- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei +130.36 19381.44 +0.68%

TOPIX +8.59 1555.60 +0.56%

Hang Seng -182.45 23963.63 -0.76%

CSI 300 +11.43 3482.82 +0.33%

Euro Stoxx 50 +26.94 3339.33 +0.81%

FTSE 100 -25.03 7274.83 -0.34%

DAX +139.87 11967.49 +1.18%

CAC 40 +23.77 4888.76 +0.49%

DJIA +118.95 20743.00 +0.58%

S&P 500 +14.22 2365.38 +0.60%

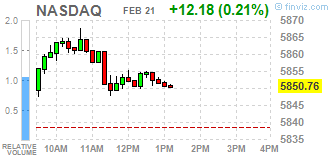

NASDAQ +27.37 5865.95 +0.47%

S&P/TSX +83.74 15922.37 +0.53%

Major U.S. stock-indexes hit record intraday highs on Tuesday amid gains across sectors as strong earnings from top retailers underscored the strength of the U.S. economy. One in every six stocks on the S&P 500 hit a new 52-week high as a rally sparked by President Donald Trump's promise of tax reforms shows no sign of fading despite concerns around valuations.

Most of Dow stocks in positive area (23 of 30). Top loser - Caterpillar Inc. (CAT, -0.73%). Top gainer - Wal-Mart Stores, Inc. (WMT, +2.91%).

Most of S&P sectors are also in positive area. Top loser - Services (-1.1%). Top gainer - Basic Materials (+1.1%).

At the moment:

Dow 20691.00 +103.00 +0.50%

S&P 500 2359.00 +11.00 +0.47%

Nasdaq 100 5339.25 +13.50 +0.25%

Oil 54.60 +0.82 +1.52%

Gold 1238.80 -0.30 -0.02%

U.S. 10yr 2.42 -0.00

U.S. stock-index futures advanced as oil prices rose and investors cheered better-than-expected quarterly reports from top U.S. retailers.

Global Stocks:

Nikkei 19,381.44 +130.36 +0.68%

Hang Seng 23,963.63 -182.45 -0.76%

Shanghai 3,253.25 +13.29 +0.41%

FTSE 7,278.95 -20.91 -0.29%

CAC 4,880.08 +15.09 +0.31%

DAX 11,895.12 +67.50 +0.57%

Crude $54.42 (+1.91%)

Gold $1,228.80 (-0.83%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 36.69 | 0.48(1.3256%) | 3662 |

| ALTRIA GROUP INC. | MO | 73.02 | 0.05(0.0685%) | 3445 |

| Amazon.com Inc., NASDAQ | AMZN | 848.66 | 3.59(0.4248%) | 25978 |

| AMERICAN INTERNATIONAL GROUP | AIG | 173.4 | 0.69(0.3995%) | 3543 |

| Apple Inc. | AAPL | 136.41 | 0.69(0.5084%) | 184866 |

| AT&T Inc | T | 41.49 | 0.01(0.0241%) | 3339 |

| Barrick Gold Corporation, NYSE | ABX | 19.93 | -0.24(-1.1899%) | 80449 |

| Boeing Co | BA | 173.4 | 0.69(0.3995%) | 3543 |

| Chevron Corp | CVX | 110.8 | 0.47(0.426%) | 1579 |

| Cisco Systems Inc | CSCO | 33.79 | 0.05(0.1482%) | 12418 |

| Citigroup Inc., NYSE | C | 60.38 | 0.21(0.349%) | 32223 |

| Deere & Company, NYSE | DE | 109 | -1.27(-1.1517%) | 385 |

| E. I. du Pont de Nemours and Co | DD | 77.5 | 0.01(0.0129%) | 301 |

| Exxon Mobil Corp | XOM | 81.9 | 0.14(0.1712%) | 59398 |

| Facebook, Inc. | FB | 133.85 | 0.32(0.2397%) | 41195 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14.4 | -0.51(-3.4205%) | 516253 |

| General Electric Co | GE | 30.46 | 0.09(0.2963%) | 51565 |

| General Motors Company, NYSE | GM | 37.65 | 0.43(1.1553%) | 22091 |

| Goldman Sachs | GS | 251.65 | 1.27(0.5072%) | 1770 |

| Google Inc. | GOOG | 832.48 | 4.41(0.5326%) | 5451 |

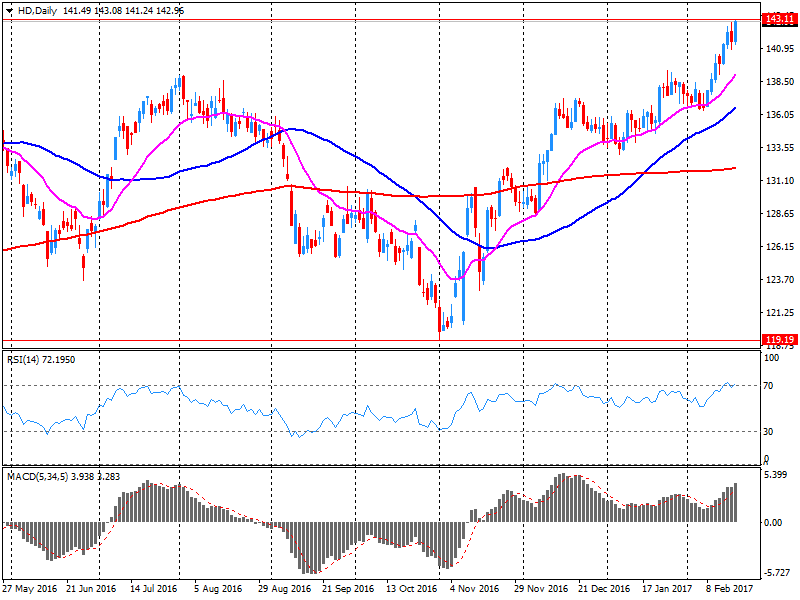

| Home Depot Inc | HD | 145.9 | 2.90(2.028%) | 96575 |

| Intel Corp | INTC | 36.66 | 0.18(0.4934%) | 29929 |

| Johnson & Johnson | JNJ | 118.57 | -0.29(-0.244%) | 13600 |

| JPMorgan Chase and Co | JPM | 90.52 | 0.29(0.3214%) | 8591 |

| McDonald's Corp | MCD | 127.5 | -0.30(-0.2347%) | 1859 |

| Merck & Co Inc | MRK | 65.35 | -0.04(-0.0612%) | 210 |

| Microsoft Corp | MSFT | 64.73 | 0.11(0.1702%) | 16048 |

| Nike | NKE | 56.23 | -0.52(-0.9163%) | 21778 |

| Pfizer Inc | PFE | 33.6 | -0.02(-0.0595%) | 13479 |

| Procter & Gamble Co | PG | 90.86 | -0.23(-0.2525%) | 4269 |

| Tesla Motors, Inc., NASDAQ | TSLA | 275.69 | 3.46(1.271%) | 56232 |

| The Coca-Cola Co | KO | 41.1 | -0.13(-0.3153%) | 6199 |

| Twitter, Inc., NYSE | TWTR | 16.69 | 0.07(0.4212%) | 30743 |

| UnitedHealth Group Inc | UNH | 157.39 | -0.23(-0.1459%) | 2453 |

| Verizon Communications Inc | VZ | 49.39 | 0.20(0.4066%) | 44687 |

| Visa | V | 87.51 | 0.05(0.0572%) | 5292 |

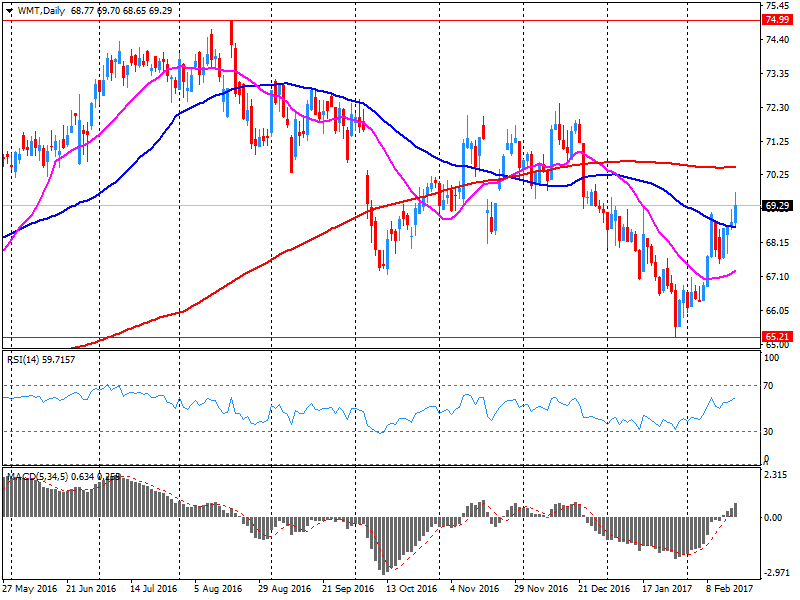

| Wal-Mart Stores Inc | WMT | 71.7 | 2.33(3.3588%) | 672570 |

| Walt Disney Co | DIS | 109.91 | -0.15(-0.1363%) | 1850 |

| Yahoo! Inc., NASDAQ | YHOO | 45.43 | 0.33(0.7317%) | 5604 |

Upgrades:

Verizon (VZ) upgraded to Buy at MoffettNathanson

Downgrades:

Freeport-McMoRan (FCX) downgraded to Sell from Hold at Deutsche Bank

Other:

Apple (AAPL) target raised to $154 from $150 at Morgan Stanley

Deere (DE) target raised to $109 at RBC Capital Mkts

Freeport-McMoRan (FCX) initiated with a Neutral at Citigroup; target $16

Home Depot reported Q4 FY 2017 earnings of $1.44 per share (versus $1.17 in Q4 FY 2016), beating analysts' consensus estimate of $1.34.

The company's quarterly revenues amounted to $22.207 bln (+5.8% y/y), beating analysts' consensus estimate of $21.810 bln.

The company also issued in-line guidance for FY 2018, projecting EPS of $7.13 (versus analysts' consensus estimate of $7.17) and revenues growth of ~4.6% to ~$98.95 bln (analysts' consensus estimate of $98.32 bln).

In addition, the company's board of directors declared a 29 percent increase in the quarterly dividend to $0.89 per share and authorized a $15 bln share repurchase program, replacing its previous authorization.

HD rose to $145.48 (+1.73%) in pre-market trading.

Wal-Mart reported Q4 of fiscal year (FY) 2017 earnings of $1.30 per share (versus $1.49 in Q4 FY 2016), beating analysts' consensus estimate of $1.29.

The company's quarterly revenues amounted to $129.750 bln (+0.8% y/y), generally in-line with analysts' consensus estimate of $130.217 bln.

The company also issued in-line guidance for Q1 and the full FY 2018. It projected Q1 EPS of $0.90-1.00 versus analysts' consensus estimate of $0.96. For FY 2018 the company guided EPS of $4.20-4.40 (up from $4.15-4.35 in October of last year) analysts' consensus estimate of $4.32.

Walmart approved an annual cash dividend for FY 2018 of $2.04 per share, up 2 percent from the $2.00 per share paid for the last FY.

WMT rose to $71.82 (+3.53%) in pre-market trading.

European stocks scored modest gains Monday, helped by jumps for Royal Bank of Scotland, Rolls-Royce and furniture seller Steinhoff International. Investors also tracked a tightening French presidential race, as well as progress made on debt-laden Greece's bailout at a meeting of eurozone finance ministers.

Asian stocks held ground on Tuesday though Chinese equities surged to a fresh two-month high as domestic funds piled into financial counters on expectations the world's second biggest economy may have turned a corner. With U.S. markets closed for the Presidents Holiday on Monday, Asian markets have had few global cues off which to trade.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.