S&P 500 2252.25 -18.25 -0.80%

Nasdaq 100 5002.50 -44.00 -0.87%

Oil 52.83 +0.58 +1.11%

Gold 1203.00 +6.40 +0.53%

U.S. 10yr 2.31 -0.06

The market in the United States opened with decline of 0.28% (the S&P500 index), which after the first trades is slightly growing. Investors are looking for new impetus to trade and those not. Moreover such arguments for the demand side were not provided by yesterday's press conference of Donald Trump.

An hour before the close of trading the WIG20 index was at the level of 2,036 points (+0,30%).

U.S. stock-index futures as market participants were disappointed with president-elect Donald Trump's first post-election press conference, which provided no clarity on his economic policy. In addition, investors awaited the start of earnings season in the U.S.

Global Stocks:

Nikkei 19,134.70 -229.97 -1.19%

Hang Seng 22,829.02 -106.33 -0.46%

Shanghai 3,119.63 -17.13 -0.55%

FTSE 7,294.73 +4.24 +0.06%

CAC 4,884.49 -4.22 -0.09%

DAX 11,583.51 -62.66 -0.54%

Crude $53.10 (+1.63%)

Gold $1,201.90 (+0.44%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 94.39 | -0.26(-0.2747%) | 2856 |

| ALTRIA GROUP INC. | MO | 87.12 | 0.31(0.3571%) | 17281 |

| Amazon.com Inc., NASDAQ | AMZN | 83.85 | 0.10(0.1194%) | 12295 |

| AMERICAN INTERNATIONAL GROUP | AIG | 94.39 | -0.26(-0.2747%) | 2856 |

| Apple Inc. | AAPL | 119.14 | -0.61(-0.5094%) | 275000 |

| Barrick Gold Corporation, NYSE | ABX | 17.07 | 0.39(2.3381%) | 165697 |

| Boeing Co | BA | 158.65 | -0.75(-0.4705%) | 4143 |

| Caterpillar Inc | CAT | 94.39 | -0.26(-0.2747%) | 2856 |

| Citigroup Inc., NYSE | C | 83.85 | 0.10(0.1194%) | 12295 |

| Exxon Mobil Corp | XOM | 87.12 | 0.31(0.3571%) | 17281 |

| Facebook, Inc. | FB | 125.6 | -0.49(-0.3886%) | 95200 |

| Ford Motor Co. | F | 12.7 | 0.03(0.2368%) | 64599 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 15.67 | -0.20(-1.2602%) | 316152 |

| Google Inc. | GOOG | 807.3 | -0.61(-0.0755%) | 1944 |

| Hewlett-Packard Co. | HPQ | 83.85 | 0.10(0.1194%) | 12295 |

| HONEYWELL INTERNATIONAL INC. | HON | 94.39 | -0.26(-0.2747%) | 2856 |

| Intel Corp | INTC | 87.12 | 0.31(0.3571%) | 17281 |

| International Business Machines Co... | IBM | 168.1 | 0.35(0.2086%) | 4695 |

| Johnson & Johnson | JNJ | 114.26 | -0.47(-0.4097%) | 11735 |

| JPMorgan Chase and Co | JPM | 86.7 | -0.38(-0.4364%) | 43226 |

| McDonald's Corp | MCD | 120.69 | -0.19(-0.1572%) | 3473 |

| Merck & Co Inc | MRK | 94.39 | -0.26(-0.2747%) | 2856 |

| Microsoft Corp | MSFT | 87.12 | 0.31(0.3571%) | 17281 |

| Pfizer Inc | PFE | 32.72 | -0.11(-0.3351%) | 26325 |

| Procter & Gamble Co | PG | 83.85 | 0.10(0.1194%) | 12295 |

| Tesla Motors, Inc., NASDAQ | TSLA | 228.75 | -0.98(-0.4266%) | 4971 |

| The Coca-Cola Co | KO | 41.01 | -0.04(-0.0974%) | 26331 |

| UnitedHealth Group Inc | UNH | 94.39 | -0.26(-0.2747%) | 2856 |

| Verizon Communications Inc | VZ | 52.54 | 0.08(0.1525%) | 16278 |

| Visa | V | 81.23 | -0.57(-0.6968%) | 8672 |

| Wal-Mart Stores Inc | WMT | 68.6 | 0.07(0.1021%) | 6180 |

| Walt Disney Co | DIS | 108.15 | -1.29(-1.1787%) | 72495 |

| Yandex N.V., NASDAQ | YNDX | 21.62 | 0.13(0.6049%) | 3239 |

Upgrades:

Merck (MRK) upgraded to Buy from Neutral at Guggenheim

Merck (MRK) upgraded to Overweight from Neutral at Piper Jaffray

Merck (MRK) upgraded to Overweight from Equal-Weight at Morgan Stanley

Downgrades:

Walt Disney (DIS) downgraded to Sell form Hold at Pivotal Research

Twitter (TWTR) downgraded to Hold from Buy at Pivotal Research

Other:

Boeing (BA) initiated with an Underperform at RBC Capital Mkts; target $136

United Tech (UTX) initiated with a Sector Perform at RBC Capital Mkts

WIG20 index opened at 2029.68 points (-0.05%)*

WIG 53690.48 -0.04%

WIG30 2345.74 -0.12%

mWIG40 4391.99 0.26%

*/ - change to previous close

The cash market opens with slight decrease of 0.05% at a turnover traditionally focused on the shares of KGHM. In Europe the German DAX starts fairly low with decline of approx.. 0.4%. The mood at the beginning is not so the best, but support for the Warsaw Stock Exchange is the weaker dollar, which leads to a peaceful start of the session.

After fifteen minutes of trading the WIG20 index was at the level of 2.028 points (-0,09%).

Yesterday's event of the day was the press conference of President-elect Donald Trump. During the conference, the US stock indices fluctuated, but at the end of trading advantage was taken over by shares buyers and as a result Wednesday's session on Wall Street ended with pros. The Dow Jones Industrial rose at the close by 0.50 percent, the S&P 500 by 0.28 percent and the Nasdaq Comp. went up by 0.21 percent.

After two sessions of heavily discount went up crude oil prices. On the stock market in New York this raw material lost on Monday and Tuesday totally 5.9 percent. Both Brent and WTI rallied on Wednesday more than 3 percent despite the fact that crude oil inventories in the US rose last week above expectations. After the conference weakened the dollar.

On the Asian markets this morning is weaker Japanese Nikkei, also China is dominated by the color red. In addition go down contracts in the United States, which in practice reflect the majority of yesterday's positive achievements. Given the above, opening in Europe is not going to be too optimistic.

European stocks rose for a second straight day on Wednesday, but with drugmakers capping gains after a late-session selloff following remarks by U.S. President-elect Donald Trump.

The Dow Jones Industrial Average closed less than 50 points from the psychologically-important 20,000 mark on Wednesday following President-elect Donald Trump's first news conference in months. The Nasdaq also extended gains to its fifth straight record close.

Asian equity markets were slightly higher Thursday, after U.S. President-elect Donald Trump largely avoided fresh attacks on global trade in his first news conference in six months. However, Trump on Wednesday also offered little clarity on his economic stimulus plans, sending the U.S. dollar down against major currencies, with the Japanese yen recently up nearly 0.3%, hurting Japanese stocks.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.