- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei -90.45 19347.53 -0.47%

TOPIX -2.62 1551.07 -0.17%

Hang Seng +112.83 24107.70 +0.47%

CSI 300 +19.22 3440.93 +0.56%

Euro Stoxx 50 -12.67 3311.04 -0.38%

FTSE 100 -24.49 7277.92 -0.34%

DAX -36.69 11757.24 -0.31%

CAC 40 -25.40 4899.46 -0.52%

DJIA +7.91 20619.77 +0.04%

S&P 500 -2.03 2347.22 -0.09%

NASDAQ -4.54 5814.90 -0.08%

S&P/TSX +19.22 15864.17 +0.12%

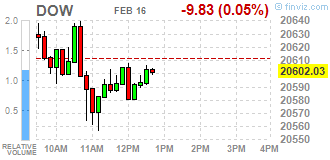

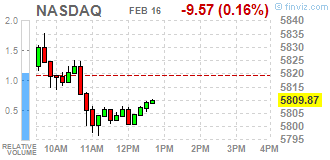

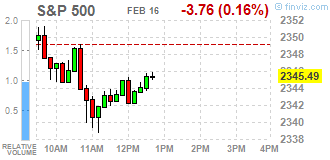

Major US stock indexes finished trading mostly "red zone" on the background of the loss of financial and health sectors after the six-day increase.

The last rally was caused by statements of the US president's "phenomenal" tax reform, fueling optimism that it plans to expand the corporate deregulation of the economy .. However, there are fears among investors due to the fact that Trump has not yet provided any significant details about their plans.

Also today, the Labor Department reported that the number of Americans who applied for unemployment benefits rose less than expected last week. unemployment initial claims for benefits rose by 5,000 and totaled a seasonally adjusted 239,000 for the week ending 11 February. Economists had forecast an increase to 245 000. The four-week moving average of applications, which smooths weekly volatility, rose by 500 to 245,250 last week. The number of repeated applications for unemployment benefits fell by 3,000 to 2.08 million in the week ending 4 February.

At the same time, the Commerce Department said that the establishment of new homes fell in January, as the construction of multi-family facilities decreased. Bookmarks new homes fell by 2.6 percent to a seasonally adjusted annual rate of up to 1.25 million units. Bookmarks for December were revised up to 1.28 million from 1.23 million. Bookmarks of new homes rose by 10.5 percent compared to January 2016. Building permits jumped 4.6 percent to 1.29 million units, the highest level since November 2015. Economists had forecast that the tab will fall to 1.22 million, while building permits rose to 1.23 million.

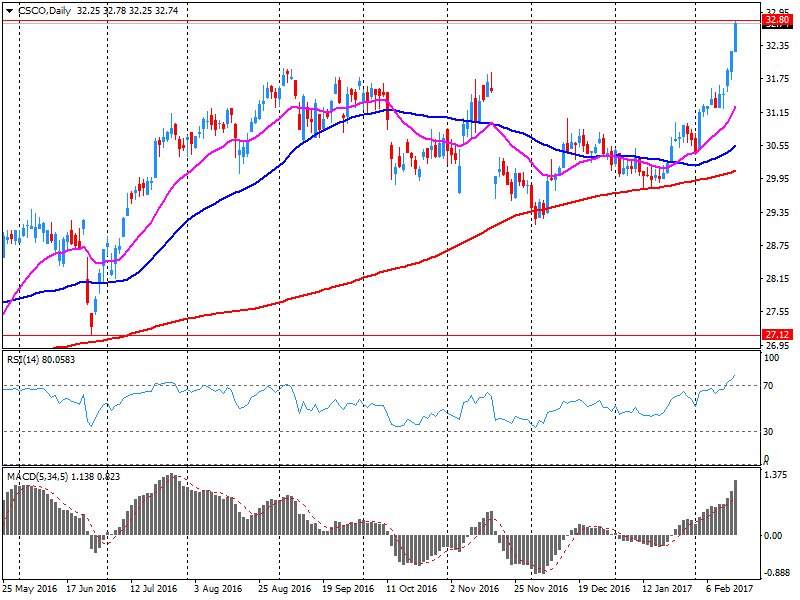

DOW index components ended the session mixed (15 black, 15 red). Most remaining shares fell Chevron Corporation (CVX, -1.87%). leaders of growth were shares of Cisco Systems, Inc. (CSCO, + 2.55%).

Most of the S & P sectors showed a decline. Most of the basic materials sector fell (-0.8%). leaders of growth were utilities sector (+ 0.6%).

At the close:

Dow + 0.04% 20,620.04 +8.18

Nasdaq -0.08% 5,814.90 -4.54

S & P -0.09% 2,347.23 -2.02

Major U.S. stock-indexes slightluy fell on Thursday due to losses in banks and health sectors, reversing course after earlier inching up enough to notch record intraday highs for the sixth straight session. The six-day streak was sparked a week back by President Donald Trump's vow of a "phenomenal" tax announcement, and fueled by optimism that his plans for corporate deregulation will expand the economy. However, worries have started to surface that Trump so far has provided no substantial details on his plans.

Most of Dow stocks in negative area (16 of 30). Top loser - Chevron Corporation (CVX, -1.33%). Top gainer - Cisco Systems, Inc. (CSCO, +2.86%).

Most of S&P sectors are also in negative area. Top loser - Conglomerates (-0.8%). Top gainer - Utilities (+0.5%).

At the moment:

Dow 20576.00 -47.00 -0.23%

S&P 500 2342.50 -8.00 -0.34%

Nasdaq 100 5297.50 -12.50 -0.24%

Oil 53.60 0.00 0.00%

Gold 1239.50 +6.40 +0.52%

U.S. 10yr 2.46 +0.04

U.S. stock-index futures fell after a recent spate of record highs, as investors looked for new catalysts to keep up Wall Street's record-setting rally.

Global Stocks:

Nikkei 19,347.53 -90.45 -0.47%

Hang Seng 24,107.70 +112.83 +0.47%

Shanghai 3,229.41 +16.43 +0.51%

FTSE 7,282.63 -19.78 -0.27%

CAC 4,904.15 -20.71 -0.42%

DAX 11,760.87 -33.06 -0.28%

Crude $53.34 (+0.43%)

Gold $1,238.30 (+0.42%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 37.8 | -0.07(-0.1848%) | 3147 |

| ALTRIA GROUP INC. | MO | 72.2 | 0.03(0.0416%) | 474 |

| Amazon.com Inc., NASDAQ | AMZN | 841.75 | -0.95(-0.1127%) | 9469 |

| American Express Co | AXP | 79.2 | -0.40(-0.5025%) | 357 |

| AMERICAN INTERNATIONAL GROUP | AIG | 60.75 | -0.10(-0.1643%) | 9522 |

| Apple Inc. | AAPL | 135.36 | -0.15(-0.1107%) | 114675 |

| AT&T Inc | T | 41.1 | -0.02(-0.0486%) | 1241 |

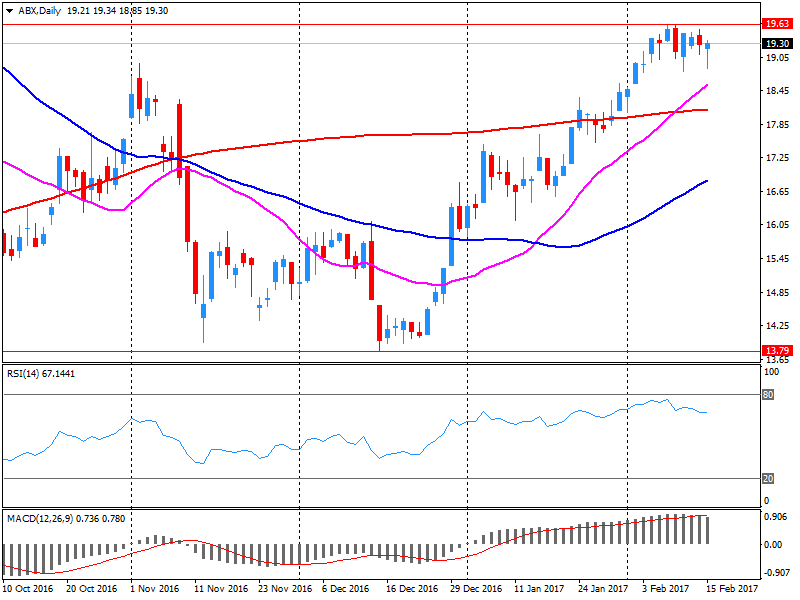

| Barrick Gold Corporation, NYSE | ABX | 19.68 | 0.36(1.8634%) | 66657 |

| Boeing Co | BA | 169.48 | 0.18(0.1063%) | 975 |

| Caterpillar Inc | CAT | 98.89 | -0.13(-0.1313%) | 3592 |

| Chevron Corp | CVX | 112.64 | 0.07(0.0622%) | 467 |

| Cisco Systems Inc | CSCO | 33.18 | 0.36(1.0969%) | 361559 |

| Citigroup Inc., NYSE | C | 60.38 | -0.12(-0.1983%) | 12181 |

| Deere & Company, NYSE | DE | 108 | -1.12(-1.0264%) | 499 |

| Exxon Mobil Corp | XOM | 83.3 | 0.14(0.1684%) | 2169 |

| Facebook, Inc. | FB | 133.15 | -0.29(-0.2173%) | 30352 |

| Ford Motor Co. | F | 12.6 | -0.03(-0.2375%) | 4012 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 15.25 | -0.12(-0.7807%) | 171379 |

| General Motors Company, NYSE | GM | 37.09 | 0.01(0.027%) | 375 |

| Goldman Sachs | GS | 249.7 | -0.84(-0.3353%) | 8691 |

| Google Inc. | GOOG | 819.6 | 0.62(0.0757%) | 873 |

| Home Depot Inc | HD | 142.45 | 0.26(0.1829%) | 1053 |

| Intel Corp | INTC | 36.14 | 0.09(0.2497%) | 9986 |

| International Business Machines Co... | IBM | 181.3 | -0.38(-0.2092%) | 1455 |

| Johnson & Johnson | JNJ | 117.08 | -0.12(-0.1024%) | 2226 |

| JPMorgan Chase and Co | JPM | 90.47 | -0.12(-0.1325%) | 14505 |

| McDonald's Corp | MCD | 126.56 | 0.08(0.0632%) | 738 |

| Merck & Co Inc | MRK | 65.13 | -0.03(-0.046%) | 700 |

| Microsoft Corp | MSFT | 64.5 | -0.03(-0.0465%) | 5758 |

| Pfizer Inc | PFE | 33.46 | -0.05(-0.1492%) | 5817 |

| Procter & Gamble Co | PG | 90.84 | -0.28(-0.3073%) | 6001 |

| Tesla Motors, Inc., NASDAQ | TSLA | 276.8 | -2.96(-1.0581%) | 36070 |

| The Coca-Cola Co | KO | 40.53 | 0.09(0.2225%) | 5489 |

| Twitter, Inc., NYSE | TWTR | 16.72 | -0.02(-0.1195%) | 57138 |

| Verizon Communications Inc | VZ | 48.14 | 0.06(0.1248%) | 4034 |

| Walt Disney Co | DIS | 109.95 | -0.23(-0.2088%) | 1559 |

| Yahoo! Inc., NASDAQ | YHOO | 45.56 | -0.09(-0.1971%) | 1153 |

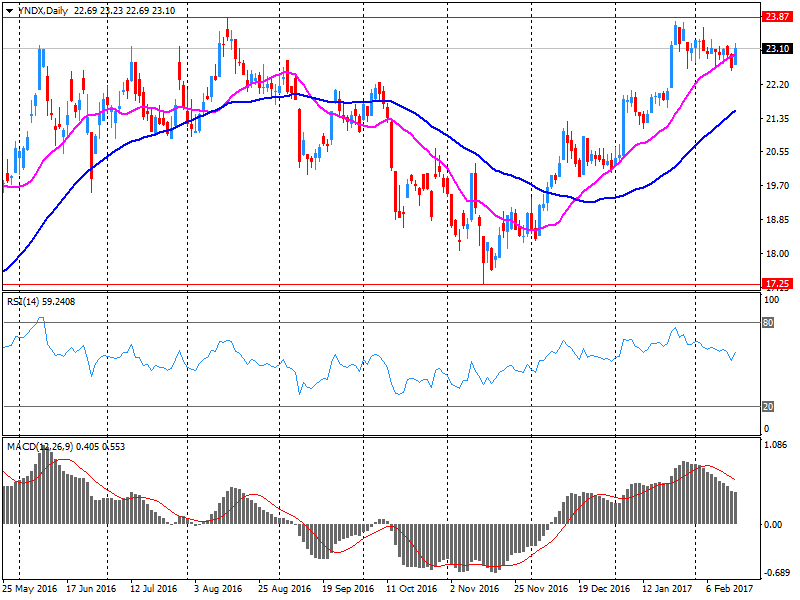

| Yandex N.V., NASDAQ | YNDX | 23.35 | 0.21(0.9075%) | 21345 |

Upgrades:

Bank of America (BAC) upgraded to Outperform at Macquarie

Downgrades:

Other:

Barrick Gold reported Q4 FY 2016 earnings of $0.22 per share (versus $0.08 in Q4 FY 2015), beating analysts' consensus estimate of $0.19.

The company's quarterly revenues amounted to $2.320 bln (+3.6% y/y), beating analysts' consensus estimate of $2.183 bln.

ABX rose to $19.62 (+1.55%) in pre-market trading.

Yandex N.V. reported Q4 FY 2016 earnings of RUB9.94 per share (versus RUB11.24 in Q4 FY 2015), missing analysts' consensus estimate of RUB11.00.

The company's quarterly revenues amounted to RUB22.119 bln (+22.2% y/y), beating analysts' consensus estimate of RUB20.843 bln.

The company also issued in-line guidance for FY 2017, projecting FY17 revenues of RUB88.0-90.3 bln (+16-19% y/y) versus analysts' consensus estimate of RUB89.27 bln.

YNDX rose to $23.42 (+1.21%) in pre-market trading.

Cisco Systems reported Q2 FY 2017 earnings of $.0 57per share (versus $0.57 in Q2 FY 2016), beating analysts' consensus estimate of $0.56.

The company's quarterly revenues amounted to $11.580 bln (-2.9% y/y), generally in-line with analysts' consensus estimate of $11.557 bln.

The company also issued in-line guidance for Q3, projecting EPS of $0.57-0.59 versus analysts' consensus estimate of $0.58 and revenues at ~$11.76-12.0 bln (-2-0% y/y) versus analysts' consensus estimate of $11.87 bln .

Cisco increased quarterly cash dividend 12% to $0.29.

CSCO rose to $33.37 (+1.68%) in pre-market trading.

The forenoon phase of today's session brought the test of the 2,200 points level for the Warsaw WIG20 index. In overall, the Warsaw Stock Exchange performed better than European markets. Still a clear distinction deserves PGNiG, but come to this following companies as PKN Orlen. This situation may arise from changes in the currency market, where the stronger euro is favorable for the Warsaw Stock Exchange, but not for the Eurozone.

At the halfway point of quotations the WIG20 index was at the level of 2,195 points (+0,52%).

The stock indices in Western Europe trading on mixed corporate reporting after the longest rally in 19 months. Yesterday the world stock market set a new record: the composite index MSCI All-Country World has updated the 2015 highs.

Investors continue to monitor the political scene, including the US news, the campaign in France and the meeting of Foreign Ministers of G20.

Shares of mining companies are getting cheaper, the industry index falls from a high of more than two years due to the negative dynamics in the price of copper. Anglo American lost 2,6%, Antofagasta - 1,9%, Glencore - 0,4%.

Cobham shares fell more than 21% to the lowest level since the end of 2004 and can show a record one-day decline. The company reported a write-off of £ 150 million ($ 187 million) and the deterioration of the forecast for profit in 2016.

The stock price of Nestle SA fell 1.2%. The company does not reach the set target for the fourth consecutive year, and its CEO Mark Schneider said that it will take years to return to the growth rates that are expected. He also reported an increase in restructuring costs.

Air France shares jumped more than 7%. Annual operating profit of the largest air carrier in Europe exceeded expectations, the forecast for 2017 has been mixed.

AstraZeneca securities decreased by 3.5%, oil giant BP down 1.6%. Shares of the French company Capgemini, providing IT-services, rose 2.3% after the firm reported a target of increasing profits for 2017.

At the moment:

FTSE 7260.79 -41.62 -0.57%

DAX 11763.34 -30.59 -0.26%

CAC 4899.86 -25.00 -0.51%

WIG20 index opened at 2185.44 points (+0.05%)*

WIG 57964.09 0.11%

WIG30 2534.23 0.13%

mWIG40 4797.83 0.05%

*/ - change to previous close

The cash market started the day from a modest increase, with modest, as the recent standards, turnover. Surrounded DAX lost cosmetically, but both beginnings can be considered as neutral towards the end of yesterday's session. After publication of the estimated results a positive posture shows PGNiG (WSE: PGN). However the market does not change its position and is located on the well-known two days levels.

After fifteen minutes of trading WIG20 index was at the level of 2,178 points (-0,25%).

Wednesday's session on the New York stock exchanges brought growth in the major indexes. The Dow Jones Industrial rose at the close of 0.52 percent, the S&P500 was firmer by 0.50 percent and the Nasdaq Comp. gained 0.64 percent. On Wednesday, Janet Yellen repeated the arguments contained in the delivered one day before to the Senate Committee speech, that the Federal Reserve should not delay the next rate hike. Data from the US economy indicate an increase in inflationary pressures, which, together with the occurrence of Janet Yellen to Congress reinforces expectations of a rate hike in the USA.

Possible optimism may dampen somewhat mixed behavior of Asian parquets, where the weaker dollar has not been welcomed in Tokyo. Other markets are dominated by caution and fear of the risks associated with technical overbuying.

Today's calendar is almost empty and rather should not be a source of serious pulses. This can promote stability, for which the preferences were seen yesterday in Warsaw and Frankfurt.

European stocks booked a seventh straight advance on Wednesday, with banks leading the gains after Federal Reserve Chairwoman Janet Yellen sparked a rally in financial stocks by hinting U.S. interest rates soon will go higher.

Stocks have done something they haven't done in more than a quarter of a century, with the Dow industrials, the S&P 500 and the Nasdaq all closing at record levels for a fifth session in a row. The last time all three benchmarks closed at records for five consecutive sessions was back on Jan. 2, 1992. They went on to do it again for a sixth day in a row in a streak that ended on Jan. 3, according to Dow Jones data.

Investors in Asia showed caution Thursday, as a weaker U.S. dollar and profit-taking sent major stock indexes lower, despite a strong overnight lead from Wall Street. After Wednesday's surge in regional equities, risk appetite cooled amid currency headwinds and broader global political uncertainty. The moves reflect a pattern of choppy trading in recent weeks.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.