- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(index / closing price / change items /% change)

Nikkei -1.57 19379.87 -0.01%

TOPIX +1.49 1557.09 +0.10%

Hang Seng +238.33 24201.96 +0.99%

CSI 300 +6.94 3489.76 +0.20%

Euro Stoxx 50 -0.06 3339.27 +0.00%

FTSE 100 +27.42 7302.25 +0.38%

DAX +31.10 11998.59 +0.26%

CAC 40 +7.12 4895.88 +0.15%

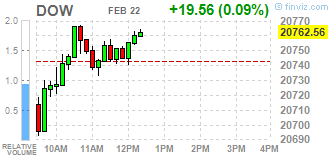

DJIA +32.60 20775.60 +0.16%

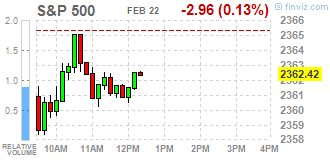

S&P 500 -2.56 2362.82 -0.11%

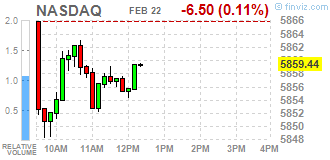

NASDAQ -5.32 5860.63 -0.09%

S&P/TSX -92.15 15830.22 -0.58%

Major U.S. stock-indexes little changed on Wednesday as investors looked ahead to the Federal Reserve's minutes of its most recent meeting for clues on the timing of the next interest rate hike. Policymakers, including Fed Chair Janet Yellen, have been hinting at the possibility of a rate hike at an upcoming meeting. But traders have priced in slim chances of a move until June despite strong economic data.

Most of Dow stocks in negative area (20 of 30). Top loser - Intel Corporation (INTC, -1.59%). Top gainer - E. I. du Pont de Nemours and Company (DD, +4.04%).

Most of S&P sectors are also in negative area. Top loser - Basic Materials (-1.0%). Top gainer - Conglomerates (+1.0%).

At the moment:

Dow 20735.00 +47.00 +0.23%

S&P 500 2360.50 +0.50 +0.02%

Nasdaq 100 5350.25 +6.50 +0.12%

Oil 53.54 -0.79 -1.45%

Gold 1232.90 -6.00 -0.48%

U.S. 10yr 2.42 -0.00

U.S. stock-index futures were flat as investors awaited the minutes of the Federal Reserve's most recent policy meeting for clues on the timing of the next interest rate hike.

Global Stocks:

Nikkei 19,379.87 -1.57 -0.01%

Hang Seng 24,201.96 +238.33 +0.99%

Shanghai 3,260.94 +7.61 +0.23%

FTSE 7,284.65 +9.82 +0.13%

CAC 4,886.14 -2.62 -0.05%

DAX 11,979.36 +11.87 +0.10%

Crude $53.97 (-0.66%)

Gold $1,240.30 (+0.11%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 36.55 | -0.16(-0.4359%) | 5226 |

| ALTRIA GROUP INC. | MO | 73.52 | -0.13(-0.1765%) | 625 |

| Amazon.com Inc., NASDAQ | AMZN | 856.445 | 0.005(0.0006%) | 20341 |

| American Express Co | AXP | 79.73 | -0.24(-0.3001%) | 1538 |

| Apple Inc. | AAPL | 41.61 | -0.12(-0.2876%) | 1017 |

| AT&T Inc | T | 41.61 | -0.12(-0.2876%) | 1017 |

| Barrick Gold Corporation, NYSE | ABX | 20.16 | 0.05(0.2486%) | 37973 |

| Boeing Co | BA | 41.61 | -0.12(-0.2876%) | 1017 |

| Caterpillar Inc | CAT | 98.2 | 0.10(0.1019%) | 5970 |

| Cisco Systems Inc | CSCO | 34 | -0.13(-0.3809%) | 3206 |

| Citigroup Inc., NYSE | C | 60.26 | -0.29(-0.4789%) | 96580 |

| Deere & Company, NYSE | DE | 108.81 | -0.80(-0.7299%) | 785 |

| Exxon Mobil Corp | XOM | 81.6 | -0.29(-0.3541%) | 989 |

| Facebook, Inc. | FB | 133.56 | -0.16(-0.1197%) | 16610 |

| Ford Motor Co. | F | 12.67 | -0.02(-0.1576%) | 6348 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.9 | -0.23(-1.6277%) | 86811 |

| General Electric Co | GE | 30.48 | -0.04(-0.1311%) | 34487 |

| General Motors Company, NYSE | GM | 37.73 | -0.08(-0.2116%) | 2721 |

| Goldman Sachs | GS | 250.49 | -1.27(-0.5044%) | 5297 |

| Google Inc. | GOOG | 830.77 | -0.89(-0.107%) | 1094 |

| Hewlett-Packard Co. | HPQ | 16.12 | -0.01(-0.062%) | 1014 |

| Intel Corp | INTC | 36.45 | -0.07(-0.1917%) | 72027 |

| International Business Machines Co... | IBM | 179.97 | -0.29(-0.1609%) | 470 |

| JPMorgan Chase and Co | JPM | 90.6 | -0.41(-0.4505%) | 8617 |

| McDonald's Corp | MCD | 90.6 | -0.41(-0.4505%) | 8617 |

| Merck & Co Inc | MRK | 41.61 | -0.12(-0.2876%) | 1017 |

| Microsoft Corp | MSFT | 64.36 | -0.13(-0.2016%) | 14948 |

| Pfizer Inc | PFE | 41.61 | -0.12(-0.2876%) | 1017 |

| Starbucks Corporation, NASDAQ | SBUX | 57.4 | -0.14(-0.2433%) | 2445 |

| Tesla Motors, Inc., NASDAQ | TSLA | 279.85 | 2.46(0.8868%) | 34882 |

| Twitter, Inc., NYSE | TWTR | 16.4 | -0.02(-0.1218%) | 33484 |

| UnitedHealth Group Inc | UNH | 90.6 | -0.41(-0.4505%) | 8617 |

| Verizon Communications Inc | VZ | 49.45 | 0.02(0.0405%) | 511 |

| Visa | V | 41.61 | -0.12(-0.2876%) | 1017 |

| Wal-Mart Stores Inc | WMT | 71.8 | 0.35(0.4899%) | 41344 |

| Walt Disney Co | DIS | 109.8 | -0.21(-0.1909%) | 100 |

| Yahoo! Inc., NASDAQ | YHOO | 45.27 | -0.23(-0.5055%) | 713 |

| Yandex N.V., NASDAQ | YNDX | 24.02 | -0.32(-1.3147%) | 1580 |

Upgrades:

Wal-Mart (WMT) upgraded to Buy from Neutral at BofA/Merrill; target $88

Downgrades:

Other:

Goldman Sachs (GS) initiated with a Neutral at Compass Point

Morgan Stanley (MS) initiated with a Neutral at Compass Point

Intel (INTC) initiated with a Buy at MKM Partners

Intel (INTC) initiated with a Sell at Rosenblat

Home Depot (HD) target raised to $158 from $153 at RBC Capital Mkts

Home Depot (HD) target raised to $154 from $150 at TAG

Wal-Mart (WMT) target raised to $67 from $66 at RBC Capital Mkts

Wal-Mart (WMT) target raised to $72 from $70 at Stifel

European stocks closed at their highest in more than a year Tuesday, finding support from upbeat eurozone data, but HSBC PLC shares suffered the most since 2009 in the wake of financial results from the London-based lender. European equities climbed Tuesday after a better-than-expected preliminary reading on manufacturing activity in the eurozone. IHS Markit's February PMI gauge of eurozone manufacturing activity came in at 56.0, outstripping a 54.3 estimate from FactSet.

U.S. stocks rallied on Tuesday, with major indexes simultaneously closing at records for a second session in a row on the back of gains in defensive sectors and energy, even as concerns remained about the market's valuation. Stocks finished near their highs of the session with the day's gains broad as all 11 of the S&P 500's sectors finished higher.

Asia-Pacific stocks rose broadly following overnight gains overseas, as investors await the release later Wednesday of minutes from this month's U.S. Federal Reserve meeting. But gains are largely muted, as are declines in the few markets whose benchmark indexes are lower.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.