- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

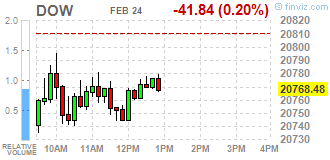

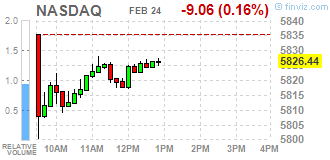

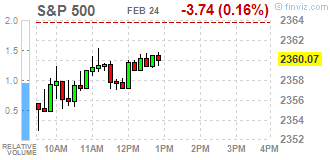

Major U.S. stock indexes slightly fell on Friday, as investors reassessed the "Trump rally" after recent comments suggested that pro-growth policies might take longer to be implemented. U.S. markets are trading at record levels since the U.S. election, spurred by President Donald Trump's promises of tax reforms, reduced regulations and increased infrastructure spending. But, with Trump giving scant detail on his plans - including one on Thursday to bring millions of jobs back to the United States - markets have recently traded in a tight range.

Most of Dow stocks in negative area (18 of 30). Top loser - JPMorgan Chase & Co. (JPM, -1.54%). Top gainer - Wal-Mart Stores, Inc. (WMT, +1.47%).

Most of S&P sectors are also in negative area. Top loser - Basic Materials (-1.1%). Top gainer - Utilities (+0.6%).

At the moment:

Dow 20755.00 -42.00 -0.20%

S&P 500 2358.75 -4.00 -0.17%

Nasdaq 100 5323.75 -8.25 -0.15%

Oil 54.12 -0.33 -0.61%

Gold 1257.60 +6.20 +0.50%

U.S. 10yr 2.33 -0.06

U.S. stock-index futures fell as a drop in oil prices weighed and investors assessed if the "Trump rally" had gone too far too soon.

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 186.56 | -0.63(-0.3366%) | 2760 |

| ALCOA INC. | AA | 33.69 | -0.63(-1.8357%) | 20315 |

| ALTRIA GROUP INC. | MO | 74.02 | -0.44(-0.5909%) | 6323 |

| Amazon.com Inc., NASDAQ | AMZN | 845.18 | -7.01(-0.8226%) | 21930 |

| American Express Co | AXP | 79.57 | -0.48(-0.5996%) | 2055 |

| Apple Inc. | AAPL | 135.33 | -1.20(-0.8789%) | 205843 |

| AT&T Inc | T | 41.75 | -0.20(-0.4768%) | 1389 |

| Barrick Gold Corporation, NYSE | ABX | 20.06 | 0.40(2.0346%) | 91765 |

| Boeing Co | BA | 176.11 | -0.75(-0.4241%) | 1997 |

| Caterpillar Inc | CAT | 94.92 | -0.63(-0.6593%) | 9132 |

| Chevron Corp | CVX | 110.5 | -0.52(-0.4684%) | 5427 |

| Cisco Systems Inc | CSCO | 33.87 | -0.17(-0.4994%) | 9620 |

| Citigroup Inc., NYSE | C | 59.79 | -0.83(-1.3692%) | 115333 |

| Deere & Company, NYSE | DE | 106.9 | -0.83(-0.7704%) | 299 |

| E. I. du Pont de Nemours and Co | DD | 79.43 | -0.16(-0.201%) | 2105 |

| Exxon Mobil Corp | XOM | 81.47 | -0.31(-0.3791%) | 5953 |

| Facebook, Inc. | FB | 133.9 | -1.46(-1.0786%) | 169133 |

| FedEx Corporation, NYSE | FDX | 191 | -0.18(-0.0942%) | 2313 |

| Ford Motor Co. | F | 12.48 | -0.08(-0.6369%) | 33681 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.3 | -0.18(-1.3353%) | 96942 |

| General Electric Co | GE | 29.91 | -0.11(-0.3664%) | 17955 |

| General Motors Company, NYSE | GM | 37 | -0.25(-0.6711%) | 3320 |

| Goldman Sachs | GS | 247.51 | -3.68(-1.465%) | 54669 |

| Google Inc. | GOOG | 35.99 | -0.19(-0.5251%) | 16808 |

| Hewlett-Packard Co. | HPQ | 17.24 | -0.36(-2.0455%) | 46443 |

| Home Depot Inc | HD | 144.12 | -0.59(-0.4077%) | 4210 |

| Intel Corp | INTC | 35.99 | -0.19(-0.5251%) | 16808 |

| International Business Machines Co... | IBM | 180.58 | -1.07(-0.589%) | 1082 |

| Johnson & Johnson | JNJ | 120.66 | -0.24(-0.1985%) | 3149 |

| JPMorgan Chase and Co | JPM | 89.85 | -1.28(-1.4046%) | 46052 |

| McDonald's Corp | MCD | 127.8 | -0.47(-0.3664%) | 3503 |

| Merck & Co Inc | MRK | 65.51 | -0.34(-0.5163%) | 2840 |

| Microsoft Corp | MSFT | 64.26 | -0.36(-0.5571%) | 46427 |

| Nike | NKE | 57.25 | -0.14(-0.2439%) | 11905 |

| Pfizer Inc | PFE | 33.95 | -0.11(-0.323%) | 2718 |

| Procter & Gamble Co | PG | 90.85 | -0.28(-0.3073%) | 2076 |

| Tesla Motors, Inc., NASDAQ | TSLA | 251.46 | -4.53(-1.7696%) | 102263 |

| The Coca-Cola Co | KO | 41.57 | -0.09(-0.216%) | 7901 |

| Travelers Companies Inc | TRV | 122.13 | -0.23(-0.188%) | 2455 |

| Twitter, Inc., NYSE | TWTR | 15.93 | -0.10(-0.6238%) | 59571 |

| United Technologies Corp | UTX | 111.74 | -0.35(-0.3123%) | 2515 |

| UnitedHealth Group Inc | UNH | 162.03 | -0.57(-0.3506%) | 2222 |

| Verizon Communications Inc | VZ | 50.18 | -0.13(-0.2584%) | 7003 |

| Visa | V | 87.61 | -0.57(-0.6464%) | 2906 |

| Wal-Mart Stores Inc | WMT | 71.11 | -0.20(-0.2805%) | 17987 |

| Walt Disney Co | DIS | 109.27 | -0.46(-0.4192%) | 5154 |

| Yahoo! Inc., NASDAQ | YHOO | 44.99 | -0.42(-0.9249%) | 2850 |

| Yandex N.V., NASDAQ | YNDX | 23.66 | -0.08(-0.337%) | 1609 |

Upgrades:

Downgrades:

Hewlett Packard Enterprise (HPE) downgraded to Hold from Buy at Needham

Hewlett Packard Enterprise (HPE) downgraded to Market Perform from Outperform at BMO Capital

Goldman Sachs (GS) downgraded to Sell from Hold at Berenberg

Other:

Hewlett Packard Enterprise reported Q1 FY2017 earnings of $0.45 per share (versus $0.41 in Q1 FY2016), beating analysts' consensus estimate of $0.44.

The company's quarterly revenues amounted to $11.407 bln (-10.4% y/y), missing analysts' consensus estimate of $12.050 bln.

The company issued guidance for Q2 EPS of $0.41-0.45 versus analysts' consensus estimate of $0.45. It also lowered its FY2017 EPS forecast to $1.88-1.98 from $2.00-2.10 versus analysts' consensus estimate of $1.93.

HPE fell to $22.69 (-7.99%) in pre-market trading.

European stock markets show negative dynamics. Market focus is on corporate reporting as well as the continued political instability in Europe and the United States.

Some support provide statistical data from France and Britain. The survey results provided by the Statistical Office Insee showed that consumer sentiment in France remained stable this month. According to the data, in February consumer confidence index remained at the level of 100 points, which corresponds to the long-term average. A reading in line with expectations. "Concerns regarding the Household unemployment were virtually stable in February - said Insee. In addition, fewer households than in January expecting a rise in prices in the next 12 months."

Meanwhile, the British Bankers' Association (BBA) said that in January the British banks approved the largest number of mortgage loans in the last 12 months. According to the data, in January were approved 44,657 applications for mortgage loans compared to 43,581 in December. The last reading was the highest since January last year, when 45,794 applications for mortgage loans have been approved, and exceeded the forecasts of experts who had expected a decline to 41 900.

The composite index of the largest companies in the region Stoxx Europe 600 was down 0.67%, to the level of 370.34. Most of the major stock exchanges and sectors traded in negative territory.

The capitalization of BASF - the world's largest chemical company - fell by 3.6% after the company reported a 6 per cent reduction in profit before tax in 2016.

Shares of Vivendi - French media conglomerate - fell by 4.2%, as financial indicators for 2017 were worse than expectations. The company also reported that in the 4th quarter adjusted net profit fell by 34%, to 130 million euros.

The cost of Royal Bank of Scotland Group fell 3.4% after the lender announced a net loss of $ 8.7 billion. For 2016.

At the moment:

FTSE 100 7226.21 -45.16 -0.62%

DAX -131.74 11816.09 -1.10%

CAC 40 4838.52 -52.77 -1.08%

European stocks ended modestly lower Thursday but stayed on track for a weekly gain, as investors sifted through earnings reports and assessed the mixed tone on the path for monetary policy from the Federal Reserve.

The Dow Jones Industrial Average extended its hot streak on Thursday, closing at a record for a tenth session in a row while the Nasdaq Composite logged its first back-to-back decline of the year, weighed down by big losses in Nvidia Corp.

Shares in Asia lost ground Friday as dovish signals from the U.S. Federal Reserve weakened the dollar, with possible consequences for the competitiveness of Asian exports. The minutes from the U.S. Federal Reserve's latest meeting released earlier this week suggested the next interest-rate increase would come "fairly soon." Some investors interpreted that as a dovish signal that the Fed was backing away from a rate rise in March.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.