- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

US stocks rose slightly up on Friday. As the US President promised last week that announced the tax reform in the coming weeks, Wall Street inched up to record highs in the coming days in the rally, where the financial sector, primarily banks, surpassed other sectors. But given that the reporting season draws to a close, many investors awaited more concrete signs of progress from Trump. In addition, as it became known today, the index of leading indicators from the Conference Board (LEI) for the US increased by 0.6% in January to 125.5 (2010 = 100), after rising 0.5% in December. However, the total amount of debt held by American households has grown significantly in the last quarter, recording the fastest pace in the last ten years, helped by a vast and stable increase in debt on credit cards, auto loans and student loans. In addition, in the 4th quarter of the amount of debt on the mortgage loans reached a peak since the last financial crisis. According to the report submitted by the Federal Reserve Bank of New York, the total household debt increased by $ 226 billion over the last three months of 2016.

DOW index components closed mostly in positive territory (20 of 30). Most remaining shares fell UnitedHealth Group Incorporated (UNH, -3.73%). Leaders of growth were shares of Verizon Communications Inc. (VZ, + 1.53%).

Sector S & P Index showed a mixed trend. Most of the basic materials sector fell (-0.6%). Leaders of growth were consumer goods sector (+ 1.3%).

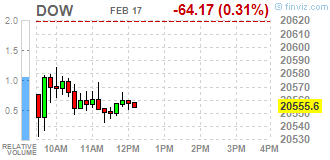

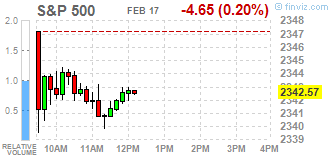

U.S. stock-indexes Dow and S&P 500 slightly fell on Friday, led by bank and healthcare stocks, as investors booked profits after a record-setting few days, while gains in Kraft Heinz help limit losses on the Nasdaq. Since President Donald Trump vowed last week to announce a tax reform in the coming weeks, Wall Street has inched up to record intraday and closing highs in successive days in a rally where financials, mainly banks, outperformed other sectors. But, with a strong fourth-quarter earnings season mostly complete, many investors say they need concrete signs of progress from Trump on his policy plans to justify more gains.

Most of Dow stocks in negative area (20 of 30). Top loser - UnitedHealth Group Incorporated (UNH, -3.73%). Top gainer - The Boeing Company (BA, +2.86%).

Most of S&P sectors are also in negative area. Top loser - Basic Materials (-0.8%). Top gainer - Consumer goods (+0.7%).

At the moment:

Dow 20540.00 -54.00 -0.26%

S&P 500 2340.50 -5.00 -0.21%

Nasdaq 100 5304.75 +4.25 +0.08%

Oil 53.48 -0.27 -0.50%

Gold 1239.60 -2.00 -0.16%

U.S. 10yr 2.42 -0.04

The US markets began the last in this week trading from discounts, which was signaled by the earlier behavior of contracts. On the Warsaw market since the sixth hour of trade the supply side has gained an advantage and into the final hour of trading market entering with a slope of approx. 1.3% for the index WIG20. Moods are clearly corrective and the session begins to change in the denial of Thursday's optimism.

U.S. stock-index futures fell, indicating that investors decided to pause after a record-setting few sessions on Wall Street, as they looked for clarity on the U.S. President Donald Trump's tax reform and prepared for a prolonged weekend.

Global Stocks:

Nikkei 19,234.62 -112.91 -0.58%

Hang Seng 24,033.74 -73.96 -0.31%

Shanghai 24,033.74 -73.96 -0.31%

FTSE 7,286.50 +8.58 +0.12%

CAC 4,847.06 -52.40 -1.07%

DAX 11,709.76 -47.48 -0.40%

Crude $53.10 (-0.49%)

Gold $1,243.50 (+0.15%)

(company / ticker / price / change ($/%) / volume)

| ALTRIA GROUP INC. | MO | 170.7 | -0.11(-0.0644%) | 8999 |

| Amazon.com Inc., NASDAQ | AMZN | 247 | -2.44(-0.9782%) | 9783 |

| AMERICAN INTERNATIONAL GROUP | AIG | 62.02 | -0.25(-0.4015%) | 2129 |

| AT&T Inc | T | 41.13 | -0.12(-0.2909%) | 16342 |

| Barrick Gold Corporation, NYSE | ABX | 20.52 | 0.02(0.0976%) | 63277 |

| Boeing Co | BA | 170.7 | -0.11(-0.0644%) | 8999 |

| Chevron Corp | CVX | 110.09 | -0.59(-0.5331%) | 3139 |

| Cisco Systems Inc | CSCO | 170.7 | -0.11(-0.0644%) | 8999 |

| Citigroup Inc., NYSE | C | 170.7 | -0.11(-0.0644%) | 8999 |

| Deere & Company, NYSE | DE | 247 | -2.44(-0.9782%) | 9783 |

| Ford Motor Co. | F | 247 | -2.44(-0.9782%) | 9783 |

| General Electric Co | GE | 30.33 | -0.12(-0.3941%) | 4542 |

| General Motors Company, NYSE | GM | 36.72 | -0.31(-0.8372%) | 1302 |

| Goldman Sachs | GS | 247 | -2.44(-0.9782%) | 9783 |

| Google Inc. | GOOG | 822.16 | -2.00(-0.2427%) | 1351 |

| Intel Corp | INTC | 36.28 | -0.13(-0.357%) | 4111 |

| Johnson & Johnson | JNJ | 118 | -0.08(-0.0678%) | 903 |

| JPMorgan Chase and Co | JPM | 89.73 | -0.80(-0.8837%) | 10345 |

| Merck & Co Inc | MRK | 65.41 | 0.15(0.2299%) | 300 |

| Microsoft Corp | MSFT | 247 | -2.44(-0.9782%) | 9783 |

| Nike | NKE | 56.05 | -0.24(-0.4264%) | 1373 |

| Starbucks Corporation, NASDAQ | SBUX | 56.39 | -0.34(-0.5993%) | 170 |

| Tesla Motors, Inc., NASDAQ | TSLA | 265.27 | -3.68(-1.3683%) | 64629 |

| The Coca-Cola Co | KO | 41 | -0.20(-0.4854%) | 11273 |

| Twitter, Inc., NYSE | TWTR | 16.4 | 0.05(0.3058%) | 49324 |

| UnitedHealth Group Inc | UNH | 158 | -5.65(-3.4525%) | 76655 |

| Verizon Communications Inc | VZ | 170.7 | -0.11(-0.0644%) | 8999 |

| Visa | V | 87.3 | -0.11(-0.1258%) | 579 |

| Walt Disney Co | DIS | 110.45 | -0.26(-0.2349%) | 2876 |

| Yahoo! Inc., NASDAQ | YHOO | 44.83 | -0.33(-0.7307%) | 499 |

| Yandex N.V., NASDAQ | YNDX | 247 | -2.44(-0.9782%) | 9783 |

Upgrades:

Credit Suisse (CS) upgraded to Overweight from Equal-Weight at Morgan Stanley

Downgrades:

Other:

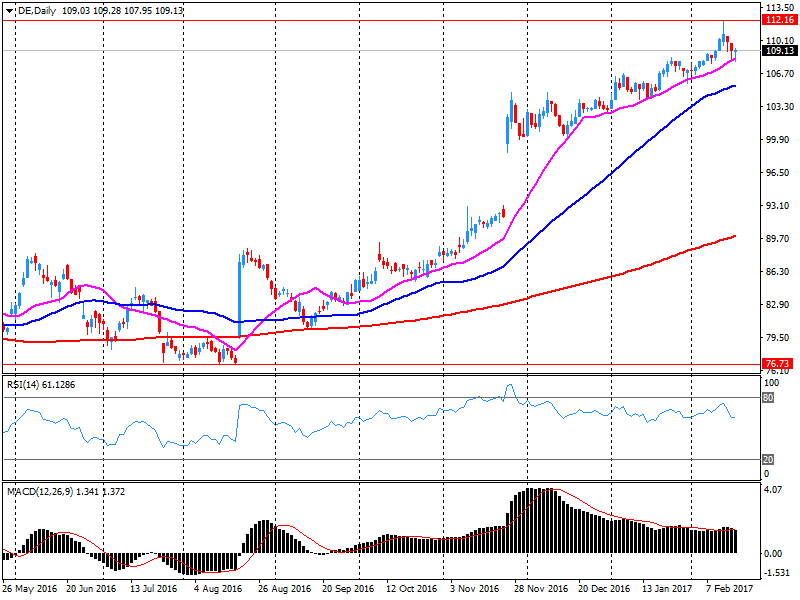

Deere reported Q1 FY 2017 earnings of $0.61 per share (versus $0.80 in Q1 FY 2016), beating analysts' consensus estimate of $0.54.

The company's quarterly revenues amounted to $4.698 bln (-1.5% y/y), beating analysts' consensus estimate of $4.590 bln.

The company also issued upside guidance for Q2 and the full 2017 year. It projects Q2 revenues at ~$7.18 bln (+1% y/y) versus analysts' consensus estimate of $6.89 bln. In FY 2017, it expects its revenues to amount to ~$24.32 bln (+4% y/y) versus analysts' consensus estimate of $23.12 bln.

DE rose to $112.66 (+3.20%) in pre-market trading.

The forenoon phase of the session was the defense of the level of 2,200 points for the WIG20 index. Under pressure from the environment, where the German DAX was looking for the bottom at the psychological barrier of 11,700 points, the Warsaw WIG20 moved under the 2,200 pts., Although support has been only slightly affected. In the following hours trading was carried out already above the level of 2,200 points.

At the halfway point quotations WIG20 index was at the level of 2,203 points (-0,55%).

The stock indices in Western Europe dropped, investors evaluate companies reporting and statistical data on retail sales in the UK.

UK retail sales unexpectedly fell in January, revealed data from the Office of National Statistics. Retail sales, including automotive fuel, decreased by 0.3 percent for the month in January, after falling 2.1 percent in December. Sales are expected to grow by 0.9 per cent. Excluding automotive fuel, retail sales fell by 0.2 percent, confounding expectations for an increase of 0.7 per cent. However, the decrease was slower than the 2.2 percent seen in December.

In annual terms, retail sales growth fell sharply to 1.5 percent from 4.1 percent a month earlier. Expected moderate slowdown in annual growth to 3.4 percent. Excluding automotive fuel, retail sales growth was 2.6 percent compared to 4.7 percent in December and expected growth of 3.9 percent.

The composite index of the largest companies in the region Stoxx Europe 600 fell by 0.51% to 368.23 points.

Allianz SE shares rise in price by 1.6%. Europe's biggest insurer increased its net profit in the fourth quarter by 23% and announced a new buyback program worth up to 3 billion euros.

AstraZeneca shares rose 1.6% after the company reported positive results from clinical trials of a drug for breast cancer.

The capitalization of the German drug manufacturer Stada Arzneimittel AG increased by 0.6%. The company announced that it received a third offer from an unnamed bidder, of nearly 4 billion euros.

Royal Vopak NV shares fell 8.6%. The world's largest operator of oil and chemical storage warned investors that it does not expect to increase profits in 2017.

At the moment:

FTSE 7265.78 -12.14 -0.17%

DAX 11707.18 -50.06 -0.43%

CAC 4856.12 -43.34 -0.88%

WIG20 index opened at 2214.85 points (-0.02%)*

WIG 58577.41 -0.06%

WIG30 2561.72 -0.11%

mWIG40 4835.11 -0.06%

*/ - change to previous close

The beginning of trading on the cash market was held in a neutral atmosphere. Flat start of the day in Europe and the correction mood at the end of the week on the core markets are not encouraged to take decisions. The level of turnover is small, indicating that investors are delaying their decisions until the balance of forces will become clearer.

After fifteen minutes of trading the WIG20 index was at the level of 2,218 points (+0,13%)

Thursday's session on the New York stock exchange has brought little change, but the series of seven consecutive days growth of indices S&P and Nasdaq was interrupted. The Dow Jones Ind. rose at the close of 0.04 percent, the S&P500 fell by 0.09 percent and the Nasdaq Comp. lost 0.08 percent. The focus of investors in the US are macro data, which confirm the strong start to the year in the local economy.

In the morning, we see a slight withdrawal of futures on the S&P500 and the decline of the Japanese Nikkei, which together indicate that after a week of changing moods investors reduce optimism before the weekend.

Looking at yesterday's behavior of the Warsaw market, we may notice that the Warsaw Stock Exchange follows it's own path. The WIG20 index broke out yesterday with a large turnover the next resistance (2,200 points) and look into the area of 2,350 pts. as the target level after breaking out of consolidation in the area of 2,000 to 1,650 points.

European stocks closed lower for the first time in eight sessions on Thursday, weighed down by a slide in shares of heavyweight Nestlé, as well as a retreat for banks and major oil companies. Stock markets globally, including in Europe, have rallied in recent days after interest rate-hike signals from the U.S. Federal Reserve and pledges from President Donald Trump to announce a "massive" tax plan soon.

U.S. stock indexes snapped a multi-session streak of simultaneous records Thursday, weighed down by a decline in energy stocks, with the Dow industrials the only index to gain another record high at the close.

Investors in Asia continued to reel in their risk appetite Friday, following a pullback overnight in two major U.S. stock indexes from record levels. The declines capped a week of choppy trading in the region, with spurts of interest in holding risk assets followed by moves into safe-haven assets such as the yen.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.